INTRODUCTION

In the crypto sphere, one unique about crypto traders is that they have different strategies and signals to analyze market reversal and price movements. And one of the basic focuses of every crypto trader is on how to identify future trends, price movements, which enable them to maximize profits. However, to identify all these, it requires indicators, like Vortex indicator (VI), RSI, Ichimoku Kinko Hyo, and other charts like the candlesticks chart.

Therefore, in this article, I will be discussing vortex indicator, the concept of vortex indicator divergence, signals of VI to buy and sell, and others.

VORTEX INDICATOR

Basically, the focus of every crypto trader is to identify trends and to detect trend reversal (market reversal). And there are hundreds of indicators, but one of which that a trader can use to detect trend or trend reversal is the vortex indicator.

However, the vortex indicator helps traders to identify trend reversal as well as to confirm current trends, which was created by Etienne Botes and Douglas Siepman. The dream was realized in the year 2010 when Etienne and Douglas applied the vortex indicator (VI) in the Technical analysis of Stocks.

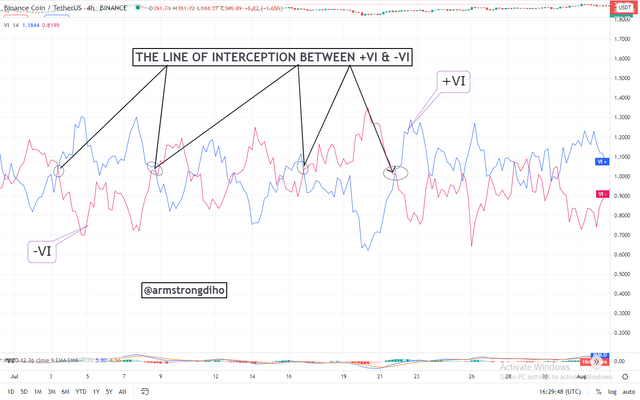

Though, it can only be possible when the trader understands the principle of vortex indicator lines. Generally, the vortex indicator has two basic lines that indicate positive (-VI) and negative (-VI) trend movements in the market. The positive line always signifies an uptrend market, while the negative line always signifies a downtrend market.

By default, these lines are colored blue and red respectively, where blue stands for positive movement in price (+VI) and red stands for negative movement in price (-VI). Moreover, the principle of this movement is once any of these lines either positive (+VI) or negative (-VI) moves above the other, signifies that the market is observing an uptrend or downtrend.

That's when the positive(+VI) indicator line is above the negative (-VI) indicator line, the market at that given timeframe is observing a bullish trend, while when the negative (-VI) indicator line, is above the positive(+VI) indicator line, it means that the market at that timeframe is experiencing a downtrend.

From the BNB/USDT chart, we can see how the positive(+VI) and negative(-VI) indicator lines are intercepted in nature at some points

It is very important for a trader to understand the interception movement between the +VI and -VI since it gives traders the advantage to predict future changes in price actions.

VORTEX INDICATOR CALCULATION

KNOW THE TREND

To ride on trade is to identify it. But in the vortex indicator, we do that by determining the distance from the current high to the previous low that in the case of an uptrend or a positive trend. Or We can subtract the current high from the previous low to get the uptrend.

For a downtrend simply subtract the previous high from the current low. Or by determining the distance from the previous high to the current low.

Now we have obtained the trend let's check out for the next step.

CHOOSE A PARAMETER LENGTH

Here you choose your desire Period, it can be 7, 25, 14, and others depending on your choice. By based on Welles Wilder's recommendation, the use of 14 periods gives a trader an accurate reading of the trend. The 14 period indicates 14 seconds, 14 minutes, 14 days, and 14 months. Remember, the 14 period is not a must to use, is just a recommendation so you can choose yours.

CALCULATE TRUE RANGE

After you might have selected your period, it is good to calculate the true range. So how do we do that is by determining the distance of the current high from the previous close, and again the current low from the previous close.

That's

Current high minus the previous close✓

Current high minus the current low✓

Current low minus the previous close✓

Is The Vortex Indicator Reliable

The reliability of VI depends on the users, not the VI. There are hundreds of indicators, all depend on the user of them are reliable including the vortex indicator. As a trader, this indicator can not offer 💯 percent reliable values about market reversal, only if you are well savvy to use it or you can understand and interpret it on any crypto chart. as such shouldn't be trusted. I always prefer analyzing trends using candlesticks because I understand and can interpret them.

However, from the course of the study, I observed that the vortex indicator is prone to provide false signals most especially when using the short-period settings. It's very obvious that when adjusting the vortex indicator to long periods will lower the frequency of the price movement, as such can lead to delay of crossover between the positive price movement or negative price movement. Also, a short period, bring out many crossovers between the positive and negative, as such can lead to failure of generating trend movement.

And with this effect, it can provide late trend reversal signals. And once a trader observes this, it means that the trader could misinterpret the trend as such make a wrong trade decision, which can lead to losses of funds. Though it is ideal for the vortex indicator in conjunction with other indicators, and candlestick to get reliable signals before making any trade decision.

Welles Wilder's recommended the use of 14 periods gives a trader an accurate reading of the trend.

HOW TO ADD VORTEX INDICATOR ON A CHART

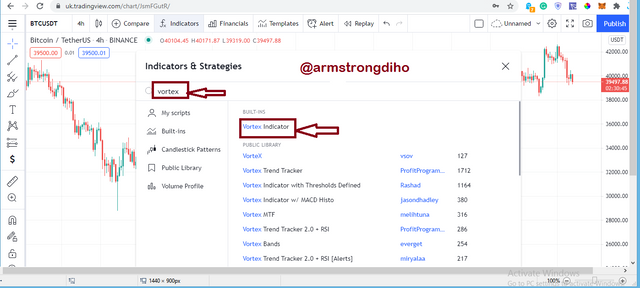

To add the vortex indicator to a crypto chart is very simple. I will use the tradingview to set it up. So let's check it out:

On your browser, you can type Tradingview.com. and log in to access the crypto chart.

From the image below, you can see I have opened crypto chart of BTC/USDT.

As you can see on the chart, I'm using BTCUSD pair to demonstrate this on the tradingview.com

Suppose you don't like the current pair, you can choose another pair of your choice on your watchlist.

On the chart, click on the "Fx Indicators" on the top menu.

CLICK ON "INDICATORS" ON THE TOP MENU. HERE IS THE IMAGE

Here, you can see from the image the notification on your screen. So to see the VI, you have to type the "vortex" on the search engine. You can see the Vortex Indicator has displayed in the Built-ins library. Choose the "Vortex Indicator" by clicking on it.

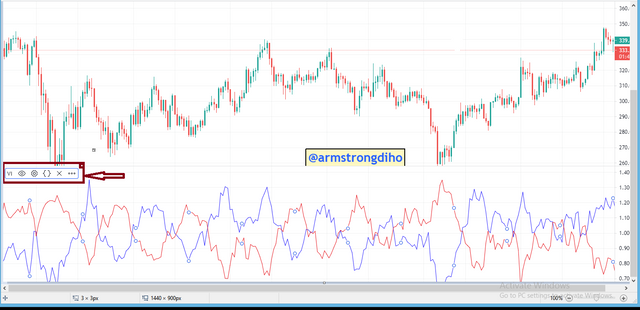

Now, I finally added the vortex indicator to the crypto chart.

WOW! I HAVE SUCCESSFULLY ADDED THE VI ON MY CHART

This clip summarized all the step above

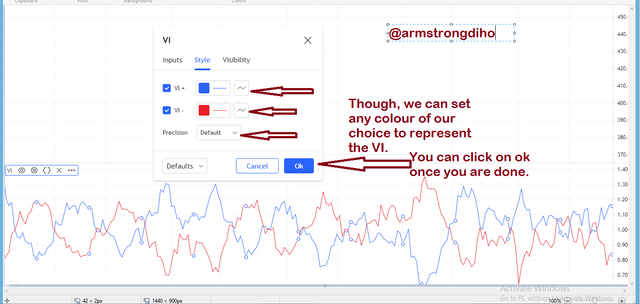

Now, above the indicator, you can see the area I marked on the image. Click on the "settings" button. On the landing page, there are 3 options

Inputs ✓

Style✓

Visibility✓

So I will kindly begin with the style. So kindly click on the "Style", you can see the Positive VI and Negative VI are set as blue and red respectively default. Though, it can change. After which click on OK.

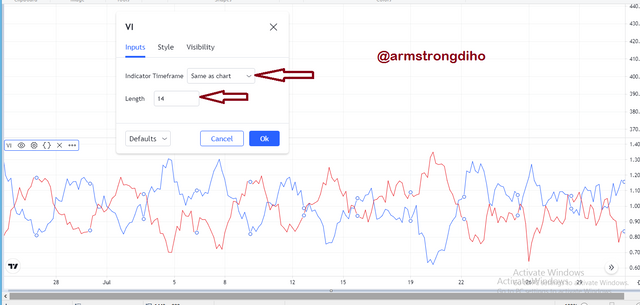

Here, I will set the inputs. So kindly click on "Inputs". Here is the landing page where you need to set up your desired period but by default, it is set to 14 periods. And it is ideal to set the indicator time frame to be the same as the chart. After which click on OK.

Lastly, the visibility section so clicks on the "visibility". From the screenshot, you can see the settings. So it is ideal to allow it just the way it's as default. After which click on OK.

RECOMMENDED PARAMETERS

Generally, every trader has a different trading strategy when using vortex indicators. 14 periods are recommended. Though, some traders prefer 7 periods as they said it is very fast to give signals for both buy and sell. Also, some traders prefer 25 instead of 14 and 7 and with different reasons altogether. Hence, any period used is very important and it all depends on the trader but what matters is the results.

Remember the 7 periods indicates 7 seconds, 7 minutes, 7 days, 7 weeks, and 7 months. Moreover, when there is high price volatility, it's ideal to make use of a long period. Welles Wilder's recommended the use of 14 periods gives a trader an accurate reading of the trend.

CONCEPT OF VORTEX INDICATOR DIVERGENCE

Basically, we have two types of divergence of the vortex indicator, which are as follows;

- Bullish divergence✓

- Bearish divergence✓

Now, let's check out the Bullish divergence

BULLISH DIVERGENCE

In the crypto ecosystem, bullish signifies an upward movement. But in the case of bullish divergence using VI, occurs when the positive line VI+ shows a higher high(HH) whereas the price movements on the chart show decreasing lows. Once we observe this, we can say that the market at that timeframe is experiencing a bullish divergence.

The below image will clarify us better;

Note: The positive vortex indicator (+VI) trendline signifies the blue trendline.

WHAT DOES BULLISH DIVERGENCE TELLS the TRADER

Once the market is experiencing bullish divergence, it means a buy signal. As such, the buyer will make a trade decision by placing a long position on that particular asset at that given timeframe.

Let's check out this crypto chart.

PRICE CHART OF BTC /USDT PAIR SHOWING THE BULLISH DIVERGENCE| tradingview.com

The above 4h price chart of the /USDT pair, shows the bullish divergence. We can see from the image above that the blue trendlines observing shows a higher high(HH) that are experiencing an uptrend, whereas the price movements on the chart show decreasing lows. As such, the market is experiencing a bullish market which is marked in the candlesticks pattern.

BEARISH DIVERGENCE

In the crypto space, bearish always indicates a downward movement. A bearish divergence occurs when the negative line VI- shows a lower high that's experiencing a downtrend, whereas the price movements show an uptrend. Once we observe this, we can say that the market at that timeframe is experiencing a Bearish divergence.

Note: The negative vortex indicator (-VI) trendline signifies the red trendline.

WHAT SIGNAL DOES BEARISH DIVERGENCE GIVES THE TRADER

Once the market is experiencing bearish divergence, it means a sell signal. As such, the seller will make a trade decision by placing a short position on that particular asset at that given timeframe.

Let's check out this BTC/USD pair.

PRICE CHART OF BTC/USD PAIR SHOWING THE BEARISH DIVERGENCE| tradingview.com

The above 4h price chart of the BTC/USDT pair, shows the bearish divergence. We can see from the image above that the negative line VI shows a lower high that's experiencing a downtrend, whereas the price movements show an uptrend. As such, the market is said to observe a BEARISH market that is marked in the candlesticks pattern.

Use the signals of VI to buy and sell any two cryptocurrencies.

Most of the traders' long positions once they observe the +VI crosses over the -VI, whereas some traders sell position by drawing a horizontal line which will serve as resistance level from the highest point on top. And once the blue line touches the line, they sell their asset.

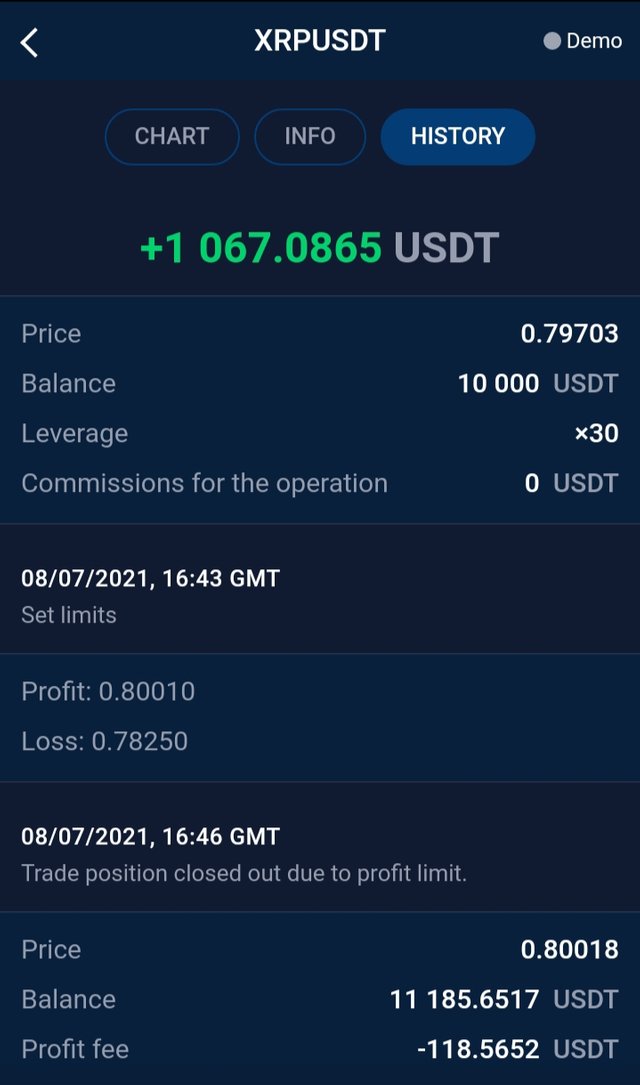

Buy XRP/USDT

I made a buy entry using the 14 periods VI, though I didn't the long the trade during the intersection instead I long after the interception. Once I received a buy signal I placed my trade and fortunately, it enters.

Here is the proof

CONCLUSION

Vortex indicator is an important indicator that shows when the market is experiencing an uptrend or downtrend and can be used to predict a future trend reversal. However, for a trader to ride on trends, the trader needs a good understanding of technical indicators such as vortex indicators, and how to interpret them on a chart is really important.

THANKS FOR READING THROUGH

CC:

@asaj

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hi @armstrongdiho, thanks for performing the above task in the sixth week of Steemit Crypto Academy Season 3. The time and effort put into this work is appreciated. Hence, you have scored 5.5 out of 10. Here are the details:

Remarks

We were hoping to see more depth and originality.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit