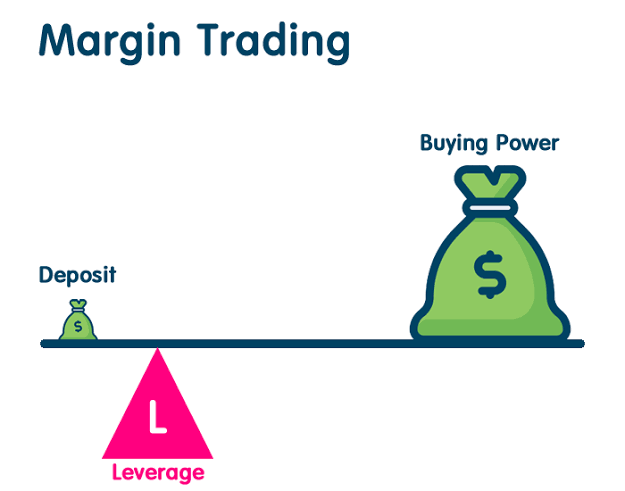

Margin Trade is a trade in which a third party provides the funds. Traders don't have the amount they are trading. Traders have access to greater capital as compared to simple trading accounts, allow users to use leverage on the trades.

This trading is very popular in International Forex market but also used somewhat in stock, commodity and cryptocurrency market.

In Forex and Stock markets the fund are provide by an investment broker while in the cryptocurrency market, the funds are provided by other crypto traders who can earn interest on margin leasing. There are Some popular exchanges which provide funds to users.

Whenever a margin traded is initiated, the trader need to lock a certain amount of the total order known as margin. The order value and initial investment (Margin) is based on the leverage taken.

Now If the name leverage comes, so we will Discuss about leaverage.

ABOUT LEVERAGE RATIO

The leverage ratio differ from margin requirement from broker to broker. The amounts which are typically offered are 10:1, 20:1 and 30:1. The leverage offered will also depend on the trade size of the position.

A minimum margin requirement of five percent is the same as 20:1 leverage. A leverage ratio of 10:1 would be 10%.

Now i will tell you one merit and one Demerit of margin trade.

Benefit of margin trading

Margin trading is made for those investors who are looking at encashing on the price fluctuations for a short-term but do not havs enough cash in hand.

Disadvantage of margin trade

The most common derit of this trade is that it has increased risk. So ypu should have a proper money management before going to this.

That is all about margin trade.