Hello everyone! I hope you are all doing well and enjoying life with the blessings of Allah Almighty. I am happy to take part in the exciting challenge hosted by SteemitCryptoAcademy community . So, without any further delay, let's dive right in! Shall we ? ........, Okay , Okay😊! .

Question 01: Understanding Volatility Metrics |

|---|

Trading decisions depend heavily on volatility indicators which show traders how prices move within markets. Bollinger Bands ATR and historical volatility tools reveal market activity patterns alongside risk metrics.

Bollinger Bands reveal how much price fluctuation exists during active periods versus quiet periods. The market experiences fast movements during band expansion while all activity shifts into low gear when the bands shrink. The market's price changes show up as its primary signals.

ATR tracks price change consistently throughout a selected measurement period. This tool indicates price movement swings helping traders set risk areas and develop smart trading strategies.

Market volatility determinations in the past inform traders about pricing behavior. This math tool tracks market price changes over time to forecast its next level of activity like reading a past market diary.

The indicators reveal market information and assist traders through turbulent times. They help traders make decisions by showing when to buy and sell instead of letting panic control their actions.

Stock traders benefit from these tools the same way they benefit from using a navigation tool. Traders use these frameworks the same way the U.S. Constitution guides national operations to success in the dynamic market system.

Traders can spot market opportunities better with well-planned methods when they use these tools together. They guide your trading decisions by keeping you on track with your financial objectives.

Volatility indicators should not be relied upon to make money but they help traders limit their exposure while gaining an edge. After all, being informed is half the battle in trading

Price volatility is determined using Bollinger Bands. They consist of three bands: the bands in the upper, middle, and lower. Actions gained from these bands can be taken accordingly by these bands that adjusts to the price movements.

The top band is resistance, and the bottom band is support. Prices may reverse down when they hit the upper band and a bounce higher when they hit the lower band. In a way, it’s like a guide pointing to potential turning points.

|

|---|

First, you have to search for Bollinger Bands on TradingView. View the chart for the operation of the bands against time adding the indicator as well to the Steem/USDT one.

|

|---|

One of its implementations is if the price moves outside the bands, this means high volatility. It means that the trend could break out or maybe it's a chance to take profits.

|

|---|

If it stays above the upper band of the rally on Steem/USDT, it may be bullish momentum. The same is true of prices toying with the lower band in a downswing illustrating bearishness or oversold status.

Traders find this clearer by analyzing Bollinger Bands. This simple tool turns complex data into easy to read signals so it is invaluable to better trading decisions.

Question 2: Designing a Range-Bound Strategy |

|---|

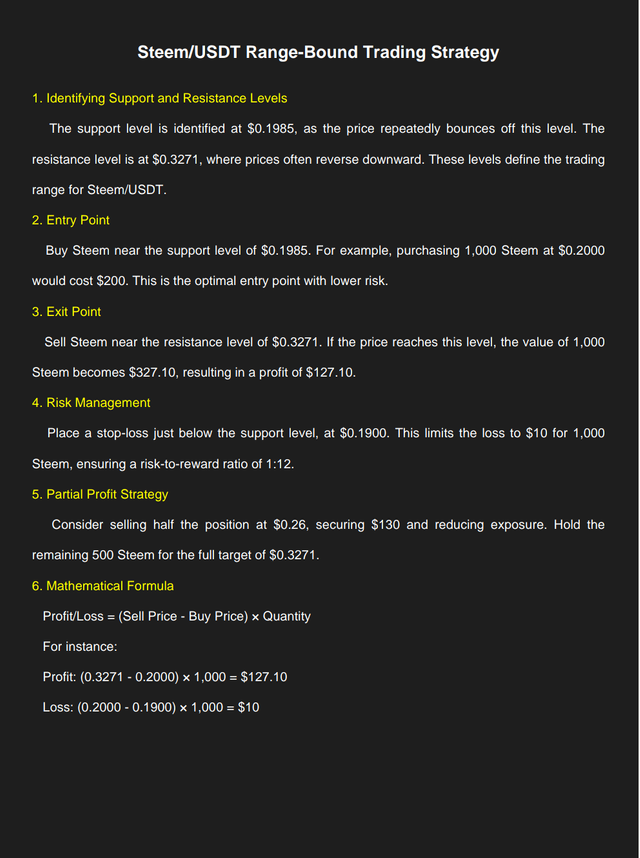

For more practical overlook of chart , If i open daily chart, we see that the Steem/USDT price moves between $0.1985 to $0.3271, which creates a clear range for the Steem/USDT to trade. With this, it will enable traders to run a strategy of buying low and selling high within this range.

Support and Resistance level Support and Resistance level |

|---|

It is best to enter the trade here near the $0.1985 support level. In cases where the price of the security getting closer to here, it’s more likely to bounce back up. For instance, if you purchased 1,000 Steem at the price of $0.2000, this will be investment of $200. By setting a stop loss at $0.1900 you can have a maximum loss of $10, at the very worst, in the event you are wrong.

|

|---|

By exiting near the $0.3271 resistance level, you ensure you’re making profits. So, if the price hits this level, your 1,000 Steem should be worth $327.10 and will create a profit from this $127.10. This provides a risk-to-reward ratio of approximately 1:12, making the trade highly favorable.

You can still select partial profit if the price moves halfway to approximately $0.26. Reducing risk by selling 500 Steem for $0.26 gets you $130, and holding the rest 500 Steem until your target of $0.3271.

By setting your stop near support at $0.1900, you’re reducing risk. A simple formula to calculate your potential profit or loss is:

Profit/Loss = Sell Price - Buy Price × Quantity

For instance, selling at $0.3271 and buying at $0.2000 gives:

$$127.10 = (0.3271 - 0.2000) \times 1,000 = (0.1271 × 1,000) = $127.10 profit.

However, if the stop-loss is hit at $0.1900, the loss would be:

$$10 loss = (0.2000 - 0.1900) \times 1,000$$

|

|---|

The most important thing is to stay discipline, focus on the range, and use these price levels if possible consistently and they will more than offset any losses over many trades.

In range bound trading, support and resistance levels are the corner stones which define the movement of the price. In the case of Steem/USDT, the price floor is at $0.1985 as buying interest is strong, and the price ceiling at $0.3271 as selling pressure.

When price consolidates or shows bullish patterns here in the price action, entry points are observed, it is determined where the price interacts with the support level. A profit that does not exit near resistance can become a loser if there is a chance of a reversal.

The fourth strategy ensures losses are reduced when the price goes below support (break) with stop loss orders at $0.1900. Furthermore, partial profit taking of mid range levels (say $0.26) reduces exposure and profits off small price movement.

Question 3: Capturing Breakouts with Volatility |

|---|

We can see the trend line in the Steem/USDT pair at $0.21. This leaves us with two possibilities.

Electing to let Steem/USDT drop to break through $0.21 and enter into a lower range at the spot price band of $0.15 USD to $0.21 USD will be the first option, forming a whole new support and resistance zone under that price range.

New support and Resistance will be formed New support and Resistance will be formed |

|---|

A potential bounce back from $0.21 to levels such as $0.26, $0.27, $0.32, and potentially even $0.36 is the second case for Steem/USDT. This pattern of the scenario seems to be having an upward momentum and; therefore, a strategy has to pull off with the price levels effectively and effectively be taking risks.

|

|---|

The first thing I check is to confirm the bounce using Bollinger Bands. The price is currently near the lower band, about $0.21, which is suggesting oversold reading and a reversal. If the price begins to rise up to the middle band (nearing $0.26), it’s a sign of bullish momentum building. This would be my buying point on Steem.

|

|---|

Since the price is getting near $0.27 (close to the middle band) I will look if there is further strength. At that point, if the price of Bitcoin crosses the middle band and heads for the upper band toward $0.32, this becomes my first exit point. The next resistance level could be set near $0.36, and a secondary exit could be projected very close to here.

I’ll put a stop-loss a little below $0.20 to help manage the risk if it mysteriously changes direction: allowing for huge losses. That ensures I have downside bounded but upside possible.

|

|---|

The risk-reward ratio will be calculated. Let's take a simple example of purchasing $0.21 with a target of $0.32, where $0.11 is the reward per unit (from buying $0.21) and we only risk $0.01 below $0.20.

Working with Bollinger Bands and being observant of support and resistance levels allow me to catch upward momentum consistently even in the midst of unpredictable moves. They have a disciplined plan of trading at Steem/USDT.

Question 4: Adapting to Volatility Spikes |

|---|

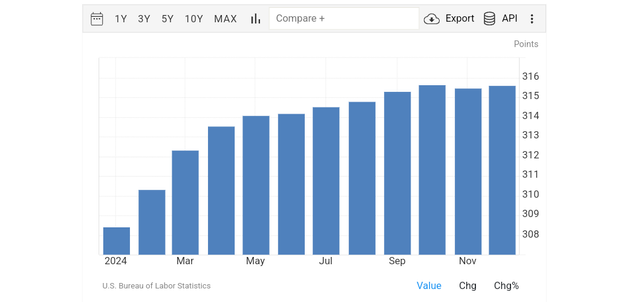

To answer this question, we’ll use an example from the world of crypto. Have you ever heard about CPI data? US CPI is a big factor for the crypto market and it stands for the Consumer Price Index of the US. CPI data plays a big role in volatility in the crypto world because US is one of the big players.

CPI Graph CPI Graph |

|---|

Just one announcement from Mr. Jerome Powell, the announcer of the CPI data can hurt the crypto market. Good news for Bitcoin is when CPI data increases, whereas a decrease is bad news. The result of this responds strongly to the crypto market making it extremely volatile.

Canvas Edit Canvas Edit |

|---|

On to the second side, let’s think about how traders should shape their strategies in the event of extreme volatility, perhaps following a major news event or macroeconomic shift?

Staying Calm During Volatility

In this case, when the market goes volatile, the first thing traders need to do is remain calm. Emotional trading is easy to get into, and it can bankrupt you for making mistakes like panic selling or buying at the wrong time. Instead stick to your trading plan and deal with risk management. Maintain a certain level of sanity, keep your head, don’t panic. Remember, the bounce back of the market is guaranteed, and patience is the key.

Volatility Indicators

Step 2 : It is to use volatility indicators such as Bollingers Bands or even ATR (Average True Range). These tools are your market compass: they help you figure out whether the market is still on a wild swing, or is beginning to settle down. An example of this kind of data include the Bollinger Bands showing when prices become too stretched, or heads up for reversals or breakouts.

Risk Management with Smaller Leverage

Last but not least, when a market becomes volatile, avoid using high leverage. While leverage can help you ‘power through’ volatility, it also makes your gains and losses that much bigger. Instead, choose to approach trading more cautiously and trading with smaller position sizes. It will protect you from big losses by managing risk well with a market going through rapid price changes.

Maintaining your calm, using the correct tools, and playing with your leverage judiciously will allow you to surf through volatility without making the enormous error.

Provide practical tips for maintaining composure and adjusting tactics.

1. Stick to Your Plan

When volatility strikes, it’s tempting to act impulsively. . Remember, your anchor is your trading plan, so stay disciplined. Define ahead of time, clear entry and exit points. Refocus when emotions begin to take over.

2. Use Stop-Loss Orders

It is recommended to try to place stop loss orders in order not to lose too much during the market turbulences. These are the safety nets to make sure that you don’t lose more than you’re willing to risk. It can be extremely useful even in the highly volatile markets to automate yourself and to stick to your risk management strategy.

3. Realize that the Market will dictate.

Depending on the market news that anyone is responding to, you should adjust your tactics. Reduce your position size**, or cut your trades down until the volatility gets back to normal. Instead, it’s best to take fewer trades with smaller risk versus ones that are trying to follow every price swing.

4. Use Volatility Indicators

You should keep an eye for volatility indicators such as Bollinger Bands, ATR or Implied Volatility. And these can help you get a sense of what’s happening in the market, and what could be a breakout, or a retrenchment. These tools help you to make more educated decisions by gauging price fluctuations.

5. Avoid Emotional Trading

With market movement at such extremes, do not let emotions be your reason for moving. Your fear of missing out (FOMO) or panic of seeing losses can eat away at your judgment. Breathe, step back and remember…it is cycle in every market. Stick to your strategy, don’t let the market push you away.

Question 5: Evaluating Volatility’s Impact on Trading Psychology |

|---|

As we understand, market volatility has a tremendous effect on trader psychology, frequently provoking fear, greed, and overconfidence. Whenever prices swing wildly, it's natural to be anxious or overconfident.

I believe fear can distort thinking. Traders might panic sell because they're afraid the market will keep falling. This is a risky response, as it tends to lose out on possible recoveries.

Yes, conversely, greed is able to drive traders to make reckless choices. The anticipation of riding the next big price wave always inspires overleveraging or neglecting risk management, which readily turns into losses.

Do you know why? Overconfidence is another trap. Having made a series of successful trades, it's simple to think you're unstoppable. This can cause reckless risk-taking, particularly in volatile times when the market can change rapidly.

What I mean is, during high volatility, it’s crucial to maintain emotional discipline. Step away from the screen when you feel your emotions taking over. Sometimes, taking a moment to clear your head is the best strategy.

As much as maintaining a balanced state of mind, employing stop-loss orders and sticking to your trading plan are critical. This keeps emotional responses at bay during swings.

I believe that journaling your trades and feelings can help you identify patterns in your emotions. By reflecting on your decisions, you can avoid repeating the same mistakes in future high-volatility scenarios.

Let me illustrate, by concentrating on long-term objectives and adhering to risk control, you can prevent being influenced by transient market fluctuations. This will ensure that you have a more sensible mindset to trading.

kind Regards

@artist1111

Adieu, folks!

May the winds of fortune

carry you to greatness!

May the winds of fortune

carry you to greatness!

my friend where is invitation 🙋♂️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Not a needed requirement .

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We can participate if we are invited. These are the general rules. Anyway, best of luck my friend. 🙋♂️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

This is excellent, am a newbie in crypto currency trying to survive but I got hook in it. Your post to me is like exactly what I face with steem. Your explanation on fear, greed and overconfident is what I should have known before trading but I didn't. My last trade I makde on steem is still pending with the loss of about $40. Why...... because that day, I made a profits of $4 and tge market was going on up trend direction so I thought of entering a short trade to make extra profits. The worst parts of it is that I didn't use a stop loss. FOMO and greed lead me to overconfident which makes me loss my capital. But I keep on learning. I have a question with a picture below

How many times frame did you use in the picture to get a second support level ?

What about trading without using the trading view?

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit