Greetings CryptoAcaday

![image.png]

( )

)

Explain why Stability is important in Digital currencies.

There are over 6,000 cryptocurrencies available today. Bitcoin is the forefather of all cryptocurrencies, and since its inception, countless digital currencies have emerged. Altcoins, or alternative coins, are the cryptocurrencies that came after bitcoin. They're cryptocurrency alternatives to Bitcoin.

Because of the problems that Bitcoin and other Altcoins were created to tackle, they have grown in popularity over time. Digital Currency was created as a substitute for fiat currencies in transactions. Unlike fiat money, there is no middleman when using digital currency. Digital currency is decentralized, unlike fiat currencies, which are controlled by the government of the country. Users of digital currencies have complete control over their funds. Furthermore, blockchain technology has been one of the fastest-growing technologies that emerged as a result of the birth of Bitcoin.

Although bitcoin and other altcoins are used for transactions, one of their primary issues is price volatility. In general, the price of Bitcoin and certain Altcoins is not steady. They are quite volatile, and the price might change at any time. Stable coins have been introduced to address the issue of price fluctuations. It is also important to be aware that there are coins referred to as stable coins. Because their price does not fluctuate, they are stable coins.

Many of these digital assets have a fixed value. USDT, TrueUSD, and Binance USD are all examples of cryptocurrency exchanges. The importance of digital currency stability cannot be overstated. Its significance cannot be overstated. There's a concept known as store value. People claim that some cryptocurrencies cannot be used to hold wealth due to price fluctuations. That's correct because any commodity with a store value must retain its purchasing power and be able to be exchanged without losing its worth in the future. As a result, unstable coins can't be utilized to hold value. As a result, storage value is dependent on stability.

Furthermore, it is necessary to have a worry about the stability of digital currencies. When you make a return on your investment and want to save some of it, you'll think about putting it in a safe place where it won't depreciate. There are occasions when you may desire to use the money for something due to a shortage of funds or a need. You may not be able to spend the money at the moment if the fund is not saved in such a way that the purchasing power is preserved.

Traders and investors can maintain their earnings due to the stability of the digital currency. Traders may not be able to secure their profits obtained through trading unstable coins if there are no stable coins available, and they may lose money at the end of the day. In other words, traders can claim to have "assets or reservoirs" in digital currencies if they are stable. It is impossible to overestimate the value of stability.

It's also important to note that the stability of digital currencies allows us to withdraw or sell without fear of losing money. You may simply withdraw your funds in stable currencies without fear of losing them. It's also worth noting that the security of digital currencies allows us to withdraw or sell funds without the worry of losing them. Without the worry of losing your money, you may effortlessly withdraw it in secure currencies.

Do you think CBDCs would be good in the future? Weigh the pros and cons in your own understanding and state your position.

Central Bank Digital Currencies, or CBDCs, are digital currencies issued by central banks. These are digital currencies that serve as a representation of a country's money. The value of a CBDC will be the same as that of the country's currency. For example, one cedies will be equal to one Ghanaian CBDC.

CBDC will be centralized because it will be a digital currency issued by the country's central bank. That digital currency will be controlled by the government of the country. Although CBDCs have not yet been fully deployed, governments around the world are beginning to develop digital currencies with the same value as their national money.

Let's take a look at the advantages and disadvantages of this digital currency.

Security

When you want to buy things worth millions of dollars, you don't need to bring a large sum of money. With the tip of one's finger, the transaction may be completed. As a result, the problem of theft or robbery will be significantly minimized. You'll only get rubbed if someone gets their hands on your wallet's private keys or password.

It has been made legal.

Because it is a digital currency issued by the nation's central bank and backed by the government, it will be protected by law and government policy. This signifies that it will be widely acknowledged in the country in which it is issued.

Bank accounts aren't required.

CBDC does not require you to have a commercial bank account. All you need is an online account and a wallet to get started. The unbanked will be included as a result of this.

It's a system that's centralized.

One big disadvantage is that it is under the supervision of the national government. As a result, citizens have little authority over their assets.

Uneducated people may not be able to use it.

CBDC may not be adopted by those who do not have experience with digital devices. Because they may not be familiar with how to utilize the wallet, confirm transactions, or transmit funds.

Government Policies

Government laws may force you to pay higher transaction fees, especially if you wish to transfer a significant sum of money, and because they control it, you have no option but to pay.

Now, if we consider the advantages and disadvantages of CBDC, I believe it will be beneficial in the future. Some of the benefits are critical, and they outweigh the disadvantages. Let me make an attempt to explain. The legalization of CBDC will encourage all citizens to adopt it as a form of payment.

One of the disadvantages, as I previously stated, is that it may not be adopted by uneducated persons or those who are inexperienced with digital devices. They can, in fact, be trained to utilize it and do so. Another advantage of using CBDC is that it provides security. When citizens go shopping, they will not need to bring cash with them.

Although CBDC is centralized, it may be used to monitor any harmful and duplicitous activity on the network. Its adoption may also lead to citizens embracing cryptocurrency. As a result, people will continue to use their country's digital currency even if they use CBDC.

CBDC, in my opinion, will be beneficial in the future because of these and other factors.

Explain in your own words how Rebase Tokens work. Give an illustration.

A rebase a token is a form of token in which the circulating quantity adjusts in response to price fluctuations. Since of the price fluctuation, it's also known as an elastic supply token because the circulating supply adjusts itself automatically.

Stablecoins and rebase tokens are similar in that both are always aiming for a price. Rebase token, on the other hand, is different from stablecoins in that its supply is elastic. Based on the rule of demand and supply, the supply adjusts automatically when the price changes.

What is the procedure for rebasing a token?

As I previously stated, Rebase tokens, like stable tokens, have a Target price. We'll examine supply and demand in relation to price to better grasp how it works. We know from fundamental economics that as demand rises, the price of a commodity will rise as well. The price of a product will also decline if the producers increase the supply of that commodity.

When the price of a rebase token rises, the supply rises as well. The increase in supply will lead the token's price to return to or near the desired price. Remember that as supply grows, so does pricing. As a result of the supply rule, the immediate price increase will return to the target price.

Similarly, if demand falls, so does the price. Then rebase the token and modify the supply by lowering the total number of tokens in circulation, causing the price to return to the target level. The law of supply states that when supply decreases, pricing rises.

Now let's take a closer look at this. Assume a rebase token has a target price of $1. If the price rises to $1.1, consider the following scenario. The rebase token will then automatically adjust itself by increasing the circulating supply (an increase in supply lowers the price) to return the price to the original target of $1. If the price drops to $0.9, for example. The rebase token will reduce supply (a decrease in supply raises price) in order to return the price to the $1 target price.

Go to the https://www.ampleforth.org/dashboard/. Check the necessary parameters and calculate the rebase %. What else can you find on the page?

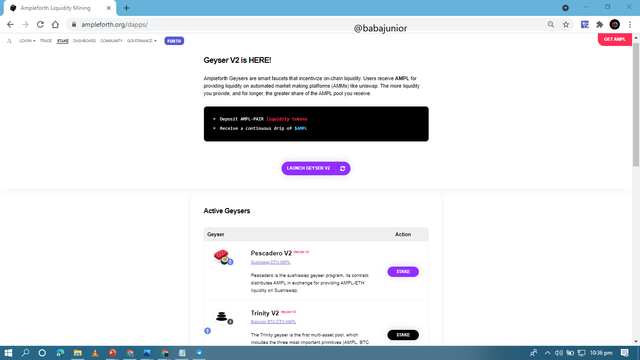

In this section of the question, I'll go to ampleforth.org and look for the parameters that will allow me to calculate the rebase percentage.

You will be taken to the ampleforth's homepage by clicking on the link in the question.

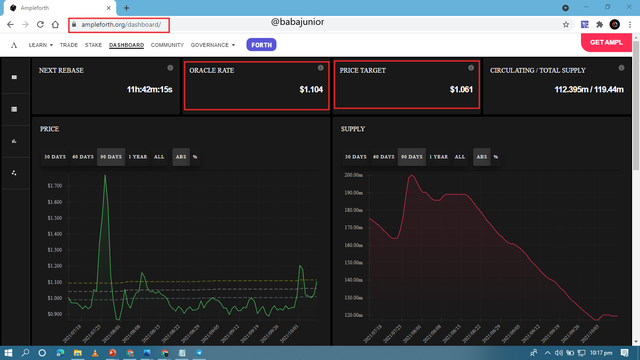

Ampleforth Website showing target price and oracle rate

Now, according to the screenshot, we can see oracle rate, price target, circulating/total supply, and next rebase

Oracle rate = $1.104

Price target = $1.061

Next rebase is $1.061

Circulating /total supply is 112.395m / 119.44m

Let's figure out the rebase percent now.

The rebase percentage formula is as follows:

Rebase % = {[(Oracle Rate - Price Target) / Price Target] x 100} / 10

From the screenshot above,

Oracle rate = $1.104

Price target = $1.061

Rebase % = {[(1.104 - 1.061) / 1.061] x 100} / 10

= {[-0.g / 1.061] x 100} / 10

= { -0.043× 100} / 10

= (-4.3) / 10

= 0.43 %

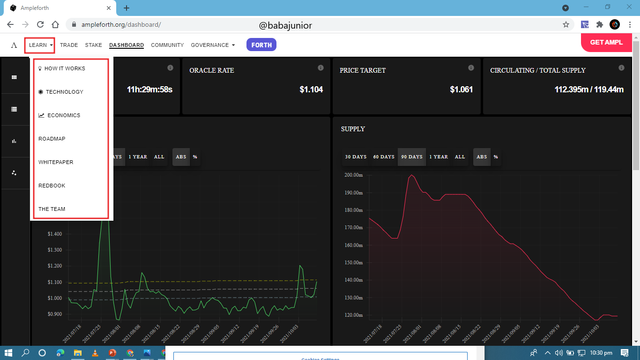

If you look closely, you will note that I chose the settings from one of the website's features, which is the dashboard. Other features may be found at the top of the page. Learn, trade, stake, community, and government are all features.

Some features will appear when you click on the learn area. Features such as how it operates, a route plan, and technology, among others. These features will provide additional information about the ampleforth.

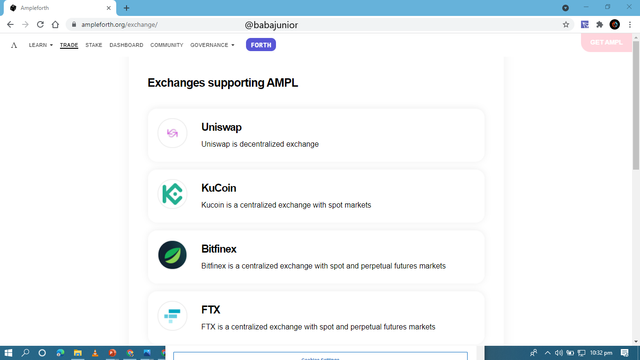

Also in the trade section. Supporting exchanges include uniswap, kucoin, FTX, bitfinex, and others. Take a look at the image below.

Screenshot of Trade Section

- The ampleforth also has a stake portion.

Screenshot of Stake Section

- There's also a community area. It is a feature that allows people to associate with one another. Please see the screenshot below.

Screenshot of Community Section

- The governance area is where you can see how everything operates, as well as the fourth token and resources.

Screenshot of Governance Section

Trade some tokens for at least $15 worth of USDT on Binance and explain your steps. (Give necessary Screenshots of the transaction).

Transfer the USDT to another wallet with the Tron Network. From the transaction, what are the pros of the stablecoin over fiat money transactions? (Give Screenshot of the transaction).

THANK YOU