Hi everyone, this is my homework post for week 7. It is about money management and portfolio management that has been the task to be completed. It was an excellent lecture deliver by Professor @stream4u as always and I have learned new things that I am going to write in this post.

Money Management.

Image source

Money management is a term that is often used in trading world. It means the way in which a user manages to trade with his total capital. There are many strategies for money management, but all depends upon the user to choose according to his goal. Moreover, greed comes into play while trading an asset. Emotions of the user can turn the profits into losses. In the trading world, reasoning is more important than emotions. One has to control his emotions and trade with proper reasoning.

Proper money management is very essential for trading and gaining profits. As we have been told in lecture, total capital should be divided in 4 or 5 portions and then each portion should be invested on different crypto assets. These investments should be made whenever this is an indication to buy an asset. Before buying any crypto asset, technical analysis should be made, we learned in previous lectures how to set buy trade to enter the market, and then one portion of total capital should be used to buy that particular crypto asset.

Money management strategy can be very helpful in gaining profits as well as lowering the risk of loss. When a user spends his whole capital in buying one crypto asset that was assumed to go upwards, but it goes downwards instead. In this way, loss will be the fate of the trader. If the trader waits for the asset to go upwards, then it can take many days, weeks or even months. So capital of the trader is locked. Otherwise he will have to exit the market with huge loss. In such scenario, if the trader has invested one portion of his capital in such trade, the rest of the capital is available to him for further trading. If one crypto asset has gone opposite to his analysis, it is possible that other crypto asset may move as per analysis. Thus the profit from other trades can eliminate the loss of one trade. In this way, capital will also be secured and risk factor is eliminated.

My Future Plan for Money Management.

It is a very sound strategy and I will surely adopt it. I am looking forward to enter trading world very soon and I will surely divide my Capital into 4 or 5 portions and then invest them properly after some technical analysis. In this way, It will help me to gain profits and lowering my risk factor.

I have plan to trade in Large capital like Bitcoin and Small Capital like Dogecoin. More assets will be added as I am gaining knowledge and experience from this Crypto Academy. Money management will be followed at any cost and emotions will be eliminated from trading.

Money management is also a tool to enter the market by buying some asset and then setting stoploss according to the risk ratio. It helps in avoiding huge loss. Take profit is another term that should also be used to manage trades and exit market. Otherwise, profit can turn into loss due to greed.

Portfolio Management.

Portfolio simply means a bag. A bag consists of the things that are needed by the user. Unnecessary things are removed from the bag. In trading world, portfolio means a tool that is used to watch and monitor some crypto assets. If a user wants to buy any crypto asset, the first thing to consider is to watch the movement of that asset and buy it when there is an opportunity to buy it based on technical analysis. So user will select the assets he is interested in to trade, and put them into his portfolio.

So, it is clear that a portfolio consists of the crypto assets that a user wants to buy for trading purpose. Portfolio management is also very essential in trading world as it helps in monitoring the movement of the assets. It also gives the idea of past trades. Previous trades can also be saved in the portfolio and a user can learn from his mistakes.

I am not a trader, but as I am planning to do trading in very near future, but still I have no portfolio to show you here.

My Future Planning of Portfolio Management.

Image source

Every strategy has its importance in trading world. Likewise, portfolio management is also very important. As I am planning to enter trading world very soon, I will surely apply Portfolio management in my trading. I am more interested in Small capital due to their potential of huge return, So I am keeping an eye on Dogecoin. And I will add it to my portfolio to watch its movement. This will enable me to trade whenever there is an opportunity to buy it. As I have learned some technical tools to analyze the market, I will use those tools alongwith money management and Portfolio management.

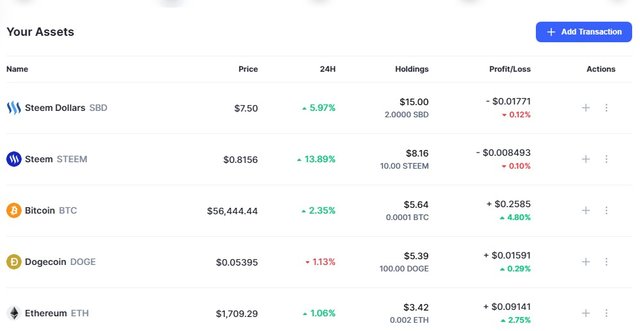

I will add some other crypto assets like Bitcoin in my portfolio management and also Steem and SBD.

Failed Investment.

As I am not a crypto trader yet, So I have not failed investment. But the point is when I will try to trade without money management and technical analysis, It will never be profitable trading. Proper money management, technical analysis and Portfolio management, these are the tools that can help the trader in gaining profits and lowering the risk of loss.

Conclusion.

As we discussed in this post, Money management alongwith Portfolio management is essential for trading. These are very important strategies that should be adopted and followed by the traders in order to avoid loss and gain profits.

@steemcurator01

@steemcurator02

@stream4u

Thanks,

Hi @babawattoo

Thank you for joining Steemit Crypto Academy and participated in the Homework Task 7.

Your Homework task 7 verification has been done by @Stream4u, hope you have enjoyed and learned something new in the 7th course.

Thank You.

@stream4u

Crypto Professors : Steemit Crypto Academy

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit