Hello guys, it has been a tough week for me and this is why I haven’t been able to write much posts on this recent lectures. But with the lectures I have been able to read through, it was very informative and good. I want to thank the professor for such a good work done.

Without wasting much time, I will go on to answer the questions.

Technical Details On Reverse Strategy

Reverse strategy is usually applied in technical analysis of cryptocurrencies to help an investor determine vast increase and decrease in prices of cryptocurrencies, in short, the bullish or bearish periods.

With the reverse strategy, the investors will be able to find out when it is the right time to enter or exit a trade with regards to the bearish and bullish periods. As a result, the investor is able to acquire more profits from the trade and cut down loss. It is advisable to take care and time to analyze the trend of cryptocurrencies when they are in bullish or bearish periods in order not to accumulate losses.

In this periods, it is always advisable to wait for a cycle of at least 1 day so that you can make proper analysis before you can enter a trade. Also the use of stop loss is appropriate to use with the reverse strategy in order to cut down loss and make more profits from trades.

How Reverse Strategy Works.

The main idea of the Reverse Strategy is to observe the trend of the crypto asset for 24 hours. It isn’t necessary to open a trade anytime you see the price of a crypto asset fall, it may happen that in the bearish periods the value can still reduce much more further. But after observing it for 24 hours and you will then note than the last price of the asset, and that is the closing price. After 24 hours if the price increases to the last closing price, it is then called the opening price. This means that it is time to start a trade.

On the other hand, if you’re wondering when it is necessary to exit a trade, you should always check out for the previous high point the value of the asset has reached. You can also decide to trade in little amounts in a case where the price has surpassed the highest point and exit when you gain some profit.

In short, the Reverse strategy solely depends on the opening and closing price of the crypto assets and these points are recorded at the end of each day. With the proper analysis, you’ll be able to cut your loss down and make more profits. Also the stop loss option is recommended when using the reverse strategy.

REVERSE STRATEGY ON BTC

REVIEW OF COINGECKO

It is a platform that provides a wide range of information about several types of cryptocurrencies. It was founded by TM Lee and Bobby Ong in the year 2014, in Singapore. It helps users of this site to sort out information about their desired crypto assets and be able to make analysis on that particular crypto assets.

It is basically a cryptocurrency library which helps users sort out information for fundamental and technical analysis in order to enter a come out a successful trade.

The coingecko website can be used in as many as 21 different languages.

How COINGECKO Can Be Helpful in a Crypto Market

We all know what we can find in libraries, and here COINGECKO serves as our library in the crypto world. You can find what ever information you are curious about on this platform with just one click of a button.

With the COINGECKO website, You don’t need to browse through several websites before you can get access to particular information you want on a cryptocurrency. All information you are curious to know about are found on the website.

You can find dates of release of a crypto asset, the volume of crypto asset that is currency in the market, the price of the asset and many other information you wish to know about the asset. You can also get information of the supply and demand of a crypto asset and the high and low point prices of the asset. With the information gathered from this website, you can now be sure from the analysis as to when it is good for you to enter a trade and when it is necessary to exit a trade.

Historical information and charts of cryptocurrencies can be found on the platform too. That is to say, you can find out the founders and dates of which a particular currency was invented. You can also find about the type of consensus algorithms used in the blockchain of that asset and also the tools and wallets it requires. With all the information acquired you can make a detailed and proper analysis and make your move.

Lastly cryptocurrencies are ranked depending on the market capitalization and dominance so as to feed users with the performance of cryptocurrencies and other necessary information.

COINGECKO Features

There are several features on the website that can help make information gathering easier and faster. You should sign up in order to access these features.

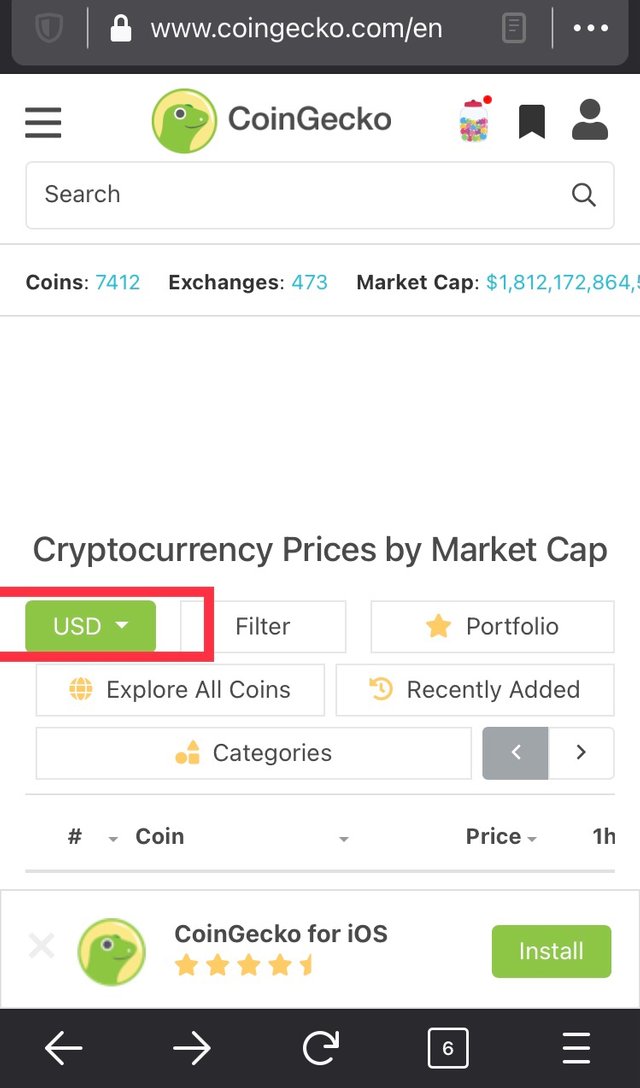

An overview of the COINGECKO mobile website

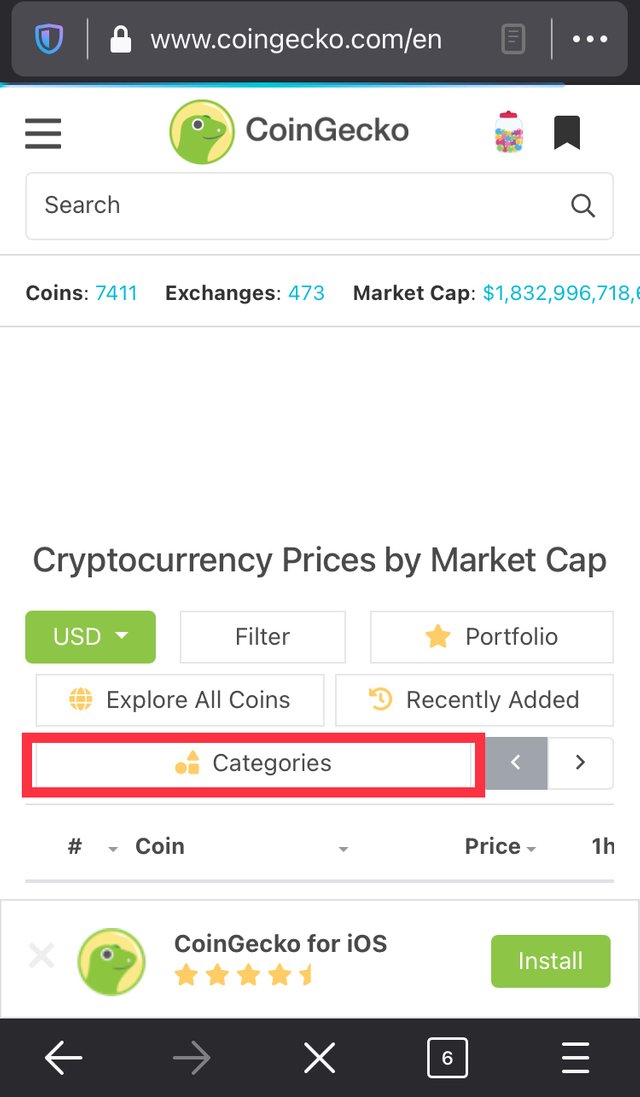

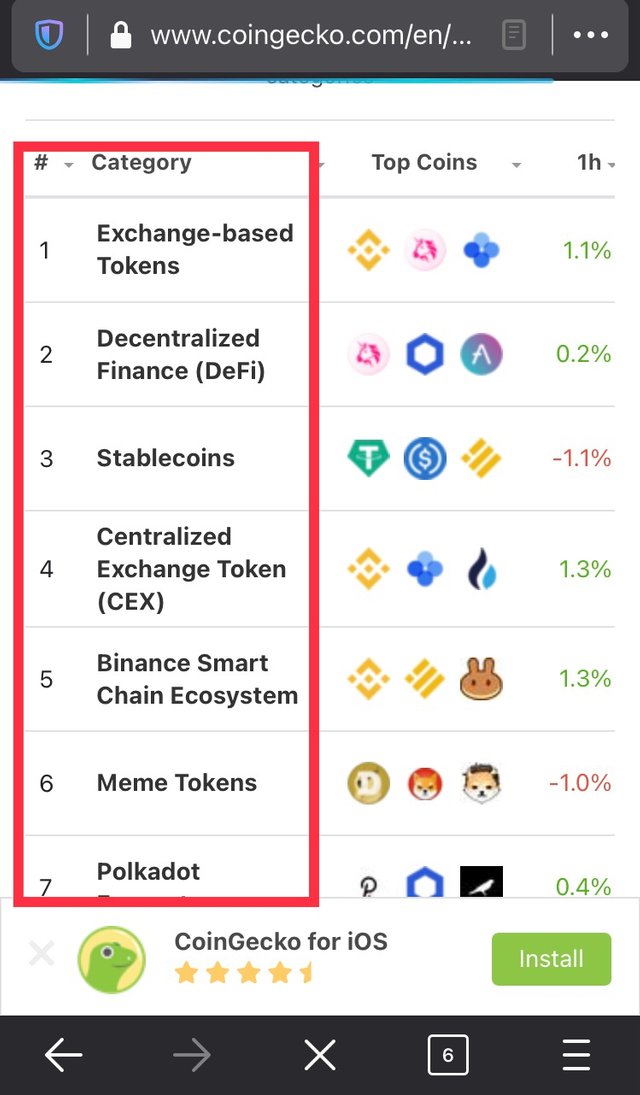

Categories: This feature helps the user to sort out the cryptocurrencies in different categories. Some of the categories include; Stable coins, Meme tokens, Exchange-based Tokens, Governance, Yield Farming and many other more categories.

Click on “Categories” to display it.

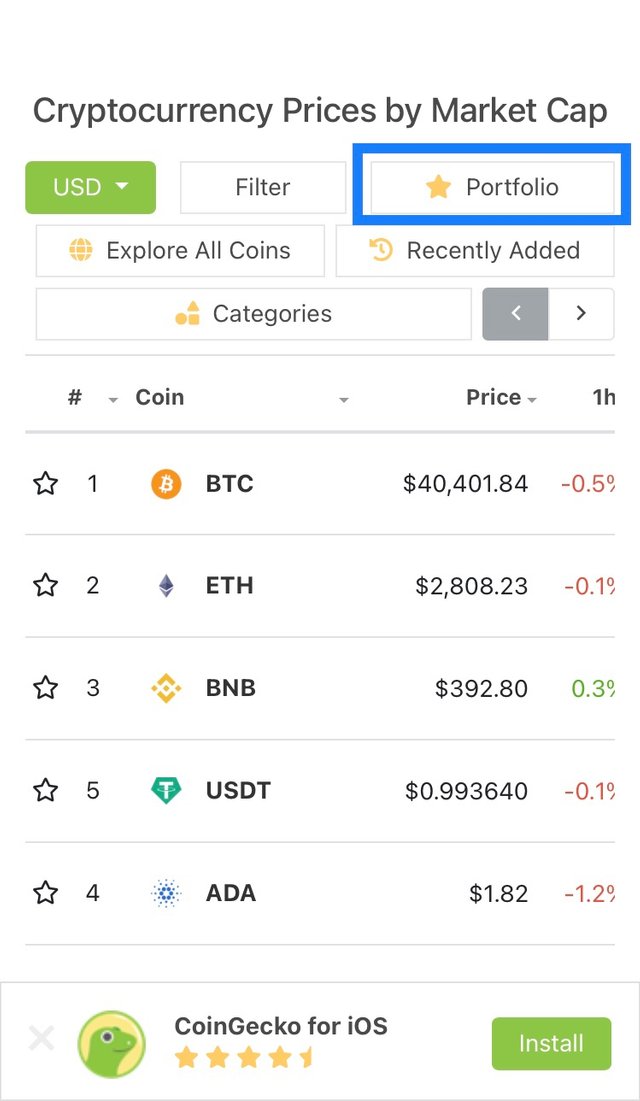

Portfolio: Already, we have learned in our previous lectures about portfolio. We were able to learn in to detail the importance of Portfolio and how traders use it. On the Coingecko site you can create a virtual Portfolio which will help you analyze in different ways the changes in the following periods.

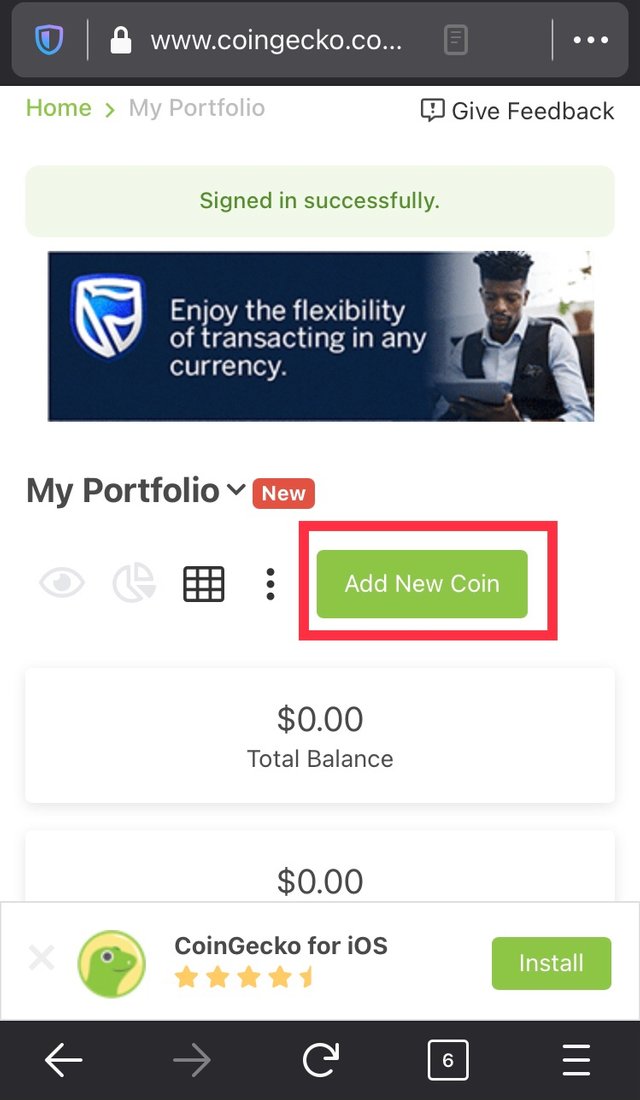

Click on “Portfolio”, feature and it will be displayed as the one below.

You can add a virtual coin by clicking on “Add coins” in order to help you make analysis on the coin.

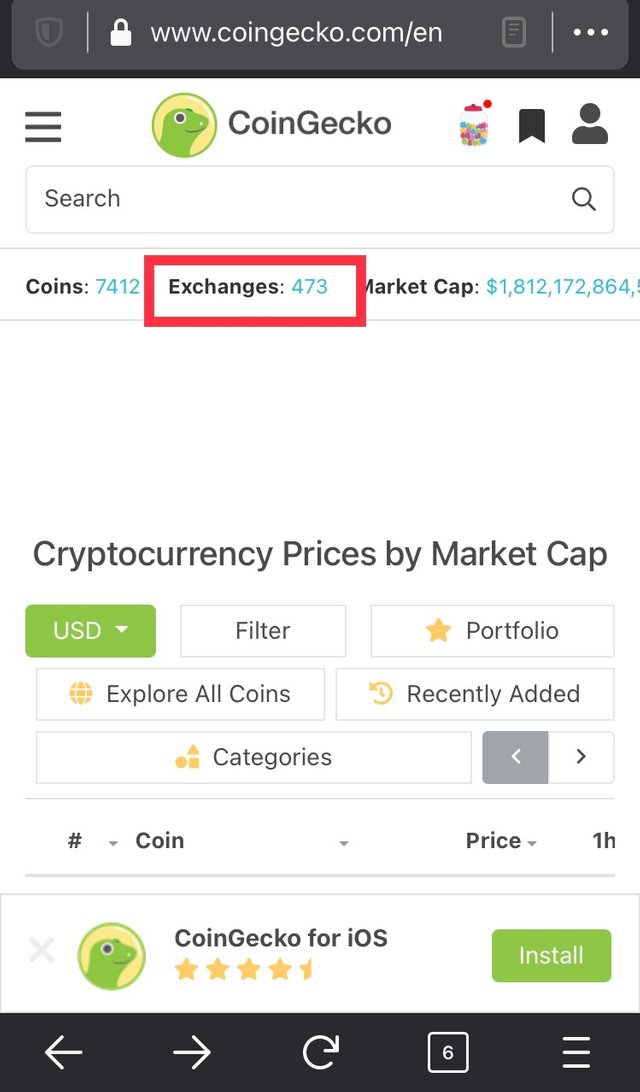

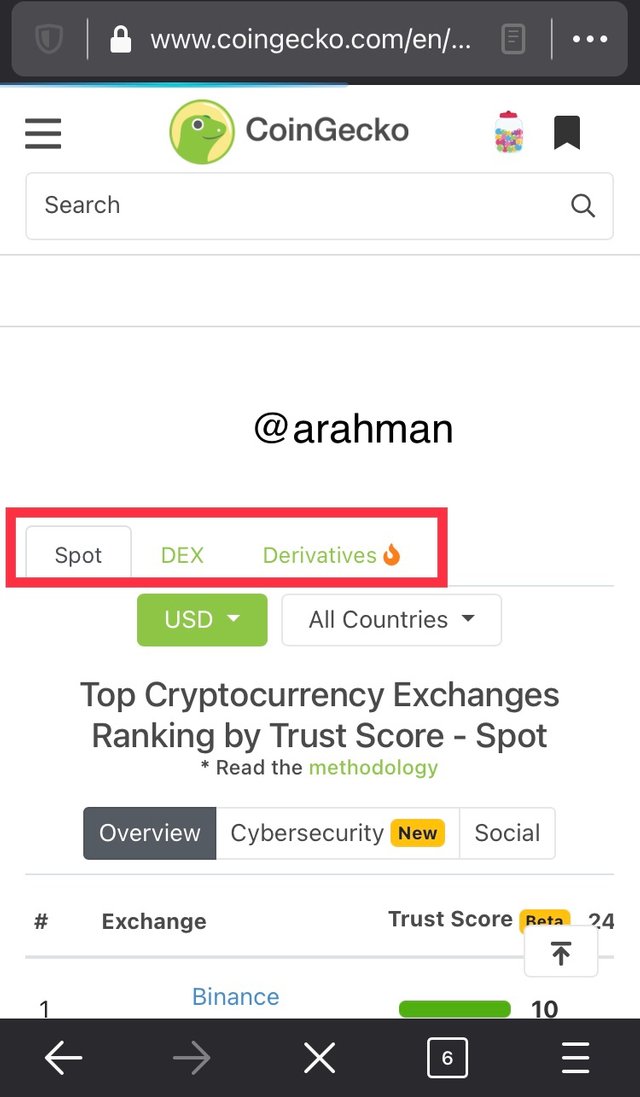

Exchanges: There are 3 different headings Coingecko site provides that aids in examining exchanges. These are; Spot, DEX and Derivaties.

Each of the sections you click on provides a specific services. That is to say, the spot section will provide spot services and so as the others.

To display the “Exchanges”, feature click on it and it will be shown as below.

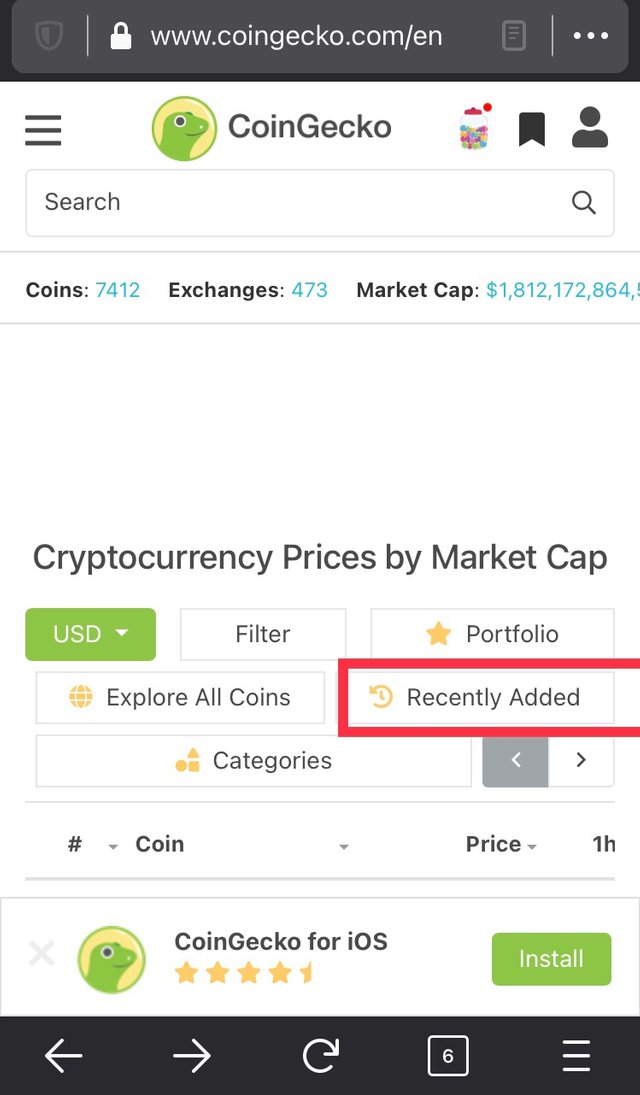

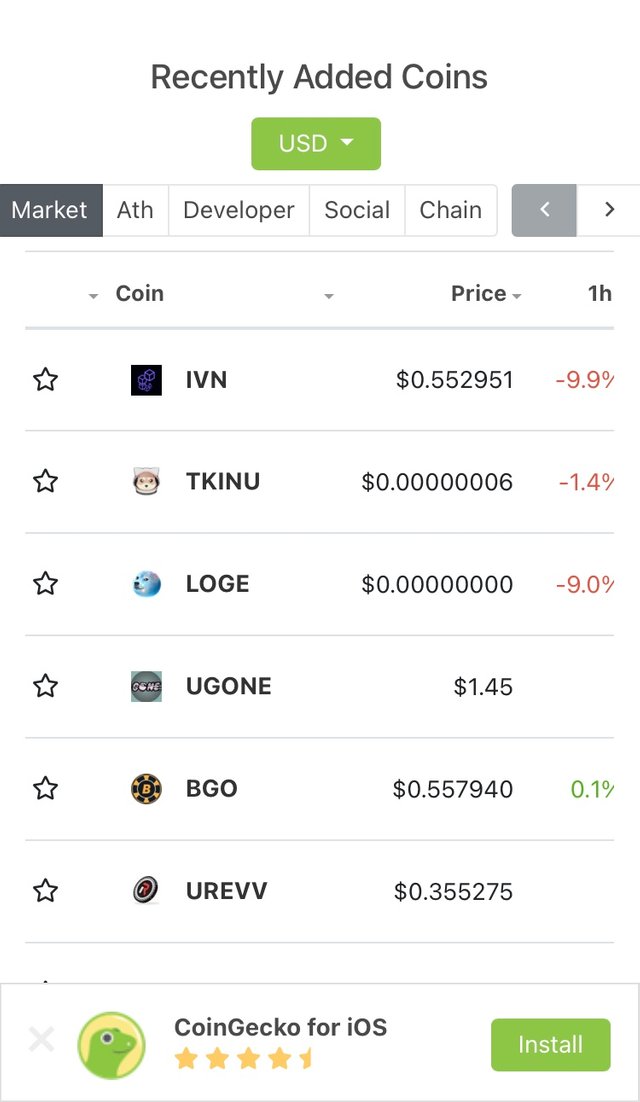

Recently Added Coins: This feature displays the coins or assets that have been recently added to the website. This helps you to discover new coins that could be good to start trading with.

To display the “Recently Added coins”, feature click on it and it will be shown as below.

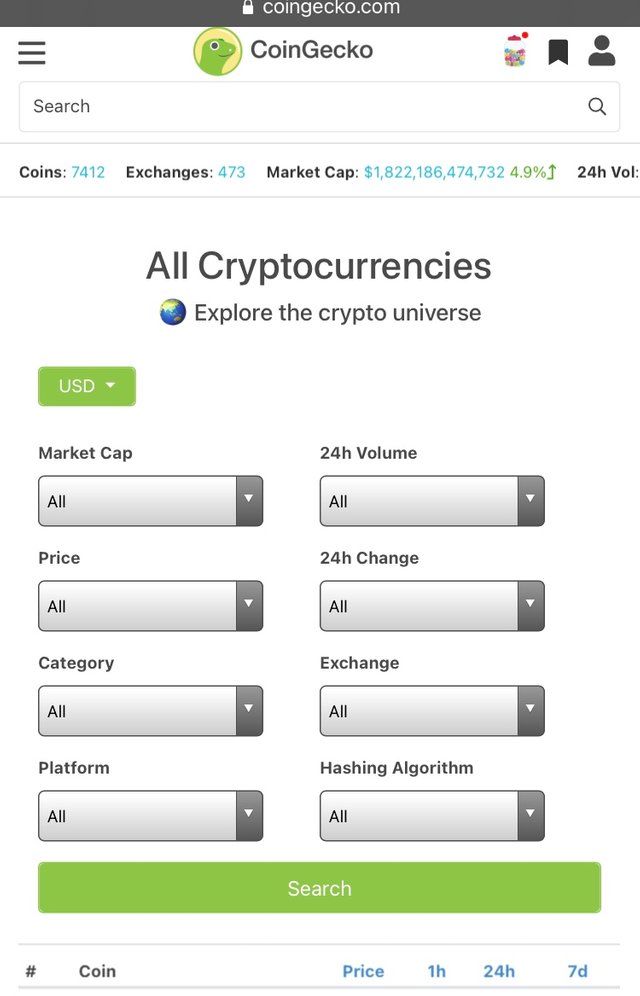

Explore All Coins: This option helps you to research on all the coins available in the crypto market. You can sieve through or filter them according to your own liking. For example you can filter them according to price, Market cap and volume.

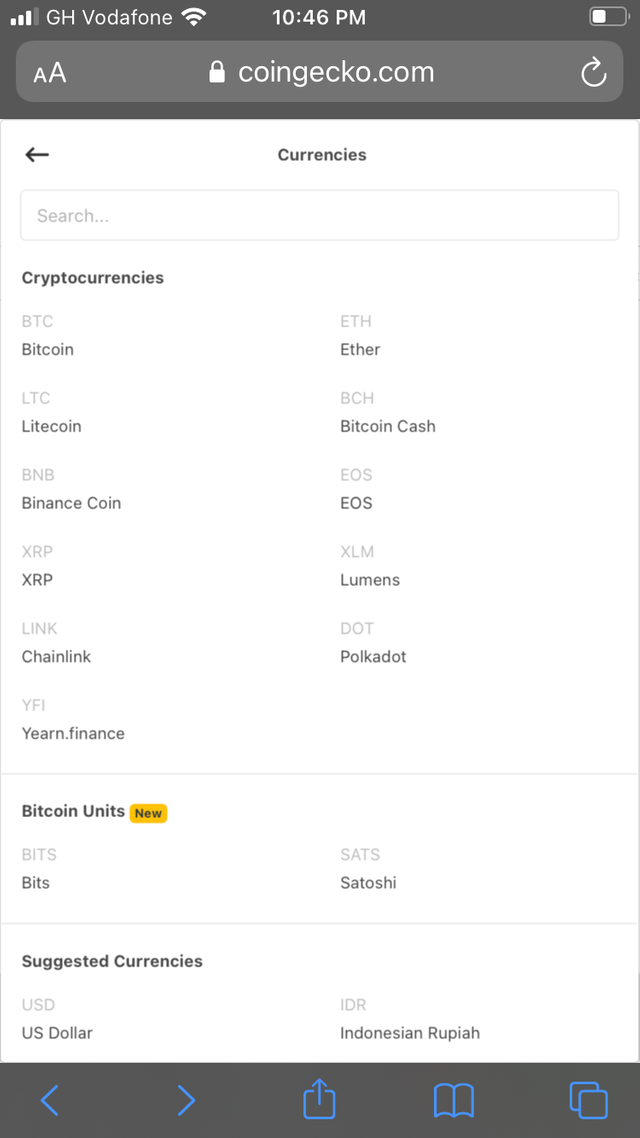

Currency: This is another useful tool that helps a user to convert from cryptocurrencies to local currencies.

WEEKLY PRICE FORECASTING FOR ETHEREUM(ETH)

Ethereum is a blockchain that is built on a decentralized platform and it was founded by Vitalik Buterin in the year 2013. The coin itself is ETH, and it is the second highest in the CoinMarketCap rank of cryptocurrencies.

My last week’s predictions for ethereum was slightly below the actual outcome. It actually exceeded my expectations.

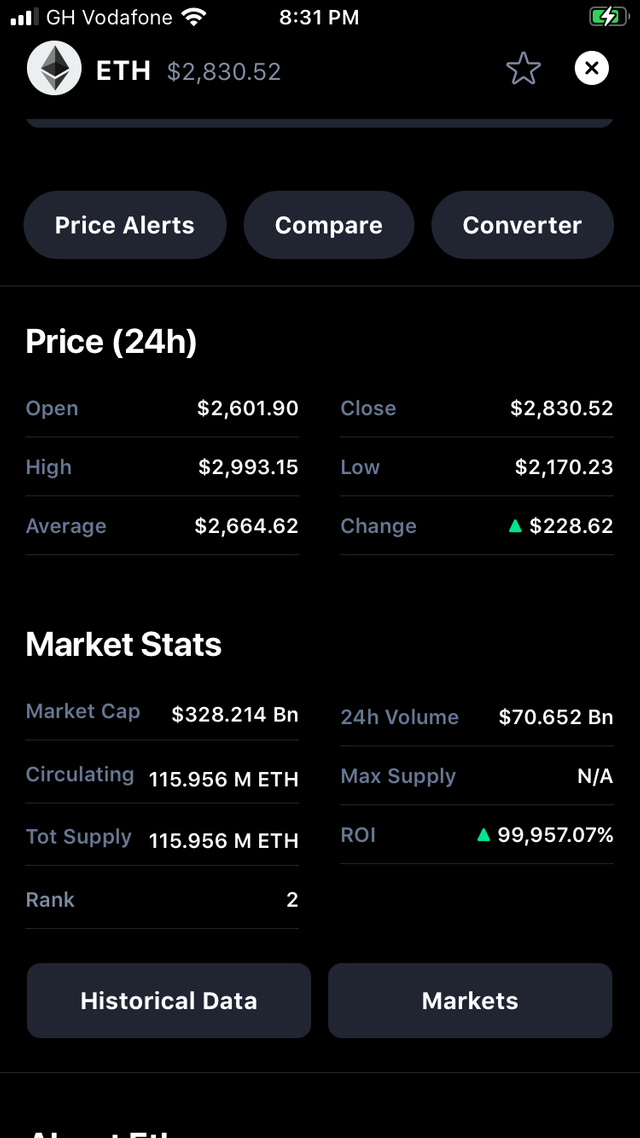

Below shows the current price and market stats of ETH:

WHY I CHOOSE TO PREDICT ETH

The performance of the ETH coin in the market has been very impressive since the beginning of this year. It has really caught my interest and I have personally ventured into trading in ETH. It has been very good until just recently when the price dropped significantly.

For this demonstration, I will be using a 7-days chart of Ethereum from CoinMarketCap app.

From at the above chart on there was a high value of $4,137.48 of 1 ETH on May 14,2021. Within 24 hour period it would have been a very good time to exit the trade. Going forward to somewhere May 18, the price reduced to as low as $3,361.70 and created a support level at 2,183.32 within some hours. At that level, I would have advised investors to start a trade as it went up gradually for a bit.

In the chart above, it can be observed that there is a new resistance level created at $3,400. But with the support as low as 2,100 and about, starting a trades is likely to bring profits. Later today on May 20, there has been hard buys of the coin, and I think it is starting to pick up pace. Hence there will some significant increase in the value of the coin in the coming days.

My prediction for the coming week is that there will be a break of the resistance and it may surpass a price value of $3,3500 and above.

Also if there is going to be a fall, I expect not more than $2,500 in the market value of Ethereum.

Conclusion

With regards to COINGECKO, I have been able to explore it very well to my satisfaction. And with time I will be using some of its features such as the currency, portfolio and added new coins so that I can discover and make analysis of cryptocurrencies to improve my trading in the crypto market.

I want thank the professor @stream4u for a very well delivered lecture. I have really acquired some new skills from COINGECKO and it is going to help me make proper analysis of cryptocurrencies so as to gain much more profits.

Thank you for joining The Steemit Crypto AcademyCourses and participated in the Homework Task.

COINGECKO Features, so there still many left which you could try to mention and explore with details.

Price Forcast For Crypto Coin , you need more research to explore this point, it is not very much well explained ,

look fine home

thank you very much for taking participate in this class

Grade :7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you prof. I will try to improve on that next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit