Greetings to Respected professor @yousafharoonkhan and dear steemitian friends.

Let me introduce myself before starting the homework task.

I am Atul Pathak lives in state-Bihar, India. I am an agriculturist and help farmers with different planting techniques.

I am also a crypto lover and I always try to learn different trading strategies.

This was a great lecture from @yousafharoonkhan about Exchange order book and its uses as well as methods for placing different orders and I learnt many new things today which will definitely improve my trading skills.

Thanks for this amazing lecture.

Now, I am starting to write my homework.

Order book

Order book in general terms is defined as a book having a list of different items(*items are crypto pairs when talking about crypto markets) which are ready to buy or sell by different traders. So, it appears as a list in which we get a simple idea that is the desired price range of a particular item that is traded by a trader. There is a lot of exchange which gives us the facility to trade in different pairs of crypto coins such as Binance, Kucoin, Bittrex etc.

These exchanges make a list of buyer's price for selling and buying which is called the Exchange order book.

How crypto order book differs from our local market. Explanation with example

In our daily life, we use to go for shopping necessary items either physically or we buy it online. Buying products from the local market may give us the facility to bargain at the maximum level. Here in India, If we get success in bargaining at the desire price level we instantly buy products but if we don't get a good buying price we do have options to buy the product or not. It depends on the actual need of items whereas if we talk about crypto we can't buy it physically so we need an exchange to buy or sell crypto and exchange facilitate us in biding our desired price while buying or selling the crypto. Putting the bid doesn't assure us that our trade will be successful. In the local market, always there is competition between different sellers. Vegetable sellers in the local market having perishable goods have much selling pressure than a crypto trader so there are chances of price fluctuation in the evening time. But in crypto trading fluctuation in order book can only be seen in sharp crash of the market, new coin listing or any impactful fundamental news. The main difference between the order book of the local market and the exchange order book is that the local market doesn't have the clear cut-price range and may vary upon the bargaining tendency of the buyer but in the exchange order book, we can see all the price range at which we can make a successful trade. If we are not getting a satisfactory price, we may place a bid for future trade. In the local market, we can't see the actual desired buyer of the same product but in the exchange order book, we can see the total buying volume and selling volume.

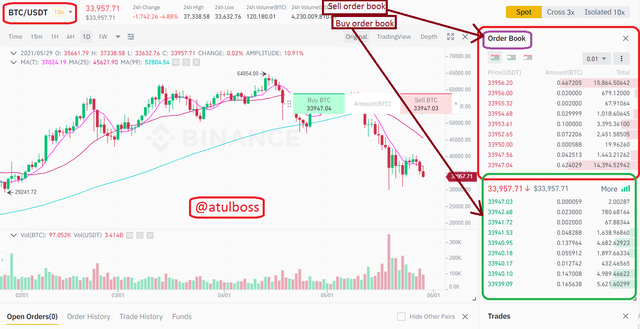

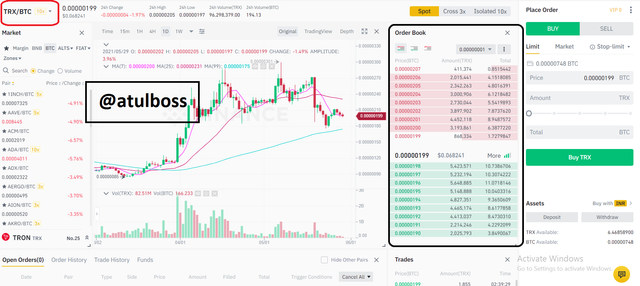

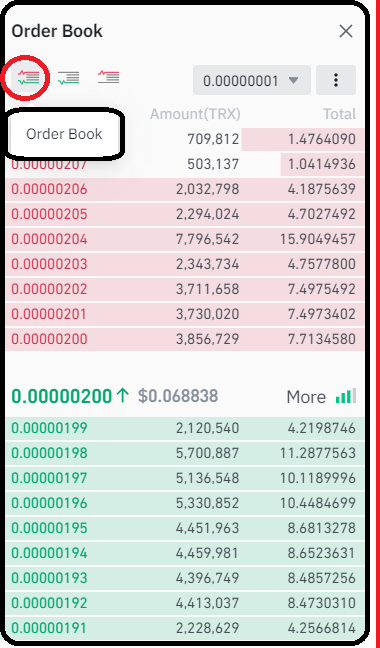

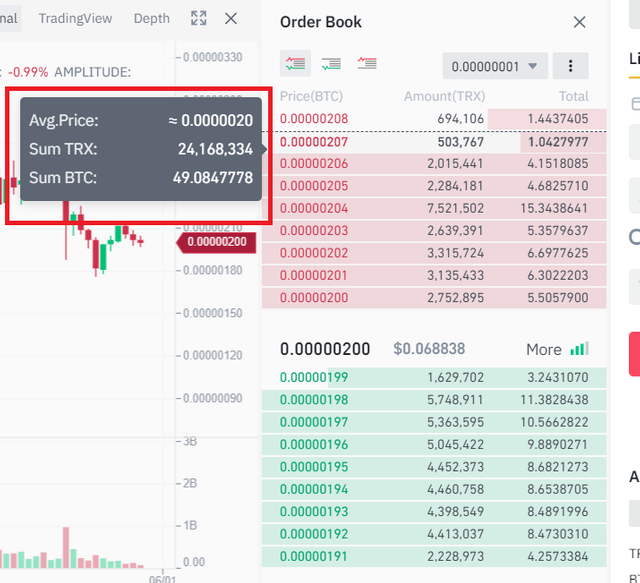

The above screenshot clearly indicates the purpose of the order book. Here we can see that different traders either buyer or sellers are putting their desired price as well as desired quantity. The buyer order book is green coloured and the seller order book is red coloured. Also

The above screenshot indicates that trades which are successfully been completed. In this, bought and sold trades are shown in the queue according to real-time in which it had been completed in a single row.

To find an order book in any exchange

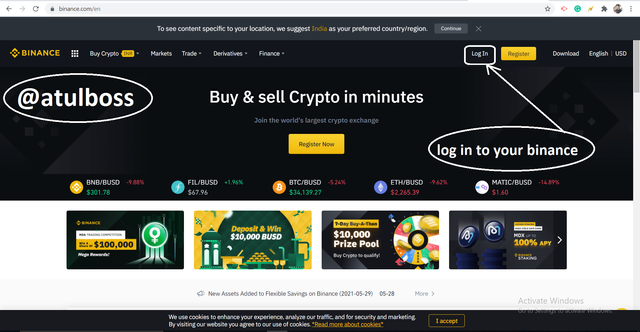

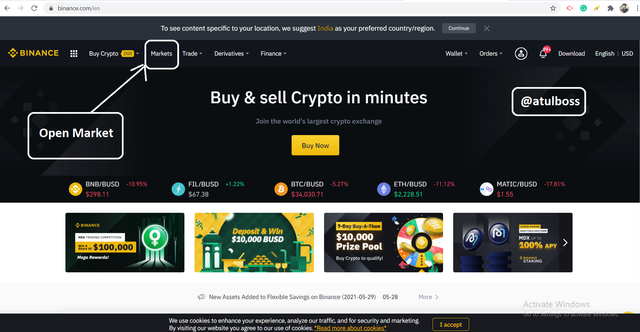

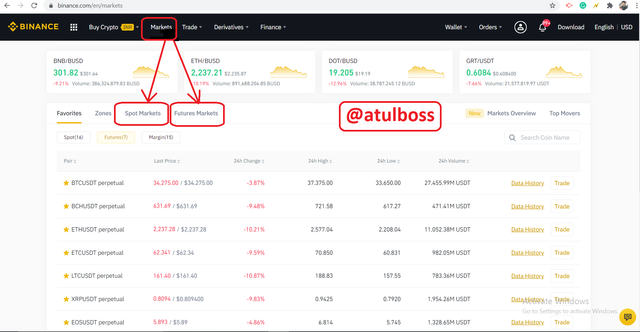

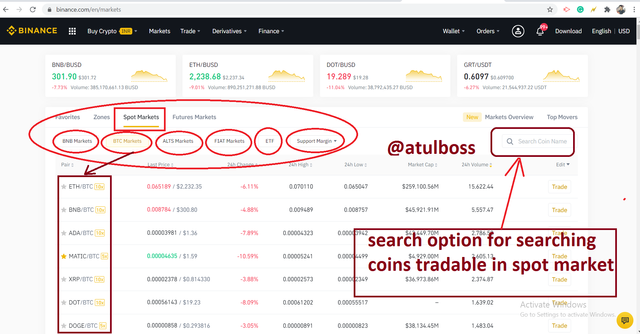

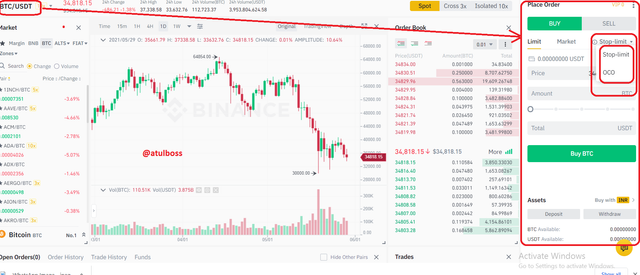

Here I am going to explain the way to find the order book in Binance exchange step by step by some screenshots of my account.

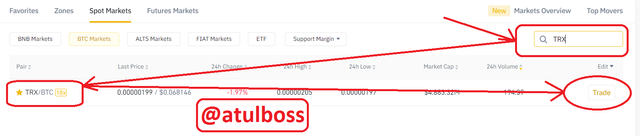

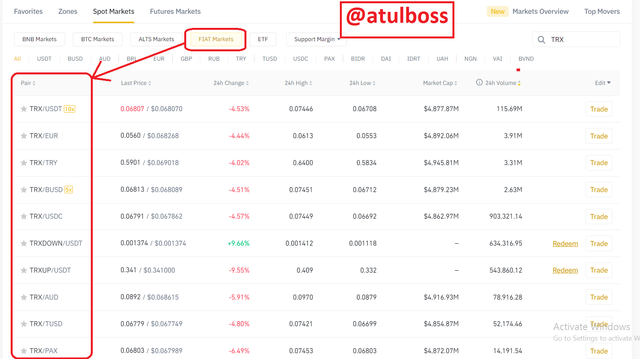

After choosing the spot market we will able to see different tradable coins with different pairs. For example, I have TRX in my account, and I want to sell and buy Bitcoin, then I will be chosen the Spot market of BTC pair. When we have chosen the spot market, we will see the SEARCH bar, which helps us to search coins tradable at the spot market at particular pair. In my case, I am going to search TRX/BTC pair.

In the above screenshot, we have chosen TRX paired with BTC but you can check that it may be paired with different coins also like BNB, USDT or some other stable coins like BUSD. For choosing different trading pairs, Binance allows you to choose alts market, Fiat Markets. I am showing the screenshot below.

As we have chosen TRX with BTC pair, here is a screenshot below showing how we find the order book.

Explaination of some technical words

Pairs:

Pairs are simply defined as tradable coin. For example, If I want to buy something that means I will have to sell something. In the screenshots, I have shown the example of the TRX/BTC pair. It means that if I want to sell TRX and buy BTC then I will search for someone who wants to sell BTC and buy TRX. I will go to the order book of the same trading pair and will put my selling bid. When a buyer agrees to my price he will sell his BTC and buy my TRX. That's why there is much significance of trading pair in the trading crypto market.

Support and Resistance

These are the lines drawn after technical study of the market which represents market movement between a range.

Support and resistance are the very basic form of technical analysis which create a great impact on traders psychology. Usually, traders put buying orders at support and selling orders at resistance. We will see the Support and resistance lines in the screenshot.

Support pushes the market upward and prevents it from falling down.

Resistance pushes the market downwards and prevents it from going UP.

When breaking in resistance take place, there is the formation of new support occurs and broken resistance act as support and vice versa in case of support also.

Limit Order

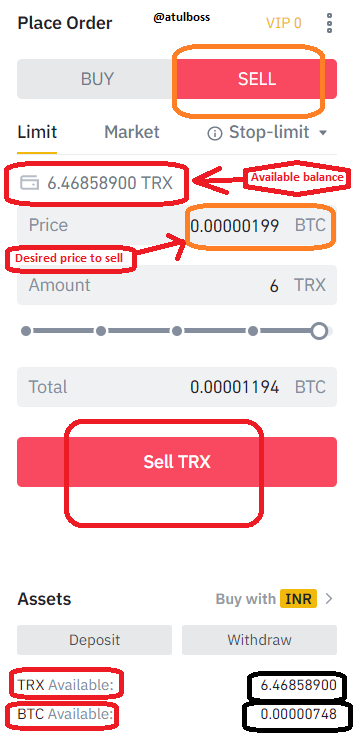

In the below screenshot, I am showing the Limit Order which facilitates us in making a bid at our desired price of the trade.

As I have to sell the TRX, the red coloured icon is visible in the Place order option. Then we get three more options, which is LIMIT, MARKET and STOP LIMIT.

Here we will discuss only Limit.

Look at the available balance of TRX. This is the maximum balance in my Binance account that is available for trade. The below available balance price option is there. Here we can set our desired price at which I want to sell my TRX. Below the total amount, there is a slider, we can move it to 25%, 50%, 75% and 100% of our available balance. Then we press SELL.

Putting LIMIT buy/sell doesn't assure that our order will definitely be filled but it depends on the actual price of the coin.

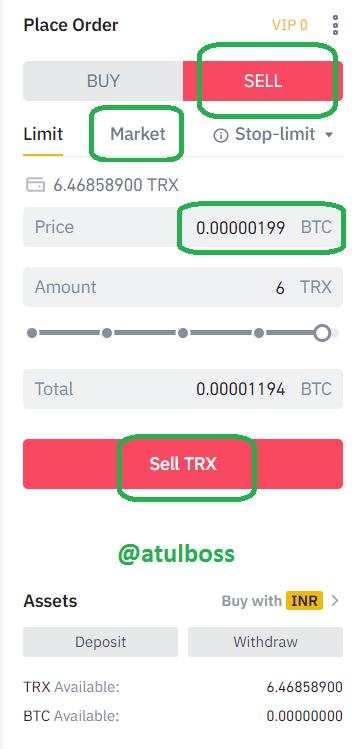

Market order

In the screenshot below, we can see that while making an order via the MARKET option, we don't have permission to make the bid of our desired price. Our order will be completed here at the current market price.

Simply put the exact quantity of coin you want to trade from your available balance and put the SELL/BUY button. The trade will be automatically completed within a second. This feature needed in an emergency situation when funds are hardly needed.

I have not shown any of the Open order because I didn't have a sufficient amount of balance for trade.

Note: For trading, we have to keep a minimum balance so that a trade can be executed.

Important features of order book

The order book has three important features.

Order Book

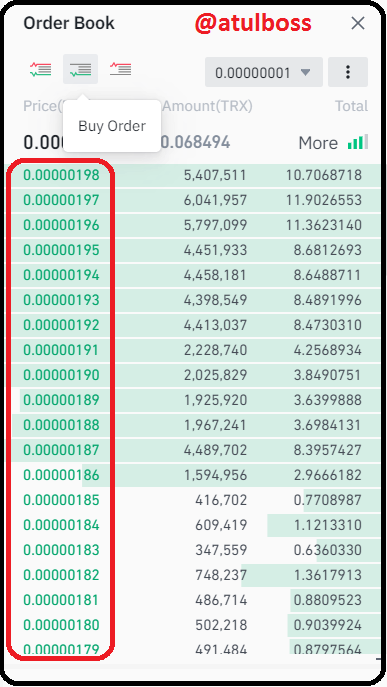

In this, the user sees both the buy orders as well as sell orders simultaneously. It helps in analysing the difference between selling pressure and buying pressure.Buy Order

In this feature only buy order can be seen.

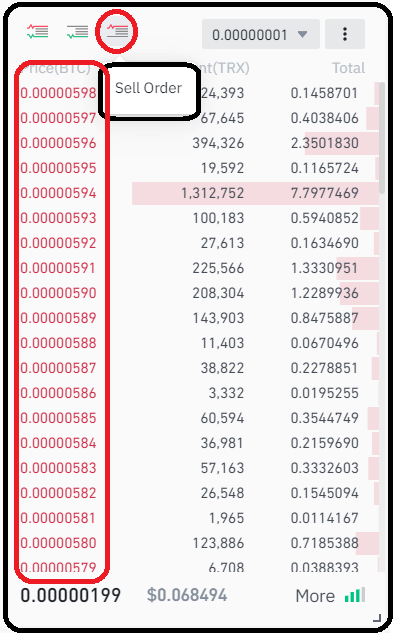

Sell Order

In this feature only sell order can be seen.

Some other features are:

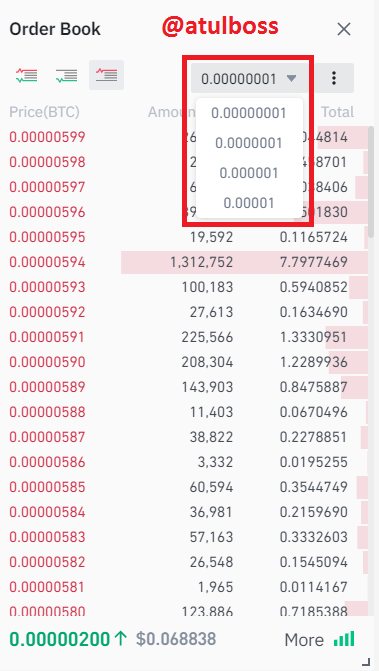

*Decimal Conversion:

This feature allows the users to see the coins in a fewer decimals system. Usually every crypto has 8 digits after decimal but enabling this feature user can see up to 5 decimal numbers.

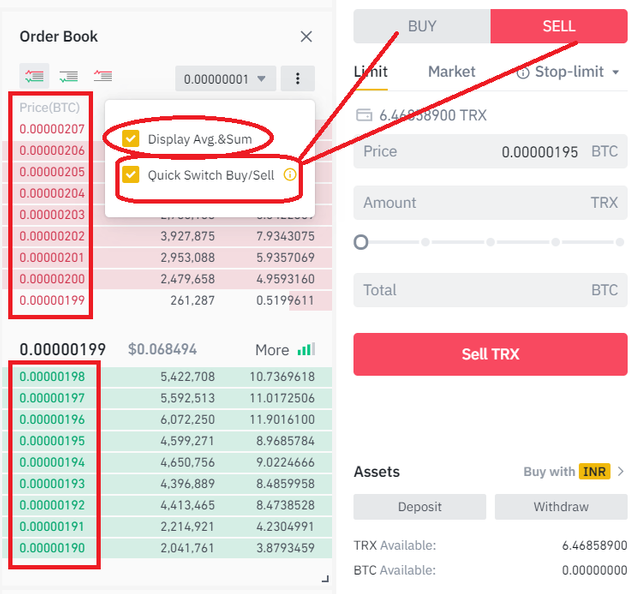

*Display Average Sum:

By this feature, a trader can see the average price of a trade by simply moving the cursor to the bid order.

*Quick switch buy and sell:

By this feature, a trade can switch the PLACE ORDER by clicking on Buy Order and Sell Order

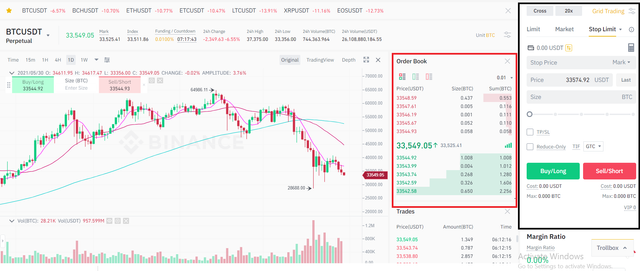

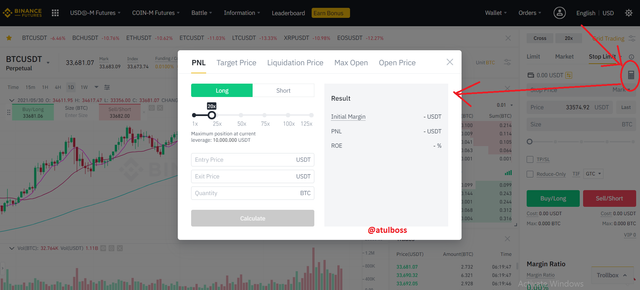

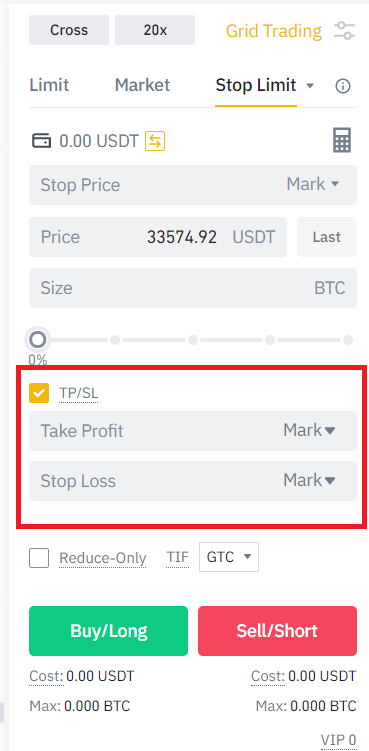

Let's see some of the order book features of Futures Market

All the functions are almost the same in the futures market except leverage trading. You can take leverage up to 125x in the futures market.

Here you also get options to set Stop loss and take profit.

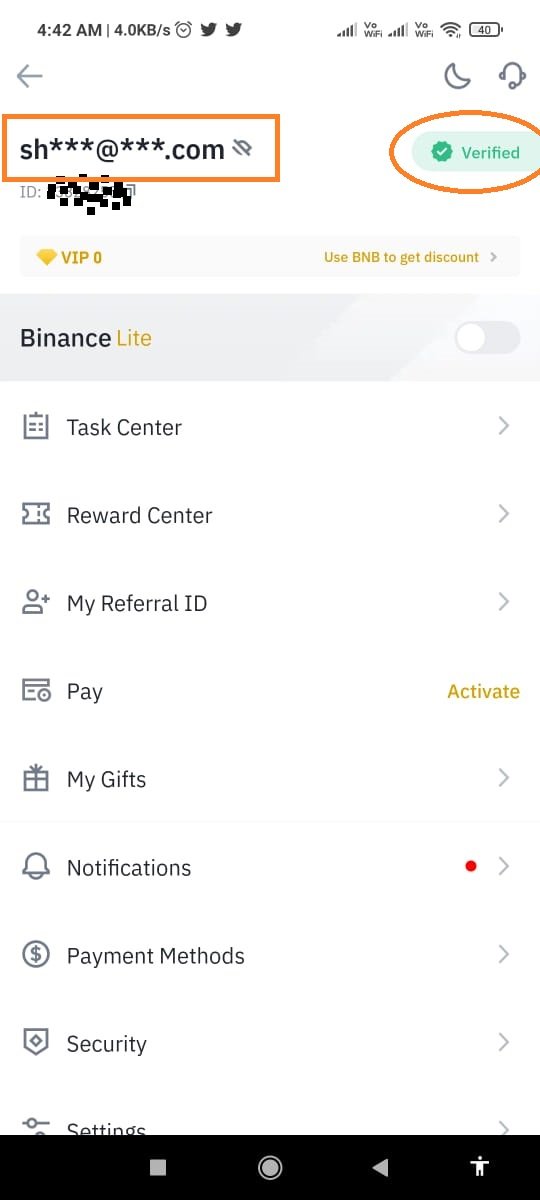

A screenshot of my exchange account verified profile

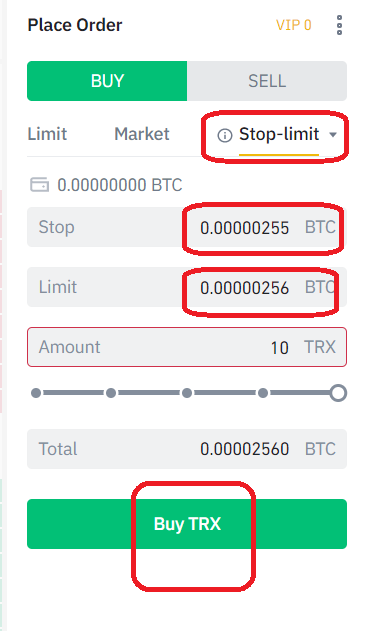

To place Buy and Sell orders in Stop-limit trade and OCO order

We have seen above how to limit order and how to place a trade at market price. Now we will see the steps to apply the Stop limit then we will also see how to apply OCO while buying or selling order.

I am able to see the Stop limit and OCO option in my verified account.

Stop Limit:

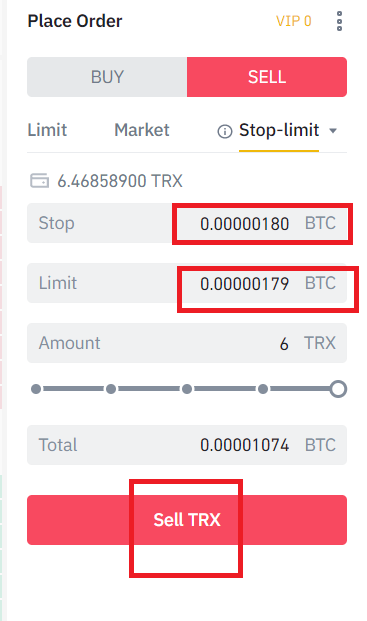

To apply Stop limit click on Stop limit.

While buying, we have to keep in mind that in the STOP column we must place a bid of a lower price than the current price so as to facilitate the easy buying of coins in case of any sudden pump. Limit column will be filled slightly higher price than STOP price because in case of market pump automatic higher bid will be placed and then it may result in quick buying. When the price will touch the stop price the buy bid will be automatically placed.

While selling also, we have to fill the STOP column with a bid of a higher price than the LIMIT price so as to facilitate the easy selling of coins in case of any sudden dump because in case of market dump automatic lower bid will be placed and then it may result in quick selling. When the price will touch the stop price the sell bid will be automatically placed.

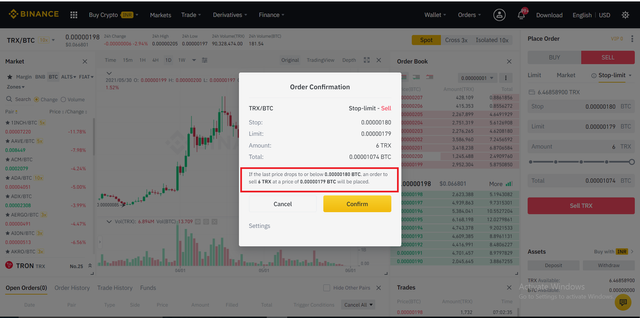

After placing the STOP, the exchange will confirm by the user like this. Please have a look at the screenshot.

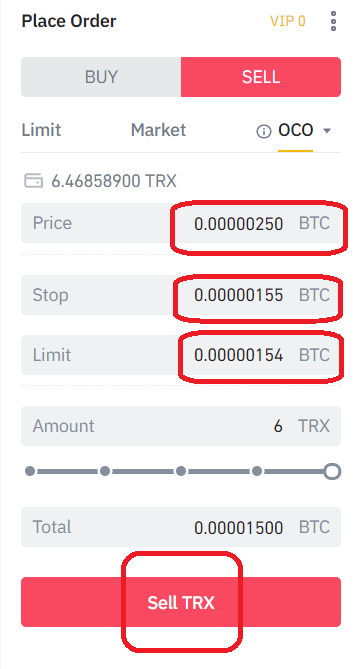

OCO(one-cancels-the-other) order

This is the great features that prevent traders from uncertain loss. Imagine a situation in which a coin is dumping for a week and trader think that it will dump more. So he put a Stop loss into it. Applying stop-loss prohibiting a trader to apply to take profit. In case of a sudden pump, he will miss the profit.

This situation created the demand of OCO, where the sudden pump will hit take TAKE PROFIT and trader book some profit out of it.

OCO creates a situation that cancels the Stop loss in case of hitting of Take Profit and it cancels the Take Profit in case of Stop loss.

In the price column, we will put our desired price at which we want to sell the particular coin. I have taken the example of TRX and its current price is 199, and I want to sell it at 250 satoshi, so I will put the price column with 250.

Now, I will put STOP 155 and LIMIT to 154. This means in case of reversal in the market, as it touches 155 satoshi price, automatic sell will be happening at 154 price and Take Profit bid will automatically cancel.

Order book help in trading to gain profit and protect from loss:

- It is having many features like a Limit order which gives chances to bargain while making a trade, a Market order which helps in emergency trading in case of any wrong coin selection or if we want to long hold the coin and a Stop Limit order which helps trader from unusual losses in case of market dump and high volatility. Also, a trader can make a profit by using OCO features.

- It helps the trader in knowing the market sentiments.

- It also facilitates us to know the trading volume in real-time.

- Having some knowledge of support and resistance, a trader can take some profit by swing trading using OCO features and risk management.

- Order book has one most important feature is to switch the PLACE ORDER. Suppose there is a case when BTC is dumping in a long spike and a trader well knows the support, he will sell the BTC into USDT and switch again from USDT to BTC with a single click.

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

it is profile verification screenshot i could not understand it , where is your verification words profile,,,

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am sorry. I don't know how it has been uploaded the wrong image. I have edited the post and uploaded the correct image. I know that if once the task reviewed, the grade cannot be changed, but at least look at the new screenshot to reply if it is OK or not?

Thanks for the review.

@yousafharoonkhan

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have been upvoted by @sapwood, a Country Representative from INDIA. We are voting with the Steemit Community Curator @steemcurator07 account to support the newcomers coming into Steemit.

Engagement is essential to foster a sense of community. Therefore we would request our members to visit each other's post and make insightful comments.

Thank you.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit