Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Steem, the digital token used on the Steemit platform, is like a hot topic in a neighborhood gossip circle. When people talk about it on social media platforms like Twitter, Reddit, and Steemit itself, they're actually giving hints about how they feel about Steem.

It's like when neighbors chat about a new restaurant in town – if they're excited, more people might try it out, but if they're not impressed, others might stay away.

We may acquire an understanding of the community's sentiment towards Steem by scrutinizing these discussions, which is akin to listening in on those friendly discussions. If everyone is giddy with enthusiasm and optimism, this might be excellent news for Steem's price since more people may want to purchase it. However, if there's a lot of doubt or pessimism around, that may be a sign of problems since people might be selling their Steem, which would down the price.

It's not only about what people say; it's also about how they say it. If the mood is generally optimistic and positive, it can be a sign of increased faith in Steem's future. On the other hand, if there's a lot of frustration or disappointment in the air, it might suggest concerns about Steem's direction.

We must, of course, treat it with caution, just like any other gossip. On social media, not every viewpoint represents the entire community, and occasionally people merely want to stir things up for amusement.

However, by observing these discussions and patterns, we can have a better understanding of Steem's potential market direction, much to how listening to local rumors can provide you with insider information about events taking place in the area.

A popular topic in the local community is Steem, the digital token used on Steemit. Discussing it on Reddit or Twitter feels like being in on the newest thing going on in the community. We are able to learn about everyone's opinions regarding Steem through these discussions.

It is possible that more individuals may want to purchase Steem if they are enthusiastic and upbeat. Negativity, on the other hand, may indicate that users are liquidating their Steem holdings, which would lower the price.

Talk is important, but so is the manner in which it is said. It may indicate that people are optimistic about Steem's future if the tone is positive. However, a high level of annoyance could indicate issues with Steem's

But, we must exercise caution when it comes to gossip—not every online viewpoint represents the entire community. People occasionally just enjoy causing trouble. However, by keeping an eye on these patterns, we may have a clearer understanding of where Steem might wind up in the market—it's like having a firsthand look at local events before the general public.

Comprehending sentiment analysis in addition to technical indicators might increase the efficacy of trade signals related to STEEM. Traders can purchase and sell STEEM with greater knowledge if they combine traditional market analysis tools with insights from social media discussion.

- Sentiment analysis

Sentiment analysis is the process of looking at the feelings and viewpoints that people post on social media sites like Reddit and Twitter. Through monitoring both good and negative attitudes surrounding STEEM, traders are able to determine the general tenor of the community. While negative sentiment may portend future market downturns, positive sentiment may herald bullish trends.

- Technical Indicators

Traders utilize technical indicators as tools to examine price changes and spot market trends. Bollinger Bands, relative strength index (RSI), & moving averages are examples of common indicators. Based on past data and market activity, these indicators offer to the traders insightful information about STEEM's price trends and assist them in forecasting future price moves.

- Integration

Trading signal accuracy can be improved by traders by combining sentiment analysis with technical indicators. For instance, traders may feel more confident purchasing or keeping STEEM if sentiment analysis reveals a resoundingly positive mood towards STEEM on social media and technical indicators also point to bullish tendencies. On the other hand, traders can think about selling or shorting STEEM if sentiment analysis shows negativity and technical indicators support bearish indications.

The digital currency used on Steemit, called Steem, is quite the talk in the community. It's like hearing the newest craze in town when people discuss it on Reddit or Twitter. Through these discussions, we can learn more about everyone's opinions regarding Steem. More individuals may want to purchase Steem if they are enthusiastic and upbeat. However, if there is a lot of negativity, it might indicate that users are selling their Steem, which would lower the price.

Sentiment analysis is the study of feelings and ideas shared on Reddit and Twitter, among other social media sites. Traders are able to determine the general attitude of the community by monitoring both positive and negative opinions toward Steem.

TradingView TradingView |

|---|

The body of the Steem candle on the TradingView chart between 2023 and 2024 showed a bearish trend, suggesting a decline in price. However, as news of the 2024 Bitcoin halving surfaced, this pattern changed to a bullish trend.

As news of the halving circulated, the price pattern of Steem became bullish. In 2023, Steem's price ranged from $2.00 to $2.50, but after the Bitcoin halving, the market became more optimistic, & the price of the cryptocurrency shot up to $3.34 to $4.00, with some significant swings within this range.

This demonstrates how trading decisions can be influenced by sentiment analysis as well as technical indicators, particularly on noteworthy occasions like the Bitcoin halving.

Binance Binance |

|---|

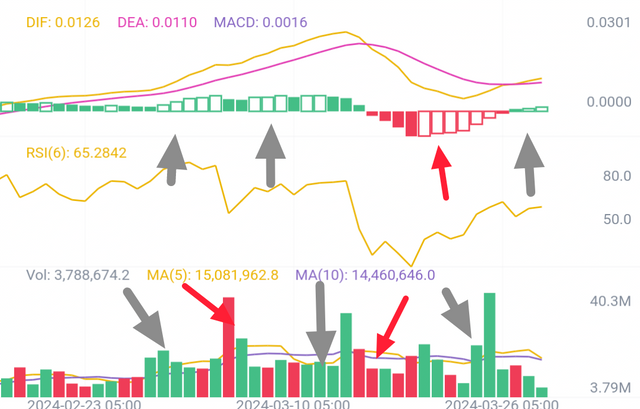

A bullish pattern is visible in the Binance daily chart, indicated by a grey arrow. This pattern aligns with the optimistic feeling over the previously mentioned Bitcoin halving. But there are other situations where selling pressure happened, as seen by the red arrows.

These swings highlight how crucial it is to use technical indicators and sentiment analysis in order to make well-informed trading decisions in the Steem market.

Binance Binance |

|---|

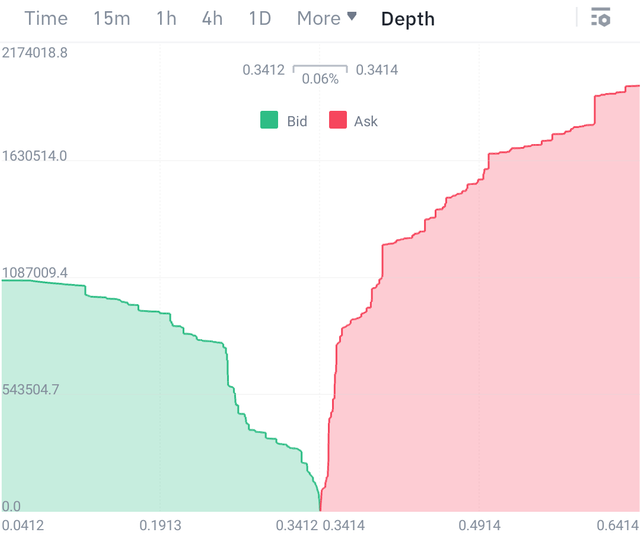

Further analysis of the Binance depth chart for Steem revealed a notable selling bid, indicating strong selling pressure.

This emphasizes how important it is to use both sentiment analysis and technical indications when navigating the Steem market, particularly when activity is high or there is a big event happening, like the halving of Bitcoin.

Making sensible choices in a volatile market such as STEEM requires careful consideration of a few key criteria when doing sentiment analysis. Investors may manage the market with confidence and reduce the dangers brought on by volatility by being aware of these factors.

- Volatility of the Market:

Prices can fluctuate quickly in a turbulent market due to a variety of variables, including news, rumors, and market mood. Investors must understand how volatility affects STEEM's price fluctuations in order to modify their trading tactics. Sentiment analysis can reveal how the market is feeling about STEEM, which can help investors prepare for future price fluctuations and modify their holdings accordingly.

- Time and Accuracy:

In unpredictable crypto markets, timing is very and very crucial, and sentiment analysis can assist investors in determining the best times to enter or exit transactions. Investors can make timely decisions that are in line with market sentiment by precisely assessing sentiment patterns on social media sites like Reddit & Twitter. To validate trade signals, reduce the possibility of false positives or negatives, and verify the quality of sentiment analysis tools, it's crucial to take into account other variables like technical indicators.

Through careful consideration of these variables and skillful application of sentiment research, investors can obtain important insights into market sentiment and make better informed judgments on STEEM.

This can give them more confidence and success as they take advantage of opportunities, reduce risks, and negotiate the unstable STEEM market.

Traders can gain a significant edge in the dynamic STEEM market by consistently monitoring trends and sentiment research on social media. Through monitoring discussions about STEEM on social media sites like Reddit and Twitter, traders may identify trends and make more informed choices.

For instance, if STEEM is receiving a lot of positive press witnesses now a days, it may indicate that more people are interested in purchasing it, which could raise the price. Conversely, negativity or skepticism may indicate that the price is about to decline.

Traders can modify their strategy by closely observing these trends. By purchasing STEEM at a high sentiment juncture and selling it at the highest point, they can profit from bullish tendencies. In a similar vein, they can profit from price drops by shorting or selling STEEM in anticipation of adverse trends.

All things considered, trading professionals can gain important insights and a tactical advantage in navigating the volatile STEEM market environment by consistently monitoring social media trends and sentiment analysis.

With Best Regards

@artist1111

Goodbye, friends. It's been a pleasure getting to know you all participating in this community. I will miss interacting with all of you, but it is time for me to move on. Take care & I hope to see you all again very soon , Best of Luck .

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

As the sun sets on the day

And the night falls softly in

We close this chapter, dear reader

But the story's not yet done

Tomorrow's pages wait, unwritten

INTRODUCTION

Your post explaining the importance of sentiment analysis on social media around the STEEM token is very thoughtful and impressive. I learned a lot from your graphical analysis.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! I'm glad you found the sentiment analysis and graphical analysis informative.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

On this incredible tool, you can manage the turbulent STEEM market environment by constantly monitoring social media trends and sentiment research. Traders may obtain a considerable advantage in the volatile STEEM market by constantly watching trends and doing sentiment analysis on social media. Traders can see trends and make better decisions by watching STEEM conversations on social media platforms like as Reddit and Twitter. You clearly described everything in a professional manner, supported by appropriate research findings. I much appreciate your work. I wish you tremendous success, buddy.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! Positive sentiment on social media boosts confidence in STEEM, aiding informed decisions. Good luck!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Think of Steem like the talk of the town in a neighborhood gossip circle. When people discuss it on social media, they're actually revealing their thoughts about Steem. It's like when neighbors chat about a new restaurant – if they're excited, more people might try it, but if they're not impressed, others might stay away. By listening to these discussions, we can get a sense of how the community feels about Steem. If there's a lot of enthusiasm and optimism, it could be good news for Steem's price. But if there's doubt or negativity, it might be a sign of problems. Of course, we should take it with a grain of salt, like any gossip. Not every opinion represents the whole community, and sometimes people just want to stir things up for fun. So, it's all about understanding the overall sentiment and being cautious.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! Monitoring social media discussions about Steem offers insights into community sentiment, impacting potential price movements cautiously.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 5

Congratulations! Your post has been upvoted through steemcurator08.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello friend greetings to you, hope you are doing well and good there.

It is possible that more individuals may want to purchase Steem have good updates and news present about it on social media. I agree to you here completely. You further said that Negativity, about a crypto asset may adversely effects it which would result in lowering it's price. I have seen some beautiful indicators you shown to us should be used in combination with fundamentals of the market.

You have given a too good description how to tickle the volatile crypto market. You said that making sensible choices in a volatile market requires careful consideration of a few key criteria. Investors may manage the market with confidence and reduce the dangers brought on by volatility by being aware of these factors. Yes this is very true, I think in volatile market, resk to reward ratio should be managed very carefully.

I wish you very best of luck in this contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! Managing risk-to-reward ratio is crucial in volatile markets. Best of luck in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

Analyzing sentiment on social media helps us understand how people feel about STEEM. Positive sentiment attracts investors and can give us confidence in the project. By tracking sentiment trends, we can make better decisions about buying, selling, and holding STEEM. Social media platforms like Reddit and Twitter are great for analyzing trends and understanding consumer behavior in the STEEM market. It's a valuable tool for businesses and researchers. Good luck in the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

What a fantastic breakdown of how sentiment analysis can impact STEEM trading! Your insights really shed light on the importance of social media chatter in understanding market trends. The graphical analysis was particularly insightful. Wishing you the best of luck in the contest

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! Glad you found the breakdown insightful. Best wishes in the contest!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Oh, okay, okay! This analogy really resonates with me. It's like when I was living in a neighborhood where everyone was buzzing about this new burger joint. The excitement was contagious, and soon enough, I found myself in line to try it out too. But if the buzz had been negative, I might have been more hesitant to give it a shot.

As far as I know, maintaining a positive tone can be a good sign in any situation. It's like when I was organizing a family gathering, and everyone was enthusiastic and upbeat about the plans. It gave me confidence that the event would be a success. Similarly, a positive tone about Steem on social media could signal brighter prospects for its future.

I feel like understanding market volatility is crucial, just like navigating through stormy weather. Once I was sailing, and the wind suddenly picked up, causing the boat to rock violently. It was a reminder of how quickly conditions can change. Similarly, in the crypto market, being aware of volatility helps investors brace themselves for sudden shifts and make informed decisions.

Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your breakdown of how sentiment analysis can impact STEEM trading is insightful and well-articulated. You've provided valuable insights into the importance of social media chatter in understanding market trends, and your graphical analysis adds depth to your explanation. thank you 🤭

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks for reading! Glad you found the insights valuable. Your appreciation means a lot!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your example contrasting Steem conversations to an area chatter circle properly catches the significance of view evaluation on social networks systems like Twitter plus Reddit. By incorporating view evaluation with technological signs, investors get useful understandings right into possible market motions, as highlighted by the visual evaluation showcasing Steem's rate characteristics amid the Bitcoin halving.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Assalamualaikum

How are you brother? I hope that you would be fine and I really enjoyed your writing. I understand your perspective and your topic that whatever you have explained about navigating this token as well as this is very interesting sentence in which you have written that sentiment is just like overview and thoughts about people about any thing so it is just like people talking about new restaurant that is in their area made newly so this is you try your best to explain sentiment in your own words.

I agree with you that if there is a level of excitement and enthusiasm present in people about a particular token or project then it means that people have positive sentiment and if there is a level of hate or distraction investors or people about a particular token or project then it means that they are not closer to particular project on token so it shows that there is a negative sentiment.

Moreover this you have truly explain that how investors decision making process and strategy strange when the truly understand sentiment so it highlights that how much it is important to stay updated about the people thoughts and thinking and specially the sentiment of influencers because they also brings much traffic on their point of view which they have about a particular project or token by attracting their followers.

I wish you much success engagement challenge you wrote very well

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Assalamu Alaikum.

Investors sell any coin by analyzing it. Since sales tend to be higher when the price trend is up, individuals always sell more when the price trend is up. But expect higher levels of investment and higher coins to increase price trends. The more the coins are discussed the more the promotion will be positive or negative. But the positives always emerge. As much positives emerge as negatives emerge, the price trend follows a pattern. If an investor wants to make a sale then the social meter data first comes and analyzes all the previous pending topics. By analyzing this, it can be understood that how well it will do in the market. Besides, they analyze all the comments and discussions of Bihi Bihar people on the platform. The most important thing is that social media will have a positive impact if we share true information. All the best to you. Wishing success in the competition.

Regards @shohel44

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

El análisis del sentimiento tiene gran importancia como factor de influencia en el mercado, por tanto es fundamental conocer a traves de las redes como está el ánimo o la tendencia anticipada del mercado como pistas que nos indican el camino. Obviamente se necesita reconocer con los indicadores técnicos esa tendencia para tomar las decisiones informadas.

Gracias por compartir.

¡Buena suerte y éxito!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit