What do you mean by Global in/out of the money? How is a cluster formed? Explain ITM, ATM, OTM, with examples

• Global In/out of the money

Global In/out of the money is an onchain metric that gives overall information of the volume flow as well as the accumulation of crypto assets by the use of clusters of data that are derived onchain so as to give detailed information about how the price of an asset has developed over time. It gives clear information about how well an asset has performed based on profit as well as loss and this is gotten when the current price of that asset is compared with the average price at which those assets were bought as indicated by the cluster of address.

It also gives clear information about addresses in possession of an asset, exact time of purchase as well as their addresses. Both in and out of the money have their various merits and demerits, and none can be classified as being better than the other, rather their various strike prices tend to be beneficial to all types of traders as well as any trading strategy used by traders.

Formation of Clusters

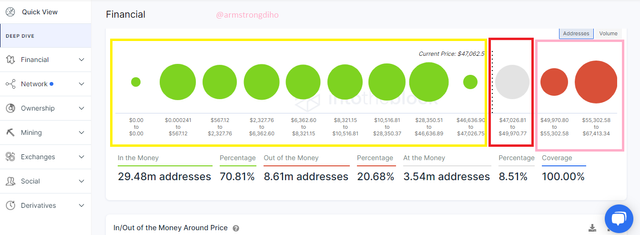

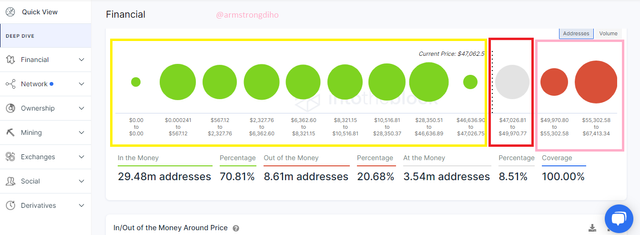

• Cluster is formed through the determination of the current market price of an asset and the rate at which it was purchased. It gives well-detailed information about the general performance of an asset, the volume of an asset, average price, and also helps to show if the addresses that bought or are holding those assets have made a profit or are at a loss. Resistance and support can be represented by the cluster depending on the price of BTC, as well as its total and size.

Intotheblock

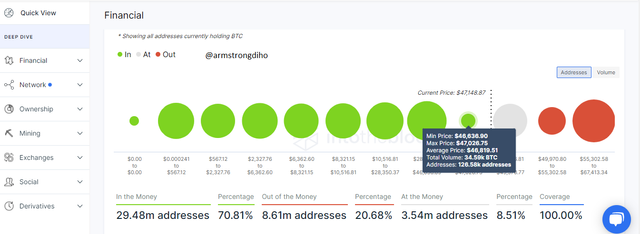

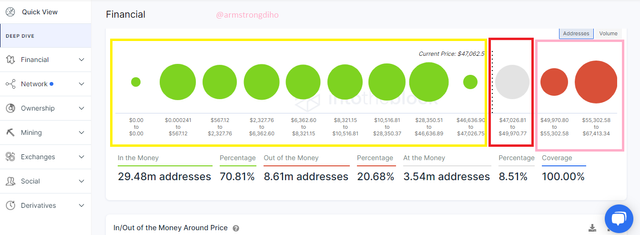

The image above shows the cluster with a minimum price of $46,636.90 and a maximum price of $47,026.75 and an average price of $46,819.51 and a total volume of 34.59k BTC from 126.58k addresses.

Intotheblock

Clusters can be classified into;

• In the Money (ITM)

• At the Money (ATM)

• Out of the money (OTM)

• ITM

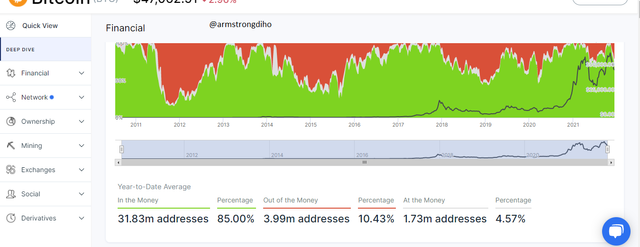

It is an acronym for In The money, it is when the current price of an asset surpasses that of the cluster price. It can be seen as the support region of such an asset and is denoted by Green colour, it also shows that addresses at this price range are in profit. From the image below, ITM has a percentage of 70.81% from 29.48m addresses.

Intotheblock

• ATM

It means At the Money, it occurs when the current price of an asset equals or falls at the same range as that of the cluster price. They are denoted with grey colour. At the money simply gives information to show that, there was neutrality in the addresses holding the asset as there was neither profit nor a loss. From the chart below, ATM has 8.51% from 3.54M addresses.

Intotheblock

• OTM

OTM, out of the money shows that the current price of an asset is lesser than that of the cluster price. It can serve as the resistance zone and is denoted with a red colour. OTM shows that addresses holding assets in this cluster are in loss. From the chart, OTM has 20.68% from 8.61M addresses.

Intotheblock

Explain about Large Transaction Volume Indicator with Examples? What is the difference between Total and Adjusted Large Transaction volume? Examples

Intotheblock

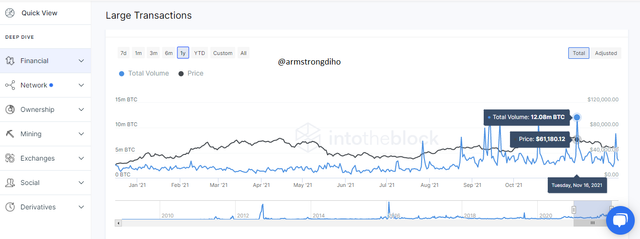

It is an onchain metrics indicator that tends to monitor and record huge transactions especially, those going out and coming into the blockchain and are well above $100,000. These large transaction volumes are usually carried out by whales and large institutions and can really mislead, because different addresses can be used for a transaction, to get accurate information, large transactions are summed and a graph is plotted and a spike in the contour of the graph either at a decreasing or increasing rate is used to show the interest of large institutions and whales at a particular asset.

Difference Between Total and Adjusted Large transaction Volume

Total large transaction volume is a type of Large transaction volume that shows All large transactions, which encompasses transactions that are sent to different addresses and then returned to the main addresses where it was initially sent from. This is quite misleading and confusing as multiple transactions can be recorded from one address, hence a wrong reading by the indicator.

Intotheblock

From the 6months chart of Total large transactions above, we can see how transactions are randomly spread.

While Adjusted large transaction is more accurate and trustworthy as it tends to filter multiple transactions and records only the addresses with which such transactions are made.

Intotheblock

From the 6months chart above, we can see the filter of multiple transactions from the same addresses, and also retransfer, with a total volume of 8.3M BTC for $48,019.97.

Analyze a crypto asset(other than BTC) using on-chain metric: GIOM, and Adjusted Large Transaction Volume? Ascertain whether it supports a Bullish or Bearish bias or Neutral? How do you find the support and resistance using GIOM? How do you ascertain the upside/downside momentum using GIOM? Use InTotheBlock app or any suitable app?

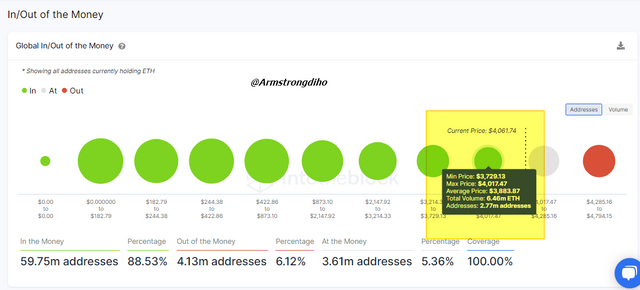

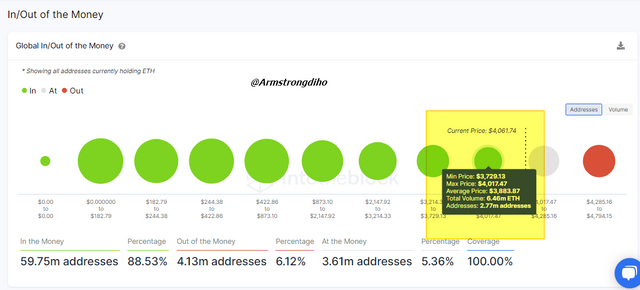

Analysis of ETH Global In/Out Money (GIOM)

At the current price of Ethereum (ETH), the GIOM data shows that a total volume of 6.46million ETH was held within this cluster among 2.77million addresses at an average price of $3883.87. Considering the current circulating supply of Ethereum (ETH) at 118m, the total volume of ETH at this cluster is 5.4% of the total circulating supply.

Long & Short Term

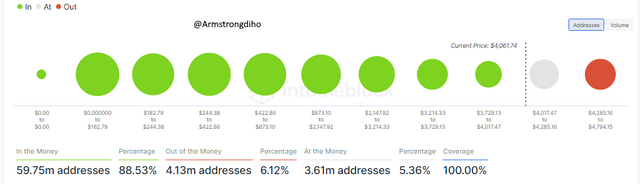

Long term:

ITM: 88.53%

ATM: 5.63%

OTM: 6.12%

The data above shows that over a long period, the market has enjoyed a bullish trend.

Long-Term Historic Level

The chart above shows the long-term historic level for ETH, and the evidence shows that most addresses holding/trading ETH had been ITM and thus in profit amounting to 88.53% (59.75m addresses). This left 3.61m addresses ATM, and 4.13m OTM.

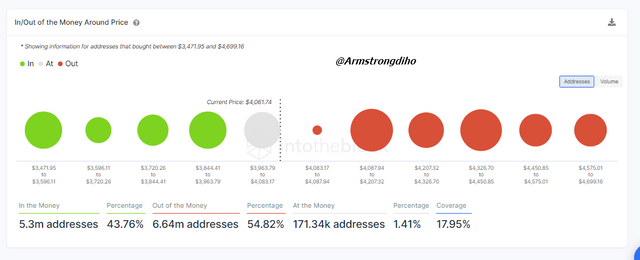

Below is the average historic support and resistance levels for ETH obtained by averaging the start and end price.

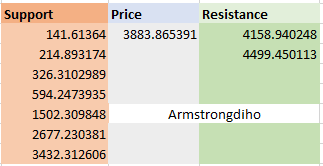

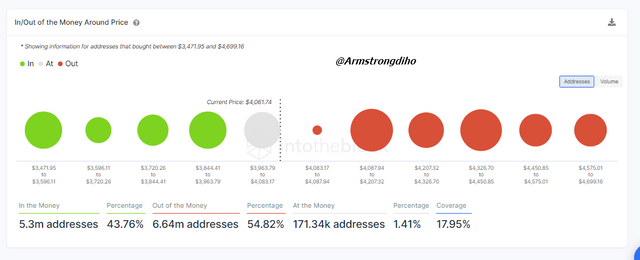

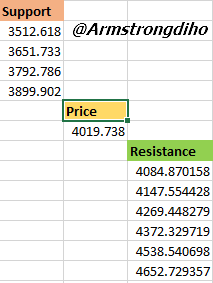

Short term:

ITM: 43.76%

ATM: 1.41%

OTM: 54.82%

With the current state of the market, the market seems to stagnate as traders are not placing long orders within this period. However, this period of stagnation was preceded by a strong bullish movement.

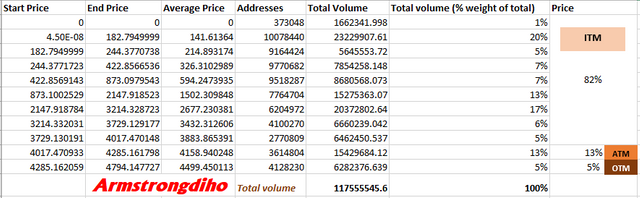

Calculating ITM, ATM and OTM

Using Microsoft Excel and data downloaded from IntoTheBlock, I was able to compute the ITM, ATM and OTM values by simply calculating the weighted percentages of the volume of the asset across periods.

From the spreadsheet above, the calculations revealed that relative to the current price of Ethereum (ETH) $4,061.74, 82% is at ITM, while 13% is ATM and 5% OTM.

Support and Resistance

Using the GIOM chart available at IntoTheBlock, support and resistance levels could be identified relative to the current price of the asset or the average price. Support levels are generally the lower price areas (ITM) marked by green circles, while the resistance is the upper-priced areas marked by red circles.

From the chart as well, it can be seen that each cluster (each circle) has a support and resistance level. The support level is the start price while the resistance is the end price.

As can be seen from the screenshot below, we could download a spreadsheet data containing GIOM information. Relative to the assets current price, the support level could be found on the top rows while resistance levels are usually the last few figures with prices generally higher than the current average price and the support prices.

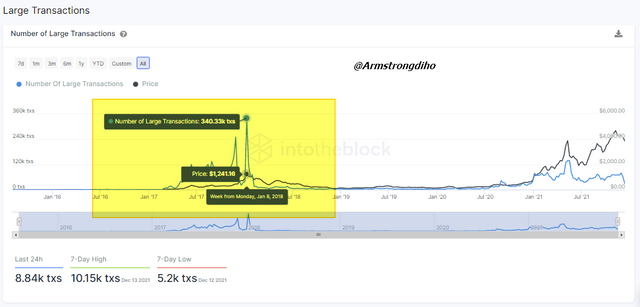

Adjusted Large Transaction Volume

From the chart above, the last significant spike in the transaction volume was 340.33tks which resulted in the prize of ETH amounting to $1,241.16.

Ascertaining the upside/downside momentum using GIOM

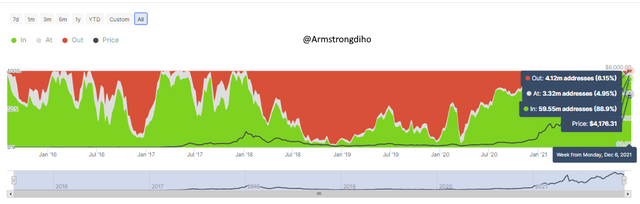

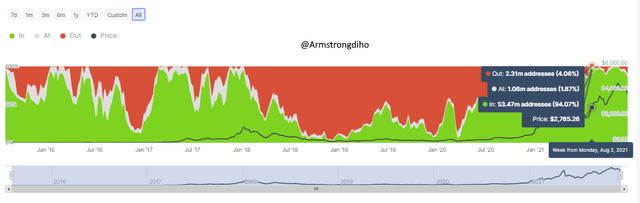

To ascertain the upside/downside momentum using GIOM, we need to examine carefully the Historical In/Out of the money chart using IntoTheBlock.

Now, let's closely examine the heart, to identify the "upside" or "downside", we need to find the difference between the OTM and ITM over a specific period and compare this week preceding data. From the chart above, ITM addresses were 59.55million.

The chart above shows momentum as of the 6th of December, let's now go back to a period of four months and see what we have.

Comparing the momentum value of August 2nd, 2021 which had an ITM address of 53.47m, and that of December 6, 2021, with an ITM address of 59.55million, it is evident that we are on the upside momentum as the ITM value increased over time from 88.8% to 94.07%. This shows that the buyers are optimistic and are place long bets over significant time; thus, more holding among traders than trading.

CONCLUSION

Understanding how on-chain metrics work can be quite beneficial. The GIOM has proven to be quite beneficial in estimating resistance and support levels, which is something that many technical analysts rely on. The tool also works well as a momentum indicator. Another relevant metric indicator is the Large Transaction Volume indicator.

The Large Transaction Volume Indicator can assist us to identify when asset volumes surge due to the presence of major players (whales in the market). Small-scale investors can use the GIOM and associated indicators to determine whether to enter or exit the market. The combination of both indicators - GIOM and Large Transaction Volume - allows us to get a more comprehensive and holistic picture of the crypto asset in question.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit