.png)

1 Theory - Understanding of Trading Strategy with "Price Action and the Enveloping Candlestick Pattern" | How to execute this Strategy

Trading Price Action and Enveloping Candlestick Pattern

Price action trading is a common type of trading in which traders rely on just charts movements and candles for trading instead of relying on the use of indicators and other tools for technical analysis.

This type of trading is based on the premise that indicators and other tools for technical analysis are usually unreliable and some traders are also of the opinion that these tools were designed by exchanges and brokers to fool/trick unsuspecting traders. That aside, price action trading is an interesting trading strategy that could be incorporated into other trading strategies. Back to the main subject.

Traders may take different approaches to price action trading, and the “Price Action and Enveloping Candlestick Pattern” is one of the most common strategies in price action trading.

Trading Price Action and Enveloping Candlestick Pattern is a price action trading strategy in which the trader carefully observe deviations in price trends by closely observing candles formed to identify enveloping/engulfing candles/engulfing patterns.

An enveloping/engulfing pattern is formed when a tiny candlestick is followed by a massive candlestick the next day/period, the body of which totally overlaps or engulfs the body of the previous day's candlestick. The bullish engulfing candlestick pattern and the bearish engulfing candlestick pattern are the two most popular types of engulfing candlestick patterns.

Bullish Engulfing Candlestick Pattern

These are candlestick patterns formed in which the candle forms engulfing the previous candles with its close above the high of the previous candle.

Bearish Engulfing Candlestick Pattern

This is the direct opposite of the bullish engulfing candle in which the candle forms engulfing the previous candles with its close below the high of the previous candle.

Steps to Execute a Trade Using Enveloping/Engulfing Candles

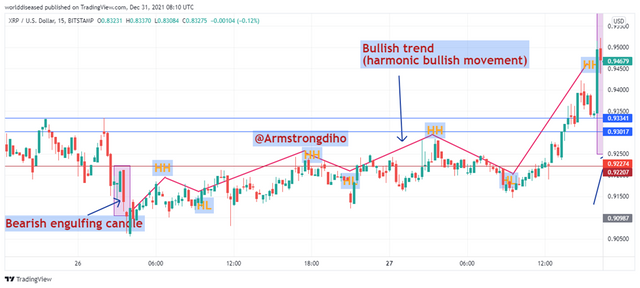

- Establish the trend along with clear harmonic movements. During an uptrend, a trend will be a chart with higher highs and higher lows; while the inverse is the case in a downtrend, with lower lows and lower highs. Like the professor, I’ve relied on a 15-minute chart view to make sure of all things.

Uptrend + Harmonic bullish movement

Downtrend + Harmonic bearish movement

- Next, we want to identify a deviation from the established trend and a price breakout. We want to find a strong price movement in the opposite direction. Using our bullish enveloping candle as an example, the price deviation and breakout point are shown in the screenshot below.

- Next, we want to change the chart to a 5 minutes view to look for entry positions, from within the 15 minutes mapped out area. To make an entry, we need to identify the breakout within this area. And within this point can a market entry be made.

2 Theory Explanation of the interpretation that should be given to a big strong movement in the market & what the price tell us when it happens

Strong movements in the market imply a lot of things as it is an indication of the bears and bulls activities. Basically, interpretations could be given to the strong movements in the market:

- The formation of a bullish engulfing candle signals buying pressure in the market, thus a strong entry whales to move price upwards.

- The formation of a bearish engulfing candle signals selling pressure in the market. Usually a result of an exit from the market from whales and other price movers.

Additionally, when there is a strong upward movement in price, it indicates that the bulls are in control of the market and are striving to push the price of the trading instrument higher; the inverse is the case when there is a decline in the price of an asset as the bears are in control to drive the price of the asset lower.

3 Theory Explanation of the trading entry and exit criteria for the buy and sell positions of the Price Action trading strategy and the Enveloping Candlestick Pattern

The entry and exit using price pattern with engulfing candles are as follows:

- First, we need to establish the current trend and a clear harmonic movement in price within this trend (Higher highs and higher lows in an uptrend; and lower highs and lower lows in a downtrend).

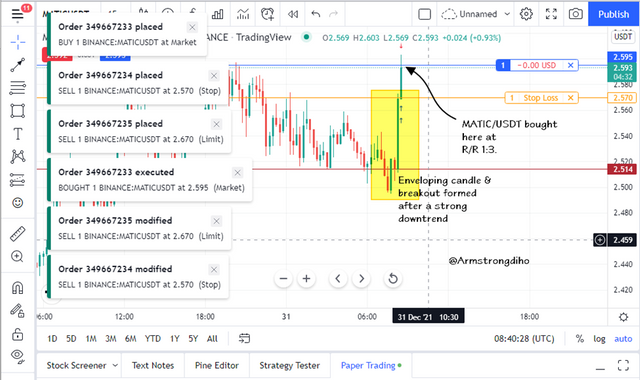

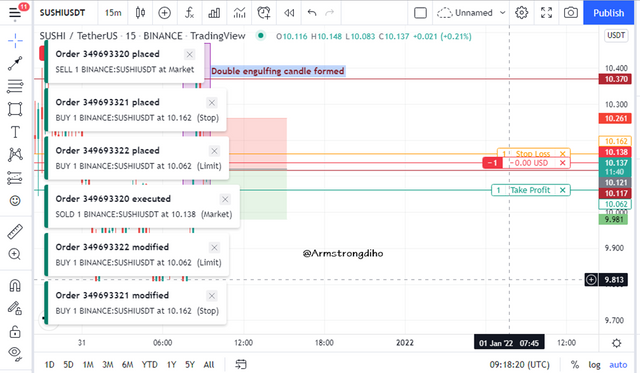

- Identify a strong trend deviation and look for the formation of an enveloping candle within the deviation. From the chart below, we can find the formation of a double enveloping bearish candle and the formation of a breakout zone, and risk: reward of 1:3 has been applied to the trade.

1 Practice Make 2 demo entries (one bullish and one bearish), using the trading strategy with "Price Action and the Enveloping Candlestick Pattern.

Bullish Order Placed

Bullish has been placed at an R/R of 1:3. Here is the observation after a brief period of time:

The trade is in profit after a brief period of time.

Bearish Entry

Above are the details of a sell market order for SUSHI/USDT following the Price action with engulfing candle strategy.

After a brief period of time, on monitoring the order, it was shown to be a profit.

In both the bullish and bearish entries, the brief subsequent review of the trade entry was profitable as the price action along with the formation of an engulfing candle confirms that a trend shift will be sustained.

Conclusion

The price action in combination with the engulfing candle is a fitting trading strategy for spot traders who intend to take quick market profits as well as may not be proficient or interested in the use of technical indicators. This strategy, however, requires a lot of carefulness and meticulous planning to be properly implemented. Thanks to Prof. @Lenonmc21 for his insight on this.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit