.png)

Hello everyone, How are you all doing?, I welcome you all to the Fourth week of the crypto academy season. This week, we will be focusing our studies on Cryptocurrency trading as well, where I get to explain to you how to trade with the help of Trends Psychology, i.e how to trade with the market movement.

On today's, I will be submitting my task to professor @reminiscence01, after I have studied and understood the Topic "Psychology of Trends Cycle", where I will explain to us how to identify entry and exit points with the trend movement, as well give explanations to the basics studies in identifying an uptrend or downtrend with the market psychology, You can as well join me to study the course from the Page. WISH YOU A HAPPY READING!!!

Dow Jones theory is the study of market psychology, where the theory explains the movement of Accumulation and Distribution Phase of the market, the Dow Jones theory tends to explain the study of the market movement according to traders' emotions where everyone is expected to acts according to the market direction as what any profitable trader should do.

The Dow Jones Theory was developed by Charles H. Dow sometimes in the year 1897, where he believes the market can only be in the Phase of Uptrend, Downtrend, and Sideway, as these phases depend on the market traders, the dow jones predicts market direction with the weight of the buying or selling amount plunge into a particular asset at the time being which this regards to the trade volume.

From the amount of Volume added into the market, where we get to use the volume indicator, we get to predict or know the number of particular assets being bought which this decision can drive other investors to buy and move the market to the accumulation phase, then when there is a scenario whereby a large investors removes his assets from the market we get to see other retailers as well to start selling and moving the market to a distribution phase causing the market to move lows.

The Dow Jones theory is simply a day-to-day activity we all took in the market, with the help of technical analysis of identifying uptrend and downtrend, we get to utilize this theory in a profitable decision and safeguard our trade.

I believe the Dow Jones theory is important in technical analysis as with the help of knowing the market trend and movement, we get to use this theory to predict or analyze a new movement in a market and make a prediction ahead of the market movement.

The Crypto market is known to be widely controlled by the market whales, which their movement os what the small investors follow, the two phases are the Accumulation and the Distribution phase, at the accumulation, the market is accumulating to the new trend which by then more people are buying while the distribution phase is the phase which enough profits have been made and the market is being taken over by the sellers.

The Accumulation Phase is the phase where the big investor, the crypto whales purchase the assets with the idea of pushing the market to a new high phase which causes the market to be depicting an uptrend movement, This movement is with the idea of gathering particular assets till it got to a matured level and eventually sell, at a well profitable level.

We have to know that the Strong hands always control the market movement, whereby they are the ones with real assets to control the market however they see fit, they are the ones who traps the small investors to a market phase, at the Accumulation Phase, the Strong hands keeps buying the assets to an uptrend.

The image below shows the example of the Accumulation Phase, as that is the phase the Whales took the market from the Downtrend market and push it in the upward direction.

The Reaccumulation Phase is the Phase at which the market tends to want to pick a new trend, but instead, the buyers still took the market over to the new phase, at the accumulation phase, the whales have made their profits and took their assets off the market reason why it wanted picking a new trend, but instead, the market was purchase by other whales which thus return the market to its previous movement.

The Distribution Phase is exactly the opposite of what happens in the accumulation phase as it is the phase where the big investor, the crypto whales Sold their portion of the assets with the idea of taking out their profits which causes the market to be depicting a downtrend movement due to the large sales from the buyers, Within this movement, the sellers as well enters the market with the idea of making a sell entry with the idea of pushing the market to the lowest movement and profiting off the downtrend direction.

The image below shows the example of the Distribution Phase, as that is the phase the Whales took the market from the Uptrend market and keep selling which thus pushes the market in the downward direction.

The Redistribution Phase is the Phase at which the market tends to want to pick a new trend, but instead, they insist and still took the market over to the phase of distribution, at the redistribution phase, the whales have made their profits and took their assets off the market reason why it wanted picking a new trend, but instead, the market was sold by other whales which thus return the market to its downtrend movement.

The Market phases are known to be divided into three Phases, Uptrend, Downtrend, or Sideways Phase. The market regardless has to obey one of these movements. And these phases can be identified by analyzing the market pattern to know the current trend at which the market is trending.

Bullish Phase - The Bullish Phase is known as the Uptrend Phase where we get to witness a series of Higher Highs on the market chart, one thing to note in the bullish phase is that the next higher highs are always greater than the previous highs. in this phase, it is considered as the Buyer's market as we get to see more investors buying the assets than those selling.

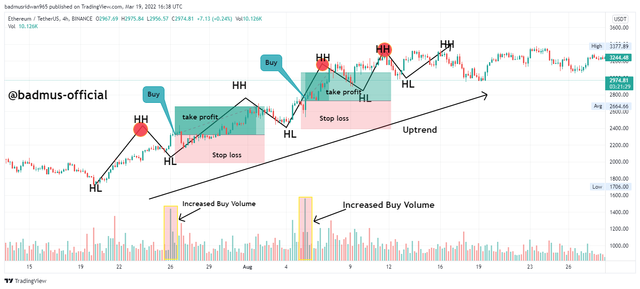

From the image above, we get to confirm the Bullish phase as we got to see the market to be moving in a higher direction and there are several higher highs, and the pattern of the market is in an upward direction.

Bearish Phase - The Bearish Phase is known as the Downtrend Phase where we get to witness a series of Lower lows on the market chart, one thing to note in the bearish phase is that the next lower lows are always greater than the previous lows. in this phase, it's considered as the Seller's market as we get to see more investors selling the assets than that buying.

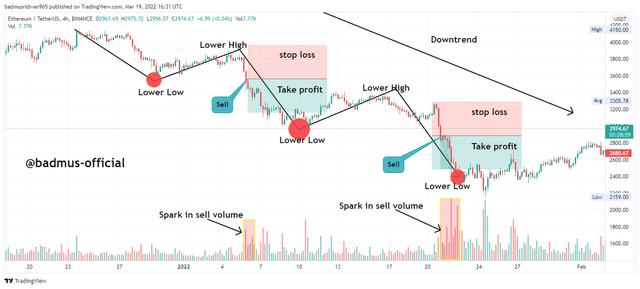

From the image above, we get to confirm the Bearish phase as we got to see the market to be moving in a downward direction and there are several lower lows, and the pattern of the market is moving in a downward direction.

The Sideway Phase - The Sideway market also known as the Ranging market is the market of support and resistance, in this case, there is no uptrend or downtrend yet in the trade as the market is still looking for a trend to pick yet.

At the Ranging phase, there are no big investors as the volume of purchase and sales is still low, at that phase, only small retailers are dragging the market between selling and buying, the market keeps consolidating till the moment a big investor plunge assets to bring the market to a new phase.

A breakout was seen from the image above after the market has consolidated enough, then a big investor eventually took the market to the uptrend as the market breaks the resistance level.

As said earlier, the Market strength depends on the number of investors in the assets at a particular moment, the volume indicator tends to tell us the weight of investment in the assets at the market at that moment.

Bullish Market:

In the Bullish market, we get to see an increase in the volume indicator as to the point the market breaks, it breaks due to the amount an investor plunge into it, as said earlier, the market is controlled by the whales who plunge a large number of buy trades in the market, in the bullish market, we get to see the Buy volume bar to be increasing in the period.

The image above confirms the Uptrend movement as we saw the Buy volume to be increasing over time the pattern is still moving up.

Bearish Market:

In the Bearish market, we get to see an increase in the volume indicator as to the point the market breaks a downtrend, a large red volume bar is to be seen, this break occurs due to the number of investors leaving the assets at the time, as said earlier, the market is controlled by the whales who plunge a large number of Sell trades in the market, in the bearish market, we get to see the Sell volume bar to be increasing as the previous buyers are now selling their shares of the market.

The image above confirms the Downtrend movement with the volume indicator as we saw the Sell volume to be increasing over time the pattern is moving downward.

Sideway Phase:

At the sideway market, we get to see a very low volume of buyers and sellers as at this phase, there is no whale yet buying the assets causing the market to have a low volume of buyers and sellers. the moment a spike occurs in the ranging market, that means a new trend is likely to occur sooner.

The Image above confirms the sideway market as the market keeps showing a range movement and there is a low volume of buyers and sellers in the market.

I will explain the criteria to utilize using the Dow Theory of markets psychology trends, which all these criteria are to be met before traders decide on buying or selling the market.

Bullish Phase - Before deciding to buy in an uptrend market, take note of the following criteria.

Ensure that the Market is in an uptrend movement as the market is confirmed to be forming several higher highs.

Ensure that there is a large number of buy volumes in the market as we took the decision when the green volume bar shows a large stick.

Ensure that the market has just started a new Higher high trendline, i.e after the market retraces from its Higher Lows, decide to buy two or three candles after recovery from the opposite trend.

Set the stop loss in your best interest, the Risk reward of 1:1 is best utilized in this position, The stop loss should be placed below the market entry just below the previous Higher Low.

An illustration of the above criteria can be seen from the image above, as I took my decision to buy after all the criteria for a bullish trade are being met with first, and the Buy volume is high as well.

Bearish Phase - Before deciding to sell in a downtrend market, take note of the following criteria.

Ensure that the Market is in a downtrend movement as the market is confirmed to be forming a series of several lower lows.

Ensure that there is a large number of sell volumes in the market as we took the decision when the red volume bar shows a large stick.

Ensure that the market has just started a new lower low trendline, i.e after the market retraces from its lower high, decide to sell two or three candles after recovery from the opposite trend.

Set the stop loss in your best interest, the Risk reward of 1:1 or 1:2 is best utilized in this position, The stop loss should be placed above the market entry just below the previous Lower high.

An illustration of the above criteria can be seen from the image above, as I took my decision to sell after all the criteria for a bearish trade are being met with first, and the sell volume is high as well.

Sideway Phase: - Thou trading sideways can tend to be unsafe as there is no pattern unlike the bullish and bearish phase discussed. In sideways, we get to trade purely based on the support and resistance level only.

Map out the support and resistance level first, as the support level is the level the market starts rising and the resistance level is the level the market starts falling.

Buy the trade at the point the market hit the support level and its retraces two candles above the support level, set in the risk management of 1:1, the stop loss below the support level, and the Take Profit at the resistance level.

Utilize a Sell trade at the point the market hits the resistance level and it has retraced two candles depicting lows at the resistance level, set in the trade management in 1;1, the stop loss above the resistance level and the Take profit at the support level.

The confirmation of my trade illustration of the sideway market can be seen from the image above, as the volume as well was confirmed to be depicting several lows and fluctuating between buyers and sellers.

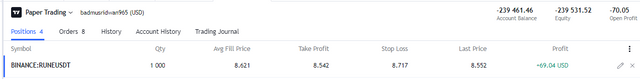

SELL POSITION - I will be selling the market of RUNEUSDT to carry on a sell trade on the Paper trading demo account.

I ensure that the market is traveling in a downtrend has I have seen several lower lows, then I structured the downtrend patterns.

I decided to sell when I saw that the market has retraced from its opposite trend and it is now traveling in a downtrend movement.

After placing my trade to sell, I set in my profit level in 1:1, and the stop loss above my entry.

The proof of my trade from paper trading as I sold 1000 units of the RUNE Coin at the price of $8.621, then my stop loss at $8.717, and my take profit at $8.542.

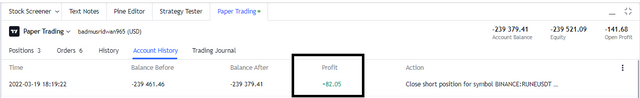

A moment later, I went back to the chart to see whether the market is moving in my predication as could be seen that the market is now depicting several lows and my take profit level has already hit.

BUY POSITION

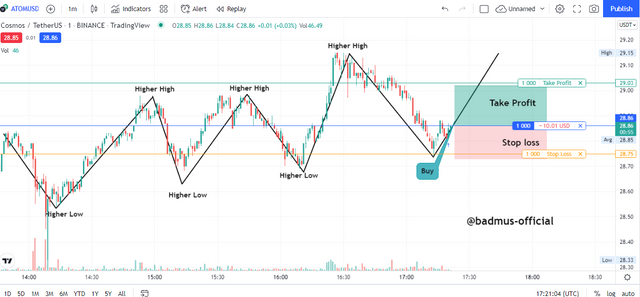

I took a buy position of the ATOMUSDT market in a 1 min time frame, I could see that the market is depicting several higher highs since its recovery from the downtrend market.

I ensure that the market is traveling in an Uptrend movement as I have seen several higher highs, then I structured the uptrend pattern.

I decided to buy when I saw that the market has retraced from its opposite trend and it is now traveling in an Uptrend movement.

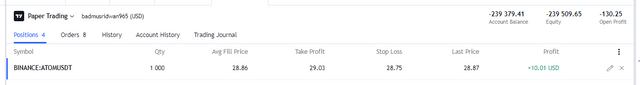

- After placing my trade to Buy ATOM at an entry price of $28.86, I then set in my profit level in 1:1, and the stop loss below my entry at $28.75 and my take profit at $29.03.

A Couple of minutes after my entry, my trade is now making profits as I was already having profits of $30.

Unfortunately, my Take profit didn't kick in despite being close to the target level, the market then retraces till my stop loss level hit as I had now made a loss from the trade, what I was able to learn is that my take profit is too wide, if not, my take profit could have kicked in before the SL hit.

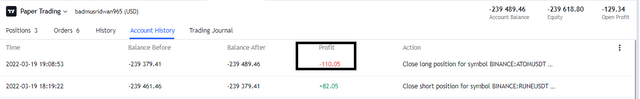

My trading Journal from the demo account as I hit the loss of -$110.

Here comes my conclusion on the Topic Psychology Of the Trends Cycle as I have been able to explain the dow theory of analyzing a trend movement and carrying trade with it.

I have also been able to analyze the criteria that must be met one utilized before carrying a bullish or bearish trade, as a professional traders, we should learn how to utilize the market movement along the strong hands known as the crypto whales, as one needs to be able to see over the market traps and avoid making a wrong trading decision at the wrong timing.

The important thing is to be able to identify the accumulation as traders are expected to buy at that point, and when we saw that the market is distributing, that is the perfect spot to sell and make a profit.

Special thanks to professor @reminiscence01, its a very knowledgeable course I was glad I took part in

Task Written by: @badmus-official

Hello @badmus-official, I’m glad you participated in the 4th week Season 6 at the Steemit Crypto Academy. Your grades in this Homework task are as follows:

Observations:

from this trade, the actual execution price at $8.621 has a bigger stoploss price than the take profit price, making this a negative ROI trade. Always ensure that your stoploss is in a 1:1 ratio to the take profit.

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit