Hello friends, hope we all are fine and enjoying Cryptoacademy Lectures. Today i am writing homework task for @fendit which is about wyckoff method. So let's begin.

.jpg)

Share your understanding on "Composite Man" and the fundamental laws. What's your point of view on them?

Introduction :Companies

and industries are now prevailing in the financial markets of a country now.

Since a country’s economy highly depends on its companies and industries so it

is important for the companies to sustain their good performance. There are

wagonloads of theories and methods which are used by the respective companies

to make their performance better. Among various business models and methods one

of the important methods is the Wyckoff Method. This method was introduced by

Richard Wyckoff. Interestingly, Richard was always fascinated by the stock

market and businesses since his early childhood. He participated in stock

exchange activities at the age of 15. Age of 25 was the avid phase of Richard’s

life. He initiated his own securities firm office which opened various windows

of opportunities for him in the world of business. Richard gradually began to

work with great traders who influenced him and triggered him to do something

great.

The method of Richard Wyckoff is a based on a

set of principles and guidelines that were set for the traders and investors.

The main concept around which the method of Wyckoff works is that the business

decisions should be finalized based on the knowledge and logical tools rather

than using emotions. Richard made this one of the basic principles of his

method to minimize the risk of loss of an investor in the stock market.

Fundamental laws

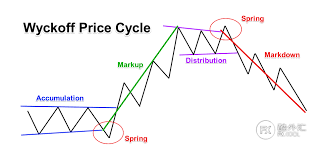

The Wyckoff method is based on three important laws which acted as an integral pillar.

1.The law of supply and demand :This is one of the basic and workable laws of Wyckoff. According to this law the price and its direction can be estimated by knowing the ratio between supplies and demands (Pruden, 2019). According to this law of supply and demand if the demand rate is higher than the supply then it leads to increase in the prices of the goods and services. On contrary to this, when the supply is more than the demand then the prices of the goods and services fall immediately (Pruden, 2019). If there are not any noticeable fluctuations in the prices, then it means that the ratio of supply to demand is almost equivalent.

2.Law of efforts and results :Effort resides in the asset of a company; thus, it also depends upon the total assets. This law deals with the prices and the volumes which has a huge impact on changing the prices direction and its trends (Fuksa, 1994). This law explains that how much it is crucial for an investor or a business to have a big asset and then sell it without creating a huge difference in the prices, this act is known as effort. The prices will not change or fluctuate until unless the intricate relationship between volume of asset and prices has been maintained. If it changes then it would automatically affect the prices. Therefore, large volume means a large effort according to the second law of Richard Wyckoff. In this respective law of Richard, the volume indicates effort, and the price indicates the results.

3.The law of cause and effect

Cause and

effect are two interlinked terms and concepts, when there is an action there

should be a reaction to as an encounter. So, it is obvious that to see or

witness an effort there should be a cause behind it. This law has a major

contribution in the two-basic phenomenon of distribution and accumulation in

the range of trading. The law of cause and effect plays a vital role in giving

major profits to a company.

3.1 Accumulation :Accumulation

is a process in the market of stock exchange that helps you to elevate the

prices. Accumulation is mostly the effect in most of the cases.

3.2 Distribution: Distribution

is a process in the stock exchange market which brings the prices down. Which

is also an effect.

Composite Man

Richard Wyckoff successfully presented his method by introducing some new terminologies to the audience in the stock market. One of the important and efficiently used terms is the “composite man”. Do you have any idea about the composite man? Or did you come across this term before? Composite man is not a real man rather he is an imaginary person created by Wyckoff in the market who help us to understand the investors and traders by representing them. Composite man is therefore, a self-centered and a selfish person who yearns to have more benefit than others. This imaginary person in the market strives to buy goods and services at a lower price and tries to sell them at a higher price. Thus, all he needs is more profit and money.

Role of composite man

1.The composite man tends to sell the stock to the investors at a much higher rate that he bought with a less amount.

2.The action of composite man helps you to know and understand the direction of the prices.

3.Composite man plays an important role in the process of accumulation. In the respective process he is responsible to purchase a huge number of coins. Through this act the composite man buys many coins before other investors of his competition buy the coins.

4.After the process of accumulation, the upward trend begins where the investors want to buy the assets which the composite man has already purchased, and he has a large stock of it. Now because of this act the demand will increase as compared to the supply. As mentioned above when the demand increases as compared to the supply then the price automatically rises with a high rate.

5.Distribution process is one of the moments of success for the composite man. Simply in this phase the composite man begins to get the sweet outcomes of his struggle. The composite man gets wagonloads of demands from various investors and he is the one with whole assets. Therefore, he sells the assets with the highest rates possible and gets the highest outcome out of it. At this stage of distribution, the investors want to buy an asset which is relatively less expensive. In the market there are already last distributors left who already increased their prices due to less supply. Therefore, on this stage of the whole process the composite man benefits by selling what he bought at the beginning.

6.The role of composite man is not just gaining benefit rather he

makes such moves where he tries to bring down his profit. However,

interestingly each move gives him benefit at the end. Right after selling all

the assets the composite man applies his markdown strategy where the prices of

the assets that he sold comes down drastically. At this point now there are a

lot of sellers but less buyers. As mentioned above when the supply amount rises

as compared to the demand then the prices rate automatically falls. In this whole process, the composite man is finding a way to

make profit for himself. In that case I would call the composite man a focused

person who takes each move with a clear vision of getting outmost profit. I

believe that you should not be surprised with the acts of the composite man

because this is how the business market and the entrepreneur’s work. Those who

take care of the laws as mentioned above such as demand and supply, cause and

effect, and effort and results become the strongest in the market.

Share a chart of any cryptocurrency of your choice (BTC or ETH won't be taken into account for this work) and analyze it by applying this method. Show clearly the different phases, how the volume changes and give detail of what you're seeing.

.png)

Accumulation:

The accumulation phase shown in the graph is the phase where the composite man has the best opportunity to store the coins. As mentioned in the graph that the volume has been kept constant and there is not any changes or movements in the volume.

Distribution :

The phase of distribution is the best and the most profitable phase for the rich. As shown in the above graph the upward trend is at its zenith and here the currencies can be distributed. In this respective phase the assets would be sold but it would not go longer.

Re-accumulation :

The

third phase of the above graph shows that the upward trend is increasing.

Therefore, in such cases it is highly recommended to re-accumulate the coins

which would result in a good and a beneficial turn. You can see the phase of

re-accumulation in the given graph.

Bearish Trend :

In the whole cycle of phases this is the last phase

presented in the graph. This is again one of the interesting phases in which

the prices of the assets are falling drastically. This is the phase where the

supply is in higher number than the demand so the prices will come down

automatically.

Conclusion and discussion :

Stock exchange market is one of the crucial platforms that

,has been used by people, industries, businesses, and companies. It is

challenging to get a lot of profit in this market when there are many composite

men playing their part of getting maximum profit. Here I have shown few charts

but in reality, the stock market is much complicated than these charts. An

individual should learn to act according to the trend in the market. As

mentioned above that according to the Richard Wyckoff theory the market of

stock works with good knowledge and credible logic not with fragile emotions.

Therefore, an individual should use his logics to play well in the competitive

market. The laws of Richard Wyckoff are of great use if a person uses them with

good intelligence and according to the need of the situation. The law of supply

and demand is I guess the most basic law that all should be familiar with. This

law gives you an opportunity to think and analyze before buying or selling any

stock in the investors. Moreover, the game of the stock never stops after this

first law rather it has a cycle to be covered. Another important law that was

discussed before is the cause and effect. Indeed, every action has a reaction

according to that if you want to get something in the stock market then you

should create a cause for it. The other concept of accumulation, distribution,

and re-accumulation are of equal importance to win the market of stock

exchange.

@

Regards

@attiyaasghar

Thank you for being part of my lecture and completing the task!

My comments:

Explanations were fine, but the chart isn't. The analysis either.

It's not that clear the distribution period and there was a re-distribution phase that you didn't mark. Also, what you showed as 're-accumulation phase' is just another cycle beginning.

Overall score:

4/10

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit