Welcome once again to another wonderful episode in the crypto Academy community. Before I present my homework post, I would like to acknowledge the professors and the crypto Academy community for making such an educative lecture possible. Today the topic is all about trading.

Ethereum Trading

Ethereum is the second-highest-priced cryptocurrency. Ethereum is one of the most valuable cryptocurrencies. Talking of its wide range of used cases, ETH is accepted by many organizations and companies. According to altcoins ranking, Ethereum stays at the first position with a very high dominance.

However, Ethereum price moves along with the price of BTC. When BTC increases, there's a very high possibility of ETH rising as well.

.png)

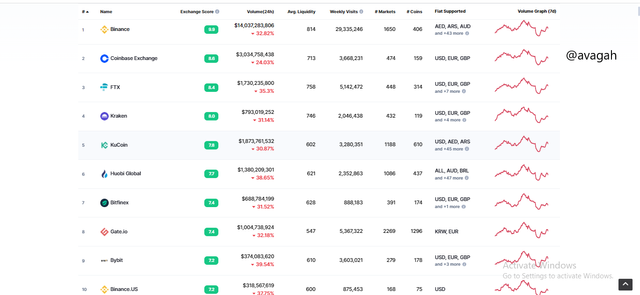

From the screenshot above, we can see the current market price of Ethereum, the current market capitalization, and the current cryptocurrencies rankings as well. There's is no doubt that Ethereum has the second highest market capitalization among all the cryptocurrencies.

Being one of the most popular crypto assets, it is currently on most of the exchange platforms to be traded. If not available on all the exchange platforms, it is available on 90% of the exchange platforms.

.png)

Techinical analysis for Ethereum

Here we would be performing a complete analysis on ETHUSDT. Since price action entails all the technical tools for analysis, I would use the concept of price action in my analysis.

Every good trader starts analyzing the longer timeframe chart. Here, we would start with the 4-hour timeframe chart.

Analysis from 1-day timeframe chart

For the 1-day timeframe chart above, we can see clearly that, the long-term trend of Ethereum is bearish. The downtrend started from ending of 2021 till date.

However, the price hits a strong support level and started to retrace back. Unfortunately, the price still turned back in the bearish direction after retracing.

The price hits the strong support level and bounced back which confirms the bullish trend reversal. Since triple bottom was formed.

The price has broken above the trendline which is an indication of a bullish trend reversal.

Analysis from 3-hours timeframe chart

According to the 3-hour timeframe chart, the price is still in a bearish trend. However, the price has currently broken above the trend which indicates a bullish trend reversal.

There’s a resistance at the top which the price needs to break for further confirmation. Hence according to the 3-hour timeframe chart, the bullish trend is not vividly confirmed.

Moreover, the MACD Indicator is also showing a bearish crossover for sell signals. But when there’s a sell signal above the 0 levels of the MACD, it’s considered a false signal. Likewise, when there’s a buy signal below the 0 levels of the MACD it’s also considered a false signal.

Hence we can conclude that the 3-hour timeframe is not giving perfect signals at the moment.

Analysis from 1-hour timeframe chart

Here, we would take trade entries.

We would use a simple strategy called the break and retest.

Since we all know the current state of the market is bullish, we allow the price to break the previous high and retest before we enter trades.

From the chart above, the price has just hit the trendline which suggests that we can quickly enter into trades.

We enter the market when a clear bullish candlestick is identified.

Place a stop loss and a corresponding take profit ratio just like the data in the chart above.

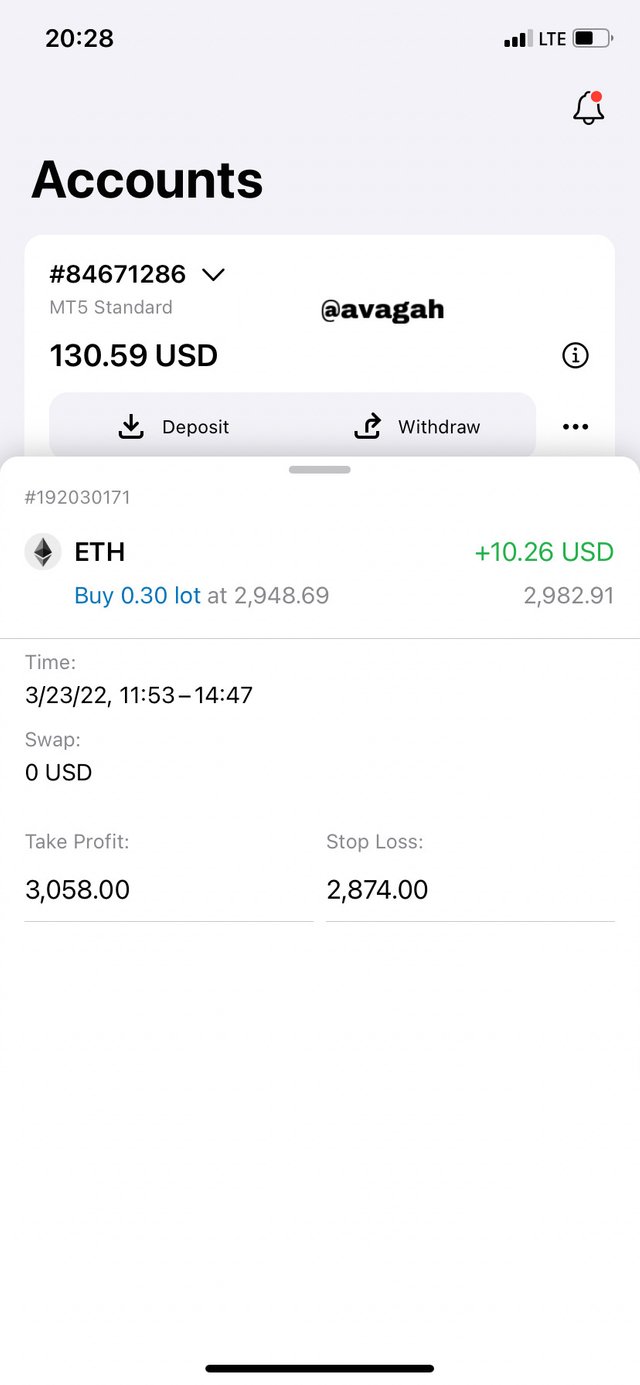

Real Transaction from my Exness broker account.

CONCLUSIONS

Trading is now the order of the day. Traders in the crypto ecosystem use numerous strategies to executed trades. However, I recommend everyone to master some 2 or three strategies which could be very profitable. Using different strategies every time would cause more harm than good.

Don't forget to use good risk management in trading. Always make sure your risk-reward ratio favors the profit. Do not risk money you are not willing to lose. Better still you can still use the 1% rule to reduce your risk.