Whether we pull out paper bills or swipe a credit card, most of the transactions we engage in daily use currency. Indeed, money is the lifeblood of economies around the world. Currency refers to paper money or coins that are in circulation. But currency is actually only a small piece of the monetary economy and just one consideration when looking at the total money supply.

Indeed, most money today exists as credit money or as electronic records stored in databases in banks or financial institutions. But still, the bread and butter of everyday transactions is currency, and that is what we will look more closely at here.

Currency is the physical money in an economy, comprising the coins and paper notes in circulation.

Currency makes up just a small amount of the overall money supply, much of which exists as credit money or electronic entries in financial ledgers.

While early currency derived its value from the content of precious metal inside of it, today's fiat money is backed entirely by social agreement and faith in the issuer.

For traders, currencies are the units of account of various nation states, whose exchange rates fluctuate between one another.

While currency technically refers to physical money, financial markets refer to currencies as the units of account of national economies and the exchange rates that exist across currencies. Because of the global nature of trade, parties often need to acquire foreign currencies as well. Governments have two basic policy choices when it comes to managing this process. The first is to offer a fixed exchange rate.

Here, the government pegs its own currency to one of the major world currencies, such as the American dollar or the euro, and sets a firm exchange rate between the two denominations. To preserve the local exchange rate, the nation’s central bank either buys or sells the currency to which it is pegged.

The main goal of a fixed exchange rate is to create a sense of stability, especially when a nation's financial markets are less sophisticated than those in other parts of the world. Investors gain confidence by knowing the exact amount of the pegged currency they can acquire if they so desire.

However, fixed exchange rates have also played a part in numerous currency crises in recent history. This can happen, for instance, when the purchase of local currency by the central bank leads to its overvaluation.

The alternative to this system is letting the currency float. Instead of pre-determining the price of foreign currency, the market dictates what the cost will be. The United States is just one of the major economies that uses a floating exchange rate. In a floating system, the rules of supply and demand govern a foreign currency's price. Therefore, an increase in the amount of money will make the denomination cheaper for foreign investors. And an increase in demand will strengthen the currency (make it more expensive).

While a “strong” currency has positive connotations, there are drawbacks. Suppose the dollar gained value against the yen. Suddenly, Japanese businesses would have to pay more to acquire American-made goods, likely passing their costs on to consumers. This makes U.S. products less competitive in overseas markets.

The Impact of Inflation

Most of the major economies around the world now use fiat currencies. Since they’re not linked to any physical asset, governments have the freedom to print additional money in times of financial trouble. While this provides greater flexibility to address challenges, it also creates the opportunity to overspend.

The biggest hazard of printing too much money is hyperinflation. With more of the currency in circulation, each unit is worth less. While modest amounts of inflation are relatively harmless, uncontrolled devaluation can dramatically erode the purchasing power of consumers. If inflation reaches 5% annually, each individual’s savings, assuming it doesn’t accrue substantial interest, is worth 5% less than it was the previous year. Naturally, it becomes harder to maintain the same standard of living.

For this reason, central banks in developed countries usually try to keep inflation under control by indirectly taking money out of circulation when the currency loses too much value.

The Bottom Line

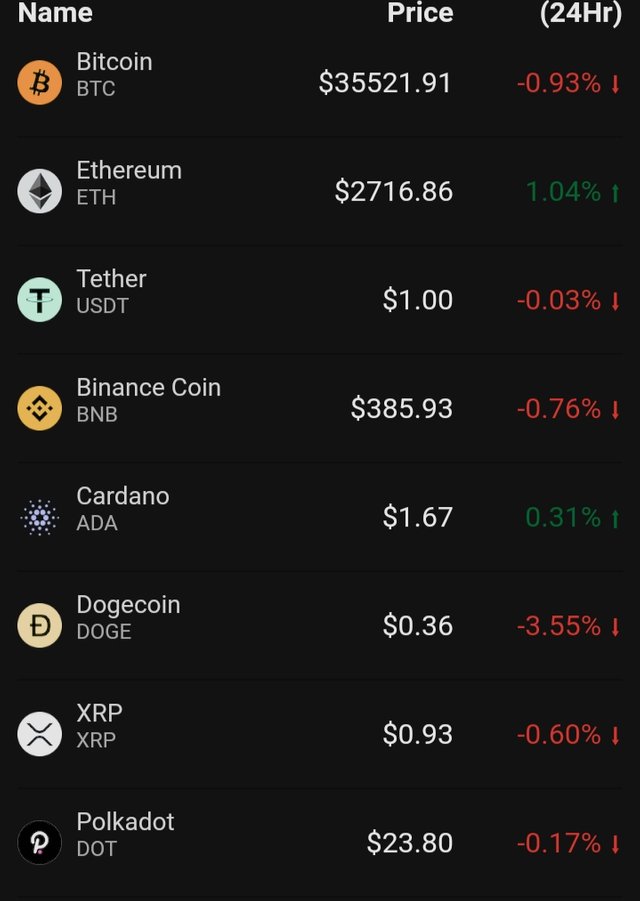

Regardless of the form it takes, all currency has the same basic goals. It helps encourage economic activity by increasing the market for various goods. And it enables consumers to store wealth and therefore address long-term needs. Currency was once limited to the domain of physical coins and bills, but today's digital economy means that money now exists as data stored in ledgers at banks, and is even transcending the possibility of tangibility with the development of cryptocurrencies such as Bitcoin which can never be made physical.

Copyright © 2021 Currency quotation

@arifps, Please do not post irrelevant content in Crypto Academy. This community is an exclusive niche for crypto-academy-related publications.

Any repeated attempt will be considered an act of spamming and will mute you in this community.

Cc- @sapwood

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit