Introduction |

|---|

To our dearest world of the investing which is often described normally "as a roller coaster ride", indeed controlled not just by the market fundamentals alone but definitely also by the amazing and powerful force of the investor psychology.

- The dynamic emotional journey which the investors undergo through the amazing market cycle—comprising of the stages in likes of optimism, excitement, euphoria, anxiety, denial, fear, despair, and hope—can massively influence their own decisions and also consequently, their unique financial outcomes. So I'll add that this very intricate interplay definitely between psychology and the market cycles always becomes the evident in a volatile markets, such as the cryptocurrencies, where all the sentiment can definitely shift rapidly and so dramatically.

In my content today, i'll write ✍️ on the psychological progression of the investors definitely through these pleasing stages, as well analyze a nice cryptocurrency price chart to really spot or identify the likely emotional stage it always represents, discuss too the very detrimental mindset of like "this time it's different," and definitely examine how the significant FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) has like really impacted the price of the STEEM token over the years.

Finally here, i'll really navigate into the amazing logic that's behind the "buy red and sell green" strategies and perfectly illustrate how well it can be very much effectively applied despite the psychological challenges it always presents.

Describe the psychological progression of investors through the stages of optimism, excitement, euphoria, anxiety, denial, fear, despair and hope. How does each step influence investor behavior?

The Understanding of the psychological progression of real time investors through the designated stages of the versatile market cycle is very necessary and crucial for always making an informed investment decisions and choice.

"so Here’s my detailed look at each stage:"

1. Optimism

As always In the very early stages of any market cycle, almost all investors do begin to really feel very much optimistic about future prospects. This kind of optimism often massively stems from the positive economic indicators, probably a strong company performance, or perhaps innovative technological advancements too. It's seen that the Investors start likely in buying assets with the expectation of it's very future gains.

Impact on Behavior: The Optimistic investors are so acknowledge to more likely enter the market and really invest heavily and massively, then driving prices up as the demand here increases.

2. Excitement

As long as the market continues to like rise, the initial gains do always reinforce investor optimism again, then changing it into a perfect excitement. Either the News media and some analysts often time highlight these very bullish trend, which do further fuels this very excitement.

Impact on Behavior: The Excited investors always tend in to increase their certain investments, and then sometimes many do even borrowing money to really buy more assets, so much believing that the good times in the market will continue indefinitely without hesitation.

3. Euphoria

Euphoria do you know what it means? okay here the term definitely represents the kind of peak of the market cycle. As at during this very stage, most investors believe so well that the market can only go up alone, they all often ignores the fundamental valuations and as well the risks too. The very fear of like missing out (FOMO) becomes so pervasive in this scene.

Impact on Behavior: All of the Euphoric investors make a much huge and aggressive investments, often verily in speculative assets, so much leading to inflated prices and the market bubbles.

4. Anxiety

The Anxiety always sets definitely in when too the market conditions starts showing signs of like instability. Any of the Small corrections or perhaps the negative news did begin to like create a doubt in almost all the investors' minds.

Impact on Behavior: Some Anxious investors at this point might start to really question their very investments but some often hold on a bit, willingly hoping that the market will definitely rebound.

5. Denial

In the denial stage as it maybe, the investors definitely ignore the warning signs of a downturn perpetually. They really rationalize negative market movements as probably a temporary setbacks and definitely hold on to their investments again.

Impact on Behavior: The Investors in the denial stage might definitely avoid selling, then holding onto the belief in mind that the prices will recover soon and much better, which leads to prolonged exposure to the declining assets.

6. Fear

And so When the very market really continues to massively decline, definitely the fear takes hold. I see well how the Investors realize that here the downturn might then be more significant and definitely longer-lasting than they really anticipated for.

Impact on Behavior: All Fearful investors do start selling their hold assets to really cut losses, which often lead or enhances to panic selling and as well further declines in prices.

7. Despair

Despair here definitely represents the minimal or lowest point of the market cycle. The Investors always feel a sense of humor in hopelessness, which believing that the market will never recover or correct. This very stage is duly characterized by maybe a widespread capitulation.

Impact on Behavior: All Despairing investors might really sell their remaining assets at a loss 😔 like all, at pin 📍 swearing off in investing altogether.

8. Hope

And too after hitting the rock bottom 😯, then the market really begins to like show signs of recoveryand corrections. The Early adopters and too the contrarian investors then start buying again and massively, this is driven by hope that the worst is really really over.

Impact on Behavior: The Hopeful investors will cautiously re-enter the market this time, this point in leading to a gradual price increases and too the beginning of a new cycle entirely.

Using a chart showing a recent movement in the price of a cryptocurrency (without date/time), identify which emotional stage of the market cycle the chart likely represents. Justify your answer by discussing behavioral signs that investors might exhibit at this stage.

On any chart 📈, To like really identify the factors of emotional stage which is represented by a well impacting recent movement in the price of a cryptocurrency,

so let's do the examining of a "BTC/USDT" price chart really showing a significant upward spike then followed by a smart sharp decline and then subsequent stabilization at a lower level.

Likely Emotional Stage: Anxiety

Justification and Behavioral Signs:

- Sharp Decline After a Peak: The very sharp decline which following a peak definitely suggests well that the initial euphoria has really defined dissipated, and the investors are now grappling with kind of uncertainty.

- Stabilization at Lower Levels: The dynamic stabilization incredibly indicates how well that while though some investors are really selling in fear, they are others who are holding on, perfectly hoping for a recovery at a soon point.

During this stage, investors exhibit behaviors such as:

- Increased Market Monitoring: All Investors do frequently check prices countless times, really looking for maybe a signs of a rebound.

- Hesitation to Sell: And too many are really reluctant and hesitate on selling at a loss to them, well hoping again that the decline is kind of temporary.

- Rationalization of Losses: Here I always see the Investors try really hard to perfectly rationalize the downturn entirely, many often blame the external factors related.

Discuss how an incorrect mindset, such as the belief that "this time it's different," can affect an investor's decisions and potential returns. How does this mentality typically affect a person's performance in the market during volatile phases?

The unique and appetizing belief that "this time it's different" is incredibly and a very dangerous mindset investors can admit which that can simultaneously lead to poor investment decisions. This very kind of mentality is do often observed probably during periods of like significant market innovation or something like the bubbles.

Effects on Decisions and Returns:

- Overconfidence: It's seen that Investors become so much overconfident, too well believing that any new market conditions really justify unprecedented valuations at all.

- Ignoring Fundamentals: They sometimes too tend to really exclude and ignore the traditional metrics and other fundamentals, deeply relying instead on their belief that the new technologies or perhaps the paradigms have indeed permanently altered the market.

- Herd Behavior: This very kind mentality again can really leads to herd behavior, where definitely the investors collectively push the prices to unsustainable levels than imagine.

Typical Performance:

- So During any volatile phases, this incredible or unassume kind of mindset often results in the investors holding on to the overvalued assets, hence leading to like significant losses when the very bubble bursts out. Meanwhile the Historical examples include that of the dot-com bubble and too the housing market crash.

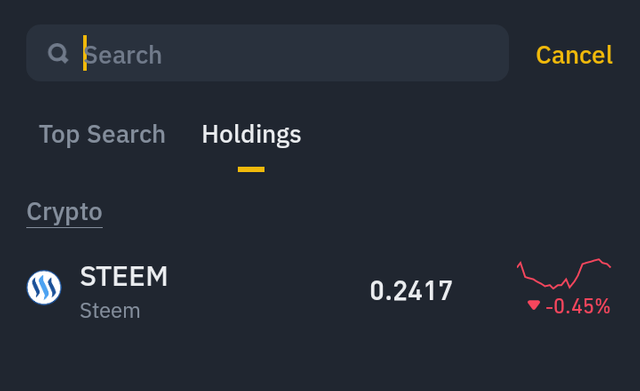

Examine a specific incident where significant FOMO (fear of missing out) or FUD (fear, uncertainty, and doubt) impacted the price of the STEEM token. Discuss how this sentiment influenced trading behaviors and the price of the STEEM token. Also suggest strategies that STEEM investors could use to avoid making decisions driven by these emotions.

Incident Analysis:

A pretty notable incident which involving STEEM really occurred when any or a major exchange do announced the listing of the very token, worthlessly sparking a significant FOMO. Then almost all the Traders so rushed to buy the STEEM, promptly driving its very price up so rapidly. And Conversely, later had some reports of the regulatory scrutiny created FUD, which causes a sharp sell-off as well.

[Steem listed on binance]

Influence on Trading Behaviors:

- FOMO: Probably During the very listing announcement, the traders always exhibited the irrational exuberance, them buying at peak prices definitely without considering underlying value too.

- FUD: Then the regulatory news definitely triggered panic to selling, as all the traders in the situation feared to potential legal implications and the losses.

Strategies to Avoid Emotion-Driven Decisions:

- Diversification: The Spread investments across the different assets to really help reduce the exposure to any or a single token's volatility.

- Setting Limits: Using of the stop-loss orders to practically mitigate losses and also take-profit orders to well obtain secure gains.

- Sticking to Fundamentals: Definitely the Base investment decisions on the fundamental analysis is more worth it rather than market sentiment.

Explain the logic behind the “buy red and sell green” strategy. Create a hypothetical scenario in which this strategy could be applied effectively and discuss the psychological challenges an investor might face when trying to implement this strategy amid an actual market downturn and subsequent recovery.

Logic Behind the Strategy:

- Contrarian Approach: This very set or kind of strategy really involves buying them when the prices are really really falling (red) and the selling when they are definitely gaining rising (green). It so capitalizes on market overreactions and as well the corrections.

Hypothetical Scenario:

Let's just Imagine a kind of scenario where a pretty reputable cryptocurrency do experiences a unique sharp decline due to probably temporary negative news.

- An investor here definitely using the "buy red" kind of strategy buys the unique asset at its low point. As too as the market do corrects with time and the asset's price try recovers again, the very investor involves here sells at higher prices again ("sell green"), well securing profits at it's best.

[case study in ETH/USDT]

Psychological Challenges:

- The Fear of Catching a Falling Knife: Most Investors always fear buying during any downturn, so worried that the prices might always continue to fall definitely.

- Greed During Recovery: And as well During the recovery, the kind of temptation to really hold on for higher gains can as well prevent timely selling in the situation.

Overcoming Challenges:

- Discipline: So the perfect point 👉 of one Establishing and as well adhering really to the predefined buy and sell points can incredibly help manage ones emotions.

- Research: And a pretty Thorough research and well understanding of the very asset's fundamentals d o equip and provide confidence in the strategy to use.

Conclusion |

|---|

In Navigating any of the complex landscape in investing, it definitely requires a pretty amazing understanding of likely both the market fundamentals and as well the psychological factors that definitely drive investor behavior in the case.

- By well recognizing the kind of emotional stages of the market cycle involves, and duly avoiding any detrimental mindsets in likes of "this time it's different," and practically managing the FOMO and FUD so effectively, as well in implementing the disciplined techniques and strategies like the "buy red and sell green," then investors can hugely make more and more informed and of course rational decisions. So Ultimately to this, well mastering these pretty psychological aspects can definitely develop and lead to a better kind of investment outcomes and a potential kind of more resilient approach to any market volatility.

"I'm inviting @bossj23, @patjewell and @chant to join me in bringing more informed knowledge of the context scenario.

connect me on Steemit"

"I Love 💗 You all Steemians"

.png)

We know that diversifying our investments means putting our money in different types of assets. This way, if one investment drops in value, the others might not, so we won't lose as much overall. It's like not putting all your eggs in one basket, which helps protect you from big losses.

In my experience, setting stop-loss orders means deciding to sell an asset if its price drops to a certain point. This helps prevent big losses. Take-profit orders are the opposite; you decide to sell when the price goes up to a certain level, locking in your gains. Both of these tools help you stick to your plan and avoid making emotional decisions when prices change.

As far as I know, the contrarian approach means doing the opposite of what most people are doing. When prices are falling and everyone is selling (red), you buy. When prices are rising and everyone is buying (green), you sell. This strategy tries to take advantage of the times when the market overreacts and then corrects itself.

Good luck

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Congratulations, your comment has been successfully curated by our team via @steemdoctor1 at 5%

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings friend,

You have got a real knack for explaining complex financial stuff in simple terms. Your ability to break down those market emotions and stages is seriously impressive. Keep up the great work.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

thank you sir

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Hello dear friend from the way you write it's obviously that you are an experienced and a very smart individual especially when it comes to crypto related event or occasions.

Yes friend this is one of the basic knowledge everyone who decides to become a crypto investor should have in their mind. This is because when you buy when they can do sticks are red then there is high chances to make profit whenever a reversal is seen in the crypto market.

Thank you so much friend for sharing sword high quality article at your free time you can also check my through the link belowhttps://steemit.com/hive-108451/@starrchris/steemit-crypto-academy-contest-s18w3-psychology-and-market-cycle

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Greetings my friend @basil20,

Great insights! "Understanding the emotional stages of the market cycle is crucial for making informed investment decisions." Your explanation really highlights the importance of investor psychology.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

my Twitter link

https://twitter.com/EmediongEtok/status/1799781502382973036?t=qiavRvIbF7Lwzf2IAzDmdg&s=19

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

“The investment world is a rollercoaster”, I also found that “The 1℅ and 99℅ smarts are emotions.

Our emotions do influence our decisions, even though from the start we know that there are things we have to pay close attention to and not be too greedy. The desire to gain multiple profits can make us analyze incorrectly which leads to misery.

Thank you for your presentation, good luck friends,

👍👍👍

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you, friend!

I'm @steem.history, who is steem witness.

Thank you for witnessvoting for me.

please click it!

(Go to https://steemit.com/~witnesses and type fbslo at the bottom of the page)

The weight is reduced because of the lack of Voting Power. If you vote for me as a witness, you can get my little vote.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Upvoted. Thank You for sending some of your rewards to @null. It will make Steem stronger.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Nice blog, you explained market sentiment nicely, it also understandable that the things that need to be considered while creating a strategies.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

TEAM 7

Congratulations! Your post has been upvoted through steemcurator09.Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit