Source

SourceExplain the following stating its advantages and Disadvantages (i) Spot Trading (ii) Margin Trading (iii) Futures Trading

Spot Trading

Spot Trading is the majorly used trading style especially by novice traders, this is the first trading style I got acquainted to on Binance because it is very simple and easy to use, trades are executed at the spot and assets purchased are delivered to the buyer instantly. It consists of a direct transaction between the buyer and the seller.

It's the Simplest form of Trading in the Crypto Market. Here the buyer holds an asset with the intention to use that particular asset to purchase another, an example is a trader with 10BUSD who wants to purchase XRP can do that with spot trading by selecting BUSD/XRP pairs. He then enters the amount of XRP he wishes to purchase which must be equivalent to the amount of BUSD he has, immediately he clicks buy his order will be executed instantly. He will receive his BUSD equivalent in XRP instantly. There are two types of spot market

Over-the Counter and Exchange Based Market. The current price of an asset is known as Spot Price. In Spot Trading traders can short the market, this involves selling assets when the price increases and repurchasing when it decreases to acquire more.

Advantages

Trades are transacted on the spot instantly, delivery of the asset to the buyer is done once payment have been confirmed this traders are not kept in suspense or delay.

It allows traders to make decisions due to low risk involved in spot trading. The trader has total control of his asset and can short the market by selling assets when the price increases and repurchasing when the price decreases.

Spot trading does not require any minimum capital for traders to get involved, with little amount of capital traders can sell and purchase asset .

Disadvantages

When traders are trading volatile assets they can buy at inflated price or sell at low prices since this price are determined by demand and supply. This could amount to loss or having to wait for favourable price.

Since transaction is concluded on the spot instantly, if a party notices some irregularities or error in the trade after the conclusion of the trade there may be no recourse. This irregularities could be caused by negative slippage.

Due to its instant trading features traders maybe in a rush to sell or purchase assets due to fear or excitement which can result in loss.

Margin Trading

To Trade on Margin means trading assets with borrowed funds from a third party or broker. This allows traders to gain access to large sums of capital thus leveraging their position. With margin trading, traders are able to maximize their profits on successful trades. These borrowed funds are acquired from other traders in cryptocurrency trading and in rare situations exchanges provide these funds. Profits are high in margin trading as well as the risk. Margin trading can be used in opening both long and short positions indicating an increase or decrease in price of an asset respectively. When a margin trade is open, the traders asset serve as a collateral for the borrowed funds and the third party who loaned the fund reserves the right of margin call.

Advantages

The obvious advantage of margin trading is that it can result in huge profit with big leverages when the trade moves in his favor e.g if I have $10,000 and I borrowed extra $10,000 making it $20,000 and I use it to purchase XRP which then rises by 25%, I have a profit of $5,000 and extra $10,000 to pay back the loan.

It allows investors to take advantage of timely market. Investors are able to invest more even though they have limited cash at hand.

With margin trading traders can diversify their portfolio because they are no longer limited by small capital and they get to buy other crypto assets.

Disadvantages

In as much as profit is high the risk are higher because these borrowed funds have to be paid back with interest since there is no guarantee that the investment will be successful.

Margin trading is technical and requires a certain level of experience and expertise which a novice don't have and thus cannot take advantage of the opportunities of margin trading.

Interest rate can be so high thus making it difficult for traders to pay back and they face the risk of liquidation of all their assets.

Futures Trading

This is a type of Trading between the buyer and the seller where both parties agree on the price of an asset set at a future date for both parties to buy or sell. Where the set price of the asset decreases at the future date the buyer is the bearer of the risk but where the agreed price increases by the set date the buyer takes profit. Simply put in futures trading party predetermined the price which an asset will be at on a future date. In future trading volatility is very high which makes the profit huge if it goes in your favor and vice versa.

Advantages

Future offers leverage on capital, traders gain access to an asset with small capital. If 1 BTC is $62,000, a futures trader with futures contract can open a BTC futures position at a fraction of the cost.

It allows traders to bet against the market thus allowing profits to be gained from the rise and fall in the value of crypto asset.

It allows for future planning as traders have a lot of time to make analysis and speculations which allows them to make correct predictions instead of rushing into the market.

Liquidity is way higher in future trading

It allows for hedging.

Disadvantages

The risk in future trading is very high and traders can lose their entire capital if their prediction fails.

Volatility is very high in future trading and this passes as a great risk to traders especially first timers. Thus determining the movement of the market is not a guarantee.

Traders do not have control over their assets unlike in spot trading where traders have total control over their assets

It is not advisable for beginners due to the high risk and technicalities involved.

Explain the different types of orders in trading, How can a trader manage risk using an OCO order? (technical example needed)

Market Order

It is the fastest and simplest way to carry out a transaction on the crypto market. Traders who make use of this orders are called market takers. This is because they agree with the market price given to them. The market order is the current buying or selling price of an asset. Here the trader place an order to buy or sell in accordance with the given market price. I like to see myself as a market taker because this is what I mostly use. The others are executed immediately because there is little difference between the bid and ask spread.

Limit Order

This type of order is placed by traders who are not interested in the current market price because these traders have their own target price for an asset. When such orders are placed they are not executed immediately until the asset reaches the target price. If Xrp is at #500 a trader using the limit order can place a trade demand to buy 1 Xrp at #450 or sell 1 Xrp at #550. His order will not be executed until the target price is attained.

Stop Limit Order

This order is a combination of both a stop order and a limit order as can be inferred from it's appellation. In this type of order a trader sets both a stop order and a limit order price. The limit order price will not executed unless the stop order price is reached. If the market price of 1 Xrp is #500 and a stop price of #450 and a limit price of #420 is set. When the current price of Xrp dips to #450 the limit order of #420 will be executed.

Stop loss Order

It is used for minimizing loss which occurs when a trade does not go in our favour. Here the trader sets the order to execute when the asset reaches or crosses the stop price. This order is used when our trade doesn't go as planned.

Take Profit Order

This is an order mostly used for maximizing the amount of ones profit in a trare. It's the opposite of a stop loss order. In this order, the trader sets the trade to initiate at a higher price than the current price in other to see how much you can make from the trade. When the price reaches the required price level then the order is executed.

OCO Order

This means one-cancels-the-other order , in this type of order two different orders are initiated but only one is to be executed. So whichever one is attained first cancels the order hence the name- one cancels the order. This is a risk managing type of order.

An OCO order is placed using a limit order and a stop limit by setting both a limit and a stop limit price for an asset for an asset which helps the trader to manage or reduce risk loses. If the price of the asset increases to his target limit order price, the stop limit order is cancelled. However, if the price deprecates to the set stop limit order price, the stop limit is executed to minimize loss and the limit order is cancelled.

How to manage risk using OCO order

OCO helps reduce risk and why is it. We set two orders, a buy limit order and a stop-limit order this depends on how we set it to greatly reduce risk. The two orders were set to check and minimize losses so whenever the sell limit order has been attained, the stop limit order gets cancelled and vice versa.

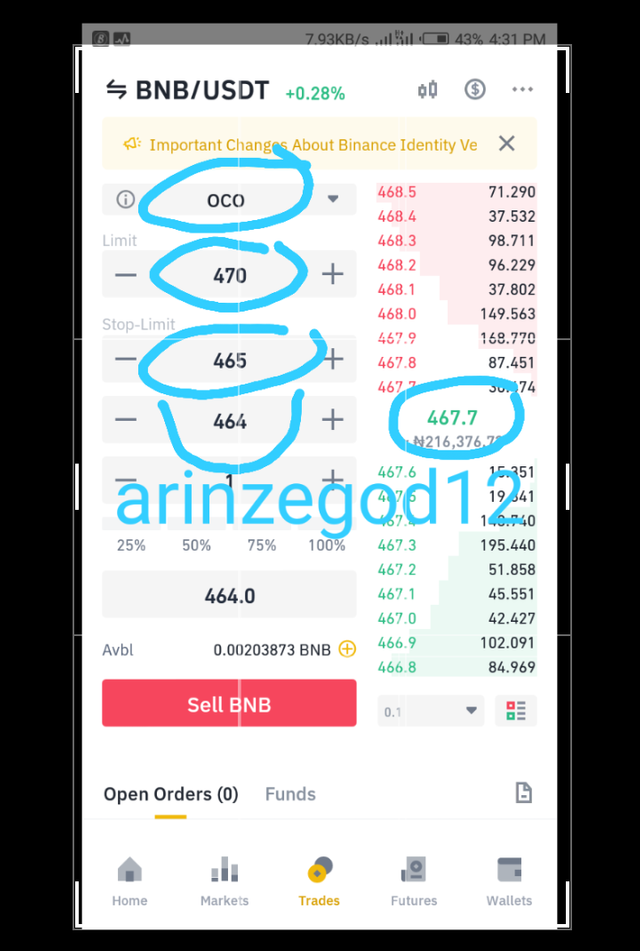

I opened the Binance app and clicked on trades and then I selected spot and set my order to OCO. I initiated my two orders, a sell limit order to sell 1 BNB at $470 and also a stop limit order to sell 1 BNB at $464 when a stop price reaches $465

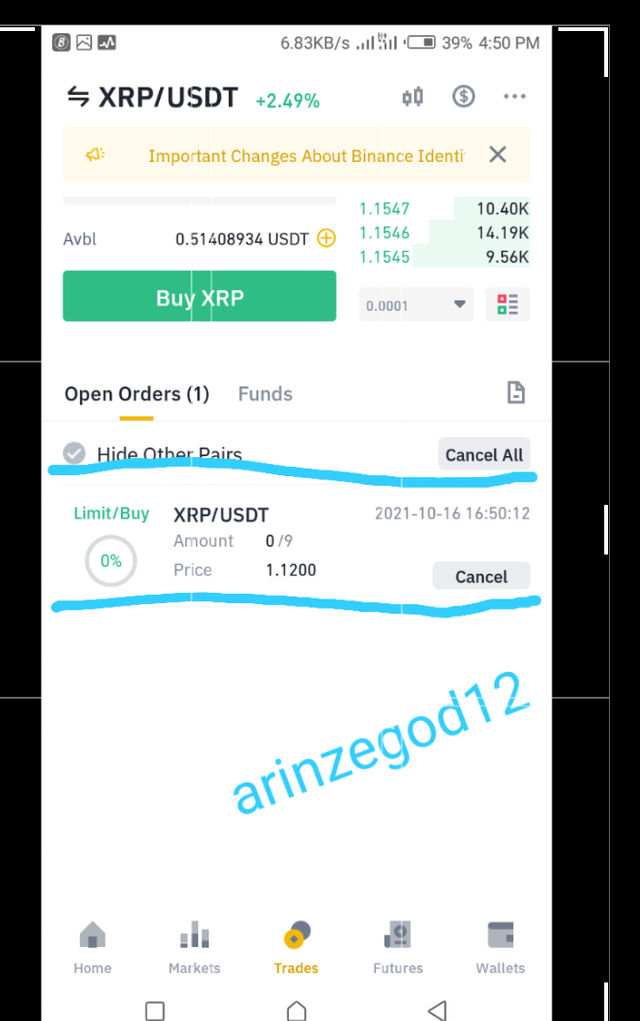

Open a limit order on any crypto asset with a minimum of 5USDT and explain the steps followed

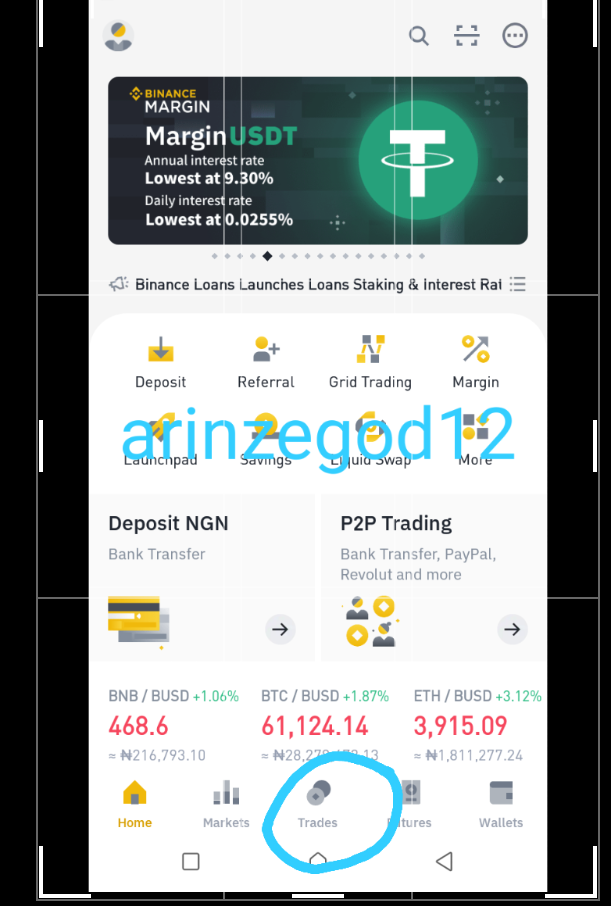

Step 1. I opened my Binance app and clicked on the trade icon which is between market and futures icon.

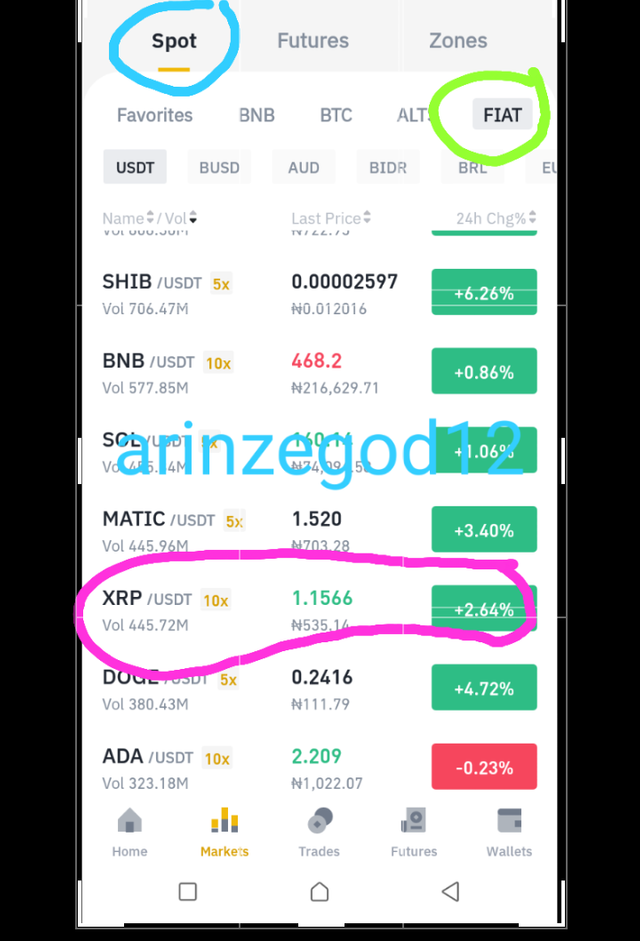

Step 2. I clicked on spot selected a coin pair for the trade in the fiat section. I chose XRP/USDT pair

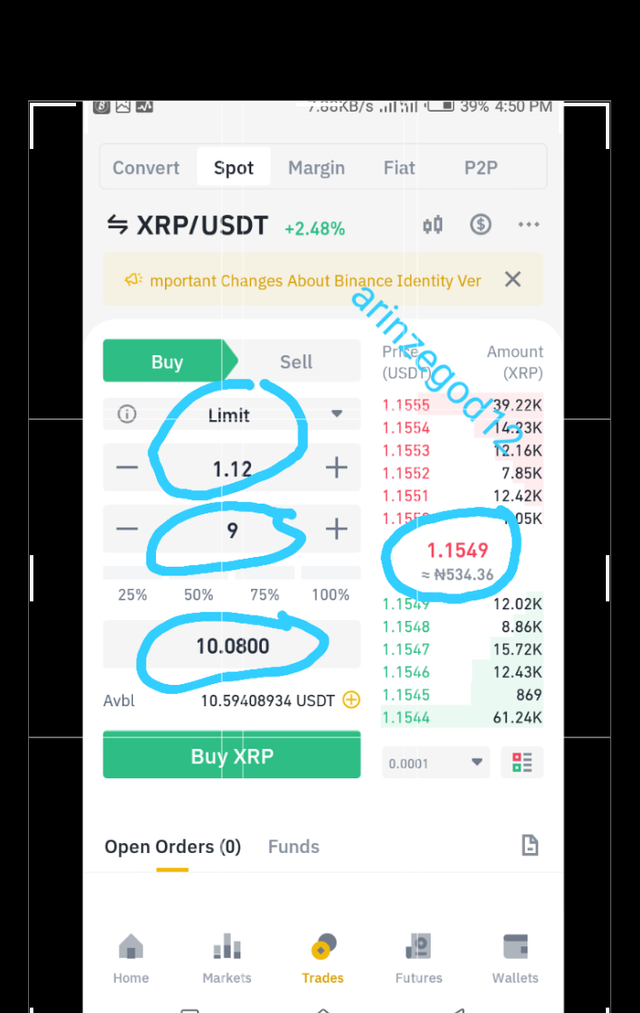

Step 3. I clicked on buy XRP/USDT pair

Step 4. Change the encircled area afrom market order to limit order by clicking the drop down. Then I selected buy.

Tweak the limit price to your preferred price. In this trade the market price is and our target limit price is. What this order means is that 9 xrp should be purchased when the market price becomes in line with our limit price $1.12 only then would our limit order be executed.

Step 6. As we can see below our order has been made so we wait until our preferred price is attained then our limit order would be executed.

Using a demo account of any trading platform, carry out a technical analysis using any indicator and open a buy/sell position on any crypto asset. The following are expected. i)Why you chose the crypto asset ii)Why you chose the indicator and how it suits your trading style.iii)Indicate the exit orders. (Screenshots required)

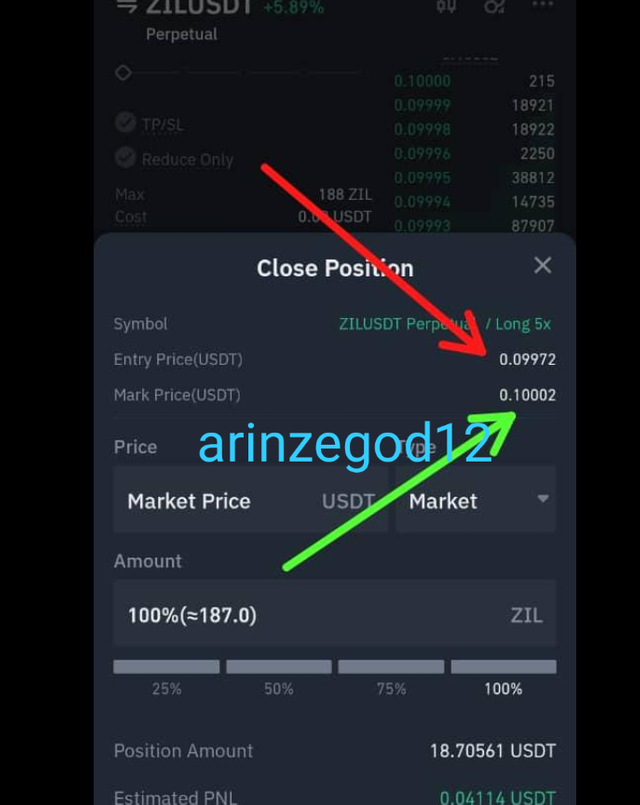

The chart above specifies the crypto asset used (ZILUSDT).

Analysing the asset, the indicator used , EMA coupled with an uptrend was quite effective in giving me a direction of where the market will be

Using EMA indicators was quite useful as it showed me possible support and resistance points depending of the time frame.

The asset so used was chosen due to its current market trend , as it was newly formed and will be expected to continue in this trend for a certain couple of highs more

Having analysed, I chose my entry point as stated with the red arrow , opening a trade pair of the asset

After sometime, from my chart , having taken a certain amount of profit, I closed my pair at a price as indicated by the green arrow

Conclusion

Before trading traders should access the risk involved and select whatever trading style suits them so they don't accumulate huge losses. An inexperienced trader should not venture into futures trading due to high level of risk. Also while Trading traders should learn to manage risk using the different orders especially OCO.

Thanks Professor @reminiscence01

Hello @arinzegod12, I’m glad you participated in the 6th week Season 4 of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Observation

You did not give a detailed answer in question 4.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks Prof @reminiscence01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit