And again, another week of the Steemit Crypto Academy comes to an end. The 3rd week ran from the 20th of September to the 26th of September. Just like in the first week, we talked about the Bid-Ask Spread this week but this time we went into the market properly. We explored the topic through the following sub-topics;

- The Order Book : Definition, Components and Importance.

- Market Makers and Limit Orders.

- Market Takers and Market Orders.

- How Makers and Takers relate with liquidity.

- Practical Transactions.

- The Mid-Market Price.

Statistics

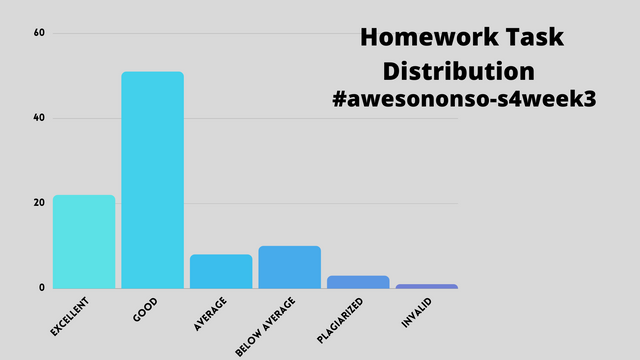

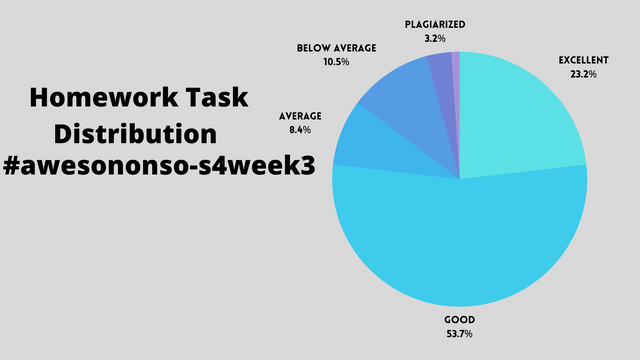

The tag #awesononso-s4week3 had a total 95 entries. The distribution for the week is given below;

Reference

- Plagiarized is for posts with spun content.

- Below average is for scores below 5.

- Average is for scores within 5 and 5.9.

- Good is for scores within 6 and 8.9.

- Excellent is for scores within 9 and 10.

- Invalid is for posts from users who do not qualify to perform the tasks.

| Rating | Excellent | Good | Average | Below Average | Invalid Entries | Plagiarised contents |

|---|---|---|---|---|---|---|

| Frequency | 22 | 51 | 8 | 10 | 1 | 3 |

Mean - 6.74

Corrections

A couple of areas proved to be difficult for most students. Let's check them out blow;

Maker-Taker relationship with liquidity:

In the lesson, we established that market makers initiate Limit orders and also that these orders are what make up the order book. A lot of limit orders at a particular price level would mean that there is a good amount of interest in the market and the market is liquid. When the market is liquid, market takers would be able to make easy transactions with their market orders. A closed market order would mean a closed Limit order when they are matched and when these limit orders reduce, the liquidity of that market would reduce.

Impact of Limit and Market Orders:

From what we explained above, we can easily answer this question. When we place a limit order for an asset we act as market makers and therefore add liquidity to the market. In the same way, when we place market orders we act as market takers and reduce that liquidity.

Special Note:

Taking out liquidity as a market taker is not necessarily a bad thing. The liquidity provided by the makers is not just supposed to pile up. The purpose of providing liquidity is to reduce it in the end. That is just how the markets work.

Observations and Suggestions

Originality:

A fact about the academy is that Students go back to older posts to learn from them. The bad thing is that some students try to paraphrase the work of others. In the first question, for example, the order book was supposed to be explored with original screenshots but in some cases the observations did not match the screenshots. This type of situation really makes a person's presentation weak and diminishes the learning experience. Let's not forget that we are here to actually learn and not just for the pay.

Creativity:

We all know that I like to talk about this. From the early days, creativity has always been a major part of learning. We are actually influenced academically and otherwise by the creativity of others. Everyone has their way of learning. It's only when we realize this that learning becomes fun. I really wish the students would not be scared to express themselves because these things always make people stand out. Be creative, be yourself!

Thoroughness:

And now for the Elephant in the room - The Orders. A number of student skipped the practical questions. Some students attempted them but with out actually placing the orders. It is expected that a user with Rep 55 would be able to make an order of at least $15 and especially of 1SBD. These orders were necessary for the students to gain the proper experience of being makers and takers. An incomplete work will always turn out to be a waste of time because it will not be up to average.

Top 3 Students

Out of the 95 entries this week, there 22 scores between 9 and 10. That is really good. You can imagine how hard it was to select the best entries. Well, after some thorough comparison, I can proudly announce the winners for the week.

The top 3 for the first week are;

| User | Task Link |

|---|---|

| @chenty | Link |

| @kwadjobonsu | Link |

| @salamdeen | Link |

Good job everyone! We have successfully completed this topic. Till next time.

Thank you.

It's an honour to be selected as one of top 3 prof. Thank you and congratulations to everyone that took part in this lesson🙏.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations to all part-takers of this lesson.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you for your hardwork professor. We are honoured 💚

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit