What can you say about Crypto Investment and how to properly utilize the investment tools available to make the right decisions?

Cryptocurrency as an investment opportunity

I am opinated that cryptocurrencies are a real and concrete investment opportunity. However, just like other assets as real estate, bonds, shares and the likes, one must first analyze any potential cryptocurrency investment and weigh the risks critically so as to reduce having too many losses. It is worthy to note that there are a whole lot of cryptocurrencies running into thousands and one must be diligent enough to study the one of his choice before making an investment.

Investing in cryptocurrencies is relatively easy with no hassles, all you need to have is your capital, email address, mobile numbers and an internet enabled device. There are exchanges such as Binance that are very trustworthy, others such as Kucoin and Huobi lets you trade without KYC. Prior to making investment, it is advisable that one understand the risks involved and know that you can either lose all your capital or make good profits.

Another risk in cryptocurrencies is the loss of access data. Anyone who loses their private keys may no longer have access to their assets in the Blockchain. For this purpose, it is advised that these keys be properly backed up especially as the keys cannot be retrieved and transcations are irrevocable. In a nutshell, the cryptocurrency market is imbedded with so many opportunities for risk takers and there's no doubt that it is the currency of the future.

How to use investment tools in making the right decisions.

Before making any investment, it is important to understand how the market works, its volatility and tools that can be used in identifying good coins and the right time to invest in them. Below are some of the investment tools that can be used.

Fundamental analysis tools:

One of the most important tools to use before making any investment is the fundamental analysis tools. This simply means checking the background of the coin, knowing when it was created, the purpose, how many coins are in circulation, all-time high and many other details. This can be carried out using Coingecko and coinmarketcap.

Stoploss

This is simply the price at which a trader or investor presets his investment to close when the market is dipping. This is usually done to reduce the chances of losing.

Technical analysis

There are usually news, rumuors and charts that tends to influence the market but one must be careful not to pay heed to them. Every trader must know how to do technical analysis using technical indicators. This can be done using Tradingview charts or other charts in exchanges.

Take profit

This is similar to stoploss. It is another preset point but this time around, it is set to ensure that your profit is secured. It helps you get accumulated profit just in case the market increases so highly and then drops. It's based on the precepts of playing it safe.

On-chain metrics

This is another good tool although complex. One needs special service providers to be able to access and utilize it effectively. It shows what's happening on-chain (real situation) and is carried out through websites such as santiment, glassnode etc.

Talk extensively about the following. Also, highlight the benefits and risks associated with each.

i. Private Sale in Cryptocurrency.

The private sale is the first step undertaken in an initial coin offering. It happens immediately the founders have been able to compile all the documents required which includes the white paper. As the name implies, it is the sale of coins or tokens to investors who come early. They are usually done unannounced and the public is usually not aware. It is left to the discretion of the blockchain companies to choose who the investors they want to invite to the event.

The essence is basically to attract influential early investors to finance the project in return for cryptocurrency that will likely yield high returns. The pitch of a private sale is carried out in person and the founding teams approach these investors to share required details. This lets the founders to explain the situation better, make a stronger case while letting the potential investors to get clarity on their concerns and questions.

These founders have the possibility of recieving good support from investors as well as networking and sharing experience. It is imperative to know that these founders have a limit to the amount of investment they want to raise and see to it.

Benefits of private sale in cryptocurrency

There are big bonuses and discounts given out as compared to presales and public sales.

It offers the ability to get quick returns if a token purchased at the discount sells for the price of the ICO when the token trading officially commences.

There are better chances of buy tokens as it focuses on influential investors at the institutional level unlike public sales and presales.

Risks of private sale in cryptocurrency

It is quite a risky investment especially due to the fact that the outcome of the presales and public sales are unpredictable.

There's usually no guarantee of refund of money if the initial coin offering doesn't hit target doing the succeeding sales.

It has a higher minimum contribution than the succeeded sales and the tendency of locking period for tokens or bonuses. In addition, there's less token liquidity because of the long period it takes for the token to be released.

ii. Presale in Cryptocurrency.

Some cryptocurrency projects conduct a presale in advance of an initial coin offering, in which tokens are sold to interested parties at a set price. This is merely a stage that occurs before to the public sale.

Preselling can be of benefits to both parties (investors and development team) if it goes as planned. It's a two-way profit street where the creators will receive the funds needed to finalize the project and the investors on the other hand will have the potential of acquiring an altcoin that couod be profitable in the future.

The creators may perform a presale in order to create publicity for the ICO with hope that the price will surge when the asset goes public. Its publicity is done on different websites, social media platforms and other advertising media. It is worthy to note that this sales comes with its own risks and if the project fails, the investors will be left owning worthless tokens that cannot give them profits on their investment. The creators will have to watch out for investors who dump their coins immediately after the launching be ause it doesn't tell good of the coin.

Benefits

It gives more profitable discounts on tokens as compared to public sales.

There is assurance of token purchase as some ICOs may decide to cancel public sales.

It gives the liberty to purchase more tokens as the ICO presale's target is big investors. In addition, these investors have the opportunity of getting a quick return if the tokens purchased at a discounted price are sold at the ICO price.

Risk

There is a higher risk of immature products or company and a higher minimum investment as compared to public sales.

There's risk of reappreciation of cryptocurrency devaluing the tokens and lack of token liquidity while waiting for the trading.

Some ICOs are quite at an early stage of their development and it is difficult to evaluate their success based on the presale.

There are some tokens which are usually sold before the presale which invariably means that the most advantageous gets sold out faster.

iii. Public Sale in Cryptocurrency.

Public Sale is the period when an asset is officially into the market and made available to the general public for purchase. This sales usually takes place in token exchanges and websites such as Tokenomy, Coinbase and Liquid. Most times, a public sale usually happens when the currency didn't reach its target cap doing presale. It is said that this is a cruccial and mainly the most impoet stage in the ICO path, hence, it is widely promoted and advertised.

It is less risky but also has less bonuses and discounts as compared to the presale and private sales. The bonuses is actually based on how early the investor contributes and the amount of contribution.

Benefits

It is very predictable and this can be done using ICO results outcomes from the presale and private sale.

It has lower risk as the products are better developed and the token have greater liquidity because there's less time to trade it.

There's lower minimum purchase amount as compared to presale and easier KYC because many do not demand accreditations.

Risk

There are lower discounts and it's possible to get lower maximum cap per user.

It may be canceled if tokens are completely sold out during the presale, and there is a risk of token-dumping if tokens are purchased at a reduced price.

What are the mediums used for Public/Pre/Public Sales in Cryptocurrency?

There are various mediums in which tokens sale can be made and I will be discussing a few of them.

Token issuer website

This is usually the first place that investors will visit when they want to purchase a coin that hasn't been listed on any exchange. The website contains details of the crypto project, the token and a good explanation about the future of the project. Sometimes, tokens can be purchased by investors from this website using smart contracts.

Bots

This is a group on Telegram where investors and other prospectives can interact with the programmed bot to release pre-programmed funds. It has been in existence for quite a while.

Meetups

Here, coins are sold directly to the investors. It may not be a trustworthy method but it is good especially for private sale investors. What happens is that these investors are met personally, sold the idea of the project and aeviced to invest in the project by purchasing the coin.

Launchpad of exchanges

Launchpad is another medium for sales. They are used by exchanges that want to engage in fundraising for a token or let an investor buy a token before it is listed. One of the most used launchpads is the Binance launchpad which is based on the BSaC chain. Here, users put in BNB and get new tokens in return.

Research about any recent (2021) successful ICO or IEO and give detailed information about the project. (Note: BETA token is excluded).

DeversiFi (DVF)

Source

DeversiFi is a decentralized ICO which operates on the Ethereum Blockchain

This platform allows users to to access DeFi opportunities and carry out transactions such investing, sending, swapping of tokens, yield farming and trading on the Ethereum network without having to pay for network fees.

The native token of DeversiFi is known as DVF.

The DeversiFi ICO took place on the 8th of July 2021 and run through to the 10th of July 2021.

How to use the ICO

To get started with the DeversiFi the following steps are taken;

- Visit the exchange and connect your wallet to it e.g Metamask wallet.

- After connection of the wallet, fund your DeversiFi account by make a deposit of USDT into the account. Then swap the USDT to DVF.

- Your exchange is ready for use, you can begin buying, selling and earning.

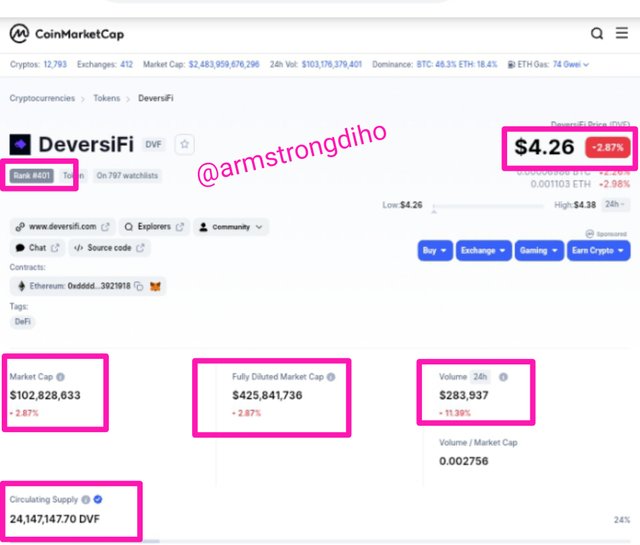

CoinMarketCap

On CoinMarketCap the price of DeversiFi (DVF) as at the time of this research was $4.26; a Market Cap of $102,828,633; Fully Diluted Market Cap of $425,841,736; 24 hours Trading Volume of $283,937; Circulating Supply of24,147,147.70 DVF; Total Supply of 100,000,000. The token is ranked #401 on CoinMarketCap.

The Purpose of DeversiFi (DVF)

The purpose of the DeversiFi is to create an easy and accessible DeFi on the Ethereum layer-2, where users don't have to pay for gas fees during swapping, sending of tokens, trading etc.

Create an imaginary token. Write about the project including its use case. Develop an ICO which includes Private sales (3 stages) and Public sales (1). Note that: You are expected to explain what the funds are intended to be used for, your Private sale should have 3 stages, and specify the initial supply available, and the price you are issuing the token in each stage. Also, specify the price you are issuing the token at the Public sale phase (including the supply).

Broadly speaking, this aspect of the question is very interesting. However, my Imaginary token is called Diho (DHO). Thus, it will be the native token of an imaginary Diho blockchain.

IMAGE SHOWING THE SYMBOL OF MY IMAGINARY TOKEN

DIHO is a main native coin of the DIHO Protocol built on the Binance Smart Chain contract. However, with the current launch of its main net, DIHO is an internet blockchain platform that is being proposed to provide solutions seeking to act as a mediator between independent blockchains working on its decentralized network, as such eliminates the involvement of a third party. DIHO came into the spotlight to render solutions, and the team of the internet blockchain is still under research and development which is led by the founder Armstrongdiho.

Basically, the decentralised internet-based protocol can offer development in the socio-economic foundation in the crypto world. We can see that the united success rate of the open-source ecosystem, public crypto assets and decentralised sharing of data has improved the socio-economic foundation in the crypto domain which is the reason why I want to build my token on this base.

DIHO is a proof-of-stake chain which primarily used for governance. Thus, the holders who hold the native token (DHO) and can stake their tokens to maintain the network and receive more DIHO as a passive reward.

The users partaking in the consensus protocol by broadcasting their votes, to agree upon the next block to be generated in the blockchain, as such each user has the same weight. However, we determine the voting power by the amount of staking tokens the users provides as collateral.

Furthermore, the blockchain will use smart contracts and dApps to assist the platform run ICO platform.

Use Case of the Token

The token will be used as collateral to the liquidity providers. That's the liquidity providers will receive the token when they lend their assets. This is to say that the protocol will allow lending, borrowing, swapping of assets as well as staking. Thus, when the users lend, borrow, swap, and stake their assets, they will receive crypto suitable with the best rates and low transaction fees.

Furthermore, the DIHO token also serves as a means of payment for services like purchasing foodstuff in the market.

DIHO ICO

The team is still on research to resolve several key issues such as Scalability, and Interoperability, as such we are committed to providing a perfect ecosystem for decentralized finance. Gratefully, the teams have developed a roadmap of the token. Hence, the cost of the project is huge and to obtain a better profit, the team has come in agreement as well as analyzed the possible cost it will take. So, the team will offer coins via private sale in 3 stages to get funds to launch the project. Let's check it out.

The total tokens created is 40 million tokens and 30% which is equivalent to 12000000 will be offered to investors through a private sale in three different stages and public sale. Firstly, the private sale coins will be offered at the rate of $ 0.8 and for the 2nd and third sale, the coins will be offered at the rate of $0.863 and $0.90 respectively.

1st Private Sale Stage

Date: Sept. 2021

First Token Price = $ 0.80

Supply Tokens = 3,700,000 DHO

Funds Raised = $1,852,000

2nd Private Sale Stage

Date: 13th Nov 2021

First Token Price = $0.863

Supply Tokens = 3,700,000 DHO

Funds Raised = $2,200,000

3rd Private Sale Stage

Timing = 15th Dec. 2021

First Token Price = $0.90

Supply Tokens = 3,700,000 DHO

Funds Raised = $2,300,000

Note: the fundraising on the first scale will be used to maintain, recruit more savvy staff, enhance the blockchain, and as well as create and Dapp wallets.

The money gotten from the 2nd scale will be used to pay the workers. It will also be used to get more hardware to be used for the launching of the wallet.

Finally, the money achieved in the 3rd scale will be used to complete the main net, listing and for testing the blockchain power up with the smart contract and the dApps.

Public Sale of DIHO Token

Date: 4th March 2022

First Token Price = $0.99

Supply Tokens = 7,200,000DHO

Funds Raised = $4,700,000

However, for all the scales, the sale will be carried out via the project's website.

What are the criteria required for listing a token on CoinMarketCap? Is there a criteria for listing an asset on a Centralized Exchange? If Yes, use an exchange for your explanation in response to the question.

To list a coin on a Coinmarketcap requires to pass through processes which is majorly online application. The the process has criteria which the coin developer have to pass through before Coinmarket teams list the coin. Though, the Coinmarket teams allow the coin developers to pass through the criteria for validation, credibility and Methodology to eliminate scamming.

Thus, any coin listed on the Coinmarketcap must pass through the criteria which I will be emphasising on below. So, lets check it out.

The Information provided by the coin developer, as requested by the team of CMC should be readable, understandable, well structured and complete, with the coin a valid proof.

After which the application should be submitted online in the right option that's exchange listing application link should be submitted under the tokens listing application link to avoid rejection.

Once the application is submitted rightly, then the project will be reviewed by the CMC team.

Let's check out the CoinMarketCap listing criteria;

Inactive Listing

Here, the project is said to be in an inactive listing when it doesn't have any form of market data supported from at least any of the CoinMarketCap exchanges.

Unverified Listing

As the name implies is a project from automated processes, but is not yet verified by the Coinmarketcap teams.

Untracked Listing

Here, is when a project fails to meet the criteria stated by the CoinMarketCap requirements regarding the list tracking criteria of market data.

Tracked Listing

Here is when projects meet some of the available requirement stated by the CMC. Thus, it only coins that are under tracked listing are recommended to be listed. Also, coins that fails to meet requirements for the tracked listing criteria of the CMC, will be rejected as such can't be listed, and will be listed in untracked listings instead.

However, there are things needed for the coin to be listed so lets check it out.

the project should have an effective and functional website, smart contract, a block explorer, medium of exchange as well as Peer to Peer (P2P). All these most especially a valid block explorer & functional website, enables the initiation of coin be achieved.

The coin creators will provide a known personnel in the institute that knows how the project works to the CMC teams. This is for easy communication.

The coin should have an exchange with the CMC tracking listing.

Criteria for listing of centralized exchange (Binance)

Just as the CMC has criteria so as centralized exchange. Let's check out the listing criteria for listing coin on any centralized exchange such as Binance.

Here, application is via online on the website of the exchange such as Binance.

In Binance, a token in it's genesis stage or new projects is applied through Binance Launchpad. Remember, this is for new project.Thus, a token that have been in other market circulating but have not been listed on Binance will be via direct listing since it already had a good foundation.

Also, applying via launchpool is a coin that the project is still in process.

LISTING CRITERIA ON BINANCE

The coin creator will provide update regularly to the teams on the project to know the effectiveness or state of the coin.

Binance Exchange primary coin BNB have to be added as well as stable coin. That's the pair BNB/BUSD will be added to the project's roadmap.

Binance have to be supported and promoted in the project's community.

Thing to abide after successfully applying for listing to avoid disqualified

The coin creators must not send white paper/ roadmap to the CEO of the exchange.

Avoid any means of bribing any of the staff of the exchange.

Also, rejected application can be reconsider after the teams might have discussed about it.

The required information needed after applying for the listing.

Don't try by nay means to claim striking an agreement of listing token with Binance when you haven't .

Exercise patience to receive calls from the exchange and it can only be received by the valid staff of the project community.

Don't pressure the exchange to list your coin either by FUD.

CONCLUSION

Cryptocurrency investment is worth focusing on as the it has lots of benefits but the user have to be savvy before embarking into crypto ecosystem as a result of it's volatile nature and risks.

Hence, it is ideal for investors to make a proper analysis for making any trade decision to minimise risk and promote profit.

Thanks For Reading Through

Cc:

@fredquantum