Hello everyone, I hope you're all doing fine, the same goes for me...

In this post, I'll be posting a homework task for crypto professor @wahyunahrul.

Question 1.

To be able to make an opinion, first, you have to know what is IDO, what's it stands for, and what are its merits and demerits.

Initial dex offering is a practice in which a new token or a cryptocurrency is launched on a decentralised platform (here the word decentralised means: The transfer of control and decision making from an organisation to the distributed network. )at an initial price so that it attracts people who wish to invest in it. In short, it is a fundraising event in which money is gathered for the goodwill of the new generated token or crypto asset.

As the crypto asset is new in the market, it may not be listed among other decentralised currencies on the platforms as a result of which the attention of people who are going to invest in the new form token is shallow, but as trade will process, with time the value of these new assets will increase. They'll become well known on decentralised platforms and will be significant cryptocurrencies.

Merits:

- As it is an open fundraise, everything is public, the market trend, asset value and other parameters for all people who've invested in it.

- it supports fast trading methods.

- it has excellent liquidity, which means it can be bought or sold in the market quickly.

Demerits:

- as it is a decentralised type of exchange, there is no control mechanism which means less security.

- as there is no limit to buy tokens, big investors can manipulate the price quickly. Also, there is no validation information present on the investors.

As we've seen, what is IDO and what are its merits and demerits.

MY OPINION

- In my opinion, it is a great practice. It supports the generation of new crypto assets and tokens. Which give people more investment offers and a chance to change the game. In simple words, there are more pros than cons. So, in my opinion, it is a great practice to perform. There are always risks of scams and frauds, but that's more to make the perfect trading systems and blockchains.

Question 2.

CAN IDO HAVE A SIGNIFICANT IMPACT ON THE CRYPTOCURRENCIES WORLD

Yes, IDO has a significant impact on cryptocurrencies, as I've listed in the previous answer. It improved the world of cryptocurrencies by a considerable amount.

It is a fundraising event that offers better liquidity of crypto tokens and assets, faster transactions, fair and open trading. It is a successor model of ICO, STO and IEO. etc.

Anyone willing to invest in the Cryptomarket can take part in the practice.

I have to participate in the pandora moon pool on Paid Ignition, which I'll show later questions.

- FAIR AND OPEN FUNDRAISING

Usually, as the token goes online, private investing organisations buy a significant amount of token for a lower price value and sell it at a very high value that gives them heaps of profits.

But with the help of the IDO system, small organisations and even startups will not need any centralised exchange and permission to knock off the fundraising.

Also, anyone can participate and organise in IDO. IT IS NOT BIASED TOWARDS PRIVATE INVESTORS AND ORGANIZATIONS.

- FAST TRADING AND TRANSACTION

It is an excellent advantage of the IDO that tokens can be traded immediately. With the help of this, an investor can buy tickets quickly when launched and sell them at the same pace when the price goes upwards.

- LIQUIDITY

It simply means the ease of buying and selling the token in the market. With IDO, the new marketed project immediately gets liquefied, which benefits the price of the token.

- LOW LISTING COST

As the token is a new one and doesn't have any significant value in the market. The listing price for its listing in exchange platforms is very low for the tokens which undergone IDO.

Question 3.

EXPLAIN ONE EXAMPLE OF TOKEN THAT HAD IDO BUT FAILED/RUG PULL

Turtledex protocol

Image created using canva

The team behind Turtledex protocol, a Binance Smart Chain (BSC) project, has reportedly rug pulled its investors shortly after raising 9,000 Binance tokens worth $2.5 million. Immediately following the confirmation of the theft, the value of the protocol’s native token TTDX reportedly plunged to near zero. At the time of writing, the social media accounts associated with the protocol appear to have been deleted.

As of reports,turtledex was a decentralised platform for users, said that it could keep data and preserve files without needing to keep them on their computer—this claim used by the turtledex team to raise funds in pre sail rounds.

This is just one case. There are a lot of rugs pulls that have been reported in the crypto exchange market.

following are some more examples:-

Iron Finance and its TITAN token

Compounder finance

people are getting scammed. Over $2.6 billion has been grabbed, according to a New York-based blockchain researcher. That figure doesn’t include a giant Ponzi scheme that just came to light in South Africa. Gob-smacking as all of this might sound, these numbers, in fact, represent a marked decline from 2019, when fraudsters walked away with an estimated $9 billion. info. source

Question 4:

MAKE A DETAILED FUNDAMENTAL ANALYSIS ON TWO TOKENS THAT HAVE DONE IDO, COMPARE THE TWO TOKENS, THEN GIVE YOUR OPINION ON THE RESULTS OF YOUR ANALYSIS.

I'll be using Raven protocol and MAHAdao governance token and make a fundamental analysis on both of them, and after that, I'll express my views based on my analysis.

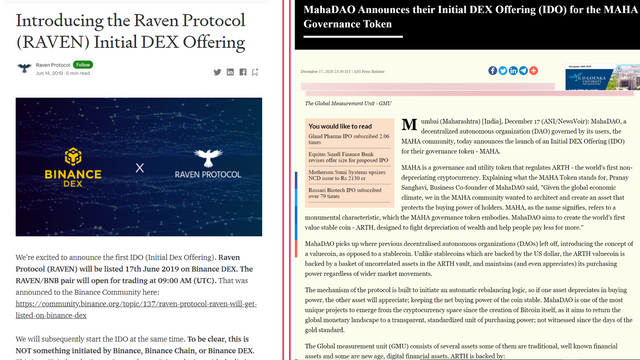

I choose these 2 because they're both undergone IDO at some point. The following images support the line that these are undergone IDO.

Image created using canva

All the theories and data is provided using the website Coinmarketcap.

Raven Protocol (RAVEN) was issued on Binance Chain as a BEP2 asset. It had a price of 1 RAVEN = 0.00005 BNB with an individual cap of 100BNB.- Raven protocol had an IDO and had a hard cap of $500,000.Total Token Supply was 10,000,000,000 RAVEN.and the total tokens allocated to the IDO were 300,000,000 RAVEN (3% of Total Token Supply). The Initial Dex Offering was $500K for 300,000,000 RAVEN, i.e. ( 3% of Total Token Supply). Total Tokens Sold (in all rounds + IDO) were 4,000,000,000 RAVEN (40% of Total Token Supply).

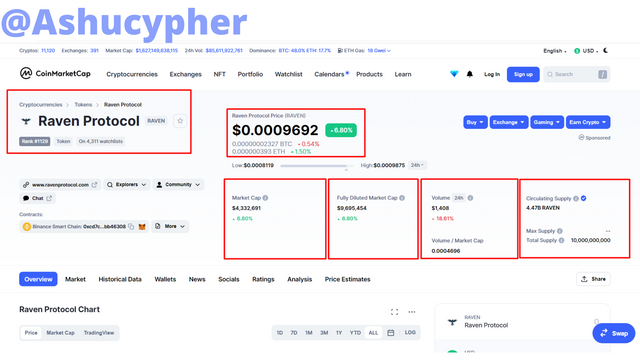

According to Coinmarketcap ,raven protocol ranked #1129,current market price is $0.0009692 with a last 24-hour trading volume of $1,408 showing downfall trend by -18.61%.The max supply of Raven protocol is 10,000,000,000 RAVEN, and the current circulating supply is 4.47B RAVEN.

The IDO price is set at 0.6$, which gives the $MAHA token a fully diluted valuation of 6 million USD with a seed sale amount Raised to $125k at a seed sale price of 0.25$ per token and a fully diluted market cap of $2.5M. The initial circulating supply on TGE is $20.83k.

- The MahaDAO project was to successfully see a lifetime longer than most crypto projects out there. The token distribution plan was set to a 10-year plan, and the initial valuation was kept low.

- This ensures that the $MAHA token is not centralized to a few parties long-term but also has short term scarcity.

.png)

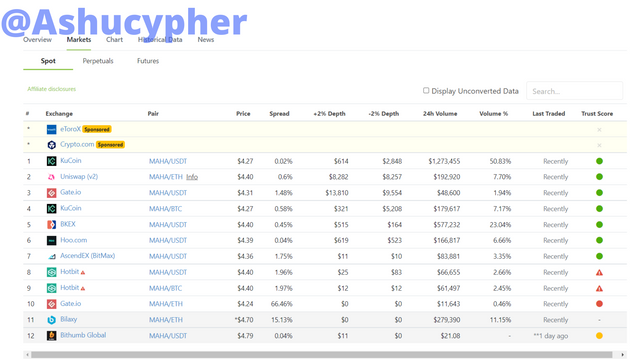

According to Coinmarketcap, MahaDAO token ranked #858. The current market price is $4.54 with a 24-hour trading volume of $3,175,048, showing a downfall trend of -21.28%. The maximum supply of the MahaDAO token is 10,000,000$MAHA, and the current circulating supply is 2,158,243.01 MAHA.(22%).

WHITEPAPER OF MahaDAO AND RAVEN PROTOCOL:

The whitepaper is the foremost thing an investor should see before investing. It contains all the features and the services that a platform or an organisation will provide.

RAVEN PROTOCOL:

- It is a decentralized and distributed deep-learning training protocol. Providing cost-efficient and faster training of deep neural networks.

- IDO that the Raven Protocol team introduced was with the listing of RAVEN on Binance DEX.

- Link for the website RAVEN PROTOCOL

MahaDAO:

- MAHADAO is a decentralized autonomous organization that is governed by the MAHA community. The MAHA token holders are at the helm of all decision-making and play a central role in fulfilling MAHADAO’s future.

-MAHA tokens keep the ARTH coin completely decentralized by ensuring governance and utility tokens that powers ARTH.

One of the features that will differentiate ARTH coin from the other stable coins and MAHADAO from the other DAOs is our Global measurement unit (GMU).- ARTH is an algorithmic value-stable coin built using robust strategies like vault optimization, auto collateralization ratio, automatic rebalancing mechanism, anti-correlated asset selection, purchasing power pegging, oracle price feeds, and more. GMU represents a basket of assets carefully selected with adequate weights to present a strong hedge strategy against all economic turbulences and many risks, especially inflation and currency risk. - Link to the MahaDAO website.

ROADMAP OF MahaDAO AND RAVEN PROTOCOL:

A roadmap of a crypto asset tells us about the developments or commitments fulfilled by a crypto project and further tells us about the future goals of that crypto project.

RAVEN PROTOCOL:

- developed an approach to distribution that speeds up that training run by utilising all kinds of devices like desktops, laptops, mobile phones, etc.

- it brings costs down for cloud services. This means Raven will create the first truly distributed and scalable solution to AI training by speeding up the training process.

MahaDAO:

- MAHADAO will be the first that will carry out IDOon Polkastarter.

- Set up low seed values in initial phases that ensures the safety of private rounds.

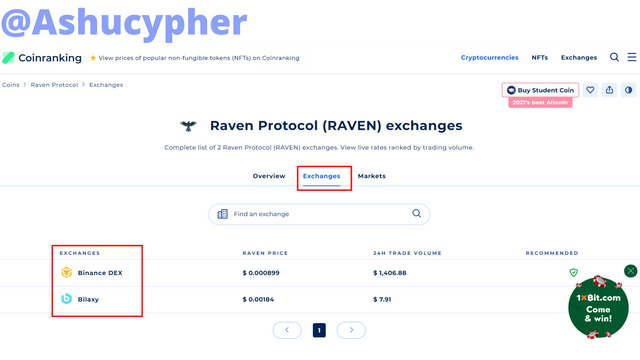

Exchanges OF MahaDAO AND RAVEN PROTOCOL:

RAVEN PROTOCOL:

MahaDAO:

The Above images show all the platforms that accept exchanges in Raven protocol and MahaDAO.

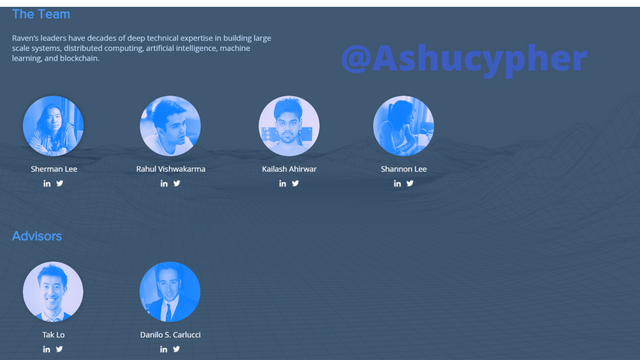

Teams OF MahaDAO AND RAVEN PROTOCOL:

RAVEN PROTOCOL:

MahaDAO :

.png)

Source

The images above show the teams working on the raven and MahaDAO.

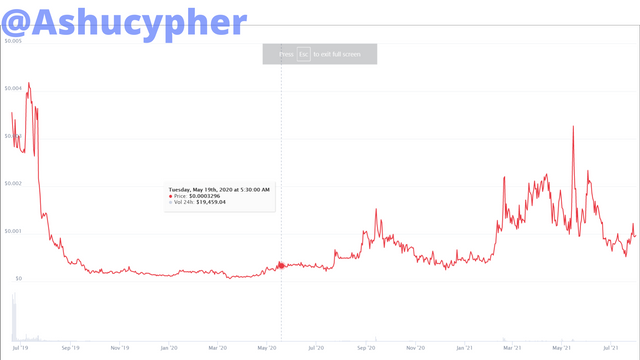

Price Charts

RAVEN PROTOCOL :

MahaDAO

MY OPINION BASED ON THE ANALYSIS THAT I'VE MADE

Both of the tokens are significantly developed and well-formed after their IDO. They show improvement in policies and their trading volumes are high, and they both show great investment potential for investors.

Other tokens that are undergoing or will start to undergo IDO events are:

- DON-KEY FINANCE

- BlockSwap Network

- BENQI

- MakiSwap

- Terablock and many other.

Question 5

LOOK FOR A TOKEN ON IDO AND EXPLAIN THE STEPS TO PARTICIPATE IN THE EVENT.

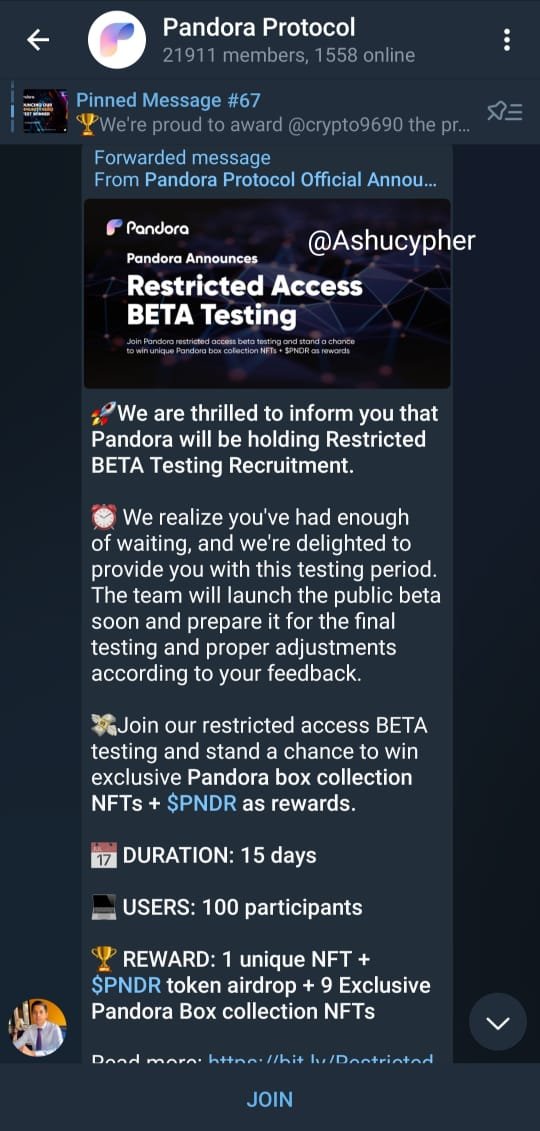

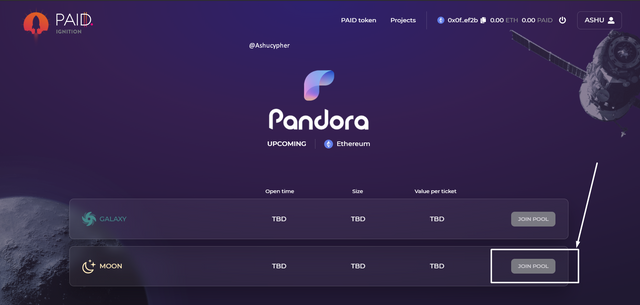

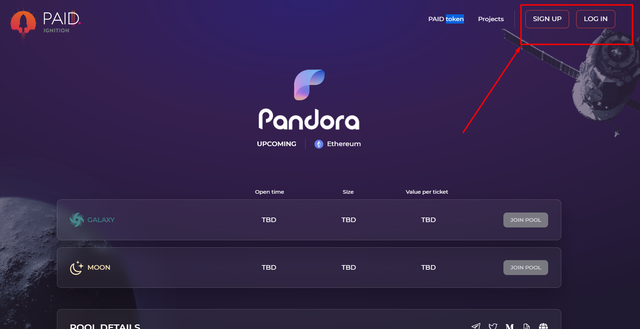

I choose Pandora Protocol for this homework post as I've seen the poster on a website.

From this point onwards ill be showing some screenshots that will help you to participate in an event.

.png)

Image created usingcanva

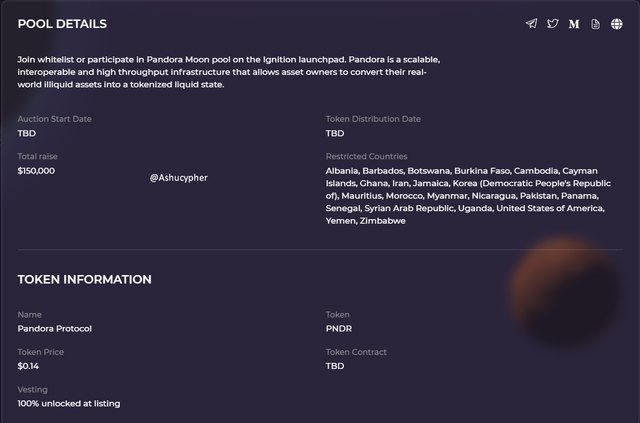

It is a mechanism that allows asset owners to convert their real-world assets into a tokenized liquid state. It is also highly scalable, interoperable and highly infrastructural in nature.

- Token Name: PNDR

- price : $0.14

- total money raised so far: $150,000 .

- IDO time :7 days.

METHOD OF PARTICIPATION

First, you have to join the wishlist. You can search online or join it by using the Telegram app.

Screenshot from My telegram.

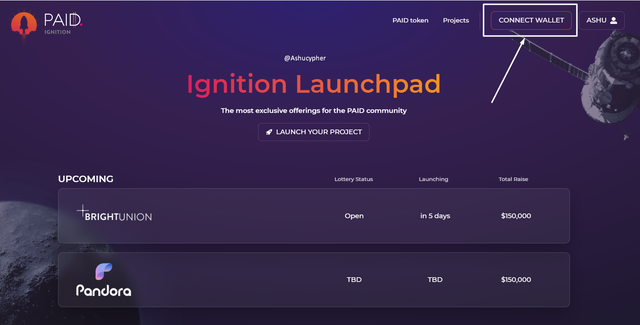

Open Paid Ignition launchpad and participated in paid Moonpool.

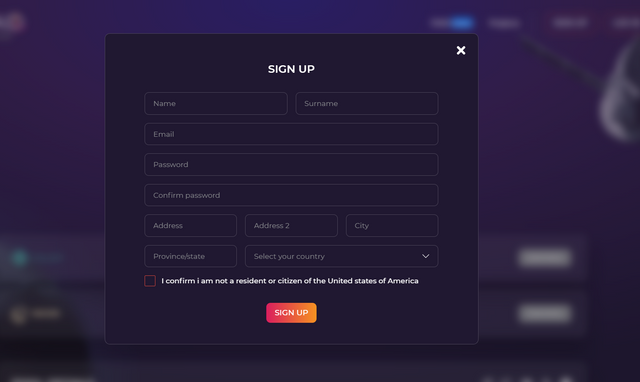

- To join the pool. First, you have to create an account.

- Create new login Credentials by filling in these details.

.png)

- paid Ignition will send a Mail for the email confirmation. Click the link on the email to confirm the account creation.

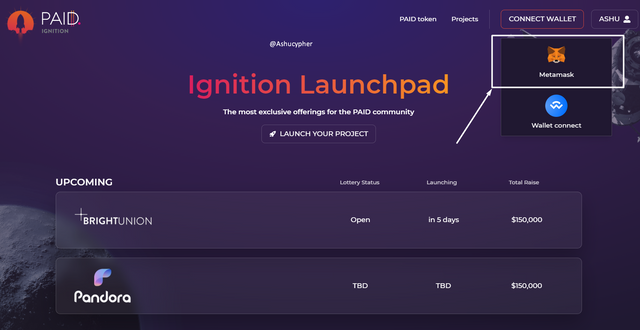

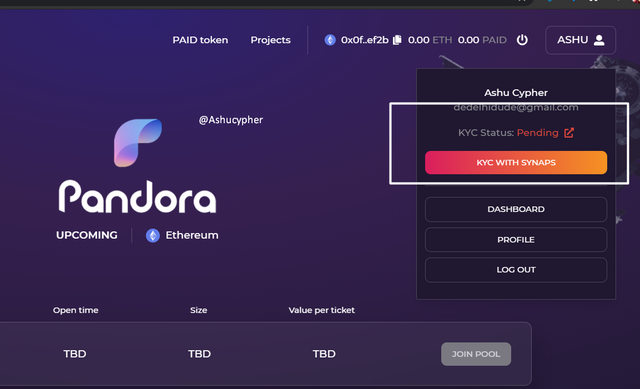

After logging into your account, you have to connect a wallet to the paid Ignition. Click on the connect wallet tab.

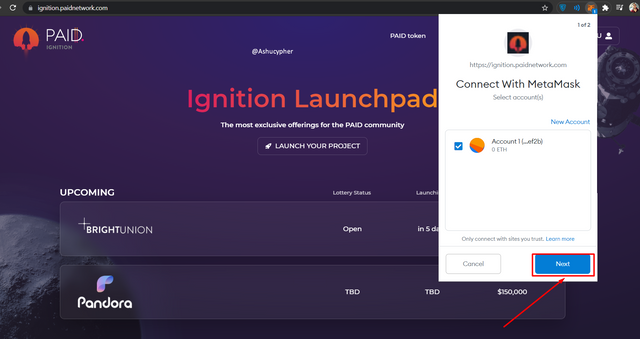

- as I have a meta mask wallet, I'm choosing metamask. If you have another wallet, you can go with that too.

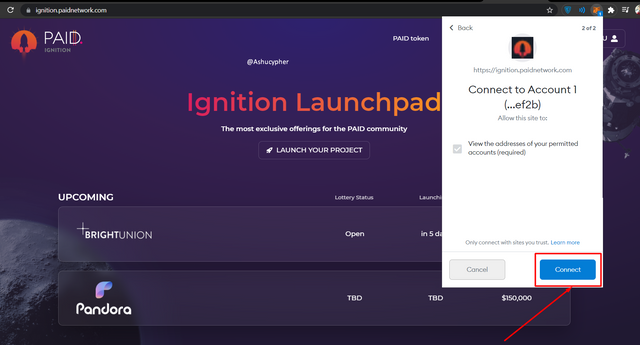

- Click on the Next button, then press connect icon.

- now, your wallet will be connected to paid ignition.

- now, click on the join pool icon, and you can participate in the IDO process.

NOTE: It requires personal details and will ask you to complete wallet KYC to advance.it will ask for personal details and other photographs

Image Showing Pending KYC.

-Read the pool details carefully before advancing.

- The Initial Dex Offering technique has been introduced to address the problems with its predecessor’s ICO, STO, and IEO to an extend. By using its decentralized exchange model, it does its work perfectly and raises funds.

If I have to give my opinion, I would say of course! It is definitely a worthy model or practice that should be done when launching a new crypto asset. It is the next step of the crypto fundraising process. But as a coin have 2 sides, similarly IDO have some loose ends, too...that need a lot of work. Like implementing and creating new control mechanisms, which will ultimately help eliminate price variation in the token until the fundraising is finished. - Also, limit token Buying system for Big investors.

- KYC Validation Information.

NOTE: All the images and screenshots are referenced to their sources, including whitelist content from the websites.

This was all from my side.

Thank you for Reading.

It was a great experience to learn such useful information from the crypto professor @wahyunahrul.

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit