Hello everyone in crypto academy community, this week the professor presented his order book in easy-to-understand terms. He demonstrated how to read the order book to learn about the crypto market. He discussed how the buy and sell orders will profit from the deal and how we may protect ourselves from losses. I comprehended and read the professor's course article, and I am now completing his homework.

1. What is meant by order book and how crypto order book differs from our local market. explain with examples (answer must be written in own words, copy paste or from other source copy will be not accepted)

Order Book simple means the order of orders of any assets that are available in the market that are waiting to be filled (buy/sell) or cancel by the trader that set the order.

In another word we can simple say a Order book is a financial record book that shows the price of selling or buying an item/assets and are waiting to be filled. The order book contains both the bidding price (buying price) and the asking price (selling price), which are perfectly documented for transactions that have been placed but have not yet occurred, as well as other transactions that have occurred in the area.

The order book is also practice in our local market, but there are also some differences.

For instance in a local market the seller usually determine the price and not the buyer but in the Crypto world the price is mainly determined by both the parties (buyer and seller).

To buy a product in a market place the buyer need to visit a particular location (the market), for example in Nigeria here we have to walk some several miles before we reach the nearest Market place whereas in the crypto world you can enter the market place as long as you have a device that is connected to the internet and can access exchanges.

In a market place the asset can be seen and touched but in cryptocurrency we don't have the previlage to see and touch our assets cause it digitalize.

Order book in cryptocurrency are transparent that is any one can see all the transactions that have taken place and the ones that are not yet filled, but in the local market only the seller usually write down his/her records and sometimes most of the seller can't produce the previous records of the transaction cause most of them are careless.

In local market there is only one currency involved that is the local currency of that region, whereas in cryptocurrency there are numerous options for currencies, we also have trading pairs e.g BTC/USD, BTC/NGN, BTC/ETH that is BTC can be bought or sold for USD (US dollar), BTC can be bought or sold for my Local currency NGN (Naira) BTC can also be bought or sold for Ethereum another crypto asset.

2. Explain how to find order book in any exchange through screenshot and also describe every step with text and also explain the words that are given below.(Answer must be written in own words)

How to find order book in Binance exchange

Login to Binance exchange, I use the app so I open the app on my phone

After you open the app in the homepage Select "Market"

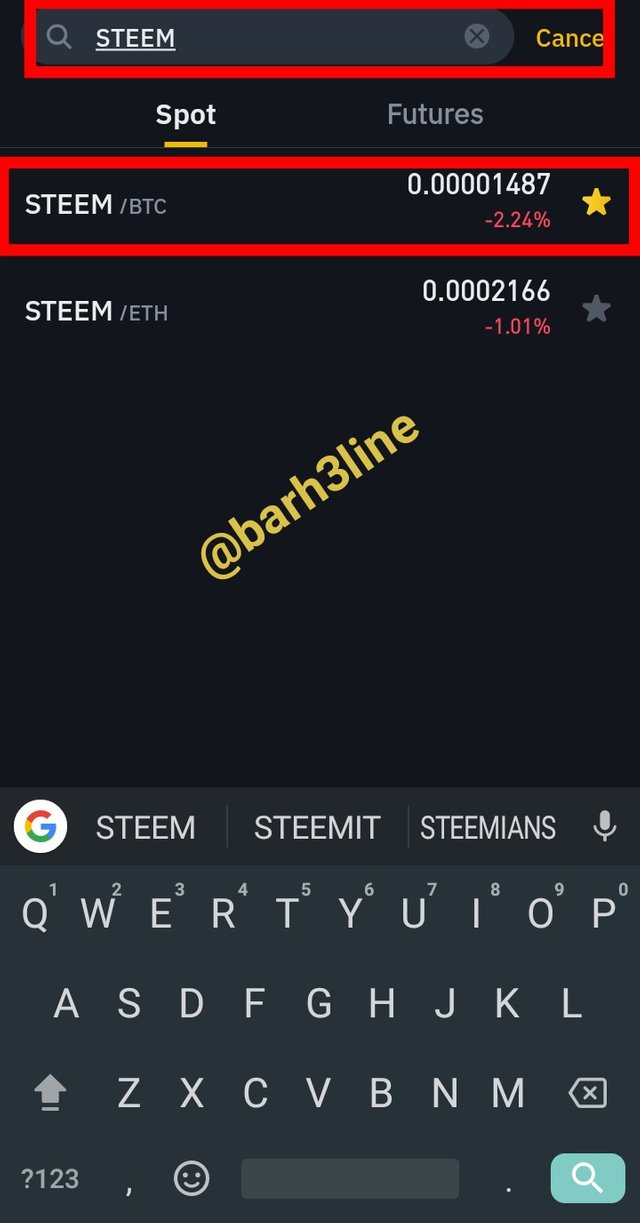

- Now search for the asset you want to check the order book, in this case I search for STEEM/BTC pair and open it

- The Next page displayed, you need page scroll down a little below the asset chart and you will find the order book of the STEEM/BTC pair.

Trading Pair

A trading pair is two assets that are matched together on an exchange and can be traded for each other. In cryptocurrency an asset can be matched to either cryptocurrency for example BTC/ETH that is BTC can be traded with another crypto (ETH), it can also be matched to Fiat Money for example BTC /USD that is BTC can be traded with (US dollar).

The example below is the screenshot of STEEM/BTC pair

Support and Resistance

Support in cryptocurrency are mostly seen in an asset chart pattern, it simple represent the level where a downtrend (Bearish) is expected to pause, this is cause as a result of strong buyer that wants to take advantage of the downtrend by buying more and more of the asset and this thereby cause the price of the asset to go up.

Support level in a Crypto chart represent the point for a trader to place a Buy order.

Resistance in cryptocurrency represent the level where an uptrend is expected to stop (Bullish) that is when the price of the asset is expected to fall, when the price of an asset keeps going up traders took advantage of the uptrend and sell off their assets causing the price to fall.

Resistance level in Crypto chart represent the point to place a Sell order

The screenshot above shows the support and resistance of BTC/USDT Trading pair on Binance Exchange.

From the screenshot above we can notice BTC experience a quiet number of resistance as traders begin to sell off whenever it goes up a bit above it support line.

And also whenever it started going down trader also jump in and begin to buy and this will make the price to go up as you can see in the above screenshoot.

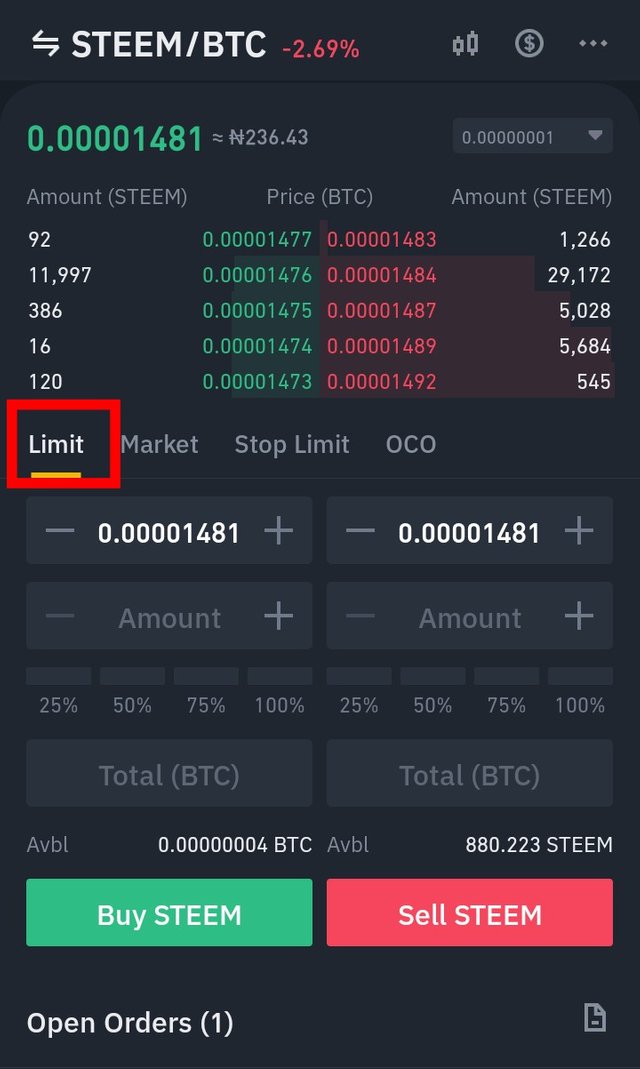

Limit order

Limit orders are orders placed in the order book at specific prices. The price is set by the trader, a trader can place a limit order to buy or sell an asset at his/her preferred price. In order to place a limit order in the buy zone For example, if a trader want to trade the BTC/USDT pair, he/she must have a significant amount of USDT in his/her wallet. the trader must have enough BTC in his/her account to create limit orders in the sell zone.

A trader can make use of the limit order to make profit in the market

Let me give example let say the current price of BTC is $37,000 and the BTC support line is $34,000 the trader can decide to place his buy limit order at the support line which is $34,000 to buy BTC at cheaper price, after the order has been filled when it reach the price, after a a while the trader can then decided to sell the BTC let say the resistance line is $43,000 the trader can decide to place is sell limit order at the resistance line of $39,000 and wait for the order to be filled and this means the trader as gain a profit of $5,000.

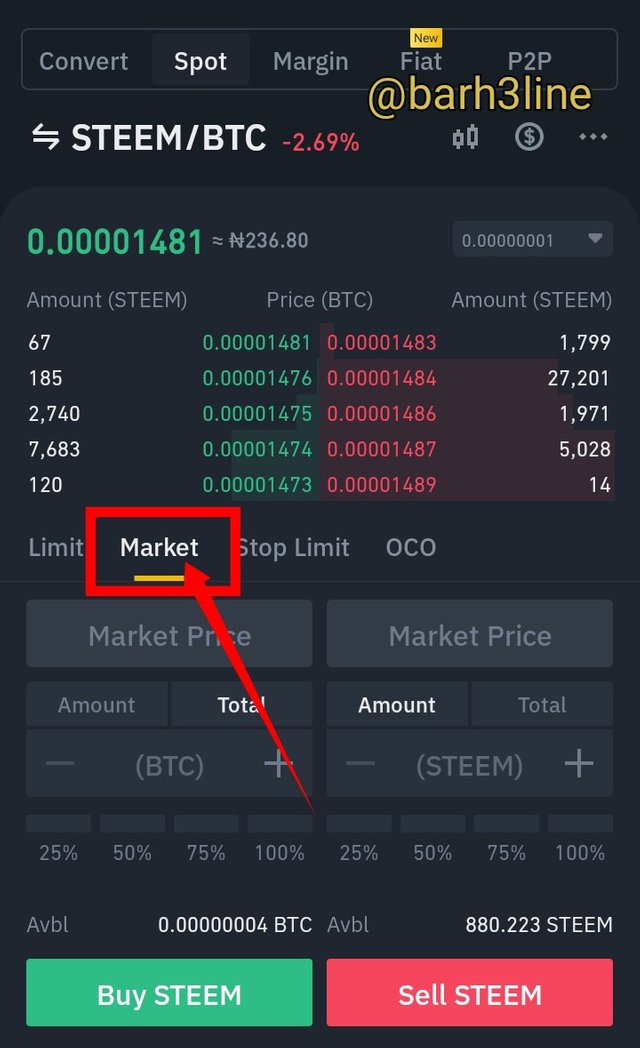

Market Order

Market order simple means an order placed by the trader to buy or sell an asset at the current market price. The market order is usually very fast and instant because the trader want to buy or sell his/her at the existing market price unlike limit order that takes some time before the order is being filled.

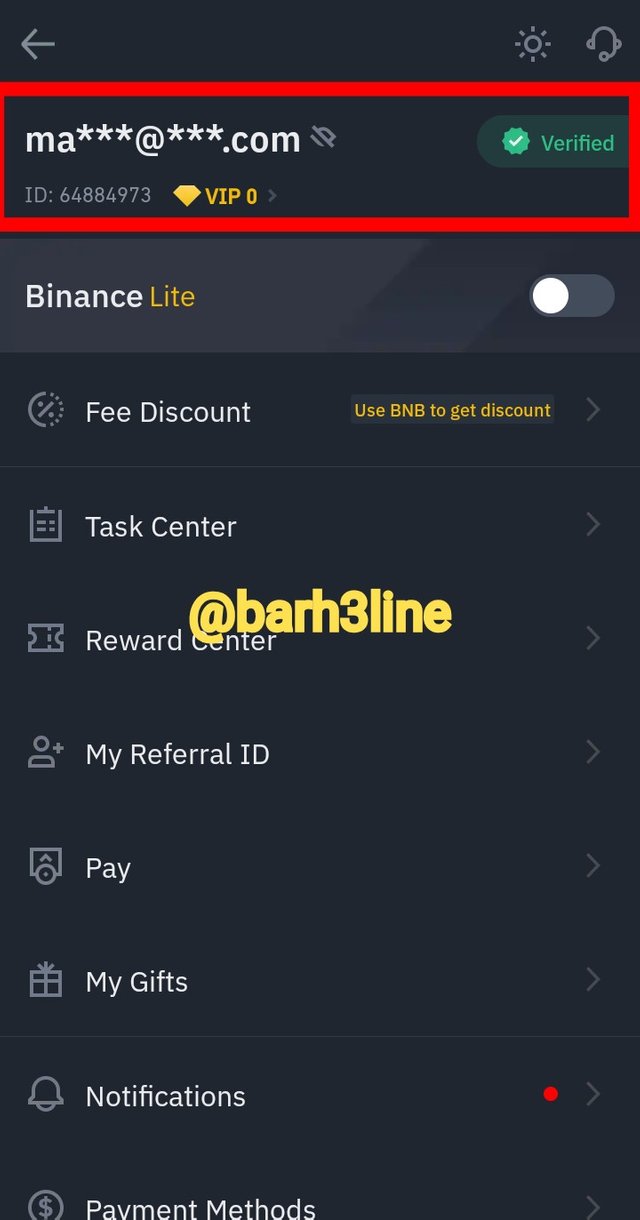

3. Explain the important future of order book with the help of screenshot. In the meantime, a screenshot of your exchange account verified profile should appear (Answer must be written in own words)

As enquiry by the professor below is the screenshot of my verified Binance account

Features of Order book

As I have explained earlier, order book contain the list of the buy and sell order of an asset awaiting to be filled or cancel by the trader.

There are numerous features available on the order book.

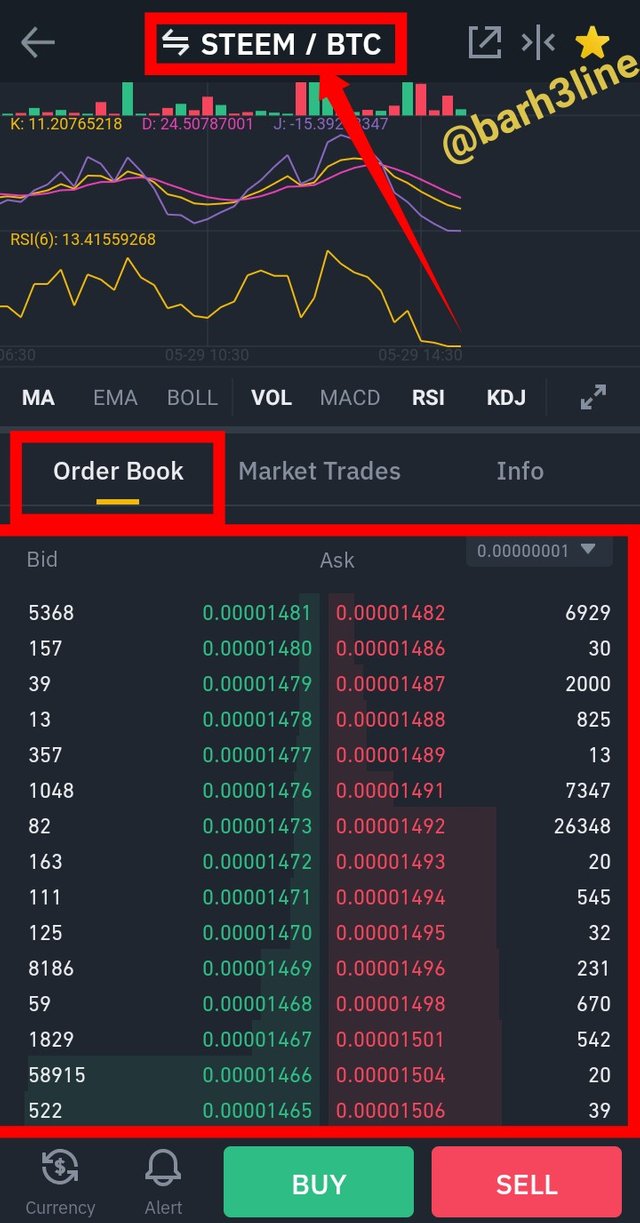

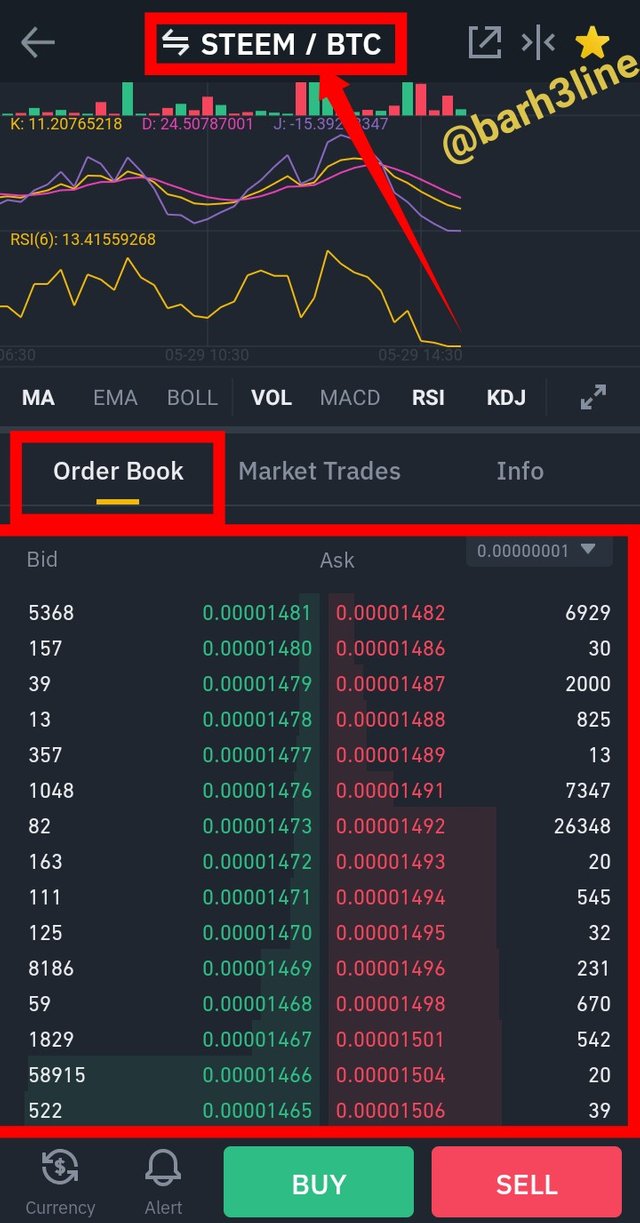

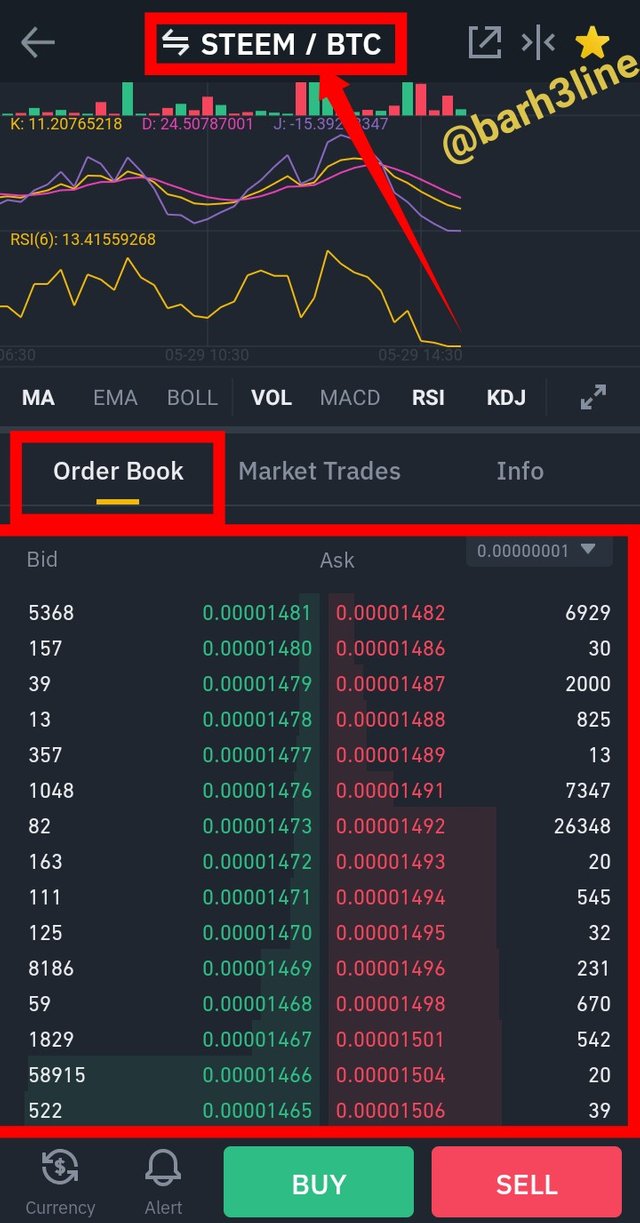

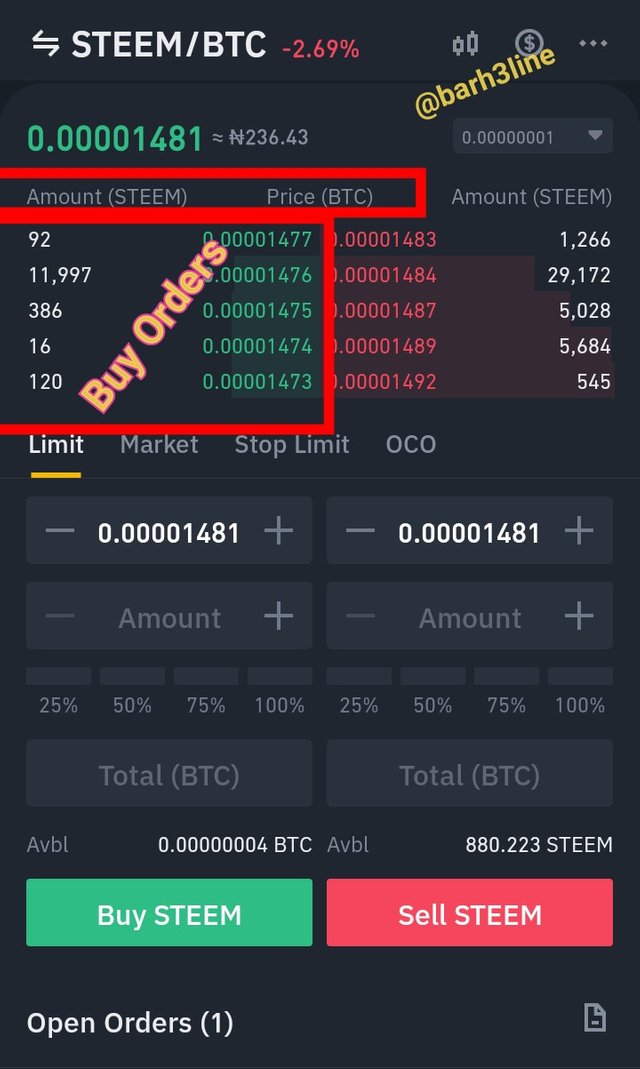

I will be using the STEEM/BTC trading pair on Binance Exchange.

Below is the screenshot of the order book of STEEM/BTC pair on Binance

#####The Buy Section (Bid)

The Buy Zone in an order book consist of all the record list of the buy orders that are waiting to be filled by a trader

The buy Zone is usually represented in green colours, it also consist of the price and the total of the asset waiting to be fille.

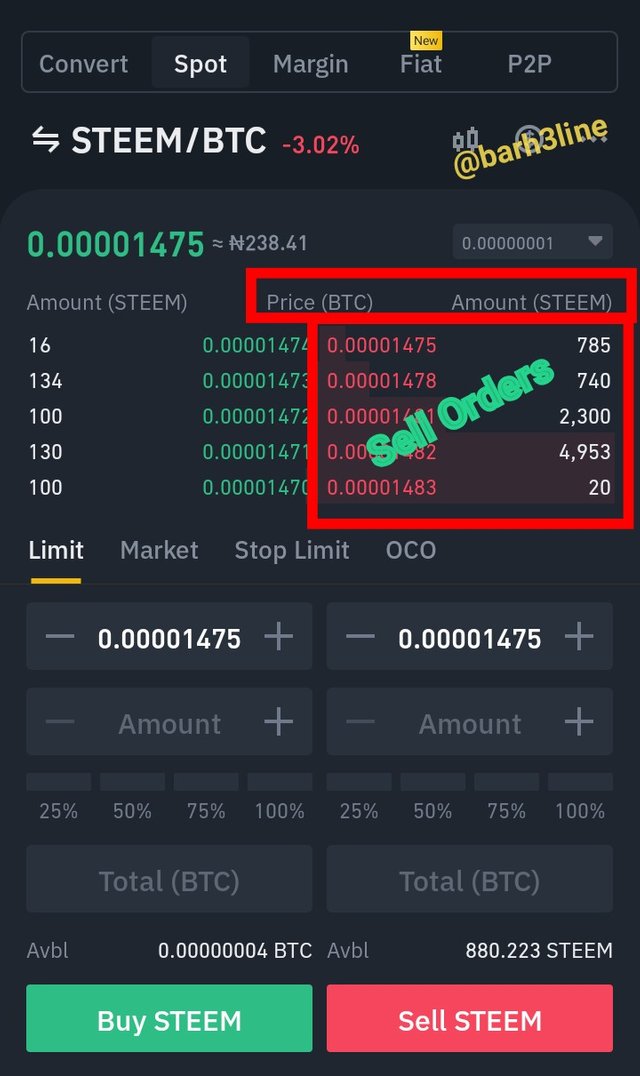

Sell section (Ask)

The sell zone in an order book consist of the lost record of all the assets that are placed in the sell order waiting for it to be filled by a trader.

The sell order is usually represented with Red colour, this zone also consist the price and volume of the asset that are waiting to be filled.

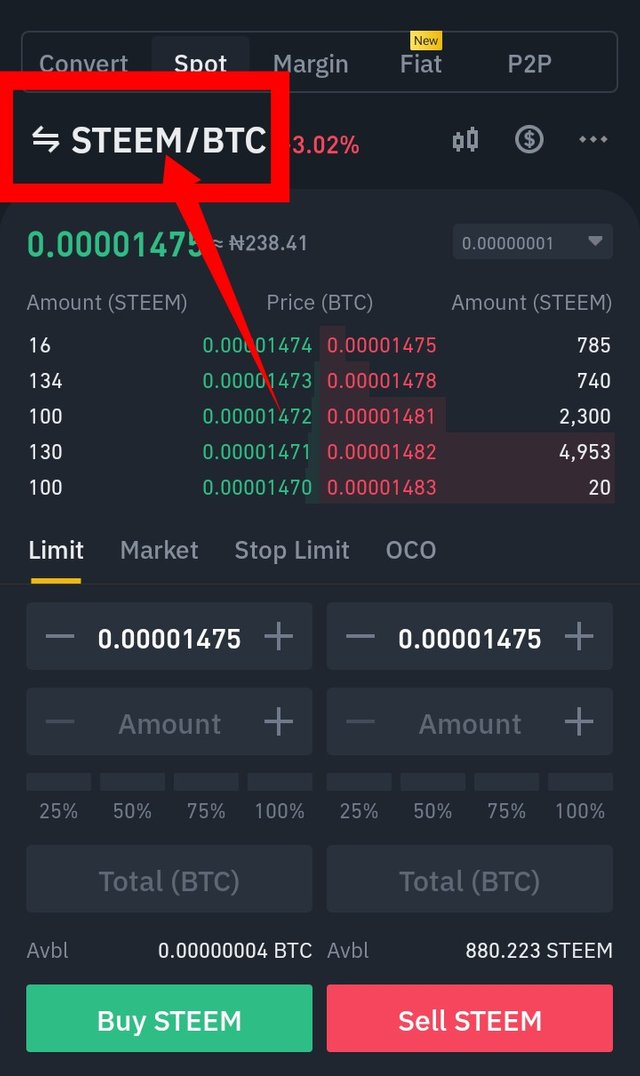

The trading pair

The trading pair is another amazing feature of Order book it is usually located at the upper side of the screen, it showcase the pair of the asset.

Below is the screenshot of STEEM/BTC pair on order book

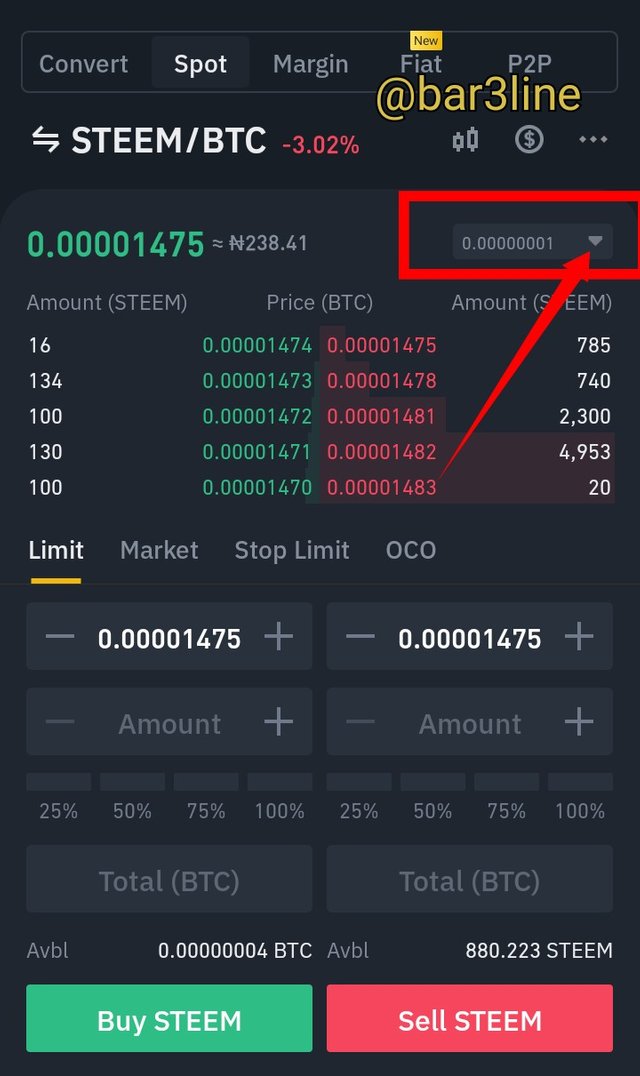

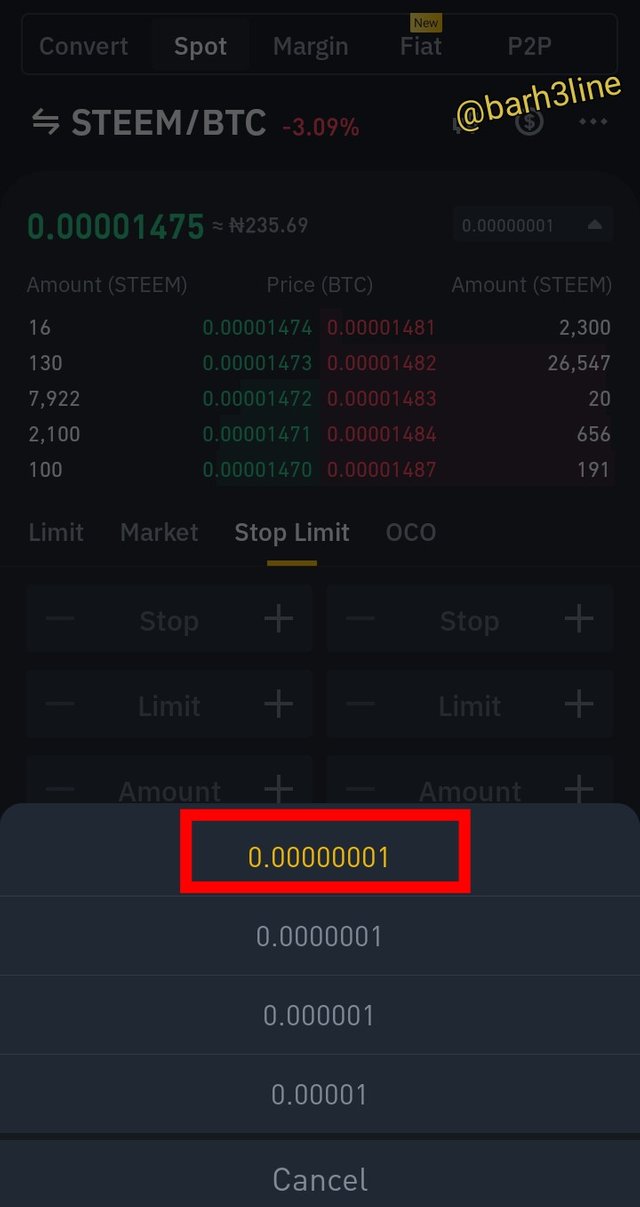

Decimal

Decimal is another beautiful features in order book, this allow the trader to filter the price he/she wants in Decimal.

All they have to do is click on the drop down menu and the side of the "decimal" will pop up then the trader will select his/her choice

See the screenshot below

After clicking that then the list of the decimal will pop up, the trader then need to choose the one he/she preferred

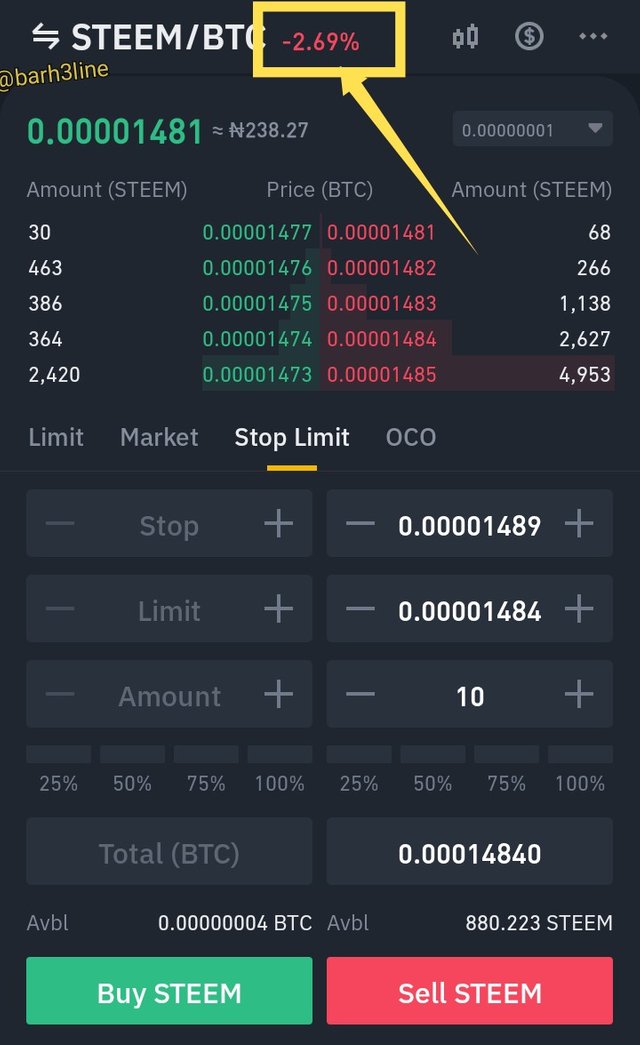

The market percentage of the pair

This is one of the features I like most, a trader can easily see how the asset has been in the last 24 hrs.. whenever it is losing or gaining.

Green represent gaining while red represent losing.

The screenshot below shows that the STEEM/BTC pair is currently losing with -2.69%

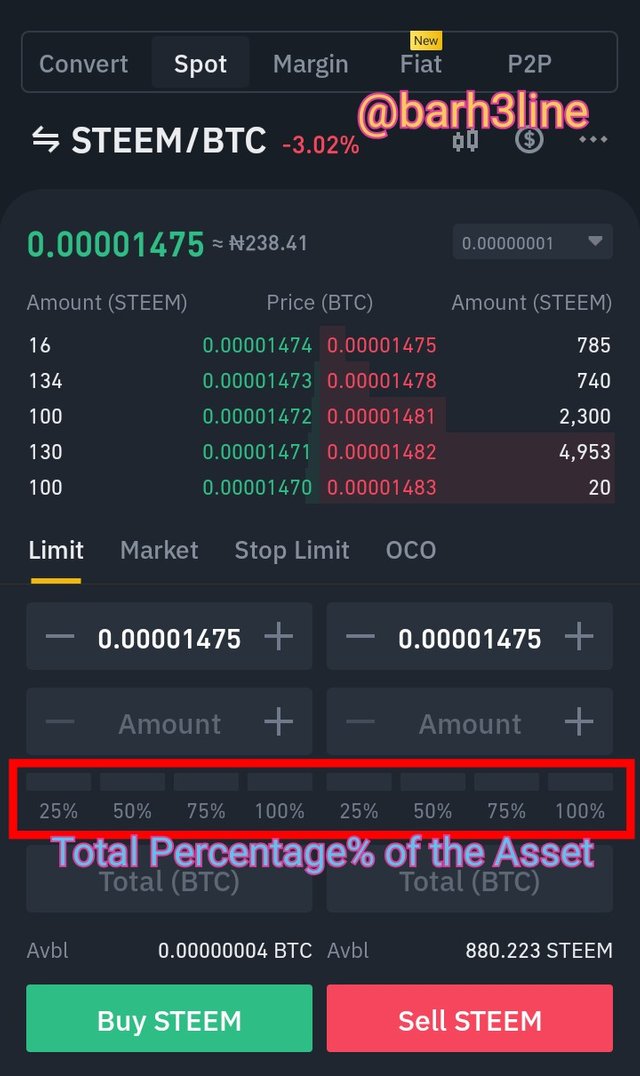

Total Percentage of the asset you want to Buy/Sell

This is another features in the order book, this feature allow the trader to easily enter the total asset he want to buy/sell by just selecting the percentage

See the screenshot below

3. How to place Buy and Sell orders in Stop-limit trade and OCO ,? explain through screenshots with verified exchange account. you can use any verified exchange account.(Answer must be written in own words)

Stop LIMIT Order

Before I show how to placed an order on Stop limit let me quickly give the meaning of Stop limit order

Stop limit order is consist of a stop loss and a limit order. It is a type of order that is used to lock in a profit or minimize a loss by establishing a stop and limit price ahead of time. So, before you place limit order you need to set two price;

Stop Price: this is when the target price start from

Limit Price: the lower limit price of the target price, it is usually set to be lower than the target price

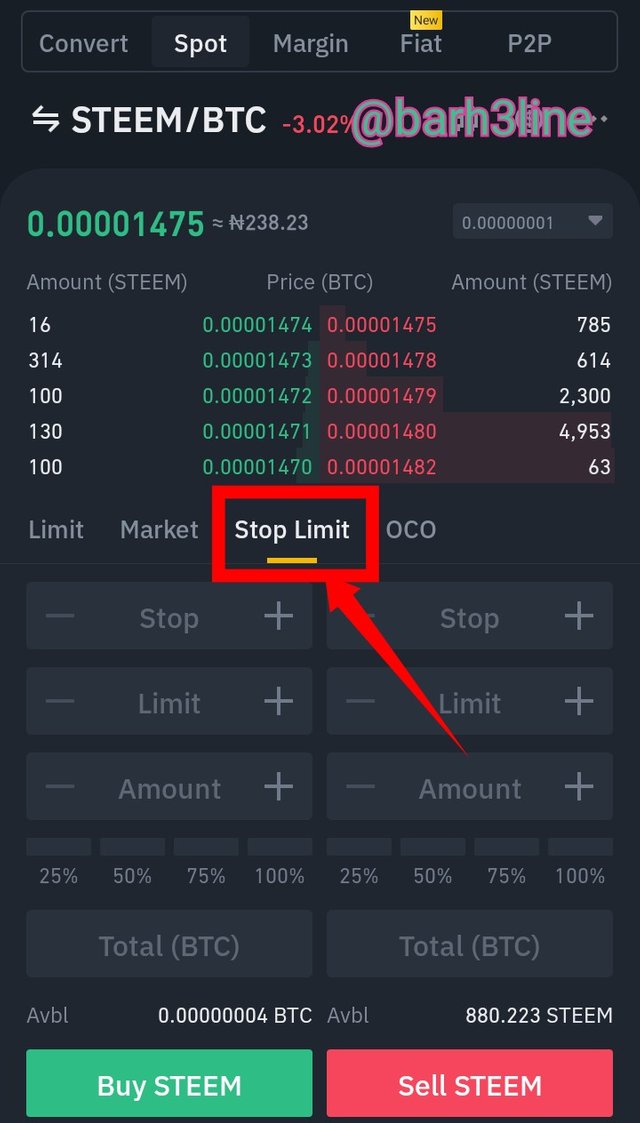

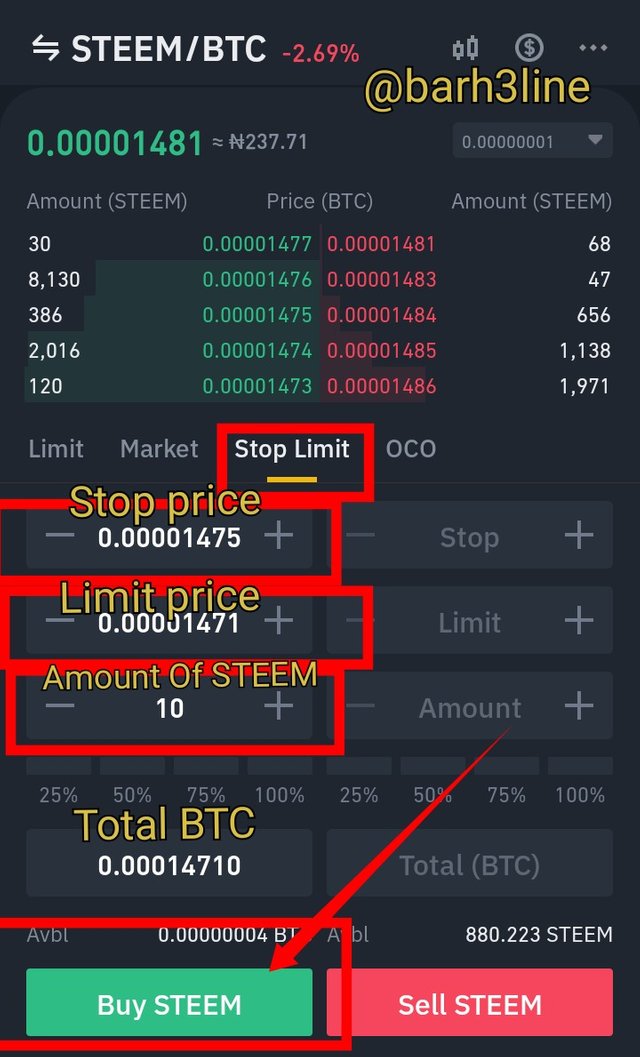

How to place Stop-limit buy orders (STEEM/BTC)

This time let me use the STEEM/BTC trading pair on Binance

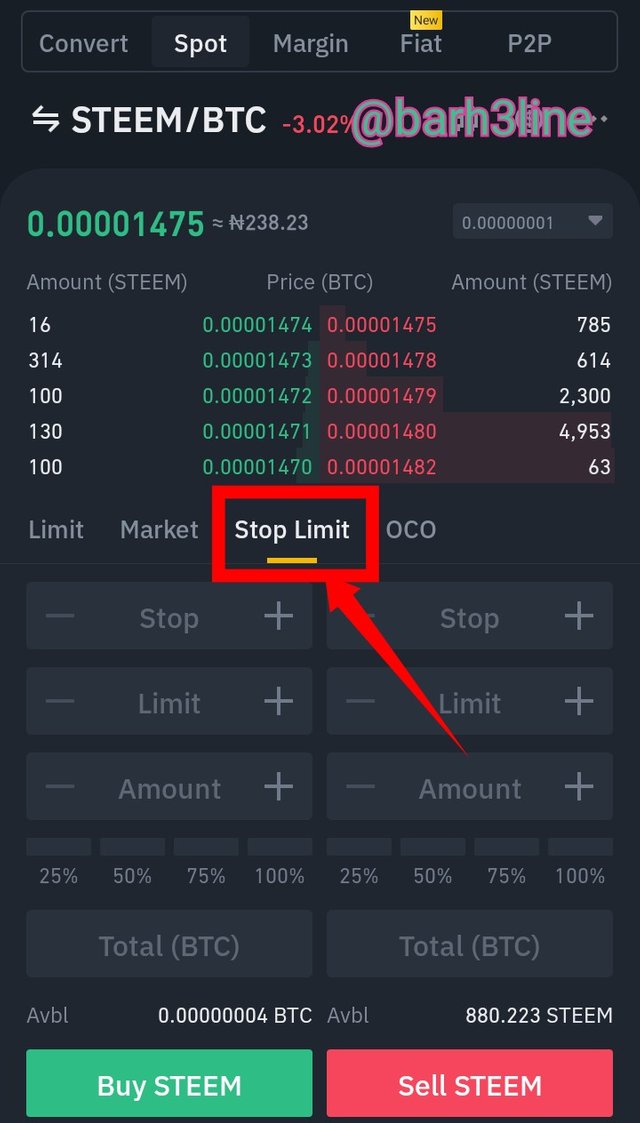

Open Binance and search for the pair then select the Stop-limit trade from the spot trading page.

- Enter the Stop-limit price (0.00001475 BTC) and the limit order at (0.00001471BTC), the total amount of STEEM or BTC and click on "Buy STEEM"

I set Stop-limit price at 0.00001475 BTC and limit price at 0.00001471 BTC to buy STEEM. Once price of STEEM reaches Stop-limit price, the order will become limit order and will be filled at limit price.

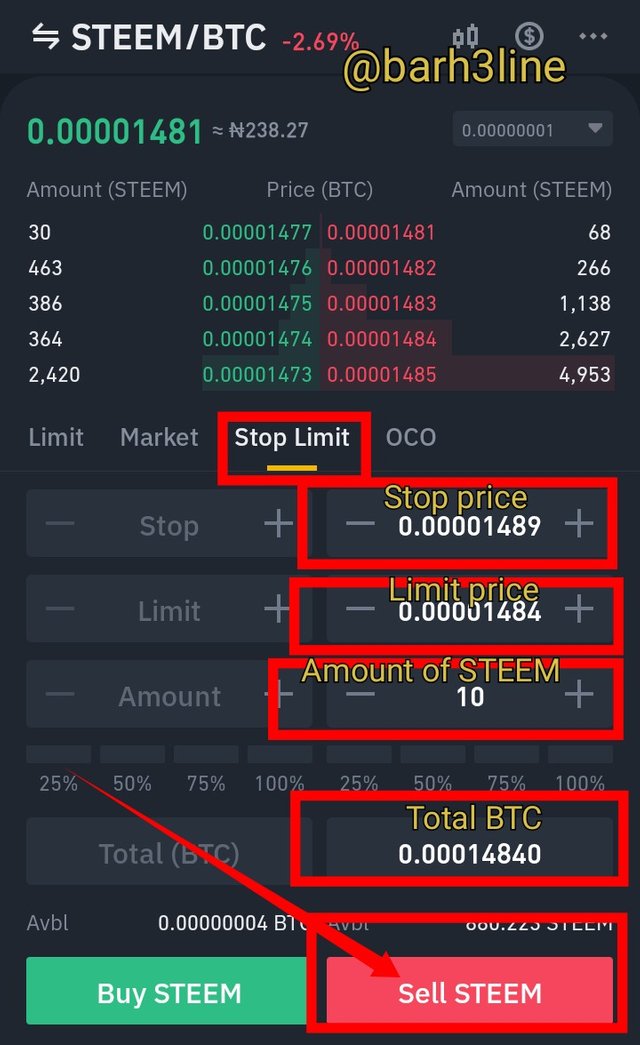

How to place Stop-limit trade sell order (STEEM/BTC)

- I still continue with the STEEM/BTC, I will click on "Sell" Stop-limit trade

- Enter the Stop-limit price (0.00001489 BTC) and the limit order at (0.00001484 BTC) and click on "Sell STEEM"

I set Stop-limit price at 0.00001489 BTC and limit price at 0.00001484 BTC to sell STEEM. Once price of STEEM reaches Stop-limit price, the order will become limit order and will be filled at limit price.

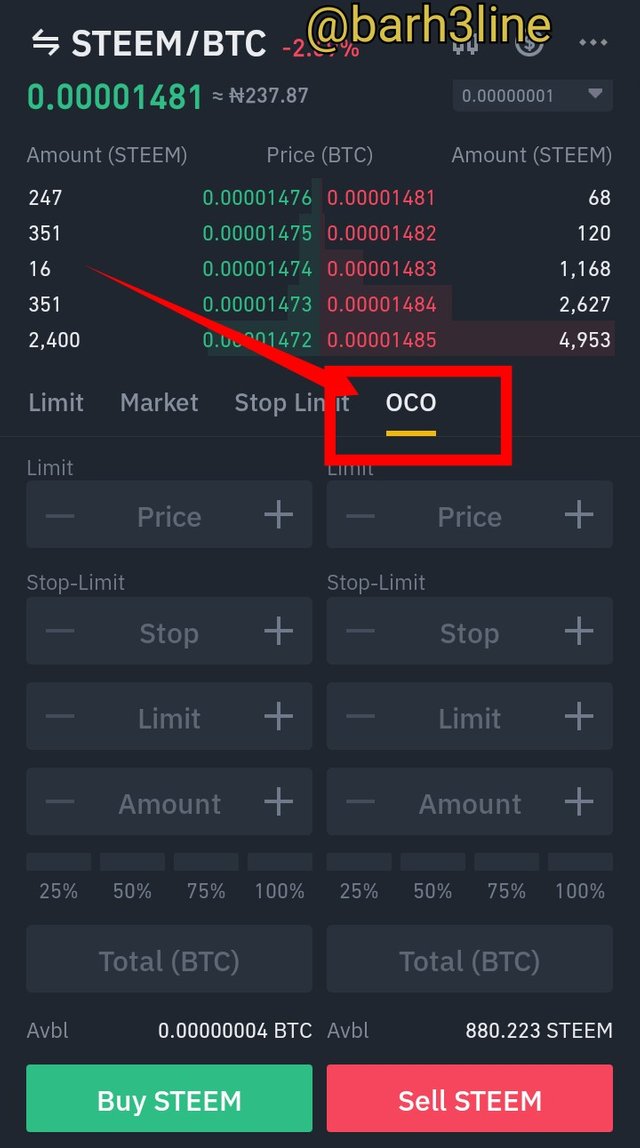

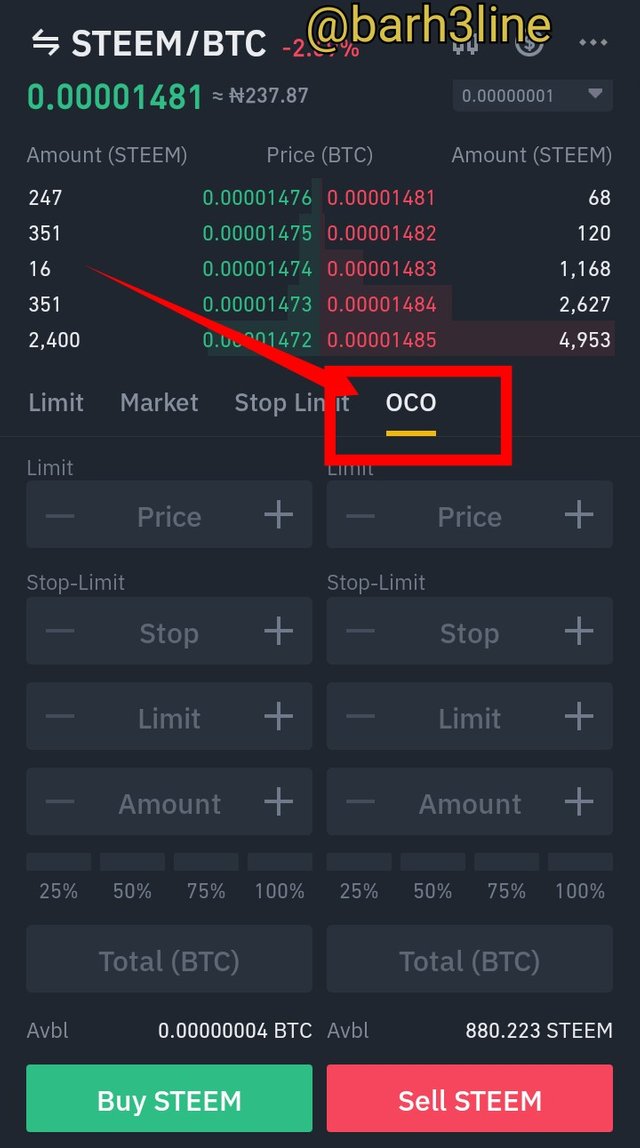

OCO order

This is an abbreviation for the One Cancels the Other trade, in which traders can place two orders at the same time, namely a limit order and a stop-limit order. In this sort of order, only one of the orders (either a limit order or a stop-limit order) would be executed. Furthermore, once the criteria for one of the orders is met, it will be executed, while the other will be immediately cancelled.

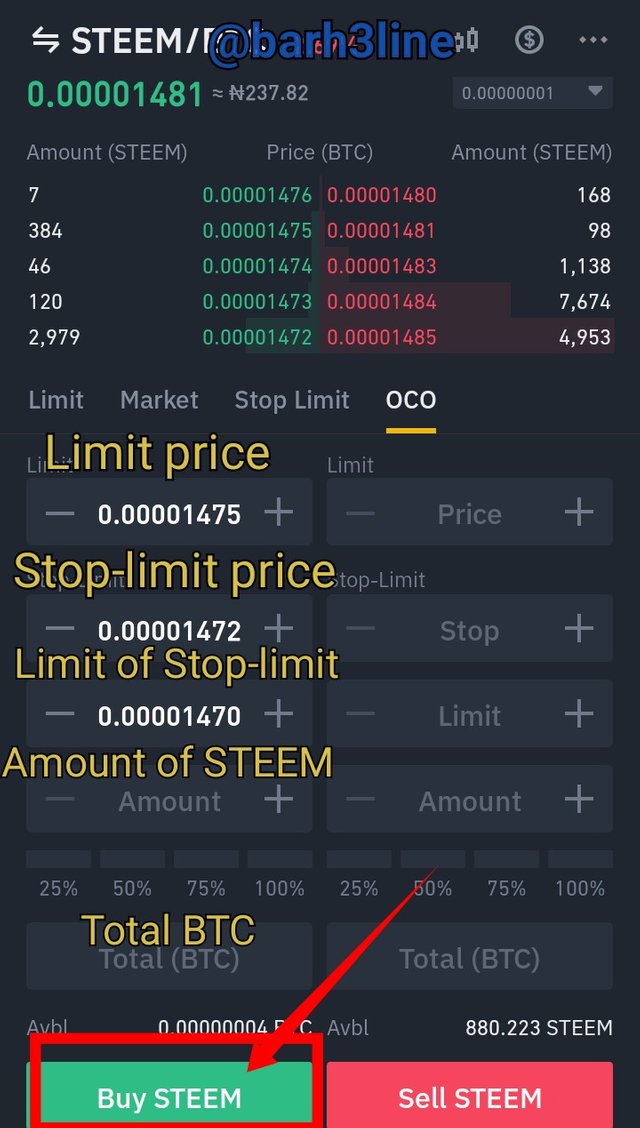

How to place OCO trade buy order (STEEM/BTC)

- It just similar to Stop limit order, at the spot trading page of STEEM/BTC pair select OCO (Buy section) instead of Stop limit

- Enter the limit price to be 0.00001475 BTC. Stop-limit order to be 0.00001472 BTC and the limit price for the stop-limit order to be 0.00001470 BTC, click "Buy STEEM"

From the screenshot above Let say the market price of STEEM goes up and reach 0.00001475 BTC, so it triggers the limit order and gets filled. The stop limit order will be cancelled automatically. If the price of asset goes down and reach the price stop limit order 0.00001470BTC, the stop limit order will become limit order and will be filled and the limit order will be cancelled by default.

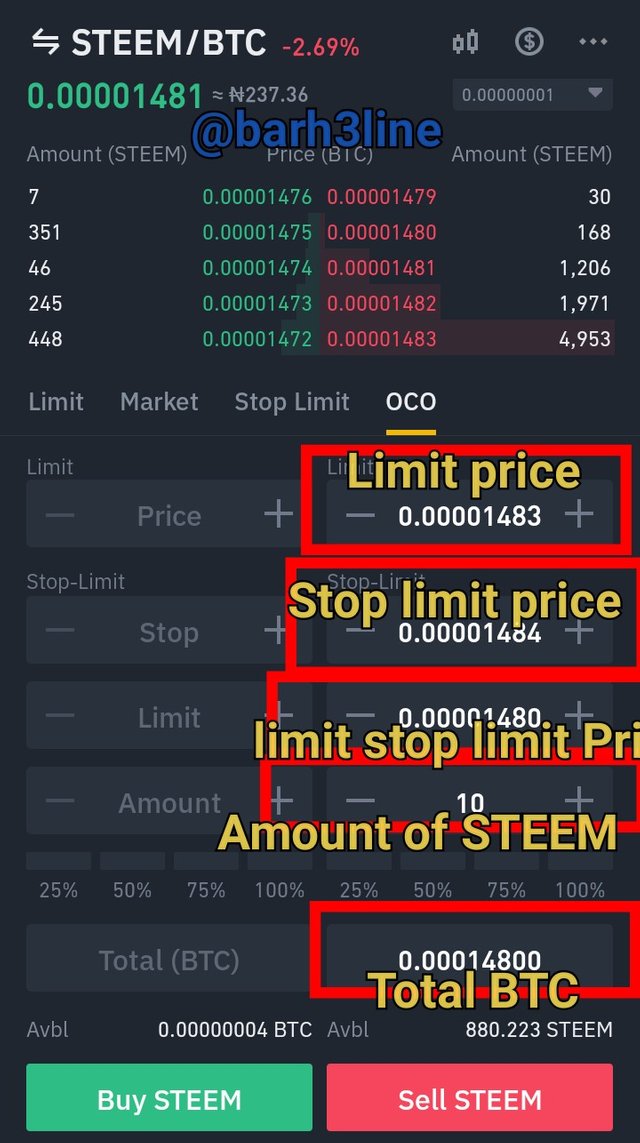

How to place OCO trade sell order (STEEM/BTC)

- At the spot trading page of STEEM/BTC pair select OCO (Sell section)

- Enter the limit price to be 0.00001483 BTC. Stop-limit order to be 0.00001484 BTC and the limit price for the stop-limit order to be 0.00001480 BTC, click "Sell STEEM"

Looking at the above screenshoot , if the market price of STEEM drop down and reach 0.00001483 BTC, so it triggers the limit order and gets filled. The limit order will be cancelled automatically. If the price of asset goes up and reach the limit price order 0.00001484 BTC, the stop limit order will become limit order and will be filled and the Stop-limit order will be cancelled.

5. How order book help in trading to gain profit and protect from loss?share technical view point, that help to explore the answer (answer should be written in own words that show your experience and understanding)

The order book has a lot of features, it assist traders in making decisions as it keeps the track and records of the buy and sell order in the crypto market.

The limit order allow the trader to enter the market at his/her preferred price.

For instance a trader can decide to buy an asset at $400 by placing a buy limit order and wait for it to be filled and then the traders can also sell it at $600 by placing a sell limit order and wait for it to be filled thereby generating profit of $200.

Using the market order the trader can quickly sell his/some asset instantly.

This type of order is very fast and instantly as the order is profits ant the current market price of the asset.

Further more the OCO trade option can be use by the the trader to place two orders together this will help them make some profits and minimise there loss.

Now let go to the technical aspects of order book. Traders can make use of the information on the order book to do some technical and fundamental analysis before placing an order.

The volume of buy or sell order need to be considered before a trader can placed either buy or sell order. Also the last price and and the current price need to be considered.

Further more the trader needs to take note of the support and resistance line before he/she placed an order.

Some technical indicator needs to be considered also,t talking about the technical indicators available on the order book like MA, BOLL, RSI,, KDJ and MACD.

All this technical indicator are very useful to the trader to make a successful order.

Conclusion

When it comes to buying and selling of cryptocurrencies , an order book is very important. It keeps track of all current trades done at various rates, allowing traders to choose the best rate to enter the market. The stop limit order also assists traders in establishing resistance and support levels in order to profit from price swings.

Thank you all for reading my post.

God bless you and the professor

Cc: @yousafharoonkhan

Thank you for joining The Steemit Crypto Academy Courses and participated in the Homework Task season 2 week 7.

If you look at feature in the order book, you will see a lot of technical and simple advance feature. You have not searched for futures in detail. it is very much important to explore the order book to use the feature that will help you in trade

it is good if you also explain order detail in text to make it more good , look good order placement ,

some points are look rewritten , always try to make quality content that can help you bring more good grade

Thank you very much for participating in this class. I hope you have benefited from this class.

Grade : 6.5

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit