Hello my friends from the Cryto Academy, nice to stop by again! Today I bring you my homework from this week 2, this time from the teacher @ reminiscence01. Which thanks to his great conference explains the introduction to the charts, more specifically, the Japanese candlestick charts ... In this task I will explain a little about their meaning and other points developed below. With nothing more to add, let's get started!

Explique el gráfico de velas japonesas. (Se requiere una captura de pantalla del gráfico) / Explain the Japanese candlestick chart. (A screenshot of the graph is required)

Japanese candles are a technical analysis tool that traders use to chart and analyze the price movement of market values. This type of graphic concept was developed by the Japanese Munehisa Homma, known for being a rice trader in his country.

Homma was able to dominate the market and became popular for finding the Japanese candlestick chart method, because with this pattern traders can determine the future price of a given market and this captivated many practitioners to be part of this commercial. Japanese candlestick charts are now a popular technical indicator that traders use in financial markets.

Japanese candles are a technical analysis tool that traders use to chart and analyze the price movement of market values. This type of graphic concept was developed by the Japanese Munehisa Homma, known for being a rice trader in his country from him.

If a Japanese candlestick chart is set to a 30 minute time frame, each individual candle will form for thirty minutes. Similarly, if the chart is determined in a 15-minute period, each candle that makes it up will take fifteen minutes to form. They provide more detailed and accurate information on price movements, compared to bar charts. They provide a graphical representation of supply and demand behind the price action for each time frame.

With Japanese candles we can analyze any time scale. When we know how to read and analyze the candlestick patterns we can study monthly, weekly, daily and inter-daily charts.

Aplicación del Gráfico de Velas Japonesas / Japanese Candlestick Chart Application

The Japanese candles will help us to simplify what has happened in a shorter period of time and summarize it to 4 price values (already mentioned above). Candles, as simple shapes, will help us to find high probabilities of patterns and attitudes that were repeated in the past and to be able to take advantage of the movements of the markets.

However, there is a lot of information that is totally unnecessary in the candles and not knowing how to identify it can take you several months of despair. Failure to understand the importance of simplification using Japanese candlesticks or another method will most likely lead to yet another failure.

All candle prices are equally important, both at the high and at the low of their opening and closing. None of them is more or less important if we want to look for their profitability.

.png)

Describe otros dos tipos de gráficos. (Se requiere captura de pantalla) / Describe two other types of charts. (Screenshot required)

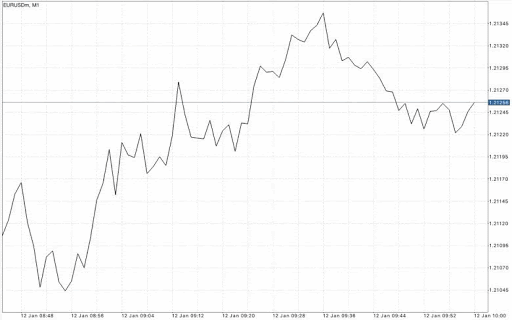

Gráfico de Líneas / Line Chart

A line chart is a graphical figure of an asset's historical price action that connects a series of data points with a solid line. It is a very simple way to show price movement, as it displays the information with a simple line using a series of data points. It is the type of chart that you may be getting used to easily seeing in newspapers as it shows the movement of stock prices.

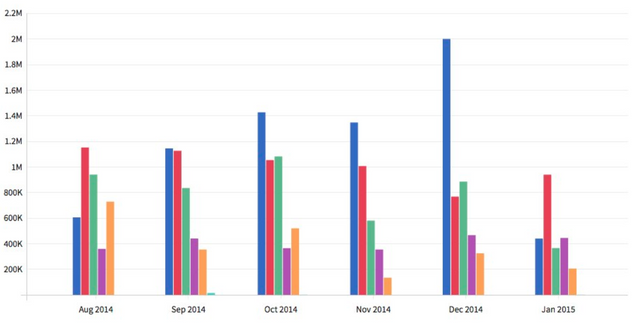

Gráfico de Barras / Bar Chart

Bar charts consist of multiple price bars, and each bar represented illustrates how the price of an asset or security translates over a given period of time. Each bar normally shows the precui of its open, high and low, and its close, although this can be adjusted to show only the high, low and close.

These charts allow investors to analyze trends, spot potential trends, and monitor volatility and price movements.

.png)

En sus propias palabras, explique por qué los comerciantes utilizan principalmente el gráfico de velas japonesas. / In your own words, explain why traders primarily use the Japanese candlestick chart.

These are some reasons that I consider why traders mainly get to use the chart;

º El gráfico de velas nos puede mostrar los puntos de precios importantes que se pueden registrar y nos enseña también los diversos movimientos de los precios en un período determinado de la gráfica.

º Proporcionan los resultados puntuales a los vendedores y compradores, ya que el movimiento del precio de los activos se señalan correctamente en los gráficos para que los comerciantes lo lean y comprendan.

º Nos pueden enseñar mucha más información visual que los demás gráficos que mencionamos anteriormente, logrando mostrar en sí los precios máximos, mínimos, de apertura y el cierre del mercado directamente al comerciante.

º Una diferencia que podemos destacar del gráfico de velas con el gráfico de barras es que este tipo de gráfico de velas logran proporcionar más información sobre los cambios de precio en el mercado, el cual logra mostrar una imagen gráfica de la oferta y la demanda que es impulsada en la acción del precio en un largo tiempo determinado, cosa que el mismo gráfico de barras no puede llegar a ofrecer.

º The candlestick chart can show us the important price points that can be recorded and also shows us the various price movements in a given period of the chart.

º They provide timely results to sellers and buyers as asset price movement is correctly indicated on charts for traders to read and understand.

º They can teach us much more visual information than the other charts that we mentioned above, managing to show the maximum, minimum, opening and closing prices of the market directly to the trader.

º One difference that we can highlight from the candlestick chart with the bar chart is that this type of candlestick chart manages to provide more information about price changes in the market, which manages to show a graphical image of the supply and demand that it is driven by price action over a long period of time, which the bar chart itself cannot provide.

.png)

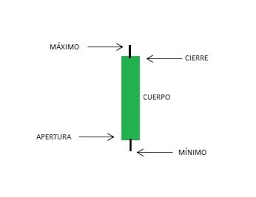

Describe una vela alcista y una vela bajista identificando su anatomía / Describe a bullish candle and a bearish candle identifying their anatomy

Vela Alcista / Bullish Candle

The bullish candle presents us with four different types of prices for a given period, which are the Open, Close, High and Low prices. Commonly, green is used when the candle is bullish and red when the candle is bearish. Although you can use others such as black and white or customize it to your liking. At the bottom of the sequence we can see the lowest price and it is the one that shows the investor the lowest registered price of an asset traded in a certain period.

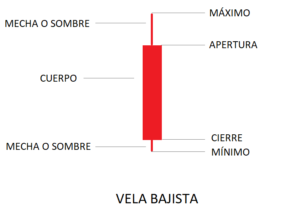

Vela Bajista / Bearish Candle

The Bearish Candle shows the reduction in the price of an asset during a given period. The closing price of a bearish candle is set and closes below the opening price, that is, it indicates that the initial price is usually higher than the final price, which indicates that prices have fallen at the same time.

.png)

Conclusion

As we have visualized, Japanese candles are very powerful tools in technical analysis, since there are many possibilities for certain patterns to happen, they are also very easy to understand once you get used to using them. Although, it should be noted that supporting our decision to invest in just candle analysis is very risky.

Candles are just a few tools in the technical study, therefore, when investing, more factors such as macroeconomic events, profitability ratios, among others ...

.png)

Hello @beatriz01 , I’m glad you participated in the 2nd week of the Beginner’s class at the Steemit Crypto Academy. Your grades in this task are as follows:

Recommendation / Feedback:

Thank you for participating in this homework task.

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit

Thank you very much professor for reviewing my homework!

Downvoting a post can decrease pending rewards and make it less visible. Common reasons:

Submit