1a) Explain the Japanese candlestick chart? (Original screenshot required).

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

a) Explain the Japanese candlestick chart? (Original screenshot required).

candlestick chart was developed by a Japanese manor in the 1700s by a Japanese muniya, the chart he and a few others took of his time as well as an outline of the market with high, low, open and closing costs . be provided.

This type of chart serves as a buying and trading tool to visualize and examine actions worth overtime for derivatives, currencies, stocks, commodities, etc.

Although the symbols used in the holder chart look like a box plot, they require completely different functions. Candlestick charts show some bits of price data, with price being close price, open price, lowest price, highest price.

Each image is compressed on the amount of time you have for the commerce activity e.g. a minute, hour, day, month. The parallelogram of the image is named the real body, and is used to show the dimensions between the open/close values for that sum. Whereas the lines running from the lowest and highest part of the body are literally known as lower and higher shadows or known as wicks.

Each shade is for the best or lowest price listed in the quantity desired. Once it opens in its optimistic position with the market taking out losses, then the color is usually white or naive, however, Mongme will continue to hold. Although the market is in a very pessimistic position, the closing is lower than the open, the color could be red or black.

b) In your own words, explain why the Japanese Candlestick chart is the most used in the financial market.

The Japanese holder chart is the one that is most commonly employed in the currency market. It provides a really detailed and really accurate graphical depiction of price changes over time.

It interprets patterns and is the primary tool for price action commerce and technical analysis. Several explanations for why it is so widely used include

Simple identification of market patterns: Japanese bearer charts display many patterns that cannot be seen on individual charts or can be very difficult to visualize. It is not possible to visualize a pattern such as a Doji square measure on a line graph.

Market Direction: It is very easy to visualize the market direction on the Japanese Holder Chart. The shape and color of candlesticks helps traders to confirm the direction of the market. You will be able to easily spot allies in nursing uptrend, downtrend, upswing, downswing etc.

Specific Price Action: The color and shape of the candles also helps in bullishing the specific price action. You will easily understand whether it is the bull or the bear that has speed. It helps in making business calls.

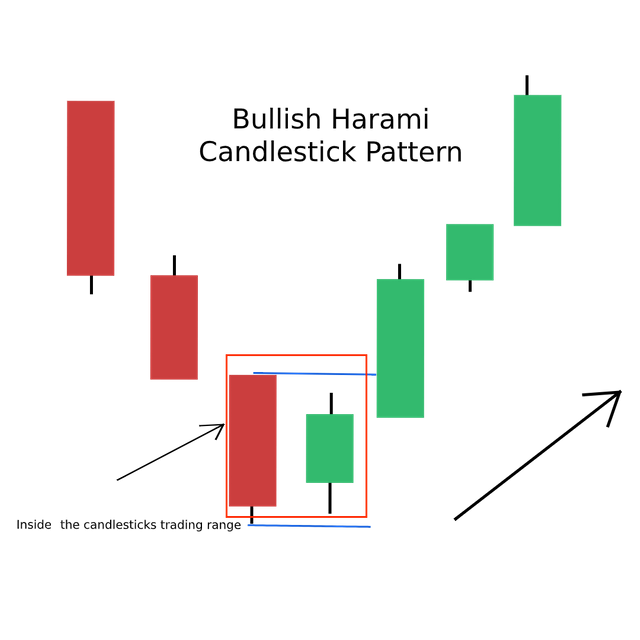

c) Describe a bullish and a bearish candle. Also, explain its anatomy. (Original screenshot required)

Bullish candle :-

A bullish candle that has been opened low, and followed by a slow high. An bullish candle consistently stops at the top of the previous candle, indicating an increase in price, which suggests that demand is high and the consumer area unit has reached momentum. Anatomy of an bullish candle An bullish holder has four main parts; High, close, low and open. All the elements represent completely different points of time.

Open: This is often where the candle starts. This is jointly known as the difference. This indicates the beginning of a movement, and an bullish holder remains open continuously.

Low: This is often a very cheap price that lasted the entire time. For an bullish holder, it could be lower or lower for price as the open is open. Once the bottom is open, meaning it has been opened, then there was the antistatic pressure that went down the bottom. But then, copying was made for the sake of pressure.

Close: This marks the top of the bar holder for your time. This is mainly referred to as the price. An bullish holder is continuously closed at its top due to the buy.

High: This was the best value to reach the entire time. For an bullish candle, it could be at the top of the top or it could be due to a single price. Once the high closes, it means there was a buy for pressure, which was spent at the top of the open. Increased cost, then decreased prevalence

Bearish candle:-

A Bearish candle may produce a candle that opens at a higher price and closes at a cheaper price over a period of time. A Bearish candle always closes below the previous candle, meaning supply is high demand and sellers (bears) AR AU FIGHT.

The anatomy of a pessimistic candle The elements of a Bearish candle are; High, Open, Close and Low.

Open: This is where the candle starts. This is jointly known as the difference value. This indicates the beginning of a price movement, and a Bearish holder always opens higher.

High: the best value in the overall original measurement. For a Bearish candle, the high will be higher than the open or similar to the open. Once the high is higher than the open, it suggests that there was buying pressure that pushed the cost higher than the open. Costs went up, then marketing pressure lowered costs.

Close: This marks the top of the holder for when you have time. This is known as conditions. A Bearish holder has always been opened as a result of marketing pressure.

Low: This may be the rock bottom value obtained in the entire fundamental measurement. For the bearish holder, the short will be at or below the close. Once the low was closed, suggesting that the price opened, then there was marketing pressure that drove the price lower. But then, there was buying pressure that kept the price a copy.

Conclusion

Japanese holding inventory is one of the sure-fire inventories that are handy for traders to have the details and knowledge needed to understand movement in price within the currency market.

.png)