Let me introduce myself before starting the homework task. I am Atul Pathak lives in state-Bihar, India. I am an agriculturist and help farmers with different planting techniques. I am also a crypto lover and I always try to learn different trading strategies.

Now I am starting my homework.

Introduction

In this homework, we will be dealing with a great strategy that helps the traders to save their capital. For a trader who trades on any crypto pairs or the businessman having a small shop, the capital is the most important thing which decides how much profits are expected after a successful trade. Having very small capital result in very little profit. Trading in crypto is easier if we could better manage our portfolio by saving ourselves from losing capital.

Question 1-Select two Crypto, perform fundamental analysis and based on your fundamental analysis Explain why you chose them. Exclude BTC, ETH, RUNE. Develop and justify your answer. Be original.

There are thousands of cryptocurrencies listed on different exchanges. Some of it pumps initially so that a newbie trader puts his money and suffer from loss after the dump. Founders of these coins usually show fake promises about roadmaps. When I was new, I was also doing these types of investments but then I got to know that real investment should be done after analysing the white paper, their recent development, the roadmap of crypto coins and many more things. Then I made a list in my Binance account and added them into favourites.

As asked in the question, I will choose MATIC and HBAR coins for this homework because these are some of my favourite coins and most importantly these are ranked under 50 in the coinmarketcap list.

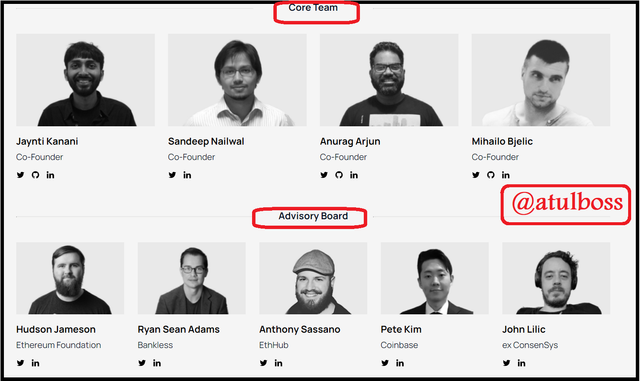

MATIC- Polygon

a). The team of this coin had a vision of solving the scalability and usability issues.

b). It is having a very fast transaction speed without compromising decentralization.

c). It chose the Ethereum network as the first platform to solve its scalability and the team are testing it on Kovan Testnet.

d). Matic Foundation is planning to start Matic wallet, payment APIs & SDKs, products, identity solutions and other enabling solutions that will allow developers to design, implement and migrate DApps built on base platforms like Ethereum.

e). It uses Proof of Stake so that after a certain time (less than 2 seconds) interval it generates a block and have a tendency to complete around 65000 transactions per second.

There are many more things in MATIC coins that make it very interesting and different from other coins.

For more details of its whitepaper, I am mentioning the link

Now, I will open the coinmarketcap to answer Why I chose this coin?

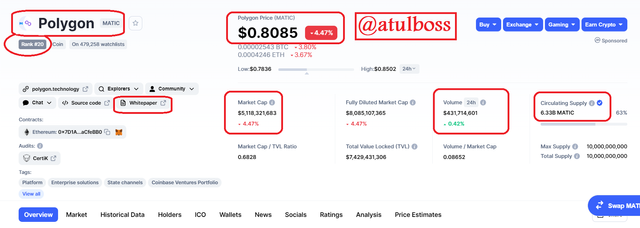

MATIC on coinmarketcap

MATIC on coinmarketcapThe above screenshot shows the coin name, its ranking on coinmarketcap, total volume, 24 hr volume, details about the whitechart, current market price in USD, BTC and ETH value.

At the time of making this homework, the price of MATIC is 0.80 USD, 2583 satoshi and 0.00004246 ETH. Its ranking on coinmarketcap is 20th which I personally like in this coin. I trust this coin that the team is working actively and are trying to push it towards single-digit rank with their development.

When it was newly listed on binance, it was pumping with great stability and it pulled my attention towards it. In a bear market, it dumped to around 50 satoshi and I bought some of MATIC coin after I read the whitepaper and its roadmap. It gave me a good profit. It always has a very good volume. In the above screenshot, we can see that in 24 hours it has a volume of $431,714,601. The Circulating supply of MATIC coin is 6.33 Billion.

MATIC is listed on almost all major exchanges like Binance, Coinbase, FTX, Bittrex, Poloniex, Gemini, Huobi, Kraken, Gate, Kucoin, Bithumb, Okex, UniSwap. This long list of exchanges listed MATIC shows that it has a good project and it can do better in future.

Here in the above screenshot, we can see that the MATIC coin has a team from all over world who are doing research and making this project better.

HBAR- Hedera Hashgraph

After reading the whitepaper, I got to know that HBAR is also involved in good developments which is discussed below:

b). Public hashgraph network and governing council.

c). Tokenization

d). Decentralization of consensus

e). Data Privacy

These are some developments and plans visioned by the team. For reading the complete whitepaper I am providing the link.

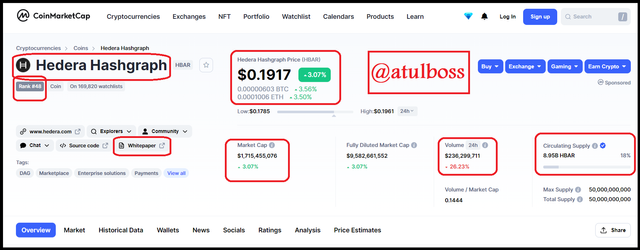

Now, I will open the coinmarketcap to answer Why I chose this coin?

At the time of making this homework, the price of HBAR is 0.1917 USD, 602 satoshi and 0.0001004 ETH. Its ranking on coinmarketcap is 48th. I like and trust those coins which are ranked below 50 in coinmarketcap. The most important part to which I am much influenced is that its price does not go much down and on the slight dump, it recovers its price quickly.

The total volume of HBAR in 24 hours is 236,299,711 and its total circulating supply is 8.95 Billion.

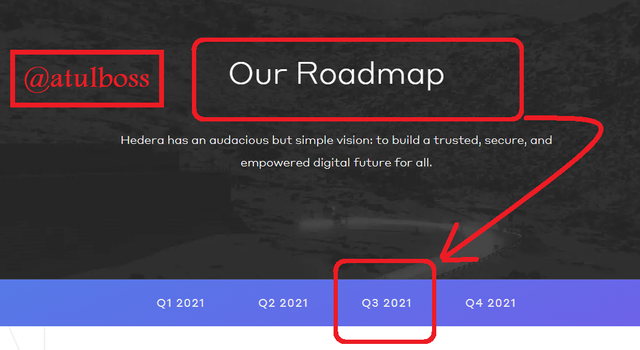

Talking towards little more details about HBAR, we should not miss the roadmap of this coin. As we are near to the third quarter of the year 2021, here are list of the roadmap:

- Staking Rewards

- State Proofs

- Sharding

- Open node monitoring

- Full Mirror node

- Additional network automation

Question 2- Through your verified Exchange account (screenshot needed), make a real purchase of one of the cryptocurrencies selected in the first assignment and explain the process. The minimum investment must be 5USD (mandatory) and must present screenshots of the verified account and the whole operation.

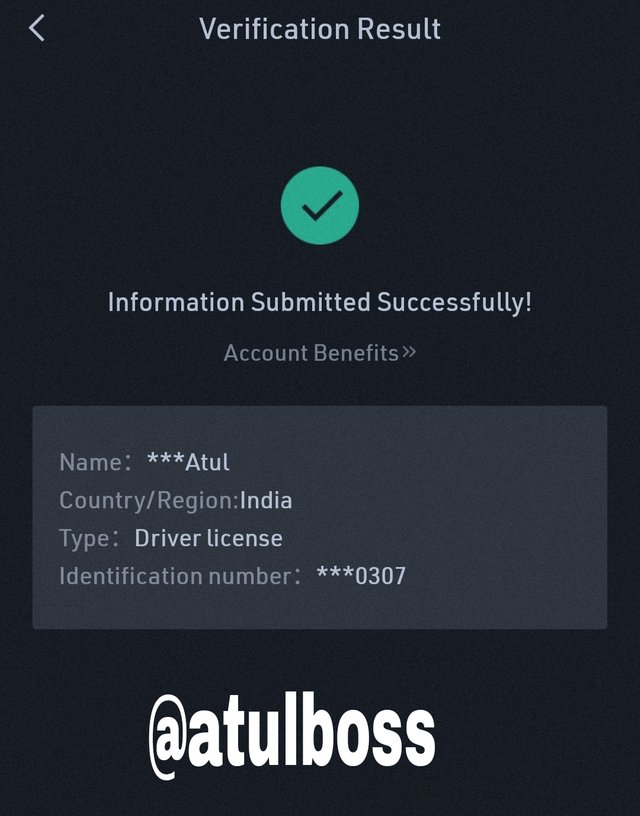

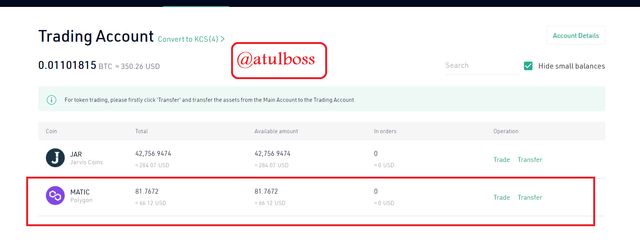

Here In the below screenshot, I am showing my verified KUCOIN account.

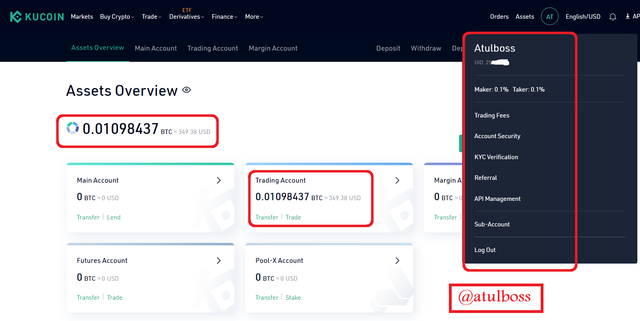

I have total assets worth 0.01 BTC in which around 66 USDT are there.

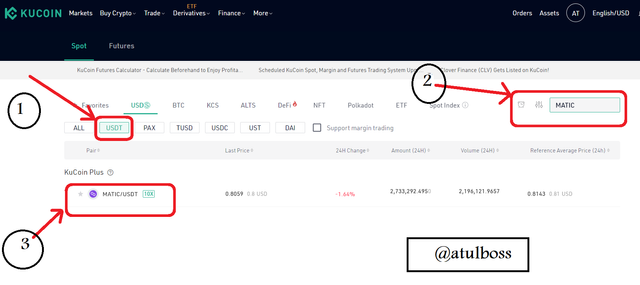

Now, as asked in question I am going to buy MATIC coin with my USDT in the same KUCOIN account.

Let's see the process of buying it.

In the above screenshot, I am choosing USDT pair, because in KUCOIN exchange MATIC is available in USDT pair only. So after choosing USDT, we will search MATIC in the search bar and open the market.

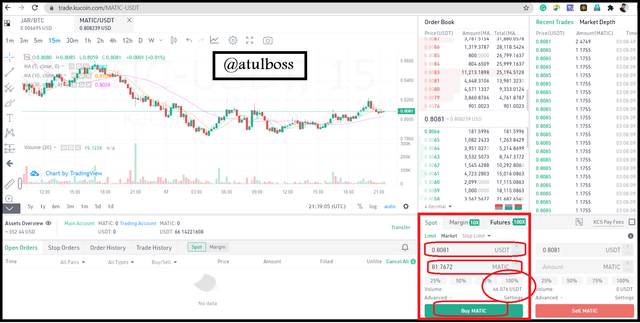

In the above screenshot, we areable to see the amount of MATIC to buy, price of MATIC to buy and also we get the option so that we can easily choose the 25%, 50%, 75% and 100% of total available capital to buy the MATIC coin. I am here choosing 100% amount of available capital to buy the MATIC coin.

I bought it at market price so instantly I got it in my wallet.

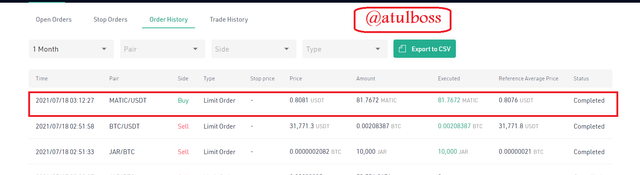

We can also see it in order history whether the order is completed or not.

So, here I have completed the task given in the 2nd question.

Question 3- Finally, make a simulated exercise, using the DCA method to perform the purchase of two assets and present charts showing the data of days in which the operation was performed, price of purchases, average price, sell point, percentage of profit or loss. (include screenshots)

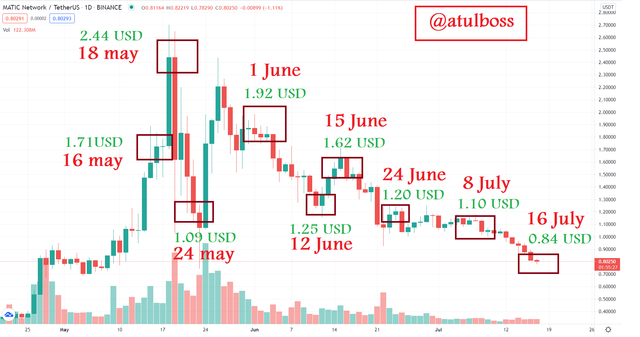

DCA method in MATIC

I made 9 trades in which I bought the same quantities of MATIC at different prices in USDT.

Let's see how DCA works here,

It can be clearly seen that 2nd trade was the biggest mistake which could result in a huge loss but after applying DCA, I managed to average the buy price.

After adding every trade buy price,

1.71+2.44+1.09+1.92+1.25+1.62+1.20+1.10+0.84= 13.17 USDT

dividing it to the total number of trades that is 9, we get the average price,

13.17/9=1.46 USDT

That means if by mistake we have bought the MATIC will full funds at 2nd trade point, we would be in huge loss, but after averaging, we reduced our average buy price to 1.46 USDT.

For a good exit, if I sell my all MATIC coins at buy price of 2.44 USDT, I will be getting nearly 67% of overall profit. That's why I loved this strategy very much.

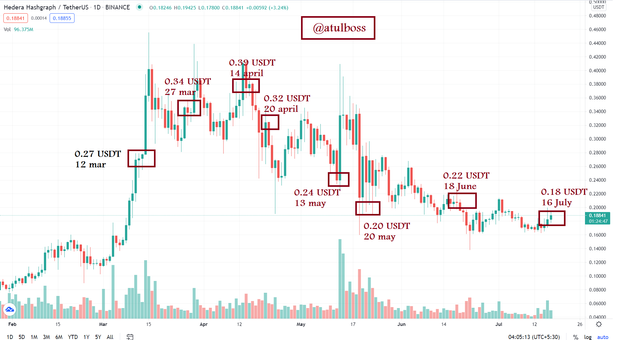

DCA method in HBAR

I made 8 trades in which I bought the same quantities of HBAR at different prices in USDT.

Let's see how DCA works here also,

It was bearish from the long term at I am accumulating it and doing price averaging. Now, let's see what is my actual average price.

After adding every trade buy price,

0.27+0.34+0.39+0.32+0.24+0.20+0.22+0.18=2.16 USDT

dividing it to the total number of trades that is 8, we get the average price,

2.16/8=0.27 USDT

We can clearly see that at some points I bought HBAR at 0.39 USDT and now after applying DCA my average price is 0.27 USDT which is 30% lower than the high buy price. So I saved around 30 % of my capital in this trade. If I sell it at the price of 0.39 USDT which was buy price of some HBAR, I will be getting about 50% overall profit. This is awesome.