To improve students after many theories, it requires practice to checkmate their understanding. However, this is a reasonable contest because it encourages the mode of trading crypto assets. Moreover, in participation in the ongoing steemit trading contest, I will be trading on the THETA/USDT pair on Binance.

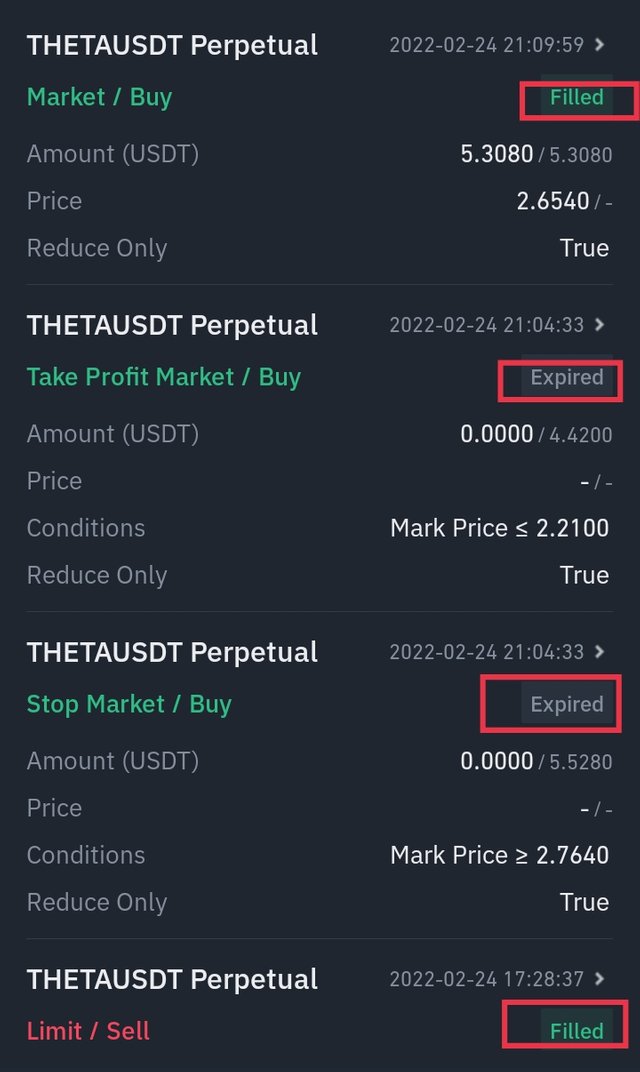

This was a margin trade (Futures) that ended in partially was an appreciation of ethical signals from the EMAs indicators applied. So, for this trade, I made it a cross margin and applied maximum leverage - 5x to minimise the risk of losing funds.

AN OVERVIEW OF THETA

Video and entertainment is one of the things we can do without especially this generation, as such, is presented by Theta network. However, Theta network is one of the most thrilling blockchain projects which provides a better solution for both technical and economic. Presently, Theta is recommended as the end-to-end infrastructure for decentralized video streaming and entertainment blockchain that provide the lags for both technical and economic.

Before I proceed, let's check out the problem associated with live streaming videos and the possible solution Theta provided.

Problems of live streaming video & Solutions provided by the Theta network.

The basic problems live video streaming platform faces are poor Quality, skyrocketing data needs and a Centralized and inefficient system.

- Presently, Video viewers get low-quality streams and limited rewards which means centralized CDNs reap the highest of the rewards which is one of the problems.

SOLUTION

Theta has a better solution to the above problem by enabling gang the viewers to earn rewards as Theta fuel. That's when users participate in the Theta network, they are rewarded for conveying excess bandwidth and computing resources which is a great profit to the viewers and have to get rid of the centralized CDNs to reap the highest.

- The content delivery networks (CDN) lack measure which has caused lots of video re-buffering and high load times as well.

Solution

Theta network as a decentralized peer-to-peer network provides a higher quality as well as a smoother video streaming which make streaming more productive globally.

Finally, in the area of skyrocketing data needs which enables users to demand high-quality streams, the Theta network curtailed the cost of delivering video streams.

In the Theta network, it is open to all creators and supporters which means any creator with a good innovative model can build on the Theta network. Also, video platforms and content providers can create worked Dapps for their audience as well as multiple content verticals that are from music, movies, Tv, etc to peer to peer live streaming are presented on the Theta network.

The most exciting about the only end-to-end platform, new blockchain and the next generation peer-to-peer architecture known as Theta authorizes users to watch video content and earn rewards with tokens as they share their excess internet bandwidth and resources on a peer-to-peer (P2P) basis.

HOW Theta works

Theta operates on a modified proof-of-stake consensus mechanism unlike the Tron network and possesses personal multi-Byzantine Fault Tolerance (BFT) which integrates a commission of 20-30 validator nodes with an additional of thousands of Guardian nodes. With this effect, it is quicker than the BTC proof of work network.

So, in the Theta blockchain, the video streaming services bank on a distributed network of users who willfully participate by sharing the excess internet bandwidth and computing resources to run Theta’s network, which in return are awarded a token called Theta Fuel (TFuel).

Furthermore, the Theta Fuel (TFUEL) is the active token of the Theta protocol. Conversely, THETA is the primary token for the Theta system that performs multiple governance tasks. The main function of the TFUEL is for on-chain transactions. So, to earn the TFUEL, the user called the relayers of the network to rely on others on the P2P network for each video stream.

The THETA is the primary token for the Theta system that operates multiple governance tasks, however, the function is for staking.

A Validator or Guardian node stake the THETA and in return obtain a proportional amount of new TFuel.

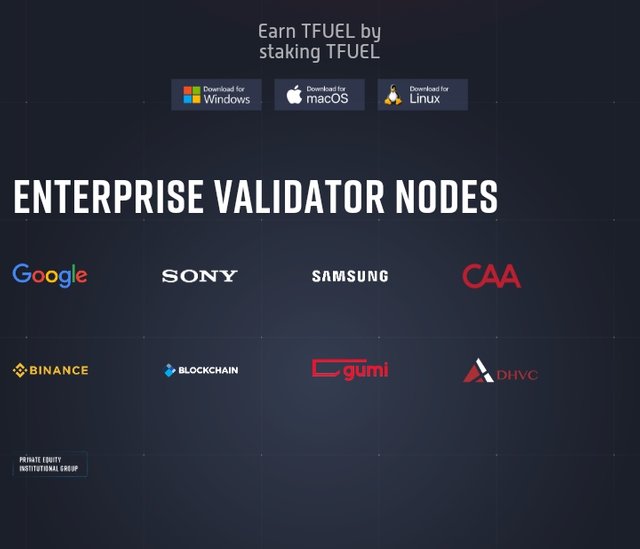

Presently in the Theta network, the validators are operated by Google, Blockchain Ventures, Samsung, Sony Europe and Binance, along with a network of community-run Guardian nodes.

Src

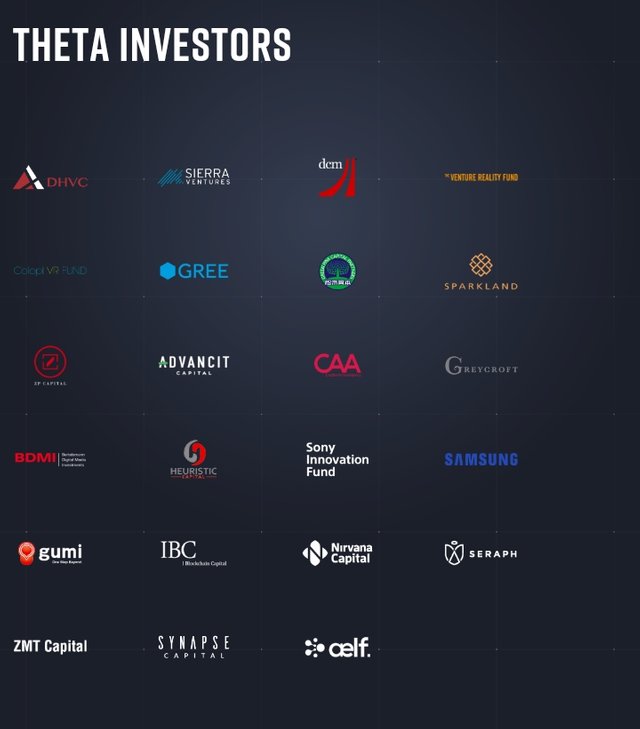

Likewise a line-up of institutional investors like Node Capital and DHVC, Theta Network is instructed by Steve Chen, co-founder of YouTube, and Justin Kan, co-founder of Twitch. With these great investors with the Theta team, the Theta system have achieves a strong proportion between consistency, speed, and decentralization.

Src

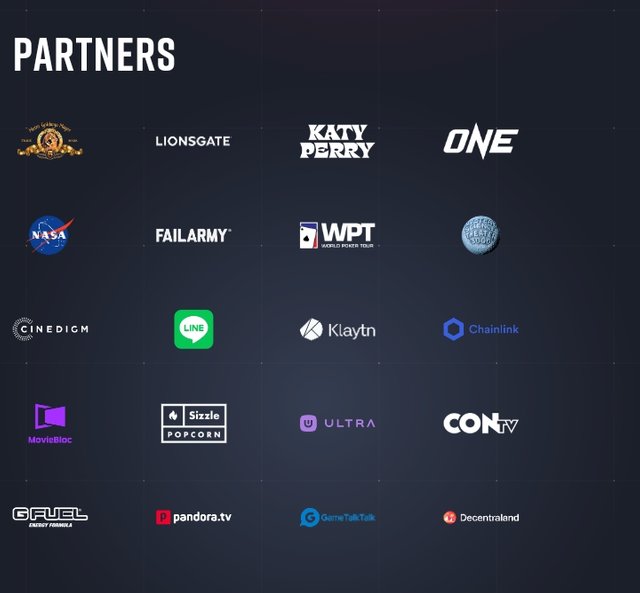

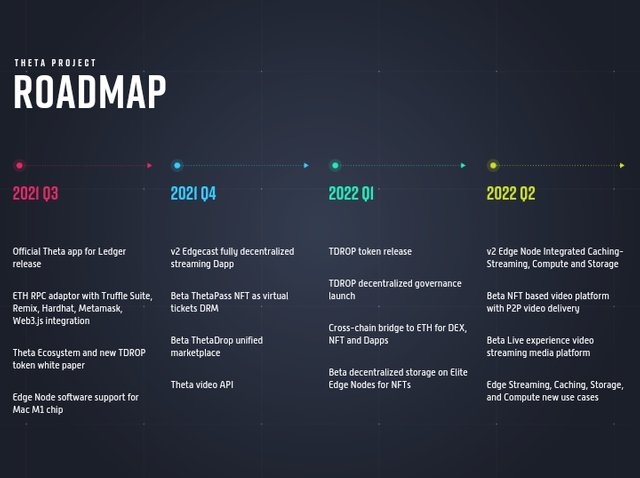

The Images above shows the THETA investors, Partners and the roadmap.

Some people might ask how can I get the Theta token is very simple. Basically, we can get the THETA on exchanges such as Binance and Kucoin.

MY THETA/USDT TRADE

I am among the set of traders who believe that the depletion of Bitcoin has a greater impact led to the fall of Altcoins. That's when BTC drops or raise, other coins fall or raise as well. The dominance of BTC is very powerful. So, most times, the fall of BTC cause the traders to sell their asset which increases the supply level as a result of high selling pressure and will cause a downtrend.

Before placing my trade, I observed Bitcoin breaks support and dumping badly as a result of Russia starting military operation in Ukraine which means the war might affect where people put their money and this could also impact the price of THETA which is among the most promising assets in the world today. Recently, the news of Russia's particular attack on Ukraine delivered the market rotting with THETA part of the dip.

However, over the last few days, it has been a bearish trend for the whole crypto market which made the founder of Ethereum- Vitalik Buterin to appeared in a bear-like nature attire at the EthDenver 2022 conference.

Src

It was during this period that I made my trade and it ended by closing the trade when I observed a massively rise of the price, precisely on February 21, 2022. At that time, the chart looked something like this:

Fundamental & Technical Analysis

For my entry, I considered the growing interests of the Russia-Ukraine crisis leading to the price dip. Also, I receive a bearish crossover of the 20 EMA below the 50 EMA. Though what enticed me was the downtrend even when the market starts showing a series of the green candle.

First, I check the 2 H chart, the EMAs is above the price with strong resistance.

Also, going down to the 1 H timeframe, the resistance still hold and I observed a bearish crossover.

Later, I went to a 45 Mins timeframe and I observed the price is below the EMAs with strong resistance and bearish crossover.

Here, the stop loss was small then I placed my entry after the order blocks. That's the small gree candle followed by high volumes of red candles. I believe there will be a new resistance at that level. The RRR risk to reward ratio is 5:05, with a margin of 6 and leverage of 5×.

Below is a screenshot of how the price progressed on the chart after my entry was triggered. The position opened and the progress was positive.

However, going back to the chart, I observed the market structure has changed as the EMAs is now below the price which indicates bullishly.

As a trader who understands price manipulation, I closed my trade claimed some profit. Though it was little guess what the trade would have hit my stop loss.

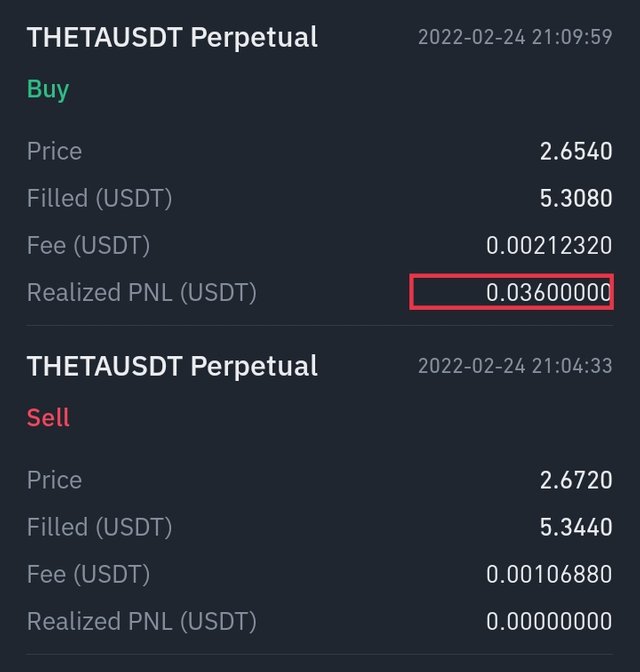

We can see in the screenshot above, my trade didn't hit my take profit and Stop loss. However, the below image shows the profit generated after closing the trade.

MY RECOMMENDATIONS

Trading is full of risk, so I recommend comprehensive research to technical indicators and understanding of price action strategies as well as proper risk management when making any trade decision. Do not enter the market based on assumption, always make a proper analysis fundamental and technically.

Fundamental projects always play a vital role in cryptocurrency just as the war between Russians and Ukraine led to the falling of crypto assets. However, in all make your technical analysis and support it with proper risk management.

Moreover, once you observed the trade is no longer favourable, you can close your position. Though a savvy trader who observed proper risk management will not. Know your strategy and control your emotions.

THANKS FOR READING THROUGH

All charts images were gotten from the Tradingview