Introduction |

|---|

In the ever regulating world of finance, understanding well the relationships between different asset classes is very much "paramount". Cross-asset correlation analysis significantly plays a pivotal role in portfolio dear management, so particularly in the very realm of cryptocurrencies.

- By properly delving into the intricate web of the correlations, most investors can sell craft robust diversification strategies, definitely manage risks effectively, and also make informed decisions based on the market conditions. This unique exploration uncovers well the dynamic nature of the cross-asset correlations and so their implications in the ever-evolving landscape of the cryptocurrency investments.

Explain the concept of cross-asset correlation and its significance in portfolio management. How does understanding correlations between different cryptocurrency assets contribute to effective diversification strategies?

The Cross-asset correlation is definitely the measure of how well different assets move in relation to each other here. In a portfolio management, this unique concept is very much crucial as it helps the investors understand well how various investments interact within a portfolio.

- When it definitely comes to cryptocurrencies, well comprehending correlations between the different assets is firmly the key to constructing diversified portfolios. By so analyzing these very correlations, investors then can identify well assets that move independently of each other, so reducing the overall portfolio risk properly.

Explore how cross-asset correlations change during bullish and bearish market conditions. How can traders leverage this knowledge to adapt their portfolio strategies based on the overall market sentiment?

And During bullish market conditions, assets do tend to like move in unison, as well leading to a higher correlations.

"Conversely, in bearish markets", correlations here may weaken as assets do react differently to market stress.

- The Traders can as well leverage this knowledge by properly adjusting their portfolio strategies accordingly. So For instance, during a bullish phases, focusing well on assets with positive correlations can well maximize gains, while in a bearish markets, diversifying well into assets with negative correlations may help to reduce or mitigate losses.

Explain how understanding cross-asset correlations can be utilized for effective risk management and portfolio diversification. Provide examples of how allocating assets with low or negative correlations can help mitigate overall portfolio risk.

Properly Understanding the cross-asset correlations is so instrumental in the effective risk management and the portfolio diversification. By always allocating assets with a low or negative correlations, all "investors" can then create a proper balanced portfolio that so minimizes overall risk exposure.

Also For example, pairing here assets that move in opposite directions can so help offset losses in the one asset class with gains here in another, and enhancing the portfolio's resilience to market fluctuations.

Explore the historical correlation patterns between STEEM and other major cryptocurrencies, such as Bitcoin and Ethereum. How have these correlations evolved over time, and what insights can traders draw from STEEM's behavior in relation to the broader market?

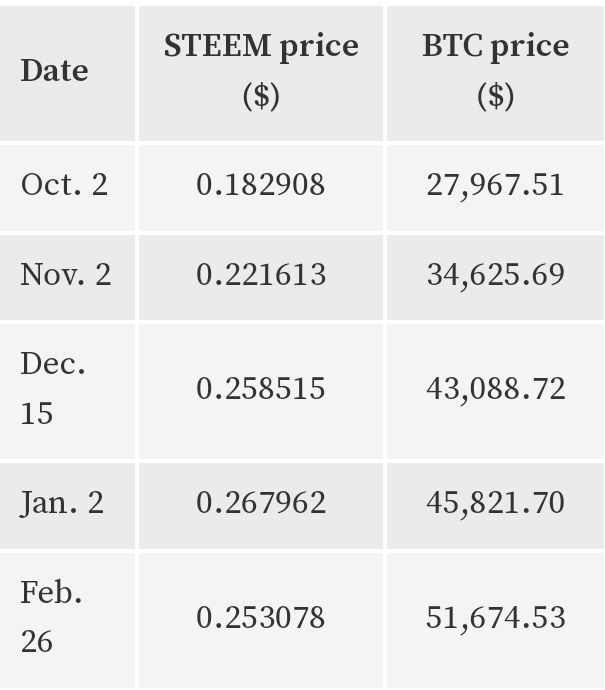

[Also checking the prices from a friend work @sahmie]

Exploring here the historical correlation patterns between the STEEM and other major cryptocurrencies like Bitcoin and Ethereum unveils well valuable insights for traders. By so examining how these correlations have evolved over time, the investors can gain a suitable and deeper understanding of STEEM's behavior in relation to the broader market appropriately.

|  |

|---|

[This shows the correlation relationship between Bitcoin and Steemit]

This very analysis can so help guide traders in making informed decisions anytime, such as in adjusting their portfolio allocations definitely based on the changing correlations among these assets.

Conclusion |

|---|

Certainly, In the intricate world of cryptocurrency investments, the cross-asset correlation analysis serves more as a "guiding light" for the investors seeking here to navigate the volatile market landscape. By well comprehending the nuances attitude of how different assets interact too, investors can well construct resilient portfolios, always manage their risks effectively, and definitely adapt their strategies based on the market conditions.

- So as the correlation dynamics so continue to evolve all day, staying well attuned to these relationships is so much paramount for duly making informed investment decisions in the ever-changing world of the cryptocurrencies.

I'm so much excited to inviting @whizzbro4ever, @bossj23 and @patjewell to please join me while we explore more on Cross-Asset Correlation Analysis.

Connect me on STEEMIT

~ "Thanks 👍 for Reading my Post" ~

.jpg)

Upvoted! Thank you for supporting witness @jswit.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

@tipu curate

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted 👌 (Mana: 5/7) Get profit votes with @tipU :)

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

hey brother your comprehensive explanation of cross-asset correlation and its significance in portfolio management reflects a deep understanding of the topic. The clarity with which you discuss how investors can utilize cross-asset correlations to construct diversified portfolios and manage risks effectively is commendable. The exploration of how correlations change during bullish and bearish market conditions coupled with practical advice for traders on leveraging this knowledge adds practical value to your contribution. Additionally your insights into effective risk management and portfolio diversification through low or negative correlations are well-explained supported by relevant examples. Your analysis of historical correlation patterns involving STEEM and other major cryptocurrencies showcases a practical application of the discussed concepts.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks 👍 so much

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

AsslamuAlikum @basil20 your article very clearly expresses the importance of cross-asset correlation analysis and portfolio management. Your intelligent discussion helps him/her understand the changes in crypto market headwinds. Providing business advice with appropriate examples in your article provides more value to readers.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks dear friend.

It's really a pleasure doing this 😊

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Your most welcome 🤗 dear☺️🤗

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

You tried your best to give us a complete understanding of the significance of cross asset correlation in the management of portfolio as well as you have also explain positive correlation and negative correlation in terms of both bullish and bearish trends and at last you have explained relationship of STEEM with BTC and ETH.

I wish you good luck in this challenge

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

I'm really grateful it's worth full to readers.

It's always a pleasure

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Yes your post gives a basic understanding of cross asset correlation tk every newbie

Good luck with this challenge and stay blessed 🤞

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Today I must say to you you broke the rule that says the lower your web the lower the quality of your article this is because you wrote so perfectly as if you are ready a professor in this act I must say I've actually learned a lot from your article and at this point I could say that you have really impacted high quality knowledge concerning cryptocurrency and this correlation trading strategies.

Thank you very much for going through I really appreciate I would love to see your comment in my article through the link belowhttps://steemit.com/hive-108451/@starrchris/eng-esp-steemit-crypto-academy-contest-s16w1-cross-asset-correlation-analysis

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thanks 👍 a lot dear.

I appreciate this effort

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit