Hello guys, it’s another week of the crypto academy and in this weeks lesson professor @imagen discussed about Bitcoin’s Trajectory. After carefully reading his post and doing some research, I have decided to complete the assignment tasks.

Canva

CanvaQuestion1: How many times has halving been performed on Bitcoin? When is the next one expected? What is the current amount that Bitcoin miners receive? Name at least 2 cryptocurrencies that perform or have performed halving.

Halving is simply a term which is associated with the mining of Cryptocurrencies such as Bitcoin. It is necessary to understand what mining is before one can clearly grasp the idea of Halving.

First of all mining involves the use of high technology and computers to solve complex algorithms in a blockchain in the process of verification and validation of blocks/ transactions in a particular blockchain.

Now halving is basically splitting the block rewards earned by miners into two (2). In addition the halving of Bitcoin usually occurs whenever 210,000 blocks are mined. It is know that the halving of Bitcoin occurs every 4 years which corresponds to the 210,000 blocks mined.

The main purpose of halving is to reduce the number of new Bitcoins created in order to sustain the proper supply and circulation of the newly mine Bitcoin.

Since the creation of Bitcoin, halving has occurred three (3) times and with the first halving which occurred in 28th November, 2012. In this first halving, miners used to get block rewards of 50 BTC but it was reduced to 25 BTC after the first halving occurred.

The second halving of Bitcoin occurred in the year 2016 and the block rewards were now reduce to 12.5 BTC after the second halving. This means that there were 210,000 blocks mined in that period to cause a second halving.

Now, the third and latest halving occurred on 11th of May 2020 were the block rewards were later reduced from 12.5 to 6.25 BTC.

It should be noted that the block rewards are allocated as a reward per block lined.

After the third halving in 2020, it is obvious that the next halving is going to occur in the year 2024 which is just 3 years away from now. The current block rewards that miners earn is 6.25 BTC per block.

In the next halving, miners will earn 3.125 BTC per block as block rewards.

Two Other Cryptocurrencies that Have performed Halving.

Bitcoin Cash Halving Is another cryptocurrency that performs halving and just as Bitcoin, the halving occurs after every four (4) years. After these 4 years 210,000 blocks must have been created. Currently, the reward per block mined is 6.25 BCH and in the next halving, it is going to be reduced to 3.125 BCH.

Litecoin is also another cryptocurrency that undergoes the halving activity. Its halving period is similar to that of Bitcoin, occurring every four (4) years. And the halving occurs after 840,000 blocks have been created. The first halving of Litecoin occurred in August of 2015 and miners were rewarded with 25 LTC different from an initial of 50 LTC. The next halving is expected to occur in the year 2023 were miners will receive 6.25 LTC.

Question 2: What are consensus mechanisms and how do Proof-of-Work and Proof-of-Staking differ?

Consensus Mechanisms simply refers to a set of regulations or protocols that must be followed in order to validate of verify blocks of data/transactions. Validation of blocks occurs from specific nodes connected to the blockchain and these nodes are referred to as miners. These Consensus Mechanisms are put in place to ensure the decentralized nature of the blockchain.

The consensus Mechanisms overseas the various activities that occur in the blockchain network and some these activities include mining and regulations. Some examples of consensus mechanisms include; proof-of-history (PoH), proof-of-work (PoW), proof-of-stake (PoS)

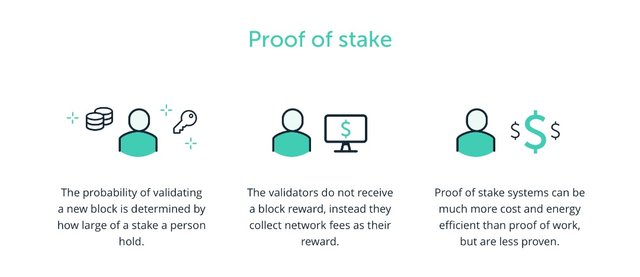

Proof of stake (PoS)

In the Proof-of-Stake (PoS) algorithm, selected nodes are given the power/responsibility to carry out the activities of the blockchain. The nodes are selected by contributing tokens/coins to them in the form of voting or delegation. In this situation, the more assets delegated to you, the more your power in the blockchain.

source

sourceThe main aim of the development of Proof-of-Stake consensus algorithm was to improve upon proof-of-work consensus algorithm. Thus reduced the high cost in the operation of that type of algorithm. It required more energy and computational power. But with the Proof-of-Stake, it does not necessarily require high computational power and energy.

Some Blockchains that make use of the proof-of-stake (PoS) consensus algorithm include; Cardano and EOSIO.

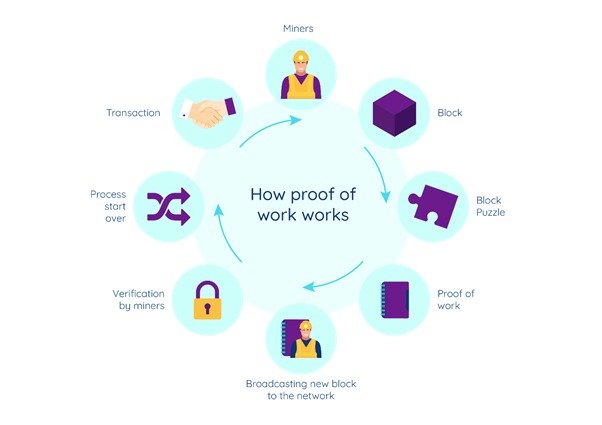

Proof-of-Work (PoW)

This type of consensus algorithm require users with high computational power and high technology to solve the complex algorithms in a blockchain network. This in general requires connected nodes to put in more effort in order to gain the right as a miner.

source

sourceAs a result of all these, there is usually more electricity and energy required to solve these complex computations/algorithm. Because of this, few of the connected nodes are able to be involved in the validation of blocks, hence there is no time to validate as many blocks which will then result in congestion in that particular blockchain.

So basically, the proof-of-work algorithm is highly costly, slow in validation of blocks and requires a lot of energy as compared to that of proof-of-stake. Typical examples of blockchains that used the proof-of-stake consensus are; Bitcoin and Ethereum.

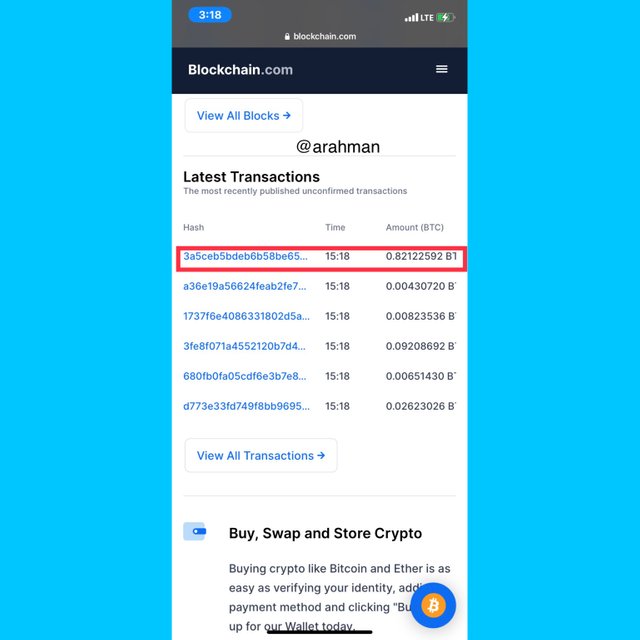

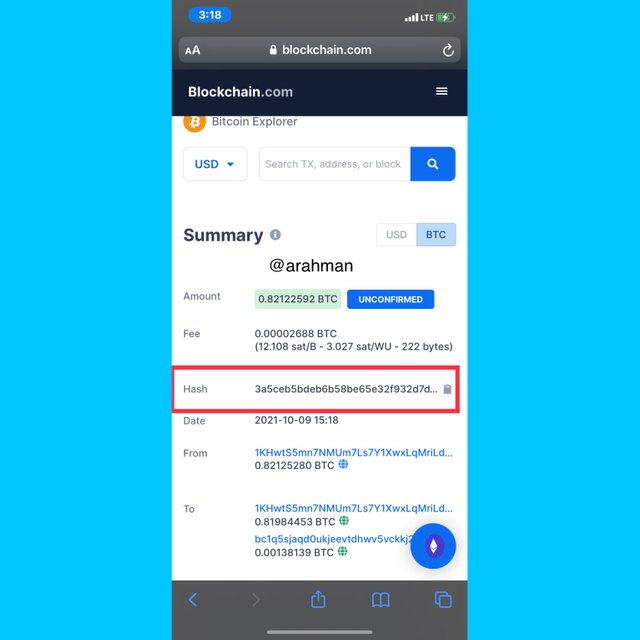

Question3: Enter the Bitcoin browser and enter the hash corresponding to the last transaction. Show Screenshot.

For this part of the assignment, I used the Bitcoin explorer. The link is here

Last transactions

Last transactionsIn the screenshots above, the hash and details of the last transaction can be observed clearly.

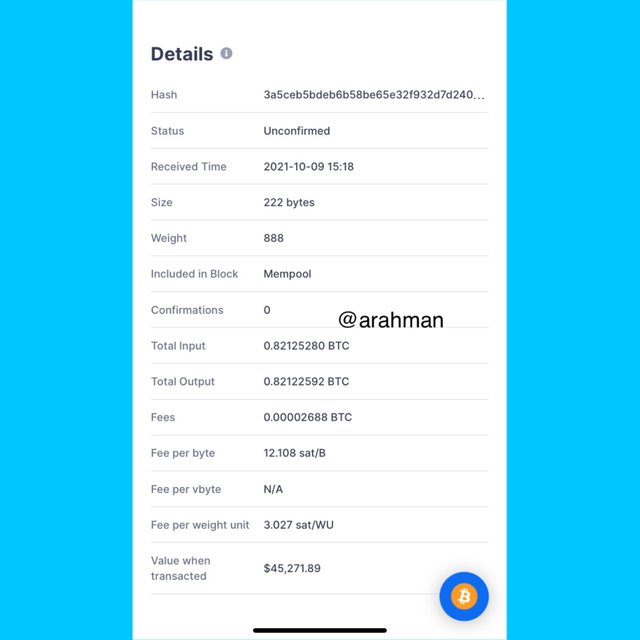

Details of Last transactions

Details of Last transactionsHash: 3a5ceb5bdeb6b58be65e32f932d7d240cc558f784a42b8007035ba351a1552c0

Details of Last transactions

Details of Last transactionsThe Bitcoin transaction was added to block: Mempool and the transaction input is 0.82125280 BTC and the output is 0.82122592 BTC. It also has a transaction fee of 0.00002688 BTC.

Question 4: What is meant by Altcoin Season? Are we currently in Altcoin Season? When was the last Altcoin Season? Mention and show 2 charts of Altcoins followed by their growth in the most recent Season. Reason your answer.

AltCoin Season

To understand this term, one must first understand the meaning of altcoins. Altcoins refers to an alternative coin other than Bitcoin that exist in the crypto space.

So generally altcoins season is a period in the crypto space whereby the various altcoins rise in value than Bitcoin. As a result, the market Dominance of Bitcoin is significantly reduced. In this period, 75% of the top cryptocurrencies will out perform Bitcoin in the crypto space.

The altcoins season occurs in a 90-days period or three (3) months. In this particular period, the altcoins become less volatile and have excellent performance.

Are we in Altcoin Season?

As I mentioned earlier, to determine whether we are currently in altcoins season, there has to be 75% of altcoins performing better than Bitcoin in top cryptocurrencies chart.

We can determine that using the data from by Blockchain center's official website. The link is here.

Altcoin Season index

Altcoin Season indexFrom the screenshot above taken at around 6:43 pm on 9th October 2021, it shows altcoins season index of 53. Since the value has not exceeded or reached 75, it shows that we are not currently in an Altcoin season.

Last Altcoins season

Last Altcoin Season chart

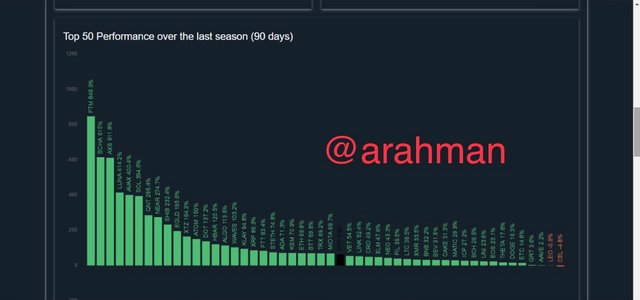

Last Altcoin Season chartThe last season of altcoins occurred in the period between 25th of March 2021 to 21th of June 2021. During that period, there was high percentage rise in many coins such as Axie Infinity (AXS), and Fantom(FTM), with more than 200% rise in these coins. As a result of this, it saw to it that the altcoin index moved up to a peak of 98%.

Two cryptocurrencies that out performed BTC

Growth of Altcoins in the last Season

Growth of Altcoins in the last SeasonDuring the last Altcoin season, several cryptocurrencies out performed BTC and some of them included; AXS, FTM,BCHA, LUNA, AVAX, SOL, NEAR, XTZ, DOT, etc.

And now I’m going to talk about just two(2); BCHA Token and AXS Token.

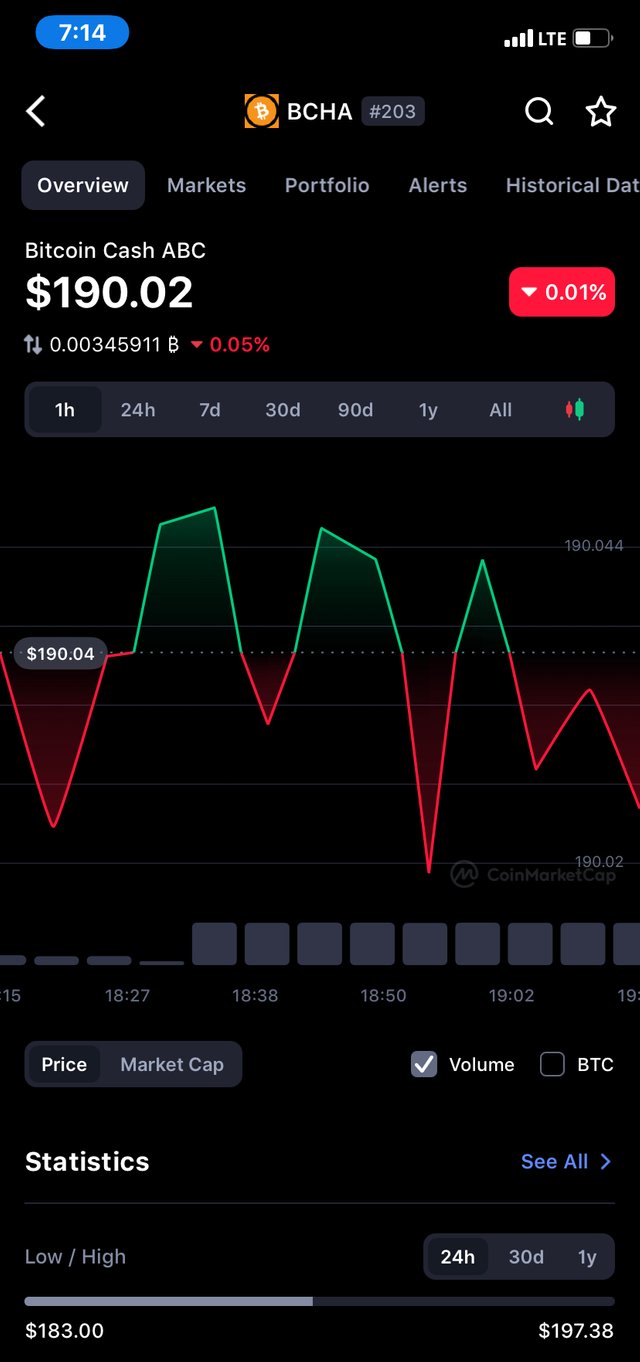

1. BCHA Token

The BCHA token is originally a native token from Bitcoin Cash ABC and this blockchain was created in the year 15th of November 2020. It was created from the hard fork of Bitcoin blockchain.

Growth Chart of BCHA from TradingView

Growth Chart of BCHA from TradingViewThe above image shows a growth chart of BCHA token during the last Altcoin season. In that period, there was a high percentage rise in the value of the token of up to about 625.1%. The BCHA token started with an initial unit value of about $32 and when the altcoin season ended, it rose to about $380.

After a couple of weeks the value of the token as decreased and it’s currently priced at $190.02. Its market value is $3.529 Bn, market Dominance 0.15%, total supply 18.573 M BCHA and $82,775.71 volume traded in the last 24 hours.

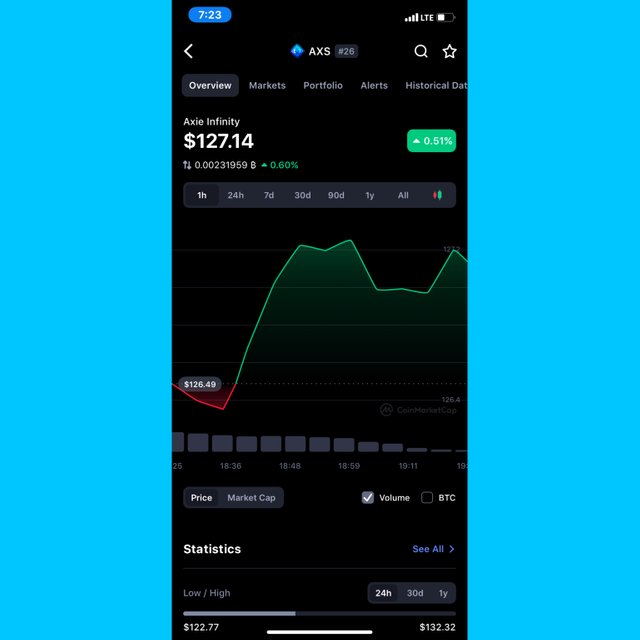

2.AXS Token

Growth Chart of AXS from TradingView

AXS comes from the Blockchain-based game Axie Infinity, and it is its native token. Before the start of the last Altcoin season, AXS was valued at $3 and it shooted very high up to about $155.08.

The percentage that this growth represented in the chart was around 980%.

[Image from CoinMarketCap]

[Image from CoinMarketCap]Currently, the price of AXS is at $127.14 with a market cap of $7.744 Bn, Total Supply of 270 M AXS, Market Dominance for 0.33% and $0.768 Bn volume of AXS traded in the last 24 hours.

Question 5: Make a purchase from your verified account of the exchange of your choice of at least 15 USD in any currency that is not in the top 25 of Cornmarket (SBD, tron or steem are not allowed). Why did you choose this currency? What is the goal or purpose behind this project? Who are its founders/developers? Indicate ATH of the coin and its current price. Reason your answers. Show screenshots.

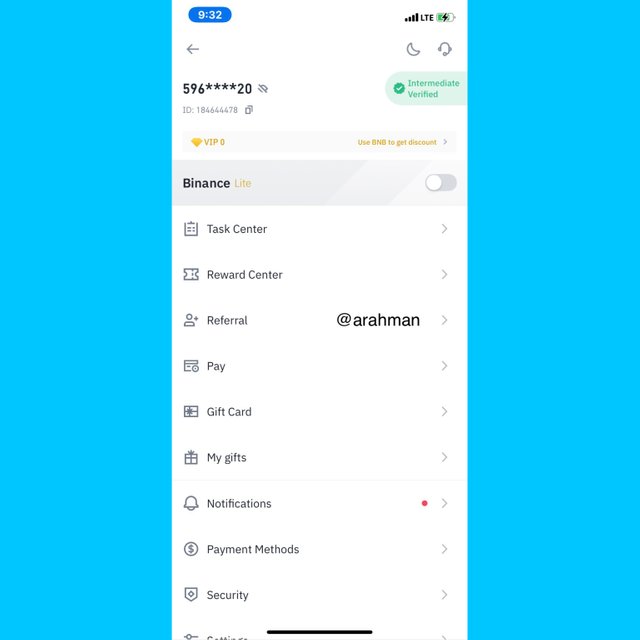

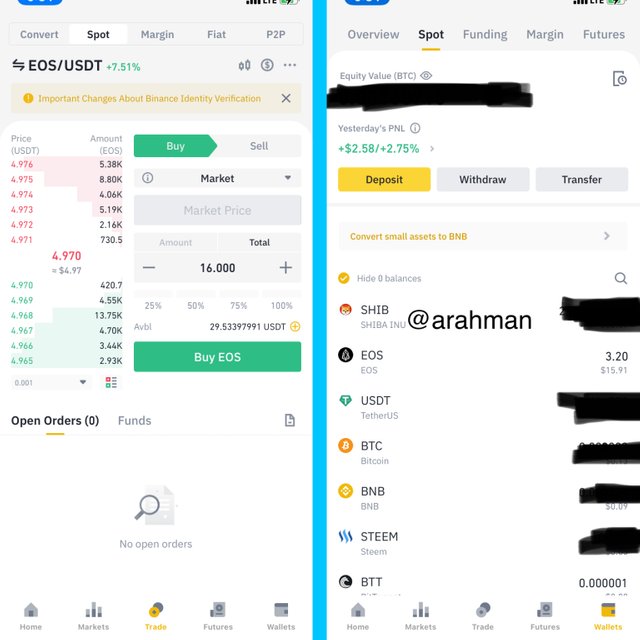

Below shows my verified Binance account and the steps I followed to buy an EOS token worth $15.

Click on trade on the homepage enter the amount of EOS to buy and click on buy.

Why I chose EOS Token

The EOS network was designed as a way of helping programmers build decentralized apps (Dapps) at very comfortable environment on the blockchain network.

EOS network uses Delegated Proof-of-Stake consensus mechanism in its operations and this makes it more scalable, fast and reliable.

This helps to create a platform for easy building of Dapps and as a result, will attract many individuals.

Goal of EOS

Since the creation of EOS in 2018, main purpose is to provide a suitable platform where developers can build and manage their DApps. Also it aim at increasing scalability, security and speed on the blockchain network.

Founders of EOS

The EOS network was developed by software company Block.One, founded in 2016 by Steemit founder Daniel Larimer and Brendan Blumer. Also, Daniel Larimer was the Chief Technical Officer(CTO) and on the other hand, Brendan Blumer was the CEO of the company . The EOS network was later launched in June,2018 by Blumer. Larimer was the one to publish its white-paper.

All time high

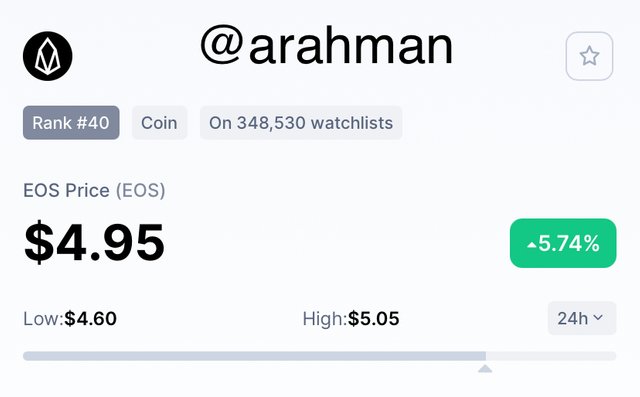

EOS has an all time value of $22.89, which occurred on Apr 29, 2018, approximately 3 years ago.

Current Price of EOS token

The current price of EOS is valued at $4.95 and it has a MarketCap of $4,755,862,113, Fully Diluted Market Cap of $5,140,930,901, Market dominance at 0.21% and with a volume of $1,459,437,167.78 traded EOS in the last 24 hours.

Also it currently sits on number 40 in the market chart.

Conclusion

From what I have learned in this week's lesson, halving is a necessary activity in the crypto space since it helps to stabilize and sustain cryptocurrencies and their prices. This is why Bitcoin perform halving every 4 years.

Also consensus algorithms are set of introductions/ protocols that guide some of the activities that occur in a blockchain. Some these algorithms include; proof-of-work, proof-of-stake and delegated proof-of-stake.

Finally, I want to thank professor @imagen for giving a very excellent and informative lesson another week again. I wish to learn more from the next lectures. Thank you once again.

Gracias por participar en la Cuarta Temporada de la Steemit Crypto Academy.

Continua esforzandote, espero seguir corrigiendo tus asignaciones.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit