Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community' Contest (ENG/ESP) Steemit Crypto Academy Contest / S15W3 : Bitcoin ETF! What impacts? So, without any further delay, let's dive right in!

What is a Bitcoin ETF, and how does it differ from owning bitcoins directly? |

|---|

A Bitcoin ETF, in the world of cryptocurrency, is akin to a link between fiat money and digital currencies. It's similar to a unique investment tool that makes it simple for average people to invest in Bitcoin without having to deal with all the intricate technical details. Our perspective on investment is being altered by this combination of new and old money!

Picture this ; Exchange-Traded Funds, or ETFs, are a cool upgrade to the usual markets, which are undergoing a major makeover. The focus of cryptocurrency right now is on Bitcoin ETFs. They facilitate everyone's entry into the Bitcoin realm by acting as a controlled entry point.

This blending of traditional banking with digital currency is creating a stir and raising concerns about how it will affect markets, what it means for average people, and how it will affect their perception of cryptocurrencies.

Assume you'd like a piece of the Bitcoin action. Direct Bitcoin ownership is similar to having your own portion kept in a digital wallet. While it's personal, tech savvy is required.

Consider a Bitcoin ETF as a quick fix at this point. It is similar to purchasing a share that symbolizes Bitcoin; you do not deal with wallets. It's easier, but all you'll have in your pocket is a fraction of what Bitcoin does!

Having your own digital currency in a wallet is the result of directly obtaining Bitcoin. It resembles owning a portion of the Bitcoin market. However, handling it calls for some computer knowledge. Consider a Bitcoin ETF as a faster entry point now. It's like purchasing a stake representing Bitcoin rather than juggling wallets.

How can the approval of a Bitcoin ETF by the commissioner of the American Stock Exchange SEC influence the cryptocurrency market? |

|---|

Imagine the big boss of the American Stock Exchange ASE , called the SEC, gives a thumbs-up to a Bitcoin ETF. This can stir up the crypto world! First off, more people might jump up into Bitcoin because it's now kinda like officially approved. Picture it like the cool kids inviting a new friend to their party😃 – Bitcoin becomes more popular.

Now, this stepping can make the crypto market a bit wild. More folks buying Bitcoin means its price might go up. It is like when everyone wants the same toy – the price shoots up. But, remember, it is not a guarantee like its proved; sometimes, the market can be a bit unpredictable, like a rollercoaster ride.

The ripple effect may also affect other cryptocurrencies. An SEC approval of Bitcoin is akin to an endorsement of the entire cryptocurrency community. Thus, additional attention may be paid to digital currencies like Ethereum and STEEM aside Bitcoin.

|  |

|---|

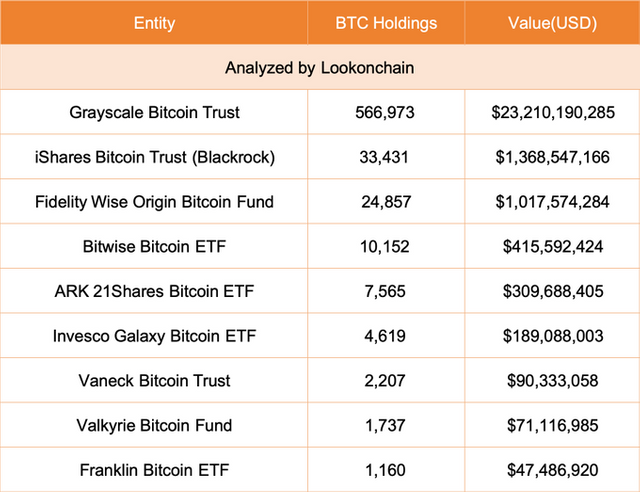

Things became a little rocky after Bitcoin ETFs were recently approved. A major factor contributing to this is the large number of withdrawals from the large ETF, Grayscale Bitcoin Investment Trust. It turns out that some people may decide to stop using the service or perhaps quit the market if more people get access to Bitcoin through the ETF.

The thrill of approval was short-lived, as Bitcoin's value fell by almost 15%. It's similar to when there are too many people at a party and not everyone gets along.

Now, there's a behind-the-scenes concern. Many ETFs trust Coinbase to keep their Bitcoin safe. However, Coinbase is facing a lawsuit from the US Securities and Exchange Commission (SEC), raising eyebrows about its role.

If Coinbase, the custodian, faces issues like a hacks or collapse, it could create a risky situation for the assets held by these ETFs. The recent fall could be a cautionary tale about the potential risks tied to the safety & security of the crypto assets in the custody of platforms like Coinbase.

How could the approval of a Bitcoin ETF by a financial authority such as the SEC contribute to the legitimacy and institutional recognition of cryptocurrencies? |

|---|

Imagine if a Bitcoin ETF receives approval from the SEC, the US equivalent of the head of finance. This endorsement is akin to a large, formal nod that says, "Hey, Bitcoin is okay!" It's similar to when your parents let you attend a hip party—everyone starts to take it seriously.

Now, this SEC nod is not insignificant in the slightest. It resembles receiving a gold star in the cryptocurrency world. "Sure, Bitcoin ETFs are good," is a statement that lends legitimacy to Bitcoin and the entire cryptocurrency community.

When a respected body such as the SEC gives its approval, the general public and large organizations may be more inclined to join in on the cryptocurrency fun.

Thus, when the SEC approves anything, it's not just about a single ETF; rather, it's like the entire cryptocurrency community is receiving a green light. It could persuade more people—particularly those with severe financial concerns—that cryptocurrencies are more than just a passing fad.

How might the introduction of an SEC-approved Bitcoin ETF interact with the decentralized governance of the STEEM blockchain, and how might these two approaches complement or diverge in investors' perspectives on asset management? digital assets? |

|---|

- SEC-Approved Bitcoin ETF and Decentralized Governance on STEEM Blockchain

The decentralized governance of the STEEM blockchain & the launch of a Bitcoin ETF with SEC approval are two independent processes that may have an impact on one another. With the SEC's permission, Bitcoin gains some official regulatory validation & gains some traction in the general public.

However, the blockchain of STEEM is based on decentralized governance, in which community members make choicely collectively as opposed to through a central authority.

- Complementary or Divergent Perspectives in Asset Management for Digital Assets.

Investors may see these strategies differently. The regulatory security that comes with the SEC's clearance draws in traditional investors looking for credibility. However, people who value independence and democratic decision-making could find the decentralized structure of the STEEM blockchain appealing. It's similar to picking between a more grassroots, community-led adventure and a more regulated one.

Investors could evaluate these possibilities according to how much regulatory stability or a decentralized ecosystem driven by the community they choose.

In conclusion, there are two different methods in the cryptocurrency space: the decentralized governance of the STEEM blockchain and the SEC-approved Bitcoin ETF. Although the ETF aims to gain widespread recognition by receiving regulatory approval, STEEM maintains a decentralized, community-driven approach. Investors must decide between grassroots governance and regulatory security.

As these routes take shape, the cryptocurrency space observes a changing scene where community autonomy and conventional approval coexist, meeting the needs of a range of investor preferences and influencing the direction of digital asset management.

With Best Regards

@artist1111

Goodbye, friends. It's been a pleasure getting to know you all participating in this community. I will miss interacting with all of you, but it is time for me to move on. Take care & I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@artist1111 What an insightful dive into Bitcoin ETFs and their impact on the crypto landscape Your breakdown of the SEC's role potential market influences and the behind the scenes scenarios adds great clarity. It's like a roadmap for both newcomers and experienced crypto enthusiasts. Best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your encouraging words! I'm glad you found the insights valuable. Best of luck in your crypto journey! 🚀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Your in-depth analysis of Bitcoin ETFs and their impact on the crypto landscape is absolutely fascinating. The way you break down the role of the SEC, potential market influences, and the behind-the-scenes scenarios really adds a great deal of clarity to the subject. It's like a roadmap that can guide both newcomers and experienced crypto enthusiasts through the intricacies of this ever-evolving space.

Your insights provide valuable knowledge for those looking to navigate the world of cryptocurrency investments. By shedding light on the SEC's involvement and the potential effects on the market, you're empowering others to make informed decisions. Your ability to explain complex concepts in layman's terms is truly commendable.

I have no doubt that your analysis will continue to benefit and educate countless individuals. Keep up the fantastic work. Best of luck with all your future endeavors in the contest and beyond.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your detailed and encouraging response! I appreciate your thoughtful analysis. Best of luck in your continued exploration of the crypto landscape!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

All always wrote so Wella Nd in depth I must say you have deep analysis and deep understanding that's the main reason your doing this much great well best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your kind words! Deep analysis is crucial in the crypto world. I appreciate your support. Best of luck to you too! 🚀

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

💜💜💜 😊😊😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You are right and the main reason for having the Bitcoin ETF that don't get lost money while directly by the Bitcoin and but the disadvantage of this is as well that there some time price differences and that was the reason of an initially falling Bitcoin price.

Best of luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for recognizing the nuances of Bitcoin ETFs. Price differences can indeed impact market dynamics. Wishing you success in your endeavors!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Assalamu alaikum

Aapane apni words mein bahut acchi Tarah se explain kiya hai ki log zyadatar Bitcoin exchange traded funds ki taraf kyon attract hote Hain aur uske Piche kya reasons Hain To iske alava aapane bhi byan Kiya hai Bitcoin ETF ko is blockchain per apply karna aur in do approaches ki divergence ko bahut acchi Tarah se cover Kiya hai.

May Apko kamyabi ki Dua deta Hun

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you dear.....😍😍😍😍😍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

It was my pleasure 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Ciertamente los ETF de Bitcoin facilitan el acceso a la inversión en BTC de la manera tradicional, saltando el obstáculo tecnológico que se requiere en el blockchain.

Esto sin duda atraerá nuevos inversionistas que no están interesado en comprar BTC directamente sino sus acciones que lo representan como un medio para ganar apostando su inversión al rendimiento del BTC .

También es cierto que fortalecerá a las criptomonedas en general, por cuanto BTC será visto con legitimidad y reconocimiento como un activo real.

Esperemos a ver que pasa con el halving y si se repite la misma reacción del mercado con la reducción.

Gracias por compartir, te deseo mucho éxito.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for your insights on Bitcoin ETFs. They indeed ease traditional access, attracting new investors. Let's see how the market reacts to the halving. Much success to you too!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

¡Saludos amigo, feliz día!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Mujhe aapki baat se bilkul time ke साथ-साथ jyada famous Hota ja raha hai aur iske alava vakai mein aisa mahsus hota hai jaise Bitcoin ATS ka approval bahut hi kareeb hai main aapki koshish per aapko good luck kahati hun

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit