Hello everyone!

Hope yo all are good and enjoying your lives in a good way.

Here is my homework task for professor @kouba01

The home work given by respected professor is as followed:

What is a cryptocurrency CFD?

How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Are CFDs risky financial products?

Do all brokers offer cryptocurrency CFDs?

Explain how you can trade with cryptocurrency CFDs on one of the brokers (Using a demo account).

Q1. What is a cryptocurrency CFD?

Cryptocurrency is all

time active business for traders offering better options to maximize their

assets. CDF is a contract-based trading option between individuals and brokers

without opening a direct position in the market.

The trader and broker get agreed to replicate market conditions and settle the differences when the position closes. CDF trading offers a series of benefits that direct trading lacks. Access to overseas markets, leveraged trading, short (SELL) positions for assets and many more are including in its advantages.

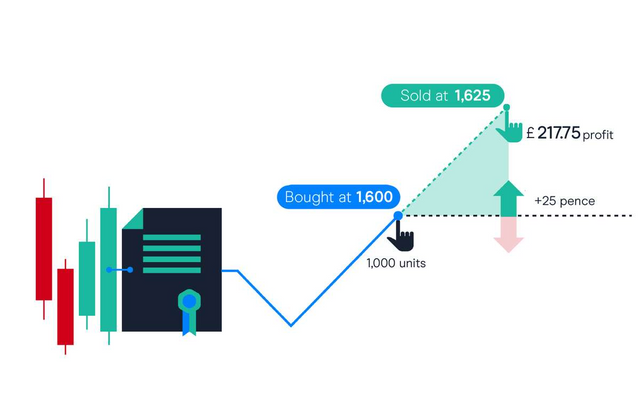

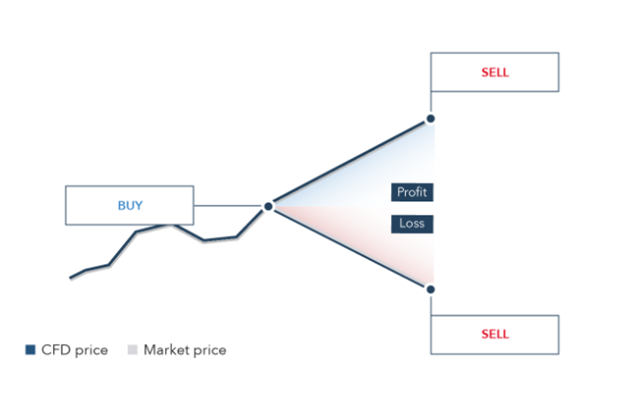

How do CFDs work?

FD trading starts

working when the traders take a position on whether an asset will increase or

fall in price. The working mechanics of CFDs is given below. The broker offers an

asset in the form of CDFs to the traders. This asset can be a stock, an index,

a currency, etc. Then the traders open a position about the asset and set

different parameters in terms of a long or short position, leverage, and

invested amount.

Both the traders and brokers participate in a contract and agree on the opening price of the established position along with fees. Now the position is opened and remains open until the trader decides to close it, or it is closed automatically in a planned way after reaching a Stop Loss or Take Profit point. It will also close when the contract gets expired.

Now, the profit or loss is determined. If the position closes at the point of profit, the broker will pay the trader. But if the broker is closed on a loss, the trader will be charged by the broker for the differences.

Q2. How do I know if cryptocurrency CFDs are suitable for my trading strategy?

Cryptocurrency CFDs

are leveraged goods. These products offer us profit from highly volatile asset

price changes. That is why they are not reasonable for every trader. CDFs can be fruitful

for our trading schemes when we have the following factors in your mind while

trading.

- we have to keep in mind cryptocurrency is not cheap but too expensive in terms of purchasing.

2. I need to find exposure to the crypto-asset business without holding capital.

3. Earn a profit from trading on margin. It is a nearly low initial capital.

4. I need to quick wins on small price changes through your investment policies.

5. Follow up a short-term trading strategy to get profit.

6. Hint at high as well as low position of cryptocurrency rates.

7. Get benefit from a safe trading environment. Usually, regulated CFD brokers provide several protections for their investors.

8. Enjoy risks while trading in a stressful environment. As profit and loss are a part of marketing.

So, CDFs are not

suitable for those investors whose aim is to preserve capital and they cannot

tolerate risks.

Q3. Are CDFs risk Financial Products?

CDFs are considered complicated and risky financial products because they follow up the terms and policies of leverage and margin trading. Traders worldwide use CDFs because of the leverage feature. Leverage (a double-edged weapon) in CDFs cryptocurrency allows investors to get exposure to the financial markets with smaller capital. This strategy is called margin trading.

For Example

If you buy $50,000

worth of real bitcoin at $8,065 per BTC. Then you resell it when BTC has

reached $8,865. It means $50,000 is needed to make a $4,874 profit. This is an

unleveraged way of trading bitcoin.

But in leverage trading, a bitcoin CFD trader requires trading a $1,000 account with a 1:50 leverage offered by the broker. It will make the same profit by only putting down $1000. But there is also a reverse from profit to loss if your stocks come down. That is why leverage trading is a double-edged sword. Not all the brokers offer CFD's.

A Demo Account (Trading CDFs Cryptocurrency)

Start trading

Cryptocurrency CFDs with a free demo etoro account. You can trade CFDs in

cryptocurrencies with a free demo account because it offers no risk. It seems a

better way to know whether you are good at investing or not. It is the perfect

way to find out if you are good at investing.

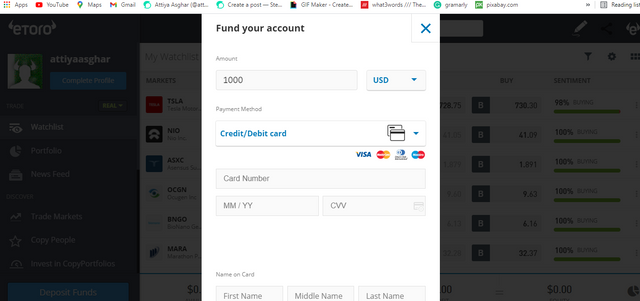

Visit the following link and steps to make an eToro account

To make an eToro account, firstly go to google, search for eToro by this link https://www.etoro.com/.

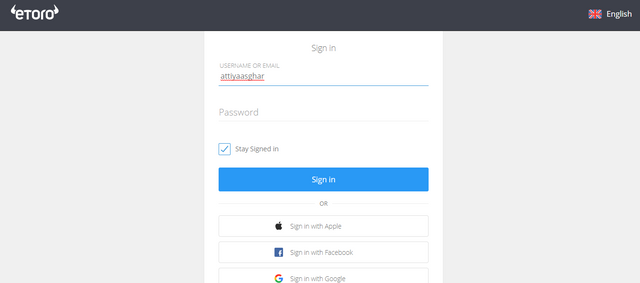

Sign in and create the account

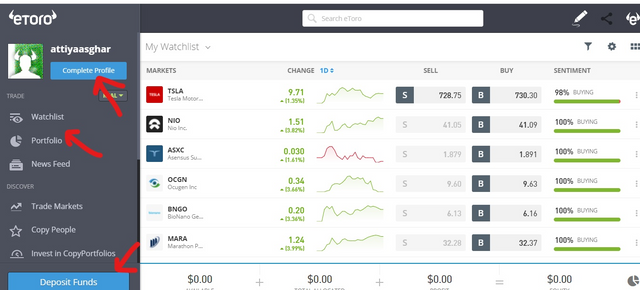

The Home page will be open. Complete the required profile information.

Click on deposit fund.

Conclusion

Cryptocurrency CFDs are recommended products and offer more inclusive exposure to the digital currency market through leverage. Simply, you need to adopt changing strategies to become a successful trader and tolerate risk. I hope you understand and enjoyed reading post

regards,

Hello @attiyaasghar,

Thank you for participating in the 2nd Week Crypto Course in its second season and for your efforts to complete the suggested tasks, you deserve an 8/10 rating, according to the following scale:

My review :

Good content overall, you answered the questions clearly. You could have had another experience with another broker and it would have benefited everyone.

Thanks again for your effort, and we look forward to reading your next work.

Sincerely,@kouba01

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you so much professor..

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear 💗 You are doing a great work and hard work too! May Allah grant you success.❤️

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you Ayesha..may Allah tallah bless you too with many more

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit