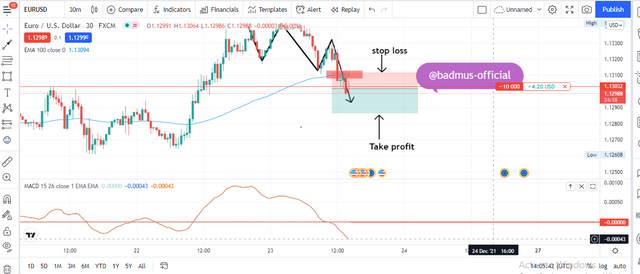

.png)

Hello everyone, I welcome you all once again to another great week in the Steemit Crypto Academy.

Here we are once again in week 6 of the fifth season, it's been a lovely season thus far. on today's topic, I will be giving insight on one of the trading concepts known as "Confluence Trading", the course was tutored by professor @reminiscence01, you can as well join me and study from the Page.

Below is my submission to the assignment, Stay on, and wish u happy reading!!

Confluence trading is one of the major concepts of crypto trading traders used in a sense to increase their chance of winning or let me say there chance of making a profit.

Confluence trading is a trading method whereby traders combined two or more technical tools to give confirmation of the trend positioning and avoid bogus signals from a trend.

Avoid fake signals in a sense whereby a market is showing a fake position but with a combination of two or three tools, it can never go wrong as it is impossible to have three fake signals at a time.

Confluence trading can be used to make confirmation of a trend in a situation whereby we see three indicators signaling the same position, that gives affirmation to that trend as its been certified more than two or one tools.

The whole practice of cryptocurrency is to trade to make a profit, whereby any chance or any tool of winning is welcome as it increases the chance of making a profit and as well filters out bad signals for traders and gives a smooth entry position for traders.

Explain how a trade setup can be enhanced using confluence trading

Enhancing a trade setup means increasing the clarity chart of our trade which there is no better way to do this other than by increasing the number of technical tools/techniques we carry out when making our trading setup.

The first thing needed to come to our mind is what indicators or strategy we understand the most, afterwards, we choose what trade setup we are most familiar with or as well determine a timeframe of the time we are carrying out a trade

The illustrations I will be making below show how to include a confluence method in our trading setup.

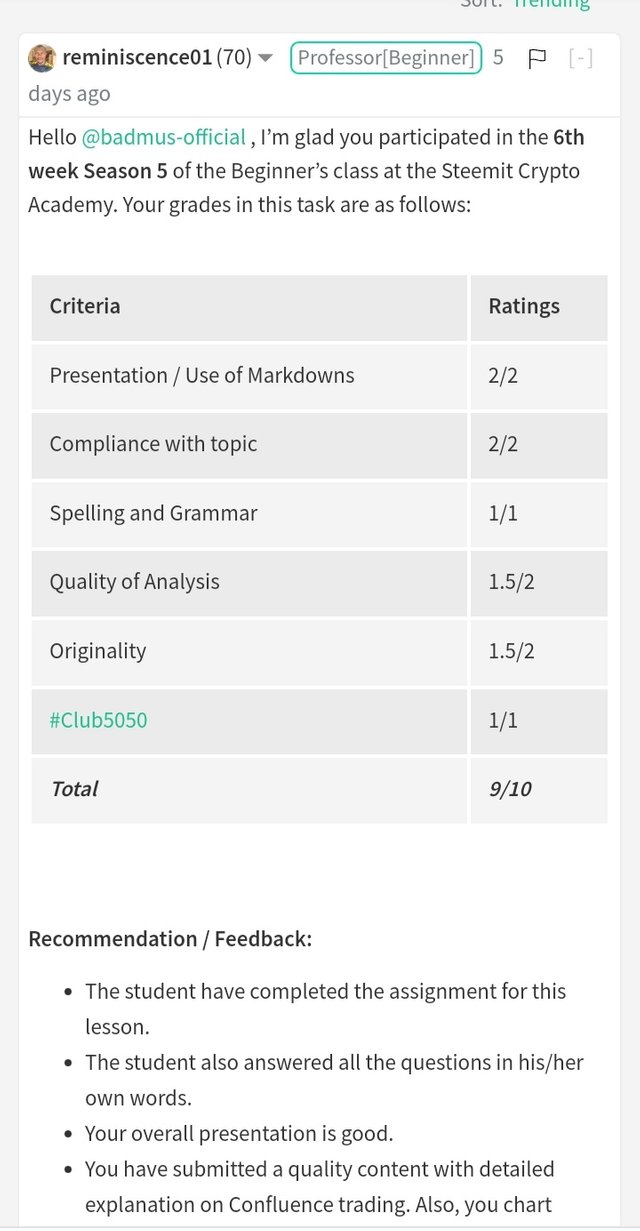

From the image above, we could see how I made confirmation of the market trend by using Confluence trading as I include the Inverse Head and Shoulder pattern in addition to Exponential Moving Average Indicator.

The Inverse Head and shoulder pattern are used in a market trend to anticipate a trend reversal, a reversal could occur either bullish or bearish depending on the pattern structure, so as seen in the chart above, as I was able to form an inverse head and shoulder pattern as the Head forms the Lowest Low with the two shoulders aligning, I was able to anticipate a breakout reversal from the pattern which thus proves the strong confirmation of a trend, but this only is not enough which is why I combined it with an exponential moving average indicator.

An exponential moving average indicator is used to confirm a trend position as a situation whereby the market is moving above the indicator line shows a bullish signal and as well when the market is below the indicator shows a bearish signal.

But from the image above, we get to see how the head and shoulder patterns form to align with the Indicator as when a breakout was expected from the head and shoulder pattern, that was the same time the market breaks High above the EMA indicator which thus proves the tangibility of our position.

Now, let us have another indicator added to the chart, the indicator I will be adding is the Moving Average Convergence Divergence (MACD) indicator.

After the adjustment made on the indicator settings as the MACD now portray signals using the zero line (The Brown Horizontal line), the MACD signal bullish when the line crosses the horizontal line to the top and as well signal Bearish when the macd line crosses below the horizontal line, so what we could simply see on the chart is how the MACD gave a false signal.

As can be seen that the Inverse Head and Shoulder pattern is not fully formed yet before the macd indicator indicates a breakout from a trend which this can be categorized as false signals at the moment or I could at least say an Early breakout, Now we could see the importance of the Confluence Trading, assuming one is only trading with the MACD as it signaled one could have made a loss at that period.

The importance of confluence trading in the crypto market can never be overemphasized enough, just as seen from the chart above as we were able to filter out false signals with the use of Confluence trading by using the Inverse Head and shoulder pattern, MACD, and as the EMA indicator. So from that, we were able to confirm our trend as we get to witnessed a reversal from the market which all three tools as well pointed in the direction, one thing we were also able to filter out is the Early breakout of the trend as we witness an early breakout from the MACD indicator.

Importance Of Confluence Trading

Identify a good trade setup - Confluence Trading helps traders identify proper trading setup as it portrays to traders the real market positioning as this gives affirmation to the trading setup.

Give Confirmation to trend: Like the idea of confluence is to give a proper price level of a chart, with the idea of combining several indicators and strategies we get to know the price level of a trend as the more the confluence signals, the more the market level confirms.

Put the ODD in Traders Favour: The confluence trading as well is important on trade to put the odds of winning in traders favor as these give traders more chance of carrying a profitable trade.

Filter out bad signal: Have show an example where the Confluence trading was used to filter out a false signal on a chart as a situation whereby we saw two techniques give an indication to a ranging market but instead the indicator was showing a breakout, with the use of confluence, we were able to filter out the bad signal instead.

Risk Management: With Confluence trading, traders can as well set their profit and stop limit on a chart as the confluence trading can be used to anticipate a market direction next which can limit traders' loss and increase the chance of winning.

Just like have explained earlier that confluence trading is the concept of combining more technical tools/indicators on a trading chart. which thus comes in the level of the confluence confirmation, we should note that the higher the level of confluence the higher the level of our trading confirmation, Now I will be explaining what it means to have 2 - level, and 3 - level confluence confirmation.

2 - level confluence is the method of trading by which traders combined two indicators or two trading techniques on a chart to have more clarity to a trend or market direction. This method is much more relevant when trading as traders can filter out bad signals from a trend as such a case whereby one technical tool is not enough to carry out successful trading, traders then combine one more indicator making it two, to give clarity to their trade entry or exit.

Example of 2 - Level Confluence below

An example of a 2 - level confluence trading can be seen in the ETHUSDT market above, as the combination of the indicator signifies how strong the market is, from the image we could see two indicators on the chart where I combined the EMA 100 indicator with the MACD indicator, then from the combination, I get to confirm the tangibility of the position as we saw the market crosses above the 100 EMA indicator same time the MACD indicator crosses the zero line, this signifies the solidity of the market position as we were able to confirm the market is truly trending bullish.

A 3 - level confluence confirmation is a situation whereby traders combined three trading techniques on a trend to have a more accurate position and as well give confirmation to their entry or exit. The 3-level confluence gives more accurate confirmation to the trend positioning other than the 2 - level, just as I said earlier, the more the Confluence level, the more the chance of winning, and as well the more we get confirmation on a trend.

Example of a 3 - level Confluence on a chart

An example of 3 level confluence trading was seen in the chart above, where I made use of break of market structure, macd, and the EMA indicator.as we could see from the chart when the market structure breaks to bullish which was the same time the market breaks above the EMA indicator and as well a confirmation was witnessed from the MACD line as we saw the macd line breaks above the zero line.

All these are added to the chart to give more confirmation to our trending position and as well depict to traders the position at which the market is currently trending. these then prove more confirmation to our trending as we already get to witness the same position from the three trading techniques.

Question 4 - Analyze and Open a demo trade on two crypto asset pairs using confluence trading. The following are expected in this question. (a) Identify the trend. (b) Explain the strategies/trading tools for your confluence. (c) What are the different signals observed on the chart?

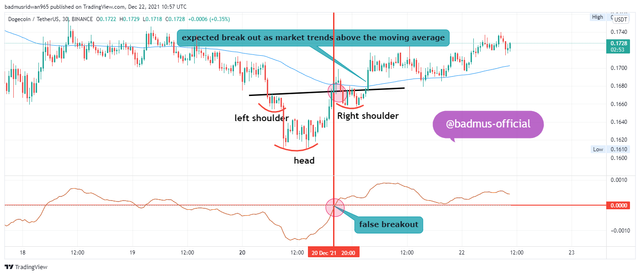

For this task, I will be using the market of USDJPY to carry out the buy trade on my demo account.

A) - Identify the trend.

The first thing to observe first before even adding indicators is to identify a trend first, we should know the market mood whether it is bullish or bearish.

From the chart above, using the market structure alone we could observe a bullish trend, as we get to see buyers been active in the market, which without even indicator we could observe a possible buy entry.

B ) - Explain the strategies/trading tools for your confluence.

The tool I will be using for my confluence is the 3 - level confluence confirmation where I combined the ema indicator with the macd indicator and as well the market structure breakout. with this, we could easily see a strong trend and as well a firm position to carry on our trade.

From the image above, at the time I want to carry out my trade, we could see the correlation between the market as we got to witness the three strategies pointing in a bullish direction, we could be in the best position to buy.

c)- What are the different signals observed on the chart?

From the chart of USDJPY, we could observe a different signal at the vertical line drawn below, we could observe the different signals from the two indicators, as we saw the market breaks below the zero line in the macd indicator but on the EMA the price keeps moving above the indicator, which thus proves we have two different signals on the trend, which is where the importance of Confluence came in as we get to pinpoint the real signal on a trend instead.

BUY TRADE

After the Confluence confirmation, I took a buy trade to purchase five units of the JPY, which as seen above, the moment of my trade, I was able to start making a profit.

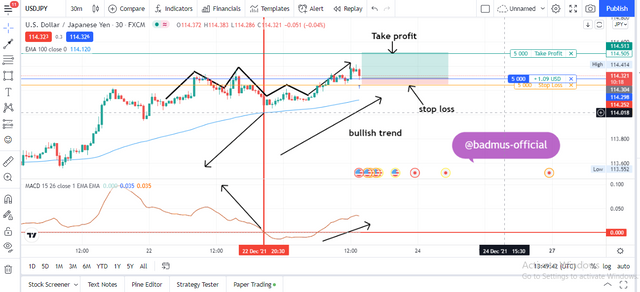

SELL TRADE

The same trading strategy was taken in the market of EURUSD as I was able to identity a sell position as the market is currently trending in bearish which is the best position to sell.

From the chart above, I was able to include 3 - level confluence trading on my chart, as I use the Market breakout structure[1], MACD indicator [2], and as well the 100EMA indicator[3], with this, I was able to confirm my entry position to Sell.

I took a buy position after the strategy was met, and from the 3 - level confluence trading I was able to confirm the market is currently trending bearish which I then took a sell position with the RISK/REWARD ratio of 2:1.

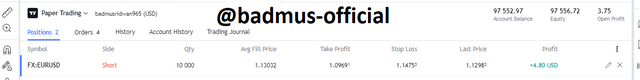

The image above shows the result of my trade, as my Short trading was already trending Profit which shows the confluence gave a positive result.

Confluence trading is a major concept in cryptocurrency trading as it is utilized to give a greater chance of winning and as well as give confirmation to the trader's position.

Confluence trading is a situation whereby traders combined two or more trading techniques on a chart to boost a trader's performance, confluence trading can be categorized into 2 - level confluence or 3 - level confluence or more.

2 - level is a concept of including at least two trading techniques and 3 - level confluence is a concept of having at least 3 trading techniques on a chart to give more chance of winning and as well boost the odds of winning a trade.

Having multiple level confluence on a trend increases the level of winning as the more the confluence level, the more the chance of having an absolute confirmation signal.

Here comes the submission to my assignment, it has been intriguing so far, Thanks to professor @reminiscence01 for a nicely delivered lecture, it's an honor to participate.

Steemit Cryptography Student: @badmus-official

@steemcurator02, here is the link to the uncuated post