1- Explain Price Bars in your own words. How to add these price bars on Chart with proper screenshots?

2- How to identify trends using Price Bars. Explain for both trend. (Screenshots required)

3- Explain the Bar Combinations for Spending the Day inside for both conditions. (Screenshots required)

4- Explain the Bar Combinations for Getting outside for the Day for both conditions. (Screenshots required)

5- Explain the Bar Combinations for Finding the close at the open for both conditions in each trend. (Screenshots required)

6- Conclusion

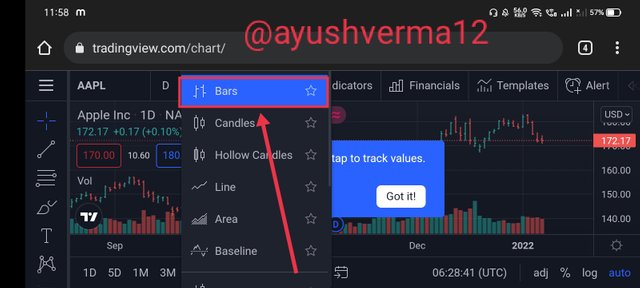

1- Explain Price Bars in your own words. How to add these price bars on Chart with proper screenshots?

Price Bar

Very much like different types of specialized markers utilized in the portrayal of outline examination of a fundamental resource like the candles, Lines, Hollow candles, Area, Heikin Ashi, and so on, the Price Bar is no exemption. That is, it is a bar portrayal of the exchanging and hidden impact of the trade exercises of a given resource which is subsequently displayed on an outline examination. The interest and supply push that occurs in a gone set is seen to be displayed in these value bars. Consequently when we have really purchasing strain in the exchange, this would address an Uptrend development of value Bars in the pattern investigation.

This is additionally no different for situations where we have seriously selling pressure where selling exercises offsets that d purchasing pressure. We have the Price bar saw in a downtrend development. The Uptrend development of Price bars is connected with the presence of Higher highs and Higher Lows in its event though the Dpwntrend development of value Bars accompanies Lower Lows and Lowe highs in its event. There the general Trend changes in a given market can be recognized by the utilization of the value bars.

Moreover, from its underlying terminology, it accompanies Open, Close, High, and Close focuses for each period taken. These all address the beginning of a pattern, the finish of a pattern, the pinnacles and lows accomplished in a day which consequently can be determined to infer the necessary presentation of a resource.

Then again, more limited value bars implies the financial backers where not excessively keen available. This implies that the was low drag between the purchasers and the venders. Very much like different diagrams are set to various time periods, the value bar graphs can be set from minutes to months.

Seeing value bars on the off chance that a specific exchanging pair will give a dealer crucial data relying upon the mix of the various bars to frame a specific pattern or value activity. At the point when value bars structure with their Open far away from the Close, this implies the market is encountering significant degree of ventures among purchasers and venders. This simply shows how dynamic dealers were available. Assuming these pieces of a value bar are extremely near one another, it implies brokers where not excessively keen on contributing on the pair at that specific time.

Open: this is the passed on even line to the upward bar which is addressing the initial cost.

Close: this is the right even line to the upward bar which addresses the end cost of the value bar.

High: this is the greatest cost reached by a value bar and is at the highest point of the upward bar very much like a candle hairpiece.

Low: the low is the most reduced cost reached during the development of the value bar.

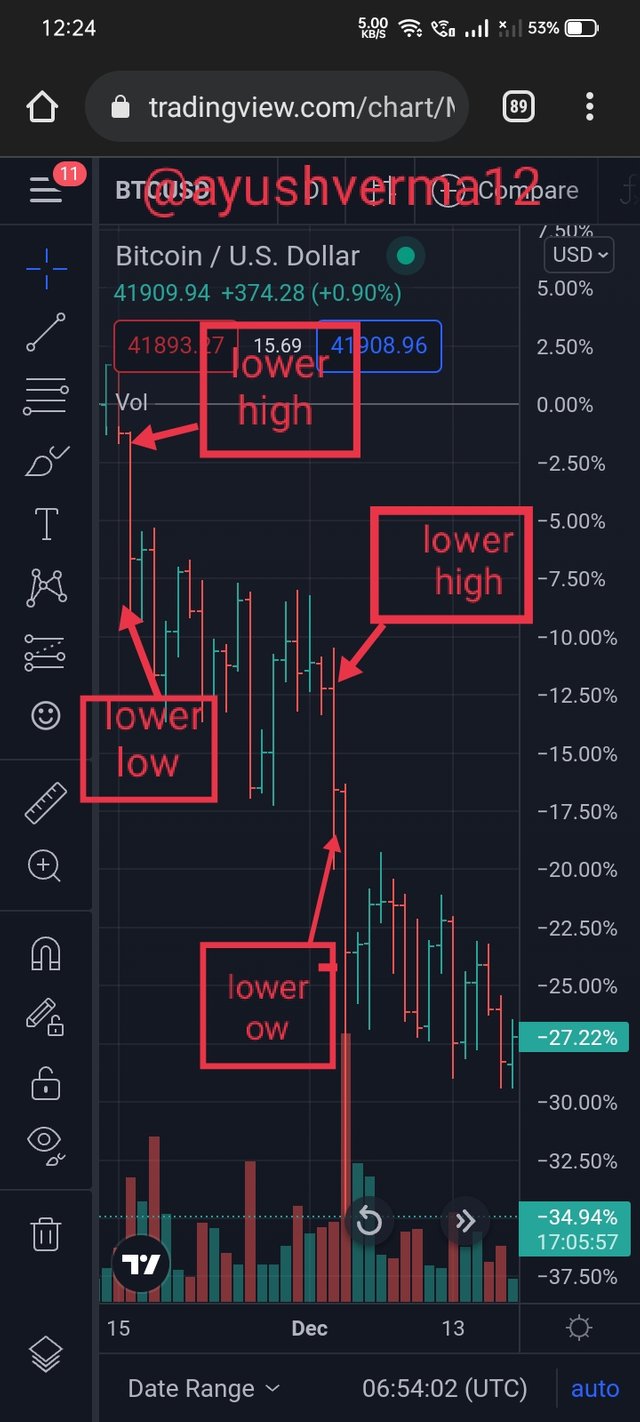

2.How to identify trends using Price Bars. Explain for both trend. (Screenshots required)

There are various ways you can utilize a bar to recognize a value pattern. For instance, when a few bars structure record setting paces all around, you can recognize an upturn creating. Then again, when the bars structure worse high points and worse low points, you can recognize a downtrend starting from shaping from past red bars on the outline.

Every day value developments can be handily followed utilizing specialized investigation, for example, the better upsides, worse high points, worse low points, and more promising low points.

A higher high is when there is another high higher than the past high

A lower low is when there is a new low lower than the past low

Lower High : This example follows the comparable example as more promising low points, which implies there is another high lower than the past high on a descending pattern .

Higher Low: there is a new low higher than the past falling short on a vertical pattern

HOW TO IDENTIFY AN UPWARD TREND

We recognize markets with time spans of specialized examination when they make ceaseless trips. This particularly applies to candle designs, which can enlighten us a bountiful number of data concerning the market on one graph.

To recognize an upswing, digital money brokers should see that the highs and lows are high. The highs and the lows ought to be the place of amicability for amazing distinguishing proof. A dealer could detect an upswing when there is another high making the past low to become lower.

Pattern merchants utilize the distinguishing proof of patterns in their higher stages to make great section focuses when they are in their starting. An early ID can assist with distinguishing your pattern to execute the right exchanges.

As found in the model over, an upturn is comprised of record setting paces all around. The course of the bolt oversees the pattern direction and we can see that new exorbitant costs are additionally higher than the past high.

The most effective method to IDENTIFY A DOWNWARD TREND

At the point when a long, red bar is trailed by a progression of short, green bars with no separate from the cost moving from the end of one day to the open of the following, we can recognize a downtrend. In this situation, a general decrease in costs is normal with the end cost constantly at or beneath its initial situation for each back to back bar. This pattern alone would show that the bears have a mind-boggling ominous force.

As found in the model over, a descending pattern is comprised of worse high points and worse low points. The bearing of the bolt oversees the pattern direction and we can see that new low costs are additionally lower than the past low.

3- Explain the Bar Combinations for Spending the Day inside for both conditions. (Screenshots required)

There are numerous blends that can exist in a value bar, and exceptionally fit for various situations. In this post I will portray one of these normal value bars called "going through the day inside". This sort is shaped when the nearby cost of the new value bar is between the open and shutting costs from the bygone one. This can happen when it's moving to bullish cases or tumbling to negative cases. I'll show screen captures of the clarification underneath

during the "going through the day inside" measures occurs, dealers are cautioned to take sharp thoughtfulness regarding the following move of the market. At these places, the purchasing pressures are nearly at balance with nobody offsetting another (contrasted with when financial backers are engaged) thus it is fitting to stay careful.

Anyway there are two conditions to be satisfied in this standards

The new value bar has a lower high than that of the past value bar

Assuming the low of the new value bar is higher than that of the past value bar and if this high arrives at a specific high point (considering the time period and downtrend), we have the subsequent condition fulfilled

Presently you can know whether the market course changed by contrasting the end of one bar with the open of the following. Assuming costs shut higher, then, at that point, the bullish-ness of that bar not really settled revived

At the point when the new value bar structures with its open at or higher than the low of the past value bar and it closes beneath the high of the past value bar, that is known as a bullish setup.

The negative day inside is the point at which the cost of another value bar opens near its high, yet in addition has a higher close. This is huge of a negative move at the hesitation table.

4- Explain the Bar Combinations for Getting outside for the Day for both conditions. (Screenshots required)

This is the direct inverse of within day and as inferred by the name, the high and low of the bar is outside rather than inside likewise, the open and close are shaped outside and this getting outside for the day is alluded to as outside day. Contingent upon the position close and open, the external bars be seen in both negative and bullish moving business sectors consequently can mean inversion or continuation of the pattern.

From the outline beneath, the open is found at the depressed spot and the nearby at the high point, and subsequently, upswing continuation or inversion to downtrend might be expected.

The following is a downtrend diagram a direct inverse of the upturn in which the open is found at the high point and the nearby at the depressed spot, connoting a likely continuation of downtrend or inversion.

5- Explain the Bar Combinations for Finding the close at the open for both conditions in each trend. (Screenshots required)

The nearby at the open or close at most elevated high accuracy setup is what happens when the end cost is practically same with the initial cost. Moreover, the perfect balance is accomplished when it's at some relative level instead of correcting on top of it. This implies it conveys a sign of negative and bullish pattern continuation and inversions just as each separate increment or abatement in bullish and bear patterns.

At the point when the cost of another value bar opens and closes at a similar level or shut to it, we realize that this means that either pattern continuation or inversion. Assuming it is open on the highest point of the body of the value bar, then, at that point, it shows more bullish force which will mean pattern continuation.

A negative condition happens when the value opens and closes at almost a similar cost during a downtrend, permitting us to distinguish an inversion or negative pattern continuation. Assuming that the open and close are to the drawback of the value bar, we realize we have high negative force and in this way a negative pattern continuation, however assuming they are to the upper side of the value bar body, we realize the bullish energy is more grounded and we might have a pattern inversion to the bullish side.

6- Conclusion

There are different value portrayals, for example, lines, bars and candles and so forth With the value bar, the dealer can break down the different bars to decide if the market is in a pattern or not. When a pattern is found, exceptional bar mixes -, for example, inside day, outside day and tracking down the nearby at the open - are then used to have the option to recognize whether there is a pattern continuation or a pattern inversion that is going to occur.This illustration about bar graph blends and examples has caused me to understand that, not exclusively are there a few other digital money diagrams, yet that each outline has its own uniqueness, application and translation.

The value bars have extremely intriguing life structures whether bullish or negative. The bars contain various parts. From this life systems and the situation of the parts, it is workable for a broker to assemble extremely helpful data with which to attempt exchanging exercises. A merchant can conclude what the market circumstance is, the overall pattern and in particular, the capability of a pattern to proceed or reverse.Price bars are equivalent to candles, on the value bar we can likewise see the open value, the most exorbitant cost, the end cost, and the least cost and we can likewise do an examination to discover the heading of the pattern utilizing the value bar. To recognize the course of the pattern utilizing value bars, equivalent to utilizing different outlines, specifically for an upturn or bullish pattern, it happens when the value shapes another high that is higher than the past high and the most recent low is higher than the past low, while for a downtrend or negative A pattern happens when the value frames another high that is lower than the past high and the new low is lower than the past low. Three examines can be utilized to see the pattern will proceed or turn around utilizing value bars, the three breaks down are going through the day inside, getting outside for the afternoon, and tracking down the nearby at the open. The three breaks down can be utilized as wanted yet should be concentrated on first to utilize them so accomplishment in exchanging is more noteworthy and we don't misunderstand the sign for the continuation of the pattern course or the other way of the pattern.