Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community' Contest (ENG/ESP) Steemit Crypto Academy Contest / S16W1: Cross-Asset Correlation Analysis || Análisis de correlación entre activos So, without any further delay, let's dive right in!

Explain the concept of cross-asset correlation and its significance in portfolio management. |

|---|

Cross-Asset Correlation Analysis means looking at how different types of investments, like cryptocurrencies and others regular stuff like stocks or gold, move together. It helps us to see if they go up and down at the same time or not.

This is super vary important for managing your money smartly. By checking these building of connections, you can figure out if one type of investment goes down, another might go up. This helps us lower risks and find better ways to grow your money.

Basically, it is like seeing if your eggs and bacon always get cooked together. If they do, you can plan your breakfast better. Similarly, if a cryptocurrencies and stocks often move together, you can plan your investments smarter to avoid big losses.

Comprehending the correlation between several cryptocurrencies facilitates the diversification of investment risks. As a result, you won't lose all of your money at once if one coin crashes.

It is comparable to having various ice cream tastes. You'll be upset if all you enjoy is chocolate and it's sold out. However, you will still appreciate your dessert if it has strawberry, vanilla, and chocolate.

You can think of yourself as a chef using different ingredients if you have a variety of cryptocurrencies that move at different times. You still have the others to make a nice dish if one doesn't taste good. You'll be able to better manage market fluctuations in this way.

Explore how cross-asset correlations change during bullish and bearish market conditions. |

|---|

Cross-asset correlations may rise when everything is rising in a bull market. This indicates that several investment classes, such as equities and cryptocurrencies, have a tendency to move in tandem with one another.

Conversely, correlations may fall while prices are falling in a down market. This occurs because investors frequently shift from riskier choices, such as cryptocurrency, to safer ones, such as bonds or cash, which causes them to move differently.

In other words, a bull market is when everyone is dancing to the same song, while a bear market is when everyone is more likely to be making their own moves. Investors can modify their strategy by having a better understanding of these changes.

Depending on whether the market sentiment is optimistic or negative, traders can utilize this information to modify their portfolio plans. Investors may concentrate on diversification their portfolio by spreading out risks by buying in a range of assets during a positive market, when correlations are high.

In contrast, traders may want to think about lowering their exposure to risky assets like cryptocurrencies and shifting a larger portion of their funds to safer options like bonds or cash during a down market, as correlations drop.

Trades can more effectively manage risks and possibly take advantage of opportunities brought about by shifting market conditions by modifying their portfolio strategies in response to cross-asset correlations and the mood of the general market.

Explain how understanding cross-asset correlations can be utilized for effective risk management and portfolio diversification. Provide examples of how allocating assets with low or negative correlations can help mitigate overall portfolio risk. |

|---|

Comprehending the interplay between several investments can mitigate risks and facilitate more astute financial decision-making. You can diversify your investments by looking into these relationships. You don't lose all of your money at once if one item fails; others might not.

It is comparable like having a variety of toys to play with. There are still others to enjoy in case one breaks. Likewise, by owning a variety of investments that fluctuate in value, you can better withstand market fluctuations and safeguard your capital.

Allocating assets with low or negative correlations helps investors lower portfolio risk. For instance, investing in both gold and equities can help offset losses if they have low correlations. Gold may increase in value as stocks decline, lessening the total effect.

Similarly, adding both bonds and cryptocurrencies to a portfolio can help us to mitigate the risks associated with each other if they have negative correlations. Cryptocurrencies may also do well during bad bond markets, acting as a hedge against losses.

Through diversification with differently moving assets, investors can reduce the overall risk in their portfolio and guarantee more steady returns even in the face of volatile markets.

Explore the historical correlation patterns between STEEM and other major cryptocurrencies, such as Bitcoin and Ethereum. How have these correlations evolved over time, and what insights can traders draw from STEEM's behavior in relation to the broader market? |

|---|

In the past, there have been a mixed results regarding STEEM's link with well-known cryptocurrencies like Ethereum and so Bitcoin. STEEM's price fluctuations have occasionally shown a strong link with those of Ethereum & Bitcoin.

But there have also been times when STEEM moved on its own or showed little connection to the Ethereum and Bitcoin.

For example,If STEEM's price may increase in tandem with Bitcoin and Ethereum during bull markets or times of widespread market of optimism, indicating a strong positive association.

On the other hand, STEEM's price may deviate from Bitcoin & Ethereum during weak markets or periods of increased uncertainty, exhibiting little to no correlation.

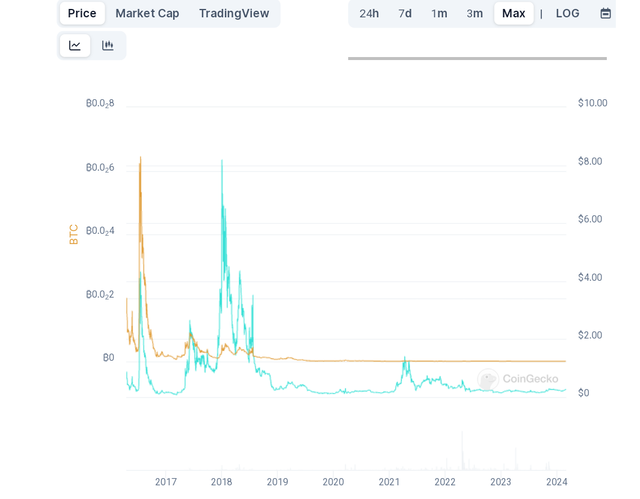

Coingecko.com Coingecko.com |

|---|

STEEM and Bitcoin showed a variable pattern of association between 2016 and 2024. Their prices occasionally moved in unison, suggesting a favorable link. For example, during the cryptocurrency bull run in late 2017, there were notable price increases for both Bitcoin and STEEM.

Their prices did, however, occasionally vary, indicating a weaker link. For example, STEEM's price was steady in the early months of 2018, whereas Bitcoin's price surged. Overall, as individual projects progressed and different market circumstances changed over time, their correlation changed.

Coingecko.com Coingecko.com |

|---|

The price correlation patterns of Ethereum and STEEM varied between 2016 and 2024. At first, there was some similarity between the two cryptocurrencies, with a fairly comparable direction of movement in their prices. But their association changed as the market changed.

For instance, there was a positive link shown by the times when the price fluctuations of STEEM and Ethereum paralleled each other. This may happen if encouraging events or market patterns had a comparable impact on both coins.

Their prices did, however, occasionally vary, indicating a weaker link. This variation may result from certain elements that affect each cryptocurrency differently, like community dynamics, platform updates, or regulatory developments.

With Best Regards

@artist1111

Goodbye, friends. It's been a pleasure getting to know you all participating in this community. I will miss interacting with all of you, but it is time for me to move on. Take care & I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

In my experience, during bullish markets, I've noticed that various investments tend to move together. This makes sense because positive market sentiments often influence different assets simultaneously.

I think having a good grasp of market changes is crucial for investors. In my opinion, adapting strategies based on shifts in cross-asset correlations allows traders to be more flexible and responsive to evolving market conditions.

From my observation, understanding how different investments interact is key to smart financial decisions. By diversifying and considering these interplays, investors can create a more stable portfolio, reducing the impact of potential risks.

Good luck .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Understanding cross-asset correlations in bull markets aids flexible strategies and smarter financial decisions. Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@artist1111 Your detailed explanation of cross asset correlation is both insightful and accessible . I appreciate the simple analogies used making complex concepts easy to grasp. Your examples of diversification and market sentiment are spot on. The historical correlation patterns analysis adds depth to your insights. Wishing you the best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your thoughtful feedback! I'm delighted that you found the explanation insightful and the analogies helpful. Best wishes to you too!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I 100% agree with you as an investor for more than 20 years when you say

I have been watching that big players keep on shifting their money from stocks to gold as the case be and the same is the case with cryptocurrencies. So when you see stock markets going down then you will see the gold and cryptocurrency marketing going up.

A nice study of the topic!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Indeed, diversifying into assets like gold and cryptocurrencies during stock market declines can mitigate portfolio risk effectively.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Well my dear friend how are you and you have done amazing job you just simplyfy the language and using the keyword which is I think easy for everyone to understand and one you talk about the question last and this was the most difficult question to answer about the historical background of the plate form and I think you have done amazing job while using screenshots is more enhancing the job.

Best of luck for your participation

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your kind words! Simplifying language and using keywords aids understanding. Screenshots enhance comprehension. Best wishes for your participation!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your welcome 😊😊😊 stay blessed best of luck you too

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your post has been successfully curated by @𝐢𝐫𝐚𝐰𝐚𝐧𝐝𝐞𝐝𝐲 at 35%.

Thanks for setting your post to 25% for @null.

We invite you to continue publishing quality content. In this way, you could have the option of being selected in the weekly Top of our curation team.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

AsslamuAlikum dear @artist1111 I'm very happy to reading your bloq here in this Engagement Challange. Your post Is very amazing and it's showing that you have great knowledge about Cross assets corelatIon.

Your example of two egg In breakfast is very helpful for understanding your bloq. Even seriously your every example ice cream and also dancing on the same song is adding extra tuch and also make your bloq easy to understand.

Thanks alot for sharing such a nice Information and article with us Best wishes for your success in This Future

congratulations in Advance.

Best Regards [ @danish578]

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wa alaikum assalam! Thank you for your kind words and appreciation. I'm glad you found the blog helpful. Best wishes to you too!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yoru most welcome my dear brother and Also thanks to you for best wishes

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greeting your explanation of cross-asset correlation is clear and relatable using examples like eggs and bacon or various ice cream flavors makes the concept easily understandable. Your insights into how understanding correlations among different cryptocurrencies contributes to effective diversification strategies are spot-on. Comparing it to being a chef using different ingredients adds a practical touch. The exploration of how cross-asset correlations change during bullish and bearish market conditions your analogy of everyone dancing to the same song in a bull market is vivid.best wishes in the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Clear explanations with relatable examples make understanding easy. Insightful analogies enhance learning. Best wishes in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have explained cross-Asset Correlation Analysis means looking at how different types of investments, like cryptocurrencies and others regular stuff like stocks or gold, move together. This is a very short, but a very valid definition of Cross-Assest Correlation. It shows us the comparison of their prices whether move same direction or opposite.

The greatest advantage of correlation between assets is, if we understand the correlation between several cryptocurrencies, it facilitates the diversification of investment risks. In simple words it decreases the risk of losing all your capital in one asset. These graphs you have shown here beautifully explaining the comparison of steem with other coins.

Wish you good luck in the contest friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Understanding how different investments move together aids diversification, reducing the risk of capital loss. Good luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have explained very well that positive correlations are when both currency are moving in same direction and negative correlations are when it is opposite then first one situation and both currencies would move in direction opposite to each other so I agree that investors can set their strategies according to the situation for prevention of their losses if there is any risk of loss but not prevention of their losses are guarrenteed for every time that's why they should be careful before any decision making I wish you success...

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Often times i hear traders say, Eth is doing fine but Btc is not, and this has made me come to understand the idea of diversification strategy when take our move towards investment. There is a kinda correlation between this asset but just as you said that doesn't mean they can't move differently. Proper analysis is needed before investment is carried out. I wish you the best.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Wow dear friend your article is so awesome and the quote at the end is inspiring and motivating, I must say I appreciate such quality post and such unique ideas friend.

Please also engage on my entry using the link below 👇

https://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It always interesting learning new things each day.

You've use the right key words and perfect terms in explaining to understanding of all.

The strategy for the week is one among other paramount techniques use by many traders and investors.

Giving us the necessary information of different variables assets and how there assemble in the market really made it a great importance to avoid losses in risk management and so making great profit.

Thanks for giving us these knowledge.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit