Welcome once again to another wonderful episode in the crypto Academy community. Before I present my homework post, I would like to acknowledge the professors and the crypto Academy community for making such an educative lecture possible. Today’s topic is simple Trading Strategy with "Price Action and the Engulfing Candle Pattern"

Without wasting enough time I would present my homework post systematically based on the questions from the professor @lenonmc21

1. Say in your own words that you understand about the Trading Strategy with “Price Action and the Engulfing Candle Pattern, also describe each step to be able to execute it (Place at least 2 examples in clear cryptographic assets and with your charts mandatory)

A trading strategy with price action and engulfing candle pattern is trading using the movement of the price of an asset previously in confluence with the engulfing candle pattern to find good trades. Traders mostly rely on price action to find entries and use the engulfing candle patterns as a confirmation of their trades.

Identifying the market structure, the price trend, and probable trend changes are all part of the price action and engulfing candle pattern trading method. After you've established the trend, you'll want to seek great entry points into the market using the engulfing candle pattern as confirmation of the new direction. The entry is at the close of the engulfing candle.

Price action is a multi-timeframe strategy and can be used effectively on the lower timeframes as well.

Step by Step for the execution of trading strategy with price action and the Engulfing candle pattern.

1. Identify a clear trend in the price of the asset

In trading with the price action and engulfing candle pattern strategy, a trend needs to be identified. There are two trends in the market. A downtrend and an uptrend. A downtrend occurs when the price is forming a lower low and lower high pattern while an uptrend occurs when the price is forming a higher high and higher low pattern.

The chart below is ETHUSDT 15 minute timeframe. The price is forming an uptrend with the market forming series of higher lows and higher highs.

The chart below is DOTUSDT 15 minute timeframe. Price is forming a series of lower low and lower highs making it a downtrend.

2. Change in trend

This occurs when the force that’s is moving price in a particular trend reduces and a trend reversal occurs.

A trend is broken when the last high of a downtrend is broken upward and also when the last low of an uptrend is broken downward.

The chart below is a downtrend in DOTUSDT 15 minute timeframe which is broken by a strong upward movement by taking out the last high.

The chart below is ETHUSDT 15 minutes timeframe in an uptrend which is broken by a strong downward movement by taking out the last low.

3. Find a break in trend and the engulfing candle pattern.

Now that we know how to identify a change in trend in step 2, we wait to see our engulfing candlestick. There are two engulfing candlesticks, a bullish engulfing candlestick occurs when the price is moving down with a bearish candlestick, and the next candlestick is bullish which covers 100% or more of the previous candlestick(it envelop the previous candlestick) while a bearish candlestick is when the price is moving up with a bullish candlestick but the next candlestick which is bearish covers the whole bullish candlestick.

The chart below is ETHUSDT. An uptrend is broken and there’s a bearish engulfing candlestick.

The chart below is DOTUSDT. A downtrend is broken with a bullish engulfing candlestick confirmation.

4. Find an entry in the 5-minute timeframe

After the chart is changed to the 5-minute timeframe, we wait for a break of the area we marked by the engulfing candlestick. However, if we change the timeframe the zone has been broken already. We must wait for a pullback then make the entry. The stop loss should be slightly below or above the pullback depending on whether it’s a bullish trade or a bearish trade. Take profit should be at the last support or resistance you can identify also depending on whether it is a buy trade or a sell trade.

The chart below is DOTUSDT 5 minute timeframe.

Stop-loss was placed slightly below the pullback and take profit at the key resistance level.

The chart below is ETHUSDT 5 minute timeframe.

Stop-loss right above the pullback and take profit at a key support level.

2. Explain in your own words the interpretation that should be given to a large strong movement in the market. What does the price tell us when it happens?

In case of a trend in the market, when the market is creating a higher low and higher high formation making an uptrend and there’s a strong bearish movement which takes out the last low of the uptrend indicates a break of structure and a trend reversal. Also, when there are lower lows and lower high formation in the market and the price breaks above the last lower high with a very strong bullish movement indicates a change in trend to the upside.

A strong movement in the market occurs when the big institutions, the banks, hedge funds and most retail traders are investing a lot of money to move a price towards a direction. When they push price against the current trend indicates a trend reversal in the market. In a bullish trend, if the big institution trades against the price of the asset will indicate a trend reversal to the downside, and if the market is bearish and the big institutions buy the asset will indicate a trend reversal to the upside.

The price of an asset is moved by the demand and supply of it. If the demand is over the supply, there will be a bullish movement and if the supply is greater than the demand, there will be a downward movement. The big banks, hedge funds, and retail traders are the most common cause of price movement.

3. Explain the trade entry and exit criteria for the buy and sell positions of the trading strategy with Price Action and Engulfing Candlestick Pattern in any cryptocurrency of your choice (Share your screenshots taking into account a good ratio of risk and benefit)?

The entry and exit criteria for a trading strategy with price action and engulfing candle pattern can be done by following certain principles.

1. Firstly, you have to identify the trend in the market whether an uptrend or a downtrend. An uptrend is when the market shows a series of higher highs and higher lows in the price of an asset and a downtrend is a series of lower low and lower highs in the price of an asset.

2. Secondly, You have to identify a break in the structure. The trend must be broken by a strong movement. In an uptrend, the price must break below the last low of the uptrend and in a downtrend, the price must break above the last high of the downtrend.

3. Moreover, an engulfing candlestick must be identified in the 15 minutes timeframe. In an uptrend where there’s a break of structure to the downside, a bearish engulfing candlestick must be spotted and in a downtrend where the structure is broken to the upside, a bullish engulfing candlestick must be identified and marked with a horizontal line at the open and close of the candlestick.

4. An entry must be identified by switching timeframes from the 15-minute timeframe to the 5-minute timeframe. The price will pull back so we will wait for it to come back to the zone we marked on the engulfing candlestick and then take our entry. The take profit will be at a key support and resistance zone around and the stop loss will be slightly below or above the pullback depending on our trade bias.

The chart below is DOTUSDT 15 minute timeframe.

Price was trending down.

The chart below is DOTUSDT 15 minutes timeframe.

A strong upward movement breaks structure indicating a change in trend.

The chart below is DOTUSDT 15 minutes timeframe.

A bullish engulfing candlestick is identified which envelope the previous bearish candlestick. The open and close of the candlestick are marked with a horizontal ray line.

The chart below is DOTUSDT 5 minutes timeframe.

The time frame is changed to find the entry and exit. We wait for a pullback the trade when the price comes back to the zone marked at the open and close of the bullish engulfing candlestick. The stop loss is placed slightly below the pullback and takes profit at a key resistance level. This is a good 1:2 risk to reward trade.

PRACTICE

1. Make 2 entries (One bullish and one bearish), using the “Price Action and Engulfing Candlestick Pattern” trading strategy. These entries must be made in a demo account, keep in mind that it is not enough to just place the images of the execution, you must place additional images to observe the development of these operations to be able to be correctly evaluated and see if they understood the strategy.

I’m going to take a trade-in of my demo account with the price action and engulfing candle pattern strategy.

Sell Trade

I spotted an uptrend in BTCUSDT. The market was forming a series of lower lows and lower highs in the 15 minutes timeframe.

The market the make a strong bearish move taking out the last low of the uptrend indicating a trend reversal in the 15 minutes timeframe.

After the sign of a trend reversal, I then lookout for a bearish engulfing candlestick. A candlestick that covers or envelope the previous bullish candlestick.

I then mark out the open and close of the bearish engulfing candlestick with the horizontal ray and the switch to the 5 minutes timeframe.

The 5 minutes timeframe showed me a pullback up and then return to the zone I marked on the open and close of the engulfing candlestick.

I take my trade right there and put my stop loss slightly on top of the breakout and take profit at the key support level.

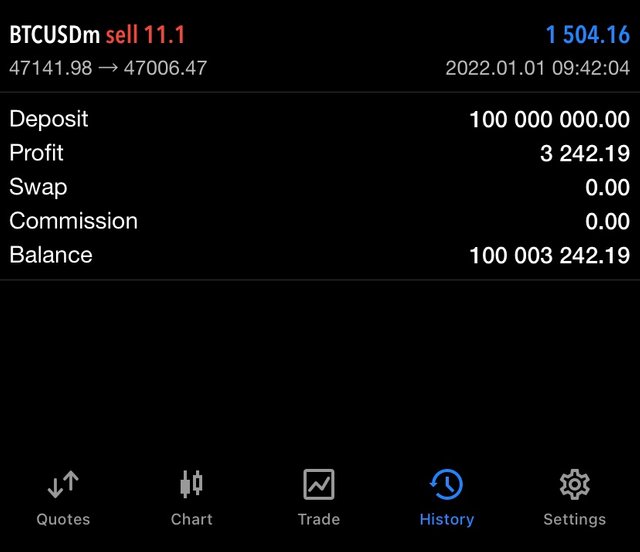

Due to low market volume and several big banks on holiday during this festive period, prices of assets barely move but I could make half of my expected profit on this trade in my demo account.

Buy trade

The buy trade is on ADAUSDT.

- Price was trending down forming a series of lower lows and lower highs.

- And a strong bullish move breaks the the trend indicating a trend reversal.

- We then find out bullish engulfing candlestick and mark it out with our horizontal ray tool.

I wait for the market to pullback to the zone after switching to the 5 minutes time frame and then take the trade in the demo account.

Stop loss is placed below the pullback.

Take profit at key resistance.

- The profit starts slow due to low volatility in the market today.

- profit made from the Price action and engulfing candle pattern strategy.

CONCLUSION

In trading, there are several strategies with some of them having high probabilities of winning. Price action and Engulfing candle pattern are the trading strategies with good confluence and a high probability to win. This strategy is simple you need to identify a trend in the market in 15 minutes timeframe -50 minutes timeframe then wait for a strong break of structure which will indicate a trend reversal. After the break of structure, you then look out for an engulfing candle then mark it out with the horizontal ray tool.

Now you switch the timeframe to the 5 minutes timeframe, you’ll wait for the market to pull back and return to your zone marked out on the open and close of the engulfing candle pattern. After the price has returned to the zone, you take your trade with the entry slightly above or below the pullback depending on your trade bias and take profit at key resistance and support around.

Thanks to professor @lenonmc21 for this amazing lecture.