I want to thank prof @reminiscence01 for this wonderful lecture. It was very educative and interesting. I will go straight to answering the home task.

What do you understand by "Risk Management

Risk management is an integral aspect of cryptocurrency trading that every good trader is expected to take advantage of. The psychological aspects of crypto trading require that every trader has a plan for minimizing losses made from the market. Risk Management is eventually more important than any strategy that a trader can use. Any strategy that does not have risk management as a vital part of it is almost useless because the trader will lose all this trading capital in the long run.

Flashback to December 2019 when I just started trading the crypto market. I had no plans for risk management because I was not taught and this led me to lose over 1,000$ in a weekend. This happened because I was over leveraging by using a big lot size and I had no stop loss in place. So I learned the concept of risk management through experience.

Risk Management is defined as the methods and skills used in reducing the risk of losing your whole or a large part of your trading capital in the crypto market. In essence, it helps a trader to be exact on the amount of money you are losing from the market if it goes against your prediction without fear of losing your whole capital. Risk Management is a very basic and important aspect of crypto trading that should be even taught and understood first before any other thing.

Losing in the crypto market is a part of trading but the only remedy to minimize it is by applying risk management. There are various tools used in managing risk like the 1% rule, using your take profit and stop loss, using risk to reward ratio, etc. I will explain these tools later.

What is the importance of risk management in Crypto Trading

Risk Management helps in Capital Security, This is the first benefit of risk management because without your capital being secured there will be nothing to trade with. It helps you to ensure that a large amount of your capital is remaining even when you lose a trade

Risk management helps to build healthy psychology for the trader - This is true because when you have your stop loss and take profit set, you will not have anything to worry about as the process is automatic.

Risk Management helps you to maximize your profit and minimize your loss which is the essence and purpose of trading itself.

Risk management helps traders in planning well-composed and perfect trades.

Explain the following Risk Management tools and give an illustrative example of each of them

1% Rule

This is one of the skills used in managing risk in trading used by most traders. This entails risking only 1-3% of your account size in a trade. This is a very important tool as it helps traders to minimize because your losses will only be in 1-3% of your account size which was put into the trade. Some traders stick to 1% while others stick to 2% and others 3% depending on their choice and account size.

Illustration

Let assume that my account size is 20,000$ and am willing to risk 1% per trade, by this rule I will have to put in only about 200$ in the trade thereby still securing about 19,800$ in my wallet.

Even if I take 5 trades in a day and lose 3 out of the 5 that means that I lost a total of 600$ that day.

Risk-reward ratio

This is another risk management tool used by many professional traders in the crypto market. It helps traders to avoid the problem of making money from trade and losing It to the next trade available. It involves simply knowing your take profit and stop-loss point. The most recommended risk to reward ratio is 1:2 which means that your take profit will be twice your stop-loss point. If your trade setup does not get up to this ratio, it's better to cancel the trade and wait for another good opportunity to execute the trade. This risk to reward ratio helps you in protecting your account from over-trading and psychological imbalances.

Illustration

If I wish to risk 50$ in a trade which is 1% of your 5,000$ account, it means that my profit target is 100$ against losing the 50$. So this is a good risk management tool because if I take 5 trades in a week risking 50$ each and I eventually loss 3 out of the 5 trades, I will still be in profit.

100$ x 2 = 200$

50$ x 3 = 150$

So you still have a profit of 50$ despite losing 3 trades.

Stoploss and take profit

This is a very good risk management tool because it helps to reduce the emotional distress attached to trading the crypto market. They are automated tools used to exit the market when activated. Stop-loss is an exit order that closes the trade when the market is unfavorable and in a loss while take profit is an exit order that closes trade automatically when the market is favorable and in profits. Every crypto trader knows that the market/trade will either be in profit or loss due to the volatile nature of the market and that's a good reason for the take profit and stop loss to maximize profit and minimize losses.

Illustration

The stop loss and take profit should be at a ratio of 1:2 as mentioned above. The stop loss should not be too tight to avoid price hitting it and bouncing back to the take profit zone. The take profit and stop loss should be included in the planning of the trade and it should be put during the trade execution as well in order to manage the volatility of the market.

Open a demo account with $100 and place two demo trades on the following;(Original Screenshots on Crypto pair required). a) Trend Reversal using Market Structure. b) Trend Continuation using Market Structure.

Explain the trade criteria.

Explain how much you are risking on the $100 account using the 1% rule.

Calculate the risk-reward ratio for the trade to determine stop loss and take profit positions.

Place your stop loss and take profit position using the exit criteria for market structure.

Trend Reversal using market structure

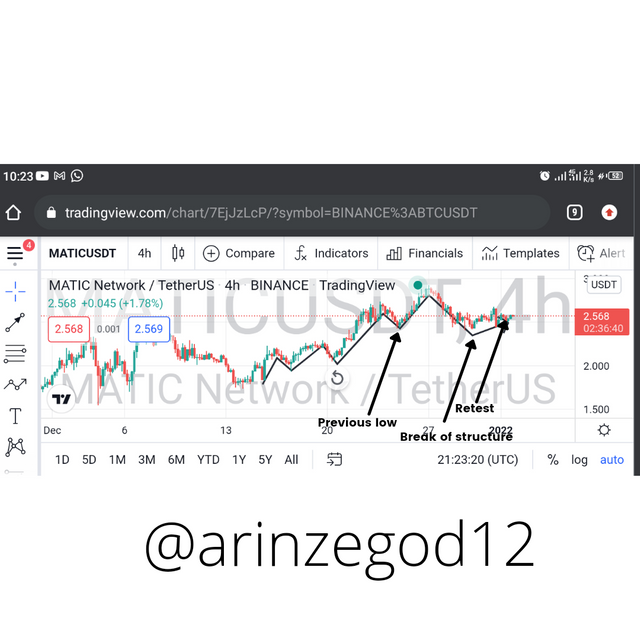

For the trend reversal, I am going to be using the chart of MATICUSD. Now, I am going to be discussing the entry and exit criteria for taking this trade.

Entry criteria

Now firstly you look out for when the price ceases to create a new high. In the screenshot below, you will notice that price was forming higher highs and higher lows and it failed to create a new high and then crushed the previous low.

Then next, after the break of market structure, we await the price to retest the broken level, which will serve as the resistance. Then, upon retracing the level, we enter the trade when an engulfing candle forms to the downside. See the screenshot below.

Source: Tradingview

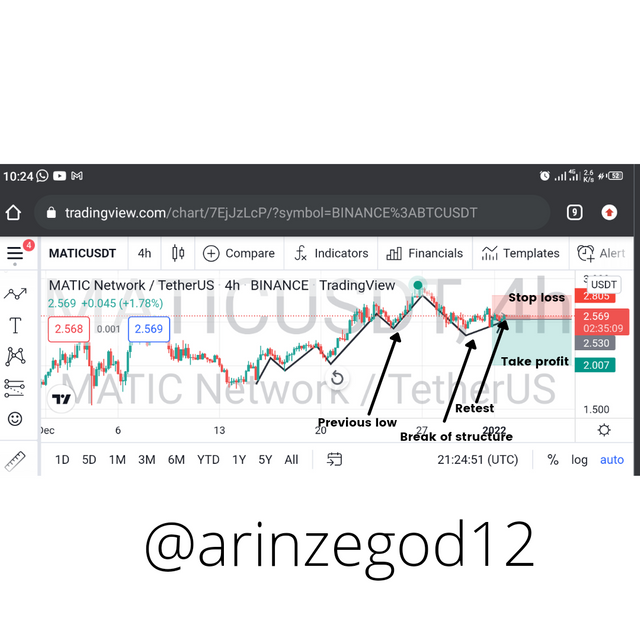

Exit Criteria

Stop loss should be placed above the formed resistance level. That is the Stop loss should be fixed above the level that got broken which is the resistance zone.

Take profit is should be two times of the stop loss point. That is it should be placed at a recommended risk to reward ratio of 1:2. However, if the closest support zone is smaller than 1:2, then that support zone should be used as the first take profit point and 1:2 as the second take profit point.

Source: Tradingview

Calculating the Risk reward ratio to determine the stop loss and take profit

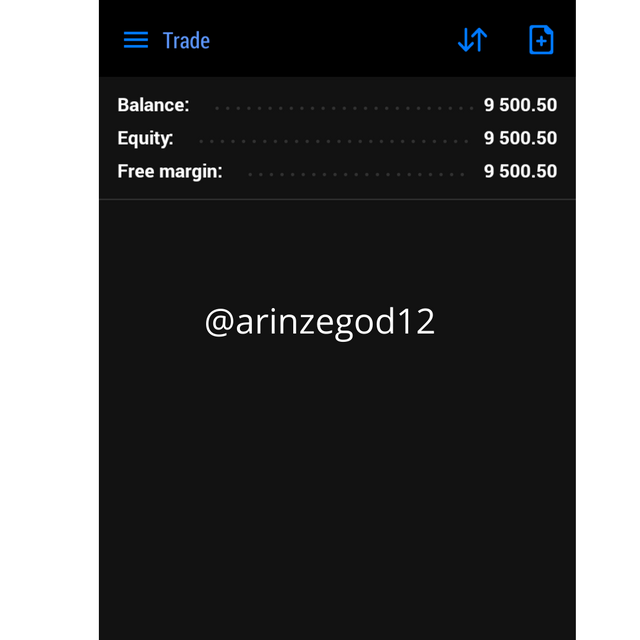

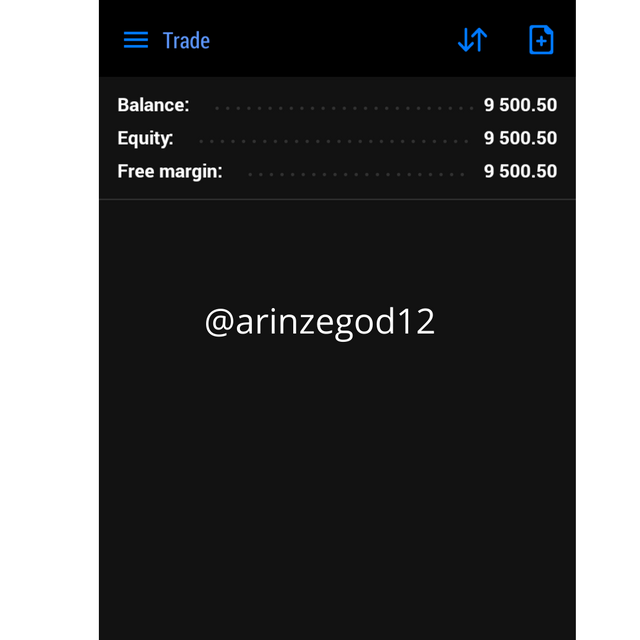

Now this depends on your trading capital and the percentage you want to risk. For this task, I have opened a demo account which is$9,500. See the screenshot below.

Now, for this account, I will be risking just 1% of this account on each of the position I trade in the market. This means that I will be risking $95 per trade

1/100 × $9,500

0.01 × 9,500

= $95

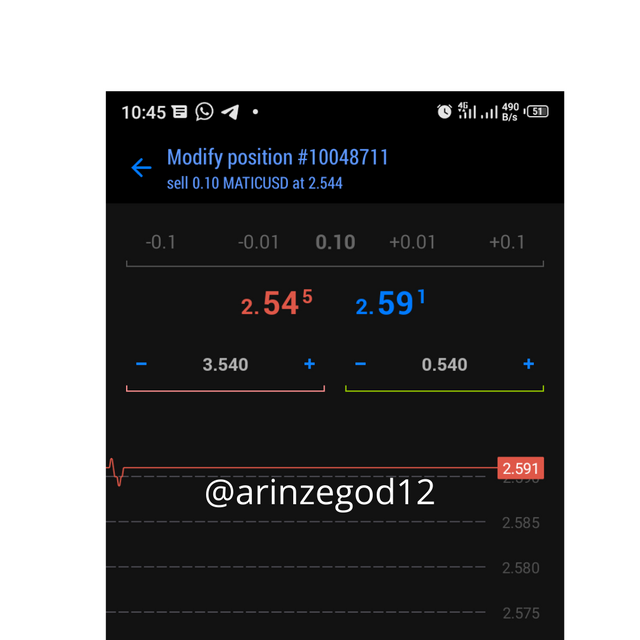

Now, I placed a sell entry at 2.540 and stop loss was placed at 3.540 and take profit at 0.540 This means that my stop loss is 100pips while my take profit is 200 pips. Then, I used 0.1 lotsize as well.

It means, if the trade is unfavorable, I will lose $95 and if it goes in my favor, I will gain $190.

Placing the stop loss and take profit

As soon as as I saw the price retraced the broken level, and a bearish candle moving to the downside, I placed the entry at 2.540 and the stop loss above the new resistance zone at 3.540 and the take profit at 0.540 making the risk to reward ratio to be 1:2.

Trend Continuation Using market structure

I will be placing a sell demo trade on the chart of SHIBUSD. I will talking about the entry and exit criteria for the trade, calculating the risk to reward ratio in order to determine the profit and loss for the trade and placing the stop loss and profit for the trade.

Entry Criteria

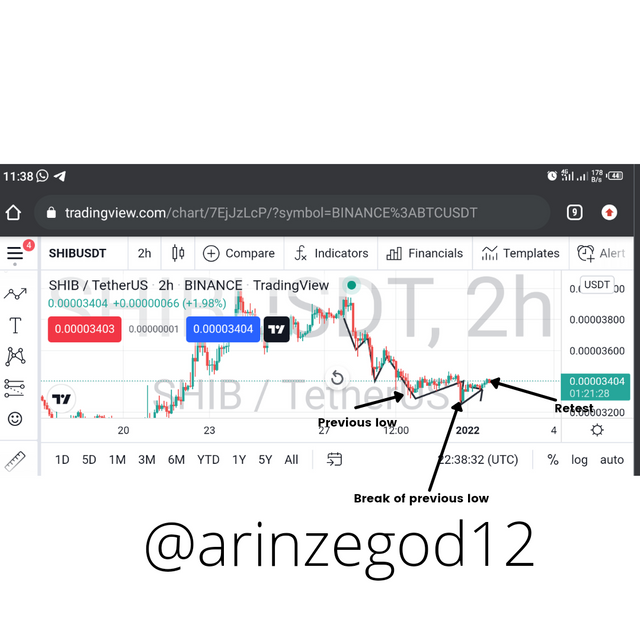

For trend continuation, we will determine the current trend of the market. we confirm for an uptrend or downtrend. So for this case it's a downtrend, I want to place a sell order, then I have to check for the market forming lower lows and lower highs which was what SHIBUSD was creating.

Then, since I wished to continue with the current trend, I would need to wait for the price to retrace and create a lower high higher than the previous lower high.

Then, a sell trade will be placed when the bearish engulfing candlestick pattern form to the downside.

Source: Tradingview

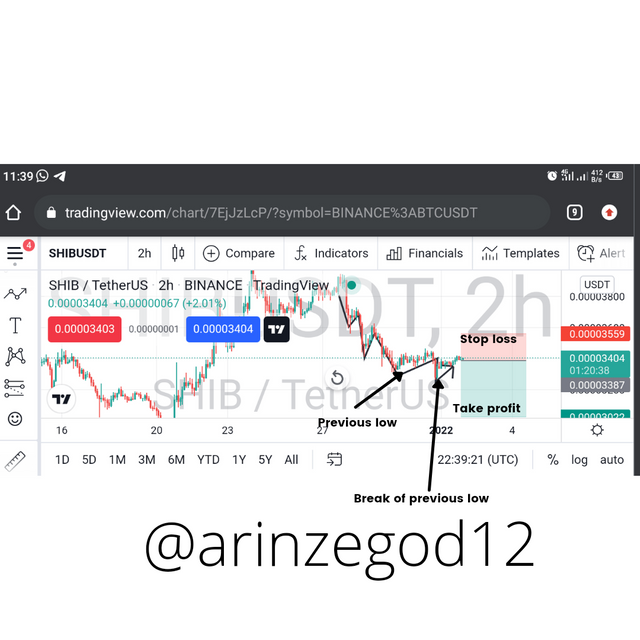

Exit criteria

Stop loss should be placed above the lower high formed and take profit should be two times the stop loss to give risk reward of 1:2

Source: Tradingview

Calculating the Risk reward ratio to determine the stop loss and take profit

Now this depends on your trading capital and the percentage you want to risk. For this task, I have opened a demo account which is$9,500. See the screenshot below.

Now, for this account, I will be risking just 3% of this account on each of the position I trade in the market. This means that I will be risking $95 per trade

3/100 × $9,500

0.03 × 9,500

= $285

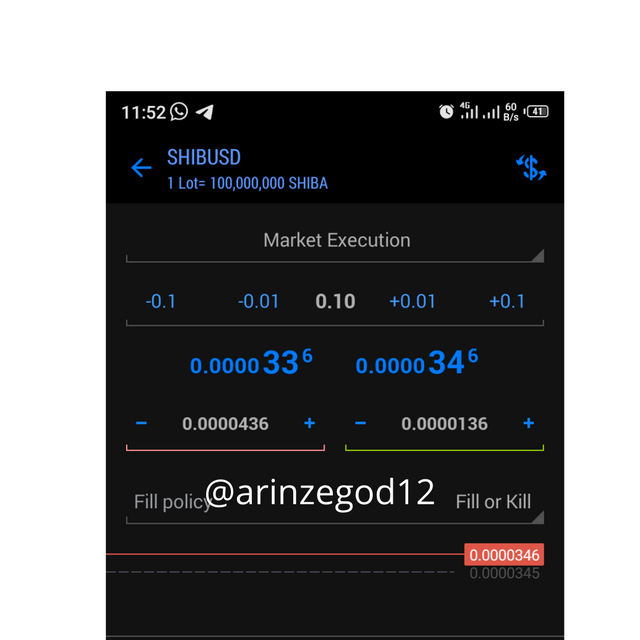

Now, I placed a sell entry at 0.0000336 and stop loss was placed at 0.0000436 and take profit at 0.0000136. This means that my stop loss is 100pips while my take profit is 200 pips. Then, I used 0.1 lotsize as well.

It means, if the trade is unfavorable, I will lose $285 and if it goes in my favor, I will gain $570

Placing the stop loss and take profit

I placed the entry at 0.0000339 and the stop loss at 0.0000436 and the take profit at 0.0000136 making the risk to reward ratio to be 1:2.

Conclusion

I must say that I really learnt a lot by studying this important trading tools. Without risk management a trader tends to give back all there trading capital to the market which can be suicidal. I want to thank prof @reminiscence01 for this wonderful lecture. I hope to see you next season.

Hello @arinzegod12 , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observations:

There's no clear market structure break on the chart above.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello @arinzegod12 , I’m glad you participated in the 7th week Season 5 of the Beginner’s class at the Steemit Crypto Academy.

Unfortunately, it is observed that you haven't powered up to 150 Steem in the last 30 days. This is a criteria to participate in the homework task.

Remark: Homework Task Disqualified.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Understand that your post will be graded if you can power up additional Steem before your post payout.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Prof @reminiscence01 I have just powered up 20steem, I hope it will do.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit