.png)

1.) Discuss Dark Pools in Cryptocurrency in your own words. How does dark pool works?

Definition of Dark Pool

Dark Pool can be defined as a privately organized financial forum or exchange for trading securities and stocks, it gives opportunities to place large orders and make trade without publicly making their intentions known during the search for a buyer or seller.

Dark Pools are heavily used in high frequency trading, it allows investors to trade without any public exposure until after the trade is executed and cleared. This has become far more common in the investing world today. Dark pools involves privately exchanging financial products that are not available to all the public, in crypto currency market, dark pools are private platform that a trader can use to trade his/her assets at an agreed price without been affected by slippage as associated with volatility of the assets in the ecosystem and other market factors.

Dark Pool can also be said to be a private platform for trading crypto currency. In normal exchanges, there are visible order book while in dark pools there are no visible order book associated with it. Dark pools are private/personal trading platform i.e each trader chooses to buy/sell assets based on personal preferences. Trades that takes place in dark Pool does not affect the actual price of an asset in the market, even if it is worth millions.

How Dark Pool works.

To know how Dark Pool works, there are two things to be noted or considered.

- Limit Order

- Market Order

Limit Order: It is used to carry out block trading in dark pools. One might want to ask what is block trading.( Block trading is the sale or purchase of large number of assets at an arranged price between two parties. Block trade can be made outside p open market through a private purchase agreement. It is an easy- to- use platform for managing your portfolio).

Limit Order helps traders to choose a predetermined price at which to sell/buy asset without slippage. It is a huge advantage as compared to the normal exchange of crypto assets. In a situation where Limit Order meets with another potential buyer/seller of the limit order, the actual price of sale is what the trader achieves at the end. With a Limit Order, a trader could set the minimum/maximum price at which they are willing to fulfil a transaction.

Market Order: It can be said to be a transaction that is meant to be executed as quickly as possible at the current market price. One can say that market order is other words called a market command. It is an order that needs immediate execution, where the price of the stock is the secondary to the speed of completion the trade. In a lay understanding, market orders are the most basic buy /sell trades, where a trader receives a security trade order and then processes it at the current market price. Market Order can change its market price due to slippage, market order offers a greater likelihood that an order will go through, but there are no guarantees, because the orders are subject to availability.

With that out of the way, it is important to note that dark pools only accept large limit orders. Traders get their large limit orders matched to orders at the same price point when they place them, an action commonly referred to as Crossing. These trades are commonly referred to as block trades, because massive amounts of the asset are bought and sold.

2.) Discuss any crypto exchange that offers a dark pool. How does its dark pool work?

Discussion on SFOX Exchange - SFOX Dark Pool

The SFOX crypto dark pool is a completely hidden trading pool launched by SFOX exchange and is institutionally focused to allow the anonymous trading of large cryptocurrency orders with zero slippage. The dark pool is available at no additional cost to all SFOX clients, whether institutional or individual.

SFOX's crypto dark pool was created to address the liquidity concerns that institutional clients have about entering the crypto markets while also providing the speed and convenience that cryptocurrency offers. This dark pool was developed out of a felt need perceived by the SFOX exchange as Institutions have expressed worries about a lack of liquidity, significant slippage, and price manipulation in traditional exchanges. To solve this problem, SFOX's dark pool eliminates all risks associated with live markets by eliminating all transaction intent information, including price and volume, while settling deals instantaneously.

For the first time in crypto, high profile investors and traders can trade exclusively in a dark pool environment or have orders routed throughout the top crypto exchanges, OTC providers, and SFOX's dark pool to receive the best price. SFOX's advanced orders routing system routes trades across the entire liquidity venues to find the best price for public smart routing orders while keeping any concealed components of order in the dark pool to maintain user privacy.

I would have loved to continue with the SFOX Dark pool, but was constrained when I discovered regional limitations to using it; so, permit me please to switch to "Kraken":)

Discussion on Kraken Darkpool Exchange - Kraken Dark Pool

The Kraken dark pool is a new feature that allows clients on the Kraken exchange to place huge bitcoin orders in anonymity and execute them against orders of equal size at potentially cheaper pricing. On the Kraken exchange, the dark pool is an addon feature that allows traders and investors to carry out trades privately, devoid of market impact.

When other traders see outsized orders, the market typically moves against them, making it more difficult to fulfil the order at the targeted price. In a dark pool, this adverse price movement can be prevented. Each trader is simply aware of his or her own orders. Through the Kraken Dark pool, traders can place large buy or sell orders without showing details of these transactions to other traders by doing so anonymously.

How the Kraken Darkpool Exchange Works

Orders from the Dark Pool can only be matched with orders from the Dark Pool, they do not interact with the live market to avoid privacy concerns as well as avoid altering the price of assets in the market. Since market orders can be made only when the market order book is visible, the market orders option has been removed as a risk measure since Dark Pool relies on an invisible. Market orders have been replaced exclusively with Limit orders which are fulfilled when they "cross," i.e. prices between traders are matched. The Kraken Dark Pool does not allow for margin trading and everyone in the market follows the same fee structure, as details of traders are not revealed, so, you won't know whether you'll be a maker or a taker in the Dark Pool.

3.) What are the supported assets on the dark pool mentioned in (2) above? What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

Supported Assets on Kraken Darkpool Exchange

At the time of this writing, the Kraken Dark pool exchange supports a few Fiat currencies and just two cryptocurrencies.

Supported fiat currencies include - United States Dollar (USD), Pound sterling (GBP), Canadian dollar (CAD), Japanese Yen (JPY), and Euros (EUR).

The supported cryptocurrencies include - Bitcoin (BTC), and Ethereum (ETH).

The table below shows how these currencies are currently being traded in pairs on the Kraken dark pool:

| Ethereum Pairs | Bitcoin Pairs | BTC/ETH |

|---|---|---|

| ETH/USD | BTC/USD | ETH/BTC |

| ETH/CAD | BTC/CAD | - |

| ETH/JPY | BTC/JPY | - |

| ETH/GBP | BTC/GBP | - |

| ETH/EUR | BTC/EUR | - |

What are the requirements for getting involved in dark pool trading on the platform? Is there any fee attracted? Explain.

The requirements to get involved in the Kraken dark pool are:

- Traders must understand that they are not trading the market directly, thus, only limit orders can be placed.

- Traders must be Pro level customers, which is the highest tier of verification on the Kraken exchange with full access to the whole range of features available on the Kraken exchange.

- Trades must be in minimum order size of an equivalent of 100,000USD for BTC pairs, and a minimum of 50,000USD for ETH trading pairs.

Fee Structure

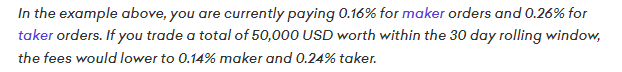

- Trading fees on the Kraken dark pool ranges from 0.20% to 0.36 per cent of the total trading cost.

- This trading fee is not static, the more transactions are done on the dark pool, the lesser the trading fee. Here is an extract from their support page illustrating that:

4.) For the chosen dark pool, give a brief illustration of how to perform block trading on the platform. (Screenshots required).

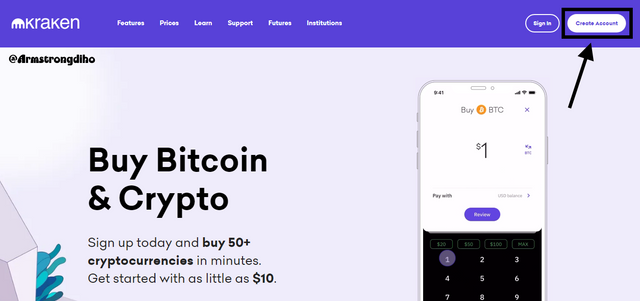

Now, let's illustrate how a block transaction can be carried out on the Kraken exchange dark pool.

- First, visit the Kraken Exchange Website, and sign up like a regular user by clicking on "Create Account":

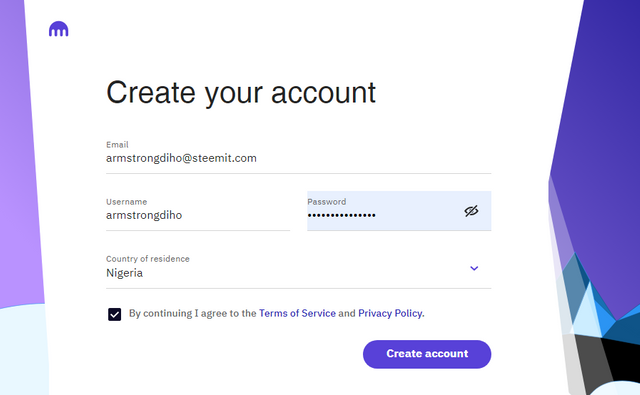

- Complete the account creation form to complete the account creation (dummy details have been entered on the screenshot for illustrative purposes).

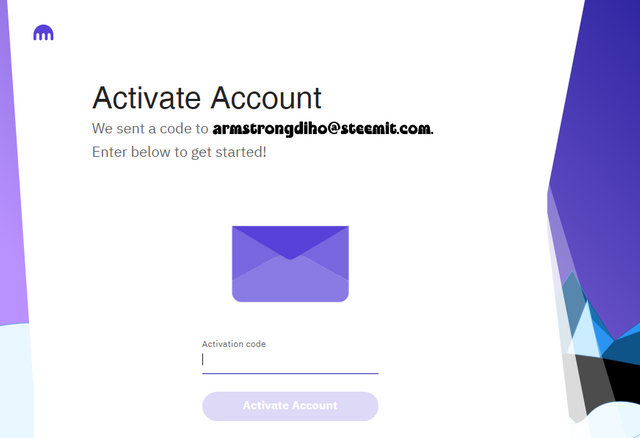

- Check your mail, and enter the confirmation code sent you to complete/finish the account creation and confirmation:

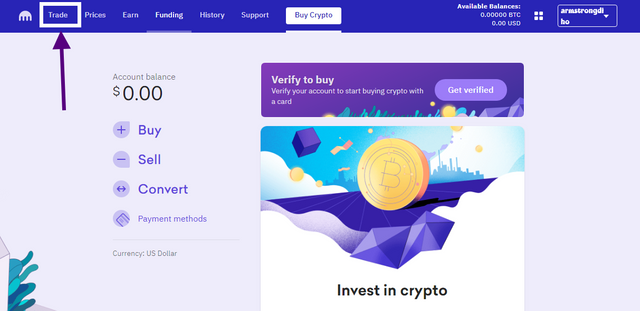

- Once you are logged in on your account page, click on Trade to switch to the Kraken classic trading view.

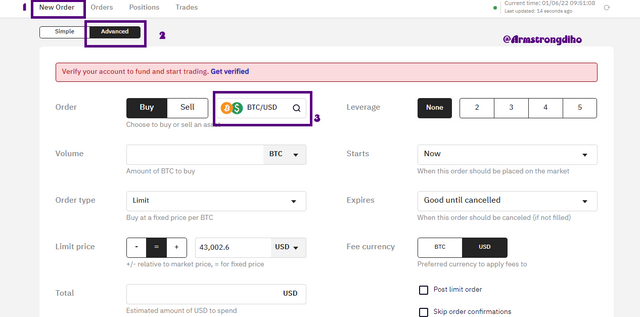

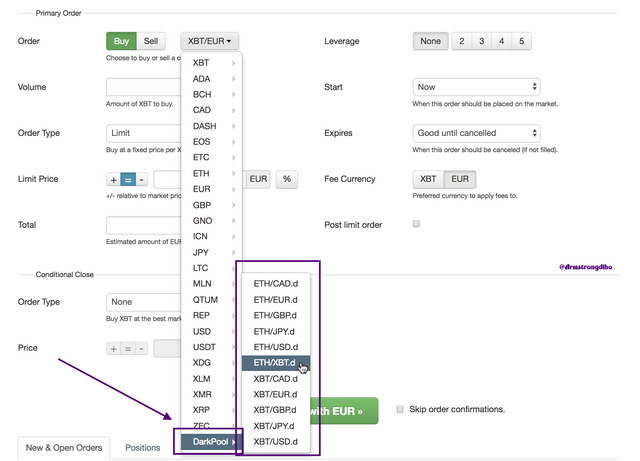

- This brings you to the option of creating a "New order [1]". Under which, switch to "Advanced"[2] view, and click on the "asset/instrument area"[3] to select the trading instrument.

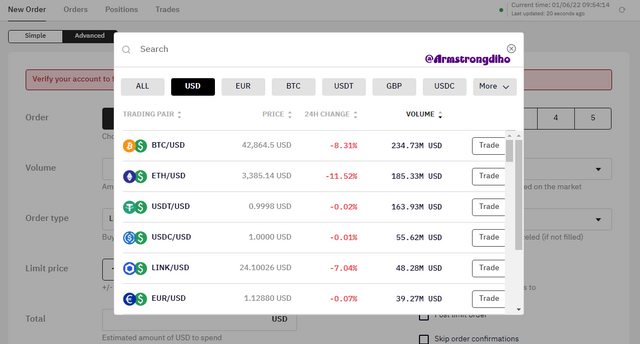

- Scrolling down to the bottom of the asset search page should reveal the list of tradeable dark pool instruments. But at the time of this writing, dark pool transactions have been disabled on Kraken exchange.

If dark pool trading was enabled, the above view should look something like this:

From the above view, limit dark pool block trades can be carried out.

5.) What's your understanding of the Decentralized dark pool? What do you understand by Zero-Knowledge Proofs?

Decentralized Dark Pool

Decentralized Dark Pool is a block trade that takes place on a decentralized exchange which disposes the presence of third parties in transactions or trade carried out in the dark Pool, which makes it more secured than trades/transactions offered by centralized exchange. In decentralized dark Pool, the exchange occurs directly between two parties, it is not facilitated by third party. Decentralized dark pools are unique in the following ways:

- Decentralized Dark Pool is anonymous in nature, because the identity of the traders are not revealed and also critical information relating to the trade such as price and volume (amount) at certain position is not revealed either.

- Decentralized Dark Pool encourages large trades of crypto currency, it minimizes price slippage in the crypto market.

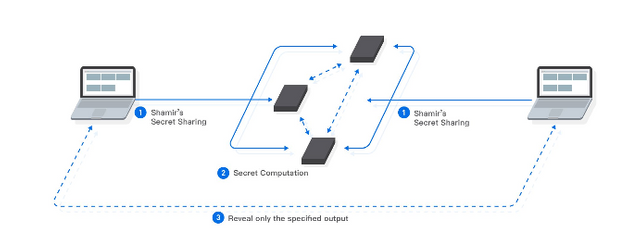

- Decentralized Dark Pool breaks down a crypto currency order into multiple fragments and match them back again using zero-knowledge proofs.

Zero-knowledge proof

A zero-knowledge proof is the process used to verify the integrity of any transaction. A zero-knowledge proof is a method where by one party can prove to another party that a particular statement is true while the prover avoids conveying any traditional information apart from the fact that the statement is very true.

The Zero-Knowledge Proof is a two-person contest. The first is the prover, who has the knowledge but must prove it, and the second is the verifier, who verifies that the prover has it.

The essence of zero-knowledge proof in crypto currency is that it proves that one possesses knowledge of certain information by simply revealing it, the challenge is to prove such possession without revealing the information itself or any traditional information.

N/B: There are three (3) essentials to zero-knowledge proofs which includes

Completeness: The information must accurate, valid, honest, whole and verifiable.

Soundness: If the prover lacks the information, the verifier remains sceptical about the fact.

Zero-knowledge: The verifier should need not know the specifics, only whether or not the prover possesses it should be revealed.

6.) State one decentralized dark pool in cryptocurrency and discuss it. How does it work?

- REN Dark Pool

The decentralized dark pool of interest is the Ren dark pool project, known as the RenEX. Ren created and published the first decentralized dark pool (RenEx) in 2018, and is currently extending this technology to establish an ecosystem for developing, deploying, and running general-purpose, privacy-preserving apps utilizing their special zkSNARK architecture which according to them is a newly designed secure multiparty computing protocol (sMPC).

How the Ren Dark Pool Operates

When an order is made in the Dark pool, it is divided via Shamir Secret Sharing and then dispersed to a network of Dark nodes, which uses two Ethereum smart contracts to complete the transaction: The Registrar and The Judge. Following order, the Registrar guarantees that fragmentation and distribution across darknodes are not reassembled by organizing the nodes in such a way that any attempt to do so is foiled. Pieces of one order are matched with fragments of another order through a series of computer procedures. The Judge uses a Zero Knowledge Proof to verify the calculations' integrity without exposing any knowledge about them. An Atomic Swap for crypto assets is initiated once the pieces of two orders have been appropriately matched.

7.) Compare a crypto centralized exchange dark pool with a decentralized dark pool. What are the distinctive differences?

| Yardstick | Centralized Dark pool | Decentralized Dark pool |

|---|---|---|

| Privacy level | Low (Requires KYC verification) | High (No KYC verification required |

| Contract type | Non-smart contract | Smart contract |

| Order execution process | Bulk transfer without splitting and use of computerized nodes | Orders are split and executed through computerized nodes |

| Users | Mostly open to institutions | Open to anyone |

| Visibility | Trades are visible to exchanges | Trades not visible to exchanges |

| Common examples | Kraken | RenEX |

8.) Research any recent huge sale in any market in the crypto ecosystem and how it has affected the market. What difference would it have made if the dark pool was utilized for such sales?

A major dip that rocked major assets such as Bitcoin, Ethereum, Binance, etc occurred on the 3rd of November 2021, where major investors such as El Salvador, tried to stop the dip but could not. A major sell off was made for BTC about 246BTC was sold off, and this resulted in a sharp decline in the price of BTC, from $62,500k to $60k. According to Coinmarketcap such huge sell off could be seen as "scam wick". The whale in this case made a market order, which resulted in a huge movement in the market.

Outcome if done differently on a "Dark pool"

This whole fall in the price of BTC, could not have happened if the whale had used Dark pool, and also the whale would have sold at a very good price, rather than the regular market order. Moreover, the whole disruption in market order would have been avoided if this transaction was carried out on a dark pool.

9.) In your own opinion, qualitatively discuss the impacts of trades carried out in the dark pool on the market price of an asset.

Qualitative Analysis of Trades Carried out on a Dark pool

There are different rationales backing Dark pool trading. We could analyse them qualitatively by examining the following schools of thought:

Dark pool trading as an approach in taming market volatility

Normally, when huge orders come on the order book, traders react based on their emotions. Large purchase orders induce traders to buy that asset, causing the market cap to rise and the price to rise. Large sell orders, on the other hand, induce traders to sell an asset, depleting its market capitalization and driving the price down. This is essentially an application of demand and supply, in which if demand exceeds supply, the price rises, and vice versa if supply exceeds demand, the price falls. Dark pool trading might assist in keeping this emotional approach to the market in check as huge orders are not constantly disrupting the market flow since all trades carried out in the dark pool are not visible in the live market.

Dark pool helps huge investors and institutions to trade against market volatility

Market volatility is less of a concern in the dark pool since traders in the dark pool determine the price at which they want to exchange their assets. The dark pool is a suitable environment for huge institutionalized traders and trading whales. So, with dark pools, merchants may deal on their own terms, hoping that the next person involved will also be prepared to trade on their terms.

Profit is based on Economics and Not Market Psychology

In comparison to the standard market, the dark pool is an exciting trading place with a small number of users. With complete detachment from the market, a trader's profitability in this arena will rely purely on their orders' ability to be matched with a buyer ready to purchase at their offering price.

10.) What are the advantages and disadvantages of Dark pool in Cryptocurrency?

Advantages

- Dark pool helps in managing the privacy of traders who want to trade large quantities of money, because they can keep their plans hidden from the general investing public.

- Dark pool helps in price improvement. Frequently, trades are being matched by averaging the best available bid and ask prices. Both the buyer and the seller gain from a better deal than they would have acquired on the open market in such scenarios (the buyer gets to buy lower, and the seller gets to sell higher).

- Dark pool gives dealers a measure of confidence that their entire trade will be performed at their intended price because most dark pool trading is done in block deals at set pricing with orders matched within similar prices.

- Dark pools may minimize transaction costs because they do not charge exchange fees and transactions based on the bid-ask midpoint do not incur the entire spread.

- Dark pools contributes to stability in the live market, as large orders are not made on the live market resulting in a huge disruption in price.

Disadvantages

- Dark pool encourages conflict of interest because the order book is buried, it's impossible to tell if a sale was completed at the best possible price. If a trade facilitation agency has a conflict of interest, it can obfuscate legitimate market prices.

- Due to high privacy, Dark pools obstruct the free flow of information, which is critical to investment and trading.

- Some traders may find dark pools to be an ideal environment in which to engage in exploitative practices which places other dark pool traders at risk.

- If market whales continually use dark pools, it is possible that the liquidity of the market will dwindle as

Conclusion

Dark pool trading is a niche space in the crypto world as this form of trading is common among whales and huge players. However, the awareness of its existence is interesting and appealing. Thanks to @Fredquantum for shedding light on this.