This is the Task 6 of the Crypto Academy season, 4 and I am thrilled to take part in this week's task by @sapwood This is where the fun is and with this lesson, we are learning more about the difference between PoS & DPoS. Let's get into it.

.jpg)

What is the difference between PoS & DPoS?

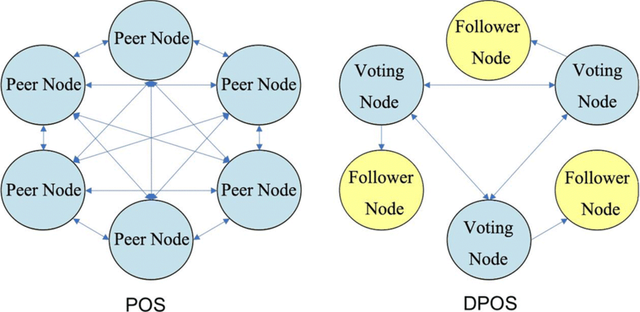

Proof of Stake

In Proof of stake certain amount of stake is necessary for a validator to verify any cryptocurrency transactions. For instance, to get a 10 coins reward as a validator in PoS, he needs to determine the 100 coins stack in the process.

In the proof of stake mechanism, the validator can verify the transactions without major investment in computing energy and hardware. In fact, a validator can do the work with a laptop.

A certain percentage is always defined in the PoS mechanism, which makes it centralized. It pretends to be less secure as compared to the decentralized system. PoS does not require any costly mining rigs in order to verify any cryptocurrency transaction by the validator.

Delegated proof of Stake

In the Delegates Proof of stake, only elected delegated can join the network and stakeholders can delegate their power to others by voting.

Also, the selection criteria of choosing delegates depending on the community voting power. The higher the stake can increase the chances of selecting the elected delegates in the blockchain native coin network.

Advantages & Disadvantages?

Advantages of Delegated Proof of Stake

High Scalability:Scalability and speed DPoS is providing high speed of cryptocurrency transactions as compared to the PoW and PoS in the digital currency market. It is a most unique advantage of DPoS.

Better rewards system:In the DPos mechanism, people that are associated in the network only elect delegates who regularly give those rewards. In this way, each person gets the most benefit.

Instant Voting security:In this mechanism, malicious activities can be spotted in real-time and the fraudulent delegate could be voted out from the system in the first place.

Less Energy Efficiency:As compared to the Proof of Stake, DPoS uses less energy which makes it highly recommended in the crypto market.

Low hardware investment:Participants in the network do not require heavy costly equipment. In fact, a reasonable computer or laptop is enough for this work.

Disadvantages of Delegated Proof of Stake

Easy for an attack:Due to fewer people are involved in keeping the network alive, which makes it less secure and 51% of attacks can be organized. A hacker can access it easily having a 51% stake in the digital wallet.

Rich can get richer:Rich people can get the most rewards the higher the number of tokens they have and it can enhance their influence in the community but with people with low number token gets nothing out of it.

Apathy can kill:In this mechanism, the system does not work with less engaged users. It's like democracy or a democratic republic in the universe. More people are engaged in the system or the majority can win the situation in this mechanism.

Advantages of Proof of Stake

Fast and efficient: As compare to the other mechanism Proof of Stake gives the fastest transaction time. Also, PoS offer or helps in the BitCoin scalability. This mechanism is more efficient in the digital currency mechanism.

Less energy:Unlikely the PoW, the Proof of stake consumer less energy. In fact, users can do the work on a regular

computer or laptop in thehome. No supercomputer or heavy equipment is required in this system.

Price Dynamics: A certain percentage is always locked in the system which helps in the price dynamics of digital tokens. Due to these features Proof of Stake has become more scalable and reliable in the digital currency world.

Ownership::As we know that, in Proof of Stake validator needs to obtain some amount of stake in order to mining the currency. So it gives a sense of ownership to the validator for having a pre-determined stake in the digital wallet.

Disadvantages of Proof of Stake

Less secure:In Proof of stake, there is a fixed certain percentage always locked in the system. Which makes it centralized and less secure compared to the PoW. As we know that, in the digital currency world people are worried about their privacy and sensitive data so, due to this centralized system makes it less secure in the eyes of traders.

Fewer rewards:The rewarding criteria are different from other mechanisms in this digital currency. For example, in this mechanism, the validator only gets the network fees as a reward and he needs to determine high stake volume to validate the transactions. Without a certain fixed stake, it’s not possible to mine the digital currency with this mechanism.

Limitation on accessibility: A major drawback of this mechanism is the richer are getting more money because in Proof of stake certain amount of digital currency is necessary for mining and the more you have the chances would be high for getting the accessibility to the mining. The rich people can get more stakes so, in this way, they can also create a monopoly and play with the market.

Name a few Blockchain projects which use the DPoS consensus mechanism and indicate the scaling capacity?

Tron

Basically, Tron is a virtual currency it was founded by Justin Sun In 2017. It is also known as TRX in the digital currency market. Also, it is working on delegated proof of Stake blockchain technology. The core purpose of creating Tron is to reward the content creators and the network of Tron is capable of doing 2,000 transactions in every second.

EOS

It was initially revealed to reduce the cost of transactions and to enhance the transactions time and speed. It was founded in January 31 2018. The smart contracts in the system help to reach the goal as transaction time and efficiency.

STEEM

Steemit is a social media blogging website that gives rewards to its content creators and curators. Steemit gives these rewards in Steem and it is also a digital currency. Steem also helps digital content creators to strengthen their profiles and to earn more rewards. In addition, Steem encourages the creator to add more value by creating great informational content and to become shareholders.

LISK

LISK is also a digital currency like Bitcoin and it gives the opportunity for developers to develop the decentralized applications in the cryptocurrency. The Dapps which will build on the Lisk can perform individually as it does not affect the overall Lisk network. It is built on the shared network software.Lisk roadmap is categorized in five simple steps are the following

- Inception

- Resilience

- Expansion

- Ascent

- Eternity

scaling capacity

After writing and analysis of both mechanisms Proof of Stake and Delegated Proof of Work, I would say that POW is more secure and well recognized in the digital market. Although it is less energy efficient than DPOS but gives the ultimate security and privacy to the shareholders.

Regard

@attiyaasghar

Ap see bt karni hn @attiyaasghar

Both zarori

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit