Hello fellows. How are you all?

This is @attiyaasghar, here I am going to share my homework post on the topic "DCA to create a Portfolio" given by respected professor @allbert

.jpg)

Select two Crypto, perform fundamental analysis, and based on your fundamental analysis explain why you chose them.

Before investing in any coin, technical analysis of that coin, or fundamental analysis should be done. This analysis will help to predict the market trend.

I chose two cryptocurrencies that are in the top 100. These; Filecoin (Fil) and NEO (Neo).

Filecoin is a decentralized storage network that lets anyone rent out storage space in the same way anyone can buy storage on the network instead of having to trust only one company with important data it can be split up and stored on different computers around the world.

Filecoin was first introduced in 2014 when Juan Bennett released the whitepaper Filecoin a cryptocurrency-operated file storage network the proposal is a blockchain network similar to bitcoin but where nodes in the network can store data guaranteed by proof of retrievability component Filecoin is developed by protocol labs.

Filecoin works the Filecoin infrastructure is a distributed peer-to-peer network whose main purpose is to provide a new way for organizations and individuals to store data around the world when people have free storage available they can become storage miners who are essentially responsible for storing data on the file coin network.

You can get more detailed information about the project by reading Plygon's white paper by visiting (https://docs.filecoin.io/)

Using the Coinmarketcap website, I would like to talk about other aspects of Filecoin.

.jpg)

The current price of Filecoin(FIL) is $45.70. It ranks 24th in terms of market value. It is on the watch list of 151,506 people. Filecoin started to become popular especially in 2019. It is an important detail that so many people are on the watch list.

It has a total market capitalization of around $4 billion. Daily Filecoin trading is around 193 million. It is a sufficient volume for the current stagnant market, but the daily volume needs to increase.

.jpg)

Filecoin is listed on almost all major exchanges. Major exchanges such as Binance, Coinbase, Huobi Poloniex, Kraken, Gemini, Gate, Kucoin, Coinbase, Bittrex list Filecoin.

First of all, it's an open-source public decentralized cryptocurrency plate form, not a controlled specific person.

Filecoin aims to store data in a decentralized manner. Unlike cloud-storage companies like Amazon Web Services or Cloudflare, which are prone to the problems of centralization, Filecoin leverages its decentralized nature to protect the integrity of a data’s location, making it easily retrievable and hard to censor.

Reffrence

Neo was developed by a company called ONCHAIN in 2014. At the time of development, it started as AntShares and gained much attention after being renamed into NEO in 2017. NEO is that it's the first and largest blockchain network developed entirely in China. According to their website.

Smart Economy refers to a productivity gain through the automated interconnection of various economic actors, as well as local, regional and global economic layers. According to Neo, this can be achieved through a distributed network that connects Digital assets, Digital identity, and Smart contracts.

Let me walk you through the three components

Digital Assets: A digital asset is anything that uses electronic data and can be programmed into smart contracts. This could, for example, be a certain amount of money or your social media profile, which you can rent out for advertising purposes... In the Neo network, two kinds of digital assets can be used: Global Assets and Contract Assets. Contract assets can only be recognized by specific smart contracts and, therefore, narrowed down to specific use cases.

Digital Identity: Digital identity bridges the physical world with digital assets. Each person, organization, application, or device needs to be identifiable in the network. To achieve this, the Neo blockchain uses the most commonly accepted digital certificate issuance model, X.509, which uses a public key infrastructure for unique identification. All your transactions and belongings are signed with your digital identity in the network, creating an accurate and fraud-proof record of your actions.

Smart Contracts: Smart contracts, as you might already know, were first proposed in 1994 by Nick Szabo. In his definition, a smart contract is defined as a pre-programmed condition that will execute the corresponding contract terms, as soon as the condition is met. Neo’s smart Contract system is called Neo Contract. Compared to Ethereum's smart contracts, which have to be programmed in Solidity, Neo supports C#, Java, and other mainstream programming languages. It's a huge advantage compared to other blockchain projects and can increase the potential for mass adoption of smart contracts and Apps.

Using the Coinmarketcap website, I would like to talk about other aspects of NEO

.jpg)

The current price of NEO(Neo) is $29.72. It ranks 41 in terms of market value. It is on the watch list of 212,678 people. It is an important detail that so many people are on the watch list.

It has a total market capitalization of around $2 billion. Daily NEO trading is around 296 million. It is a sufficient volume for the current stagnant market, but the daily volume needs to increase.

.jpg)

NEO is listed on almost all major exchanges such as Binance, Huobi Poloniex, Kraken, Gemini, Gate, Kucoin, Bittrex.

I choose NEO because it is One of my most favorite currencies. I like it because it is a distributed network that connects Digital assets, Digital identity, and Smart contracts. Moreover, as we know that NEO blockchain Network was entirely developed in China So we can think that NEO will definitely get a huge pump in the Future.

Furthermore, NEO is ranked on the 41st number on Coinmarketcap and has a total market capitalization of around $2 billion. Last but not least, NEO is listed on all the major exchanges like Binance, Huobi Poloniex, Kraken, Gemini, Gate, Kucoin, Bittrex.

So, these were the reason I choose NEO Coin.

Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation

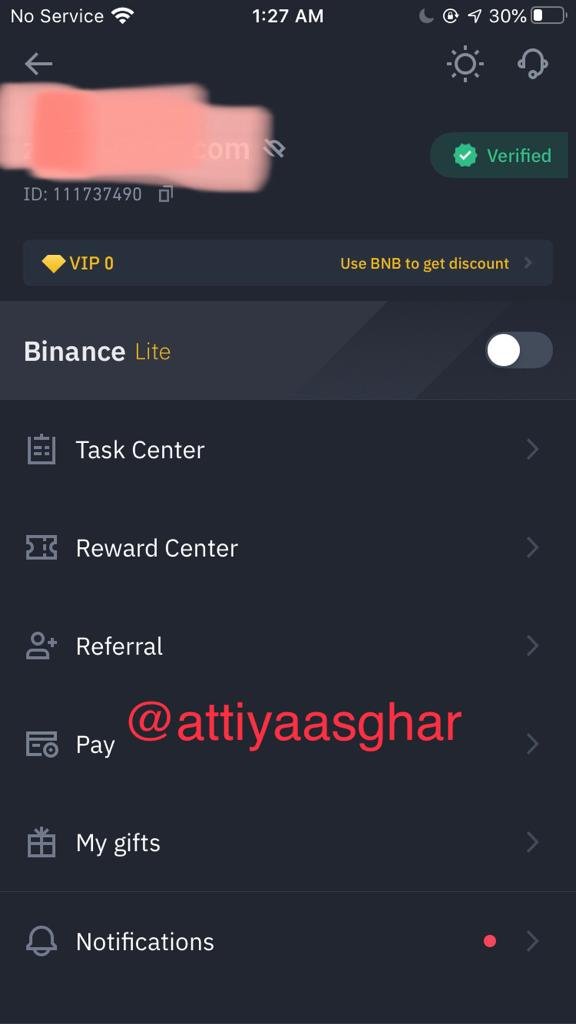

I decided to buy a NEO coin with Usdt pair, For buying a Neo coin I used Binance verified exchange let me explain to you how to buy a Neo toke on Binance Exchange.

- Binance verified account

I select FIAT Market and then I Type in the search bar Neo, Vet is listed with 7 pairs are Neo/Usdt, Neo/Bus, Neo/Usdc, Neo/Bnb, Neo / Try, Because I have Usdt in my wallet so I can select Neo/Usdt pair

And the next page will appear from on you and select your desired amount and press to buy Neo,

.jpeg)

In 2 seconds Neo coins are reflected in my spot wallet.

.jpeg)

Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (include screenshots)

DCA strategy is a very helpful strategy in minimizing losses. For this practical Experiment, I choose Dot and Ada coins for investing $500 in 5 trades. Each coin is $250 and 5 trades.

.png)

Purchase date price: June 1, 2021 – 22.672 DOT

Purchase date price: June 7, 2021 – 20.692 DOT

Purchase date price: July 14, 2021- 21.068DOT

Purchase date price: July 21, 2021 – 15.557 DOT

Purchase date price: July 1, 2021 - 15.235 DOT

Now let’s calculate the average for estimating the loss of profit. Sum of all prices: 95.224

Average value:95.224 /5= 19.0448

The current price: 12.291

If I am compared to the average price with the current price there is a 7% loss relatively, if I buy my all coin when the price was at $22.672 on the first attempt the then i have to face a 10% loss.

I save my money because for applying the DCA strategy, But the DCA strategy should be applied in a way that the market should not be in bull and hence the price should be kept near to the average price.

Exit scenario: As we know our average price is $ 19.448 when the market cross over the average then we can exit the market easily. if we can see the market trend It revolved around my average price if I come out at $15,44 then I have no profit no loss. if I wait I hope I get a good profit.

**The next coin I am performing the DCA strategy is the Cardano

.png)

Purchase date price: June 1, 2021 – 1.7004 ADA

Purchase date price: June 8, 2021 – 1.4637 ADA

Purchase date price: July 14, 2021- 1.5263 ADA

Purchase date price: July 21, 2021 – 1.3220 ADA

Purchase date price: July 1, 2021 - 1.3179 ADA

Now let’s calculate the average for estimating the loss of profit. Sum of all prices: 7.3303

Average value:7.3303 /5= 1.46606

The current price: 1.1772

Again here you can see the average price is lower then current price ,Now if we calculate the loss, it comes out to be 0.29% with the average price due to DCA strategy. if i made purchase all coin in ist attempt the then i have to loss 0.52% .

Exit scenario: Right now i have not to much loss so i can wait when the market will be bullish mood the i will sell my asse if see the last month price graph ada was hit the $ 2.004 if hit gain that price i will sell at this point then and take 0.53% profit it it will go down the i will buy more coin in the next round.

The lecture was very informative we learnd about fundamental anylisis and , And so today I read about the DCA strategy. This is a great strategy that I can take full advantage of in the future while trading. This is a way for us to divide our investment into different parts and invest in any coin . This is a way to get more profit and less loss.

Hello, @attiyaasghar Thank you for participating in Steemit Crypto Academy season 3 week 3.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit