Hello wonderful people, how are you today? I hope you're having a fantastic week. I'm ecstatic to be a part of this unforgettable lecture. In this article, I'll share my experience with Alligator Indicator

Discuss your understanding of the use of the Alligator indicator and show how it is calculated?

- Smoothed moving averages are used in the Williams Alligator indicator, which is a technical indicator.

- To begin, the indicator calculates a smoothing average using a simple moving average (SMA).

- It includes three moving averages with intervals of 5, 8, and thirteen periods. The Jaw, Teeth, and Lips of the Alligator are made up of three moving averages.

Usage.

Investors can conclude that the marketplace lacks direction whenever the green, red, and blue lines are relatively near to one another and linked.

Whenever the red and blue moving averages are going the same way and the green moving average crosses over them, all three moving averages end up travelling in the same path, it indicates to the investor that a pattern is about to begin.

There seems to be an upswing whenever the green line is above the red line and the red line is above blue line, and a decline when the line' sequence is inverted. The tendency is confirmed when the lines extend.

The alligator indicator is used to detect the start of a trend and its intensity in the market. In furthermore, it aids in the detection of market shakiness and pattern inversion. The entire aim of any indication is to generate trading signals, and the alligator indicator does a good job of it.

Calculations.

- SUM1 = SUM (CLOSE, N)

- SMMA1 = SUM1/N

- Subsequent values are:

- PREVSUM = SMMA(i-1) *N

- SMMA(i) = (PREVSUM-SMMA(i-1)+CLOSE(i))/N

Smoothed moving average (SMMA) is a type of moving average. The smoothed moving average is an exponential moving average that does not neglect earlier information and takes previous data into account.

Show how to add the indicator to the chart, How to configure the Alligator indicator and is it advisable to change its default settings ?. (Screenshot required)

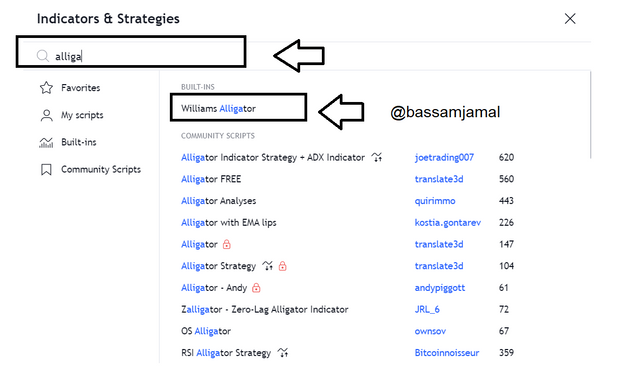

-I'll be utilizing the Trading View. You can do it via the Trading View official site.

Any trading pair can be chosen. The pair's chart will appear.

From the top menu, select indicators.

- Then, in the search box, type "William's Alligator" and choose Indicator from the options.

- Then it will be added to the chart like this.

Configuration of the Aroon Indicator.

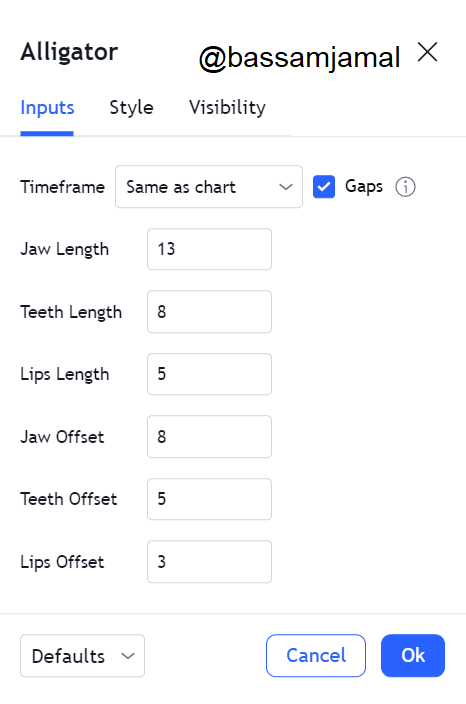

- The settings will load after you click the Indicator setting button.

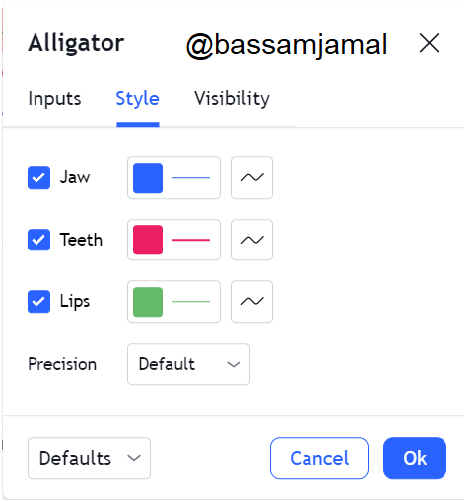

- Style settings: Now we can pick the colour and clarity of the indicator, as well as any colour for the three lines.

- We have indicator timeframe and onset parameters in the inputs. Jaw length, teeth length, lip length, jaw offset, teeth offset, and lip offset are all available options.

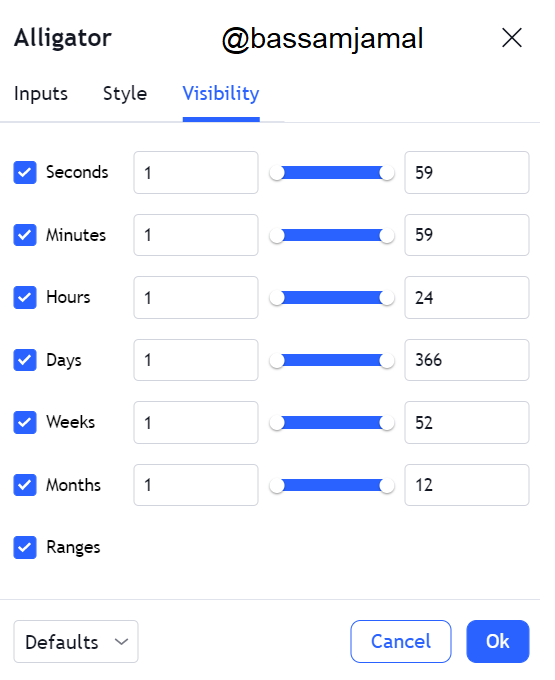

- We have seconds, minutes, hours, days, weeks, and months of visibility. For now, let's stick with the default visibility settings.

Bill Williams recommended the alligator indicator's default configuration, and it is not recommended that you alter them. It could be for a variety of factors, such as the fact that we cannot question the inventor's intelligence because the indicator settings were designed largely on his extensive experience and not by chance.

Secondly, values 3, 5, and 8 are components of the Fibonacci series, and we know that the Fibonacci numbers constitute critical support and resistance levels for pricing.

How do we interpret this indicator from its 3 phases: the period of rest(or sleep), awakening, and the meal phase?(Screenshot required)

The three stages of the indicator can be comprehended by comparing them to the various sections of an alligator at various stages.

Rest or sleep phase

Moving averages make up Alligator. Moving averages display the average price readings over a given time period, as the title suggests. As a result, if the MAs are in the identical spot on the graph and their curve does not indicate a pattern, the marketplace is not moving. To put it another way, the market is trading sideways.

An alligator rests with all three parts (jaw, lips, and teeth) aligned and exhibits no motion when it is at rest. The similarity to the marketplace can be seen in the intertwining of lines symbolising the jaw, lips, and teeth.

Awake and Meal phase

The lines are structured in the following sequence if the direction is up: The green line is at the highest, followed by the red line, and finally the blue line. All three lines are pointing upward. The gap between the lines is growing as the tendency continues.

On a technological level, the three lines of the indication are widely away during the waking phase, however, they were near enough throughout the resting phase. The trader must therefore continue the pattern and collect the gain (meal phase) throughout this waking process.

Based on the layout of its three moving averages that make up the Alligator indicator, how can one predict whether the trend will be bullish or bearish (Screenshot required)

Following the sleep period of the alligator indicator, it is capable of predicting the direction of the trends, if it will be bullish or bearish, by monitoring the actions of the three moving averages utilised in the indicator.

The three lines are close together throughout the sleep period and far apart during the trendy period. As a result, the starting of a pattern would be characterised by lines shifting away from one another, and the fading or dying down of a trend would be indicated by lines that had separated during the tendency to merge again.

Bullish.

The concept is straightforward: if the blue line is at the lowest and the green line is at the peak, it indicates the start of an uptrend.

Bearish.

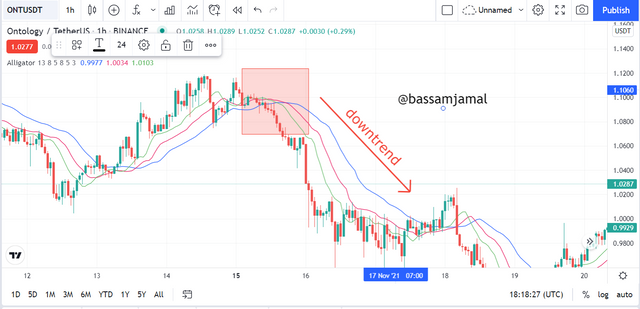

If the green line is at the bottom and the blue line is at the top, it indicates the start of a downturn or negative pattern.

Explain how the Alligator indicator is also used to understand sell / buy signals, by analyzing its different movements.(screenshot required)

The type of signal produced is determined by the predicted pattern, which is determined by the positioning of the Moving Averages. Whenever the Alligator indicator forms a sign, the blue and red lines travel horizontally in almost the same way before the green line passes it. The red line passes the blue line in the very same way as the green line, having left the blue line at the opposite end.

Buy Signal.

The blue and red lines would proceed in an identical way well before the green line crossed them up, indicating a purchase signal. The red line then passes the blue line up, putting the blue line at the bottom as verification.

The Green Moving Average passed the Red and Blue Moving Averages above on the QNT/USDT chart, signalling a buying opportunity. The indication is confirmed when the red line passes the blue line in the very same manner as the green line. In the end, a blue line is maintained.

Sell Signal.

The very same process occurs for a sell indication, although in the other manner. The Greenline descends, crossing the Red and Blue lines. The Redline passes the Blue line and descends with the Greenline to validate the indication.

The Green Moving Average surpassed the Red and Blue Moving Averages down on the SFP/USDT chart shown, signalling a profit opportunity. The indication is confirmed when the red line passes the blue line in same direction as the green line. The topmost line is left alone which is blue.

Do you see the effectiveness of using the Alligator indicator in the scalping trading style? Explain this based on a clear example. (Screenshot required)

Scalping is a trading strategy that includes placing trades depending on small price fluctuations and taking positions for a short period of time (mins) in order to accomplish quick profits. Scalpers can benefit from the Alligator indicator in the same way that long-term traders can.

Is it necessary to add another indicator in order for the indicator to work better as a filter and help get rid of unnecessary and false signals? Use a graph to support your answer.

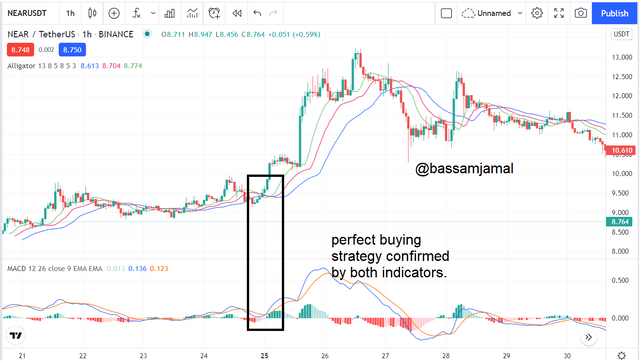

When trading, it is critical to use a combination of indicators. This holds true for the Alligator indicator as well. For better outcomes, regardless of how dependable this indication is, it should be paired with other indicators. The MACD would be my choice if I had to integrate any signal with the Alligator indicator

To provide you with a better understanding of the MacD Indicator, it is broken into two sections: 0 to -100 and 0 to 100. Whenever the indicator lines are around 0 and 100, the marketplace is in a downtrend, and when it is within 0 and 100, the market graph is in a bullish trend. Whenever the indicator line is at 0, the marketplace is in a consolidation phase market.

False Indication.

Right Indication.

List the advantages and disadvantages of the Alligator indicator.

Advantages of the Alligator Indicator

This indicator only generates a small number of incorrect signals. In comparison to single lines indications, you can literally count the number of misleading signals because there are fewer possibilities.

When used in conjunction with other indications, it is quite effective.

The lines of the Alligator indicator are straightforward to understand, so even beginner traders may use it.

Disadvantages of Alligator Indicator

- Similar to all previous indicators, the Alligator Indicator generates misleading indications too.

Alligator is constantly lagging since it is made up of 3 moving averages. This means that traders may miss out on an entrance since the price has shifted before the signal is given.

It might not be enough to change market fluctuations in the short term.

Conclusion

The Alligator indicator is a valuable tool. It will perform in a marketplace that is currently trending. Investors can use this indication to locate short sale and purchase opportunities. This will also be useful when the trending market comes to an end. Because it is made up mostly of moving averages, it is a lagging indicator that might create erroneous indications. As a result, we determined that using it with other indicators is more reliable.

cc : @kouba01