Introduction

In crypto space, every trader is required to understand the direction of each indicators before trading. In technical analysis, studying the indicator is very important

However, in this class we are concentrating on the Relative strength Index (RSI).

What is the Relative Strength Index - RSI and How is it Calculated?

RSI -Relative strength Index as the name implies, it's an important tools or indicator in which a trader uses in technical analysis so as to quantify price change of a cryptocurrency as such it can be used to identify an overbought or oversold of a particular crypto asset or pair of crypto asset. The RSI give the trader idea on market entry and exit in crypto trading.

The indicator has been in existence for about 40 years and it has been frequently used in technical analysis by traders which was discovered by a mechanical engineer named J. Welles Wilder Jr.

RSI=100-[¹⁰⁰/(1+RS)

Where,

RS ; signify (Average gain /Average loss)

Suppose the last 14days we have a price change that lead to average gain as 9, and the average loss as 3 of a crypto currency.

RS=(AV. Gain/AV. Loss); 9÷3=3

Therefore, RS=3

We can now input the RS value in the below formula;

RSI=100-[¹⁰⁰/(1+RS)

RSI=100-[100/(1+3)

RSI=100-25=75

Hence,

RSI=75

The result shows there was overbought at that period and should in case we had 25 it then shows there was oversold.

Further verification;

- RSI <70 is known as overbought

- RSI >30 is known as oversold

Can we trust the RSI on cryptocurrency trading and why?

This indicator has been in existence for long time and some traders uses it in daily occasion as such has produced a better results for them but that does not really mean we can trust it . One of the attribute of the indicator, is that sometimes it gives false signals and when this occurs suppose the trader is not that savvy might have a big loss. Other indicators like the support-resistance, moving average, double top and down ,and many more should be used with the RSI as well to get a good result and this can be trusted to an extent.

As a crypto trader, using only RSI indicator is not that okey because it gives false signals sometimes.

How do you configure the RSI indicator on the chart and what does the length parameter mean? Why is it equal to 14 by default?Can we change it?Screen capture required

Different platforms have different ways of configuring the RSI on the chart. However, I'm using Huobi in illustrating this and it's very simple .

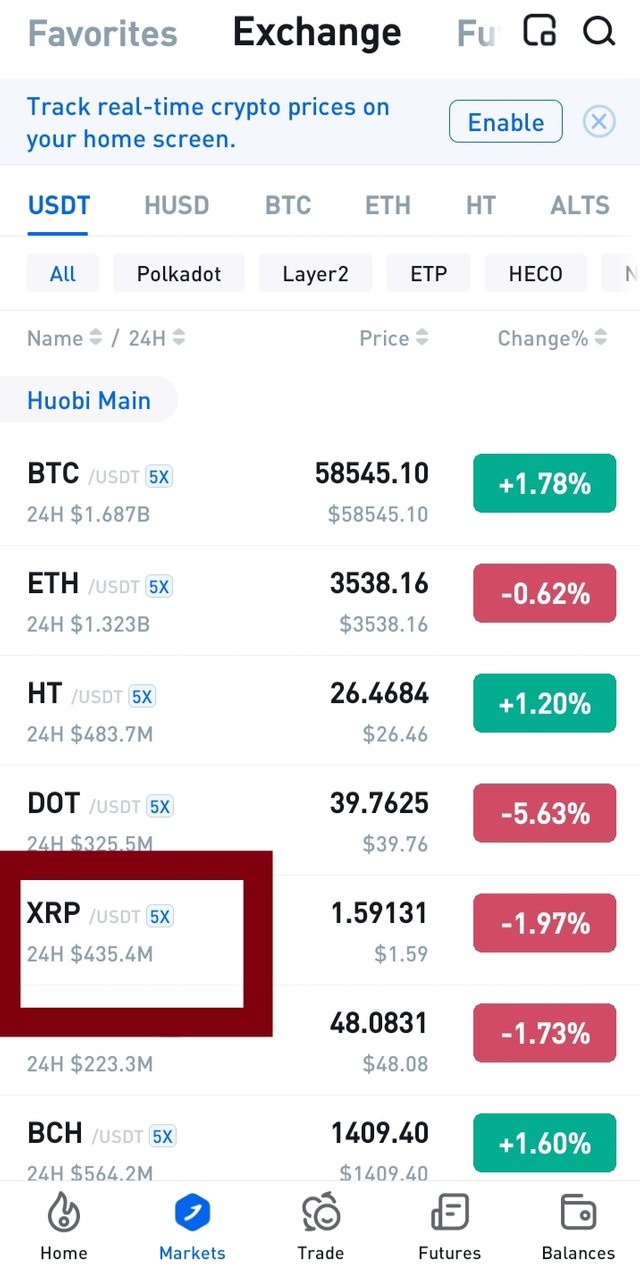

On Huobi , the first step in setting up RSI is by choosing any Crypto asset prair of your choice. For instance,I'm using XRP/USDT

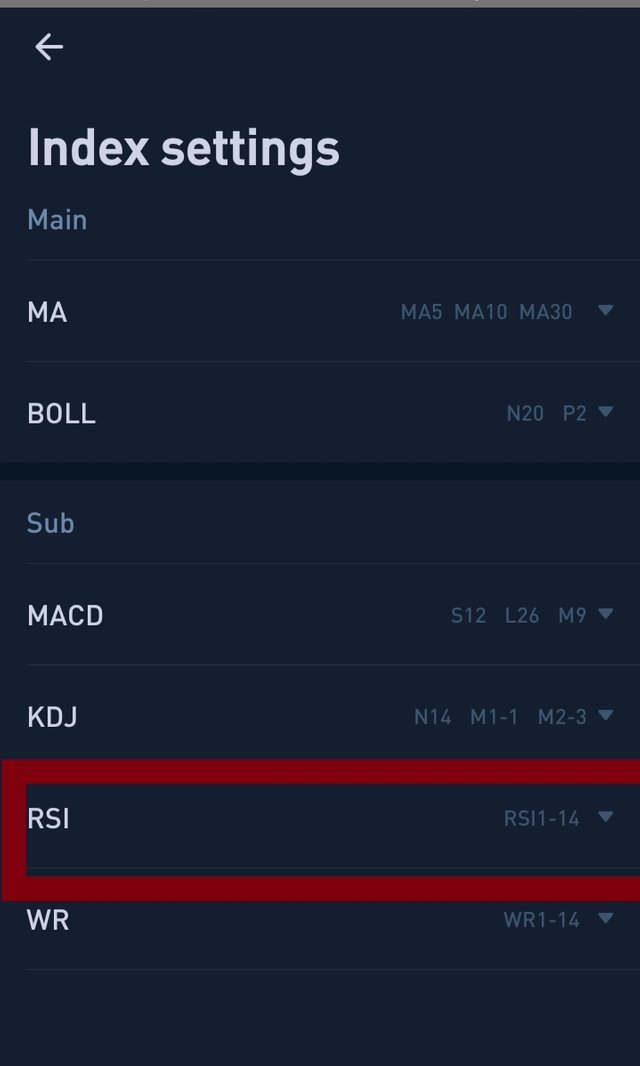

Click on the bottom right marked on the screen. The marked place is known as index setting in Huobi.

After that scroll down a bit and you will see the RSI then click on it.

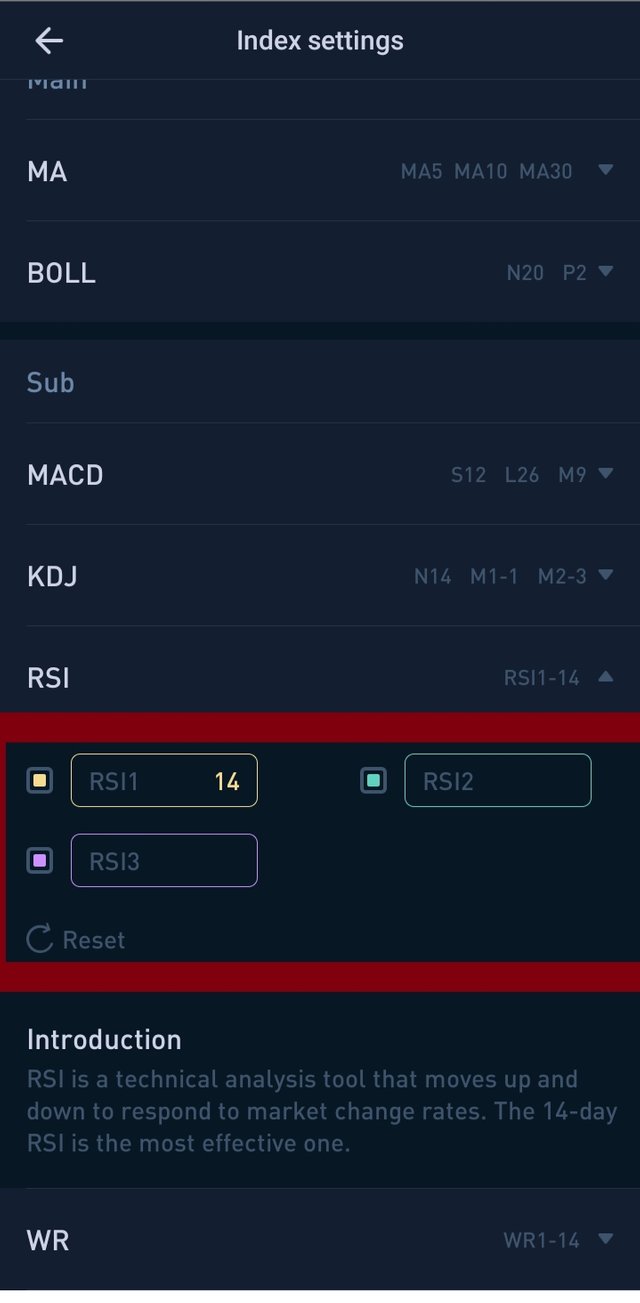

The below image will show, and there are 3 options while setting the length parameter . The RSI14 is default but the RSI 12 and 13 can be changed.

After which you can press the back button .

Click the RSI button to on the chart to enable you visualize the RSI. The bottom left on the screen is the recent recent RSI

The length is an important parameter of RSI used to determine the magnitude of price change with the help of the candlestick on the chart.Normally, 14period are used in RSI indicator which is okay for many traders. The 14 period could be 14days or 14hours . So the length of the RSI is set at 14 by default.

How do you interpret the overbought and oversold signals when trading cryptocurrencies? (Screen capture required)

Below the images I marked the RSI zone since Huobi platform doesn't have calibrated scale to detect the exact RSI value.

When the RSI value is > 70 and <30 signify overbought and oversold respectively. This will be a guide to identify when it's overbought and oversold.

Overbought

An asset is said to be overbought when the RSI value is above the limit of 70.This present that the number of the sellers in the market is more higher than those buyers.

The green candlestick represent sell. So from the above chart, the RSI indicated 77:71663 which signifies overbought.

Oversold

An asset can be presented as oversold when the RSI value is below the lower limit of 30 . This signify that the number of buyers in the market is more higher than that of the sellers.

The red candlestick represent sell. So from the above chart, the RSI indicated 17:54924 which signifies oversold.

How do we filter RSI signals to distinguish and recognize true signals from false signals. (Screen capture required)

Actually, to identify a true signals it requires the RSI and other indicators like the support resistance to be conjuncted. In some case, the true signals and false signals mixes which can lead to change. Once the asset price is no longer in the same direction with the RSI is referred as divergence. The divergence can be bullish or bearish.

Bullish Divergence

A divergence is said to be bullish when there is oversold and then the RSI shows a higher low while the price of the asset shows a lower low in the chart. In the bullish divergence, the market regain when the price of the asset increases after dips.

Bearish divergence

Here the price of the asset is dropping after observing a massive increase in the market. Therefore, the RSI then shows a very lower high, perhaps the price of the asset shows a very higher high.

The RSI value is above the limit of 70, this present that the number of the sellers in the market is more higher than those of the buyers. However, from the image shown below the chart of ETH/USDT shows overbought when the RSI value is above 70 as such shows bearish Divergence. Also when the RSI value is below the lower limit of 30, this signify that the number of Buyers in the market is more higher than that of the sellers as such shows bullish divergence.

Conclusion

Relative strength Index is an important indicator which gives a trader the idea when to buy or sell as such it requires a well savvy trader that can understand the appropriate calculations and as well study the candlestick chart so as to obtain high profits.

However,the RSI shouldn't be trusted because it can give false signals which can cause a high losses to a trader. Therefore, is recommended to use other indicators as well as the divergence to obtain a better result.

Thanks Prof. @kouba01 for this great and amazing lecture. Honestly,I really learnt a lot from the lecture.

Cc: @yohan2on

Hello @armstrongdiho,

Thank you for participating in the 4th Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve a 6/10 rating, according to the following scale:

My review :

Generally acceptable work, your answers were short and lacked an analytical dimension. Try to delve deeper into the points raised with more research and criticism.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit