image designed by using PixelLab.

Hi everyone. Welcome to this post. Hope you are all well and happy and enjoying your health by the grace of Allah SWT. Today, I am here to present the homework assigned by my dear professor @imagen in Week 7 Season 5 of the Steemit Crypto Academy. before, this week's lecture has been well explained by the professor and I will do homework for it.

Leased Proof-of-Stake is another version of Proof-of-Stake (PoS) that has gone through a modification stage. This will allow users to rent out their stakes to miners. Then distribute or return part of the income from the mining to the leaser. Need to know, LPoS is a new way for us to benefit from the mining process, without the hassle of mining yourself.

The wave network is one of the crypto that supports LPoS, unlike other types of PoS systems, which require nodes to store a certain number of coins in a mining block, here all LPoS nodes can participate directly in mining activities by renting out the wave coins they have, to the node as a whole in a service called account leasing.

In this protocol, network users (nodes) may lease the network or their ownership to full nodes to use to receive the rewards earned as a percentage of the payments.

On the wave platform network, only full nodes can validate transactions. So that validators will be selected from the full node owners according to their ownership. So platform users cannot have full nodes.

If you want to participate in mining, users can choose to switch to fullnode or just help the owner of fullnode selected as validator by renting out the waves they have to participants. LPoS involves two main types of transactions:

Lease Transactions:

Activate the rental process. Coin holders initiate transactions by specifying the recipient's address (node address), and the amount of funds to be rented.Lease cancel transaction

Namely stopping the leasing process.

Leased Proof of Stake and Proof of Stake consensus mechanism?

| Leased Proof of Stake (LPoS) | Proof of Stake (PoS) |

|---|---|

| This is an enhanced version so that users will be able to rent out the tokens they own to users for mining purposes. only full nodes are granted eligibility to validate and add new blocks to the network hence, this generates rent on the network to allow small token holders to earn on the network. | Proof of Stake is a consensus mechanism that allows cryptocurrency holders to stake their coins, and is eligible to create a new block to the chain, and used to confirm transactions. |

| In LPoS, the Rewards earned from creating new blocks are shared between the validator and the leader as a result of the leasing function of the leased share consensus proof | While in the Proof of Stake mechanism, rewards are not shared because renting between nodes is not possible. |

| In LPOS, any cryptocurrency holder can participate in the mining process regardless of the number of tokens they have | here not everyone can participate in creating a new block on the Proof of Stake consensus mechanism. There is a minimum token that must be owned to be able to stake and become a validator. |

It is a decentralized exchange platform built on the Waves Blockchain network. It is also known as WavesDex, Waves.Exchange. here is a safe place to look at buying crypto, staking tokens with low fees. More precisely it is a location that offers many opportunities for crypto money dealings.

the platform was founded by Sasha Ivanov in 2016. This is a multi-currency wallet created as the official wallet of the wave protocol to facilitate easy storage of wave tokens and special asset issues on the wave blockchain. We need to know, what is interesting here is,

This platform is not only developed as a storage or exchange of assets. Its functions are more complete and many, but they come from crowdfunding through ICOs. Let's take my tour here, we'll start from logging in/signing up if you haven't registered yet.

- Register.

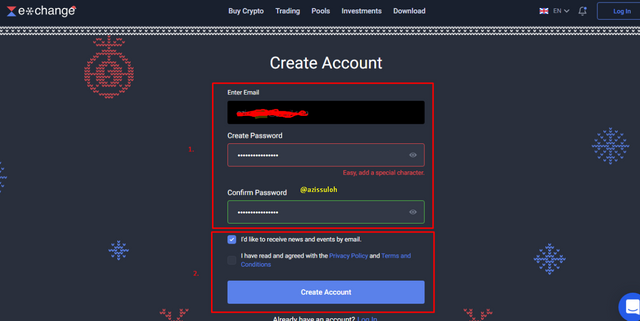

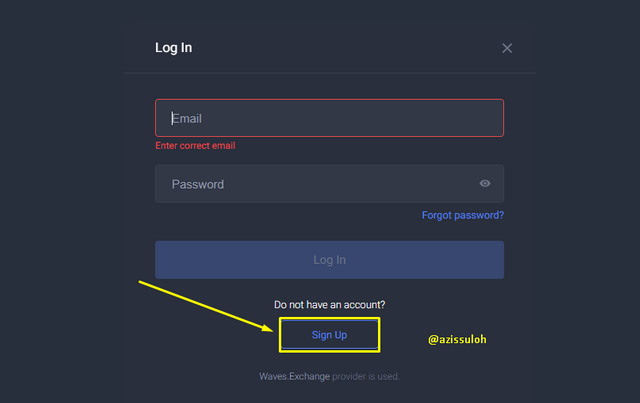

Since it's my experience exploring this platform, I'll sign up first. In the upper right corner of the homepage, there are three lines, click on them and a list will appear. At the bottom of the list we can see Login and Register. I signed up via email.

source

- Please fill in your email address, a good and strong password, then click register.

you will be sent a code to the email address you wrote down earlier. open the email, and write one by one the code they sent. If you have then press the button, your account funds are complete. You will be directed to re-login, according to the email and password you filled in at the time of registration.

The following is a review of the functionality on this platform:

BUy Crypto-source

The first is the Buy Crypto tab, in this function users can buy currencies such as BTC, EGG, USDN, OTC and WAVES use their debit or credit card after creating an account. We can do the buying process with several currency options there, such as USD, EUR, RUB, GBP, UAH, KZT, BRL, TRY.

as you can see on the picture above, In the trading section, there are three other sub menus, namely:

Spots.

The spot market on wave.exchange is equipped with the necessary tools to facilitate effective trading. Users can carry out the trading process by sharing the types of pairs available

SPOT Sub-menu source

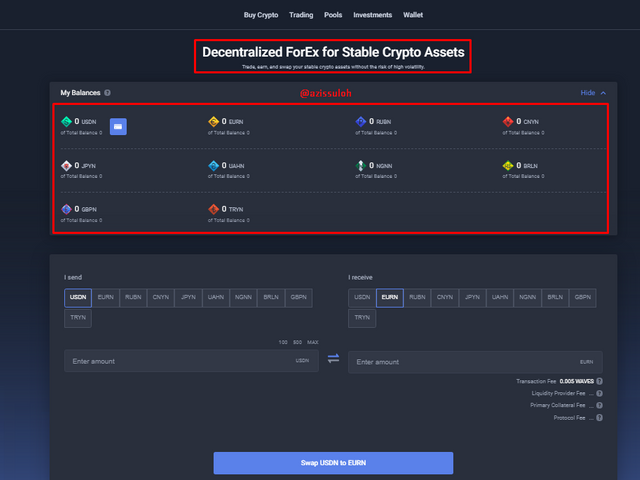

Decentralized ForEx swap

It facilitates the exchange of stablecoins for Decentralized ForEx (DeFo). Defo is a neutrino protocol interface that allows users to exchange stable coins via smart contracts thereby ensuring reliability and transparency.

DeFo source

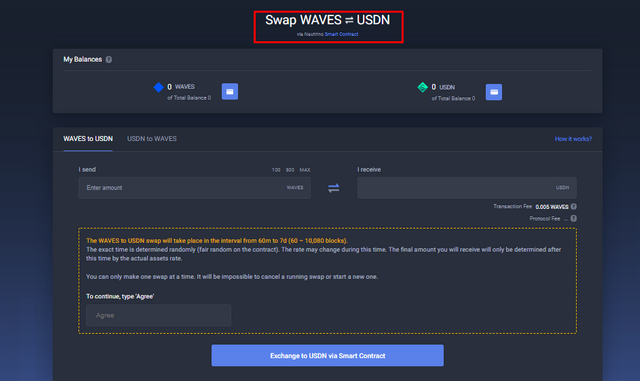

SWAP

This is one function that is known to be easy, here the user will be facilitated an easy exchange between waves with USDN. Please note, the transaction fees are very low, which is in the range of 0.005 waves. Process trading using smart contracts.

If the trading menu only has three sub menus, then in this menu pool section, we will find 7 sub menus, including:

Pools

In this function, Users can deposit to any pool of their choosing by clicking on the Deposit function located near each pool. This function in the first sub menu, allows WAVES token holders to be able to bet their tokens and will get prizes at WAVES. By doing so, the holders rent out the tokens they own, to the node operators for later use for mining. The wave that we rent is still under our control as the owner.

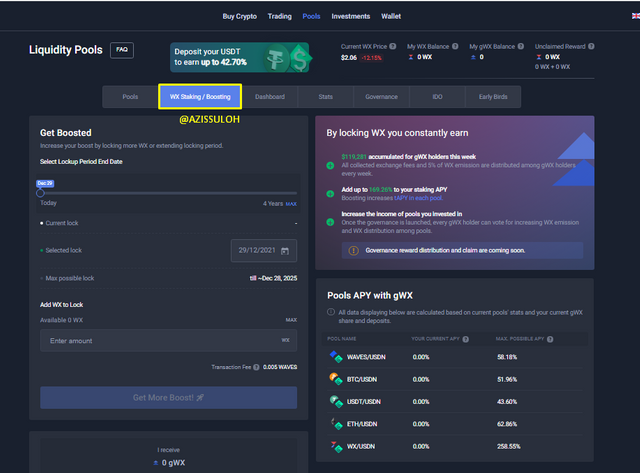

WX Staking / Boosting

In this wx staking/boosting menu, users will be very likely to lock the wx tokens they have. The deadline or duration of this waiver is determined by the user himself. By locking those wx tokens, users are entitled to be rewarded with token exchange fees.

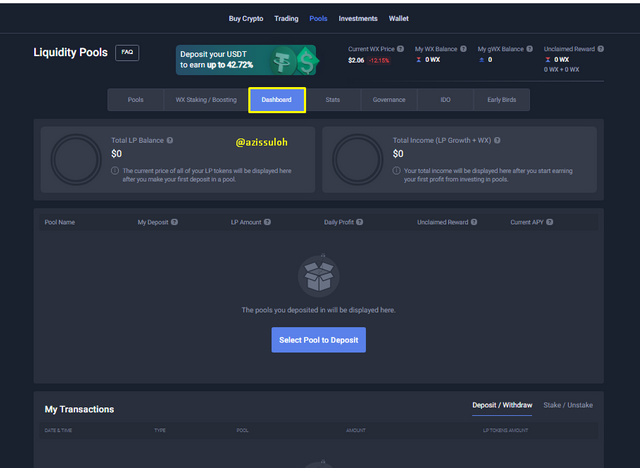

Dahboards

Through the dashboard menu, users can see the amount of their wallet balance. i.e. the total LP balance which is the current price of all the LP tokens they own, And also the total of their earnings.

Stats

Here we will take a look at the detailed overview: starting from the release schedule, and many other information such as the total number of WX tokens released or and the total number of tokens locked daily. And we can see a breakdown of the number of tokens burned on a daily basis.

Governance

In the governance section, users can see the total number of wx tokens they have, those wx tokens are the tokens they have collected from rewards.

Those are the five sub menus from the pools menu, actually there are still two more menus left, because there are 7 sub menus. The two sub menus that I did not detail because there is no data and details about the two are IDO, AND EARLY BIRDS.

Investment options available then we turn to the investment option available menu, In this menu section we will see 9 box-shaped menus each of which has its own meaning. These include liquidity pools, Lambo Investments, Algorithmic Trading, LP Staking, Neutrino Staking, WAVES Staking, Neutrino Pools, and Neutrino Governance.*

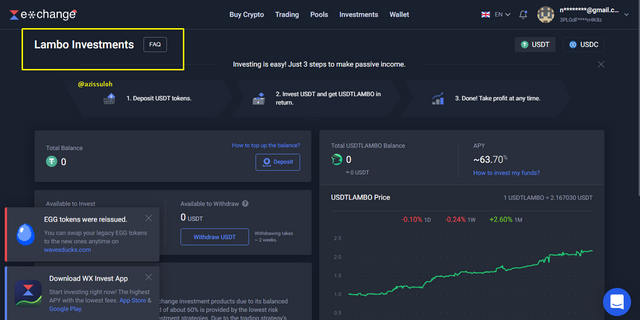

Lambo investments

It's a trading strategy built using algorithms, investing in LP bets based on smart contracts. Why I choose to explain lambo investment, exchange platform as it promises a maximum withdrawal of 10% on investments. This investment option gives APY up to 64%. Besides that, my reason is because here has a balanced risk strategy. It stands out more than other investment options.

LP Staking

LP Staking is Defi's interchain product that allows users to stake BTC to earn rewards. Assets that users risk, they can release whenever they want. The trick is to exchange the BTCLP token that the user has with BTC at a better price. This type of investment strategy gives up to 21% APY.

that's two sub menu in the main investment menu. The choice to explain the two sub menus can be read in the respective reviews section

The last part of the main menu is the wallet. Wallet is a function on Waves.exchange that allows users to store their own funds or crypto. Wallets also function as and access to send and receive tokens from exchanges or other users. With this function users can generate their own tokens.

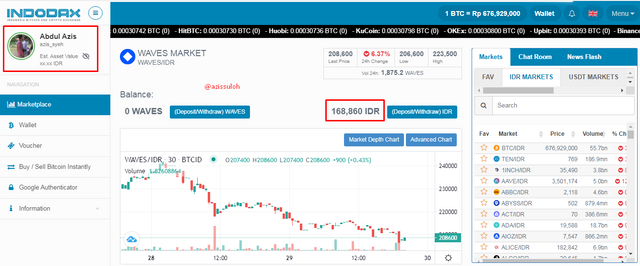

3.a

To perform this task, I will use indodax, one of the largest crypto asset markets in Indonesia and I am verified. I currently have around IDR 168,000 if we calculate it to USD, it is in the range of 11.78 USD in my spot wallet, so i will trade on the spot market to get the wave.

My verified wallet account - source

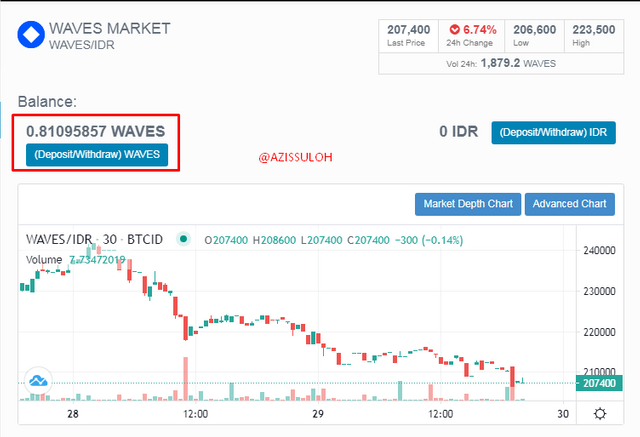

Buy Wave

Because I'm already on the market wave page, so I immediately switched to the buy wave section. I immediately made a wave purchase with a balance of 11.78 USD.

buy wave - source

Success

And the total wave that I got is 0.81095857 . I have successfully made a purchase in my indodax wallet.

3.b Shows the wave asset transfer process to the official Waves platform.

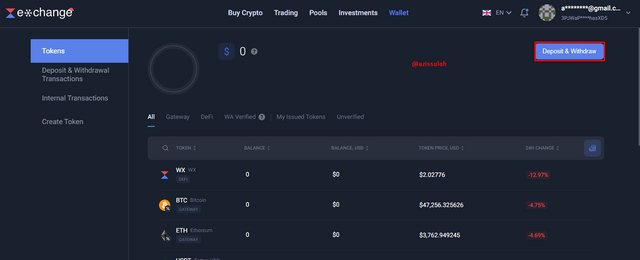

- log into the waves.exchange

The first step we have to do, of course, is to log into the waves.exchange that we have listed earlier. If you have successfully logged in, then select the Deposit and Withdraw menu.

- Click the deposit and withdraw

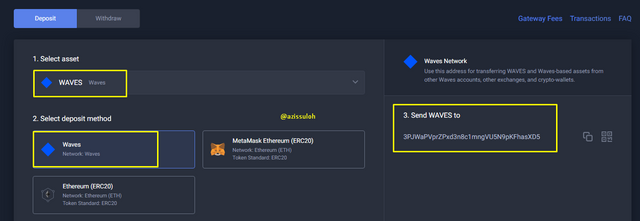

and there we can choose which coin we want to deposit. After that, there are several deposit methods that we can use as shown in the picture. Well Well I choose coin wave, and selecting the wave network, we will be given the address to send the token shown on the right side as shown above. before that, you need to select the token you want, I chose waves.

If we want to deposit wave assets, we just need to copy the address earlier. for example I use the existing wave balance in my indodax wallet. There I will select the widthraw wave, then it will be directed to the page as shown in the image. Fill in the number of waves that I want to send. And the most important thing is to copy the address of the previous wave.

select withdraw/deposit wave

fill in everything, don't forget to fill in the smart contract that we copied from the page waves.exchange

what is WX Token?

The WX token is the native currency of the Waves.Exchange platform and has been operating since 2017. These tokens are locked in smart contracts and released in small portions into circulation depending on the token emission level. This wx token is used for the Waves.Exchange Governance platform.

The creation of this token is intended to be a problem solver involving the creation of a good decentralized platform for trade, and transfer of control over ecosystems. November 2021 marks the start of the issuance of this token by wave.exchange. the available stock at the time of initial issuance is 1,000,000,000 WX coins. Not without reason, the issuance of wx tokens aims to increase platform liquidity and market creation.

What are WX Token functions within the Waves ecosystem?

WX token function usage:

- WX tokens are used for various purposes on the Waves platform. Here are some benefits of wx tokens

- We can invest WX tokens in the Liquidity Pool available for WX pairs on the exchange platform.

- Most importantly, we can use WX tokens or use them to lock contracts. If we do this, the user will get a bosst reward (Gwx). The more WX tokens we lock, the more prizes we get. It depends on how many WX tokens we lock.

- We can trade on exchanges, like other tokens on the platform.

- We can use this WX Token as a fee payment in trading on the platform.

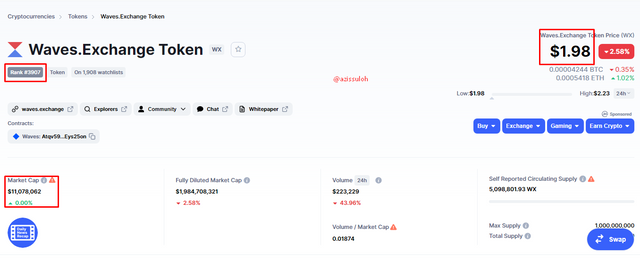

WX TOKEN According coinmarketcap

According to coinmarketcap, At the time of compiling this post, the WX Token is trading at $1.98 with a rating of 3907, a market cap of $11,078,062 and a self-reported circulating supply of 5,098,801.93 WX WX Tokens.

Wave ducks is a platform for staking as well as digital gamification. This is the result of innovations and developments in the crypt space. Especially NFT. More precisely, wave duck is a digital game platform that is included in one of the projects on NFT, wave ducks is based on the wave ecosystem.

If you are a gamer, this is the right place to play games. Users can play games, and will later get a collection of NFT duck images. Amazingly, these NFT ducks can be bred, bred, even more interesting we can sell it in various available markets whenever we want.

The information about the EGG token is shown in the screenshot below. I took this information when I wrote this article.

| Token Name | Waves Ducks |

|---|---|

| current price | $612.29 |

| current rank | 5576 |

| Max Supply | 1.000.000 |

| Total Supply | 989.212 |

| Market Cap | $28,011,343 |

start playing

To access waveducks, we can go through this link. If you have entered the old waveducks. Prospective users can directly click the "start playing" button as shown in the picture.

sign up

We will be transferred to the new old, if you already have an account, please fill in the registered email. If not then click the sign up button. View image.

Finishing

If you have finished it, then we will get an inbox in the email, as a form of verification. Fill in the numbers given, finished, then legally we already have an account, and can enjoy the game.

Blockchain technology is developing day by day and new blockchains with new and interesting features are starting to appear. The Waves platform based on a new convention known as Leased Proof-of-Stake (PoS), is a testament to the developments in the blockchain world. The Waves ecosystem is also a blockchain ecosystem like the Ethereum ecosystem. It has its own exchange named Waves.Exchange.

After going through various stages in doing this task we see, below on the Waves.Exchange platform there are three main pairs namely Waves pairs, BTC pairs and stable coin pairs. on the other hand. so many benefits provided in terms of conventions and to nodes in the wave blockchain. this is certainly very different when compared to other blockchains that practice traditional PoS convention mechanisms.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit