Introduction

With so many elements to consider in the crypto and financial markets, a lot of indicators have been built to perform certain functions for traders. Some indicators track momentum and strength of a trend while others might be volume or volatility based. All these indicators play important roles in trading.

Some of these indicators however, are a package of different functionalities. This week, professor @reddileep has explained a very special indicator under this category. This indicator is the VuManChu Cipher B indicator. After properly studying the lesson, I will now attempt the tasks given to the best of my abilities.

1- Define VuManChu Cipher B Indicator in your own words.

It is always advisable to combine technical indicators when approaching the markets. Indicators filter each other out and if properly combined could increase the success level of a trade. Unfortunately, sometimes we are limited by the maximum number we can combine on a trading platform or the fact that some of these indicators are not free. Fortunately, there are a few indicators that combine the properties of several indicators to produce fairly accurate signals. The VuManChu Cipher B is one of these indicators.

The VuManChu Cipher B indicator is a multipurpose indicator that is quite popular among traders. It combines the properties of RSI, Money Flow index, Market Momentum and Market Volume indicators which make it of a great advantage. Other indicators included are the Schaff Trend Cycle and the MACD depending on how the indicator is customized. Thanks to this indicator, we can use these four popular indicators in one in our analysis. This bypasses the 3 indicator limit on TradingView and gives traders a wider approach to the markets. The best part is that this indicator is totally free.

The VuManChu Cipher B is clearly a very versatile indicator. It can be used to measure the strength of of a trend and spot divergences in the market. It can also be used to determine the volume of buy or sell orders in a market to know if a market would be bullish or bearish.

A very important feature to mention is that the VuManChu is used to check the money flow direction of an asset. This is thanks to its similarities with the Money Flow Index. This feature and a couple of others can help generate buy and sell signals that are quite accurate. This is what we have discussed on the indicator in the lesson and I will illustrate it again for this task.

2- How to customize the VuManChu Cipher B Indicator according to our requirements? (Screenshots required)

First we have to add the indicator to a chart.

Adding the indicator to the chart

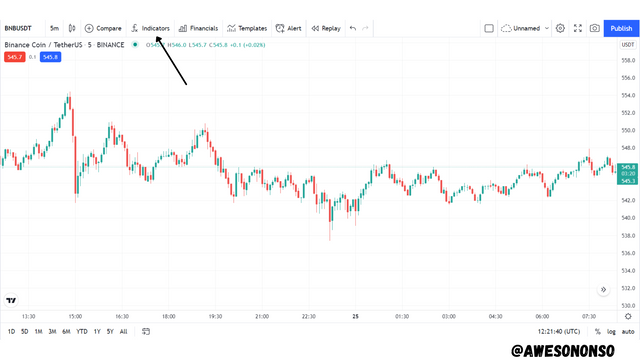

Step 1: On TradingView, choose a chart and click on fx indicators.

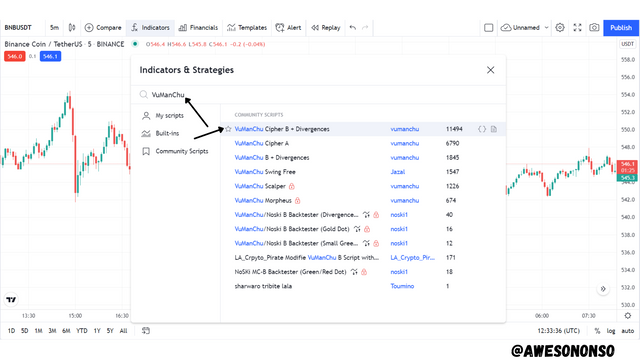

Step 2: Search VuManChu and select the indicator.

And then the indicator is added.

At first glance, the indicator is complicated and frankly overwhelming. There are some of components of the indicator that are not necessary for this lesson. In order to make it as simple as expected for this lesson, we have to customize it.

Customizing the indicator accordingly

Step 1: Click on the Corresponding settings icon.

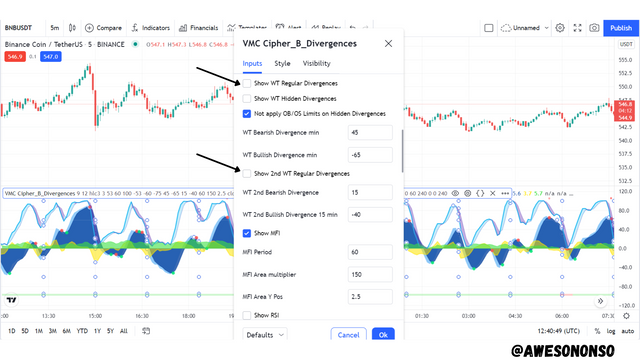

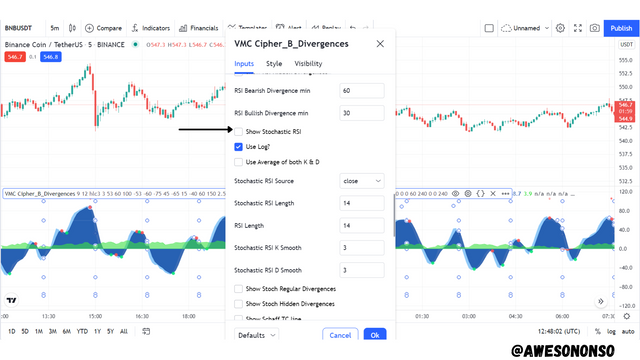

Step 2: Under the Input tab, we have to uncheck the following boxes;

- Show WT Regular Divergences.

- Show 2nd WT Ragular Divergences.

- Show Stochastic RSI.

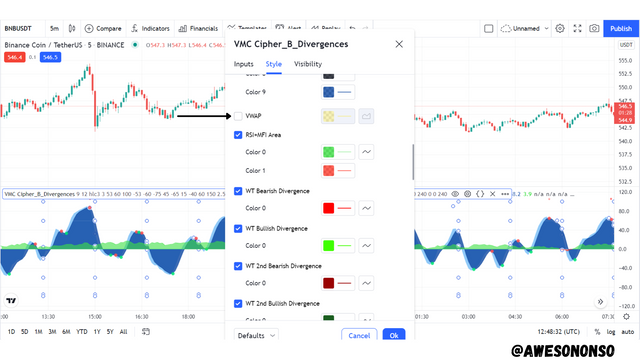

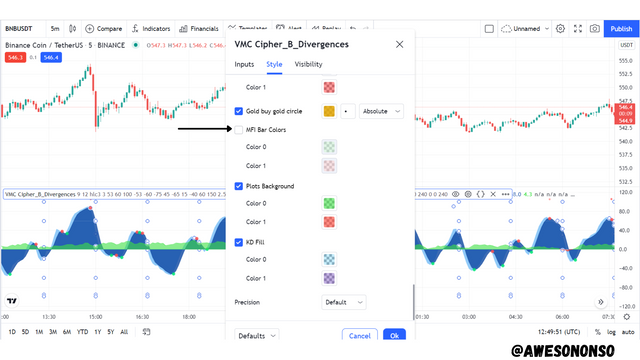

Step 3: Under the Style tab, we have to uncheck the following boxes;

- VWAP.

- MFI Bar Colors.

After doing all these, we would notice that the VuManChu Cipher B would be less complicated.

3- Explain the appearance of the VuManChu Cipher B Indicator through screenshots. (You should Highlight each important part of this indicator by explaining their purpose)

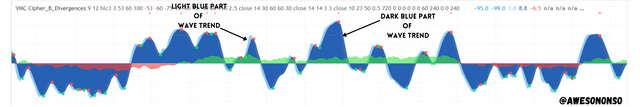

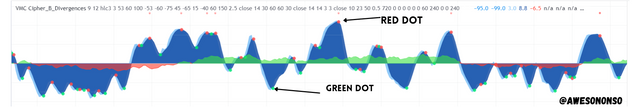

Wave Trend Indicator

This part of the VuManChu Cipher B indicator comprises of two waves which cross each other as they go. One of the waves has a Light Blue colour while the other has a Dark Blue colour.

When the Light blue crosses the Dark blue upward, a Green dot is indicated. Also, when the Light blue crosses the Dark blue downward, a Red dot is given.

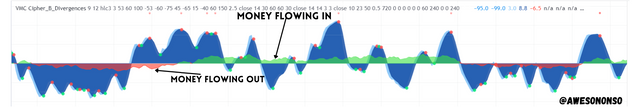

Money Flow Index

Another part of the the VuManChu Cipher B that is necessary for our study today is the Money Flow Index. This is characterized by a less peaked cloud-like wave. This part can either be Green or Red depending on the direction of money flow in the market. If money is flowing into the asset then the index would be green indicating a bullish movement. Conversely, if money is flowing out of the asset the asset then the index would be red indicating a bearish movement.

4- Demonstrate your preparation for the Trading Strategy combining other indicators. (Instead of showing the addition of indicators to the chart, you should explain the purpose of each indicator for this trading strategy.)

No matter how sure an indicator might seem, it is always advisable to reinforce signals with the help of other indicators. The VuManChu indicator is a versatile indicator for sure but it should be combined with other indicators for more accurate trades. That said, I will be using two Exponential Moving Averages with periods of 55 and 200.

EMAs are very basic technical indicators that act as dynamic support and resistance levels to the price action. When more than one EMA is used in trading, they can generate even more signals through their interaction with each other. In the case of our study, the 200 EMA is a slow moving average while the 55 EMA is a fast moving average. Since the 55 EMA is the fast moving average, it would react to price changes quicker than the 200 MA. The effects of this is that the 55 EMA crosses the 200 EMA to generate signals that are then confirmed by the VuManChu Cipher B.

For a buy signal, the 55 EMA would cross the 200 EMA upward and both would serve as support to the price action. For a sell signal, the 55 EMA would cross the 200 EMA downward and both would serve as resistance to the price action. When these signals are generated, they have to be confirmed by the VuManChu Cipher B before a position is opened. I will illustrate one of these with a chart below;

In the image above, the 55 EMA (Blue) crossed the 200 EMA (Yellow) upward. After the VuManChu Cipher B confirmed the signal, there was am uptrend. I will explain the confirmations of the VuManChu Cipher B in the next question.

Considering the combination of these indicators, we should note that if the EMAs cross and the VuManChu Cipher B does not give any signals, then a position should not be opened. Similarly, if the VuManChu Cipher B gives signals that are not confirmed by crosses of the EMAs, then a position should not be opened.

5- Graphically explain how to use VuManChu Cipher B Indicator for Successful Trading. (Screenshots required)

Like I explained earlier, we need to combine the VuManChu Ciper B with other indicators for a greater chance of success. We have already established the fact that this indicator can be combined with two EMAs with periods of 55 and 200. Now I will explain how this works in the two different scenarios.

Buy Trade

For a buy signal, the 55 EMA would cross the 200 EMA upward and both would start to support the price action. On the VuManChu Cipher B, the Money Flow Index would be green indicating an inflow of money to the asset. The Light Blue Wave of the Wave Trend would cross the Dark Blue wave upward forming a green dot. This dot would be the confirmation for a Buy entry.

For this type of trade, I would use the recent support as the Stop Loss and then calculate a profit with the ratio of about 1:1 or higher depending on the market condition.

Sell Trade

For a sell signal, the 55 EMA would cross the 200 EMA downward and both would act as resistance to the price action. On the VuManChu Cipher B, the Money Flow Index would be red indicating an outflow of money from the asset. The Light Blue Wave of the Wave Trend would cross the Dark Blue wave downward forming a red dot. This dot would be the confirmation for a sell entry.

For this type of trade, I would use the recent resistance as the Stop Loss and then calculate a profit with the ratio of about 1:1 or higher depending on the market condition.

6- Using the knowledge gained from previous lessons, do a better Technical Analysis combining this trading Strategy and make a real buy or sell order in a verified exchange. (You should demonstrate all the relevant details including entry point, exit point, resistance lines, support lines or any other trading pattern)

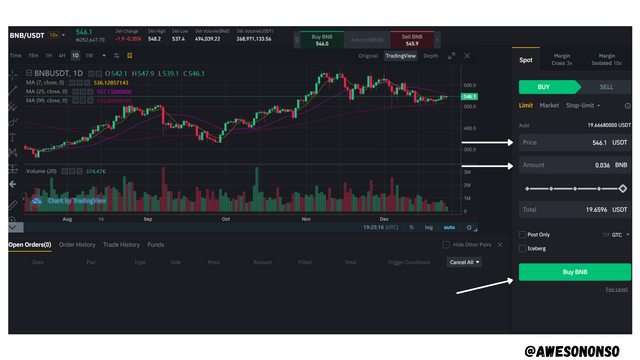

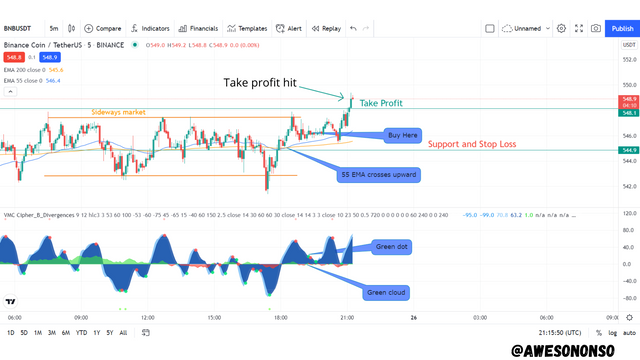

On TradingView, I loaded BNB/USDT chart with a 5 minute Timeframe.

During the sideways market, the 55 EMA had crossed the 200 EMA upward. This is an indication of a possible upward movement. The Light Blue wave of the Wave Trend eventually crossed the Dark Blu wave and a Green dot appeared. There was a little green cloud which meant there was some cash inflow in the asset.

The signal is very small because the market is not trending. So basically my intent is to ride the retracement by placing a buy order. I would place the Buy order at 546.1. Stop Loss is at 544.9 and take profit is at 548.1. This is a Risk-Reward ratio of 1:1.

Taking everything into consideration, I went over to my verified account on Binance Exchange to place the trade.

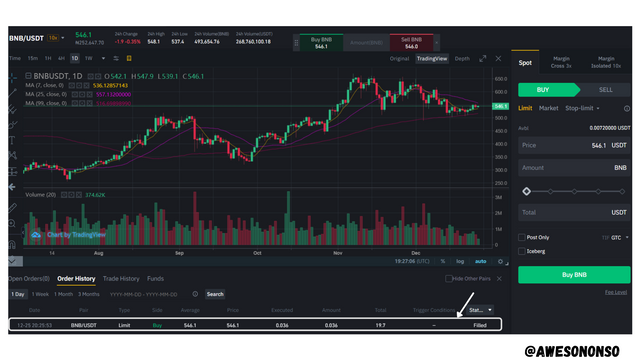

I placed a limit order right at 546.1. After a while the order is filled.

In the End, my take profit was hit.

Conclusion

The versatility of the VuManChu Cipher B definitely makes it a top indicator pick for me. The combination and strategy we have learned with the indicator is very creative and effective from my observations. The VuManChu is quite complex but with just the Wave trend indicator and Money Flow index, a good trading strategy was made. If we are able to properly understand the indicator and use its other components, it would open doors for new strategies. However, as we have learned, it is still important we combine this indicator with others in order to filter and confirm signals.