This is the fourth week

of the Crypto Academy season, 4 and I am thrilled to take part in this week's task by @reddileep This is where the fun is and with this lesson, we are learning more about Cryptocurrency Triangular Arbitrage. Let's get into it.

.jpg)

1- Define Arbitrage Trading in your own words.

Arbitrage Trading:

source

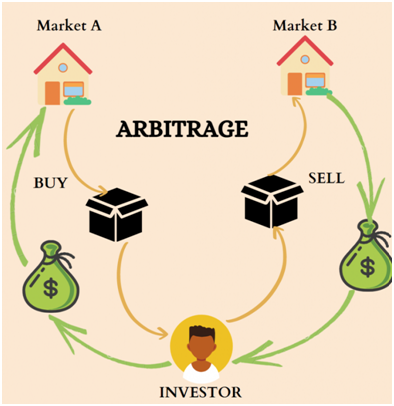

It’s a trading technique that involves taking an edge from the price indifference of a similar asset in a dissimilar market.

Example:

Let me explain it to you through an example.

source

As demonstrated In the picture it can be seen that Mr. X who is an investor, in this case, purchased an asset from Market A later he sold that asset in Market B where the same asset was being purchased at a rate different than the one he purchased on initially. It observed he took advantage of the price difference in two exchanges to gain profit.

2- Make your own research and define the types of Arbitrage (Define at least 3 Arbitrage types)

In arbitrage, there are a number of methods used by investors who are aiming for their preferred way of trading. There are many types of arbitrage some of these have multiple names while some are further classified into more types. However, I’m going to list few types and define any 3 as required.

Arbitrage is classified in the following types:

- Merger Arbitrage

- Statistical Arbitrage

- Covered Interest Arbitrage

- Locational Arbitrage

- Triangular Arbitrage

Covered Interest Arbitrage:

In order to understand this trade following are the terms you need to be aware of:

Exchange rate:

Interest rate:

Future Contract:

Covered Interest Arbitrage

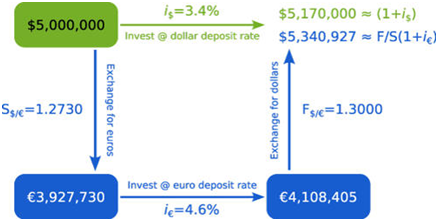

In this trade, an investor takes advantage of the difference of interest rates of two separate currencies by utilizing a future contract in order to eliminate the risk of changing exchange rates.

Let me explain it to you through an example:

Suppose Mr. X is trading between two currencies i.e. Currency A& B. The interest rate of currency A is 3% annually and of B it is 6%. Now the exchange rate of A to B is 0.90 so X will now invest *xxx” amount in B currency for a year now in the fear of the exchange rate going low he will perform a future contract to finalize the current exchange rate of currency from B to A i.e. 1.20 After a year An investment will be more than he originally did as 6% interest will be added. Now X will convert this investment back into currency A and will gain a profit because of the exchange rate is higher i.e. 1.20.

For further understanding, you can see in the picture below where trade is made between dollar and euro.

source

Locational Arbitrage

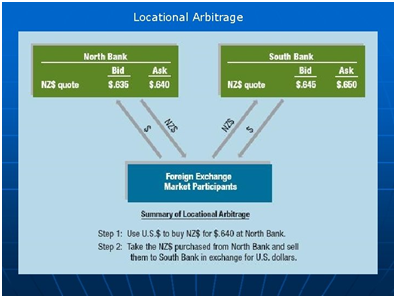

In this type of trade, the investor utilizes the difference of price of a similar currency in different banks.

For example, A man purchases a sum of currency from one bank where the bid price was $1.50 now another bank has an “ask price” of $1.40 for the same sum of money. Now that man sold his money in the second bank resulted in him having a profit of $0.10

Here’s a graphical representation of locational arbitrage.

source

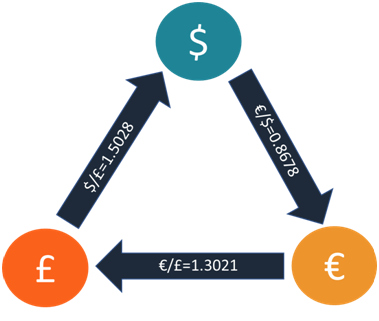

Triangular Arbitrage

This arbitrage type revolves between three currencies where an investor makes use of price indifference of three currencies. It is different from covered interest arbitrage as this trade is made only between three currencies and also it is performed simultaneous,ly, unlike covered interest.

For further explanation here’s the graphical representation:

source

3- Explain the Triangular Arbitrage Strategy in your own words. (You should demonstrate it through your own illustration)

It is an arbitrage method in which an investor trades between three sets of coins. Let me explain how it’s done through an illustration:

.jpg)

As you can see In the beginning I had 20 Ethereum coins I sold these 20 Ethereum coins on 0.1176 and got myself170.068 coins of Crypto BNB. With 170.068 Crypto coins (selling them on 0.4318) I purchased 394.132 Litecoins. After that, I finally purchased Ethereum coins back from these Litecoins and got myself 20.01402 Etherium coins by selling my Litecoins on 0.05082.

Conclusion

Initially I had ethereum coins and at the end of my triangular arbitrage trade I now have 20.00219 ethereum coins. It can be seen there’s a profit of .01402coins.

Make a real purchase of a coin at a slightly lower price in a verified exchange and sell it in another exchange for a higher price. (Explain how you get your profit after performing Arbitrage Strategy, you should provide screenshots of each transaction showing Bid, Ask prices)

Following are the steps to make a verified exchange between two markets

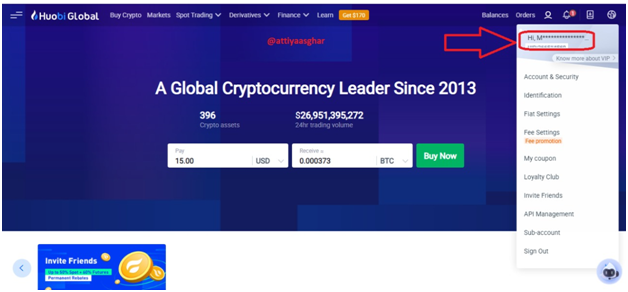

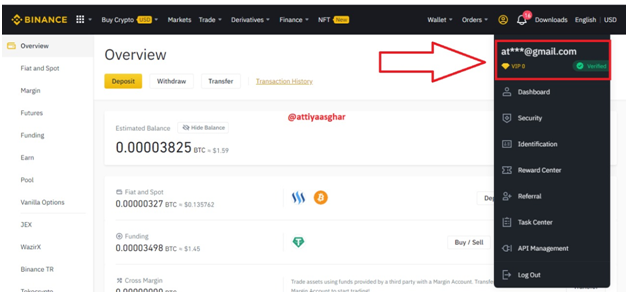

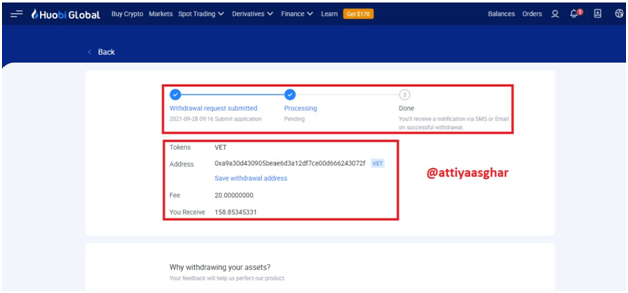

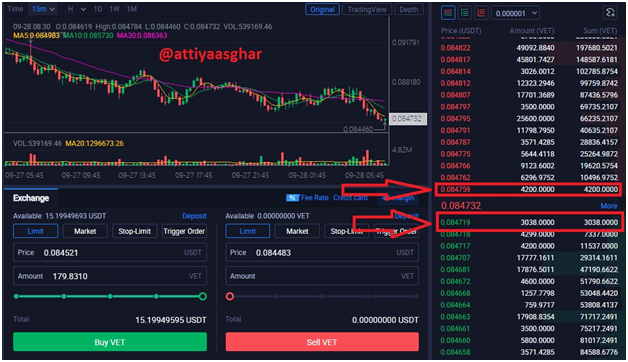

- Here you can see that purchases are being made from verified accounts on Huobi global exchange and Binance.

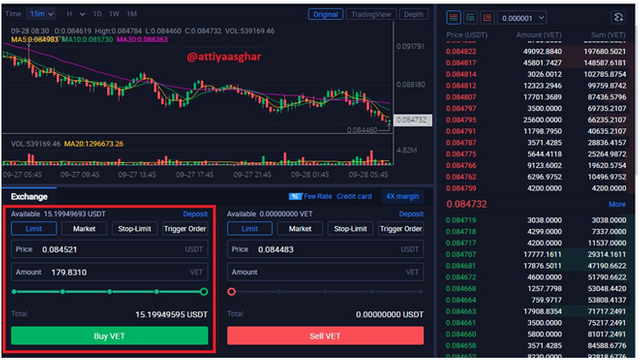

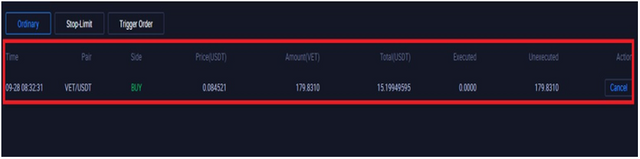

Now you can see I’m going to buy 179.8310 Vet coins for $15.19949595 I have in my wallet. As you can see I now have 179.8310 coins in my account.

Here in the picture below you can see my order details.

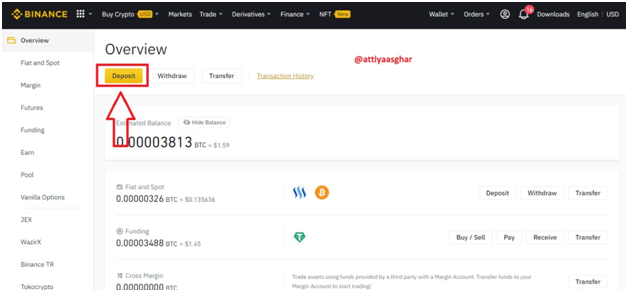

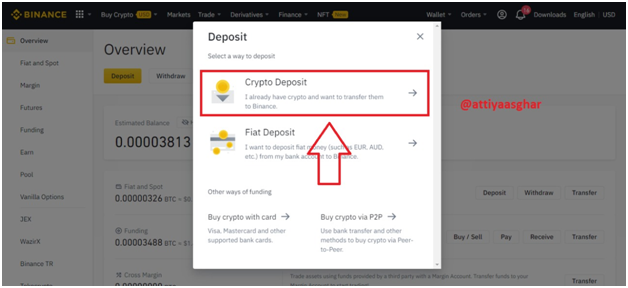

I’ve opened my verified (shown in the first picture of this question) Binance account here I’ll click on the deposit button to deposit my Vet coins in Binance.

After clicking on the deposit button there will be an option of crypto deposit. I will select that option.

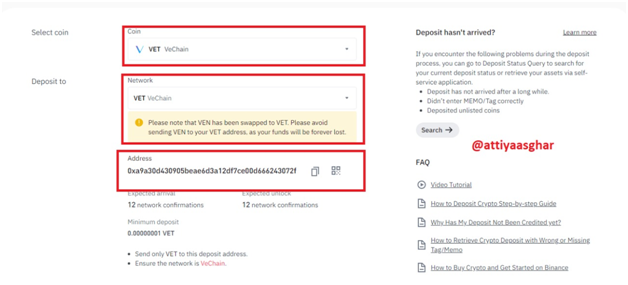

Now in the next screen I will select VET coin upon selecting that the Binance app will provide you an address upon which you can deposit your VET coins here in Binance.

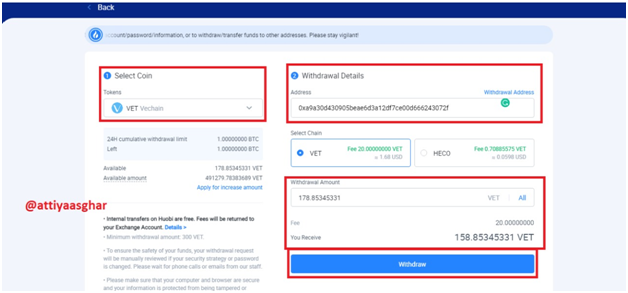

Now I went back to Huobi global where I’ll click on withdraw button upon clicking that they’ll ask me to select the coin which I want to withdraw and the address I want these coins to be deposited. Here I will select VET coins after that I will paste the address I copied from Binance. Here in the same picture, it can be seen there’s going to be a 20 VET coins fee for the transaction. Here I will click on confirm button.

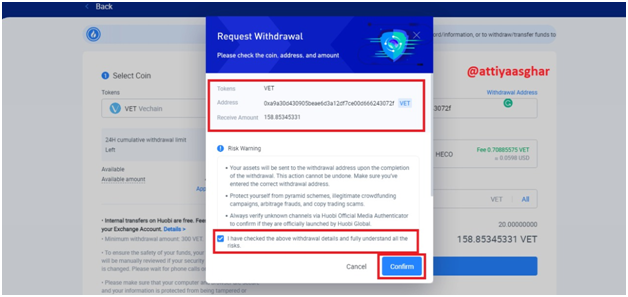

After that there will be a warning pop-up screen where they asked me to confirm my address as sending on the wrong address cannot be undone. I’ll mark the tick where needed and after that will click on confirm button.

Now my withdrawal request is submitted and the deposit is in process.

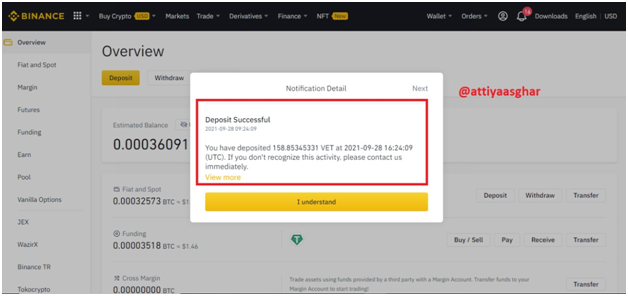

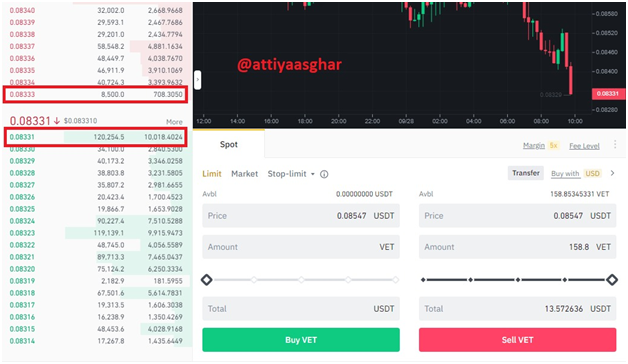

I came back to Binance here I got a notification of a successful transaction and received a total of 158.85245331 VET Coins. Now I will sell these coins on Binance.

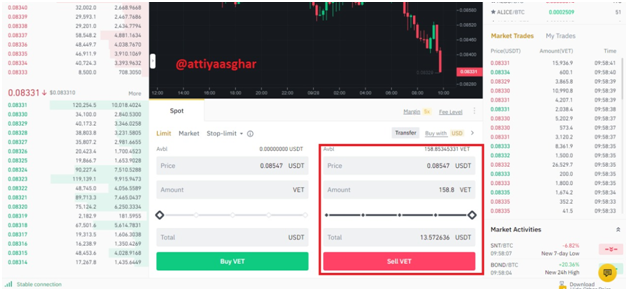

As you can see I’m selling my VET coins in exchange for USDT and I’ll be getting $13.572636.

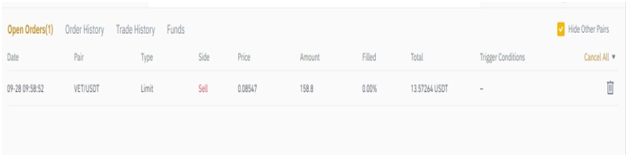

Here it can be seen I sold my 158.8 VET coins on 0.08547 and got $13.57264.

CONCLUSION

Because the fee of VET coin was 20 I only got 158.8 VET coins due to which I faced a loss as I only purchased VET coins for 15$, However If I would have purchased more VET coins my trade would be profitable.

BID PRICE/ASK PRICE

Here In the picture below I have highlighted the bid price and ask price when I purchased VET coins from the Huobi exchange i.e. ask price was 0.084759 and the bid price was 0.084719.

Here in the picture below I’ve marked the asking price and bid price of USDT when I was selling my VET coins in exchange for USDT i.e. Ask price was 0.08333 and Bid price was 0.08331.

Invest for at least 15$ worth of a coin in a verified exchange, and then demonstrate the Triangular Arbitrage Strategy step by step using any other coins such as BTC and ETH. (Explain how you get your profit after performing Cryptocurrency Triangular Arbitrage Strategy, you should provide screenshots of each transaction)

To demonstrate the verified exchange, you can see in the screenshot below that exchange is from a verified account.

.jpeg)

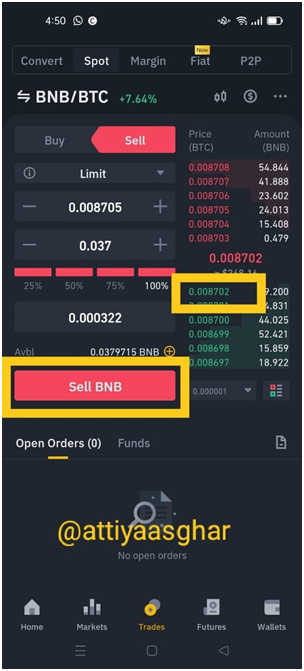

Moving further in the screenshot below it can be seen I have $13 in my wallet from which I’m going to purchase 0.0379715 BNB coins.

After purchasing 0.0379715 BNB coins I’m now selling them in exchange for 0.000322 BTC coins

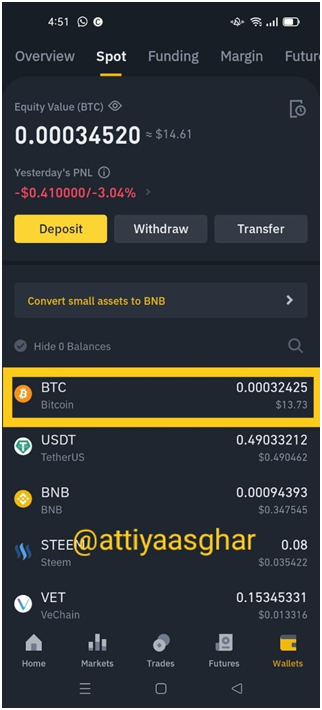

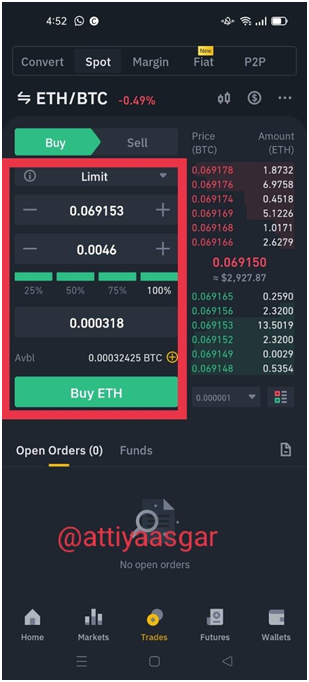

I now have 0.00032425 BTC coins which can be seen in the picture below.

From 0.00032425 BTC coin, I’m going to purchase 0.0046 Ethereum coins at the rate of 0.069153.

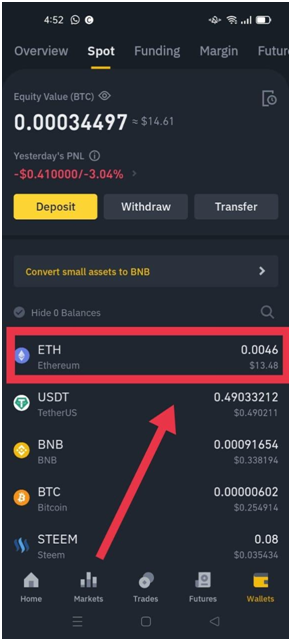

I now will be having 0.0046 Ethereum coins in my wallets which can be seen highlighted in the screenshot below.

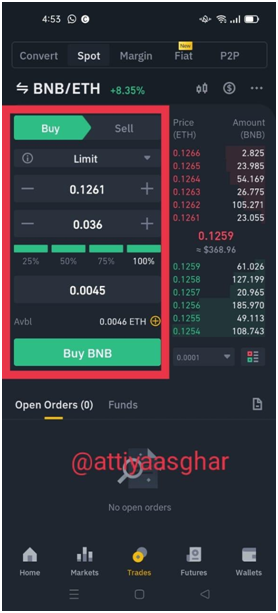

Now finally I’m going to buy BNB coins back from 0.0046 Ethereum coins at the rate of 0.1261 to complete my triangular arbitrage trade.

As it can be seen in the screenshot provided below that I now own 0.00034582 BNB coins i.e. $13.99 in my wallet.

CONCLUSION

From the triangular arbitrage trade done above, it can be concluded that my trade went with no profit & no loss as I have the same amount i.e. $13.99 in the initial and final stage of my trade.

Explain the Advantages and Disadvantages of the Triangular Arbitrage method in your own words.

Advantages of Triangular Arbitrage

People with different jobs and responsibilities can take part in Triangular Arbitrage as it is performed simultaneously and doesn’t take much time.

Students or people having a low budget can participate in trading and get themselves.

Many advanced operating systems are now available to accomplish successful results.

Disadvantages of Triangular Arbitrage

Highly advanced software is necessary to make this trade as there are quick fluctuations in the market.

Trade can result in loss because of the illiquid market.

Regard

@attiyaasghar