Hello everyone, how are you doing, I hope everyone is doing great, I welcome you to week 3 season 6 of the engagement challenge, and here I shall be participating in the contest discussion of "Tokenomics in the Crypto Ecosystem".

On this topic, I shall discuss the importance of Tokenomics in the crypto ecosystem and why the structure of token economics is important to attract investors, Happy Reading!!.

Tokenomics is a word that conjoined Token and Economics, this is a term that is used to describe the economic value and growth of a particular token, this gives a general illustration of the impacts of a token in its ecosystem, this affects the use of a token and also its market value is affected by it.

When considering an investment in a token, assessing the Tokenomics is equally important as you get to view the token mechanism such as its burning schedule, the token maximum supply, and circulating supply, and this has great effects on the value of the token so as to be sure whether the assets are worth investing or not.

Tokenomics also shows the importance of the token in its blockchain, this holds a vital part as it entails the details of when the particular token will max out, its mining reward, and also its market value for use as time goes on.

Highlight the main importance:

The main importance of tokenomics is to provide transparency in the particular project, when this is known to the investors, it gives a certain credibility to the network and this makes it certain for investors whether to invest or not.

Tokenomics also has its effects on the value of assets, when the token has a great tokenomics mechanism with high utility, this made it certain for investors that it is a coin with a good project and a valuable use and this gives credibility to its time-to-time usage.

Before considering the investment of assets, the tokenomics is what attracts investors whether it is worth the investment or not, the tokenomics decide the usage of the token, and it also factors into the major value of the particular token.

The components of tokenomics are the major important factors that illustrate the supply mechanism and the initial schedule for the development of a token.

The Token Supply:

This is a vital part of the supply mechanism as this is used to determine the supply and demand pressure affected by a coin, and these are the circulating supply and the maximum supply.

The Circulating Supply - The Circulating supply of a token refers to the amount of the available supply of that token in circulation, and these are the tokens that can be burned, traded, and also be used for transactions at that moment.

The circulating supply gives more value concerning its demand, as this shows the available amount of the token at the moment, this circulation means it's getting closer to its maximum and when this runs out, the coin value might tend to be framed at a higher value as there will be more demand for it with lesser supply.

The Maximum Supply - This means the maximum amount of the coin available, and this has been set at the initial of the coin, which is going to be the total supply of the coin, and when this is done, there is no more minting of the coin anymore, and what will be left of the coin is what is in circulation.

There are some instances where some token doesn't have their maximum supply as this might be a coin pegged to another, for example in the case of terra UST and Luna, this coin has no maximum supply as they are built to back each other in terms of circulation.

The Tokens Utility:

This is another great factor that affects the value of a token, this simply refers to the use of that particular token, a token with a day-to-day service tends to be more valuable.

For example, in the LTC token, which is used for daily services such as transaction fees and trading fees, the utility of a token also determines how the token is used in its blockchain, for a case whereby a token is used as governance within its network, this give more chance for holding such a particular token so as to participate in changes and be able to vote in its protocol.

The Burning Schedule:

This is also a great mechanism in a tokenomics, as this is used to determine the burning structure of a token, token burns are used to reduce a token circulating supply, and when this is done, this brings more inflation to the project making the project more valuable for the moment.

The Token burn schedule is also a great component in its mechanism, as this has proven more stable when there is a burn. so from the burning schedule and the amount at which the projects are willing to burn, this brings hope of high investment as burning has a great impact on the supply of the token.

And the three listed are the major components affecting a token economy.

The token I choose to discuss is the LTC coin also known as Litecoin.

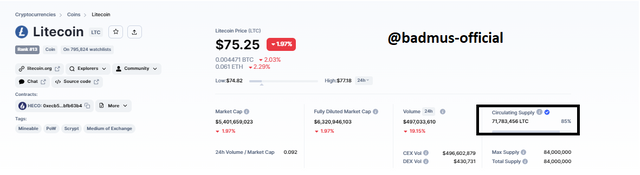

image Screenshot from coinmarketcap

Litecoin token is a token created as the lite version of bitcoin in terms of operation and use, it has a faster operation, and is also used for day-to-day utility.

Litecoin has been available since 2011, and it has a Circulating Supply of 71,783,456 LTC, and the token has a maximum supply of 84,000,000 LTC, which shows the circulation is at 85% and the coin will soon max out.

What makes this unique is the ability of its utility, the coin is ranked 13th, and it has a broad use for transactions across most platforms, this is a great choice for investment as we can see the coin has great productivity in the crypto ecosystem, and it has great utility benefits making it a great choice of investment.

do you consider the asset worthy of investing in? Why?

YES, I do consider LTC worthy of investing due to its utility benefits and it has been made as a mode of payment by over 2000 merchants across the globe.

And also coupled with the fact that the token is close to its maximum supply which afterward we get to be sure of high values of returns, this is a coin have been studying for a while and I will consider investing in it as soon as I can.

Transparency - The idea of tokenomics is to give transparency to investors, with this brings certainty to what the investors aimed at, investing in a project without a full studying of its tokenomics is called a blind investment or gambling, the tokenomics is vital and gives certainty of the returns or projects the future value of a coin.

Growth Of the TOken - This is also another major factor for its importance to investors, before anyone would consider investing in a particular asset, the major factor is to check if the coin has a chance of growing in the future, the tokenomics determined this, especially the supply and demand pressure, this can then made investors have the choice of waiting or holding the assets for longing with respect of making a profit in the future with it.

Yielding - This is also a factor of importance to investors, before considering investing in a token, the tokenomics determine the future yield of the assets, in a sense when the burn occurs quarterly every year, this might give a heads up for investors to determine whether it is a good decision to buy or sell.

These are all the points that are attached to the importance of tokenomics for investment as this is done to determine whether the particular asset is a great choice to buy at the moment, or wait it out for a little and watch the tokenomics before considering it as an investment.

If I should create my own token, the part I will consider more important is the Token Utility part.

The circulation and maximum supply as well will be given great consideration as well as the token burnt, but it's my belief that it's the utility that drives the market value more.

The utility of the token determines its usage value in day-to-day activity, and a token with more daily usage gives a great choice for investors as this pose that it is a solid project with an important use, a token that is used as a mode of payment every day will surely drive investors, even when there get to be price movement, the token will also be able to maintain great stability in terms of price action.

So this is the part I would consider most important and it also has a great chance of driving investors to invest in the project.

The Tokenomics of a token Is used to determine the possible price activity of that token, its for sure know that when a token gets to its maximum supply, there will be a great demand for it at a lower supply.

The whole price action is dependent on the Law of supply and demand, and a great project with low supply tends to have more value in the market provided that it is backed by a great utility, the project will definitely be a great choice of investment.

Thank you, everyone, for coming, and I hope you have a great day, I hereby invite @solexybaba, @josepha, and @Sahmie to participate in the contest as well.

Hi @badmus-official,

Your informative post is a source of very good concepts new to me.

These things will surely help the newbies like me in the cryptocurrency innitiative. There are many things that can contribute of the token economics of a company.

I also agree with your this point of view that the utility token is another basic reason of the price growth of that token. The use case is more means that the economy is good.

I wish you much success in this contest of the week.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

We support quality posts anywhere and any tags.

Curated by : @chiabertrand

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks alot chiabertrand

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

A well explained and we managed post. You have given a very beautiful understanding about the Tokenomics.

The components of the Tokenomics are also well explained. These components are the token utility, token burning, token supply and many more that can help the traders to understand well about the project.

Yes, you are very right here. Maximun supply of a token actually refers to the total amount of the tokens that will be available till the complete stop in its mining.

When the mining of the token is stopped, there is a decrease in the supply of that token and hence it will surely increase the demand (price) of that tokens.

Thanks a lot for sharing your Quality post with us and wishing you a very happy contest ahead.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You have written a wonderful piece here my friend, the statement you made as highlighted below is very true

The use case of the token is what makes the price the appreciate the more. When the token can be use for many purpose then the price can go higher. I wish you success in this contest my friend.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I must commend that you have done justice to this task friend. Tokenomics determines the value and usability of any given token. The aspects of tokenomics to consider when creating a token include the token’s supply and demand, its utility within a given platform, the incentives for holders and users, and its security measures.

Supply refers to the total amount of tokens that exist, while demand is determined by investor interest and usage. If there is high demand for a certain token, its value will increase accordingly.

Thanks for sharing and goodluck in this contest.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit