INTRODUCTION

Order book is an important record book that plays an essential role both in crypto space and in local market. Because that's where the price to buy and sell records for an asset is being list, their demand as well as their market value, as such can't be overemphasized.

However, from the lecture, the Prof. explained in simple terms in order for the students to understand the basic information order book gives to a trader in regards to the direction of the market, and how traders can protect their assets from losses. And in this article, I will be discussing majorly concerning the below questions asked by Prof.@yousafharoonkhan.

Order book and how crypto order book differs from our local market.

In every typical market you will see a seller and a buyer. The seller take goods and services to the market to sell for the buyer, while the buyer go to the market to buy things from the seller which makes market lively. One good thing about the seller and the buyer relationship is that the both has equal right, that's the seller can decide not to sell if the price is less, while the buyer can decide not to buy if the price is high. But if the both agree on the price, then it means the market has been actualized.

For instance:

Armstrong= Crypto Vendor

Chibueze= Buyer

Suppose Armstrong sells steem in one of the local exchange platform, and has 50 steem to sell at the rate of $50. Fortunately, he sees a buyer called Chibueze, and wants to buy all the 50 steem at the rate of $30 but the seller say no that the price is not encouraging then said he can sell at the rate of $45. Then Chibueze price again at the rate of $35 and the seller said no again that his last price to sell is at the rate of $40. And chibueze knows the price is now ok for him to buy and said ok I agree with the $40. Here comes the final deal and end of negotiation so the both will go home with joy

From the example I illustrated, you can see the buyer and the seller price quote. So combining the list of both price quote is known as an order book.

However, I can say that an Order book is said to be a list that shows the record of buy and sell orders for any crypto asset which are placed by the buyer or the seller based on their suitable price. As such, the buyer or seller can cancel the order at any time when the order is not yet executed.

Hence, order book is not only useful in crypto space but as well useful in local markets. So in Cypto space, the order book is slightly different from that of the local market order book. Below are my difference;

FEATURES

In crypto Trading, there are many features such as Limit order, Stop Limit order, One-Cancel-One(OCO) order which is not available in local market.

PRICE FLUCTUATIONS

In crypto space, there is high price volatility of cryptocurrencies order and it's something that can change very fast within a seconds. Just like last week 1SBD produced 19steem and still on the week 1SBD yielded 11steem.

But in local market there is no significant price volatility and it is not something that can happen within seconds.

Price forecasting

In crypto market, there is price forecast. A traders can predict the price of steem next week through technical analysis. But in local market, there is no technical analysis used for price forecasting. Instead, the price volatility sometimes are determined by the sellers, government, or climate change. When the price of steem order drops or increases, everyone globally will experience it but in local market the market order differs globally.

TRADE PAIR

In crypto space, there is cryptocurrency pair system during trading. That's to say that before any crypto is being trade, there must be a trading pair between to crypto currency.

For Instance; Assume Armstrong is a crypto trader, and wants to trade Dogecoin. He can only trade the coin with other cryptocurrencies like USDT, BUSD, RUB, TRY, BTC, AUD in Binance exchange platform that's Dogecoin/USDT. Although the pairing currencies depend on the exchange platform.

While I'm local market, one coin can be used to exchange goods and services.

how to find order book in any exchange (Binance)

• Pairs

• Support and Resistance

° Limit Order

° market order

I really prefer using Huobi global and Binance exchange platform for crypto trading because I'm convalescent with them. In Binance you can either explore it in your web browser or with your Android mobile App. Therefore, I will be illustrating this task using my Binance mobile App.

First step is to log in to your Binance exchange platform. After that the following steps below are to follow.

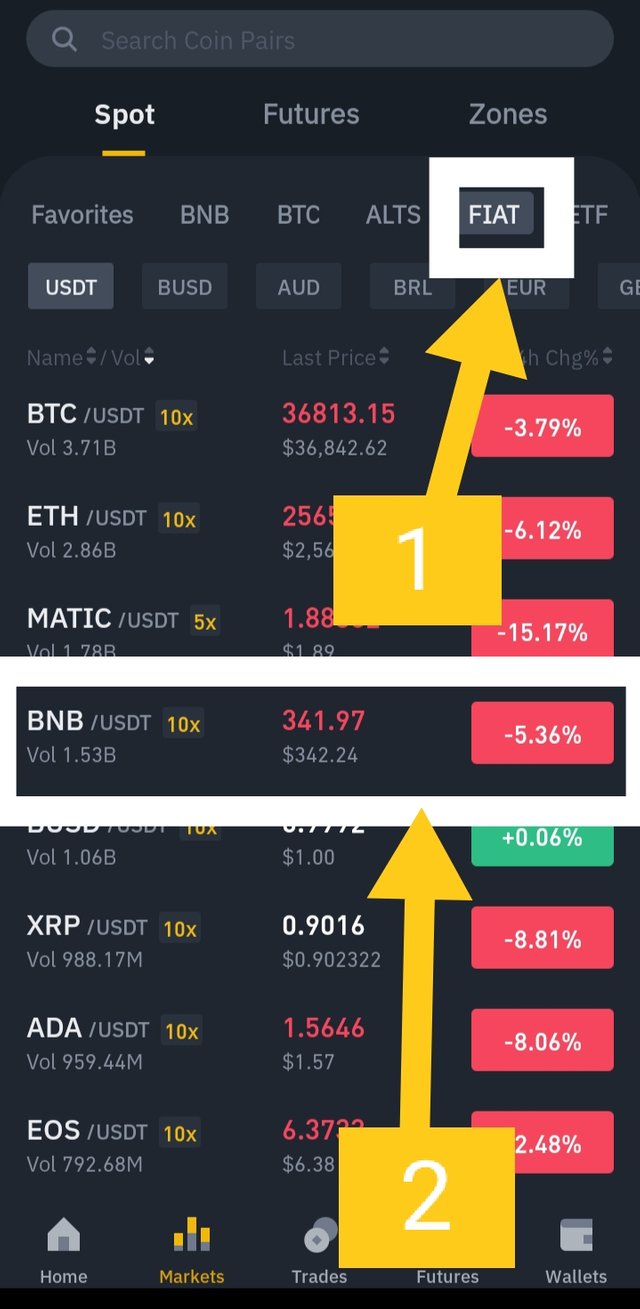

• Click on the market at the bottom part of the screen.

• After that you can see different crypto assets on top of the screen under the Spot which you can as well use but herei like using the fiat because is a stable coin, so get that click on the Fiat

• Choose any of the pair of cryptocurrencies of your choice like BNB/USDT. But to make it very fast and simple you can search for it like BNB on the search page.

• Click on the selected pair and below you will see the crypto pair price chart, and Order book. So I can now buy BNB using my USDT or sell my BNB to get USDT.

PAIRS

In crypto trading, when two currencies are paired together for the purpose of exchanging in any exchange platform is called Pairs.

****For instance, Dogecoin/USDT can be called trading pairs. Using these two pairs, Armstrong a trader can use his USDT to buy Dogecoin, and can also sell his Dogecoin to buy USDT.***

However, this pairs work either by Crypto to Fiat pair such as Dogecoin/USDT or crypto to crypto Such as Dogecoin/BTC.

SUPPORT AND RESISTANCE

Support and Resistance are one of the Important tools traders uses during technical analysis to determine the price levels on chart.

Support and Resistance are different in the sense that;

SUPPORT:

Is what prevents price from going downwards as a result of demand or buying interest. As such, the support line are formed immediately the buying interest or demand increases due to drop in price of the assets. One important of this technical indicator called Support is that it gives a trader an important chance to buy most especially when identified by the trader.

RESISTANCE:

It prevents price from going upwards as a result of sellers interest or supply. So I can say that the resistance zone is formed when the price increases as a result of selling interest or supply. One important of this technical indicator called Resistance is that it gives a trader an important chance to sell most especially when identified by the trader.

Hence, these two technical indicators are very important because when identified by a trader, it gives the trader the potential idea for entry the market or exiting from the market.

LIMIT ORDER

Limit order is an important feature that can either be called buy Limit order or sell limit order, which enables the trader to place order of their assets at a different price from that of the market price.

The buy Limit order can only be executed or filled when the order is lower than the current market price or is at the limit price, whereas sell limit order can only be executed or filled when the current market price is higher or at the limit price. But when the buy limit order or the sell limit order placed by a trader is not executed, the trader can cancel the order at any time when the order is not yet executed (bought or sold).

For Instance; Suppose Armstrong wants to buy Dogecoin in exchange for USDT (Dogecoin/USDT), and set his buy order at the rate of 0.34029 and the current price is at the rate of 0.84029. If the current price dropped to 0.34029, this means his buy order will be filled on the order book, but if the price still remains in 0.84029, it then shows his order is not yet filled as such, he can either cancel it or allow it till it reaches his buy order.

This illustration also occurs in sell limit order. As such, Limit order gives trader the chance to better control the prices of the assets they are trading on most especially when the trader don't trust the market order due to the high volatility.

MARKET ORDER

In this type of order, the trader don't have better control to place an order just likein the limit order, instead they buy or sell their assets based on the current market price. So in this case, the trader buy or sell limit order can only be executed or filled at the current market price.

Important feature of order book

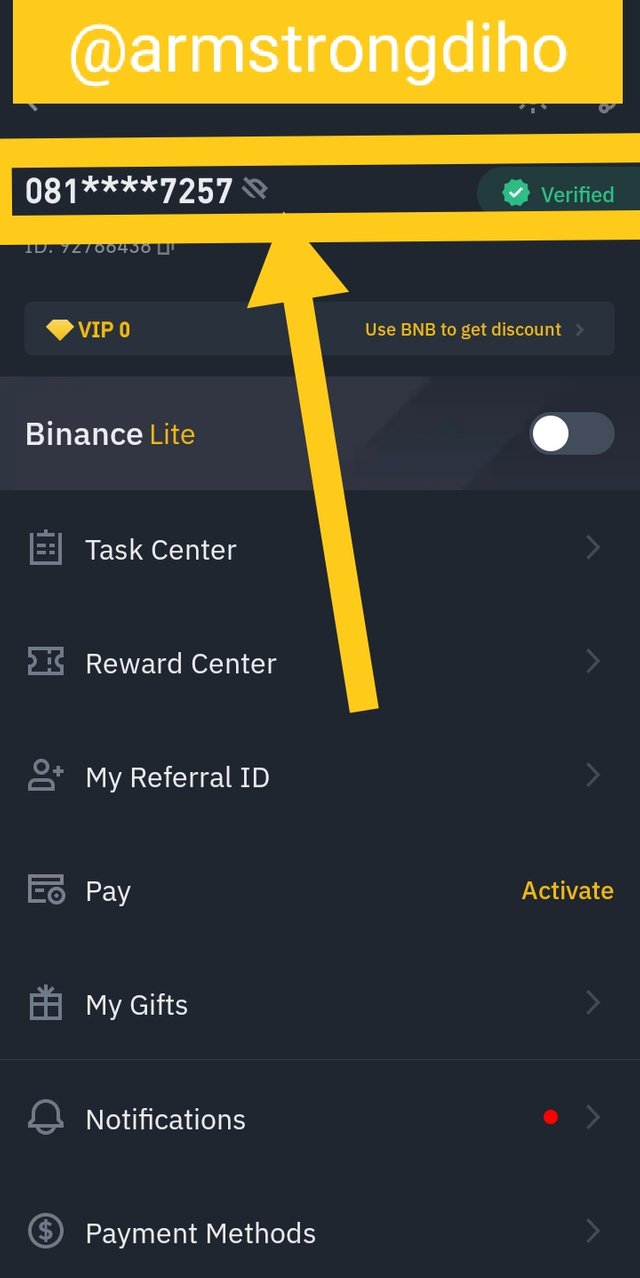

Just as I mentioned that I used Huobi and Binance exchange platform, but in this question I will use my Binance exchange platform and below is my verified profile.

Binance exchange platform really have some of the feature of order book and I will explain them with the help of screenshot as well.

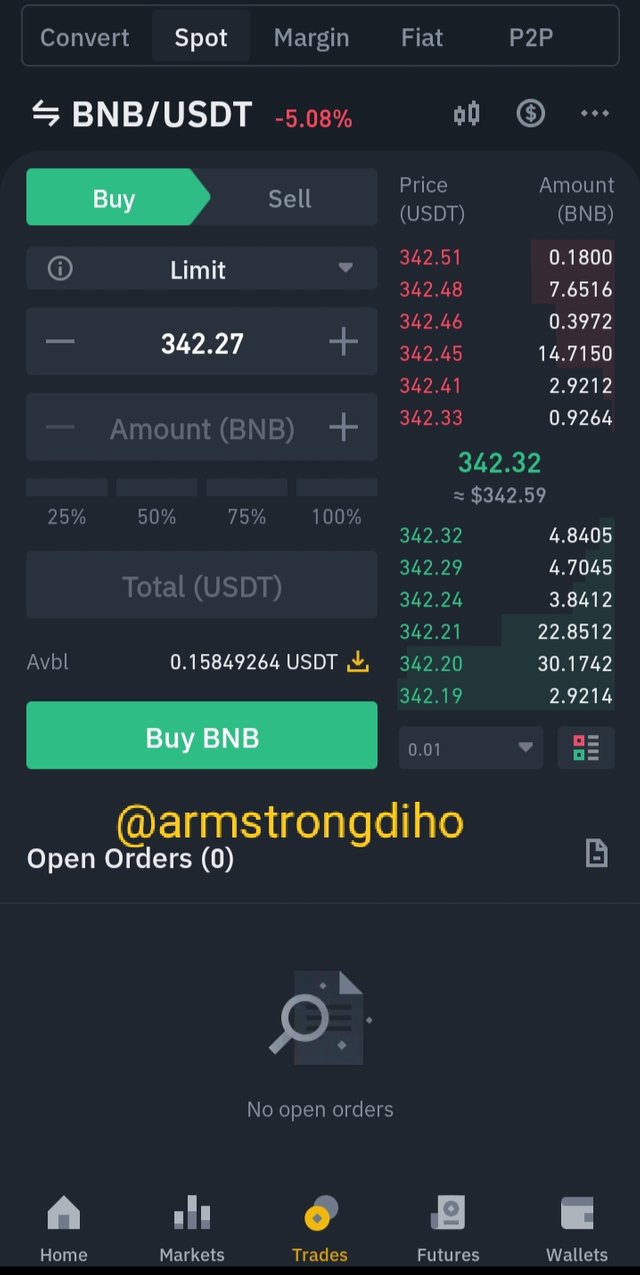

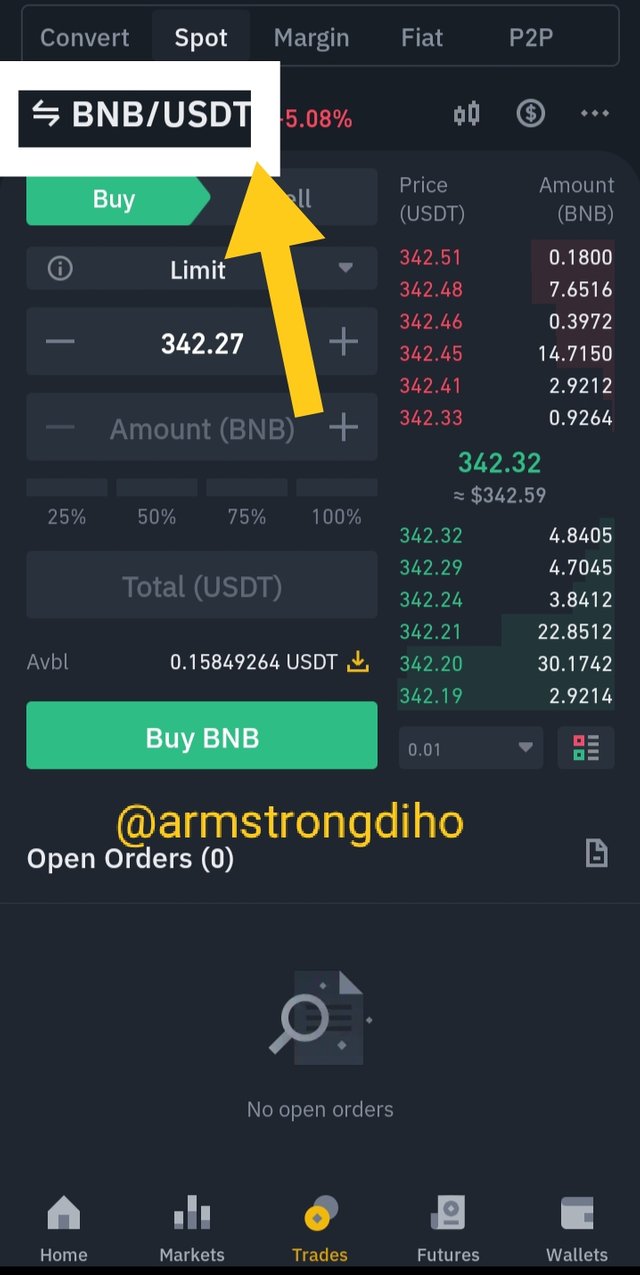

TRADING COIN PAIR

Before an order will be place there must be a coin pair which is very important in order book. For instance, I will be using BNB/USDT to illustrate this and from my screenshot, you can see the pair where I marked it. BNB/USDT entails us that the buyer can be able to buy BNB with his USDT and the seller can be able to buy USDT with his BNB.

LIMIT ORDER, STOP ORDER AND OCO

LIMIT ORDER

Actually I have emphasized on this when I said Limit order is an important feature that can either be called buy Limit order or sell limit order, which enables the trader to place order of their assets at a different price from that of the market price.

Therefore, I will explain more about it by breaking it down.

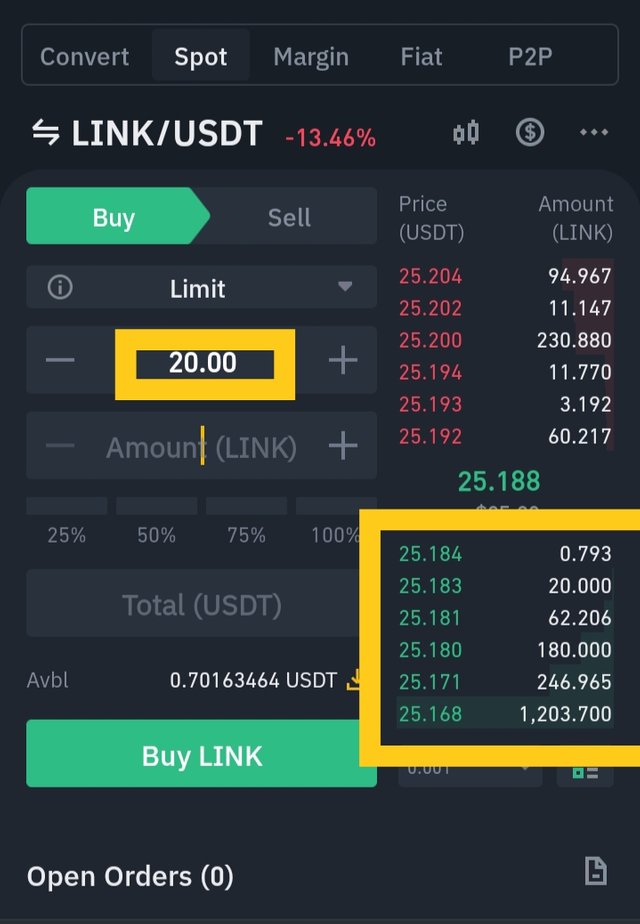

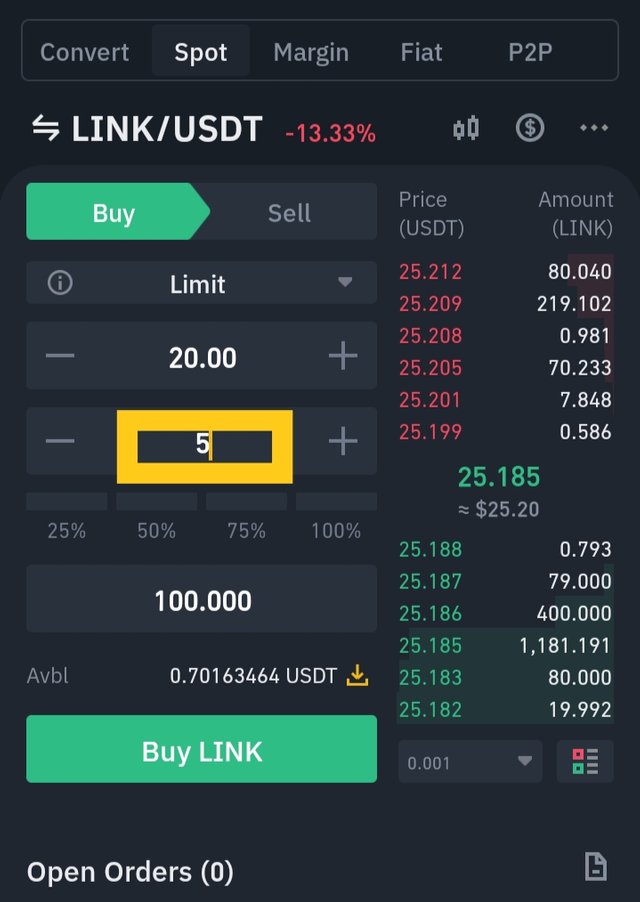

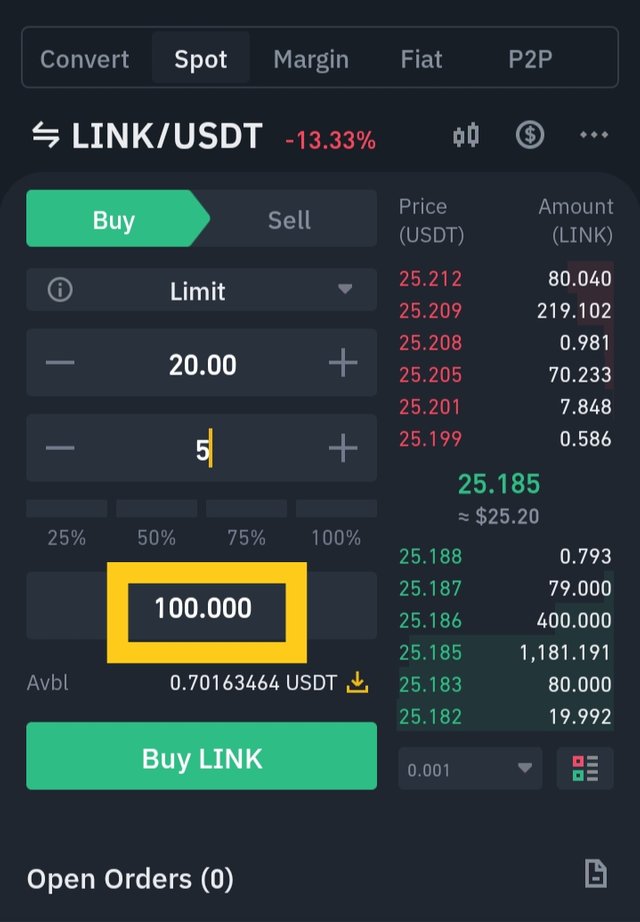

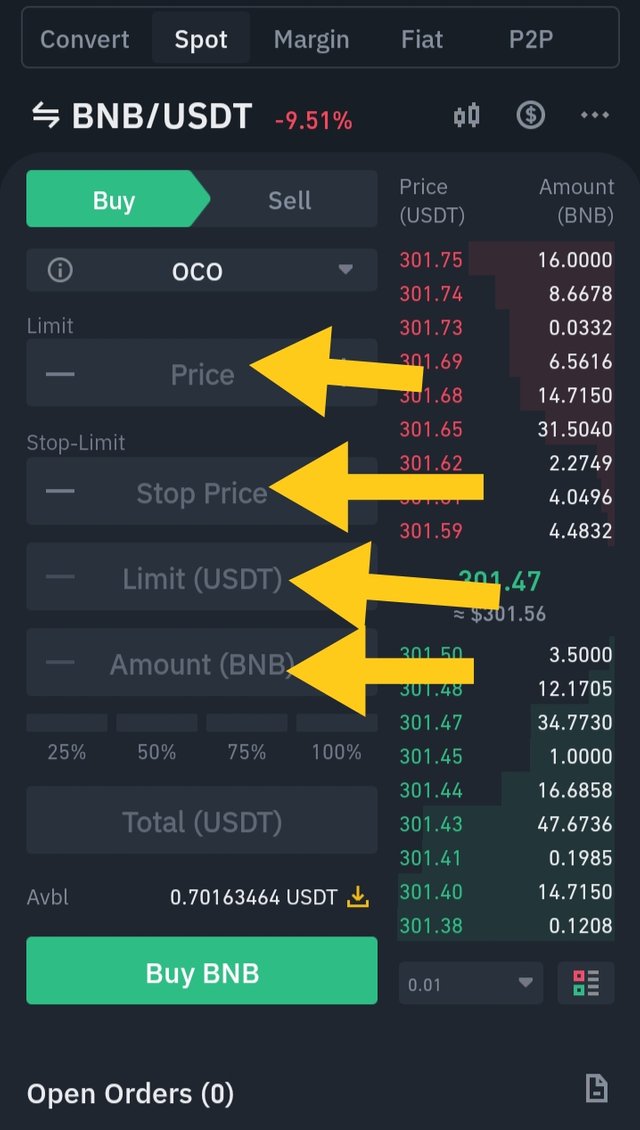

BUY LIMIT ORDER

Buy limit order in Binance, Huobi and some other exchange platforms uses green part as the buy order limit while the red is the sell order limit this is to distinguish them so as traders will be able to identify the buy and sell limit. Remember, the trader has better control to place his own buy price and this can only be executed or filled when the order is lower than the limit price or is at the limit price.

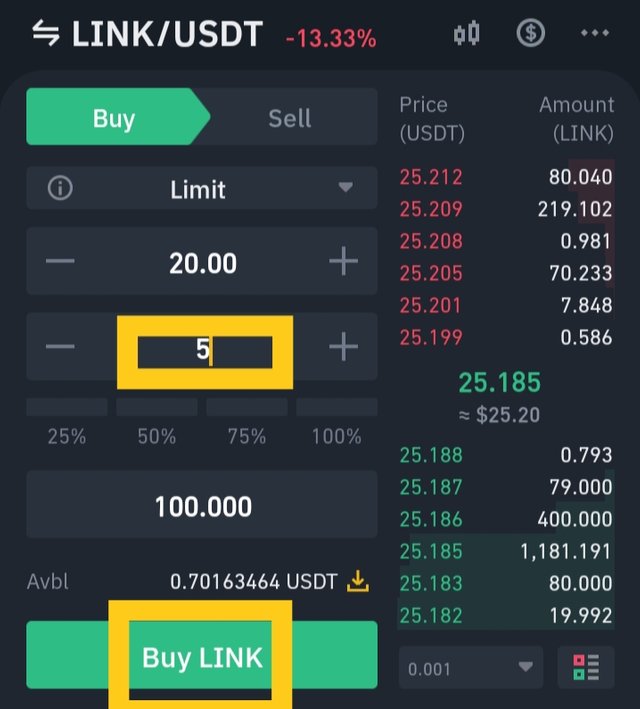

To place buy order, the following steps below are;

• After you might have selected your Trading pairs, click on the buy.

- At the place where I marked, you can place your buy order at the price you think is suitable for you.

• You can now put in the amount of USDT you want to buy the Link.

• You can see from the screenshot the quantity of the link which such USDT can buy will appear.

• After that click on buy and it can only be filled when the order is lower than the limit price or is at the limit price.

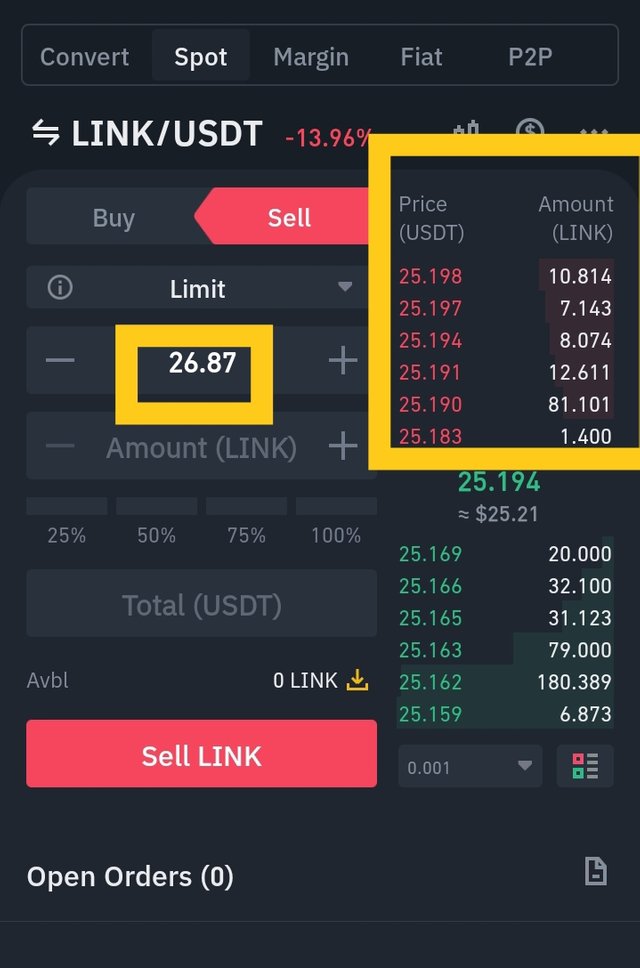

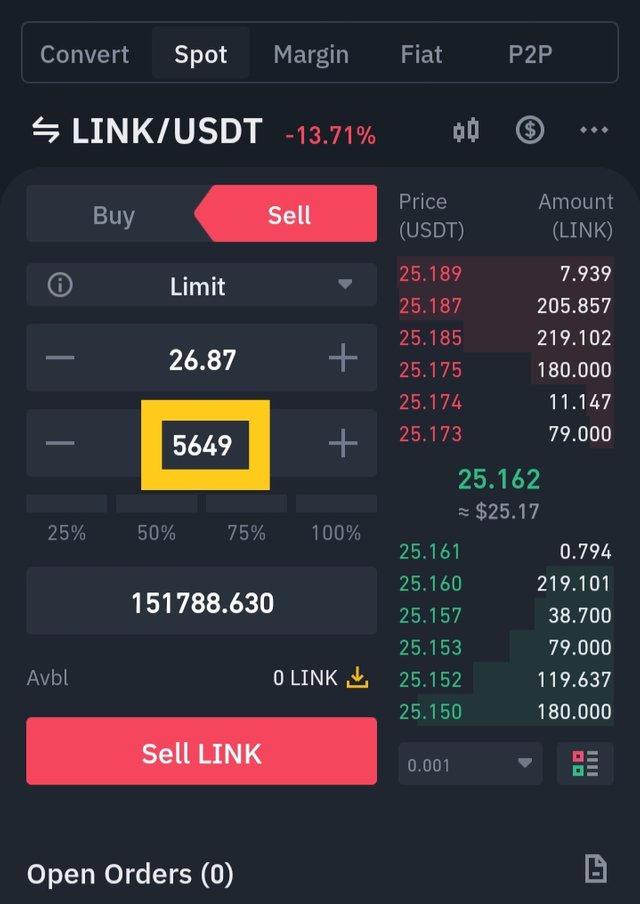

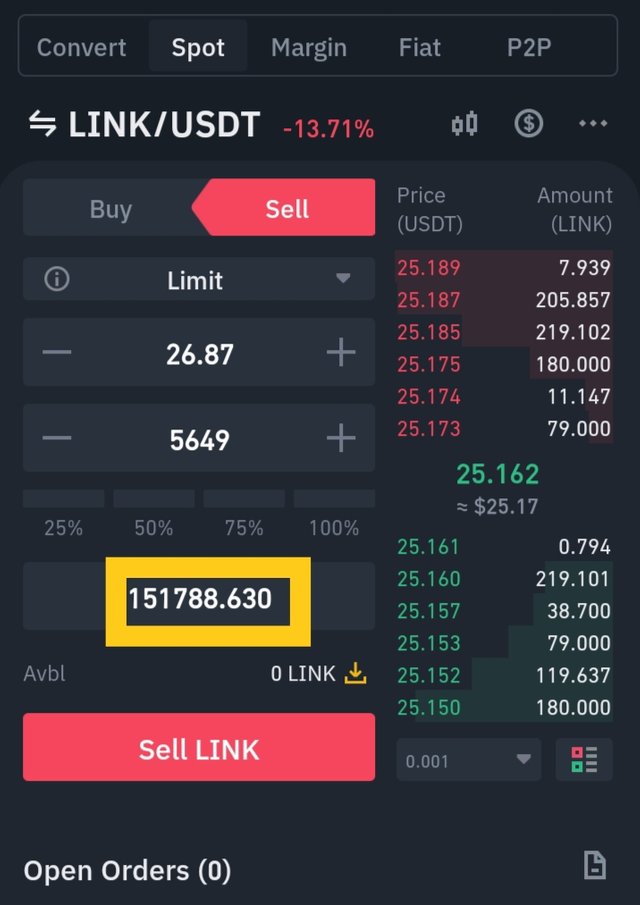

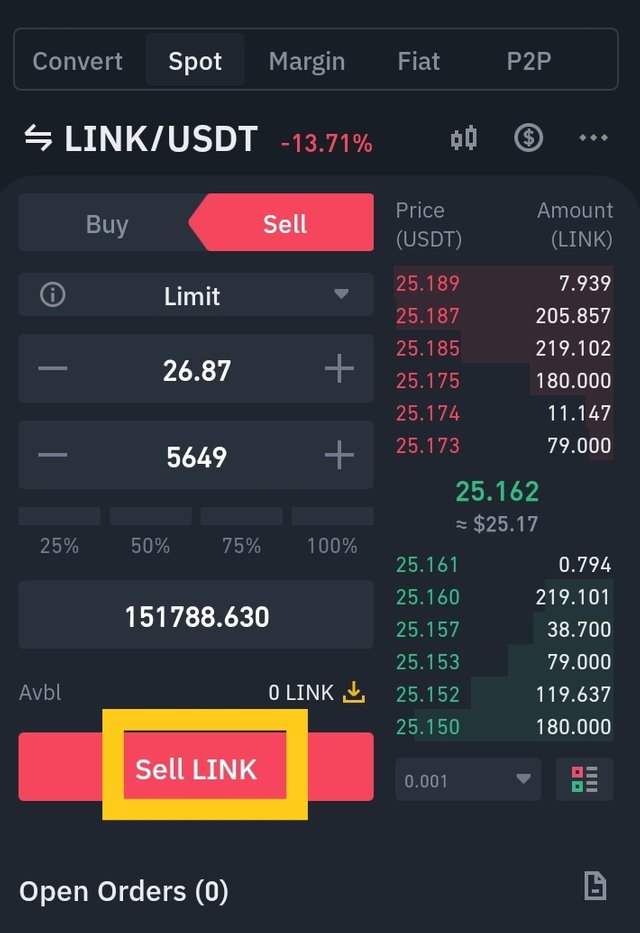

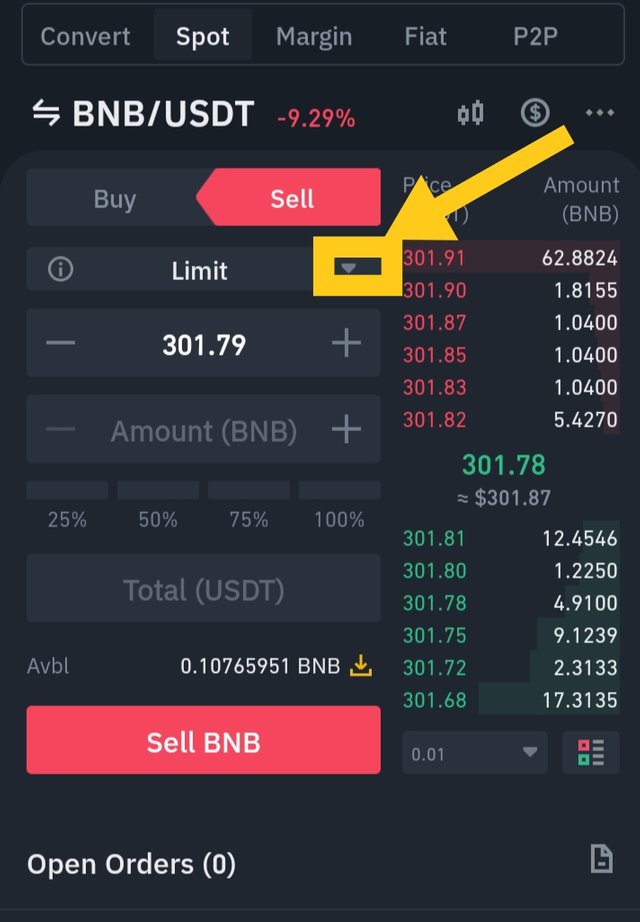

SELL LIMIT ORDER

Just as said earlier that the sell part signifies red. sell limit order can only be executed or filled when the current market price is higher or at the limit price.

How can one set this sell limit order? It can be set through the following steps:

• After you might have selected your Trading pairs, click on the sell.

- At the place where I marked, you can set your sell order at the price you think is suitable for you.

• You can now put in the amount of BNB you want to sell in order to get the USDT.

• You can see from the screenshot the amount of USDT it will generate

• click on sell, the order set qil display on the open order and can be executed once the current market price is higher or at the limit price.

How to place Buy and Sell orders in Stop-limit trade and OCO.

STOP LIMIT ORDER

Stop limit order is an important feature that helps traders to mitigate risk during trading.

So the stop-limit is in conjunction with the stop loss with that of the limit order(buy Limit order and sell limit order).

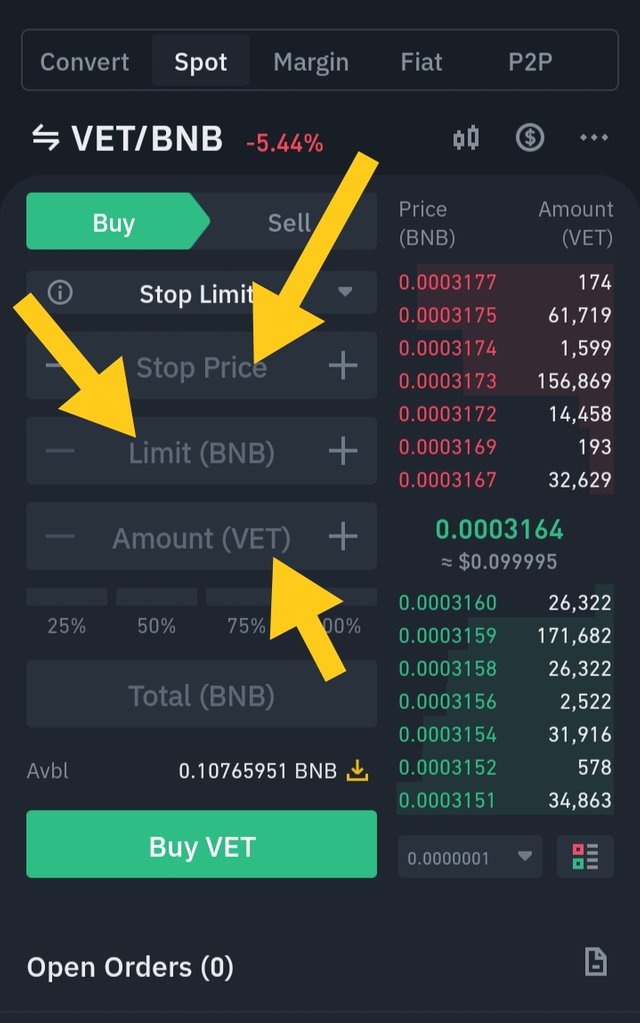

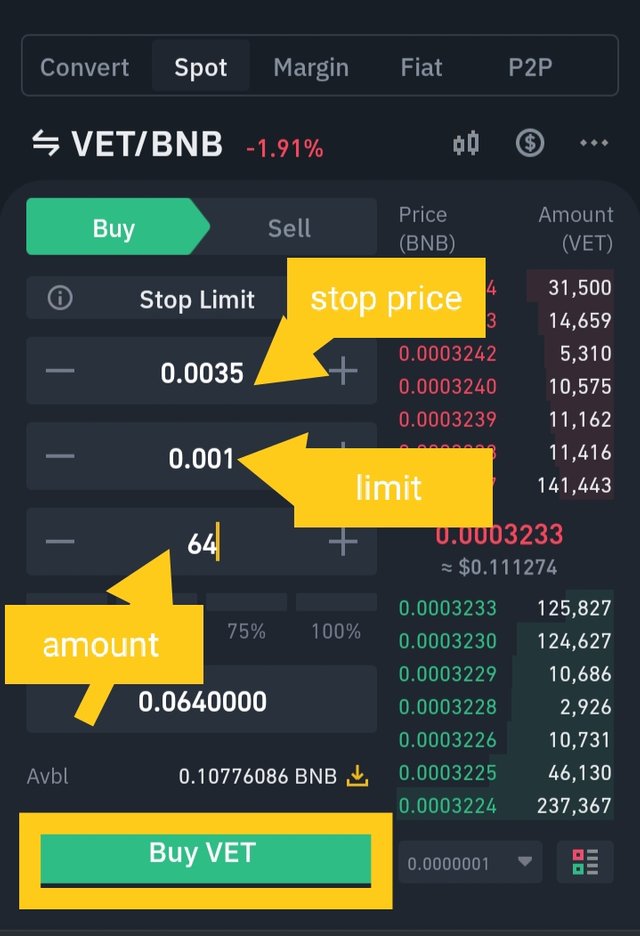

Before a Stop limit order should be set, trading analysis should be done to know the particular stop price and limit price to be set. Hence, there are two price needed to be set are;

STOP PRICE; Here you set the price at which you want your target to be triggered.

LIMIT PRICE; Here is the price at which the trader set his specified target that will be executed.

The stop limit order is said to be filled at the current market price immediately the set stop price is achieved or obtained.

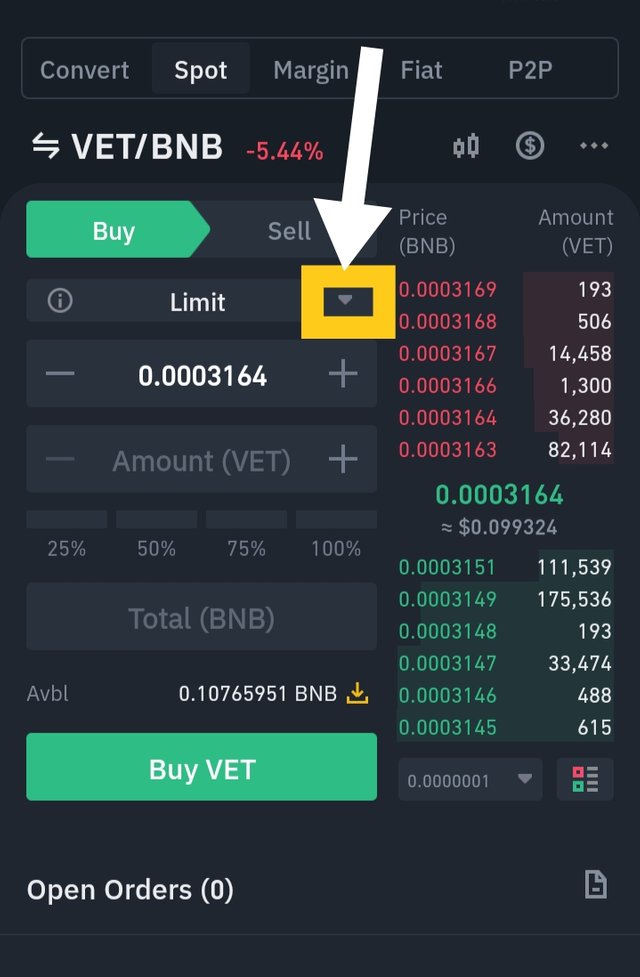

To set stop limit buy order the steps should be followed.

After you might have selected your Trading pairs, click on the buy.

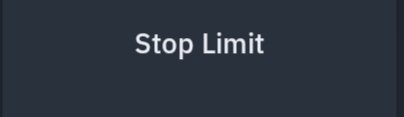

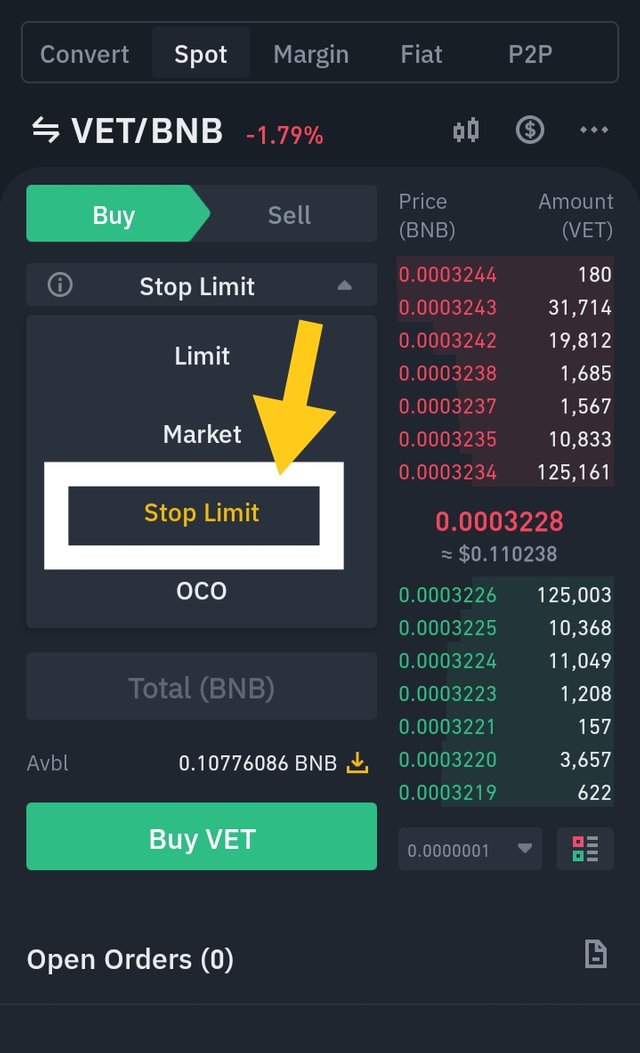

Click on the marked button then you will see stop limit from the image shown below. Then click on the Stop Limit.

• Set your stop target price and buy price, then click on buy.

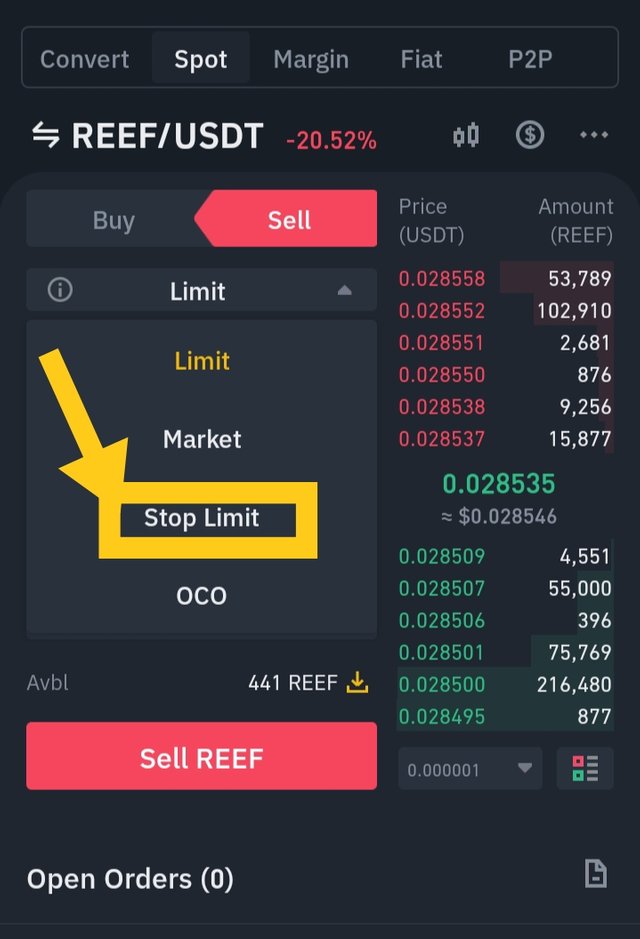

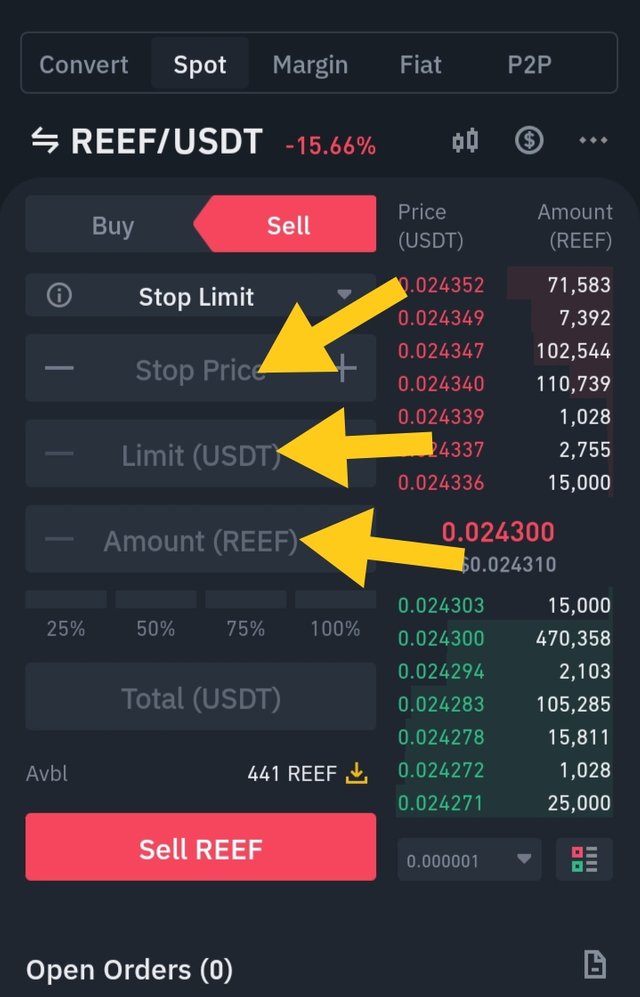

Procedure to set stop limit sell order.

- After you might have selected your Trading pairs, click on the sell.

- Click on the marked button and select the stop limit.

- Set your target price, sell price and sell amount you desire.

- After which click on sell

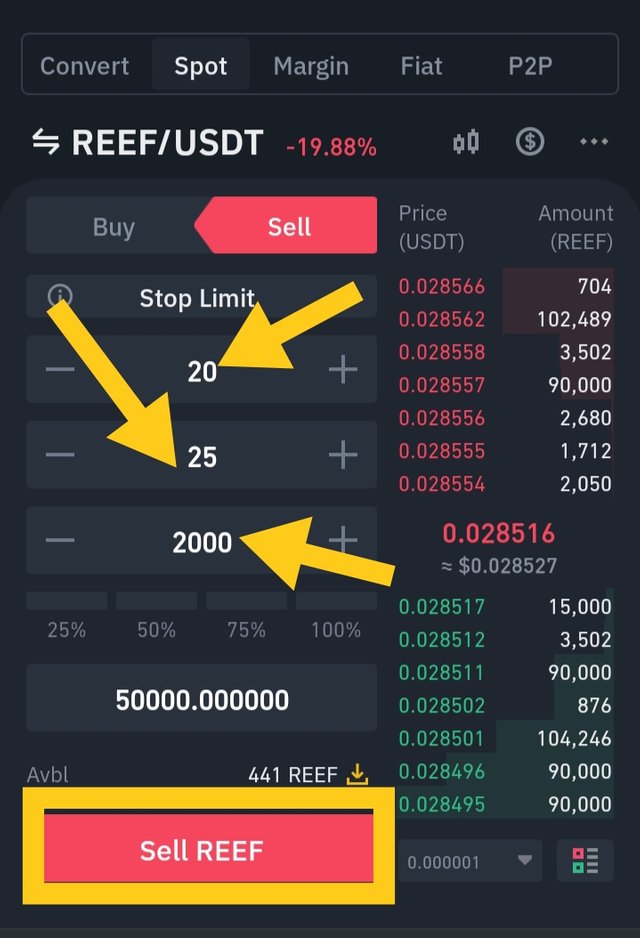

For instance;

Diho has 2000 Reef and wants to sell at the rate $25 and the current price of the Reef is at $15. After his technical analysis, Diho believe the price will increase above the rate of $20 and have confidence his $25 will be realised.

Diho understand the volatility of assets and knows he can not monitor the price all through out the period because he has other things to do, so set his stop limit sell order at his desire rate($25).

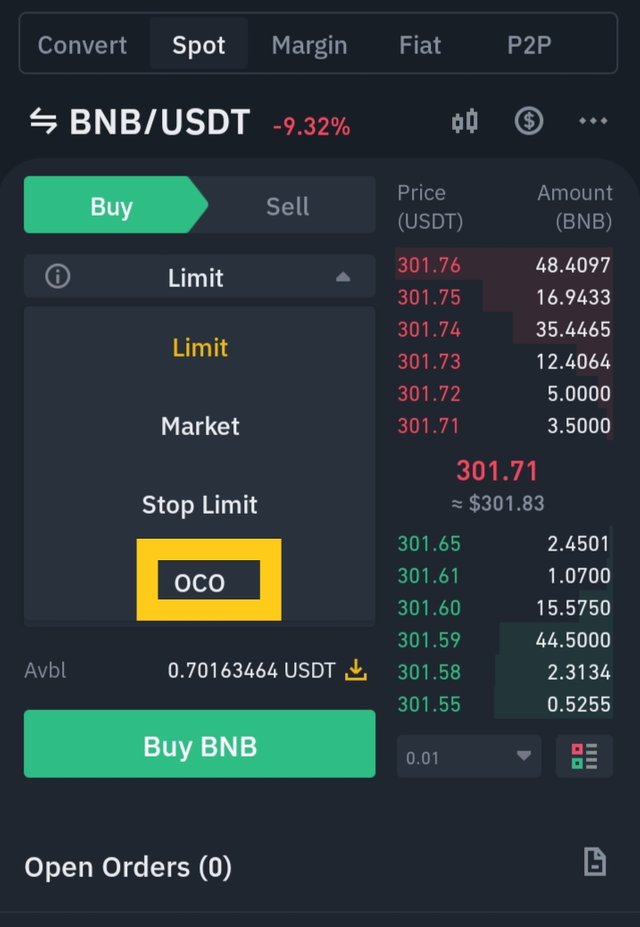

ONE-CANCELS-THE-OTHER

OCO; This stands for one cancels the other. It is a versatile order that has both the stop order and limit order. This works immediately one of the order which can either be stop order or Limit order execute, then the remaining other will cancel automatically without the trader's permission. Hence, traders uses OCO orders minimize risk before trading.

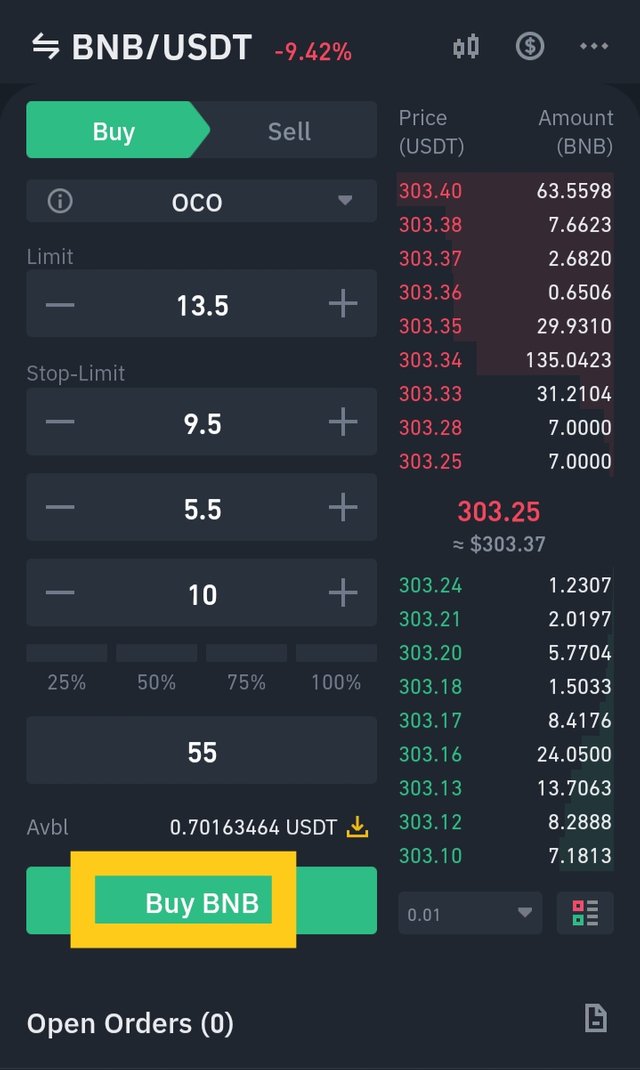

BUY OCO ORDERS

Suppose Manic wants to buy BNB from USDT. The he will set his OCO order (limit and stop limit order). For limit order he placed the price at the range of 13.5 and for stop limit, he placed stop price at the rate of 9.5 and finally placed his limit price at 5.5.

If the market price of BNB is above the limit he set, immediately the limit order will trigger and gets filled or executed. Automatically, the stop limit order will be cancelled. The same also occurs when the price drop and reaches the stop price Limit, it will trigger and get filled. Immediately, the limit order will cancel automatically.

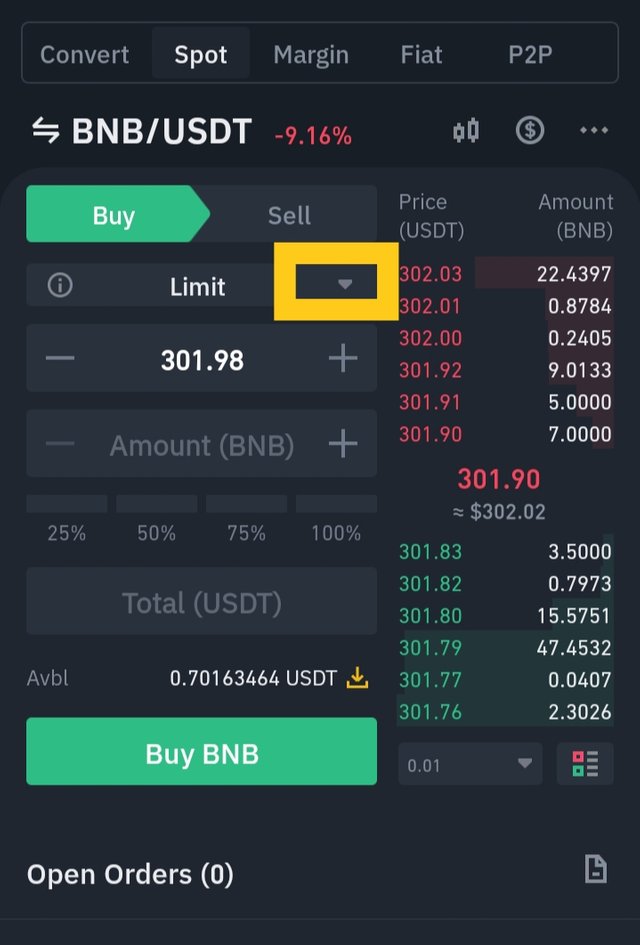

To set stop limit buy order the steps should be followed.

- After you might have selected your Trading pairs, click on the buy.

- Click on the marked button then you will see stop limit from the image shown below. Then click on the OCO.

• Set your OCO order, then click on buy.

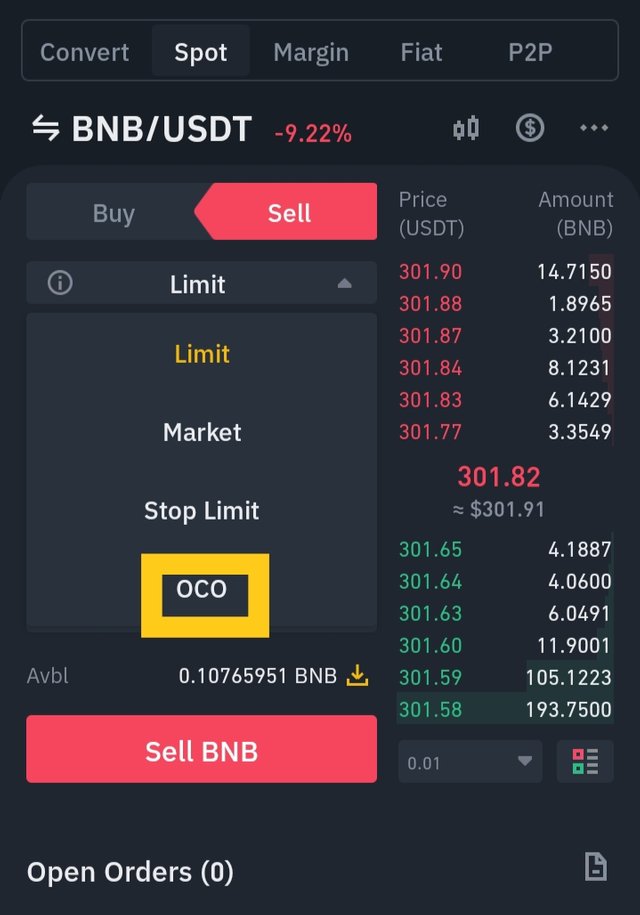

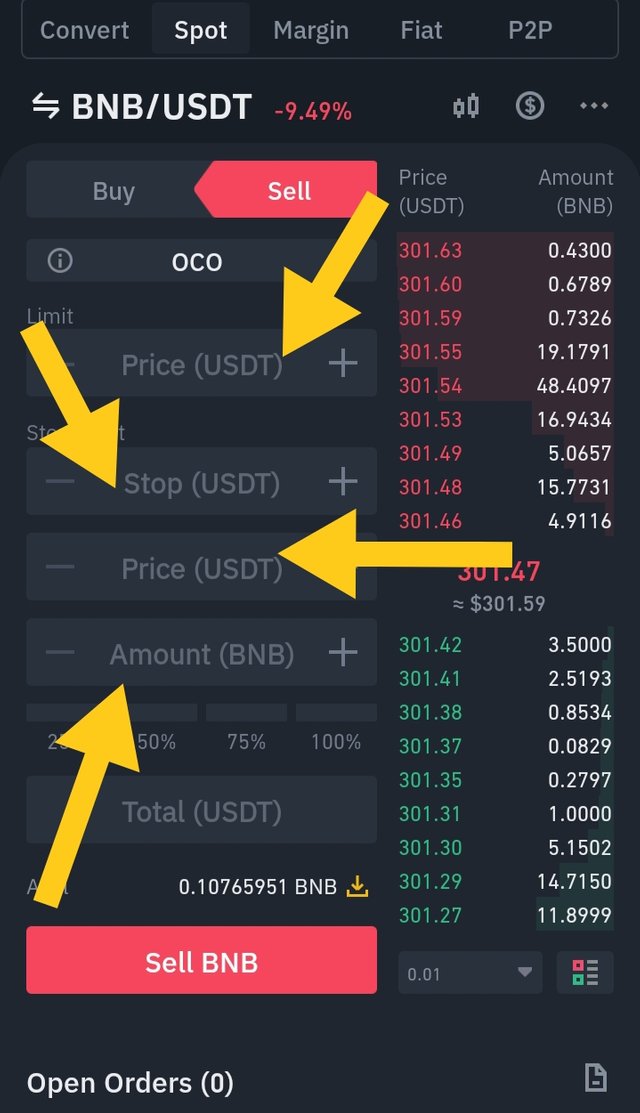

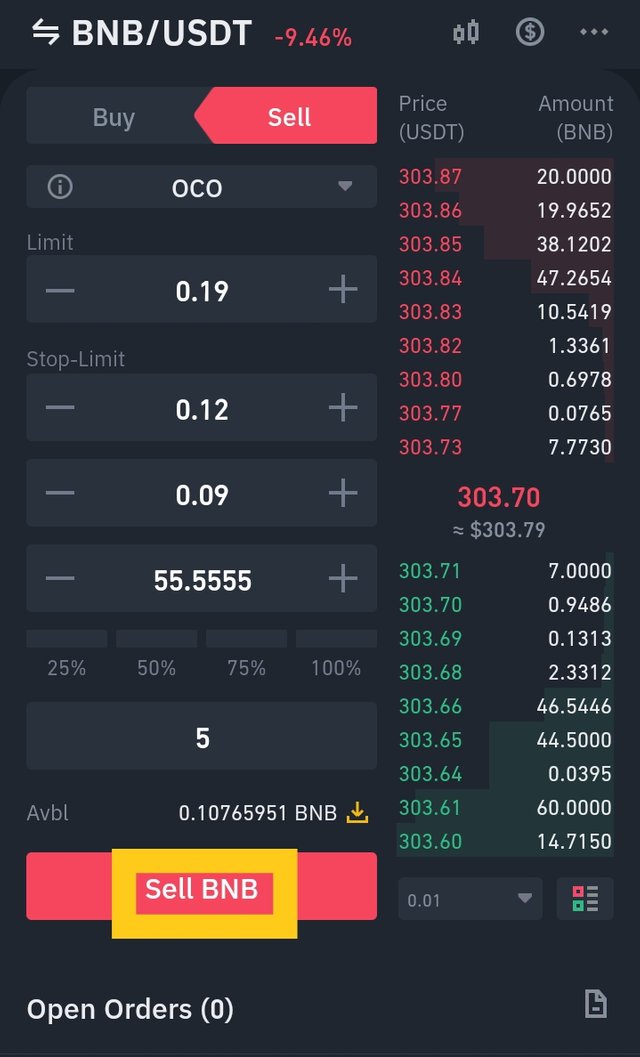

SELL OCO ORDERS

Assume Manic observed the market and wants to sell his BNB to get USDT which he can used to buy other coin. So since the volatility of the asset can't be trusted and he decided to set his OCO sell order (limit and stop limit order). This time he set his limit order price at the range of 0.19 and for stop limit, he placed stop price at the rate of 0.12 and finally placed his limit price at 0.9.

If the market price of BNB is above the limit he set, immediately the limit order (0.19) will trigger and gets filled or executed. Automatically, the stop limit order(0.12) will be cancelled. The same also occurs when the price drop and reaches the stop price Limit, it will trigger and get filled. Immediately, the limit order will cancel automatically.

To set OCO sell order.

- After you might have selected your Trading pairs, click on the sell.

- Click on the marked button and select the stop limit.

- Set your OCO order and sell amount you desire. After which click on sell

How order book help in trading to gain profit and protect from loss

In trading no one wants to lose their money most especially in crypto market. Hence during trading, there are important features which Order book has that helps in preventing loss like the stop limit order, OCO and other technical indicators like the support and resistance which I discussed above.

UNDERSTANDING STOP-LIMIT ORDERS AND OCO

Stop limit order and OCO are features of order book and really helps to gain profit and protect from loss. Understanding how to determine the settings of stop limit order and OCO plays a vital role in trading most especially where to set their limit. So understanding how to set your stop limit order really depends on your risk, as such traders should know the basic principles on some of the indicator such support and resistance before placing their stop limit order because through the support and resistance traders has better control and chance to buy and sell most especially when identified by the trader.

OCO is another important feature that helps to secure profit and prevent loss. But OCO is not found in all exchange platform like Huobi global does not have this important feature of order book. This made OCO not to be well known by some of the traders. One benefit of this feature is that it is versatile as it has stop loss and limit order.

Technical analysis should be carried out before any trader starts trading. Understanding the indicators like the support, resistance, RSI and Other indicators is very important. Studying the indicators before entering the trade gives a trader an idea when to enter and exit on the market like when the RSI indicator is <70 and >30 meaning it's overbought and oversold respectively.

Identifying the market trend and volume is necessary which one can see in order book. In crypto space, anytime there is increase in volume of any Crypto asset, it shows there's either increase or decrease of the asset. Hence, when the volume is high in the buying area due to more demand,the market value of that asset will increase.

Also when the volume of the asset is more in the sell part due to more supply , this shows that the market value will decrease.

Therefore, understanding the market volume and market trend enables the trader in making good decisions in setting their orders, as such helps to mitigate risk.

CONCLUSION

From the course of this task, it observed that order book features helps to mitigate risk and to secure profit. Therefore, traders should understand the basic features of like stop loss , OCO.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 8.5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit