C

C Explain in your own words what FOMO is, wherein the cycle it occurs, and why?

The fear of missing out occurs usually in the bullish period and this happens when the price of a particular asset is increasingly going high. When this happens, one may receive some information about the asset and how it has currently been increasing in price. With this some investors feel left out and hence try to start a trade at that moment in order to also get some profits and they usually do that, hoping there will be another increase in the price of the asset. At the end it goes the other way, leaving investors who entered the market late to attract huge losses.

A clear example can be observed with Bitcoin, sometimes it goes up and sometimes it goes low. For some investors, they might thing the price of BTC may never go up and so the feel reluctant to invest into it. But suddenly if they hear or find out about the sudden increase in the price of the coin, they will feel that there is the need for them to start putting investment into the asset. When this happens, people who were able to enter the market before might have made enough profits on the asset and will decide to sell. And this may actually cause a significant drop in the price of the asset, causing late investors to incur losses.

When dealing with cryptocurrencies, it is mostly advised that you remove your emotions out of it and focus on facts and analysis before you start investing. When you’re able to do this, you will understand the price volatility of crypto assets and this will help prevent FOMO from catching up to you. Also this Fear of missing out usually occurs in newbies in the crypto market but sometimes to the less experienced ones get caught up in this act.

FOMO is best experience at the point when the bullish period is nearing an end and it is point where market entry is wrong and not advisable. This areas where the market entry are closed can be referred to as thrilled zones . But usually it is triggered in the human emotion at a lower spike thereby causing newbies to contemplate their choices, leaving them in a state where they are left to choose whether to invest in the asset or not to invest in the asset. This triggering stage of FOMO is referred to as the Belief stage.

I will now explain further with the image below.

As you can see in the above image I have clearly stated all the three stages that occurs in FOMO. In the first stage that is the belief stage, investors who have not yet entered the market and have not done any analysis will be thinking that price of the asset may not go up and will now be reluctant to invest. As time goes by, they will check back to see it has gone significantly high, that is the thrilled stage and they become eager to also enter the market to try and get some profits. When this happens, the bullish period would be approaching its end and investors entering the market at the end of the bull period, find themselves making losses.

Explain in your own words what FUD is, wherein the cycle it occurs, and why?

Just like FOMO, this FUD also happens with human emotions and this only happens in the opposite direction of FOMO. That is to say FUD occurs when there is rapid declination of price of an asset causing fear in inexperienced investors to make wrong exit points of the trade. When this happens, the might think that they have prevented a much worse case of making losses but in truth, it is not the case. If they were patient for sometime, the chart would have been corrected within the next few days and they would have made profit.

To understand it clearly, I would be using an example of Bitcoin. After a bull period of Bitcoin has ended, many investors would have sold their assets in order to prevent losses but on the other hand, newbies who have not monitored the trend would tend you start opening trade at The start of bearish period of Bitcoin. Within sometime, the price of BTC may start to drop and this would cause some fear and doubt in the newbies. Here, the will thinking if they don’t sell their assets, they will later be forced to get nothing and this leads them to conceding some percentage of losses. And now they will think they have made the right choice by selling their assets when the price has started dropping not know there will be a correction in the trend which will even change to give them much profits.

Now I will be explaining further what FUD is with sample chart of a crypto asset below.

In the above image, I have clearly stated the various stages in the FUD cycle. The very early stages is the complacency stage where there is a slight signal of the future bear period and this is where experienced investors quickly exit the trade. After sometime when the price has started dropping, that is the anxiety stage, the newbies who might have entered the trade at that time will start to become cautious of the trend. The denial stage is where some newbies might be attempting to exit the trade in order to avoid further losses. In the panic stage, most of the newbies would have decided to exit the trade, and this would give them some huge losses. Now, the experience traders will take this opportunity to observe and analyze this market cycle to anticipate a good entry position in the future.

Choose two crypto-asset and through screenshots explain in which emotional phase of the cycle it is and why. Must be different phases.

For the purpose of this demonstration I have chosen BTC/USD and ETH/USD pairs.

As seen in the above chart, I have clearly indicated the various stage of the market Cycle of BTC. in the Hope stage some investors made some hard purchases of the coin giving it a steady uptrend in the chart and later on, when the price was going high it created some awareness to more investors and that is the Optimism stage. This is where more experienced investors decided to enter the market of BTC.

After the continuous uptrend of the bullish period, some experienced investors also decided to join in the trade by making purchases of BTC and that is in the Belief stage. Due to FOMO effect some traders also decide to join the trade by making entry positions at the thrilled stage and in this stage buying BTC at a high price than in the belief stage.

The next stage is Euphoria and this where the price of BTC might have reached its peak. When this happens, experienced investors start making plans to create a good exit position and prepare for the bearish period. So immediately there is a sign, that is the Complacency stage, they start to exit the trade and make enough profits by selling their assets.

After a while, the FUD effect comes in the anxiety and denial stages to further confirm the bearish period and this is where more of the newbies plan to exit the trade.

In the panic stage, the inexperienced traders would all have exited the trade and made losses. At this moment, there’s is small chance for the experienced investors to go back to the market but at latter part of the chart disbelief stage is where the current market of BTC is and this may be a good opportunity to start a trade but currently, the market cycle is in disbelief stage.

From the image above, there is clearly indication of the stages in the market cycle of ETH. From the early part of the chart, it can be seen that the market is starting to recover from an ended bear period, hence there is a creation of the hope stage. In this stage the experience investors will start to monitor the trend of the chart and will be anticipating a market entry. When it reaches the belief stage some of them start to open a trade hence causing some steady increase in the price of the ETH.

With this, the thrilled stage appears and it attracts more investment into the coin which will also make some more significant increase in the price of the coin. Later on, the coin reaches its higher peak causing the euphoria stage. At this point the experience investors are anticipating an exit point so as soon as there is appearance of the complacency stage, it creates awareness for future bear period. Hence they decide to exit the market at this point. This stage is too late to enter the trade but due to the FOMO effect, some newbies are not aware and so they decide to enter the market.

When there is further dip of ETH, thus in the anxiety and denial stage it confirms the theory of a bear period and the inexperienced traders start to plan an exit position. Before it is too late they realize they have made a mistake and hence exit the market at wrong position, that is the panic stage and they tend to have bear some losses. The next stage is not clear whether there is going to be an uptrend or downtrend and this leads to the disbelief stage.

In the current market cycle of ETH one can not truly state whether it is in the belief stage or disbelief stage but it can be seen that there is some uptrend in the ending part of the chart.

Based on the analysis done in question 3, and the principles learned in class, make the purchase of 1 cryptocurrency in the correct market cycle. The minimum amount of 5USD

For this demonstration, I have chosen to make a purchase of BTC and below are the steps I went through.

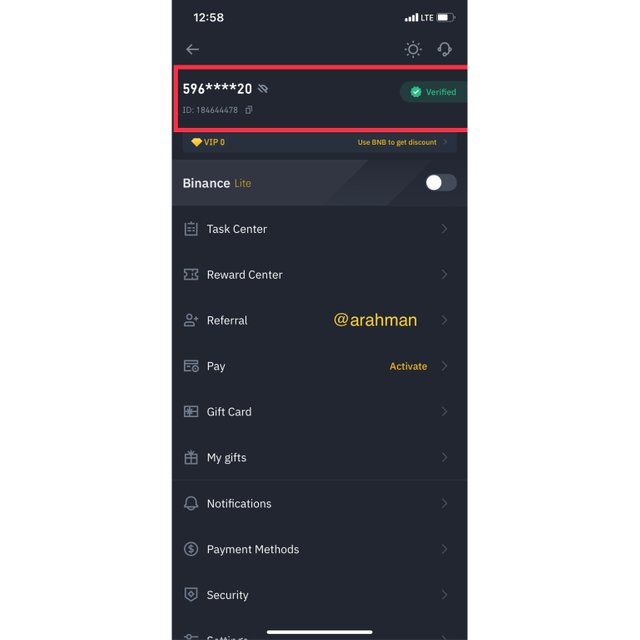

Screenshot of my verified account

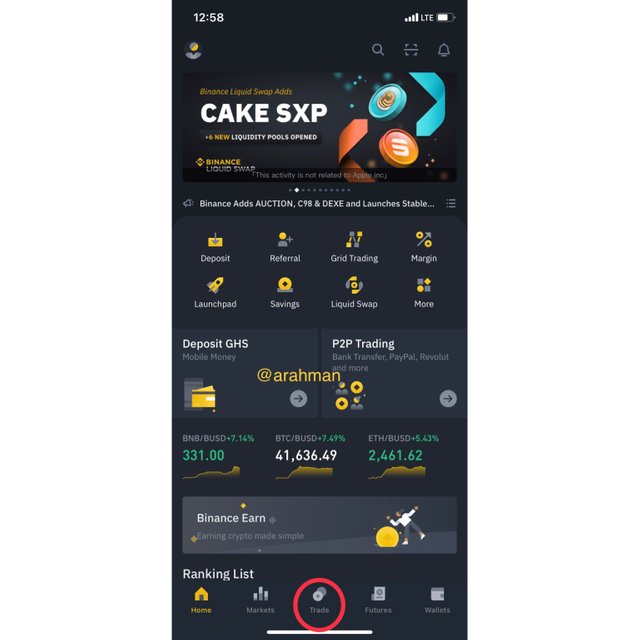

After opening my Binance app, I go ahead and click on “trade” at the bottom part of the screen.

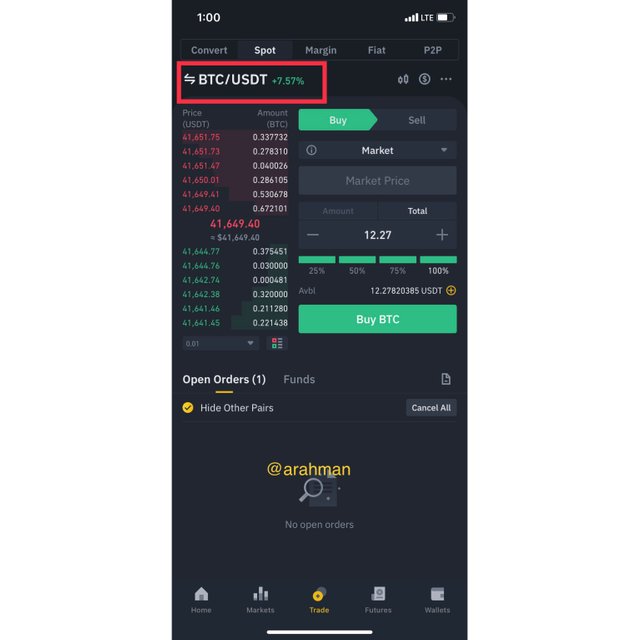

In the next screen I select my preferred pair. ie BTC/USDT and enter the amount of USDT I want to trade for BTC. Then click on “Buy”.

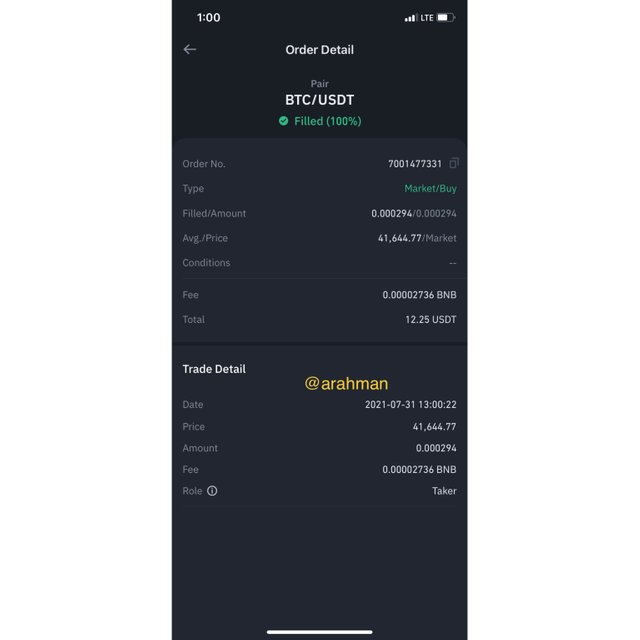

Below is prove of the transaction I just made and that is the purchase of BTC worth about $12.

Conclusion

When it comes to cryptocurrencies, we should always try to remove our emotions from in and always keep in my price volatility of crypto assets. When we are able to do this, we can earn much more profits from trading in cryptocurrencies. It is not always necessary to try and recover your losses and any attempt to do such thing may even worsen your losses.

From my observation, both experienced and inexperienced investors can both get caught up by their emotions and the FOMO and FUD can affect most of us in the crypto market. So the best way out is to always be patient and also try to do some technical and fundamental analysis when trading and this can definitely improve our trading.

Thank you professor @allbert for this lecture, it has really been informative.

Hello, @ Thank you for participating in Steemit Crypto Academy season 3 week 5.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you professor @allbert, I will take note of your advice and improve next time.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit