.png)

Show your understanding of the Super Trend as a trading indicator and how it is calculated?

It is ideal to make the trend your friend since trading crypto assets in the path of the trend direction will always be a valid and successful principle in the affair of crypto trading. However, Trading per and principal of the trend enables the trader to picture out the current status of the market.

Generally, there are several technical indicators to spot the direction of the trend, however, the SuperTrend Indicator is known as a trend-based indicator that is designed to determine the trend direction of an asset's price with a given time. Perhaps, interpreting and understanding this indicator is very important since it provides reliable trend direction signals which can lead to a profitable trade.

However, the SuperTrend was first realized by Oliver Seban. After the invention, SuperTrend indicator is recognised as one of the popular indicators that traders can make use of any timeframe to identify positive buy and sell signals as well as to know the current status of price volatility.

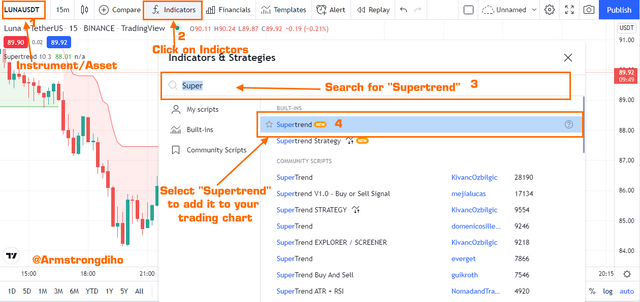

IMAGE SHOWING THE CHEMISTRY OF SUPERTREND INDICATOR

SuperTrend indicator is a trend following indicator just as the name implies, simple and easy to use. Perhaps, it is designed on the price of crypto assets to generate accurate reading about the current trend direction. The SuperTrend indicator has the same properties just like the Moving average and MACD. Thus, the Supertrend indicator gives the technical analyst a positive buy or sell signal, and detect the trending market over a given timeframe.

It is understood that indicators derived their price data from mathematical representations. Thus, the SuperTrend is designed with two basic parameters known as the trading period (ATR length) and the multiplier (factor). Though it makes use of calculated average values of the candlestick derived within a specific timeframe. By default, the average true range length and multiplier values for constructing a superTrend indicator are 10 and 3 respectively.

The trading period (ATR length) and the multiplier (factor) determine the performance and signals of the indicator. Hence, once they're altered, it affects the execution and signal of the indicator. Let's check it out.

For the period (ATR length) of the indicator; the longer the period, the more valid the signal and the shorter the period, the more false signals are created. Also, the factor performs as the multiplier. So, it is ideal for a trader to adjust the period that will suit their trading style.

Identifying trends (uptrend and downtrend) using the Supertrend indicator is very easy as such make valid buy and sell signals simple as well. Looking at the chemistry of the SuperTrend indicator, the trend direction varies with green and red colours of the indicator representing uptrend and downtrend respectively. When the price of the asset whipsaw beneath the Supertrend indicator, it demonstrates a downtrend as such the indicator changes to a red colour. Conversely, when the price is whipsaw above the indicator, it implies a bullish trend with the indicator changing to green.

Moreover, in a trendless market, the indicator change to horizontal, indicating that the market is ranging. Perhaps, when the market is experiencing an uptrend movement, the supertrend indicator conforms as support and it performs as a resistance when the market is in a downtrend.

CALCULATION

Knowing the SuperTrend indicator is very good, however, the technique of calculating this indicator worth focusing on since understanding the mathematical representation indicate the price change which signifies the usefulness to the traders. However, the SuperTrend indicator calculation technique is based on two sensitive parameters, known as the period and the multiplier. With this, the calculation of the SuperTrend is easy as such can be used to identify uptrend and downtrend.

Let's check out how to calculate the SuperTrend.

To calculate an uptrend;

The higher value is added to the lower value which is divided by two. After which the value generated is added with the value of the multiplier (factor) and period (ART). For better clarification let's check out the formula below.

UpTrend = (Higher + Lower) / 2 + multiplier(factor) x period( ATR)

To calculate a downtrend

Here in a downtrend, the higher value is added to the lower value which is divided by two. After which the value is substrates with the value of the multiplier (factor) and period (ART). Let's check out the below formula for better clarification.

DownTrend = (Higher + Lower) / 2 - multiplier (factor) x period (ATR)

Since we have gotten the formula, let's proceed to the next calculation which entails more about the ATR.

Now, we will calculate the True range obtained by selecting the highest between the following expression.

1st TR = CH - CL

2nd TR = CH - PCL

3rd TR = CL - PCL

Where,

CH = Current High

CL = Current Low

PCL = Previous Close

TR = True Range

We have drafted out some formulas, hence to determine the ATR is by taking the simple moving average of the True range using 13 periods. We can express this as the following formula. Where the ATR is calculated using the below formula

ATR = [ATRpp* (n _ 1) + TR] / n

Where

pp = previous Period

TR = True range

n = "n" is the number of candles considered (periods).

Therefore, determining the current candlestick enables the SuperTrend indicator to specify the situation of the market trend.

2 - What are the main parameters of the Supertrend indicator and How to configure them and is it advisable to change its default settings?

The Main Supertrend Indicator Parameters

The Supertrend indicator's parameters are factors through which the Supertrend indicator provides data that could be utilized by a trader in order to make successful trades and technical market analysis using the Supertrend indicator. Most of these parameters could be configured to the users content. Here are some of the key Supertrend indicator's parameters:

- ATR Length (period)

- The Multiplier factor (can be simply referred to as factor)

By default, the ATR length/period is set to 10 but may be changed to suit one's personal trading strategy and plan. Though, the default option is the most recommended.

By default, the multiplier factor is set at 3. The factor is a multiple of the average real range, which is calculated using the asset's volatility at a given period.

Setting Up and Configuring the Supertrend Indicator

- To set up the Supertrend indicator in a trading chart, first, visit TradingView website; load up your trading instrument/asset and go to the indicators section, then search for SuperTrend indicator, click on it to add it to the chart as shown below:

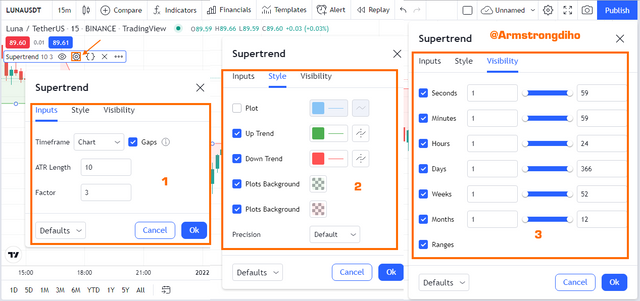

- The Supertrend indicator has been applied to our trading chart for LUNAUSDT as shown below:

- Next, we need to configure the "Supertrend" indicator to fit the trading strategy we want. To do this, hover around the Supertrend indicator and click on it to reveal the modification options like this:

; click on the gear icon highlighted to reveal the settings options; you will be presented with three main settings: inputs [1], style [2] and visibility [3]. This is shown below:

; click on the gear icon highlighted to reveal the settings options; you will be presented with three main settings: inputs [1], style [2] and visibility [3]. This is shown below:

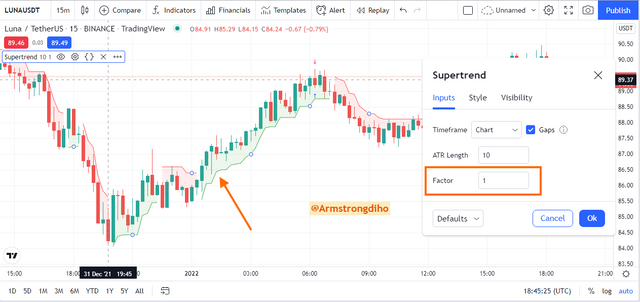

- Of all the parameters that can be modified from within the Supertrend indicator, the inputs tab is the most crucial as it determines the kind and quality of data that will be fed into the Supertrend indicator, this column is best left as they are as the developers have determined the period and factor length at 10 and 3 respectively as the best possible input variables that this indicator is tradable with at least for non-pro users. You should change these values if you know absolutely what you are doing.

Let's say you modified these values, you can either make the signal less usable or too noisy. For example, in the chart below, we can see that the factor parameter has been brought down from 3 to 1 and as a result, the Supertrend indicator is appearing inexistent.

The styling and visibility options basically deal with appearance customizations and can be mildly modified to suit traders taste or left as it is.

3 - Based on the use of the SuperTrend indicator, how can one predict whether the trend will be bullish or bearish (screenshot required)

Predicting a Bullish Trend Using the SuperTrend indicator

Using the SuperTrend indicator, we can simply identify a bullish trend by looking out for the formation of green shades under a range of candles. this is usually followed by the upward movement of the price indicated by upward moving candles indicating that demand is greater than available supply in the market. Here is a representation of this:

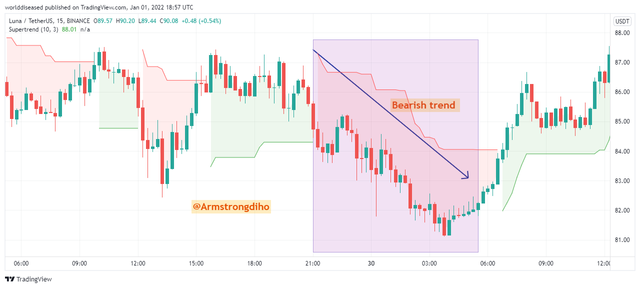

Predicting a Bearish Trend Using the SuperTrend indicator

This can simply be achieved by observing the chart for the formation of reddish shades above candles and trailing downwards indicating downward price movement easily observed through obvious lows and lower lows on the trading chart. Here is the representation of the bearish trend indicated by the Supertrend indicator.

Explain how the Supertrend indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

The Supertrend indicator has different uses. Not only pointing out market trends, but a technical analyst can also use this indicator to spot buy and sell signals. It also provides a valid time to enter and exit the market.

Just as I mentioned above, the lines of the indicators are illustrated as support or resistance point. When the price action whipsaws up with a consistently raise, the lines represent the support, perhaps when the price is falling with the continuous downward move, the line serves as the resistance point. However, the SuperTrend will always change positions in the suggestion of the price.

Nevertheless, before placing any trade, it is ideal to wait and see a clear entry. Using SuperTrend indicator, it is observed in most cases that the indicator forms a horizontal line and once the price action breaks the line, it means a trend reversal is about to form. Identifying trend reversal in time gives the trader advantage to ride on the market since trend reversal show clear entry or exit from the market.

Although the position and the colour of the Supertrend indicator enable the traders to determine market signals, exit and also detect buy and sell signals. The change in the position and colour of this indicator makes it simple.

For instance, in a bearish position, if the indicator changes to green colour and price breaks and whipsaws below the SuperTrend indicator, this is a perfect signal for a buy exit meaning long trade should be closed to avoid losing some cash. The same is applicable during a bullish position but here the indicator change to a red colour and the price will break above the SuperTrend which indicate a sell exit.

BUY AND SELL SIGNAL

Now, a buy signal position can be observed when the market is in a downtrend, and then the price action whipsaw above the Supertrend indicator with a green colour. Thus, this shows uptrend signals and valid buying opportunities can be seen. Conversely, when the market should be in an uptrend and then the price action must whipsaw below the Supertrend indicator with a red colour indication which has lots of positive selling opportunities.

How can we determine breakout points using Supertrend and Donchian indicators? Explain this based on clear examples. (Screenshot required))

Generally, when a trend becomes weak or forms a range market, and there is a massive volume in the market, instantly the price of the crypto asset will change relatively. As such could mutate the price direction either in an uptrend or in a downtrend based on the velocity of the direction which can break the prior resistance and support points, as such we can suggest this concept as breakout.

Now, we have understood what breakout is all about let's focus on how to make use of the SuperTrend and Donchian Channel indicator to determine breakout points.

I have discussed much about SuperTrend indicators and we have understood the basic functions it can afford to traders. Nevertheless, the Donchian indicator is another indicator that is worth focusing on since it is a very useful indicator that enables traders to obtain positive entry and exit points by identify the trend reversals.

Basically, the Donchain indicators are characterized by three lines ( upper, middle, and lower band). Thus, when the price moves upward and breaks the middle band with consistent upward moves this signifies that an uptrend transition as such the downtrend has been reversed into the bullish trend which means the trader can see a valid long trade. Conserve, when the price moves down and breaks the middle band with the consistent downward move, this shows that the bullish trend has been reversed into the bearish trend as such the trader can see a short trade.

So, the Donchian channel with the Super trend indicator will produce useful and valid breakout points. Now, I have added the donchian channel with the super trend indicator on the crypto chart. Hence, I will join these two indicators to find breakout points. Though one indicator (SuperTrend) will be used for confirmation and the other (Donchain) will be used to identify the breakout. So, let's check out the following examples to clarify how to use these indicators to find breakout points.

UPTREND

To confirm an uptrend breakout, the market must be in an uptrend which means the price will whipsaw up forming consistently a series of higher highs. Thus, the price of the asset should be above the superTrend, however, this can be observed with the green colour of the indicator. When the green colour is formed, indicating a bullish trend. Perhaps, the breakout is not yet observed until continuous bullish candles break the upper band of the Donchian indicator. As such we can see a possible long position. For better clarification let's check out the image below.

IMAGE SHOWING UPTREND BREAKOUT USING DONCHAIN WITH SUPERTREND INDICATOR

DOWNTREND

To confirm a downtrend breakout, the market must be in a downtrend which means the price will whipsaw downward forming consistently a series of lower lows. Therefore, the price of the asset should be below the superTrend, however, this can be observed with the red colour of the indicator. When the green colour is formed, indicates a downtrend. Perhaps, the breakout is not yet observed until continuous bearish candles break the lower band of the Donchian indicator. As such we can see a possible short position. The image below will clarify us better.

IMAGE SHOWING DOWNTREND BREAKOUT USING DONCHAIN WITH SUPERTREND INDICATOR

Do you see the effectiveness of combining two SuperTrend indicators (fast and slow) in crypto trading? Explain this based on a clear example. (Screenshot required)

The possible means to know how to optimize the use of a technical indicator is very important, and one of the possible ways is to combine fast and slow indicators. However, combining the two Super trend indicator is not different from combining the two EMA, and this combination helps to strengthen the indicator and filter false signals. When combined enables the trader to picture reversal signals as well as selling and buying and so on. Profit able trade will be generated when using the signals obtained from it.

For better clarification let's add two SuperTrend indicators on the crypto chart. Here, one of the Supertrend indicators will be a fast Supertrend (21 period, factor 4) and the other one will be slow ( 10 period, factor 3). Now, I will be using the combined SuperTrend indicator to identify some buy and sell entries. And the principle I will be using to determine the entry is when both indicators (Fast and slow) have similar colours, red for sell while green for buy.

BUY ENTRY

Confirmation of buy entry using both SuperTrend means the market must be in an uptrend, and the uptrend should be in confirmation with both superTrend indicators. The price asset should be above both SuperTrend with the colour of the indicator changed to green. Now, we can see from the chart the effectiveness of combining two SuperTrend indicators to determine to buy entry.

IMAGE SHOWING BOTH SUPERTREND INDICATOR FOR BUY ENTRY

SELL ENTRY

Confirmation of sell entry using both SuperTrend means the market must be in a downtrend, as such should be in confirmation with both superTrend indicators. The price asset should be below both SuperTrend with the colour of the indicator changed to red. Now, we can see from the chart the effectiveness of combining two SuperTrend indicators to determine to sell entry.

IMAGE SHOWING BOTH SUPERTREND INDICATOR FOR SELL ENTRY

In my perspective, I don't think it is ideal to make use of the slow SuperTrend with the Fast SuperTrend is a good strategy during trading. However, in some points, the concept is useful but requires a savvy trader who understands and interprets it better.

This concept can't function effectively since, adjusting the length to a period such as 21 with factor 2 will make the ST less sensitive as such can lead to fewer trading signals but good signals. Similarly, modifying the length to a period such as 10 with factor 3 will make the ST indicator over-sensitive which will lead to a higher amount of trading signals(buy & sell) as such rise more market noise.

Hence, using the fast and slow SuperTrend indicator combined, have a higher tendency of missing out on entry and exit point since both indicators use more time to show the same colour. Moreover, using slow and fast ST indicators requires carefulness when making a trade decision. Instead of using a combined ST indicator, it is ideal to make use of other indicators like the RSI, ROC, EMA, and so on.

Is there a need to pair another indicator to make this indicator work better as a filter and help get rid of false signals? Use a graphic to support your answer. (screenshot required)

No indicator is 100% accurate and effective. There is every tendency that an indicator will generate false signals which will result in rising of more market noise. Hence, false signals generated from indicators can cause a trader much loss as such is not ideal to make trade decisions using only indication most especially when used as standalone.

Remember, the SuperTrend indicator is not 100% accurate and can develop false signals. However, the remedy to avoid such false signals is to combine the SuperTrend with some other indicators like the ROC, EMA, etc. In this illustration, I will combine the SuperTrend with the ROC indicator.

The Rate of Change (ROC) indicator is as we all know is a momentum-based indicator that assesses the diverse percentage change in price from the current price to the price of the asset over a specific timeframe. ROC is illustrated with an oscillating indicator line that is set against a zero-level called the midpoint. The midpoint fluctuates either above or below the midpoint and when the line crosses the midpoint indicates a positive zone(uptrend) and when the lines whipsaw below, indicates a negative zone(downtrend).

Traders use the ROC to picture out the positive and negative zones of a given asset within a timeframe. Perhaps, the traders also use the ROC indicator to understand the degree of the market.

Therefore, using the superTrend indicator in conjunction with the ROC indicator will produce a good entry and exit point as such lead to a profitable trade. Thus, false signals can be filtered out. Let's check out the following illustration below.

The below crypto chart shows how we can filter out false signals. The SuperTrend produce produced false signals, however, were filtered out using the ROC. On the crypto chart, the price action is observing a downtrend but the SuperTrend is still indicating the uptrend and the colour of the trend is green which signifies that there is a bullish trend.

Perhaps, the ROC indicator also generated a downtrend signal. This shows that the ST indicator is generating false signals which we have filtered out using the ROC indicator.

We can see how efficient and effective using the ST and ROC indicator to filter out false signals is.

The second image below shows the ST and the ROC is in confirmation. Here, the price action was in an uptrend corresponding with the ST and ROC indicator. The ROC lines whipsaw above the midpoint indicating a bullish trend as such buy opportunity is identified. Also, the ST is in an uptrend as the indicator colour changes to green which indicates buying opportunity.

- List the advantages and disadvantages of the Supertrend indicator

Advantages

Supertrend indicator is one that gives good results and perfect signals when it is used in combination with other technical tools.

It is not a complex indicator, as such it is very easy to use even by advanced traders as well as beginners.

• Traders are able to make good trading decisions with the use of the super trend indicator as it gives vital information with regards to the trend of a market.

• The super trend indicator is found in the various trading platforms and can actually be used without charge.

• It is one of the best indicators that can be used with ease. It is quite unique in the sense that noticing when this indicator changes colour, as well as its location, can tell a trader that it is time to either buy or sell an asset and also it can serve long term trading purposes.

Disadvantages

This indicator can not be used alone to filter false signals, it must be used in addition to other technical tools.

It is not to be depended on as it can sometimes produce signals that are not true and late too

It is an indicator that is only suitable for a market that is trending and not to is used in a market that is ranging.

Conclusion

The main aim of every trader before going into a trade is to make a good profit and to be able to do this, it is wise to use technical analysis tools that are available and one of them is the use of a super trend indicator. From this lecture, I have come to under how to use, as well as modify the settings of the super trend indicator. The super trend indicator is quite easy as it can be used by advanced and novice. It is one that helps in the confirmation of trends in the market as well as able to give a buy or sell signal.

The super trend indicator should not be relied on for 100% efficiency as it could give false and late signals, it is wise to make use of other technical tools for maximum trade. It was a wonderful ride with you @kouba01. I hope to learn more with you, next season.