INTRODUCTION

The finger-trap scalp trading strategy is one out of four main trading styles that traders rely on. I have seen traders execute a number of trades with the scalp trading style without really knowing how it worked. I’m grateful to professor @yohan2on for taking the time to teach this lecture.

I have done my own research on how to use the finger-trap scalp trading style. Now I will go ahead and perform the task given.

What is the finger-trap scalping strategy?

The finger-trap scalp trading strategy was developed by James Stanley as a means of leveraging the smaller time frames in trading markets. This technique uses Moving averages to determine overall trends and determine the best entry position. With the short time frames, traders enter and exit the market quickly.

For this assignment I’m going to use XTB mobile app because the MT5 market is currently closed.

I’m will be explaining how the finger-trap works as I make examples. Let’s start with XRP

XRP finger-trap scalp trading

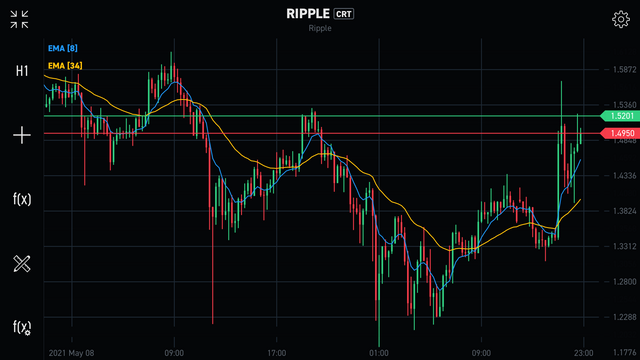

Step 1: We’ll start by viewing the XRP chart on a bigger time frame.

Step 2: We then apply the Exponential Moving Averages with periods 8 and 34. The 8 is the fast EMA showed as blue while the 34 is the slow EMA showed as yellow.

The reason we use EMAs instead of Simple Moving Averages (SMAs) is because EMAs respond to price changes more quickly.

The fast EMA when higher than the slow EMA has to have the price above it to indicate a strong uptrend. When this fast EMA is lower than the slow EMA, the price will have to be lower than the fast EMA to indicate a strong downtrend.

I indicated above, instances of uptrend movements.

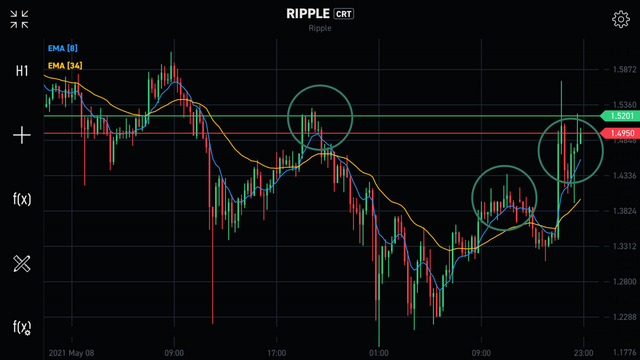

Step 3: Make the charts more short term. It should be about 5 minutes for the scalp trading strategy.

Observe where the fast EMA crosses the price. There is always a bounce back except at the red marked area where it seemed to be having a trend reversal. Still, it recovered and continued an uptrend.

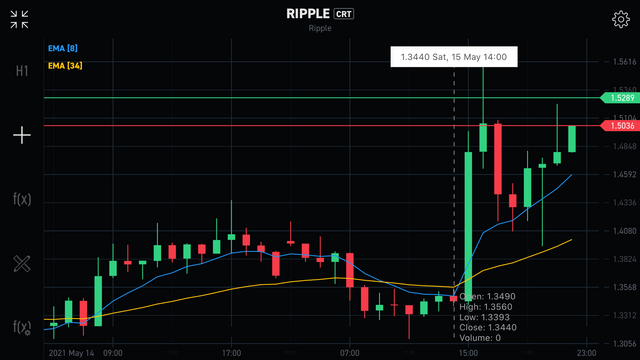

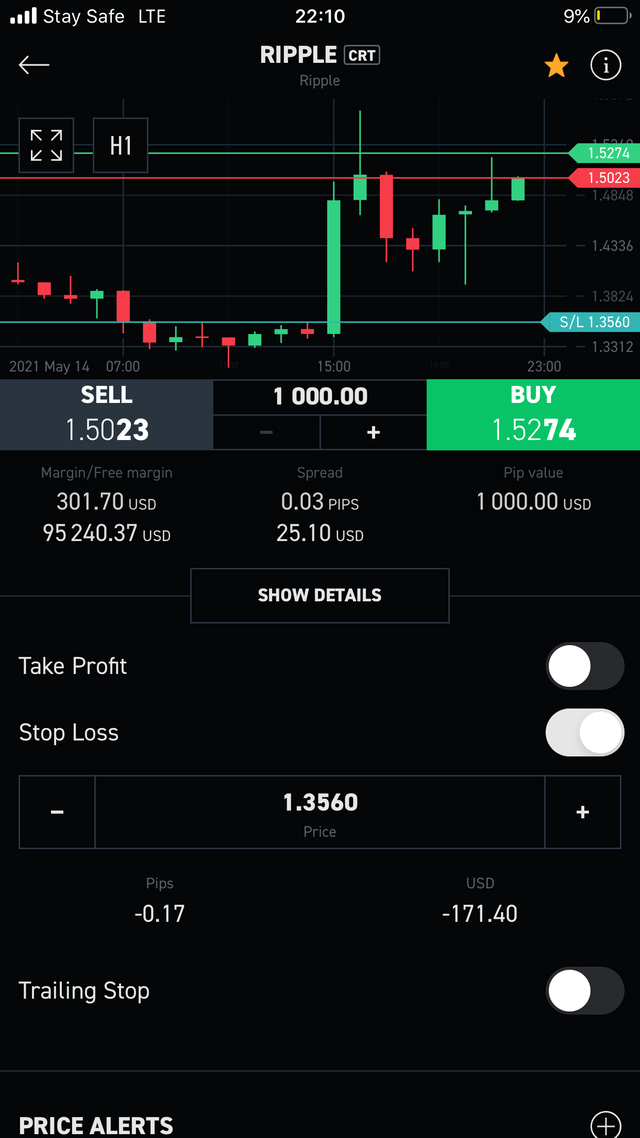

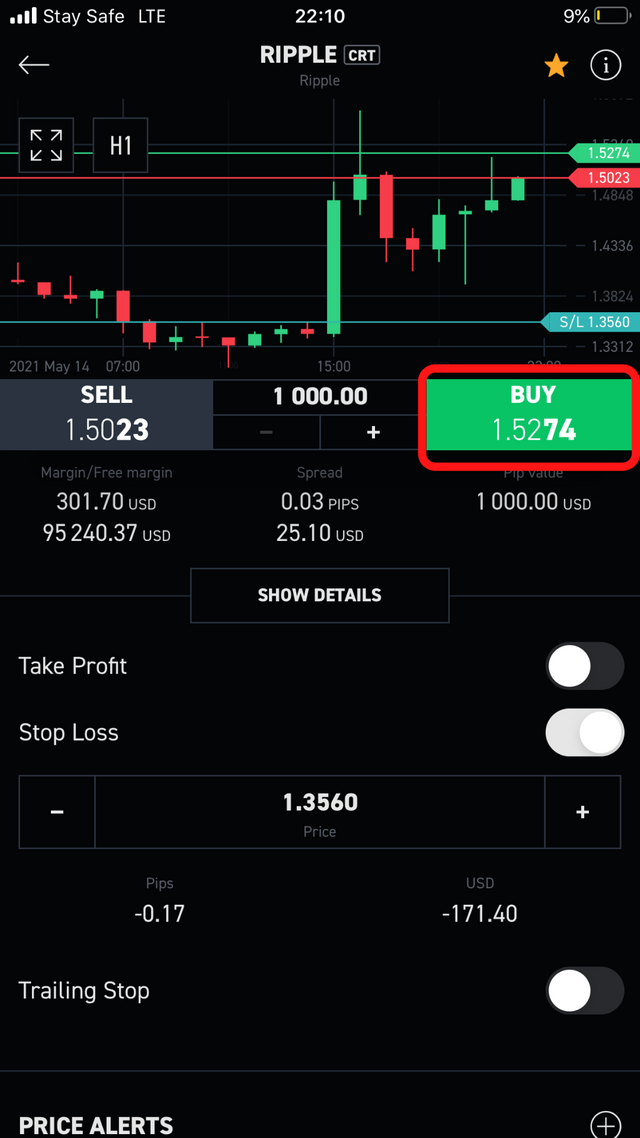

Step 4: In this step, we place a stop loss. Still on the short time frame, I noticed a previous spot where the fast EMA crossed the price and placed my stop loss there.

Step 5: Go ahead and set the stop loss and open a position. I opened a buy position.

Step 6: I watched the price go up in my direction.

Litecoin finger-trap scalp trading

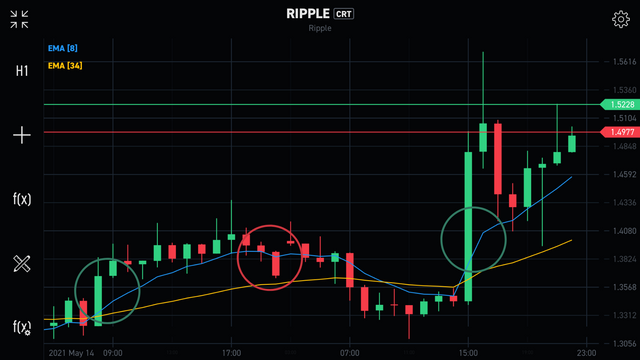

Step 1: View the Litecoin chart in a bigger view.

Step 2: Apply the Fast EMA (blue) and slow EMA (Yellow) to determine trend. The trend below is a down trend.

Step 3: View the chart is a smaller view to observe where the Fast EMA crosses the price.

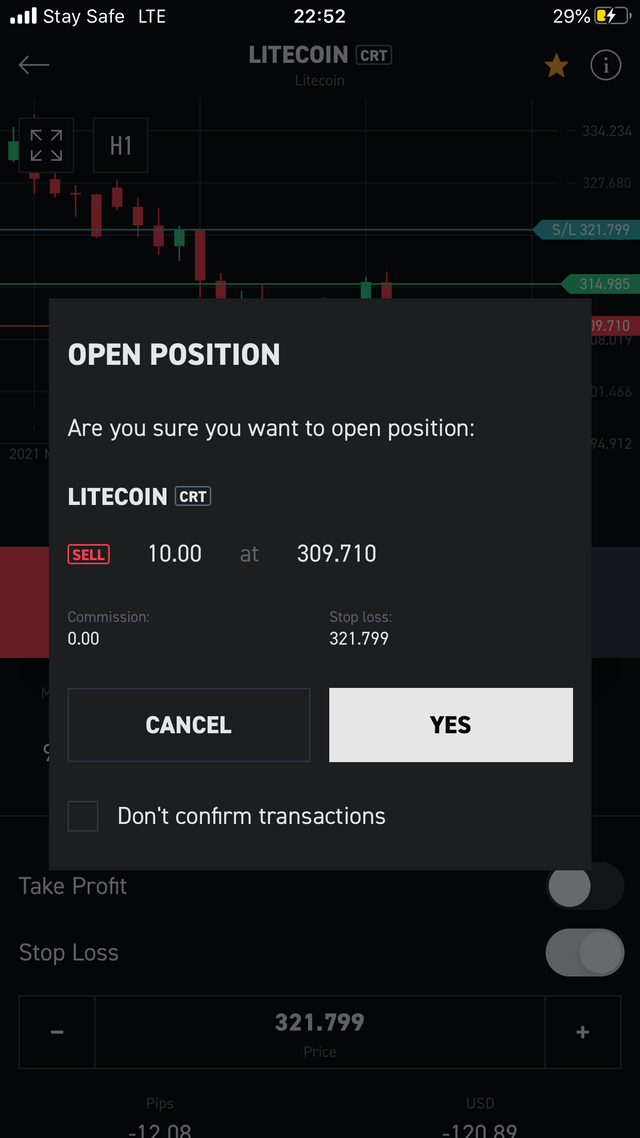

Step 4: Then I find a good place to place a stop loss for the sell position I would open.

Step 5: I set the stop loss and opened the position.

I watched the price fall and go right in my way. Looks like a good place to close the position.

Advantages of Finger-trap scalp trading

Quick results: The Finger-Trap is just like any scalp trading variety that produces quick results due to the short time frame. You can realize profits quickly and walk away.

Simple to use: This trading strategy is really easy to understand and more easier to use while trading.

Stop loss: The position of the stop loss in a finger-trap trading style ensures that not much losses can occur than required.

Watch on the market: Finger-trap traders, unlike other traders, keep a regular eye on the market and can stop any bad trade to avoid mistakes or massive losses.

Disadvantages of finger-trap scalp trading

Fast losses: I already mentioned that there are quick results in this type of strategy. Well, the results can be in any direction; profit or loss.

Possibility of a trend reversal: This strategy is not all that reliable because it just shows trends and cannot predict them. Trend reversals can occurs anytime blowing away the expectations of traders.

CONCLUSION

With new technique of trading popping out regularly, it is important to know the right one to adopt. Scalpers can go ahead and try out this finger-trap technique as it is easy and straightforward. I will try it more to really get a feel of it.

Special thanks to @yohan2on

Hi @awesononso

Thanks for participating in the Steemit Crypto Academy

Feedback

This is good work. Well done with your research and the practical demonstration of the scalp trading style using the finger trap strategy.

Though on Litecoin, you placed your stop loss wrongly. You had to place your stop loss a few pips "5 to 10" from the most recent swing high. You have to give your trades room for that zigzag movement of the market price.

Homework task

7

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes you’re right. I was not really focused during the trades. I will take correction.

Thank you prof!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I am not ready for this flashlight yet Because i just read steam

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit