Welcome once again to another wonderful episode in the crypto Academy community. Before I present my homework post, I would like to acknowledge the professors and the crypto Academy community for making such an educative lecture possible. Today the topic is all about trading.

Polygon (matic) Trading

The polygon is one of the most renowned blockchain technologies which was built byJaynti Kanani, Sandeep Nailwal and Anurag Arjun, and some blockchain developers in 2017.

The main aim of the project was to solve blockchain problems. The ETH blockchain network and the bitcoin blockchain seems to complete transaction very slow and charge huge transaction fees as well. However, the polygon improved on both the scalability and transaction fees problem. Moreover, the polygon provided better security to transactions as well. This has prevented double spending which was previously common on the ETH and Bitcoin blockchain network.

The Matic being the native token on the polygon blockchain network was initially built to be used as a transaction fee. Just like many other native tokens on other blockchain networks. However, the polygon blockchain has been able to solve many problems and has widened its use cases. Due to its performance, the Matic token has increased tremendously over the past few days.

The Matic can complete 65,000 transactions within a second which proves to be one of the fastest blockchain networks among the old blockchain networks. Moreover, Matic makes blocks confirmation in less than 2 secs.

.png)

Technical Analysis of Polygon

Good traders always start analyzing the longer timeframe. No traders would like to trade against a trend. A good trader taking buy signals in a bearish market could cause more harm than good. Hence, it is very advisable to start the analysis in a longer timeframe.

Analysis from the 1-day timeframe

The 1-day timeframe shows a clear bearish trend. The trend started in the last days of December 2021 and still moving bearish.

However, a double bottom has formed at the end of the trend which indicates a bullish trend reversal. But the price seems to be retracing when it touched the trendline. This could result in a clear triple bottom formation.

The MACD falls below the 0 levels indicating a downtrend. However, the MACD also indicates the weak volume in the downtrend.

Analysis on the 2-hour timeframe

The 2-hour timeframe also shows a clear downtrend. Forming a series of lower lows and lower highs. However, the market formed inverted head and shoulders patterns indicating possible uptrend formation.

The William %R indicator is also found in the oversold region which confirms the presence of a possible bullish trend reversal.

This means, if we are going to make a swing trade, we would go for buys since all confluences are aligned in the right order.

However, we would be making some quick scalp on Matic which means we would use the shorter timeframe to make our entries.

Analysis on the 30mins timeframe

According to the 30 mins timeframe chart, the market is forming some bearish market structure.

Here, we draw a trendline on the bearish trend.

We used a very simple strategy called the Break and retest.

Since the market is in a bearish trend, we allow the market to break the previous low and retest the break before we enter our trade. Just as shown in the screenshot above.

We set a tight stop loss just above the trendline and set a corresponding take profit ratio.

Transaction details

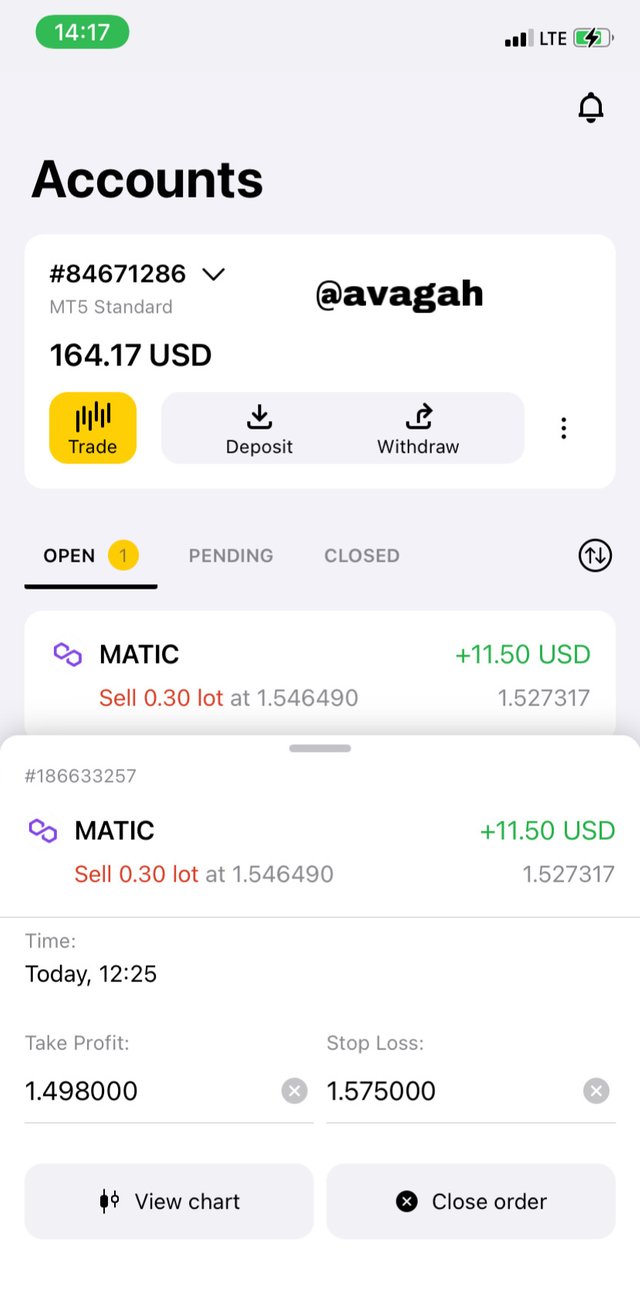

Screenshot from meta trader

Real Transaction from my Exness broker account

As I’ve been saying, scalping could be very profitable with good risk management.

A good trader shouldn’t always allow the trade to hit tp before you take profit. Sometimes it’s very wise to take partial profits before the market turn otherwise.

CONCLUSION

Trading is now the order of the day. Traders in the crypto ecosystem use numerous strategies to executed trades. However, I recommend everyone to master some 2 or three strategies which could be very profitable. Using different strategies every time would cause more harm than good.

Don't forget to use good risk management in trading. Always make sure your risk-reward ratio favors the profit. Do not risk money you are not willing to lose. Better still you can still use the 1% rule to reduce your risk.

Hello @avagah , I’m glad you participated in the 2nd week Season 6 at the **Steemit Crypto Academy Trading Competition **. Your grades in this task are as follows:

Recommendation / Feedback:

Good research on Matic. Thank you for participating in this trading competition.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yeah I understand counter trending. There’s no doubt that the market was communicating a bullish reversal. That’s why I said a quick scalp on the shorter timeframe. Sometimes you can take advantage of the market with simple techniques.

Besides I have some experience with scalping. Thanks once again on your multi timeframe lecture.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit