Hello everyone, I hope you all are doing well. I am here to share my participation for Steemit Learning Challenge Season 22 Week 1. It's always pleasant feeling to share participation in crypto academy and learn something new.

Identifying Emotional Triggers in Trading.

Emotional triggers are the traders' psychological reactions that impact their decision-making ability, often leading to some irrational trading behavior. The most common emotional triggers we know are; fear, greed, and overconfidence. Each of these can manifest during different market conditions, greatly influencing traders' strategies and performance.

1. Fear

Fear arises when the market goes against the trader and he/she perceive potential losses or uncertainty in the market. It often leads to hesitation or panic decision getting exist from the market (selling).

Manifestation:

Market Downturns: When prices fall down, traders may get panic and sell their assets to avoid further losses. They often get exist from the market to avoid further lose, but the market get recover from there.

Missed Opportunities: The market may get reverse from the point, where you exist from the market due to extreme fear.

Example: Few days ago it happened to me. I have bought DOT and at $9.1, but when it went to $7.5 I sold it out in panic. The market got recovered instantly then I have to bought it again at $8.5.

2. Greed

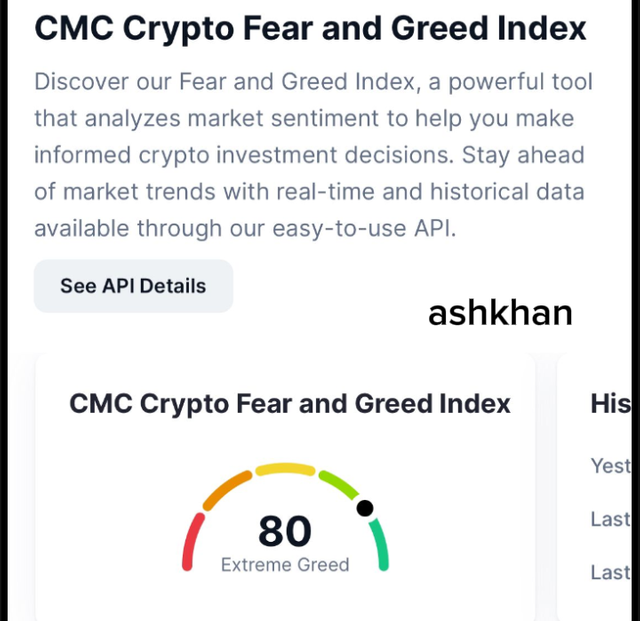

Greed is the another psychological mind set of traders, which pushes them to take excessive risks in pursuit of higher profits. They often ignore the sound of high risk and management principles.

Manifestation:

Chasing Overextended Markets: Traders may continue to buy to get enter into a rally, often forgetting they are the late riders. They believe the trend will never end. Here the prices are overvalued.

Overtrading:Having greed in mind and Driven by it, traders may open multiple positions without proper research from authentic sources. They become greedy to take profit at any cost. In contrast they receive huge loses.

Example

The perfect example is of BTC. No one was ready to buy it when it hit $14k back in 2023, but when it's above $100k now everyone want to buy it. This is actually because of over greed. Now BTC is out of perfect buy zone.

3. Overconfidence

Overconfidence traders go beyond their limitations. They believe their skills, completely ignoring the presence of risk. Such people also receive a shock back from the market, when get trapped.

Manifestation

Ignoring Risk Management: Overconfident traders trade without using stop loss or take profit. They have full confidence on their own, often exposing themselves to catastrophic losses.

Failure to Adapt: A trader have confidence on his strategy hardly stick to it completely ignoring the market changing conditions.

Example Believing in your own strategy and going against the trend, it may results in significant lose.

Managing Emotional Triggers

Developing a Trading Plan: Always do proper research and analysis and then define perfect entry, and exit points and manage risk to reduce impulsive decisions.

Practicing Discipline: Be disciplined and follow the strategy you are too good at. Your comfort zone will help you minimize emotional influence.

Using Tools Must use stop loss and take profit. If you are a spot trader you must know about doing proper DCA.

Reflecting on Mistakes: Do learn from your past mistakes and try not to repeat it again.

Overcoming psychological barriers in trading, such as Fear of Missing Out (FOMO), loss aversion, and overconfidence, is essential for consistent success in trading field. Let's have a thorough discussion about all these.

1. Fear of Missing Out (FOMO).

This is the wrong entry time in the market. FOMO often arises when traders feel compelled to get enter into a trade due to fear of losing out on potential gains, mostly in a trendy market.

Techniques to Overcome FOMO:

Follow a proper plan You must have in your mind, where to get enter into the market and when to get exist. Proper entry should be followed. *** For example, You have seen Steem pumping, decide beforehand that you will enter only after a pullback to a support level rather than chasing the rally.***

Detach Emotionally: Remind yourself that opportunities are endless in trading. In one case missing one trade doesn’t mean losing future chances.

2. Loss Aversion

Loss aversion causes traders to hold the wrong trades for too long. They fear from the realization of loss, or sometimes to exit from the winning trades too early to lock in small profits.

Techniques to Overcome Loss Aversion:

Set Stop-Loss Orders: Do adjust the maximum loss you are willing to accept. For example, You have bought Steem at $0.26 and put stop loss at $0.24 if their is an important level. Same should be the mechanism for taking profit.

Accept loss Accept small, managed losses as the cost of doing business. Take it in a positive way and think optimistically.

Focus on Risk/Reward Ratios: Always manage the potential reward outweighs the risk (e.g., a 1:3 risk/reward ratio).

3. Overconfidence

Overconfidence leads traders to take unnecessary and excessive risks, such as over-leveraging, ignoring market conditions, or trading without proper analysis and research. They only know few things and apply it boldly to every market situation.

Techniques to Overcome Overconfidence.

Review Past Mistakes: Regularly analyze your past trades where overconfidence led you to losses. For example, You have done technical analysis of STEEM and it's telling you to go for long, and their are negative news in the market and the sentiment are negative too. You ignore these things and are confident on your analysis. You may receive lost here.

Follow Market Data: Pay attention to news, volume, and sentiment. Overconfidence often stems from focusing only on technical analysis and not doing research about other fundamental matters.

Set Position Size Rules Try to avoid high leverage even how much you are sure about your trade.

A well-structured trading routine always helps traders stay disciplined, focused, and emotionally balanced. It never leads a trader to have loss. Let's dive into it's completely explanation.

Daily Trading Routine

1. Pre-Market Preparation (Before Trading Hours).

Reviewing Market ( News and events) search and find out key events, earnings reports, or news of the day that could impact the market.

Set Realistic Goals Define your goal for today, the percentage gain you want according to your portfolio or you may set your target in dollars, for example $50 per day.

Analyze Charts and Develop a Watchlist Review key technical levels, find trends, and patterns for potential trades. Identify assets to focus on and you want to trade on for today.

2. During the Trading Session

Follow Your Trading Plan Must stick to your pre-defined plan. Make proper entry, exit, and stop-loss levels to avoid emotional decisions.

Monitor Emotions Always trade with a fresh and easy mind. If you feel stressed or impulsive get pause and don't do any trading.

Limit the Number of Trades Do avoid over trading by setting a maximum number of trades per day. It will mix up your mind.

Find market volatility If market is too much volatile, it's mean high rise is involved there. Try to avoid trading in volatile market.

3. Post-Market Reflection (After Trading Hours).

Journaling

Analyze your own and find out your emotional state. How do you feel watching your trade. Don't let the emotions control you. Let your trade the way it's going.Review Performance: Analyze whether trades aligned with your strategy and let it go. Your exit point (both in profit and lost) should be defined.

Practice Gratitude: Reflect on lessons, try to learn from the mistakes and acknowledge progress, even if trades were unsuccessful.

Weekly Trading Routine

1. Review the Past Week

Evaluate Trading Journal Identify recurring themes, such as your past week common mistakes, emotional triggers, or successful strategies.

Update Trading Plan The best lesson is the one you get from your mistakes. Make adjustments to strategies or risk management based on lessons learned.

Acknowledge improvements try to identify your progress you are making day by day to reinforce positive behaviors.

2. Prepare for the Upcoming Week.

Market Analysis Make your mind for the upcoming week. Review broader market trends, key levels, and news that may impact the week ahead.

Set Weekly GoalsAvoid past week mistakes and focus on process-oriented goals, such as improving discipline or reducing emotional trades.

Engage in Skill Development Spend time studying trading strategies, try to improve as much as you can. Watch webinars, or practice in a demo account for more experience.

I have a perfect example of Bitcoin. Back in 2021 Bitcoin experienced a dramatic surge in price, reaching an all-time high of nearly $65,000 in April. Too many retailers get enter here (FOMO). They think they will miss profit opportunity and want to double their portfolio in days.

Bitcoin's price began to decline in May, and it reached almost $35k in few weeks. It's almost 40% decline (lost). Now imagine a retailer who have entered at $65k must have taken exist at this point point (FEAR). He has lost almost half of his portfolio. You must know that after few weeks Bitcoin regain it's price and it went to $50k. Now what is the out put of this scenario.

- A retailer get entered to BTC at $65k (FOMO).

- Not Selling his assets at $50k,$45k and then $40k (Loss Aversion).

- Selling at $35k (Panic selling).

- Missing a chance to sell it at $50k after BTC renounce (Trading without proper knowledge and research).

How Emotional Discipline Could Have Prevented the Loss?

Following a Trading Plan The retailer should have the reason why he/she is getting entry into Bitcoin, how long he/she should hold it and when to get exist of it.

Risk Management Always invest in crypto the money you afford to lose. It will give you you emotional confidence. Trade according to the best risk Management mechanism to avoid any sufficient lost.

Seeking Education and Guidance First Learn and then Earn. Get hold on technical analysis, also learn how to analyze market fundamentally.

Maintaining Emotional Control The biggest secret of becoming a successful trader is to control your emotions in trading. Don't let your emotions control you, instead you control your emotions.

Building mental resilience for a trader is too much essential for his success in high-stress trading environments, particularly when it comes highly volatile markets. Resilience give energy to a trader to remain focused, make rational decisions, and avoid emotional pitfalls. Here are some of my strategies and techniques to build and maintain mental resilience.

1. Develop a Strong Psychological Foundation

Identify your emotions when your trades are open, both in lost and Profit situation. Examine yourself on the basis of it. Try to overcome your emotions when trading.2. Establish a Robust Trading Plan

Your trading strategy should be too much open and defined. You should have the reason of why getting entry in the market and why getting exist from the market. Their should be a proper Entry point, take profit and stop loss.3. acquiring more Knowledge

Knowledge will always gives you confidence, which will help you overcome your emotions. If are 100% sure about your trade you will be so much confident about it, even if you see lost in first phases.4. Risk Management

Try to learn proper risk management. Always use the amount you can afford to lose. It will also help you become emotionally strong.For example I have 1 million dollars and I go for a trade having $1000 lost chances in it, it will never bother me even if I lose it from my portfolio. But having $1000 in portfolio and going for a trade of $800 lost chances isn't a perfect risk Management. You will be in the hands of your emotions.5.Maintain Physical and Mental Well-being

Be mentally stable and fresh when you are trading. Always try to get focused, close your door and tell the people not to disturb you or bother you. You should have a separate room for trading where you can get perfect decision peacefully.6. Practice Emotional Regulation

Examine your emotions regularly and also Analyze your performance and compare it with past. For example in previous month out of 100 your 70 trades went successful, and now in this month 80 out of 100 went successful, when you compare these two months results it will give you confidence and positive energy.7. Read market nature properly

Try your best to keep yourself away from a volatile market. It's highly risky which can liquidate you in no time.

This was all about my participation. I hope professor like my post and share valuable suggestions. I would like to invite my friends @sahmie, @m-fdo, @pea07 to share their participation and learn something new about crypto world. Best wishes to all participants.