Definition of Price Action

Price action can mean a lot of things. Here are some possible ways to view price action:

Price movement : Price action can simply be described as the movement of the price of an asset. This usually consists of continuous up and down movements of the price of a particular asset. In a trading chart, prices go different directions, usually three (3) common directions:

- Up

- Down

- Sideways

tradingview.com Trading Pattern/Strategy: Price action could also be considered a trader's pattern of trading. Here, price action refers to the act of trading using the trading chart alone with no reliance on any indicators. It is the use of chart tools and chart settings, as well as past asset values, to predict how a transaction will proceed.

Price action enables traders to understand how a market behaves in various conditions and to discover entry and exit locations. The majority of traders trade without employing indicators or other trading tactics, relying solely on the price of the asset. To make trades, a trader who employs the price action trading method relies on the asset's previous close, high, low, and open prices.

The Balance

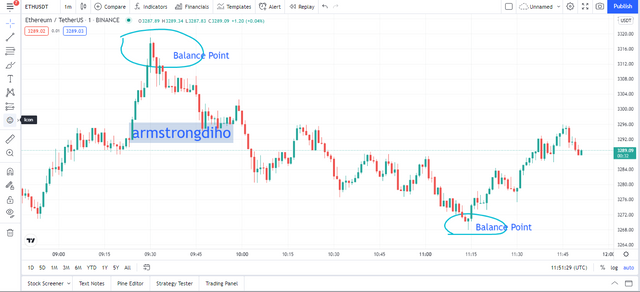

Define and explain in detail what the "Balance Point" is with at least one example of it

The Balance Point (Breakeven Point) is the point at which a trade earns no profit or losses, and the price of an asset equals its initial cost.

A change in trend is signalled by the presence of the balancing point in a trading chart. The trend must have been continuous for this point to be indicated in a candle, and the candle should be the candle that indicates the end of the trend (shown on the chart below).It can usually be found on a market chart at the support and resistance levels, which are normally located between the low and high of the candle that comes last at the end of a trend.

Traders can use this balance point to determine whether a market will move in a bullish or bearish direction in the future.

tradingview.com

Clearly describe the step by step to run a Price Action analysis with "Break-even"?

tradingview.com The screenshot above shows a simple Price Action analysis done using chart view on TradingView

Here is a simple step by step procedure on how to perform a simple price action analysis:➘To begin, open a chart with the asset pair you want to trade, in this case, the ETH/USDT trading pair.

➘Then, for the analysis, select your preferred time frame. My ideal time frame is under 15 minutes (your choice may vary).

➘In the chart, draw the support and resistance lines of the price movement zone being studied. This allows us to make better decisions with more precision.

➘Determine the current market trend.

➘Finally, choose the breakeven points in a time range of fewer than 15 minutes, taking into account the market trend, and find entry chances.

What are the entry and exit criteria using the breakeven price action technique?

Profit is an important aspect of trading. As a result, traders must understand when to enter and exit the market. Here are several major methods a trader can enter (put trades) and exit the market (take profit or stop loss) using the price action strategy:

Following the completion of the price action analysis, the trader must identify several places on the chart, such as resistances, supports, and breakeven points. After determining a breakeven point, a trader must seek out a powerful candle and join the market from that position.

The trader must then position the Stop Loss below the candle that marks the Break-Even Point for risk aversion's purpose.

With at least the same percentage of risk in loss, a take profit must be sought. The trader may select to employ a reward risk of 1:1, which implies that if our stop loss is 5% away, our take profit will be 5% away as well. This is illustrated in the chart below:

tradingview.com

What type of analysis is more effective price action or the use of technical indicators?

Price action analysis, when compared to the use of technical indicators, could be judged as a more effective practice for the following reasons:

It increases the likelihood of success in trading operations and executions as price action allows traders to evaluate the market in real-time and make quick executions.

By considering the market's demand and supply, a trader can almost correctly forecast how the price will go (whether bull or bear) and make decisions with the information.

Price action analysis is less time consuming and do not require too much expertise while being relatively safe (reliable) and as profitable or even more profitable like the use of technical indicators.

While the basic purpose of entering a trade is to maximize profit while reducing losses, each trader should employ whatever strategy they believe is acceptable and effective.

Technical indicators and price action are powerful instruments. It all relies on what type of trader the dealer looks to be. Technical analysts use mathematical calculations of an asset's price and volume to calculate their entry and exit positions on trades, whereas price action trumps technical analysis by examining the movement of prices in the market over time.

Practical

Make 1 entry in any pair of cryptocurrencies using the Price Action Technique with the "Break-even Point" (Use a Demo account, to be able to make your entry in real-time at any timeframe of your choice)

tradingview.com As shown in the chart above, I entered the market at the breakeven point formed at 11:00 at the price of 3270.63ETH/USDTH.

The take profit point is set in the area marked using the regression tool. However, using the 1:1 ratio, I took profit at 3284.39H/USDT.

Conclusion

Based on the discussion so far on price action, it is clear that price action is a good trading strategy, especially for on-the-spot trading.

CC;

@lenonmc21