1. What is Zethyr Finance?

Zethyr Finance is a decentralized finance (DeFi) dApp developed on the Tron Blockchain network. Zethyr Finance is one of the well-known Tron DApp as it is ranked #29 in the TRON network, and based on DeFi ranking Zethyr Finance is ranked #158 and #266 in dApp ranking category.

Zethyr Finance dApp is a very efficient and reliable dApp operated with over 1300 nodes on the blockchain.

Tron holders and users can easily communicate with the Zethyr Trust smart contract of the dApp and make purchases and selling of their tokens.

Zephyr Finance is regarded as the Tron blockchain number one (#1) DeFi application which enables Tron holders and users to be able to borrow and lend their tokens (Tron) in order to make a profit

Zethyr Finance has the sole aim of providing a more transparent exchange platform in the crypto space.

The amount a user can borrow at any point in time on the Zethyr Finance platform is dependent on the total amount of asset deposited by the user to be used as collateral.

And amount used for lending is also used as collateral by users to borrow on the platform.

Source

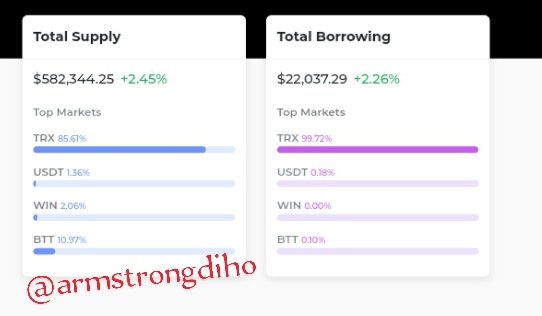

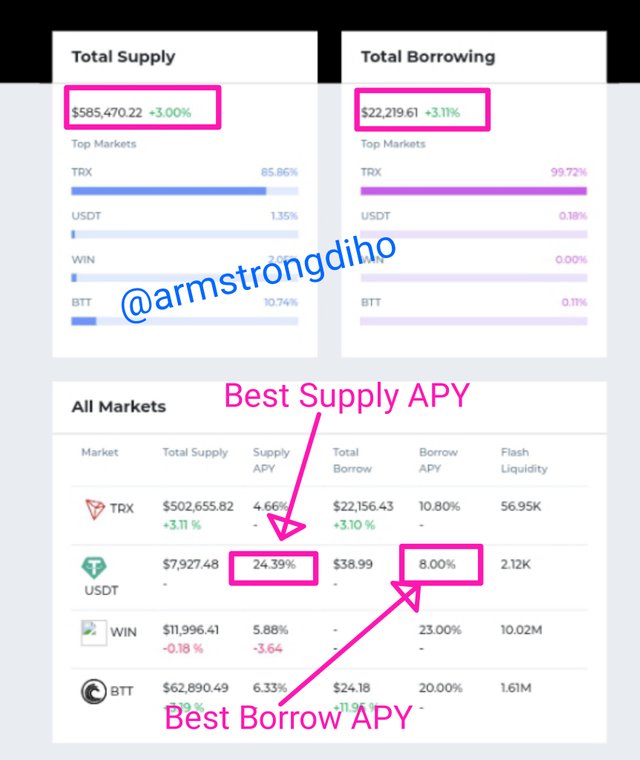

As at the time I was making this research the Total Supply of Zethyr Finance was $582,344.25 with 85.61% TRX, 1.36% USDT, 2.06% WIN, and 10.97% BTT.

The Total Borrowing of Zethyr Finance was $22,037.29, with 99.72% TRX, 0.18% USDT, 0.00% WIN, and 0.10% BTT.

2. What are the features of Zethyr Finance? Discuss them. What's your understanding about DEX Aggregator?

Zethyr Finance comprises of many features and they are as follows

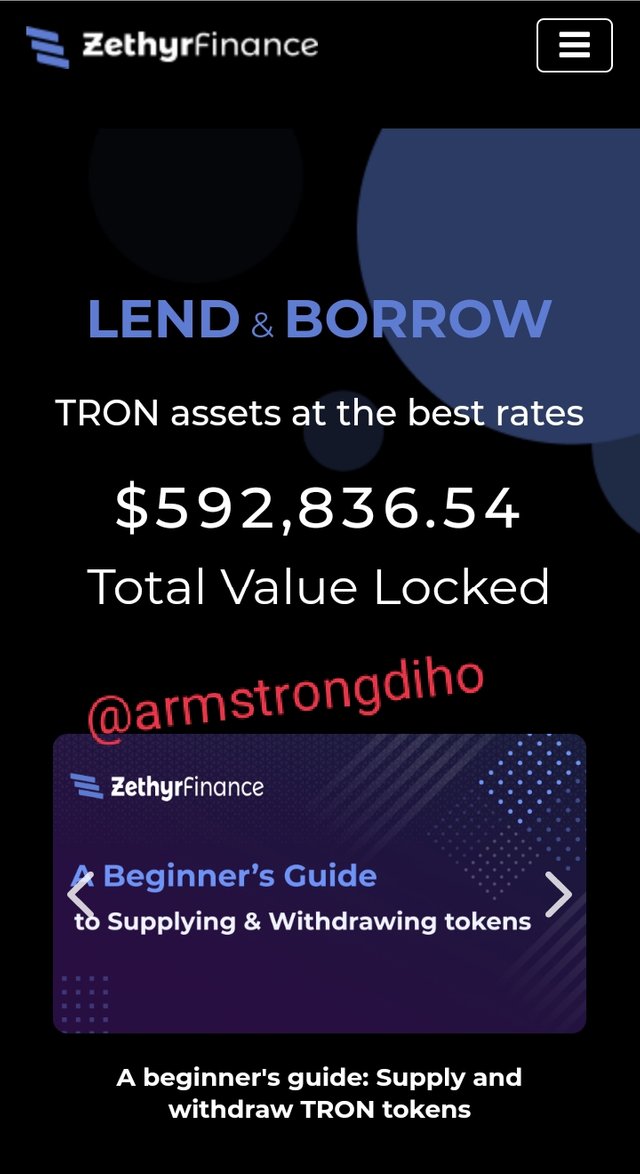

Lending and Borrowing feature

The Lending feature allows uses on the Zethyr Finance platform to lend out their asset and earn profit in return. Users who participate in the lending pool of Zethyr Finance thereby adds liquidity to the pool. The amount users lend out is used as borrow collateral.

The Borrowing feature allows users on the platform to borrow assets. To participate in this protocol a user has to first deposit an amount of asset to be used as collateral, borrowers pay an interest rate to the lenders in agreement to the smart contract. This is done to maintain the integrity of the system.

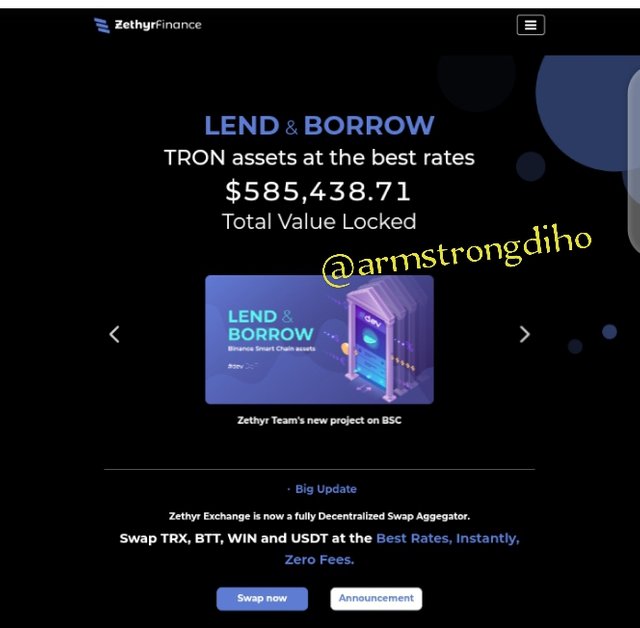

At the time of this research, the total value locked in was $585,438.71.

Source

Source

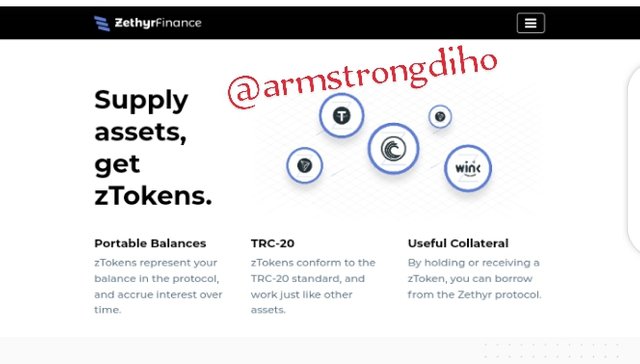

zTokens

zToken is the native token of Zethyr Finance. With the zToken users can participate in borrowing and lending protocols on the Zethyr Finance platform and users are rewarded with zToken when they participate in lending. zToken can be traded, stored and minted upon deposit and also burned on the platform.

Source

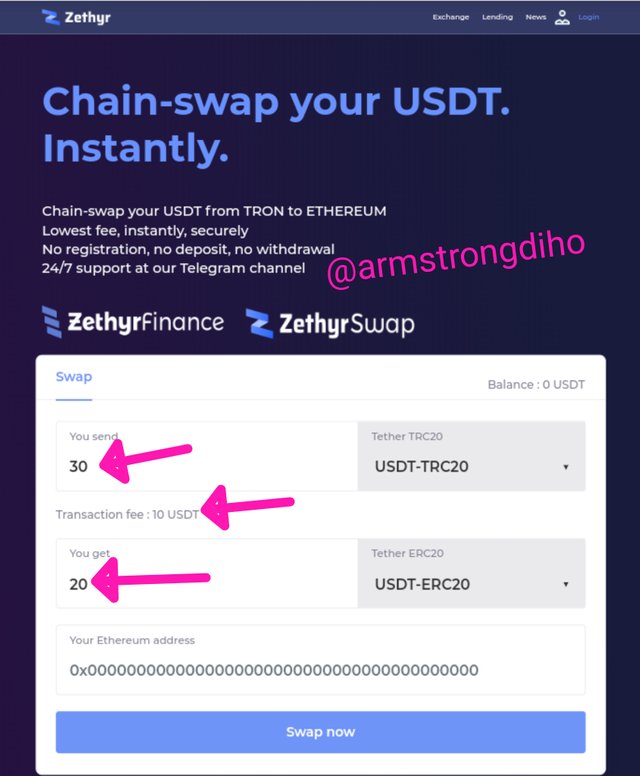

Stable Feature

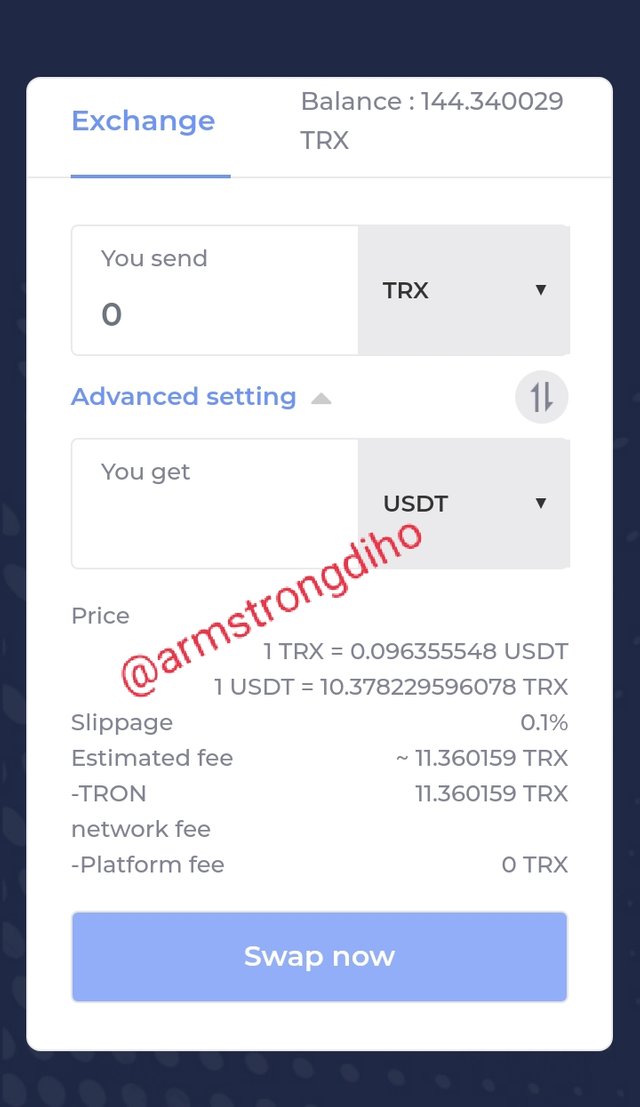

The stable coin feature is used to swap stable coins on the Zethyr Finance platform, where users can easily swap the stable coins such as USDT to TRX and to ETH.

For every swap transaction, 10USDT is charged a considerably high transaction fee.

For example from the screenshot below when I entered 30USDT for TRC20, I was charged a transaction fee of 10USDT and the total amount to be received will be 20USDT for ETH20.

Source

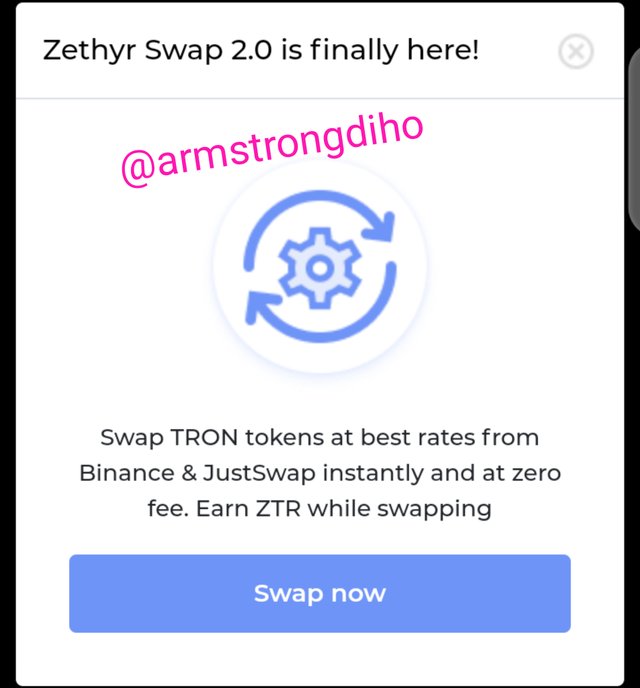

Swap and V1 feature

The V1 and swap feature is used basically to swap tokens in the Zethyr Finance platform. They make use of the Zethyr Swap newest version (version 2.0). Swapping using the IV and Swap features is done via Justswap and Binance and there are no transaction fees involved.

Source

Source

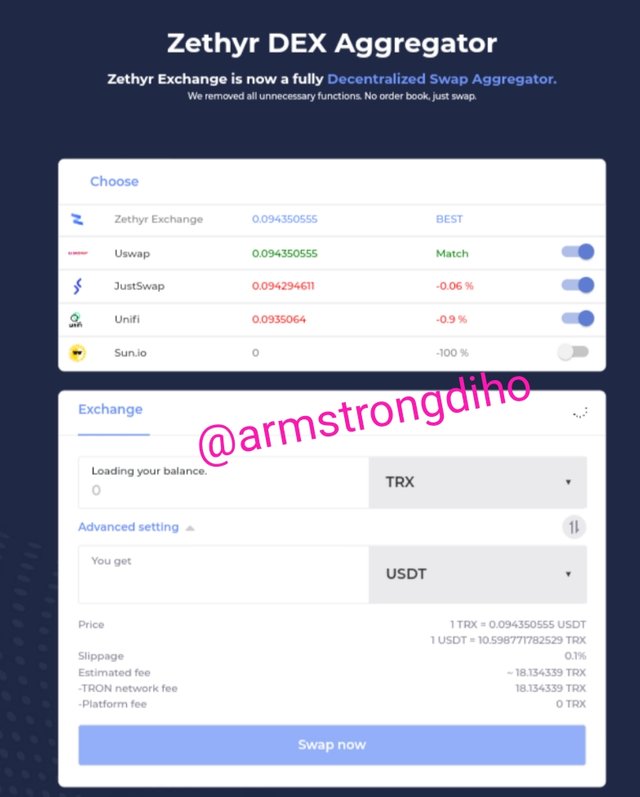

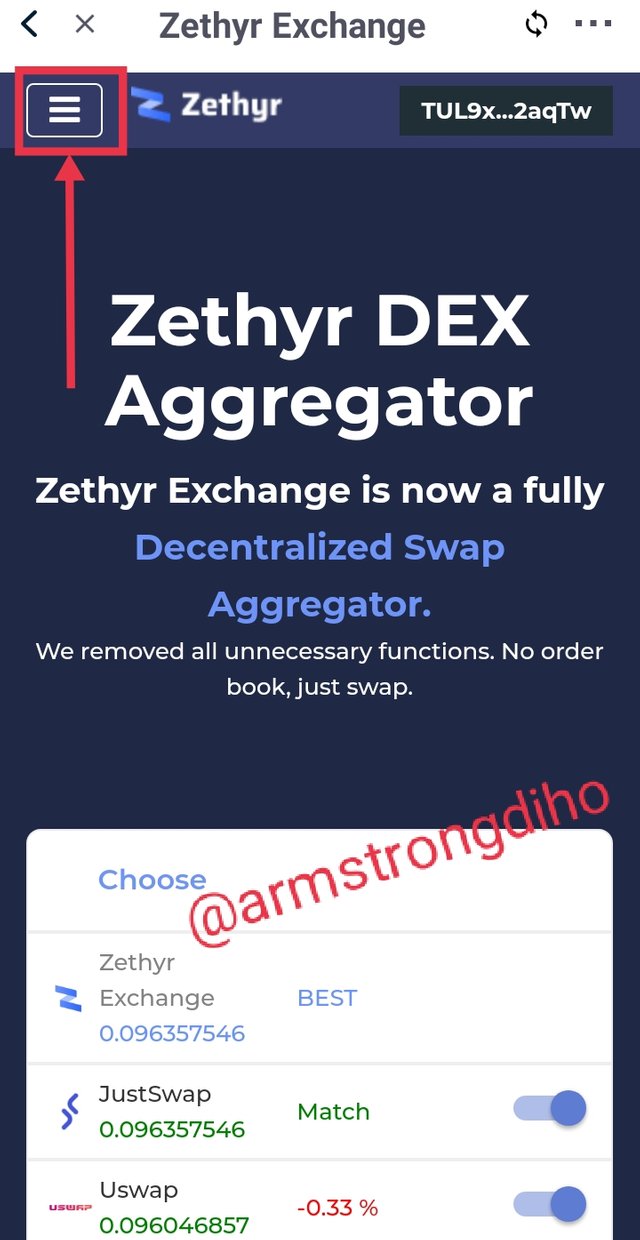

DEX Aggregator

DEX Aggregators came from the evolution of DEXs. They help source liquidity from different swap and exchange platforms, which at the end of the day, they finally come up with the best token swap rate that will be suitable and convenient for users.

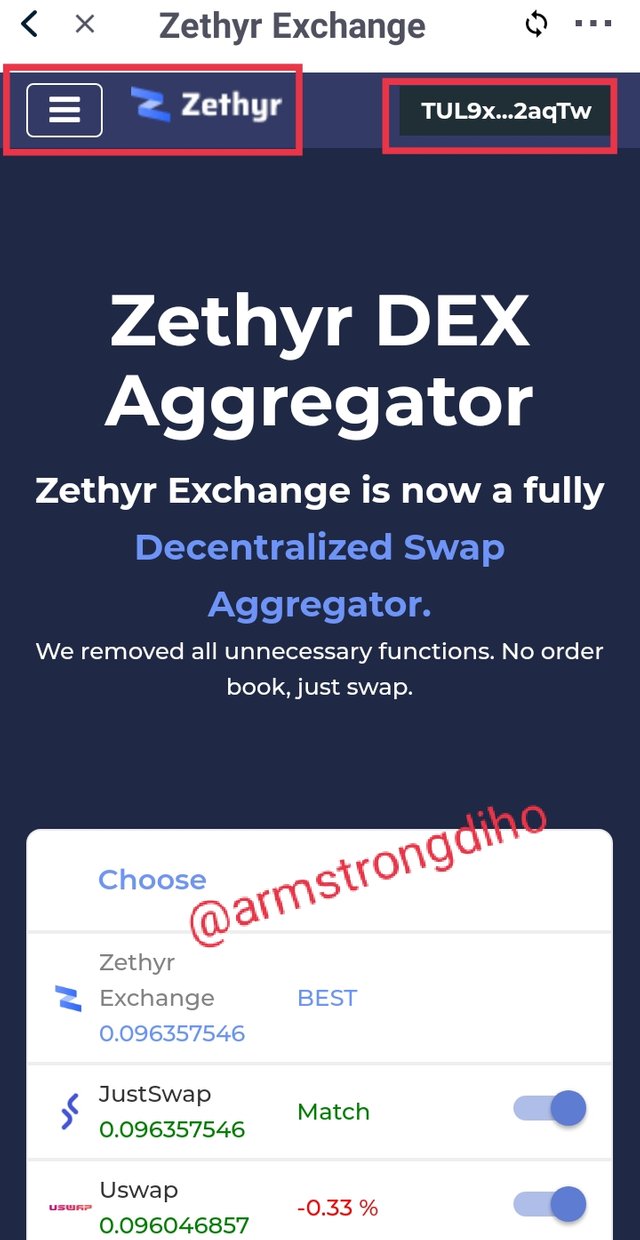

Zethyr Exchange on the Zethyr Finance platform has now integrated into is a DEX Aggregator thereby removing the order book function and replacing it with an instant swap of tokens.

Some examples of the Zethyr DEX Aggregators are JustSwap, Uswapetc.

Source

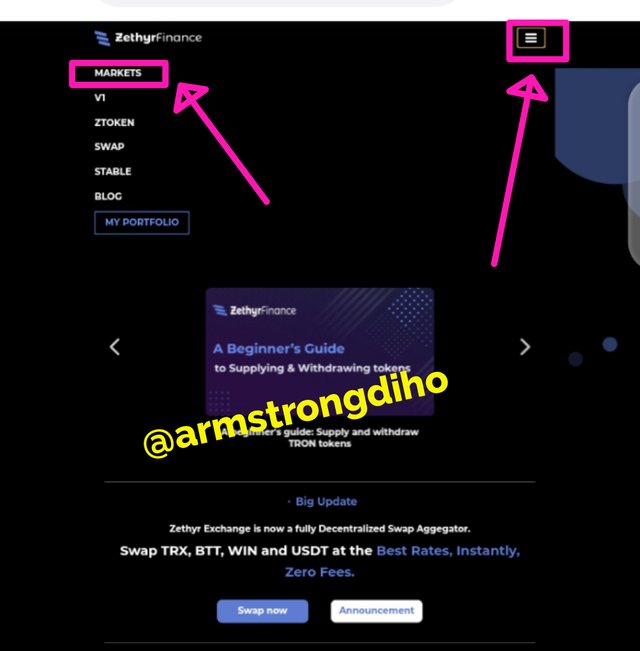

3. Explore the Zethyr Finance Markets and show your observations in terms of profitability of Supply and Borrow (Hint: Best Supply/Borrow APY). Screenshots required.

To start the exploring process, we will be visiting the official website of Zethyr Finance.

- Click on the three dash lines at the top right and then click on market.

Source

Source

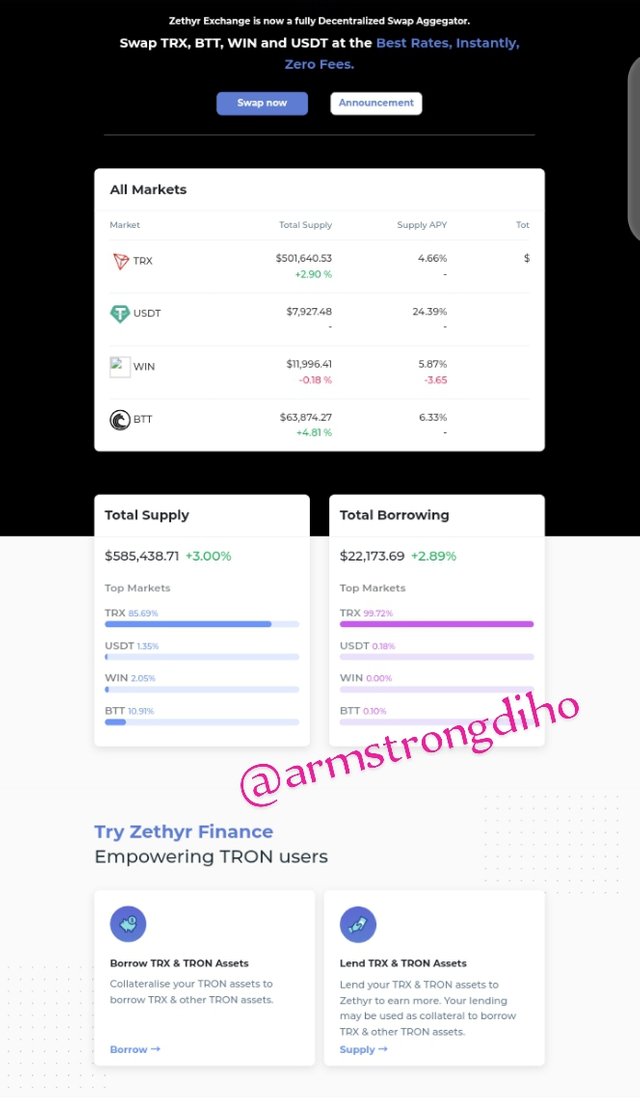

The Zethyr finance market has four assets in the market as seen on the screenshot above. They include; TRX, USDT, WIN, and BTT.

It can be noticed also that the market have a Total Supply of $585,935.28 and a Total Borrowing of $22,219.79.

Supply value of Assets from the highest to the lowest

Among the above-mentioned assets on the Zethyr finance market TRX has the highest supply volume of $502,655.82 seconded by BTT with a total supply value of $63,355.55, WIN comes third with a total supply value of $11,996.41, and then lastly USDT with a total supply value of $7,927.48.

Borrowing value of Assets from the highest to the lowest

Here TRX still take the lead as the asset with the highest borrowing value of $22,156.43, seconded by USDT with a borrowing value of $38.99 and BTT with a borrowing value of $24.36, the WIN asset doesn't have a borrowing value here.

From the data above it is clear that TRX has the highest pool for supply and borrowing.

Best Supply and borrowing APY

The asset with the best Supply and borrowing APY in the Zethyr finance market is USDT with a supply APY value of 24.39% and a borrow APY value of 8.00%.

The USDT supply APY has a high value and the borrow APY has a low value which shows that the pool has the highest number of users lending with it than those that borrow with it.

4. Show the steps involved in connecting the TronLink Wallet to Zethyr Finance. (Screenshots required).

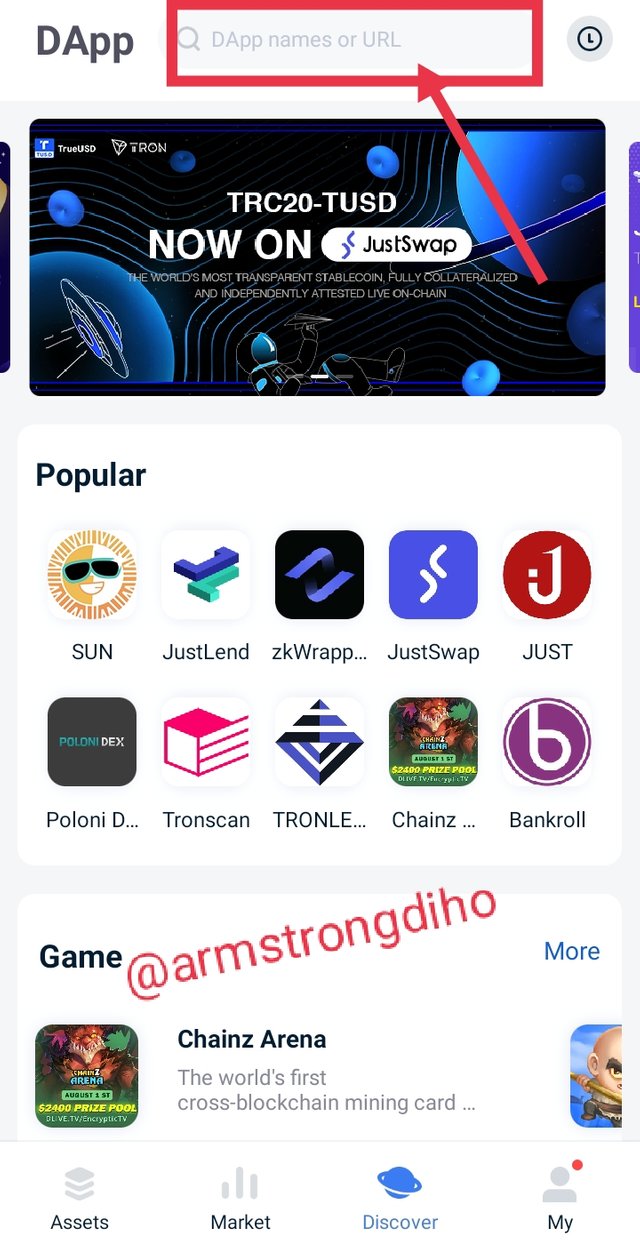

In answering this question I’ll be using my Tronlink wallet mobile app.

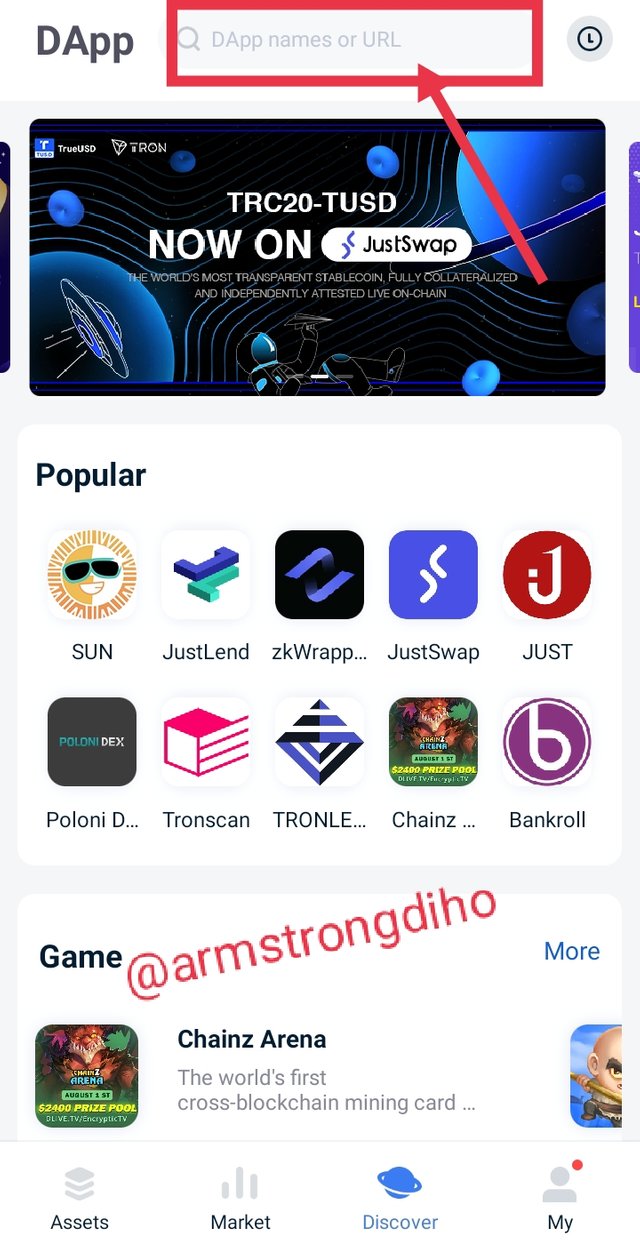

- First I logged in to my Tronlink wallet, then click on the Discover

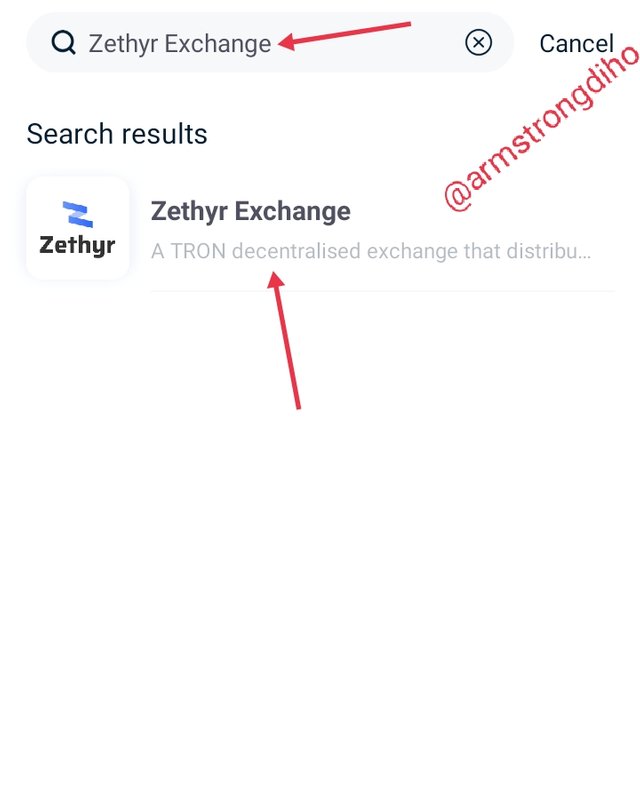

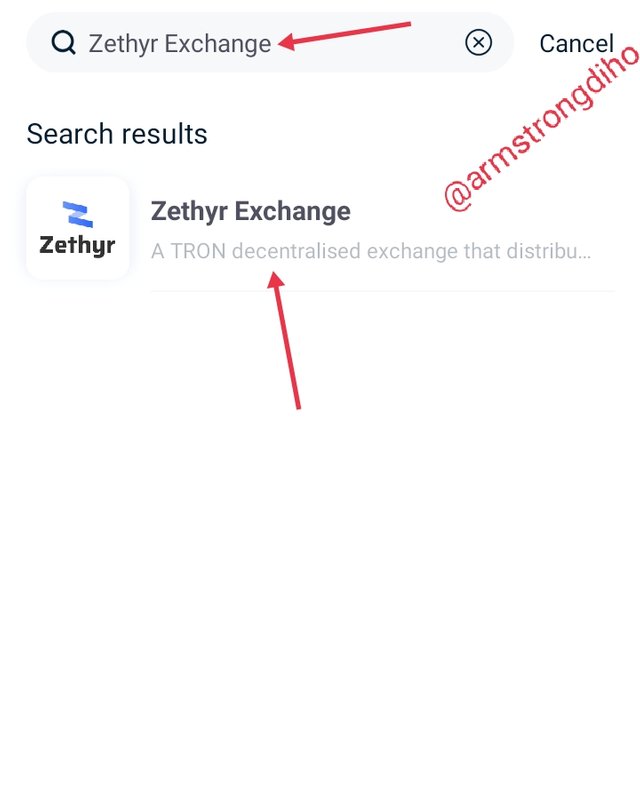

- On the landing page, click on the search engine and then search for Zethyr Exchange on the search bar.

- When the Zethyr Exchange appears Click on it to open the Zethyr Exchange.

- From this screenshot it can be seen that the Zethyr Exchange is already connected with my Tron wallet.

This is the section of the Zethyr Exchange where you can swap different tokens.

5. Give a detailed understanding of ztoken and research a token of another project that serves the same purpose as it.

The zToken is the governance token on the Zethyr finance ecosystem, it is the means of interacting in the Zethyr finance ecosystem. With the zToken a user can easily participate in borrowing and lending on the Zethyr Finance platform and the rewards for participating in lending is done using the zToken. zToken can be traded, stored and minted upon deposit and also burned on the platform.

The zToken is built per the TRC-20 token standard and the value of zToken is fixed on the value of the tokens deposited on the Zethyr Finance platform, that is zToken recognizes and get along with the TRC-20 standard when been deposited into the platform.

Users in Zethyr Finance borrows in the platform by using the zToken as collateral and this is done when users deposit underlying assets such as TRC20 which is pegged with the zToken in a ratio of 1:1.

When users are rewarded with zToken, it can be swapped on the platform to any corresponding asset of the users choice.

The jTokens is another token that functions like the zToken. It is the governance token of the JustLend dApp built on the Tron blockchain and it is also built-in correspondence with the TRC-20 token standard. jToken t represents the TRC20 token on the JustLend wallet.

jToken is used for lending and borrowing on the JustLend platform and users who participate in lending protocols and add liquidity to the liquidity pool are rewarded with the jToken

jToken is used for borrowing, lending, minting, and transferring tokens etc.

6. Perform a real Supply transaction on Zethyr Finance using a preferable market. Show it step by step (Screenshots required). Show the fees incurred.

Step by step procedures on how to Perform a real Supply transaction on Zethyr Finance

*. First I logged in to my Tronlink wallet. Click on the Discover.

*. Then search for Zethyr Exchange on the search bar.

*. When the Zethyr Exchange appears Click on it to open the Zethyr Exchange.

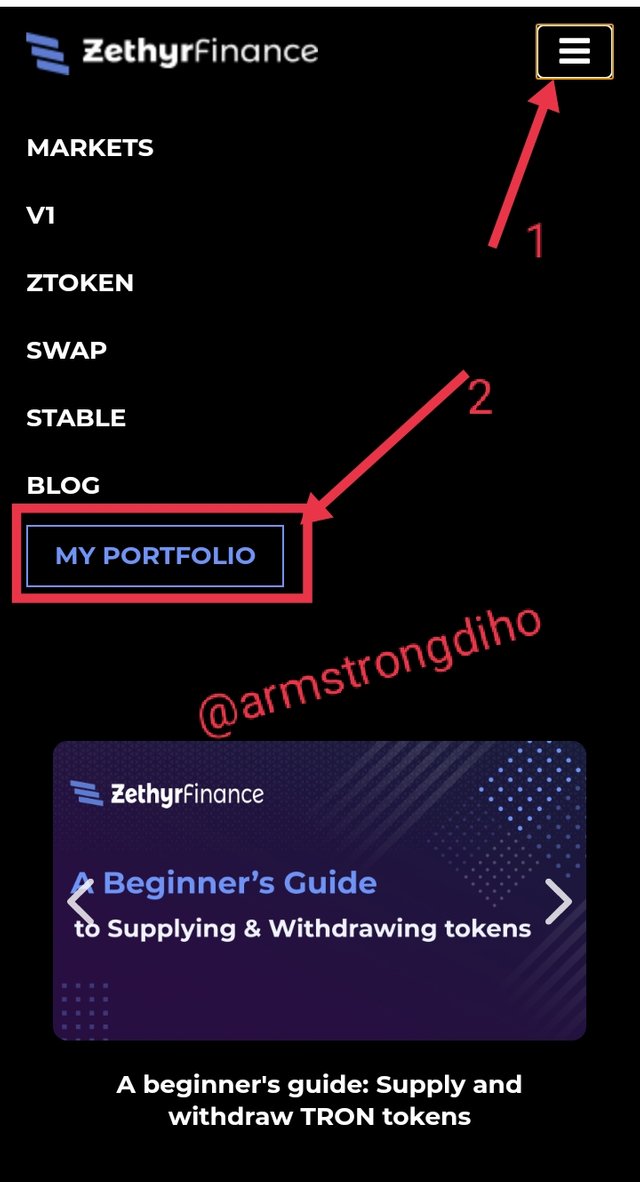

*. The Zethyr Exchange will be connected to the Tron wallet. Then Click on the three dash lines at the top.

- In this interface, click on lending to confirm the account has been connected.

- Select on portfolio after clicking on the three dash lines as shown on the screenshot.

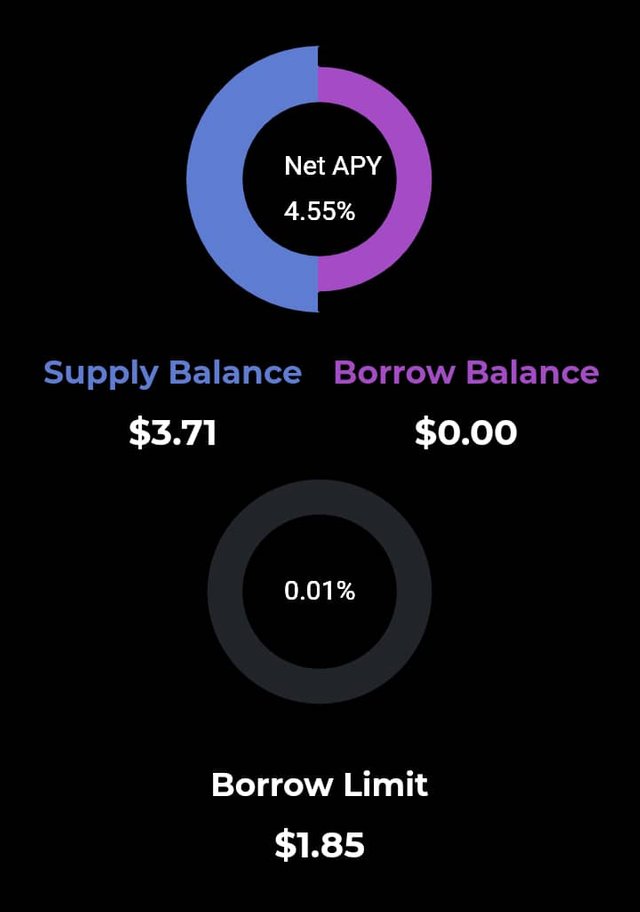

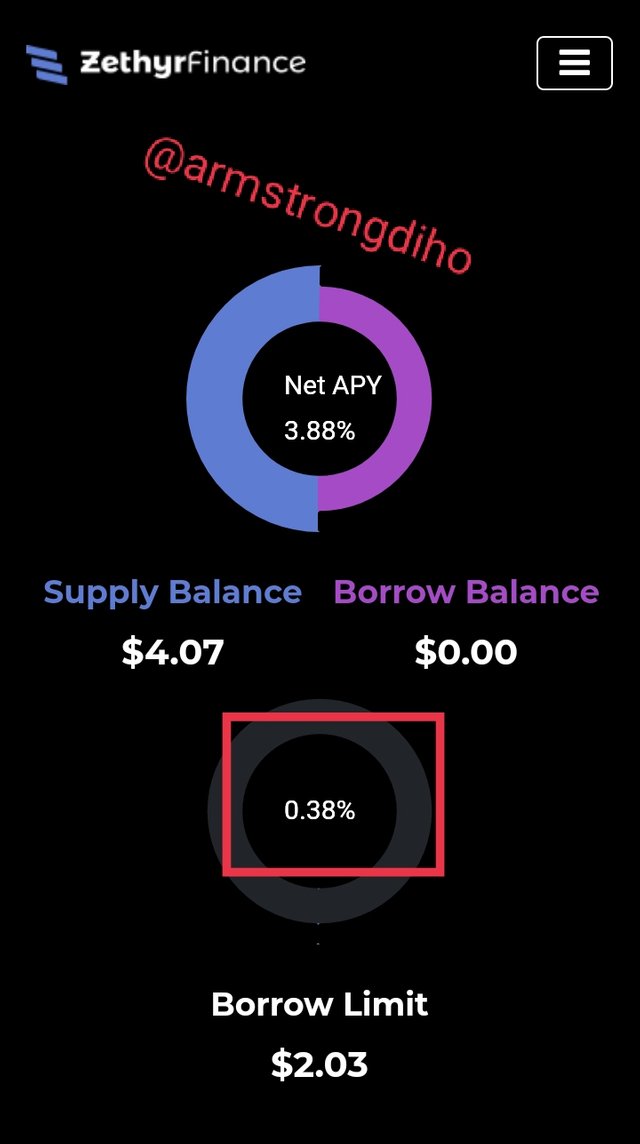

*. On the landing page shows the Supply and Borrow balance so, scroll down to see the Supply option.

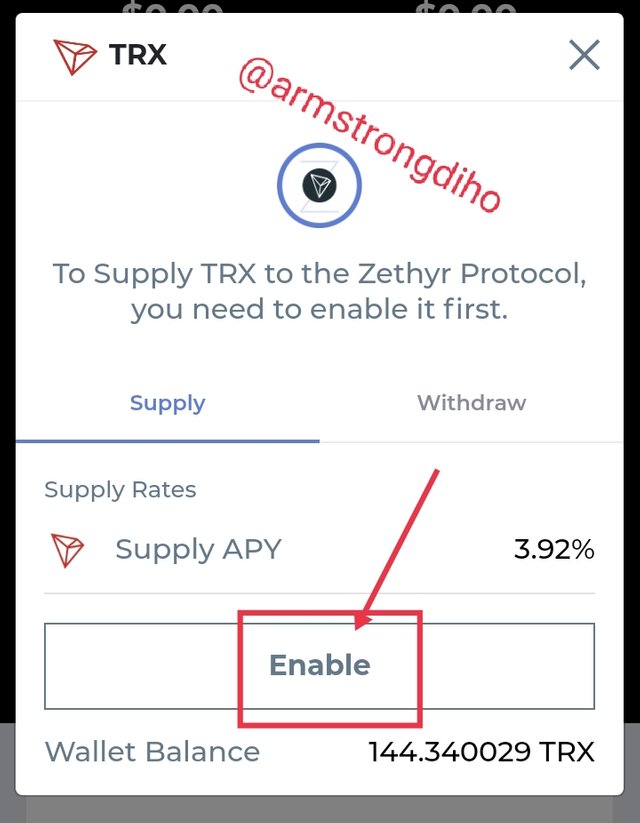

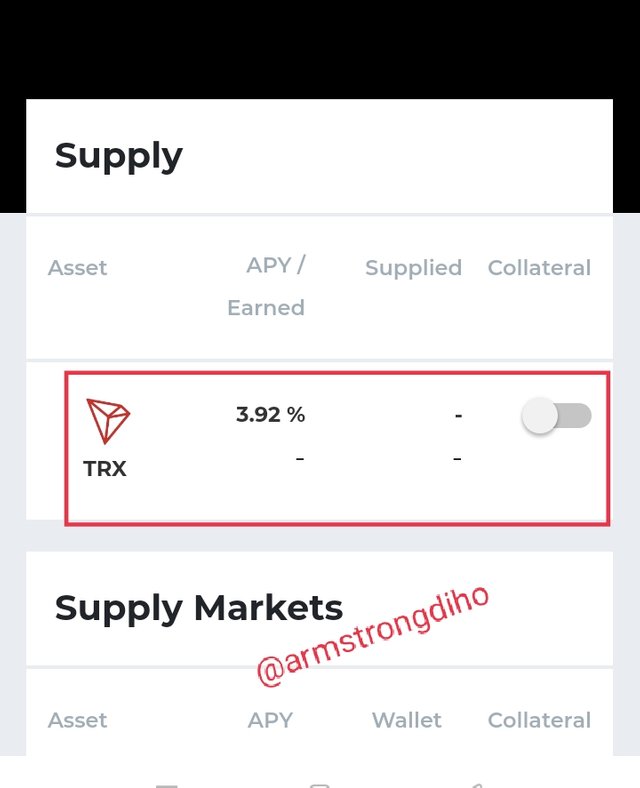

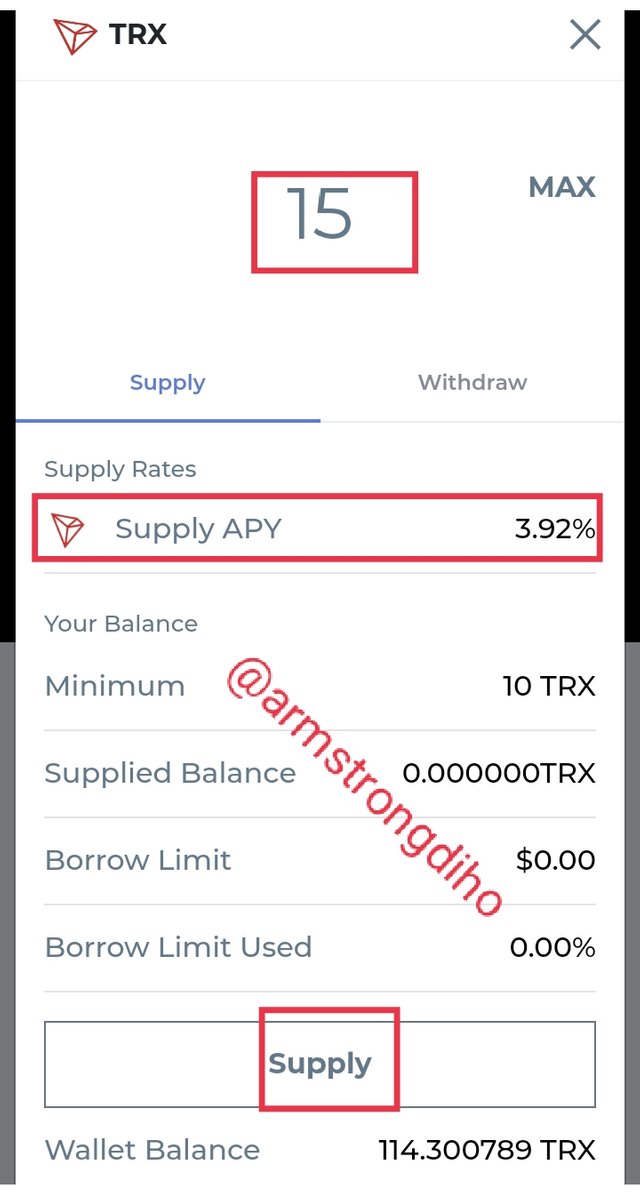

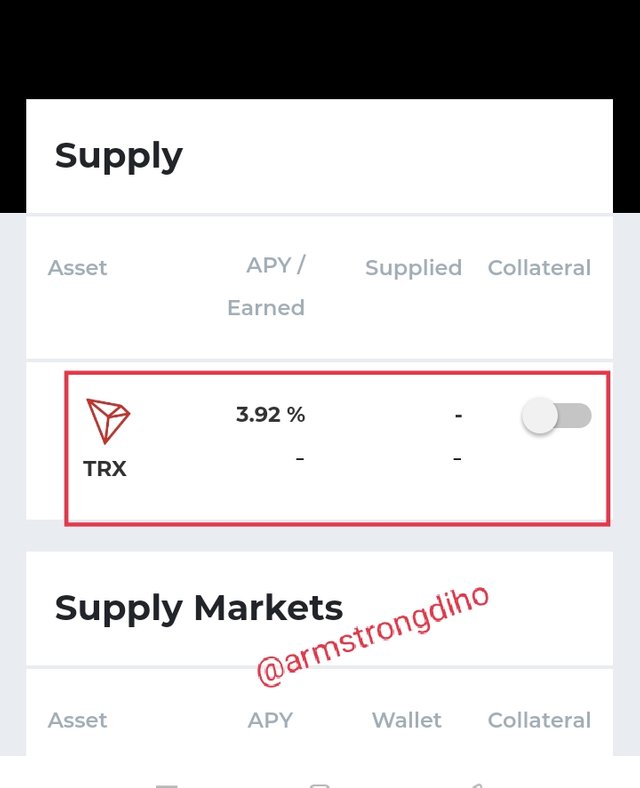

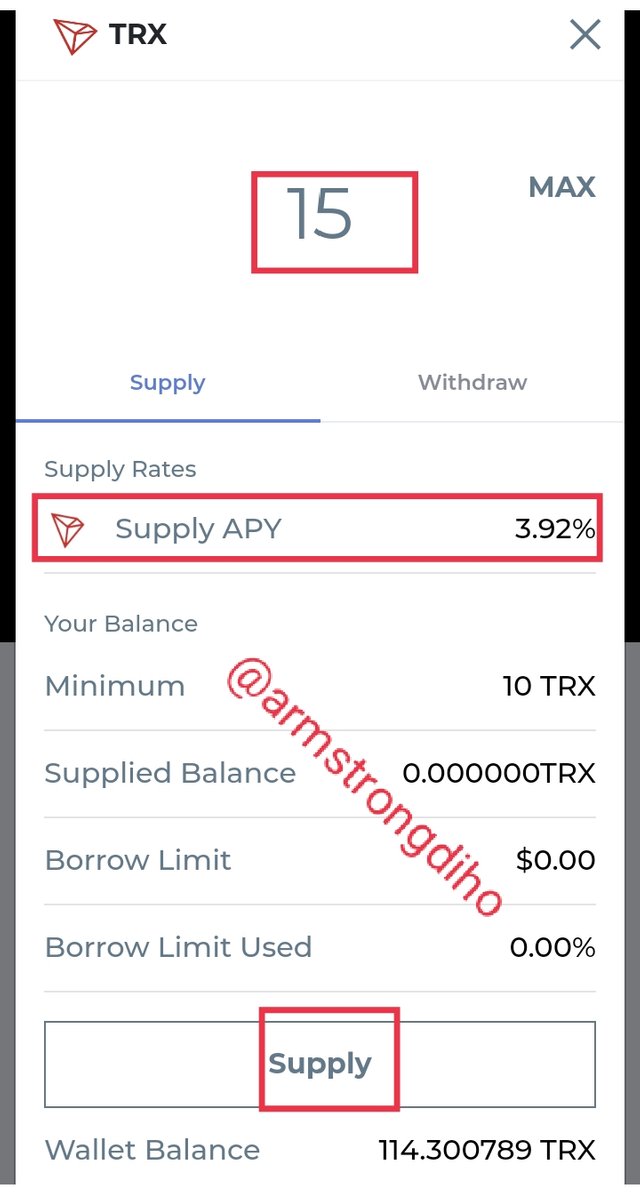

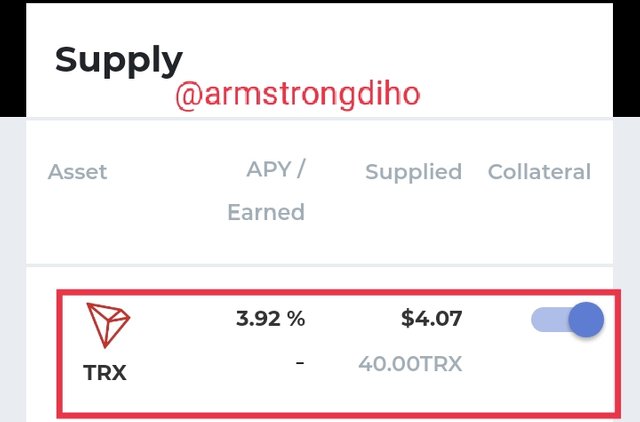

*. Here, I'll select my preferred market to be TRX since I have TRX tokens in my wallet.

- You will be required to enable the supply market, click on enable to continue.

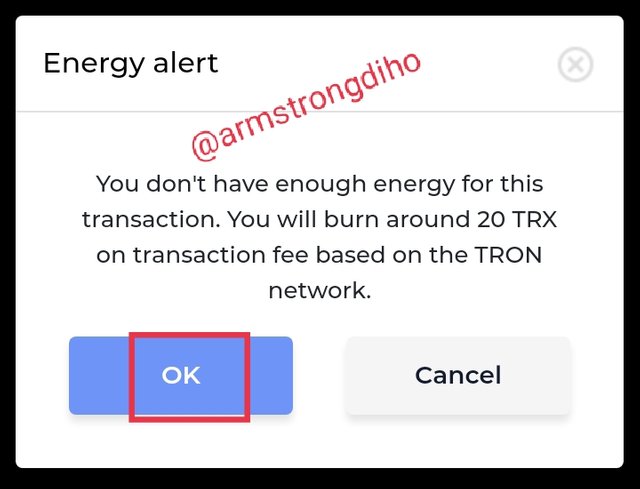

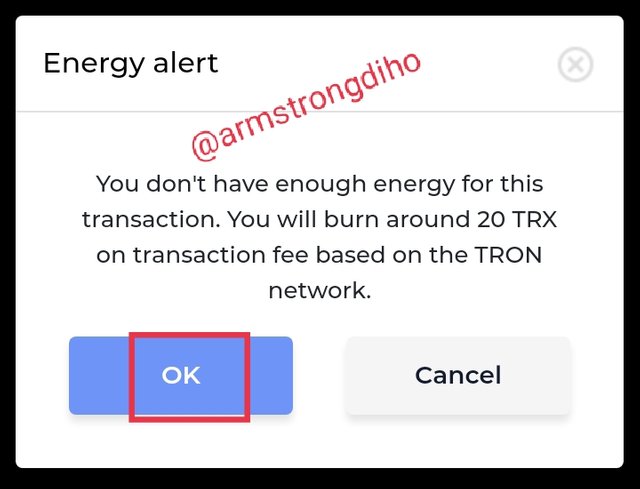

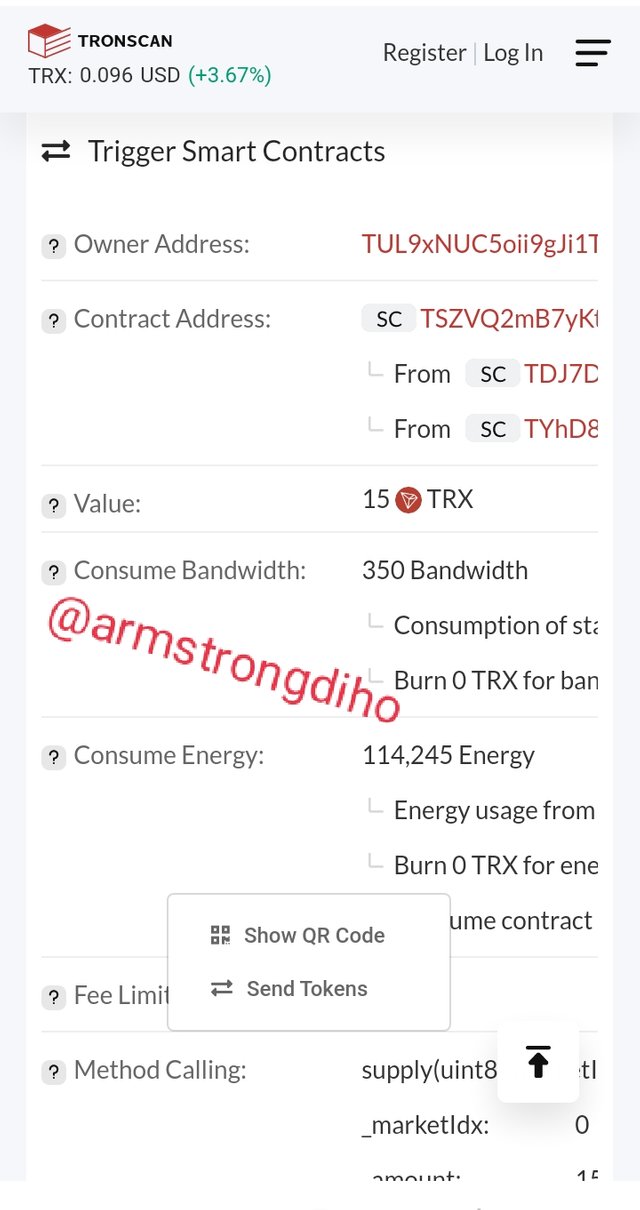

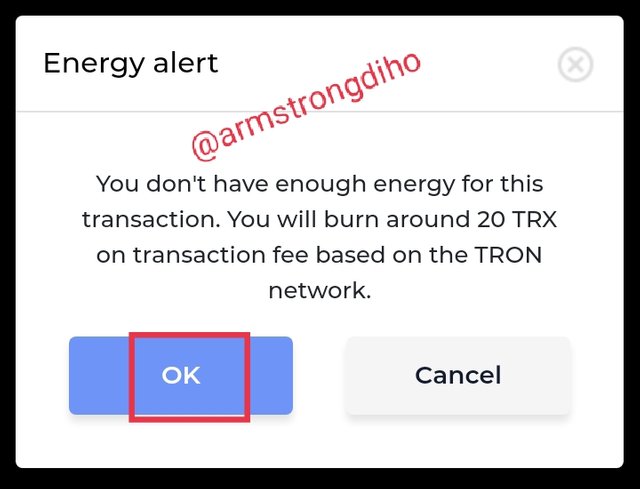

*. 20 TRX will be burnt as a transaction fee in process of the transaction.

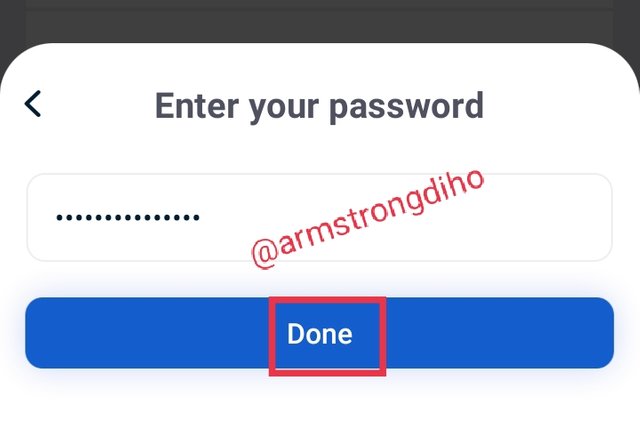

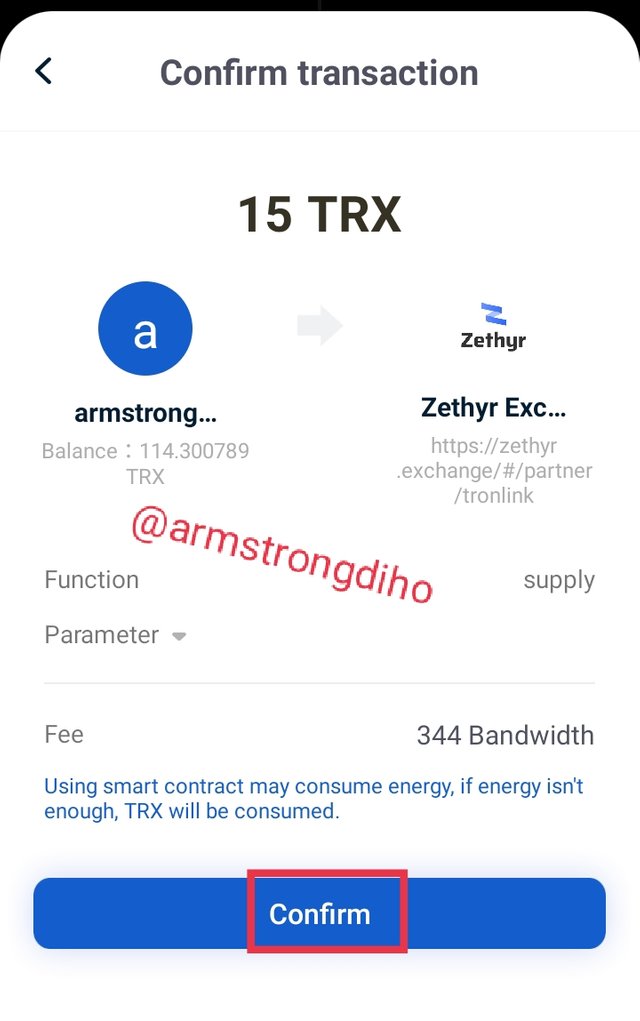

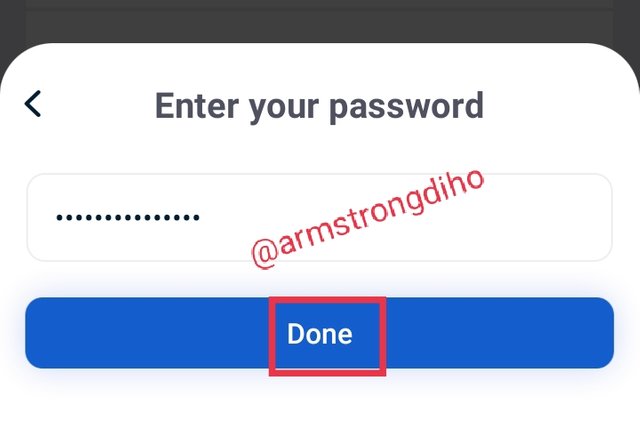

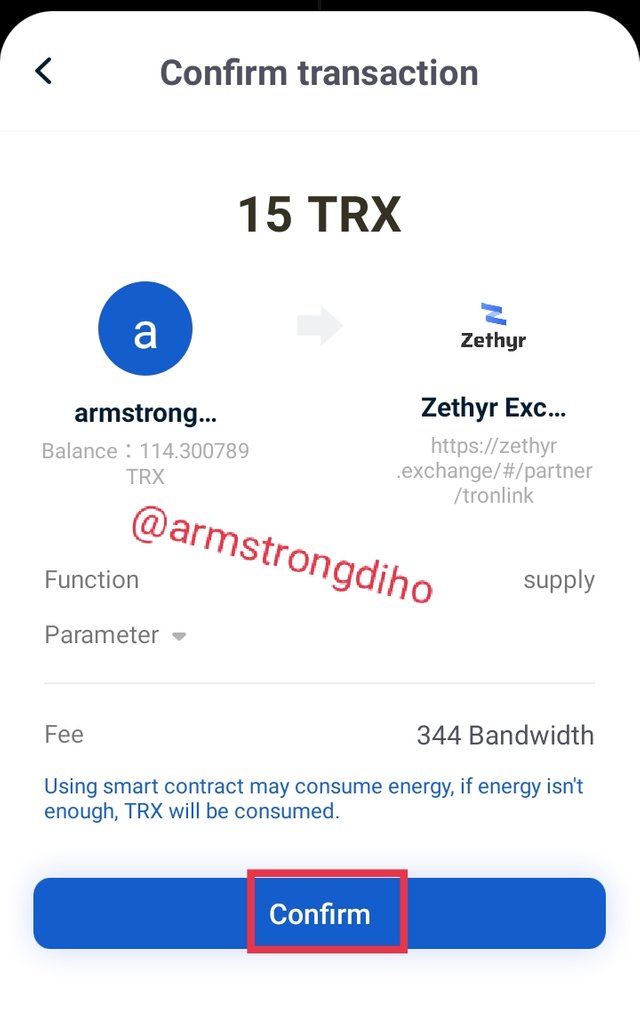

- . Click on confirm and input the password to gain access.

Supplying TRX asset in Zethyr Finance requires the following step.

- Now, Click on the Asset

- In this interface, enter the TRX amount to be supplied. we can see I have a supply APY of 3.92%, then Click on the supply tab.

- The Energy required to burn transaction 20TRX

- Here, Click on Confirm to continue

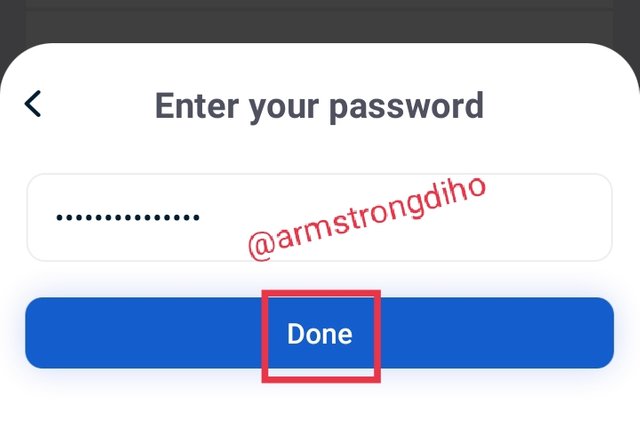

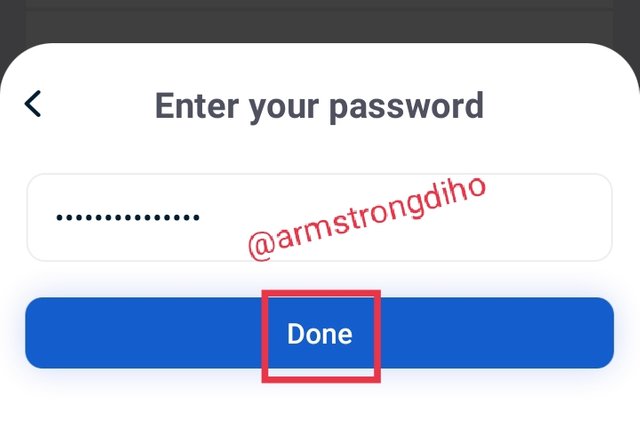

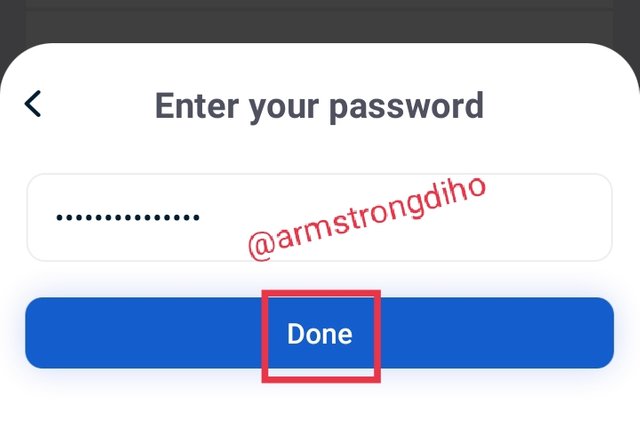

- To proceed further, enter your password to sign the transaction

- Finally, I have successfully supplied. With a supply balance of $1.44.

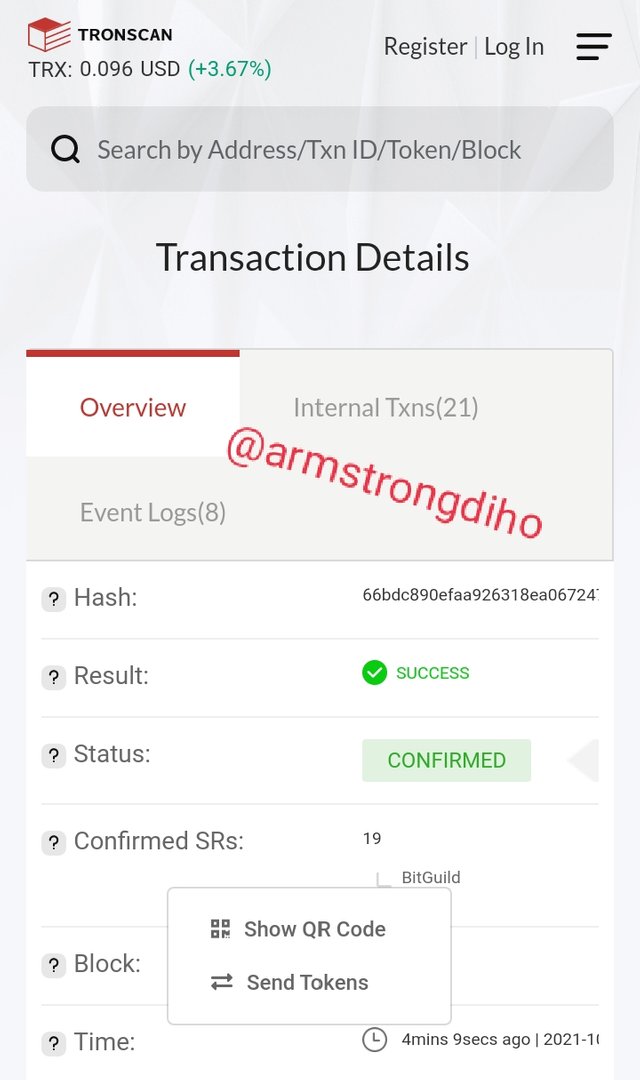

Here is the confirmation screenshot from the Tronscan.

7. Collateralize your asset to Borrow on Zethyr Finance, repay the borrowed asset and withdraw your supply. Show the steps involved and your observations (like the fees incurred). (Screenshots required).

Collateralizing my asset to Borrow on Zethyr Finance

Collateralizing asset on the zethyr Finance allows users to borrow on the platform. The following steps below are taken for asset collateralizing.

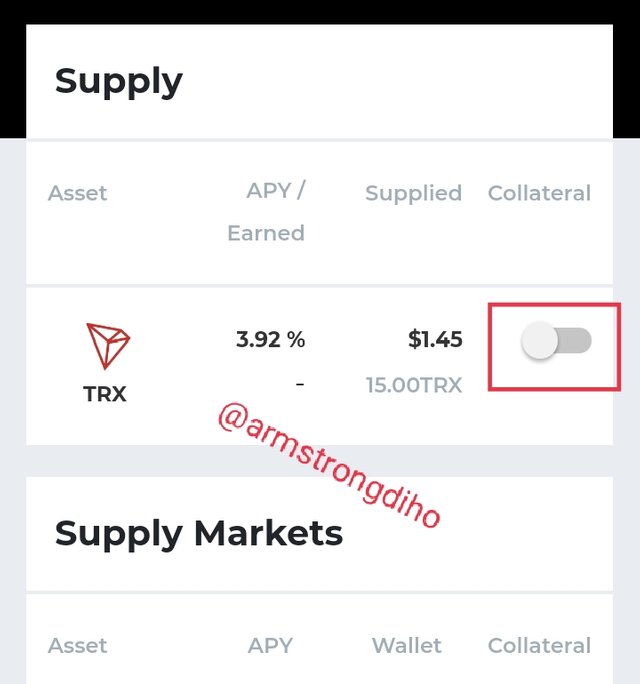

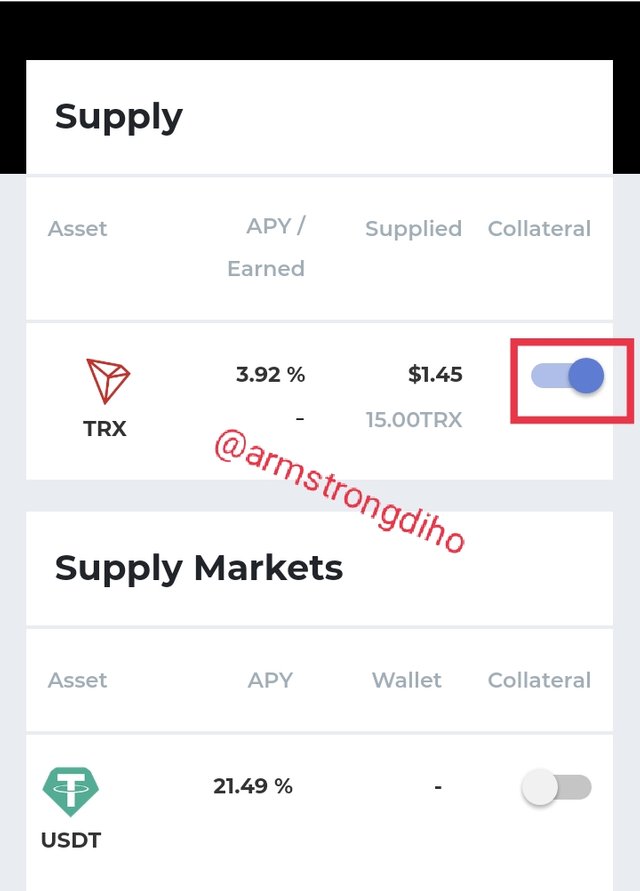

- Enter the supply section, click on the TRX asset and turn on collateral by switching the arrow from left to right.

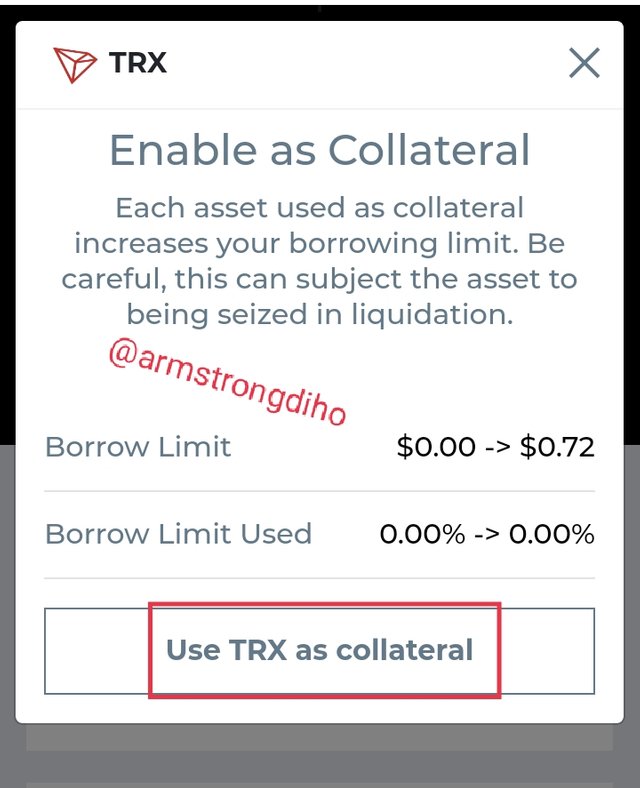

- A pop-up message will come up asking for your permission to use TRX as collateral, click on "Use TRX as Collateral"

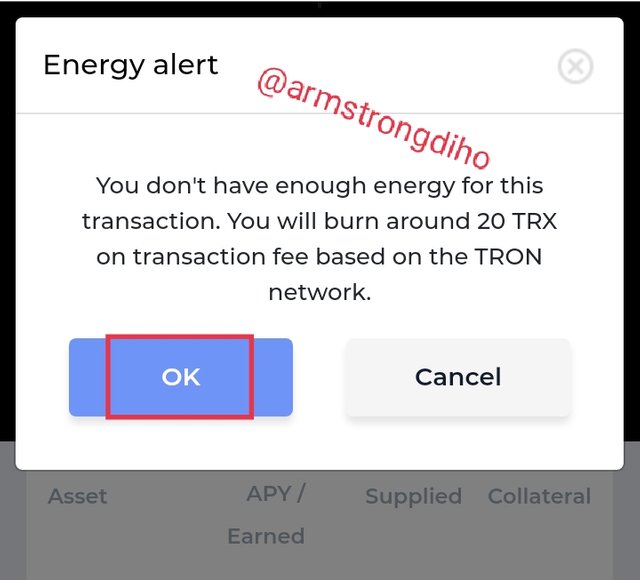

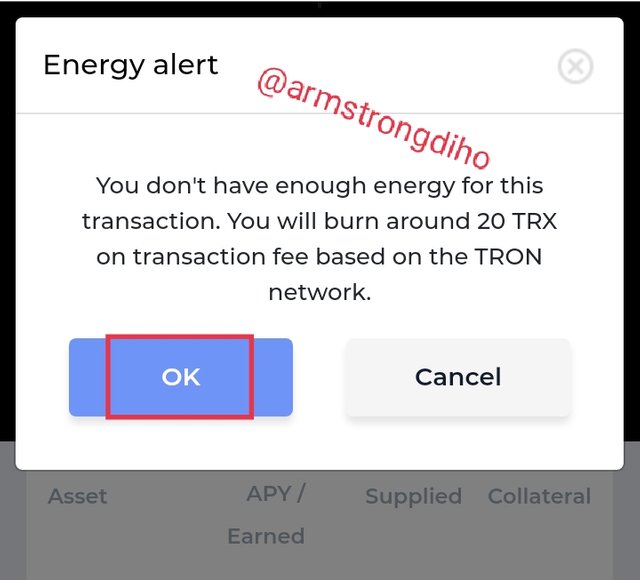

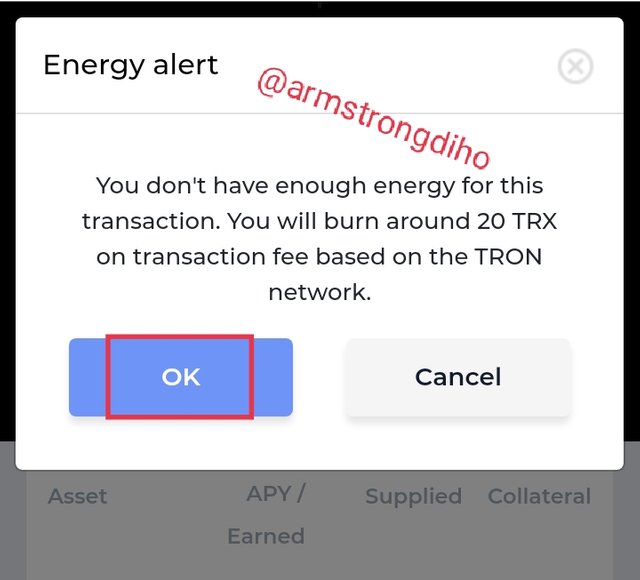

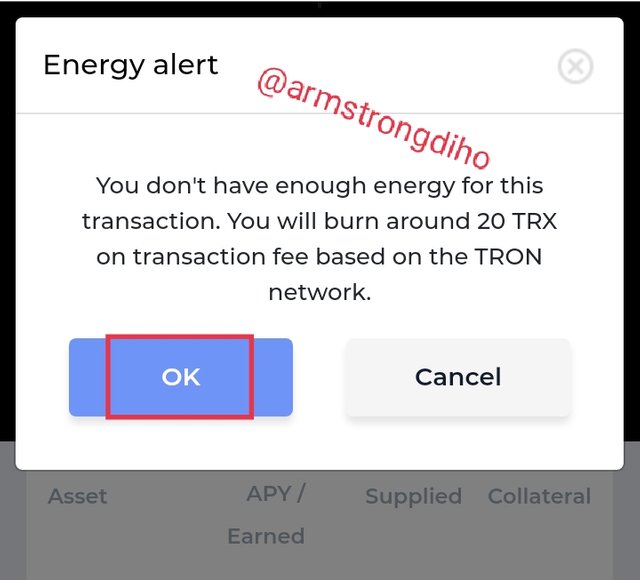

20 TRX energy will be required for the transaction, click on “OK” in acceptance.

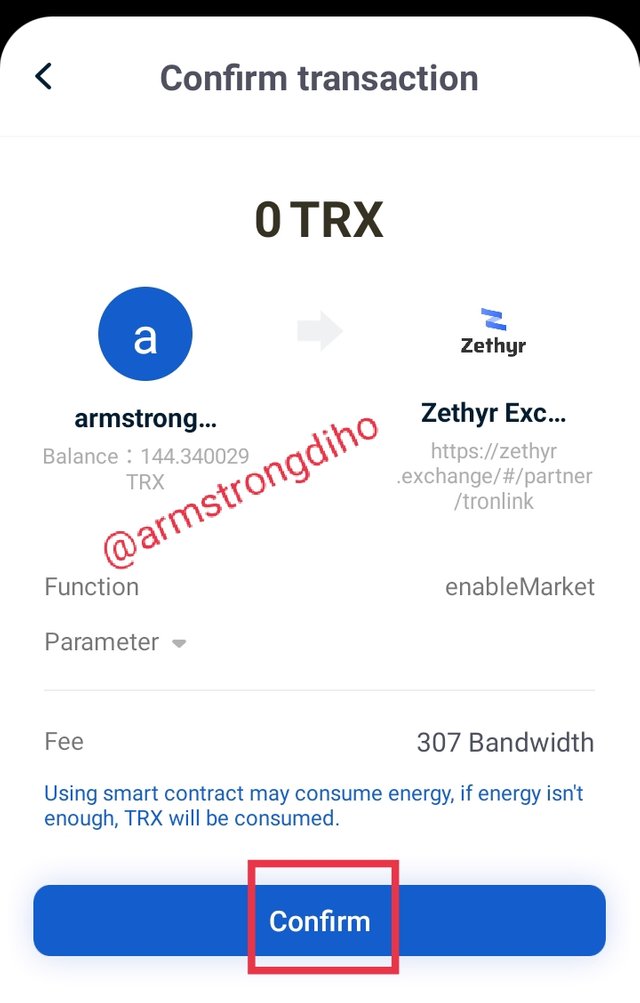

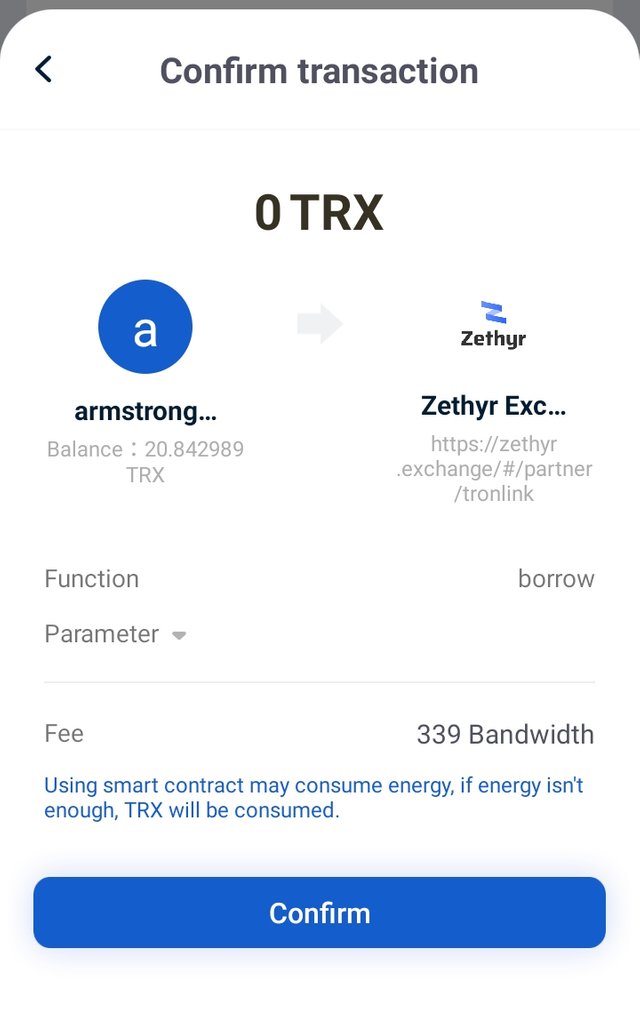

To confirm the transaction click on “Confirm”.

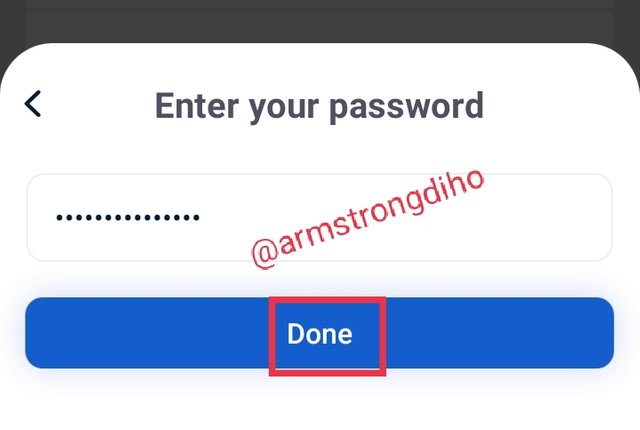

Input your password for the transaction to be signed.

The Collateral option bottom is now activated.

Note: I re-supplied TRX due to insufficient funds to meet up the minium required borrow amount. Below are the image.

Borrowing from the Zethyr Finance

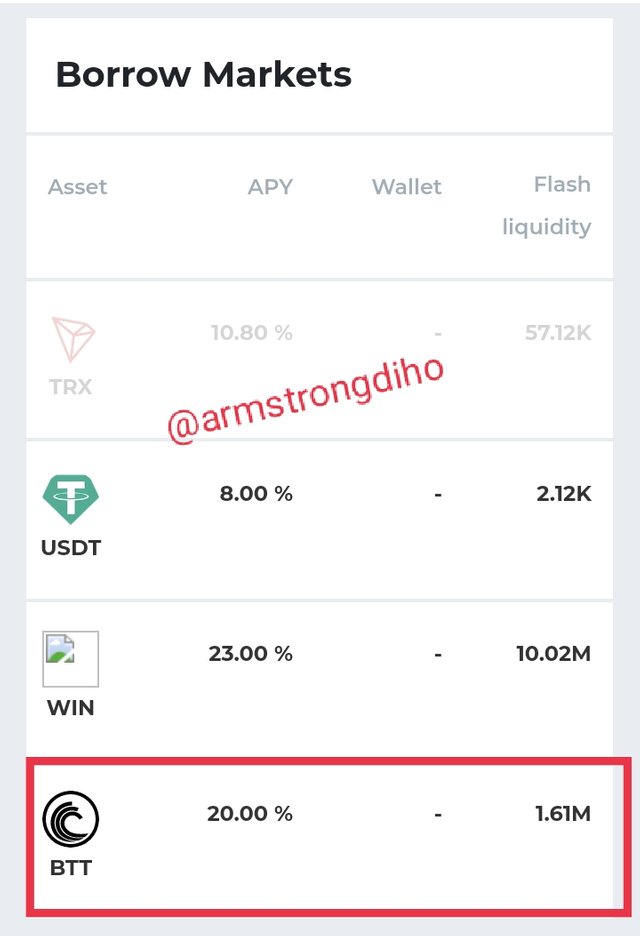

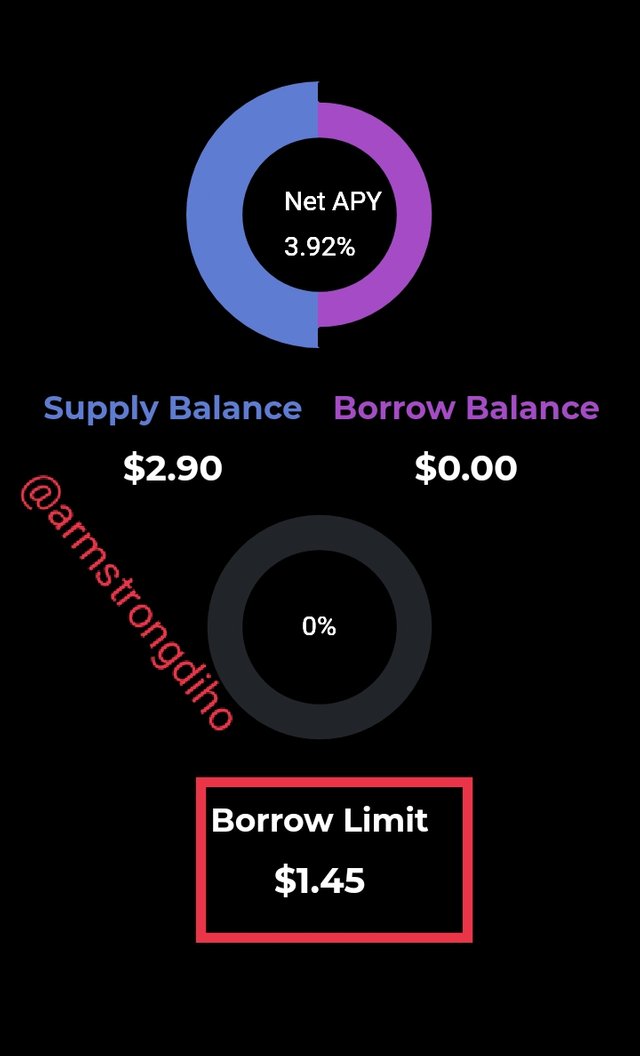

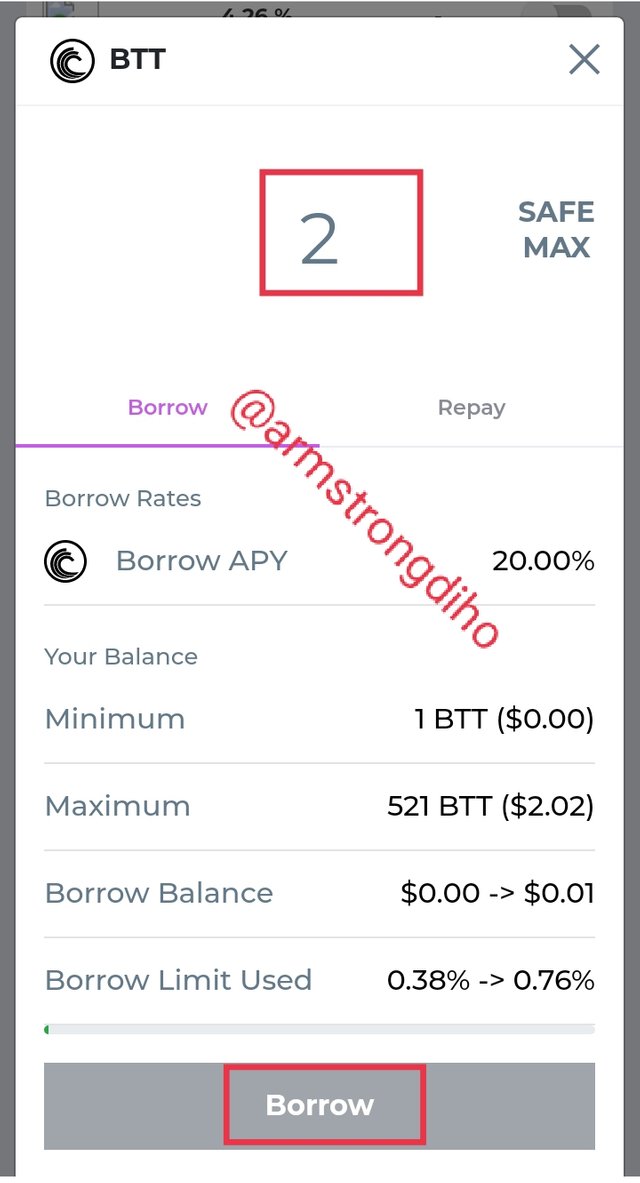

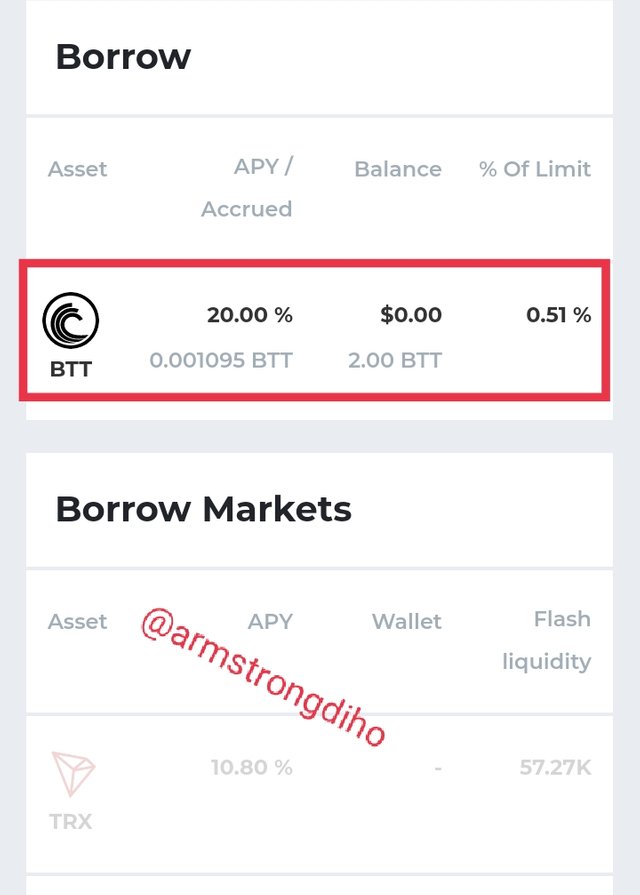

- Enter the borrow asset option. Then I'll click on BTT because that's the asset I want to borrow but then I can only borrow within my borrow limit of $0.40.

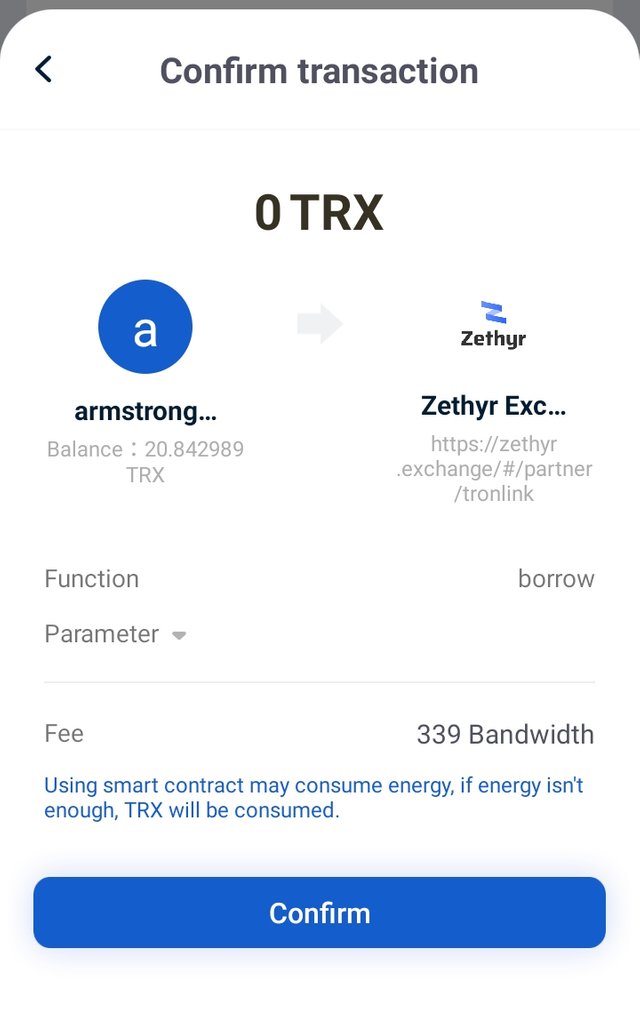

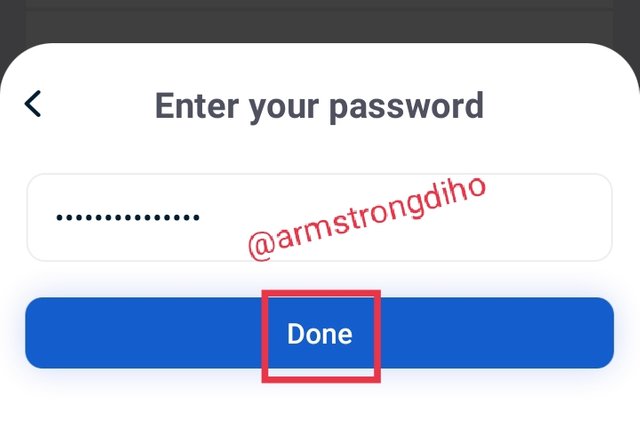

- For the energy requirement of 20TRX, click on “OK”.

- Click on “Confirm”.

- Input password for the transaction to be signed.

- The borrow option is now activated, click on the asset (BTT) to be borrowed. Remember, you have to enable ot before you proceed.

Input the amount you want to borrow or click on the SAFE MAX button for the maximum amount to be inputted automatically. Click on “Borrow”.

20 TRX energy requirement messages will be received, click on “OK”.

Click on “confirm”.

Input password for the transaction to be signed.

- Here, on my borrow option, there was no value instead 0.00 even when I have borrowed 2 BTT.

OBSERVATION

I observed the 2 BTT borrowed was not enough as such didn't reflect on the borrow option. However, on the borrowed option, it reflected. The following image below will clarify us better.

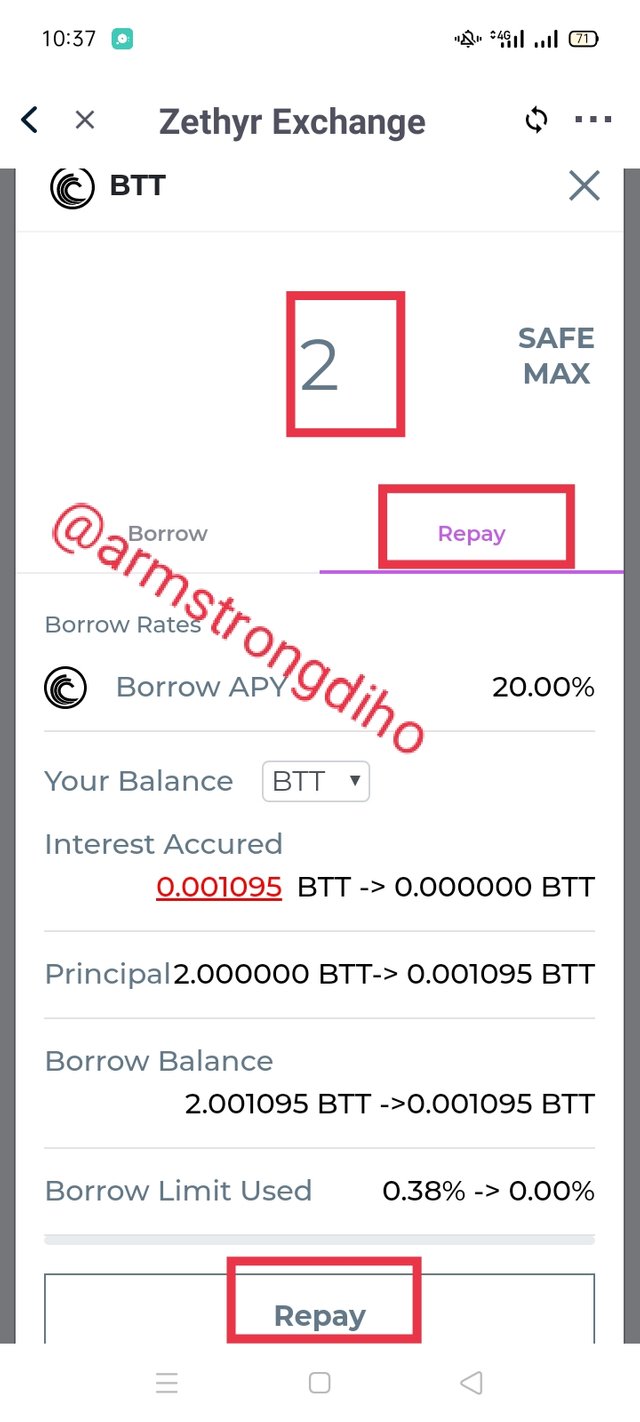

Repaying of the borrowed asset on Zethyr Finance

- From the borrow section switch to the repay option. Input the amount to be repaid or click on SAFE MAX to repay the whole borrowed amount, and then click on repay.

- Click on “OK” to accept the energy requirement of 20TRX.

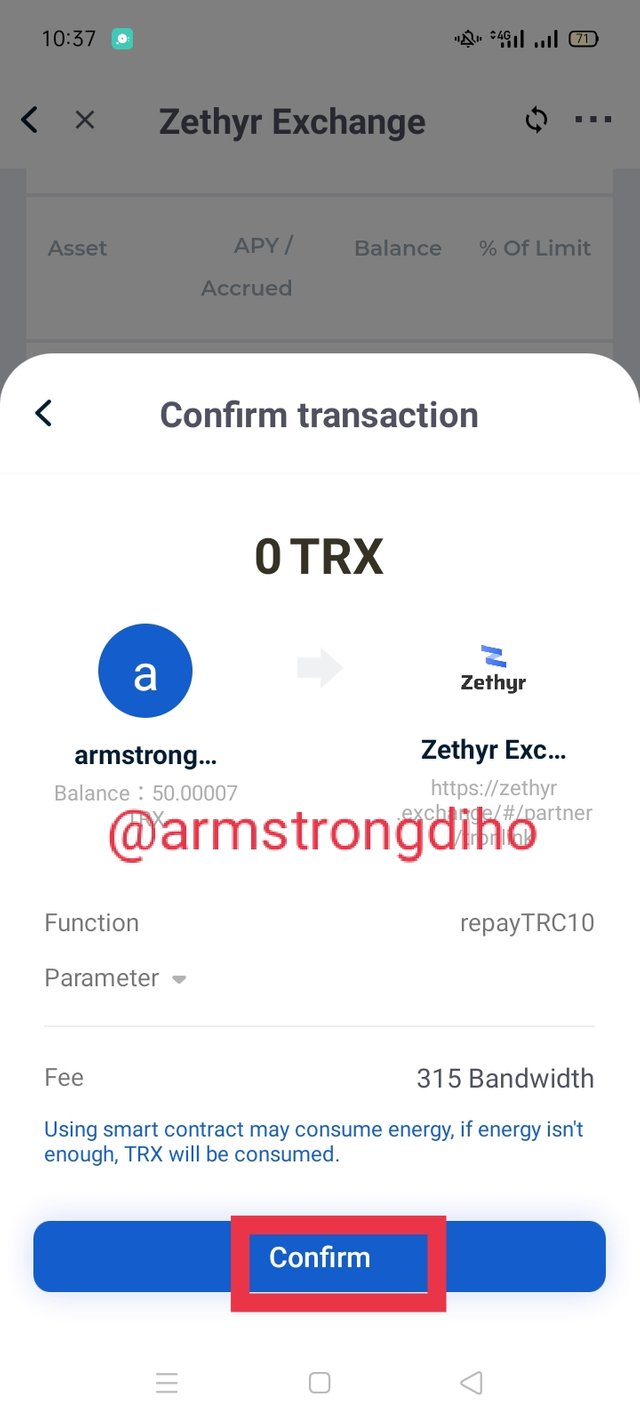

- Click on “Confirm”

- Input password for the transaction to be signed.

- From the image below we can see there is a change

Withdrawing Asset from the Supply Pool on Zethyr Finance

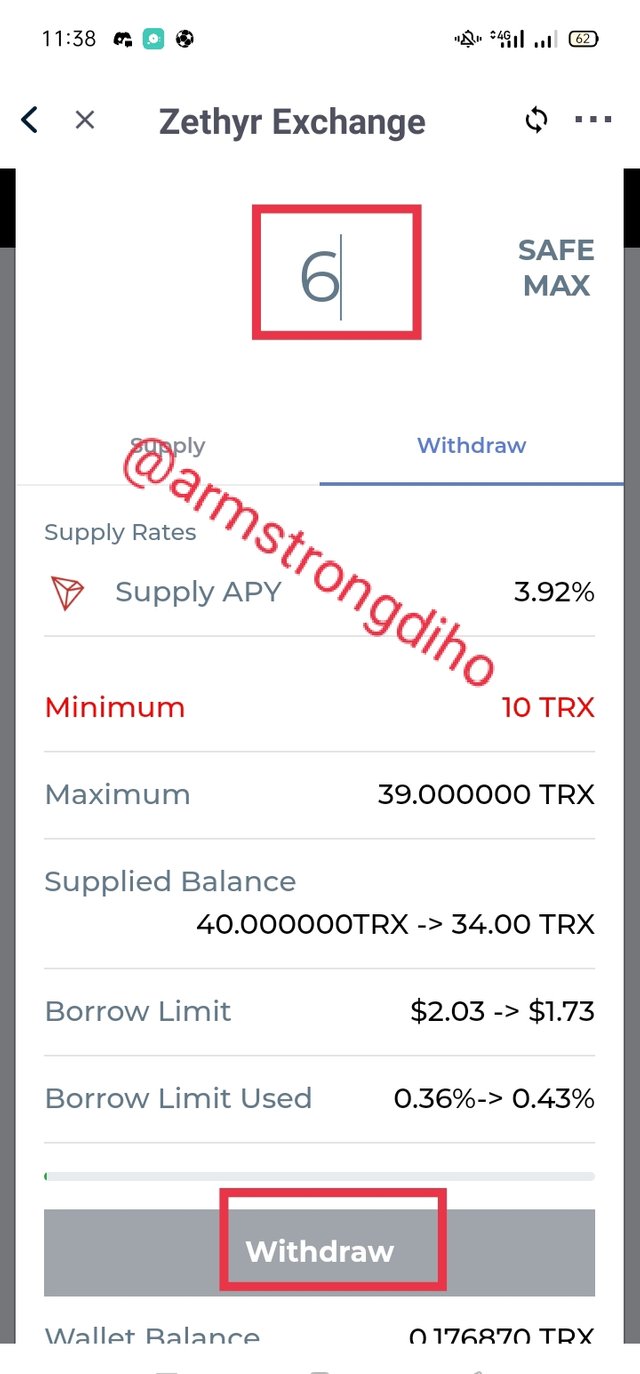

- Enter the supply option and click on the already supplied asset.

- Switch to the withdraw option and input the amount to be withdrawn or click on SAFE MAX to withdraw the whole supplied amount and click on withdraw. After which Click on “Confirm”.

- Input password for the transaction to be signed.

Note: I was unable to withdraw as a result of not having any trx to execute it.

8. What do you think of Zethyr Finance? Is it great or not? State your reasons.

I think Zethyr Finance is a great platform for the following reasons;

the lending and borrowing features of the platform allows users to participate in supply wherein they are rewarded in zTokens. The borrowing feature also allows users to borrow assets and participate in other smart contracts on the platform. The lending feature help users to lend and earn more on the platform.

The Zethyr Finance also allow users to swap/exchange different assets on the platform as well as swapping stable coins. Interestingly the swapping process on Zethyr Finance doesn't require a high transaction fee as it is a DEX aggregator.

CONCLUSION

The Zethyr Finance is a Decentralized Exchange that help users in trading, most especially swapping tokens without stress but consume more trx as energy . Indeed, it is a good partnership between the Tron blockchain and the Zethyr team as such worth focusing on.

#club5050 😀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit